How to use the calculator

Instructions for using the average salary calculator

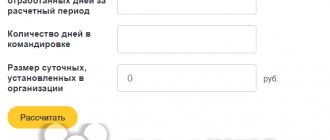

- Specify the calculation period - any number of months preceding the calculation date.

- Indicate the date on which the calculation is made, the method of recording working hours, and the days excluded.

- Enter wages and bonuses for the selected months. When you pay your salary for the first month, for convenience, the data is automatically entered for all the following months.

- Click "CALCULATE". You will receive data on your average daily earnings with all the calculation details.

About the average salary calculator

The average salary calculator will be useful for independent calculations, as well as for checking the accuracy of the calculations made by the accounting department. Calculation of wages based on average earnings may be required to calculate wages for the periods:

- suspension of the enterprise's activities;

- long downtime;

- the employee is on a business trip;

- downtime during a strike (letter of the Ministry of Finance of the Russian Federation No. 149KV dated January 23, 1996).

In addition, based on average earnings, severance benefits are calculated for employees upon their dismissal as a result of liquidation of an enterprise or reduction of staff.

For your information! Any event that entailed the need to use average indicators for calculating wages will be called the moment the right to maintain average earnings arises.

The calculator is not used to calculate payments and benefits for vacations, sick leave and periods of maternity leave. These payments, although made on the basis of average earnings, are actually calculated using a different methodology, which includes the calculation of payments that are not included in wages.

An employee resigns: we make the final payment

Let's look at an example. An employee of Atmosphere LLC, P. N. Semenov, got a job as a manager in the sales department on January 15, 2020. In September he was offered a higher-paying job, and on September 15 of this year he quit.

The accounting department made calculations in connection with his dismissal: calculated wages for days worked in September and compensation for unused vacation.

To reflect salary calculations, companies use the unified form T-49 “Payroll Sheet”.

And to calculate compensation for unused vacation, you should use form T-61 “Note-calculation upon termination (termination) of an employment contract with an employee (dismissal)”, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. If the employee used vacation in advance, then This form will calculate the amount of overpaid vacation pay.

An inspector of the personnel service takes part in filling out the T-61 form, who will indicate on the front side of the form information about the employee (full name, position), details of the dismissal order and make a note that the employee did not use all of his vacation ( or part of it) or took vacation in advance.

Legal regulation

All accounting operations, one way or another related to the calculation of average earnings, are regulated by the same Decree of the Government of the Russian Federation No. 922, as amended on December 10, 2016.

Thus, when calculating, all types of payments within the framework of remuneration are taken into account. Let us clarify what exactly labor is, since any allowances for food, travel, financial assistance of any kind, various compensations will be excluded from the total income received as a result of labor activity.

The calculation period is taken to be the last 12 months before the start of the period for the emergence of rights to average earnings.

The 12-month period excludes time periods during which the employee did not actually perform his job duties. Thus, the following times are subject to exclusion:

- confirmed disability of the employee;

- employee maternity leave;

- downtime of the enterprise due to the fault of the enterprise itself, or for reasons beyond its control, for example in the case of a strike in which the employee, although he did not take part, was not able to perform his labor functions;

- provided as additional days off to care for disabled children;

Accordingly, amounts received by employees during the above periods are also excluded from the calculation of average earnings.

How to count correctly on our calculator

Enter the initial data

Next Previous

Step 1. Last name First name Middle name of the employee

This item is optional. The full name is entered at your discretion - convenient if the calculation results need to be printed on a printer.

Step 2. Choose a tax rate

By default, we have set a rate of 13% for all residents of the Russian Federation. A rate of 30% applies to non-residents of the Russian Federation.

Step 3. Select a calculation option

- Direct calculation: enter the amount of income from which all employer and employee taxes are calculated. As a result, we get the amount of salary that the employee should receive in hand.

- Reverse calculation: if we have the amount that an employee should receive in hand, then we can calculate what salary should be accrued to him. At the same time, all taxes are also calculated.

Step 5. Enter the salary amount

Here you must indicate the salary amount, depending on which method is chosen: direct or reverse.

Step 6. Indicate the employee’s income since the beginning of the year

This point may affect the correctness of the calculation, since if income from the beginning of the year exceeds 350 thousand rubles, then standard tax deductions no longer apply, however, deductions that do not depend on the payroll apply.

Step 7. Specify deductions

According to the Labor Code, a citizen has the right to use standard child deductions:

- 1400 rubles for the first and second child.

- 3000 on the 3rd and subsequent ones.

- 12,000 rubles for disabled children and 6,000 rubles if the deduction is applied by the guardian parent.

In a separate column, you can indicate a deduction that does not depend on the payroll received by the employee since the beginning of the year.

Attention! To receive a child deduction, an employee must write an application. It is necessary to take into account that the standard deduction for a disabled child is also summed up (Letter of the Ministry of Finance dated March 20, 2017 No. 03-04-06/15803).

Step 8. Regional coefficient and northern surcharge

If a citizen works in the northern regions, then it is necessary to indicate the amount of the bonus in the top line, for example, 1.25. The default value is 1.

The regional coefficient as a percentage is also indicated. The default value is 0, for 25% percent in the column we simply indicate 25.

Attention! In the column below the coefficients, you must indicate bonuses that do not participate in their calculation, if there is such an accrual.

Step 9. We indicate the amount of deductions to the Social Insurance Fund for accidents

By default, we have a coefficient set to 0.2. But it can be installed separately for each employer.

Step 10. Calculation

Now you can do the following:

- Calculate the salary based on the entered initial data.

- Reset entered data for a new calculation.

- Print the result.

Attention!

In order to re-calculate on the calculator, you need to reset the data, otherwise the result may be incorrect. Next Previous

We get the calculation

The “Payroll calculation” field displays data on the employee’s salary before and after taxation, tax deductions, northern allowances, and personal income tax is highlighted at the rate specified in the source data.

Next, in the “Taxes paid by the employer” field, the amounts that the employer pays at his own expense to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund are displayed. At the same time, the calculator takes into account regressive rates in the Pension Fund and the Federal Compulsory Medical Insurance Fund, if the payroll is indicated from the beginning of the year.

The “Total amount of taxes” field displays the total amount of taxes that the employer must pay to the budget from his own funds to the Pension Fund, FFOMS, Social Insurance Fund and the National Tax Service, as well as as a personal income tax tax agent at the specified rate from the employee’s funds.

Accounting for bonuses

When calculating average earnings, bonuses and other types of additional remuneration are taken into account according to a special algorithm.

Thus, one bonus is taken into account for any one indicator for each month that is calculated. That is, if we assume that the employee received two additional remunerations in one month, but according to different indicators, for example, one for exceeding the plan, the other for an improvement proposal, then only one of them will be taken into account.

In the same way, the following are taken into account:

- bonuses and any other remuneration issued based on the results of two or more (up to 12) months;

- bonuses and other types of remuneration issued based on annual results within a calculated period of 12 months. The time of accrual of annual bonuses will not matter, the main thing is that the period for which the bonus was issued was included in the last 12 months;

- one-time payments for long service.

Filling out form T-61

THE FRONT SIDE MUST CONTAIN THE FOLLOWING INFORMATION:

— Name of the organization, OKPO code

— Number and date of document preparation

— Number of the employment contract and the date of its conclusion with the employee

— Full name, position, personnel number of the employee and the name of the structural unit in which he works (if any)

— Data on dismissal: date of termination of the employment contract, grounds for dismissal (article of the Labor Code of the Russian Federation), number and date of the order

— The number of days of unused vacation, as well as, if necessary, the number of days on vacation in advance (in this case, the amount for “extra” vacation days will be deducted from the calculations)

— Signature of the HR department employee and date of filling out the document

Column 1. Year of the billing period.

Column 2. We indicate 12 calendar months before the date of dismissal

Column 3. The total amount of payments to the employee for each month of the billing period is recorded. If in any month the salary was increased or any allowances were made, then this is all taken into account in the indicated amount.

Column 4. The number of calendar days in the billing period (per year) is indicated. The number of calendar days in each month is taken to be a conditional number - 29.3 days, provided that the month has been fully worked out. If a month is not fully worked, calendar days are calculated using the formula: (29.3 days / Number of calendar days in a month) * Number of days worked

Column 5. To be filled in if summarized working time recording is established for the employee.

Column 6. The amount of average daily earnings is indicated. Calculated using the formula: Amount of accruals (line “Total” in column 3) / Number of calendar days (column 4 or 5)

Column 7. Number of vacation days used in advance.

Column 8. Number of unused vacation days.

Column 9. Amount of payments for unused vacation days. Calculated using the formula: (Column 8 – Column 7) * Column 6

TABLE “Calculation of payments”

Column 10. Amount of accrued salary.

Column 11. Amount of vacation pay (take the value from column 9).

Column 12. Other charges.

No salary

If the employee does not have any payments during the calculation period (12 months) or for a time period exceeding this period, the accounting department must take the employee’s monthly salaries for the previous period as a basis. Thus, if from June 1, 2017 to June 1. In 2021, the employee did not receive a salary or did not work at all, then the time period from June 1, 2016 to June 1, 2016 will be taken as the calculation period. 2021.

If the employee did not have payments before the start of the pay period, then the accounting department will take as a basis the salary in the month from which the employee became entitled to maintain the average salary.

In the case where payments did not take place and during the period of occurrence of the case giving the right to maintain the average monthly earnings, the calculation will be carried out based on the salary assigned to the employee.

Part 2. Calculation of vacation pay

This section is completed by an employee of the accounting department .

To calculate compensation for unspent vacation days, you must enter the necessary information in all columns of this section according to the algorithm below.

Next comes the column number in numbers and a description for it.

- — the year is entered here (necessary for calculating the average monthly salary of an employee);

- — months are indicated here (before the date of dismissal);

- — here you need to write the employee’s income for each of the months taken into account;

- — the number of days (according to the calendar) in the period taken as the calculation period;

- — is issued only for hourly wages of the employee;

- — the calculated amount of the average daily wage is indicated here;

- — the number of vacation days that were taken in advance;

- — unspent vacation days;

- - the final amount of money due to be paid to the employee for the specified number of unused vacation days. The calculation is made as follows: (from the data in column 8 you need to subtract the data in column 7) multiply the result by the data from column 6.

Calculations in case of salary increase

The calculation of the average salary in the event of a salary increase carried out by the employer or as a result of the adoption of framework legislation will be carried out taking into account exactly when the salary increase took place.

- If the salary was increased during the pay period, then the average monthly salary will be calculated taking into account the increasing coefficient, calculated according to the scheme: the official salary in the month of the increase is divided by the official salary before the increase. The difference will be the coefficient, the calculation of which is included in the calculator system.

- If the salary was increased after the end of the billing period, but before the occurrence of an event giving the right to maintain the average monthly salary, then the average earnings for the billing period will be increased.

- If the salary was increased after the occurrence of an event giving the right to maintain the average salary, then the average salary will be increased from the day the salary was increased until the day the right to maintain the average salary ends.

The very fact of a salary increase will entail an increase not only in official salaries, but also in other types of remuneration directly resulting from the size of the salary.