Nowadays, almost no company can do without business trips - either it is necessary to conclude an agreement with suppliers, or to resolve issues with customers (for example, to set up the supplied equipment), etc. Today, we will step by step consider the procedure for sending an employee on a business trip and point out the typical mistakes of employers in this case .

According to Art. 166 of the Labor Code of the Russian Federation, a business trip is recognized as a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. Business trips of persons whose permanent work is carried out on the road or has a traveling nature are not recognized as business trips.

The specifics of sending employees on business trips are established by the Regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 .

1. Choosing who to refer. The first step is to remember the restrictions that are established by labor laws. Thus, some employees are completely prohibited from being sent on business trips, while others can be sent, but only with their written consent.

By virtue of Art. 259 of the Labor Code of the Russian Federation prohibits sending pregnant women on business trips. It is prohibited to send minors on official trips (with the exception of creative workers of the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with the lists of jobs, professions, positions of these workers, approved by Decree of the Government of the Russian Federation of April 28, 2007 No. 252 ).

Note!

During the period of validity of the apprenticeship contract, employees cannot be sent on business trips not related to the apprenticeship ( Article 203 of the Labor Code of the Russian Federation ).

In addition, pay attention to the rehabilitation program for a disabled person if you plan to send him on a business trip. If this document contains a ban on business trips, sending a disabled person on a business trip will be unlawful and may entail administrative liability for the employer. This follows from Art. 23 of the Federal Law of November 24, 1995 No. 181-FZ “On the social protection of disabled people in the Russian Federation” : disabled people employed in organizations, regardless of organizational and legal forms and forms of ownership, are provided with the necessary working conditions in accordance with the individual rehabilitation program for the disabled person.

Sending women with children under three years of age on business trips is permitted only with their written consent and provided that this is not prohibited for them in accordance with a medical certificate. Let us remind you that the procedure for issuing such conclusions by medical organizations is approved by Order of the Ministry of Health and Social Development of the Russian Federation dated May 2, 2012 No. 441n .

Here it is important to understand that it is the medical report that matters to the employer - a certificate will not do. Conclusions are issued to citizens based on the results of medical examinations, medical examinations, clinical examinations, decisions made by a medical commission, as well as in other cases. But certificates are issued by doctors (in some cases, paramedics and obstetricians) based on entries in the citizen’s medical records or based on the results of a medical examination.

Please note that it is necessary to obtain written consent for a business trip and check for medical contraindications if you plan to go on a business trip ( Articles 259 , 264 of the Labor Code of the Russian Federation ):

- a father raising children without a mother;

- guardian (trustee) of minors;

- mother (father) raising children under the age of five without a spouse;

- an employee with a disabled child;

- an employee caring for a sick family member in accordance with a medical report.

2. We obtain consent and notify about the possibility of refusal. In addition to the fact that it is necessary to obtain written consent for a business trip from employees of these categories, they must be informed in writing of the right to refuse the trip. This is usually formatted as follows. The employer prepares a notice in which the employee is invited to go on a business trip and informed that he has the right to refuse it. The notice is drawn up in two copies and may look like this.

| Limited Liability Company "April" (April LLC) Ref. No. 12/4 To the Public Relations Manager from 04/15/2015 A. I. Ponomareva Dear Anna Ivanovna! We ask you to agree to be sent on a business trip from 04/20/2015 to 04/25/2015 to the All-Russian Joint Stock Company "Nizhny Novgorod Fair", located in Nizhny Novgorod, to participate in the exhibition "GardenExpo 2015". Additionally, we notify you that, on the basis of Art. 259 of the Labor Code of the Russian Federation, you have the right to refuse to be sent on a business trip because you have a child under the age of three. Director Ivanov V.P. Ivanov I agree to the business trip. I am familiar with the right to refuse a business trip. Public Relations Manager, Ponomareva, 04/15/2015 |

Of course, an employee can express his consent or disagreement to a business trip in the form of a separate document, for example, an application that he submits to the personnel department.

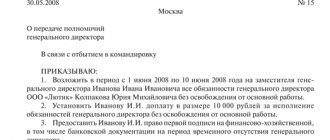

In this case, it is advisable to indicate in the notification the time frame within which the employee must make a decision, for example: “You can inform about the decision made in a separate statement, which must be submitted to the HR department by ... (such and such a date).” 3. We issue an order. Before talking about the order, let us recall that previously, in order to be sent on a business trip, the employee had to issue a work assignment and a travel certificate. However, due to changes made by Decree of the Government of the Russian Federation of December 29, 2014 No. 1595 to the Regulations , the registration of these documents has been cancelled. They were used to confirm the presence of an employee at a specific time in a specific location for reimbursement of expenses in connection with a business trip. But various departments have written that in some cases, marks on a travel certificate cannot be placed physically (for example, during negotiations with individuals), so the fact of being at the place of business at the appointed time can be confirmed by other documents - an order (instruction) on sending the employee on a business trip, travel documents, hotel bill ( letters from the Ministry of Finance of the Russian Federation dated August 16, 2011 No. 03-03-06/3/7, Ministry of Labor of the Russian Federation dated February 14, 2013 No. 14-2-291 ).

For your information

Since the need to prepare a work assignment and a travel certificate has disappeared, it is in the order to send on a business trip that the official assignment must be spelled out in as much detail as possible, that is, the purpose of the trip, as well as the deadlines for completing this assignment.

Before 01/08/2015, a service assignment was usually indicated as the basis for issuing an order, since according to the previous version of the Regulations , the purpose of an employee’s business trip was determined by the head of the sending organization and was indicated in the service assignment, which was approved by the employer.

After the named date, as the basis for issuing an order, you can indicate the details of the documents (if any), in accordance with which the employee was required to be sent on a business trip (agreement with a counterparty, an order to conduct an inspection, an invitation to an exhibition, etc.).

Since the organization has the right to continue to issue official assignments for business trips and require employees to report on their implementation (if this is provided for by local regulations), an official assignment can also be indicated as the basis for the order.

For your information

To send an employee on a business trip, you can issue an order using the unified T-9 form (T-9a for sending a group of employees) or using a form developed and approved by the organization itself.

The order is signed by the head of the organization (or another authorized person) and the employee is introduced to this document against signature.

Let's talk separately about the shelf life. According to the List of standard management archival documents generated in the course of the activities of state bodies, local governments and organizations, indicating storage periods , approved by Order of the Ministry of Culture of the Russian Federation dated August 25, 2010 No. 558 , orders for sending on business trips must be stored ( clause 19 ):

- for 75 years - if orders are issued on long-term domestic or foreign business trips, as well as on business trips of workers with difficult, harmful and dangerous working conditions;

- within five years - if orders are for short-term domestic and foreign business trips.

Of course, difficulties may arise with storage periods, since neither the Labor Code nor the above-mentioned list of standard management archival documents provide criteria for classifying business trips as short-term or long-term. Therefore, we recommend keeping orders for business trips longer than three days for 75 years.

| Limited Liability Company "Vesna" (Vesna LLC) Order No. 31 about sending an employee on a business trip April 14, 2015 Samara Send Ivan Ivanovich Ivanov, leading specialist of the information technology department, on a business trip to Leto LLC, located in Arzamas, Nizhny Novgorod region, for a period of 3 (three) days from April 21 to April 23, 2015 in order to provide software installation services , designed to control the movements of the moving parts of the supplied machines. Reasons: supply contract No. 24 dated January 13, 2015, concluded between Vesna LLC and Leto LLC, memo from the head of the information technology department P. P. Petrov on the need to install software dated April 13, 2015. Director Sidorov S.S. Sidorov I have read the order. Ivanov, 04/14/2015 |

4. We issue an advance. According to clause 10 of the Regulations, when an employee is sent on a business trip, he is given a cash advance to pay for travel expenses and rental accommodation and additional expenses associated with living outside his place of permanent residence (daily allowance).

Please note that when traveling on business to an area from where the employee, based on transport conditions and the nature of the work performed on the business trip, has the opportunity to return daily to his place of permanent residence, daily allowances are not paid. To issue cash to an employee on account of expenses associated with the activities of a legal entity or individual entrepreneur, an expense cash order form 0310002[1] is drawn up in accordance with a written application of the accountable person, drawn up in any form and containing a record of the amount of cash and the deadline, on which they are issued, the manager’s signature and date ( clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” ).

Based on the order for sending on a business trip, the accountant calculates the preliminary amount of expenses associated with the trip and coordinates it with the head of the business trip unit and the chief accountant.

The amount that needs to be paid to the employee is determined based on the duration of the business trip specified in the order for assignment, the cost of travel, the approximate cost of housing, the amount of daily allowance established by the organization for business trips in Russia and abroad. If an employee is sent on a business trip outside the Russian Federation, payment and reimbursement of expenses in foreign currency (including payment of an advance or repayment of an unspent advance in foreign currency) are carried out taking into account the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control” ( clause 16 of the Regulations ).

5. We record the departure of an employee. Based on clause 8 of the Regulations, the employer is obliged to keep records of employees leaving on business trips from the sending organization and arriving at the organization to which they are sent. This is done in the appropriate journals. According to Order of the Ministry of Health and Social Development of the Russian Federation dated September 11, 2009 No. 739n , the employer or a person authorized by him by order (instruction) must appoint an employee of the organization responsible for maintaining the departure log and the arrival log.

The form of the logbook for employees leaving on business trips from the sending organization is given in Appendix 2 to this order. Information about the last name, first name and patronymic of the posted worker, the name of the organization to which he is sent, and destination are reflected.

Please note that the form contains the column “Date and number of travel certificate.” So: from the moment of amendments to the Regulations , that is, from 01/08/2015, this column will remain blank.

Note!

The employer (or a person authorized by him) is obliged to ensure the storage of the departure log and the arrival log for five years from the date of their registration.

6. We put marks on the working time sheet. Since, by virtue of Art. 91 of the Labor Code of the Russian Federation, the employer is obliged to keep records of the time actually worked by each employee; the time spent on a business trip must be recorded in the working time sheet. Let us remind you that working time is recorded in a timesheet and the employer has the right to use both the unified form T-13 from the Resolution of the State Statistics Committee of the Russian Federation dated January 05, 2014 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment” , and the timesheet form, developed independently.

Based on clause 8 of the Regulations, the actual period of stay at the place of business trip is determined by travel documents presented by the employee upon return from a business trip. If he travels to the place of business trip and (or) back to the place of work on personal transport (car, motorcycle), the actual period of stay at the place of business trip is indicated in a memo, which is submitted by the employee upon returning from a business trip to the employer along with supporting documents confirming use of the specified transport for travel to the place of business trip and back (waybills, invoices, receipts, cash receipts, etc.).

Days of absence of an employee from the workplace due to a business trip are indicated by code “K” (or “06” - “business trip”), while the number of hours worked is not entered.

7. We accept the report. Upon returning from a business trip, the employee is obliged to submit to the employer, within three working days, an advance report on the amounts spent in connection with the business trip and make a final payment on the cash advance issued to him before departure for travel expenses.

The employee must report on expenses for travel, housing and other expenses made with the knowledge of the employer. But he does not need to report for daily allowances - the basis for their payment will be the number of days of business trip recorded in the order for sending on a business trip.

Attached to the advance report are documents on the rental of accommodation, actual travel expenses (including payment for services for issuing travel documents and providing bedding on trains) and other expenses associated with the business trip.

Let us recall that organizations use the advance report form AO-1, approved by Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55 .

For your information

For public sector organizations, a different form of advance report has been established, as well as a time sheet. Currently, the Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state ( municipal) institutions, and guidelines for their use." From the moment this order comes into force, these institutions will be required to use the forms approved by it.

Typical violations

When sending employees on business trips, employers make a fairly wide range of mistakes, ranging from incorrect registration to incorrect reimbursement of expenses.

Some employers:

- send employees on official trips who are prohibited from being sent there;

- they do not inform the employee of the right to refuse a business trip when, by virtue of the Labor Code of the Russian Federation, they were obliged to do so;

- require the employee, during a business trip, to perform duties not provided for in the employment contract;

- do not reflect the business trip on the timesheet;

- they do not issue an order to send you on a business trip.

For example, the Voronezh Regional Court considered a case based on the complaint of Beta Link CJSC against the decision of the state labor inspector, who found the director of the CJSC guilty of violating Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation and imposed an administrative fine in the amount of 3,000 rubles. Among the violations identified during the inspection activities was incorrect registration of business trips; in particular, business trips were not documented by order, as required by labor legislation. The director of the company could not refute the facts recorded by the inspector in the protocol. In this regard, the decision of the GIT inspector was recognized as legal and justified ( Decision of the Voronezh Regional Court dated 02/03/2009 in case No. 77-9AP ).

Business trip arrangements

Now let's figure out how an employee's trip is documented.

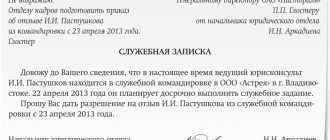

Like any action or decision within an organization, especially if it is related to personnel, a business trip requires the preparation of a very specific list of documents. Is it necessary to issue a memo when sending an employee on a business trip?

There is no need to formalize, except in cases where such an obligation is provided for in the employer’s internal documents (in particular, in the accounting policies) and (or) in the employer’s local regulations (for example, in the Regulations on business trips).

The form of the memo, the procedure and cases for filling it out are not provided for by law. Therefore, the organization independently decides for itself whether it needs to be formalized when sending an employee on a business trip or not. The decision on the need to draw up a memo should be enshrined in the organization’s accounting policies for accounting purposes and (or) in the employer’s local regulations (for example, in the Regulations on Business Travel). Confirmation: Art. 8 of Federal Law No. 402-FZ of December 6, 2011 , part 2 of Art. 5 , part 1 art. 8 of the Labor Code of the Russian Federation.

In addition, the grounds and purposes for sending an employee on a business trip are indicated in the order (instruction) of the manager on sending the employee on a business trip and in the official assignment.

The use of unified forms of personnel documentation approved by the State Statistics Committee of Russia is not mandatory (taking into account a number of features). That is, the employer has the right to independently develop the forms of primary accounting documents that he will use. At the same time, the legislation does not prohibit the continued use of established forms of unified primary documents. In any case, the forms used must contain all the required details listed in Part 2 of Art. 9 of Federal Law No. 402-FZ of December 6, 2011

Depending on which forms the employer decides to use, he can either determine his own procedure for filling them out, or be guided by the instructions that apply to the unified forms developed by the State Statistics Committee of Russia (if it approves them for use). In particular, an order to send an employee on a business trip can be issued using Form No. T-9 or Form No. T-9a (applied when sending two or more employees on a business trip at the same time), and a service assignment - using Form No. T-10a and follow the instructions for their application and completion (Instructions for the application and completion of forms for recording labor and its payment (No. T-9, No. T-9a, No. T-10a), approved by Resolution of the State Statistics Committee of Russia No. 1 of January 5, 2004). This document will serve as confirmation of the period spent on a business trip. It indicates the dates of arrival and departure, which the employee must mark directly at the company where the employer sent him. However, this requirement only applies to business trips within Russia.

What is meant by an official assignment when sending an employee on a business trip?

This is understood as an assignment to a posted worker to perform certain work (perform certain actions) within the framework of his labor function, stipulated by the employment contract and job description given by the employer. For example, conduct negotiations, conclude an agreement, set up equipment operation, conduct interviews, etc. Confirmation: Part 1 of Art. 166 , Art. 60 of the Labor Code of the Russian Federation.

The official assignment to the posted employee must be clear and comprehensive. It needs to be formulated in the job assignment.

In particular, when using the unified form of official assignment in form No. T-10a, lines in column 11 of this document are specially provided for formulating an official assignment for a posted employee. Upon returning from a business trip, opposite the official assignment, the employee must write a short report on its implementation.

Confirmation: Instructions for the use and completion of forms for recording labor and its payment (No. T-10a) , approved. Resolution of the State Statistics Committee of Russia No. 1 of January 5, 2004

How to fill out an order to send an employee on a business trip?

It must be filled out in the order established for filling out the form, which is approved for these purposes in the accounting policies of the organization. When an employee is sent on a business trip, a corresponding order is drawn up. In particular, when using a unified form of an order to send an employee on a business trip (forms No. T-9, No. T-9a), its columns are filled out in accordance with the Instructions for the use and completion of forms for recording labor and its payment (No. T-9, No. T-9a), approved. Resolution of the State Statistics Committee of Russia No. 1 of January 5, 2004

In the title part of the order in a unified form it is necessary to provide: – the name of the organization that sends the employee (workers) on a business trip; – number and date of document preparation.

In the main part of the order in a unified form, you must indicate: - last name, first name, patronymic and personnel number of the employee (workers) whom the organization sends on a business trip; – the structural unit in which the employee (employees) works; – position (specialty, profession) of the employee (workers); – destination of the business trip (country, city, name of organization); – start and end dates of the business trip; – duration of the business trip and its purpose; – source of financing expenses associated with the business trip (indicated if necessary); – details of the document that is the basis for drawing up the order (for example, an official assignment).

This document is filled out by an employee of the personnel service (personnel department, personnel department). It is signed by: – the employee(s) who is sent on a business trip; – the head of the organization (the person authorized by him for this purpose).

What form should I use to prepare a travel certificate?

The use of unified forms of personnel documentation approved by the State Statistics Committee of Russia is not mandatory (taking into account a number of features). That is, the employer has the right to independently develop the forms of primary accounting documents that he will use, including a travel certificate. At the same time, the legislation does not prohibit the continued use of established forms of unified primary documents. In any case, the forms used must contain all the required details listed in Part 2 of Art. 9 of Federal Law No. 402-FZ of December 6, 2011

Depending on which forms the employer decides to use, he can either determine his own procedure for filling them out, or be guided by the instructions in force in relation to the unified forms developed by the State Statistics Committee of Russia (if it approves them for use).

If the employer decides to use the forms developed by the State Statistics Committee of Russia, he must draw up a travel certificate according to form No. T-10 (see Sample). The columns of the unified form No. T-10 are filled out in accordance with the Instructions for the use and completion of forms for recording labor and its payment (No. T-10), approved. Resolution of the State Statistics Committee of Russia No. 1 of January 5, 2004

All of the above documents are important for personnel records. From a tax accounting point of view, to confirm business trip expenses, the only fundamental thing is the presence of a travel certificate. In case of his absence, that is, when crossing the border, notes about this in the international passport will be confirmation of the fact of the trip. In addition, in order to be able to take into account travel payments when calculating the tax base, it is necessary that the employee, within 3 days after returning, draw up an advance report listing all his expenses, as well as attaching all documents confirming payment for travel, accommodation and other monetary expenses within the framework of his business trips.

Summarize

After changes were made to the Regulations, registration of a business trip was simplified - there was no longer a need to draw up a work assignment and a travel certificate.

The main document confirming that an employee is on a business trip is an order to send him on a business trip. But do not forget in certain cases about the preparation of other documents - the employee’s consent to a business trip, notice of refusal of a business trip, etc. - and also store the documents in the prescribed manner. [1] In fact, this is the KO-2 form, approved. Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88.

Source: Magazine “Human Resources Department of a Commercial Organization”

Business trip certificate - rules for drawing up

Initially, you need to pay attention to an important aspect. A certificate of being on a business trip can only be issued to a posted worker. The information contained therein cannot be disclosed to other organizations or persons.

The sample business trip certificate does not have a standard form and is drawn up in any order. However, in order for the document to have legal force, it is necessary to pay attention to the mandatory aspects:

- title of this certificate;

- information about who it is provided to;

- date and place of filling out the form;

- information confirming the employee’s place of work;

- confirmation that during the specified period of time the employee was or will be on a business trip by order of management;

- signature of the manager and necessarily the seal of the organization.

If the business trip was carried out abroad or involved a long period, then the place where the employee was located may also be indicated. When drawing up, it is not indicated for what purpose the employee was assigned to travel, his income or position. This sample documentation is only confirmation of the fact of absence, and not reporting.

The document is usually drawn up in printed form, but a handwritten version is also allowed. If executed correctly, they have the same legal force. In practice, such confirmation is not often required; usually other forms of documentation are provided - travel tickets, a copy of the appointment order, a copy of the official assignment, if one was issued.

Certificate from the place of work about a business trip to the place of requirement

When issuing confirmation, it is mandatory to indicate where it is provided. This could be an educational institution, a management company or another organization. However, the general wording is often indicated, depending on the location of the requirement.

Such a sample can be submitted to any organization. The employee can obtain it from work and submit copies to different institutions. However, many require the original document, which clearly displays the personal signature of the manager and the seal from work.

An instruction to present at the place of demand is often followed in cases where difficulties arise with the correct spelling of the name of the addressee.

Certificate to the institute from the place of work about a business trip

Situations often arise when an institute student is sent on a business trip. And if the trip falls during a session or other important educational events, a business trip certificate from the place of work becomes a sought-after confirmation of the student’s absence.

Such a sample is usually provided in advance of the trip, along with a request for the opportunity to take the exams earlier or later than the deadline. It is necessary to indicate the time frame of the trip, confirming that the student will not be in this locality during the specified period.

Submission to the registry office

According to the law, a couple who applies for marriage can be married only after a month. However, if a long business trip is expected for one of the applicants for the specified period, the deadline may be postponed to an earlier date.

The Family Code contains a list of situations in which the registration of newlyweds can be accelerated. Secondment does not appear on this list. However, in practice, the registry office may meet halfway and set a different date. To do this, a business trip certificate must be submitted along with the marriage application. If the business trip turns out to be urgent and is issued after submitting an application, the necessary documentation is submitted to the registry office in a separate manner.

Presentation to court

A certificate of travel to court may be needed in cases where it is necessary to confirm your absence at the time of the hearing. Such a sample is drawn up according to the general rules, however, additional documentation may be required to reschedule a meeting:

- travel tickets;

- evidence indicating that the employee is working at the specified location.

It is recommended to notify the court of your absence in advance. Otherwise, it will also be necessary to indicate why such a warning was not given in a timely manner.

In this case, the decision on the transfer is made by the judge. If, in his opinion, the case can be considered in the absence of the specified person, then the transfer will not follow.

Sample of a business trip certificate for presentation to the court