What is sick leave? Can a working pensioner receive money while on sick leave? How is sick leave paid? How to independently calculate the amount due, and what data do you need to know for this? What can a pensioner count on when he starts working again?

A sick leave certificate (or temporary disability certificate) is a document that confirms the legality of a citizen’s absence from work due to his illness. A certificate of incapacity for work gives the right to receive funds, even despite being absent from work. All working citizens who make payments to the funds of state and commercial enterprises can count on receiving sick leave and full payment for the duration of its validity.

All actions relating to payment of sick leave are carried out in accordance with the Federal Law of December 29, 2006. No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

Are sick leave paid to working pensioners?

The employer is obliged to pay sick leave in the amount prescribed by law. An employer can dismiss a pensioner, even if he is absent from the workplace due to illness for quite a long time, only at the personal request of the employee.

During illness, another person may be replaced by a pensioner, provided that as soon as the employee is able to begin performing his duties, his place will be vacated.

Pensioners who continue to work can be on sick leave for as long as it takes to fully restore their health, but according to the decree of the Ministry of Health, all persons filling out a certificate of temporary incapacity for work are required to report to a medical institution after 10 days to extend the sick leave to 30 days, or to be discharged and return to labor activity. All subsequent extensions are made for a period of 30 days. Read more about how to obtain insurance coverage for sick leave in this material.

You can get sick leave only in public or private clinics. In emergency departments, as well as at blood transfusion stations and institutions that deal with disease prevention, it is not possible to obtain confirmation of the disease.

General provisions on sick leave for pensioners

Employed pensioners, like other company employees, can rightfully claim compensation for sick days if they have documentary evidence - they have a sick leave certificate (another name is a temporary disability certificate).

It is the sick leave provided to the accounting department that is the basis for providing the subject with compensation amounts.

The attending physician of the sick employee is responsible for issuing a certificate of temporary incapacity for work. Employees of the ambulance, emergency department, blood transfusion stations, as well as those involved in preventive work cannot issue it.

Contrary to the stereotype, the status of the clinic does not affect the legal validity of the document.

The frequency of sick leave is also determined by the doctor to whom the patient consulted. Often, this period does not exceed 15 days. However, if the illness drags on, the doctor may decide to extend sick leave for a similar period.

Based on Art. 183 of the Labor Code of the Russian Federation and Federal Law No. 255 of December 29, 2006, compensation payments must be provided to an employed citizen (including working pensioners) for all officially recorded days of illness.

Often, after an inpatient course of treatment, a pensioner is referred by a doctor to a sanatorium. In this case, compensation is provided to the person for no more than 24 days of such sick leave.

The final amount of funds will depend on the average salary of the pensioner over the last two years of work and his length of service.

In conditions where a pensioner resigns, in the event of subsequent illness, the insurance period will not be taken into account in payments.

Temporary disability benefits must be accrued by the employer no more than 10 days after subordinates submit sick leave to the company’s accounting department. It is also important to note that the actual disbursement of funds to the employee occurs on the next day of salary payment, determined by the local act of the enterprise, unless otherwise stated therein.

How are they paid?

If the pensioner was fired, his sick leave will still be paid for 30 days by his previous place of work. It must be said that the organization will pay only for the first three days of illness, and the rest of the time during which the citizen is unable to work will be paid from the Social Insurance Fund. Having an electronic medical policy will also be a significant advantage.

It is possible to receive a payment at work if the illness occurred no later than a month after dismissal, within six months, provided that the pensioner did not get another job during this time. Unfortunately, you will only be able to receive 60% of your previous salary.

Payment procedure and calculation of sick leave for working pensioners

The volume of state assistance in case of illness, including for working pensioners, is regulated by Federal Law No. 255-FZ dated December 29, 2006.

The form of sick leave or bulletin is regulated by order of the Ministry of Health and Social Development N 347n.

Duration of stay on sick leave

At the first visit to the doctor, a sick leave certificate is issued for ten calendar days. After this, the person must come again for examination by a medical officer. The medical employee has the right to increase the period of incapacity for work up to thirty days. All subsequent extensions are already thirty days.

Payment after dismissal

If the employment contract between a former employee and his employer is terminated, payment for the ballot after the dismissal of a citizen of retirement age is fully borne by the employer.

A legal entity pays only for the first three days of sick leave, the rest is paid from the Social Insurance Fund.

Statute of limitations for payment of sick leave

The period for payment for the newsletter by the enterprise is six months. This is provided that the pensioner no longer works at this enterprise, less than 30 calendar days have passed since the dismissal, and the citizen has not yet contacted the employment service to register.

How to calculate

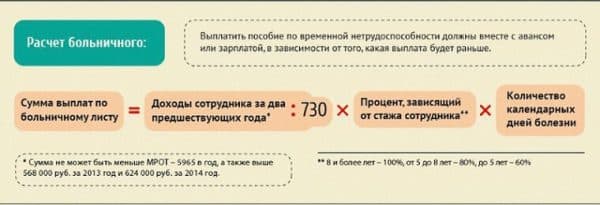

In order to calculate the amount that a citizen is entitled to during his illness, the salary for the previous 2 years must be divided by 730 and multiplied by a percentage, which depends on how much work experience the patient has earned. Then the resulting number must be multiplied by the number of days that the citizen spent on sick leave.

A citizen's insurance experience of less than five years will allow him to receive only 60% of his daily earnings, from 6 to 8 years of insurance experience make it possible to receive 80% of wages for one working day, and those employees who have worked for 8 years or more are entitled to 100% payment sick leave. If a pensioner was injured at work and was forced to temporarily stop working because of this, sick leave will be paid to him in the amount of 100% of his salary.

If a citizen has worked for less than six months, sick leave will be paid in accordance with the minimum daily wage, which in 2021 is 196 rubles. 11 kopecks The maximum amount that can be received while on sick leave is 1,632 rubles 87 kopecks for each day of illness.

Required data

To fully understand how much you can count on while on sick leave, you need to have the following information:

- indicate data on the salary of a citizen on sick leave for the last two years;

- the minimum wage at the time of applying for payment, a citizen of the Russian Federation;

- citizen's work experience;

- insurance experience;

- and it is also important to indicate the exact number of days spent away from work due to illness.

It is necessary to understand that insurance length does not equal working experience. What is important is not how much time the pensioner spent at work, but how much deductions were made to the social insurance fund.

Payment of sick leave to a working pensioner

Employees at risk do not need to go anywhere to fill out the paperwork themselves! Your employer was required to send a list of employees in the “65+” category to the Social Insurance Fund (SIF).

If the employer has forgotten about this, still does not know, or is trying to pretend that he does not know, we recommend reminding him by referring to Government Decrees No. 402-PP and No. 417-PP.

Next, the algorithm for considering the application is as follows: information is transferred from the Social Insurance Fund to the medical organization. An electronic certificate of incapacity for work is generated there.

After this, the payment is automatically assigned.

How much will be charged for forced sick leave?

The amount of payments is calculated in the same way as in pre-virus times. According to the general rule for calculating sick leave.

If an employee has more than 8 years of insurance experience, the amount of disability benefits is equal to 100% of average earnings.

If the employee’s work experience is from 5 to 8 years – 80% of average earnings.

If the experience is up to 5 years - 60% of average earnings.

The minimum amount of sick leave payments has also been introduced if the employee does not have enough work experience.

For a full month on forced sick leave, you must pay at least 12,130 rubles.

The money will be credited to the employee’s account 7 days after the certificate of incapacity for work is issued.

Why sick leave can be canceled

If a pensioner violates the self-isolation regime, the sick leave may be invalidated.

Let us remind you that according to the rules of complete self-isolation, citizens who are part of the risk group can leave the apartment only in the following cases:

– in case of a direct threat to life and health;

– to receive emergency medical care;

– to purchase groceries, medicines and essential goods in nearby stores and pharmacies;

– for walking pets no further than 100 m from the house;

- for taking out garbage.

The costs of sick leave during quarantine are fully borne by the Social Insurance Fund. The employer does not pay anything.

Is it possible to refuse sick leave and continue to go to work?

No. You will have to choose one of three: either you are on vacation, or working remotely, or on sick leave.

It is prohibited and punishable for older people to move around the city - coronavirus is most dangerous for older people.

Yes. An employee sent on sick leave will receive payments for sick leave from both employers.

What should we do if we get sick during quarantine sick leave?

You will need to call a doctor to your home and convert your quarantine sick leave into sick leave due to illness. This will not affect the amount of payments in any way: for quarantine and illness, the payment is the same. Since the calculation of the amount of payment is made according to the general rules for issuing a certificate of incapacity for work, the portal domsovet.tv explains

What is the difference between home and remote modes and who do they apply to, says RBC.

In both regions, restrictive measures are currently in place, and citizens over 65 years of age are prohibited from free movement.

The mayor of the capital ordered employers to send older workers home, with the exception of those whose presence at the enterprise is necessary. They need to organize remote access to work whenever possible.

How to apply for sick leave for persons over 65 years of age in Moscow and the Moscow region: also in electronic form at the request of the employer.

If the pensioner was fired, his sick leave will still be paid for 30 days by his previous place of work. It must be said that the organization will pay only for the first three days of illness, and the rest of the time during which the citizen is unable to work will be paid from the Social Insurance Fund. Having an electronic medical policy will also be a significant advantage.

In order to calculate the amount that a citizen is entitled to during his illness, the salary for the previous 2 years must be divided by 730 and multiplied by a percentage, which depends on how much work experience the patient has earned. Then the resulting number must be multiplied by the number of days that the citizen spent on sick leave.

A citizen's insurance experience of less than five years will allow him to receive only 60% of his daily earnings, from 6 to 8 years of insurance experience make it possible to receive 80% of wages for one working day, and those employees who have worked for 8 years or more are entitled to 100% payment sick leave. If a pensioner was injured at work and was forced to temporarily stop working because of this, sick leave will be paid to him in the amount of 100% of his salary.

If a citizen has worked for less than six months, sick leave will be paid in accordance with the minimum daily wage, which in 2021 is 196 rubles. 11 kopecks The maximum amount that can be received while on sick leave is 1,632 rubles 87 kopecks for each day of illness.

To fully understand how much you can count on while on sick leave, you need to have the following information:

- indicate data on the salary of a citizen on sick leave for the last two years;

- the minimum wage at the time of applying for payment, a citizen of the Russian Federation;

- citizen's work experience;

- insurance experience;

- and it is also important to indicate the exact number of days spent away from work due to illness.

It is necessary to understand that insurance length does not equal working experience. What is important is not how much time the pensioner spent at work, but how much deductions were made to the social insurance fund.

You can receive money for sick leave along with an advance payment or salary. Personal income tax will be deducted from the total amount.

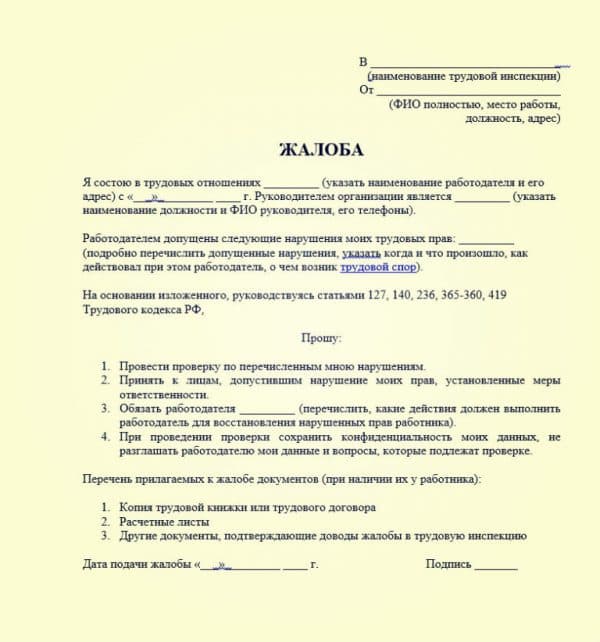

For more information regarding tax deductions for working pensioners, see below. If the employer delays payment of the temporary disability certificate, you can submit a claim in writing, sent to the regulatory authorities of the organization.

In this complaint, you must clearly state your complaint, and you must also attach to the document photocopies of a sick leave certificate, an employment agreement, a payslip in which the amount due during sick leave is calculated, a certificate from an individual bank account stating that the money is not credited to it arrived. A complete list of documents must be clarified in the accounting department at your workplace, or by calling the local Social Insurance Fund department.

If over the past two years the pensioner has worked in another place, he must bring documents to the new place of work confirming this fact and that he has sufficient work experience. This is necessary for the general calculation of wages, on which the amount of sick pay depends. If the pensioner has not worked anywhere over the past two years, the sick leave benefit will be calculated in accordance with the current minimum wage, which for 2021 is 5,965 rubles.

Please note that when changing jobs, a pensioner has the right to dismissal without service.

Upon reaching retirement age, the employer does not have the right to automatically dismiss an employee unless he himself expresses the initiative. Pensioners, like other employees, can be dismissed only in accordance with Art.

77 and art. 81 of the Labor Code of the Russian Federation (upon expiration of the employment contract, liquidation of the enterprise, reduction of staff, inconsistency of the employee with the position held or failure to comply with his work duties, etc.).

Consequently, if a worker who has reached retirement age continues to work diligently and fulfills his duties, he has the same right to temporary disability payments. Sick leave is issued on a general basis.

As mentioned above, working pensioners have the same sick leave conditions as other employees. As for the question of how long a pensioner is allowed to stay on sick leave - as long as necessary.

In accordance with clause 11 of the Order of the Ministry of Health and Social Development of Russia dated January 24, 2012 No. 31n, during outpatient treatment of diseases or injuries in which the employee is temporarily unable to work, sick leave is issued by the attending physician for a period of up to 15 calendar days. After this time, the employee again undergoes a medical commission, by which decision the sick leave is extended if necessary.

Self-isolation may be mandatory or advisory. For example, in Moscow and the Moscow region there are now different standards; in the capital, citizens over 65 years of age must necessarily stay at home, in the region this is only recommended.

Clause 2.1 of the Temporary Rules states that sick leave for the duration of quarantine is issued before the end of the period of restrictive measures if local authorities establish the need to comply with the self-isolation regime. Clause 2 states that sick leave can be issued by persons observing such a regime. The Social Insurance Fund also explains that payments are assigned to citizens who choose self-isolation. It follows that sick leave is issued under both mandatory and advisory conditions

Periods of self-isolation are introduced by orders of the regions for a certain period, for which sick leave is issued and paid within 7 days.

If you have an employment contract, you are entitled to benefits in case of illness.

It is issued through the employer. Unemployed people employed under a civil contract and individual entrepreneurs without voluntary insurance do not receive it.

Sick leave is the colloquial name for temporary disability benefits. If insurance premiums are paid for a person - usually as part of compulsory social insurance - then during the period of illness the state compensates him for lost earnings.

You can be treated at home or in a hospital and receive money. Provided that a sick leave certificate has been issued.

Calculation procedure

You can receive money for sick leave along with an advance payment or salary. Personal income tax will be deducted from the total amount. For more information regarding tax deductions for working pensioners, see below. If the employer delays payment of the temporary disability certificate, you can submit a claim in writing, sent to the regulatory authorities of the organization.

The complaint form must be submitted to the labor inspectorate.

In this complaint, you must clearly state your complaint, and you must also attach to the document photocopies of a sick leave certificate, an employment agreement, a payslip in which the amount due during sick leave is calculated, a certificate from an individual bank account stating that the money is not credited to it arrived. A complete list of documents must be clarified in the accounting department at your workplace, or by calling the local Social Insurance Fund department.

Conditions for paying sick leave to a pensioner who has started working again

If over the past two years the pensioner has worked in another place, he must bring documents to the new place of work confirming this fact and that he has sufficient work experience. This is necessary for the general calculation of wages, on which the amount of sick pay depends. If the pensioner has not worked anywhere over the past two years, the sick leave benefit will be calculated in accordance with the current minimum wage, which for 2021 is 5,965 rubles. Please note that when changing jobs, a pensioner has the right to dismissal without service.

conclusions

- By law, the employer is obliged to pay sick leave to a working pensioner for as long as necessary, and does not have the right to fire him, even if the employee is absent from the workplace for quite a long time.

- If you fall ill within 30 days after dismissal, you can count on full payment of sick leave at your previous place of work. You can apply for a settlement within six months.

- In order to get an idea of the amount you can count on while on sick leave, you need to know what your salary was for the previous two years, the current minimum wage, work and insurance experience, as well as the number of days spent on sick leave.

- Money for sick leave will be accrued along with the advance payment or final salary. Maybe,