What does the law say: is sick leave paid on vacation without pay?

If you have a valid reason, you can go on leave without pay.

To do this, you should write an application addressed to the manager. The possible duration of such a break in work is discussed in Art. 128 Labor Code of the Russian Federation. But if the unexpected happens and the employee gets sick during this period, then sick leave on vacation at his own expense is not payable. According to Art. 9 of the Law “On Mandatory Social Insurance...” dated December 29, 2006 No. 255-FZ, days of unpaid leave are not included in the days for payment of sickness benefits. And this is understandable: when an employee does not receive income, then insurance premiums do not accrue, and therefore there is no reason to pay for sick leave on vacation at his own expense.

Clause 22 of the Procedure for issuing certificates of incapacity for work states that the certificate must be issued from the day of the planned return to work. However, the employee does not always know about this, and the doctor often forgets to ask. If the leave at his own expense has ended and the sick leave has not been closed, then the employee has the right to benefits for those days when he was supposed to go to work.

How an insurance agent should fill out a ballot, read the article “An example of filling out a sick leave certificate by an employer.”

ConsultantPlus experts explained what to do if an employee brought sick leave for vacation days. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Answers to common questions

What is the difference between paying sick leave during a vacation at your own expense and a regular vacation?

The most important difference is that on personal leave, sick leave is paid only from the moment it ends, but on annual leave, firstly, it is paid in full based on length of service, and secondly, the employee’s leave is extended for the period of incapacity. If an employee’s child falls ill while on vacation, and a certificate of incapacity for work is issued for him, such leave is not extended; this is possible only if the employee himself is ill.

What common mistakes occur when filing sick leave?

The most common mistake is incorrect indication of the organization where the employee is employed, as well as incorrect coding of the disease for which the sheet was issued. If a duplicate is provided, this must also be noted.

An example of sick pay on vacation without pay

Employee Yakovlev S.A. went on leave at his own expense for 3 days - from June 18 to 20 - due to the birth of a child, but fell ill on the third day and, according to the sick leave issued, was ill for 7 days - from June 20 to 26. On June 27, he went to work and brought a certificate of incapacity for work to the accounting department.

In this situation, benefits will be accrued for 6 days - from June 21 to June 26. For the first three days of illness accepted for payment, money will be paid from the company’s funds, for the remaining days - from the Social Insurance Fund (Article 6 of the Law “On Amendments...” dated December 29, 2020 No. 478-FZ, Decree of the Government of the Russian Federation dated December 30. 2020 No. 2375).

ATTENTION! The procedure for calculating temporary disability benefits, which was established for the period from April 1 to December 31, 2021 inclusive, has become permanent. Now the amount of sick leave, calculated as if the employee had been ill for a month, must always be compared with the minimum wage. Let us remind you that if the benefit turns out to be less, its amount will be calculated based on the minimum wage (2 Article 4, Part 4 Article 8 of the Law “On the Peculiarities of Calculating Benefits...” dated 04/01/2020 No. 104-FZ). Please note that in 2021 the minimum wage is 12,792 rubles.

Vacation at your own expense: definition of the concept

Leave at your own expense is not paid, but gives the employee a guarantee of maintaining his job. Unlike paid rest, time off without pay is issued at the request of the employee. The time is negotiated separately with the manager.

It is provided after obtaining the employer’s consent strictly for valid reasons. In some organizations, conditions for recreation at one’s own expense are described in the collective agreement. Such vacations are sometimes paid if they last no more than the number of days established by local regulations.

To take time off without pay, you will need to submit an application indicating the days and reasons for absence. Then go to your boss or director, get approval and signature. If an employee decides to leave early and begin his duties, by decision of management, an order is issued to change the validity period of the application.

It is important to know! There are exceptions when an employer cannot refuse to provide time off. Such special occasions include the day of marriage, the birth of a son or daughter, or the death of relatives. Sometimes the collective agreement includes employee anniversaries among such reasons.

Results

The law does not provide for payment for ballots issued for the days an employee is on unpaid leave. In addition, such a break in work cannot be postponed or extended due to illness. Not only HR managers, but also employees should know about this.

Read about what to do if an employee has presented a fake sick leave in this material.

Sources:

- Labor Code of the Russian Federation

- Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it possible to get sick leave if you get sick during study leave?

Unfortunately no. The employer will not pay for days of incapacity for work falling during the period of study leave (clause 1, part 1, article 9 of Law No. 255-FZ). The fact is that an employee’s illness during study leave does not lead to loss of earnings, that is, an insured event does not occur. The employee's days of incapacity for work before and after study leave must be paid as usual.

Study leave is paid during sick leave in the usual manner: in the amount of average earnings.

Annual paid leave: extend or postpone

Annual paid leave must be extended or postponed to another period determined by the employer taking into account the wishes of the employee, in the event of temporary disability of the employee (according to Article 124 of the Labor Code of the Russian Federation).

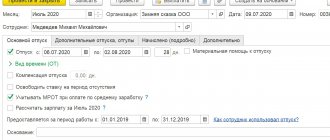

| Situation: According to the vacation schedule, an employee is entitled to a vacation of 10 days. He went on vacation, but a day later he fell ill and was on sick leave for 7 days. This means that the employee either leaves vacation 7 days later than originally expected, or leaves on time, but still has 7 days of vacation left. An employee can go to work exactly when, according to the order for granting leave, his leave should have ended. In this case, the working time sheet will contain the code “OT” (annual leave) not for 10 days, but only for 3 days. And in 7 days - code “B” (temporary disability). During these days he will receive disability benefits. |

The period for which the vacation will be postponed (the remaining part of the vacation) is determined by the employer, taking into account the wishes of the employee expressed in the application (Part 1 of Article 124 of the Labor Code of the Russian Federation). Accordingly, the employer is obliged to postpone the vacation at the request of the employee. But the transfer date is determined not only based on the wishes of the employee, but also taking into account the capabilities of the employer. After the employee and employer agree on the date of the new vacation, it is necessary to issue an order to postpone the vacation. And based on the order, make changes to the vacation schedule.

| Important! What should an accountant do with vacation pay? For example, in the situation discussed above, vacation pay was paid for 10 days, but in fact 3 days of vacation were used. Is it possible to deduct vacation pay from an employee for unused vacation days? Article 137 of the Labor Code clearly states cases when certain amounts can be withheld from an employee’s salary. This list is exhaustive and is not subject to broad interpretation. The current situation is not on this list. This means that vacation pay for 7 days cannot be withheld from the employee. |

Despite the fact that the mechanism for such recalculation is not specified directly in the Labor Code of the Russian Federation, it is necessary to do so. After all, vacation pay accruing during the period of vacation actually not used due to illness is, in fact, no longer the average earnings saved for vacation days. For the days that the employee was ill, his lost earnings are compensated by paying temporary disability benefits. In practice, they do this: accountants recalculate and spend vacation pay for sick days as an advance to the employee towards his salary, which he will begin to earn after returning from vacation. And such actions are legal, the prohibition of the Labor Code of the Russian Federation on withholding is observed - no amounts are withheld from the employee. When the employee goes on vacation, it will be necessary to issue a new vacation order and accrue vacation pay to him again, calculating the average earnings.

| Important! But if an employee is delayed in returning to work for exactly the same number of days as the sick leave was issued for, it means that he decided to extend his vacation. And he should not write any applications to extend his vacation. There is no need to draw up an order to extend vacation or make changes to the vacation schedule. The only document that the employee must provide and which obliges the employer to extend the leave is a certificate of temporary incapacity for work. In such a situation, there is no need to recalculate vacation pay. The employee must be paid sickness benefits (Clause 1, Article 15 of Law No. 255-FZ of December 29, 2006). |

| Situation: In practice, employees determine the date of return from vacation in case of illness independently, counting the number of days of incapacity from the last day of vacation. However, the number of sick days and the number of vacation days that an employee has taken is not always the same. For example, if a non-working holiday falls during the period of illness, there is no need to extend vacation for it - it no longer falls within the vacation period, but is excluded from it along with days of illness (Part 1 of Article 120 of the Labor Code of the Russian Federation). Or the number of sick days may be greater than the number of vacation days not used because of it. Vacation is extended specifically for vacation days not used due to illness, and not for sick days. |

If an employee falls ill before the start of the vacation and does not have time to recover by the time it begins, the vacation must be rescheduled for another date.

Additional Information

If a citizen has taken leave at his own expense from his main job, but is employed part-time in another, then the sick leave will be fully paid for him in the additional position.

Read useful information about the rules for issuing sick leave, as well as the registration procedure and issuance deadlines, in our new article.

When a mother is on maternity leave to care for a child under 3 years of age, she is not entitled to pay for sick days. But if she is studying and has left for the exam, and the child is accompanied by a father or grandmother who works, then in this case the issued sick leave should be paid on a general basis as for caring for a sick child.

While on administrative leave, you should know that sick leave taken during this time cannot be paid according to the law. This is explained by the fact that during this time there are no contributions to the Social Insurance Fund for this employee. You can only try to re-issue the application with the permission of the employer, adjusting it for sick days.

Sick leave for caring (during vacation) for sick family members is not paid to the employee

The accountant must remember that sick leave due during vacation is paid to the employee only if temporary disability* occurs personally.

*Due to illness or injury.

The specifics of the procedure for issuing certificates of incapacity for caring for a sick family member are also established by Order of the Ministry of Health and Social Development No. 624n, which approves the Procedure for issuing certificates of incapacity for work.

According to clause 40 of the Procedure for issuing certificates of incapacity for work, certificates of incapacity for work are not issued for care:

- for a sick family member over 15 years of age during inpatient treatment;

- for chronic patients during remission;

- during the period of annual paid leave and unpaid leave;

- during maternity leave;

- during the period of parental leave until the child reaches the age of 3 years, with the exception of cases of work performed during the specified period on a part-time basis or at home.

At the same time, according to clause 41 of the Procedure, if a child falls ill during a period when the mother (another family member providing care) does not need to be released from work*, sick leave to care for the child (in the case when he continues to need care) is issued from the day the mother must start work.

*Annual paid leave, maternity leave, parental leave until the child reaches the age of 3 years, leave without pay.

However, a representative of a medical institution may not know that the person to whom he is issuing sick leave to care for a child or other family member is on paid leave.

Accordingly, an employee can bring to the accounting department sick leave for child care, the dates of which fall during his vacation.

Such sick leave is paid only for those days that do not fall on paid vacation dates.

In addition, in this case, the provisions of the Labor Code of the Russian Federation do not provide for the transfer or extension of leave due to the employee caring for sick family members.

Indeed, according to the provisions of Article 124 of the Labor Code of the Russian Federation, annual paid leave must be extended or transferred to another period determined by the employer taking into account the wishes of the employee, in the event of temporary disability of the employee.

However, as noted in his Letter dated 06/01/2012. No. PG/4629-6-1 Rostrud, an employee’s vacation can be extended or postponed if this is provided for in the employment contract or other internal company documents:

“In accordance with Art. 124 of the Labor Code of the Russian Federation, annual paid leave must be extended in the event of temporary disability of the employee.

It follows from the above norm that the employer has an obligation to extend leave by the number of calendar days of incapacity, if temporary incapacity occurred during the period of annual paid leave, only in the event of temporary incapacity for work of the employee himself.

Thus, the illness of a child or another family member, in accordance with Art. 124 of the Labor Code of the Russian Federation, is not an automatic basis for extending annual paid leave, despite the presence of a certificate of incapacity for work issued to the employee.

In accordance with paragraph. 4 hours 1 tbsp. 124 of the Code, annual paid leave must be extended in other cases provided for by labor legislation and local regulations.

Thus, such a case as the illness of a family member may be provided for in a local regulatory act adopted by the employer in the prescribed manner as a basis for extending annual paid leave.”

According to the materials of the Decision of the Supreme Court of the Russian Federation dated December 3, 2012 No. AKPI12-1459:

“By virtue of paragraph two of part one of Article 124 of the Labor Code of the Russian Federation, annual paid leave must be extended or transferred to another period determined by the employer taking into account the wishes of the employee, in the event of temporary disability of the employee.

Within the meaning of the above norm, the federal legislator, regulating labor relations, by temporary disability of an employee during the period of annual paid leave means the disability of only the employee himself and protects his right to rest, allowing the extension of annual paid leave for the time when he was incapacitated due to illness in specified period."

Vacation pay

If a person gets sick or injured while on vacation, it is important to know whether he will be paid sick leave or not. First of all, it depends on what kind of vacation the sick employee was on.

Sick leave received during any annual leave must be paid according to the law. The first 3 days are compensated by the employer himself, all subsequent days are compensated from the Social Insurance Fund, to which monthly deductions are made from the accrued amount of earnings of each employee (2.9%). The amount of payment for sick days is determined by the average salary calculated for the last 2 years of work (Government Decree No. 375 of June 15, 2007). If the length of service is insignificant (less than 5 years), then 60% of this earnings will be accrued for days of incapacity for work. If the duration of work is from 5 to 8 years, 80% is paid. Only if the employee has been on the staff of the enterprise for more than 8 years, the accounting department calculates the amount on the certificate of incapacity for work in the amount of 100% of the average payment.

Important! All vacation days that coincide with an officially registered illness must be taken into account.

If a person gets sick while on vacation, sick leave must be paid

There are 2 options:

- The employee continues to complete his deadline without drawing up any additional papers.

- An employee, having decided to go to work earlier than expected, draws up a statement in which he indicates the number of days remaining from this vacation. Subsequently, they should be provided to him so that he can continue his interrupted vacation.

Vacation at your own expense

The situation is completely different with sick leave received during days taken at one’s own expense. According to Federal Law No. 255 of December 29, 2006, Article 9, Clause 1.1, it is impossible to receive payment based on a document issued by a medical worker evidencing a disease. This position has its own explanation. A sick person, while on unpaid leave, does not bring any income to his enterprise during these days. Consequently, there are no contributions to the Social Insurance Fund, from which sick leave is paid, for a specific person. This means that the employee cannot count on paid sick leave. In addition, such a document should not be issued while the employee is on administrative leave. Typically, sick leave is issued due to the patient’s ignorance of the laws. There is no particular problem in this. An illness document should only be issued from the time the employee is due to start work.

If a person is on unpaid leave, then sick leave will not be paid

It is possible to solve the problem of paying for such sick leave. Since the leave without pay was issued in agreement with the administration, you can try to resolve the issue of revising the received number of days to less, that is, before the start of the date of issuance of the certificate of incapacity for work. You should write an application for termination of previously received administrative leave. The employer has no right to interfere with such a decision.

In a situation where sick leave was started during vacation, but the employee did not have time to recover before its end, the days after the vacation taken at his own expense must be paid in accordance with the rules established by law.

Example: An employee took 5 days leave without pay for the funeral of a loved one from July 5 to July 9, but from July 7 he fell ill. According to the rules, sick leave can be issued only from July 10, but even if the document is provided at the clinic from July 7, the company’s accounting department will make payment only from the end of such leave.

Not only during administrative leave, sick time is not counted. The reasons for refusal to pay for sick leave may be the following, presented in the table.

| Reasons for refusal to pay sick leave | |

| Child's illness | The employee was on annual leave |

| Disability due to the fault of the employee himself | The employee was drunk or under the influence of drugs |

| When suspended from work | Downtime due to the fault of the employee, refusal to undergo a medical examination |

What happens if the company pays for sick leave?

If the employer pays for sick leave during an employee’s vacation at his own expense, such expenses will not be accepted by the Social Insurance Fund. These payments are made at the expense of the employer and on his personal initiative.

If temporary disability benefits are erroneously accrued and then not accepted by the Social Insurance Fund as expenses, you need to do the following:

- if possible, withhold from the employee the amount of excess sick leave payments and adjust the personal income tax previously withheld from sick leave;

- if it is not possible to withhold payments from the employee, attribute the overpaid amounts to the organization’s expenses, and also charge insurance premiums from these payments and transfer them to the budget.