The concept of “average salary” means an indicator of the amount of remuneration calculated on average for a particular period of work. Depending on the purpose for which it is necessary to calculate the average salary, it can be determined for a month (the so-called average monthly salary), quarter, year or other period. However, when calculations are made to accrue certain payments to an employee, the base value is the average daily earnings.

The average monthly wage for labor (average earnings) can be paid to citizens in all cases provided for by law. How can you correctly calculate this value? What are the nuances of such a calculation? Let's look at the answers to these questions later in this material.

In what cases are employees entitled to average monthly earnings?

The list of options when payments to employees are calculated based on the calculation of average earnings is determined by law. Among the most common and most common situations in the activities of a regular institution that require calculations of average monthly earnings are:

- Payment of vacation pay.

- Issuance of compensation for unused vacation periods (as part of dismissal or for part of vacation more than twenty-eight days).

- An employee goes on a business trip.

- Payment to an employee for a period of training while away from work.

- Payment of severance pay.

General provisions on average earnings

Key concepts about average daily earnings are enshrined in Government Decree No. 922 of December 24, 2007 (as amended on December 10, 2016). Payment based on average earnings is used when calculating all types of payments arising within the framework of labor relations. These include:

- payment for the period of the next labor leave;

- amounts for the period of additional, educational leaves;

- salary for the period of business travel;

- vacation compensation upon dismissal;

- payment for periods of downtime due to the fault of the employer;

- other types of accruals calculated based on average earnings.

The calculation of average daily earnings within the framework of labor relations is calculated for the 12 calendar months preceding the month in which the incident occurred. For example, an employee goes on vacation in April 2021, therefore, the calculation should include the period from 04/01/2018 to 03/31/2019.

Periods covered:

- days of illness (injury, maternity leave, illness of children and relatives);

- vacation days (paid and unpaid);

- days of downtime, regardless of the reasons;

- days of care for a disabled child;

- days of stay on a business trip;

- other days during which the employee retains his average daily earnings in full or in part -

are not taken into account.

Calculation of average earnings: formula

Many people are interested in how to calculate average monthly earnings. The calculation for certain payments at work is always done based on the daily average. The general formula can be presented as follows: “SmZ” is equal to “SdZ” multiplied by “N”.

In this case, “SmZ” is the average monthly payment, “SdZ” is the average daily earnings, and “N” implies the number of days that must be paid. Next, let's talk about the intricacies of calculations in specific cases. You can also use the average monthly earnings calculator, which can be found online.

Average earnings for a business trip

To calculate the average salary for the duration of your stay on a business trip, you will also have to calculate the base for calculation and determine the billing period.

Include similar categories of payments in the database, but exclude material assistance, benefits, compensation for travel, accommodation, recreation, and food. Take into account the amounts that were accrued over the previous 12 months.

Include only the time actually worked in the pay period. Exclude days of illness, other business trips, vacations, downtime and other unworked time from the calculation.

Having determined these indicators, divide the base by the number of days worked. The resulting average daily earnings must be multiplied by the number of days spent on a business trip.

Please note that the duration of a business trip includes days spent on the road (to the place of business and back), days of downtime or delays. For weekends and holidays on which the employee did not work while on a business trip, average earnings are not accrued.

Calculation features: formulas and examples

The main feature of calculating payment per day is that different rules for calculating it are established:

- To provide payment of vacation money and compensation for unused vacation.

- All other cases.

Calculation (except for vacation situations): “SdZ” is equal to the salary for the billing period divided by the days actually worked in a given period of time. This period is twelve months.

If the employee worked less than this period, then the time period is equal to the actual activity time. As part of the payment of vacations, including unused ones, presented in calendar days, the formula will be as follows: “SdZ” = wages for the billing period, divided by twelve, and then by 29.3.

How to use the calculator?

Step 1. Select the date for which you want to make the calculation.

Step 2. For each month, enter the data in the fields (if in the month the employee did not go to work on holidays and did not have non-working days, simply leave the fields blank).

Step 3. Fill in all 12 months with data and at the end click the “Calculate” button.

Adding a service to bookmarks helps you quickly and taking into account all the nuances to calculate the amount of average earnings. It is not necessary to constantly look for new calculators or formulas to determine, because the online service displays a detailed report of the actions. The sequence of entering information is quite simple:

- First, you should indicate the number of calendar days of the billing period. The default is 12 months, but there is a choice.

- Next, you need to enter the current calculation date.

- Then the number of days that should be excluded from the billing period is indicated (time of incapacity for work, various vacations or business trips is removed).

- It is necessary to indicate the amount of payments received for each previous month. They include all types of bonuses, advances, and travel allowances.

- At the last stage, you need to click the “Calculate” button.

The online average salary calculator shows not only the exact amount, but also the correct and detailed algorithm for calculating the indicator. This tool is absolutely free and makes accounting work easier for both economists and anyone who wants to make calculations.

To obtain a reliable result, it is worth keeping in mind that filling out all fields is extremely important. You must make payments for all specified months. If the employee was not at work during one of the periods, then the value should be set to zero.

If not fully worked out

In the event that some months out of twelve were not fully worked or there were periods of time that must be excluded from the calculated period, the average payment per day is calculated as follows: “SDZ” is equal to the salary divided by 29.3, which is multiplied by the calendar full months, plus days worked.

The number of calendar days in incomplete months is determined as follows: 29.3 is divided by the number of days in a month and multiplied by those actually worked. In order to more accurately understand how to calculate average monthly earnings, consider an example of such a calculation.

Let's say an employee was sick from October 19 to 30, 2021. Then the number of days in a partially worked month will be as follows: 29.3 divided by 31 and multiplied by 12 (a person’s work for the period from the first to the eighteenth of October), which is equal to eleven days.

Let’s assume that for the twelve months from November of the previous 2017 to October 2021, 494,600 rubles were accrued to the employee. He worked all the remaining eleven billing months. Then the daily average earnings in November will be equal to: 494,600 divided by (29.3 multiplied by 11 plus 11), which will ultimately amount to the average monthly earnings of 1,483.95.

If vacation is provided in working days, then the calculation of average earnings for vacation pay is calculated as follows: “SdZ” is equal to the salary divided by the number of working days according to the calendar of a six-day work week.

How is the average salary of an employee at an enterprise calculated?

Rules for calculating average earnings

Regardless of the mode of work, an employee’s average monthly earnings are determined by taking into account his actual salary and the actual time worked during the year. It is important that the period is calculated from the first to the thirtieth day, except for February.

It is important to consider the procedure for calculating the average salary for unused vacations. In this case, the amount of salary for the last year is divided by the average number of days according to the calendar.

It is necessary to pay attention to the payment of so-called incentive salaries when calculating vacation pay. Additional payments are part of the salary and therefore must be taken into account when calculating vacation pay.

There are common cases when additional payments are accrued before an employee goes on vacation. Moreover, when calculating vacation pay, this indicator is not taken into account at all, but is transferred to the next year. You just need to remember that next year this amount will no longer be equivalent.

According to the law, when determining the amount of average earnings, the employer is required to include all types of employee benefits. Bonuses that were issued on holidays are no exception, if their payment is provided for in the company's policy.

Moreover, it is important how exactly the award was named. Based on the law, a bonus that is designated as a holiday means that payments are possible only on this holiday and the company does not have the right to make other holiday awards.

It should be borne in mind that cash payments that are exclusively social in nature are not taken into account when calculating average earnings.

Thus, monetary contributions that are classified as social cannot be a component of the average salary.

Certificate of average monthly earnings

To receive such a document, the employee must compile an application indicating:

- your personal information along with data from your superiors;

- the text of the request itself;

- writes the date and puts a personal signature.

Based on the application, the person must be given a document about income for a certain period within a three-day period.

It is written with a black or blue pen, and can also be printed. This documentation does not allow edits or corrections. Such a certificate can be certified by a stamp (but it is important to note that the stamp should not cover the signature). If an institution or individual entrepreneur operates without one, then one of the following documents is attached to the paper:

- Confirmation of the authority of a legal entity in the form of an extract from the Unified State Register of Legal Entities or from the minutes of the meeting.

- A copy of the passport along with a photocopy of the entrepreneur’s registration certificate.

Calculation example

For example, V. Kuznetsova’s working time at the enterprise is two years. From October 11, 2015, she will be dismissed at will. The accountant must determine the amount of compensation due for the unused vacation period.

The time period for calculating the average daily earnings will be the months starting from October 2014 until September 2015. During this period, Kuznetsova was on vacation from the thirteenth to the sixteenth of December 2014. This month cannot be considered fully worked by her; the number of days of vacation will not be taken into account, however, as and the amount of vacation pay, without which the employee was accrued a total of 210,000 rubles for the year.

Earnings per day

Average daily earnings should be calculated as follows: eleven months have been fully worked. Eleven multiplied by 29.3, which equals 322.3 days. For December they include: 29.3 divided by thirty-one days of the month, which is multiplied by twenty-seven days = 25.5. As a result, Kuznetsova’s average daily earnings will be: 210,000 divided by (322.3 plus 25.5), which will be equal to 603.79 rubles.

For retirement

In order to determine for which time period of work it is more profitable to take earnings for retirement, the employee’s average monthly earnings for any sixty months in a row must be divided by the average salary in the Russian Federation for the same period. As a result, the resulting indicator is considered the ratio of the average monthly payment of the insured person to the same value in the country, and it should tend to a higher value. To determine the average monthly wage in the Russian Federation, Rosstat data is usually used.

Calculation of average monthly earnings for an employment center

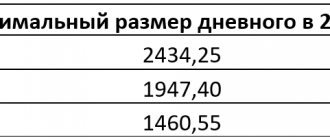

Currently, average monthly earnings must be calculated in accordance with the Calculation Procedure for determining the amount of unemployment benefits. This is accrued in the first twelve-month payment period:

- For three months in the amount of seventy-five percent of the salary, which was calculated for the last quarter at the last place of work.

- Over the next four months in the amount of sixty percent.

- In the future, in the amount of forty-five percent, but in all cases no more than the maximum amount of unemployment benefits and no less than its minimum values, increased by regional coefficients.

It has been established that the average monthly earnings for the employment center are calculated for the last three months (from the first to the first), which precedes the period of dismissal. Let's give an example. Let's say an employee quit on November 7, 2021. What time period do you need to take to fill out the certificate? In this case, the calculation period is considered to be from the first of July 2021 to the thirty-first of October 2016. Please note that if an employee resigns on the last day of the month, then the month of dismissal can be included in the calculation period, but only if the average earnings are more.

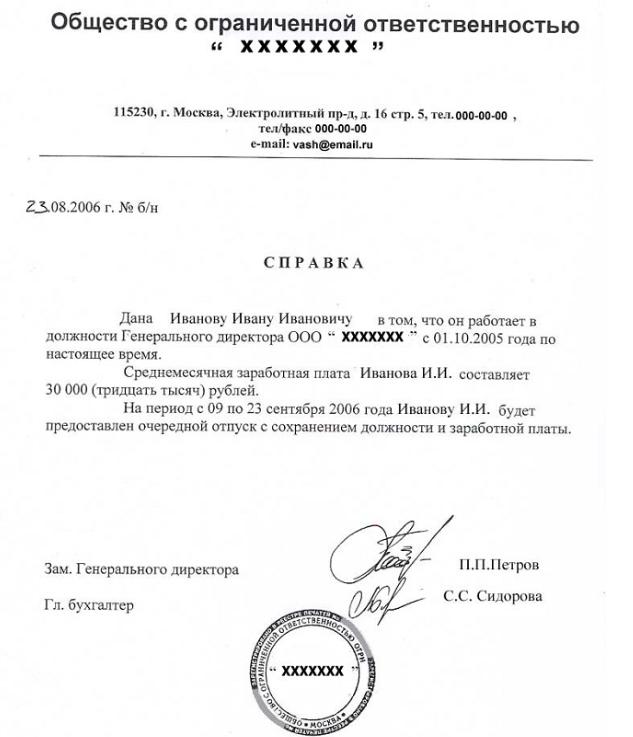

Help for the employment center

The document is submitted to the labor exchange to calculate benefits. It is important that it is compiled correctly. Certificate of average earnings - an example of a correct calculation: Ivan Ivanovich Ivanov demanded that the employer give him a certificate of average salary to submit the document to the Employment Center. The employee was warned of dismissal due to the liquidation of the enterprise. The company's accounting began to calculate the average salary, based on available indicators:

- billing period – from May 1 to July 31, 2021;

- number of days worked – 63;

- number of days worked in actual order – 60;

- earnings in the billing period – 31,500.

Calculation for three months

The calculation of average monthly earnings includes any payments due specifically for work. That is, the wage itself, along with allowances, bonuses, overtime and other additional payments for work. Also taken into account:

- Absolutely all days worked by the departing employee.

- The number of days he was required to work according to the schedule.

In order to understand how you can calculate the average monthly earnings for 3 months, it is most convenient to use the formula for calculating it for one month: “Sz” equals “Vz” divided by “Dr” multiplied by “Dg” and divided by 3.

In this case, “Sz” is the average earnings for one specific month. “Vz” involves payment for work within one quarter. “Dr” is the days worked during the specified period. “Dg” denotes days of work according to schedule.

Let's give an example. Until March thirty-first, 2017, Shirokova K. worked twenty days a month with a wage of 40,000. In January, for several days of work on holidays, she received an additional payment of five thousand rubles. In February, she was given a bonus for exceeding the plan in the amount of 10,000. In March, the citizen fell ill and because of this she was unable to go to work as scheduled, thereby missing four days. Her salary for March ended up being 32,000 rubles:

- “Vz”: 40 thousand multiplied by two plus 32 + 5 + 10 = 127 thousand rubles.

- “Dr”: 20 multiplied by 3 minus 4 = fifty-six days.

- “Dg”: 20 multiplied by three = 60 days.

- “Sz”: 127 thousand divided by 56, multiplied by 60 and divided by 3 = 45,357 rubles.

As a result, Shirokova's average payment was more than her rate, thanks to bonuses and additional payments.

Payments that are taken into account when calculating average earnings

As part of the calculation of this indicator, all transfers that are provided for by the institution’s remuneration system are taken, including:

- Wages (we are talking about time, piecework, as a percentage of revenue paid in kind or in cash).

- Various incentive bonuses with additional payments, as well as all payments for working conditions.

- Bonuses with other similar rewards.

- Other transfers that apply to the employer.

At the same time, calculations of average monthly earnings do not take into account social payments, such as, for example, financial assistance along with payment for food, travel, utilities, etc.

Calculation basis

Please note that not all types of accruals can be taken into account in calculating the average indicator. You cannot include social payments, all types of financial assistance, certain categories of compensation in favor of the employee (compensation for the cost of food, travel, rest, vouchers, travel to vacation spots, travel expenses, etc.).

In the base for calculating the average salary, include all types of accruals that are provided for by the regulations on remuneration in the organization. For example, include:

- official salary;

- incentive bonuses;

- bonuses;

- additional payments for overtime, night work;

- payments for combining positions;

- territorial and district allowances;

- other types of payments within the framework of remuneration for labor provided for by the current system of remuneration.

How is average earnings calculated? To do this, you need to divide the calculation base by the number of days in the calculation period. It is worth noting that, for example, for vacation pay the procedure is somewhat different from the generally established one.

If you need to calculate your average earnings, an online calculator will help you do this easily.

Time periods that are excluded from the billing period

As already noted, the calculation period involves twelve months, which precede the stage in which average earnings are determined. True, individual time stages, as well as accrued amounts for them, are excluded in the calculation. These are the periods when:

- The employee retains his average earnings (only breaks for feeding the baby are not excluded).

- Employees are paid maternity or sick leave benefits.

- The employee did not work due to downtime for which the employer was to blame, or for other reasons that were beyond the control of both parties.

- The employee did not participate in the strike, but also did not fulfill his duties because of it.

- The employee was given days off to care for a disabled person.

- In other cases, the employee was released from activities with partial or full retention of wages or without it.

Program "1C Enterprise"

Calculation of the average amount of earnings in this program is carried out in documents entitled: “Sick leave”, “Vacations”, “Business trips”, “Child care”, “Payment for days of care for the disabled”, “Absence of an employee with continued payment”, “Downtime” employee”, “One-time accruals”, “Dismissal”.

The calculation period for calculating average earnings is automatically determined as the twelve months that precede the start date of the event, except in cases where average earnings are calculated in the month the person was hired. In this case, one calendar month is considered calculated, that is, the time period when the employee was hired.

If the collective agreement provides for a different period for calculating average wages in the 1C Enterprise program, then you can set it manually directly in the form called “Data entry for calculating average wages.” This option is opened by a button that looks like a green pencil in the section called “Average earnings”. It is used to calculate the average saved payment by setting the switch to the “Set manually” position. The payroll period may also need to be manually changed if the employee did not receive accrued wages in it.

Indexation in an enterprise: how to calculate average earnings under such conditions

Average earnings in case of salary indexation

First, you need to understand what indexing is. Indexation is an increase in employee wages in the event of an increase in prices for consumer goods.

It is important to take into account that, according to the law, during the indexation period at an enterprise, the boss is obliged to take into account the increase factor when determining average earnings if:

- There was a wage increase in the middle of the estimated time. In this case, it is necessary to multiply the increase factor by the cash payments before the increase occurs.

- If the salary increase occurred after the billing period, then all payments made during this period should be multiplied by the coefficient.

The question arises as to how to correctly calculate the increase factor. It is necessary to divide the new salaries by the old tariffs.

Important! The indexation coefficient, the number by which an employee’s salary will be increased, is not affected by the position held by the employee.

The salary increase is calculated based on cash receipts that were made in the month of indexation.