Legislative regulation

The specifics of financial obligations between an employee and an employer in Russia are formed by state laws. Let's consider a few main sources that you should focus on:

- Art. 136 Labor Code of the Russian Federation. The main regulatory act regulating the procedure, timing and place of payment of salaries to employees.

- Art. 372 Labor Code of the Russian Federation. Determines the procedure by which the entrepreneur, together with the trade union or other representative body of employees, establishes the form of the pay slip at the enterprise.

- Art. 145 of the Criminal Code of the Russian Federation. Provides for the imposition of a large fine on an organization in a situation where salaries to the staff are delayed for more than 2 months in a row.

- Art. 72 Labor Code of the Russian Federation. Regulates the accrual and issuance of funds to an employee when he performs his job duties outside his permanent workplace due to a business trip or transfer.

- Art. 178 Labor Code of the Russian Federation. Mandates the issuance of severance pay to an employee upon termination of employment. The amount of payments varies depending on the circumstances under which the employment contract was terminated.

- Art. 80 Labor Code of the Russian Federation. Regulates the right of an employee who has notified management of the fact of his dismissal two weeks in advance with a corresponding statement, to demand payment on the day of departure, even if the employer has not issued a work book or issued the required order.

Timing and procedure – how many times a month?

The deadlines for providing wages to employees are fixed in accordance with the Labor Code. On October 3, 2021, amendments to Art. 136 Labor Code of the Russian Federation.

According to these amendments, companies are required to issue earned funds to employees until the 15th day of the next pay period, inclusive.

However, the feature of paying funds at least 2 times a month has been preserved. Consequently, funds must be transferred to the employee’s account or issued to him through the organization’s cash desk with a gap not exceeding 15 days.

For this reason, employers should be extremely careful and pay the money correctly. If you transfer your salary to the staff strictly on the 15th day , then the advance will be due on the 30th day of the paid month.

In months that include 31 days, there will be no problems with issuing money. But if 30 is the last day of the month, or it’s February and there is no such date, by law the employer will have to deduct personal income tax from the advance .

According to the rules, tax is not withheld from the advance payment paid in the month for which it is accrued. Therefore, if personal income tax is withheld from both the advance payment and the main salary payment, the company increases the risk of problems with the tax service.

The days no later than which the management of the organization undertakes to pay wages to employees are indicated in a special administrative document - an order on the timing of payment of funds.

In accordance with the Labor Code of the Russian Federation, the break between these dates should not be more than half of a calendar month.

Each organization must have a document regulating the establishment of deadlines for the payment of salaries. All company employees should be familiar with it.

If payments are delayed, employees have the right to contact the prosecutor's office or labor inspectorate , and if the delay is more than 2 weeks, not go to the workplace until they receive the funds, if they have previously notified their management through a written statement.

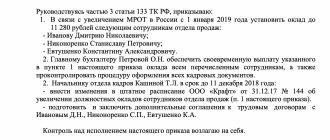

Example of an order.

___Company name___

Order No____ _______________ “__” ___________ 20___

About the timing of payment of wages in 20___

In accordance with Art. 136 of the Labor Code of the Russian Federation I ORDER:

Set the following deadlines for the payment of wages: the 25th of the current month - the deadline for the payment of wages for the first half of the month (advance); The 10th day of the month following the billing month is the deadline for issuing wages for the second half of the month.

Head of the organization: ____________________________ Full name

What nuances need to be taken into account when leaving? According to Article 140 of the Labor Code of the Russian Federation, funds to an employee upon termination of an employment agreement must be paid as follows: when the working day is the day of dismissal, earnings must be paid on the same day .

When leaving a job falls on a non-working day, the funds earned are transferred the next day after dismissal.

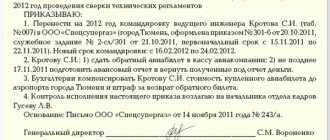

Deadlines for issuing salaries: order to change the date

» Directory » Doing business » Forms and documents

According to the laws established today, payment for the work of personnel is carried out twice a month, with an interval of two weeks. The internal documentation of the enterprise indicates the date when the payment was made.

Quite often, the administration of the enterprise uses special orders that set deadlines for payment of wages. Below, we propose to consider the rules for drawing up such documents, and we will tell you how to set a new payment deadline.

The commented law provided for changes to Article 136 of the Labor Code of the Russian Federation

Previously, the Labor Code of the Russian Federation did not consider the timing of payment of wages. However, in two thousand and sixteen, this provision was revised.

According to the decree of October 3, salary payment must be made by the fifteenth day of each month. In this regard, many organizations where payment of wages is carried out later must draw up a report on changes in payment terms.

The order on the timing of payment of wages in accordance with the established procedure must contain the exact date of payment.

Let's look at what else this document should contain:

- name and details of the enterprise;

- date of writing the document;

- place where the document was written;

- type of form;

- table of contents.

The completed order must be certified by the signature of the head of the enterprise and a seal.

According to the new resolution, documents such as the Regulations on Remuneration, the employment contract and internal regulations must indicate specific deadlines for issuing payment.

If this documentation does not contain a clearly established framework, then the above documents need to be completely redone.

To summarize all of the above, we can say that today, when drawing up an order for calculating wages, you should indicate a specific date, and not an approximate period, as was previously allowed.

Important! If there is a need to change the deadline for issuing a salary, the enterprise administration must notify each employee. Such notices will be provided in writing. It should also be taken into account that such documents are drawn up in advance (at least two months from the date of payment).

"Closed Joint Stock Company "Pyramid" INN 0000000000

Marketing department employee D.B. Potapov

Notification

on amendments to the employment agreement

JSC "Pyramid" brings to your attention that according to the current rules of legislation, based on changes dated October 3, 2016 under Article No. 136 of the Labor Code, the data of the employment agreement (dated March 23, 2021 No. 90-Employment Agreement) has been corrected. From October 1, 2021 of the year, clause 6.4 of the Employment contract shall be explained in the following wording: “The advance payment is issued on the 21st of the current month. Payments are made on the 7th day of the month following the previous one.”

Chief: I.T. MikhailovIntroduced to: D.B. Potapov."

In each organization this date is determined individually

According to article of law No. 136 of the Labor Code, the administration of the enterprise is obliged to enter into an additional agreement with the staff if the timing of payment of wages does not meet the requirements in the above article. If there is a collective document, such changes are formalized in one act.

In the case of individual contracts, it is necessary to prepare additional agreements for each employee. In the event that a company employee refuses to sign the above act, the administration has the right to dismiss the employee.

This rule is spelled out in the seventy-fourth and one hundred and seventy-eighth articles of the Employment Agreement.

“Additional consent No. 6k to the labor agreement dated May 15, 2007 No. 26

On amendments to the employment agreement, according to the new law of the Labor Code

Voronezh November 20, 2016

In accordance with the requirements specified in Article No. 136 of the Labor Code, the parties agreed on changes to the clauses of the labor agreement in order to bring them into line with the amendments, namely to clarify clause No. 5.7 as follows:

- Other terms of the previously concluded employment agreement remain unchanged.

- This agreement comes into force on October 1, 2016.

- This document was drawn up in several copies for each party.

- Each copy has equal legal force.

Set the following dates for payment of wages:

- for the first half of the month worked – the sixteenth day of the current month;

- for the second half of the month worked - the first day of the month following the current one.”

The details of each party must be specified below, and the completed document must be certified by the seal of the organization. It should also be noted that with a fixed period for salary payment in the collective agreement, this procedure has a number of its own features.

When making amendments to a collective agreement, a special commission must be created, consisting of representatives of the personnel and management of the enterprise. At the meeting, details and details of the future agreement are discussed.

Only after such a meeting is held, the act itself is drawn up, in which various amendments are indicated.

The legislation clearly states that every employee must receive a salary at least twice a month

The initial task of the accounting department employees is to check current standards for compliance with the new requirements set out in the amendments to the Labor Code. If the current documentation complies with the established form, then no additional changes are required.

If inconsistencies are discovered, an appropriate order should be prepared, where new dates will be prescribed. When setting new payroll dates, the wishes of the staff should be taken into account. If there is a trade union company in the organization, it is necessary to obtain its consent.

In most cases, the management of the enterprise tries to issue salaries on the first days of the month.

Due to changes in the law, many organizations are wondering whether it is possible to issue wages earlier than the deadline. This approach is often practiced and is not considered illegal.

This situation does not imply the imposition of penalties on the management of the company. Once the deadline for issuing wages has been agreed upon, an order must be prepared.

"Closed Joint Stock Company "Zima"Order No. 231

September 09, 2021 Omsk

About making edits

To bring changes and amendments into conformity with the standards specified in Article No. 136 of the Labor Code

Introduce the necessary amendments to the order of Zima CJSC dated June 21, 2015 No. 5 “On labor regulations”, setting out paragraph 4.9 as follows: The amendments made will take effect from October 1, 2021.

To the head of the accounting department - chief accountant Valieva T.V. make payments for work within the period specified below.

Employees of Zima CJSC are paid for their labor activities twice a month:

- For the first part of the month – the nineteenth day of the current month;

- For the second part of the month - the fourth day of the month following the current one.

Head: Tarasov P.D.”

If the company has a large staff, it is necessary to attach an employee familiarization sheet to this order.

We invite you to familiarize yourself with: Debt on penalties to the tax office

If the employer has the desire, he can pay his subordinates at least every day at the end of the shift

Changing the deadlines for payment of wages without notification, as well as failure to pay on time, is a crime. In this situation, such violations may entail administrative or criminal liability.

In case of violation, the organization must provide financial compensation to the employee. The amount of compensation previously amounted to one three hundredth of the refinancing rate.

Today, this amount is one hundred and fiftieth of the key rate.

The resulting number should be multiplied by the amount of wages. The result obtained is the amount of compensation per day of delay. Compensation to an employee for violation of payment terms for work activities may exceed the given figures if this nuance was specified in advance in the employment contract. In this case, the reason for the delay in financial payment is not taken into account.

Amendments to the current Legislation have significantly increased the amount of additional financial compensation to an employee. In case of systematic violations by the enterprise administration, high financial penalties are provided. These circumstances are discussed in detail in the Labor Code.

For the first delay in payment of finances, the amount of the fine in relation to individual entrepreneurs and organizations ranges from 1,000 to 5,000 rubles, and from 30,000 to 50,000 rubles, respectively. Otherwise, the tax authorities have the right to stop the company’s activities for three months.

It should also be noted that such responsibility rests with the official. If there are violations, the amount of penalties ranges from 10,000 to 20,000 rubles.

In addition, a warning is issued to the official. In case of repeated non-compliance with the rules, the fine varies from 20,000 to 30,000 rubles.

In addition, tax authorities may issue a ban on holding a position for a period of three years.

Salaries cannot be paid less than twice a month.

The current law of the Labor Code also provides for situations where delays in issuing wages to employees entail serious consequences.

Is it possible to pay before the due date?

In contrast to delays in the provision of wages, transferring funds to a bank account or issuing cash at the cash desk earlier than the regulated period is not punishable by law. This fact takes into account the linking of transactions for transferring funds to employee cards to banking days.

For this reason, banks transfer salaries to company employees not on Saturday or Sunday, but on Friday, since the last two days of the week are not banking days.

And if the payment is made on Monday, it will be possible to talk about a delay, which will mean additional expenses for employers.

Also, an employee can receive a salary ahead of schedule

- when going on vacation;

- under special circumstances in the life of the employee himself;

- ahead of the long holiday period;

- before a long business trip.

Registration of changes in deadlines

Company management may indicate the dates for the provision of salaries in the following documents:

- Employment contract.

- Collective agreement.

- Rules of routine.

- Regulations on payment of wages.

Download a sample Salary Regulations here for free.

If the dates were fixed in the first document, adjustment of the conditions in this paragraph is only available with the consent of both parties . It will not be possible to change payment dates without the employee’s consent.

In the case where the terms are stipulated by the collective agreement, management will need to make an entry in this document about the change in payment dates .

The most common and convenient method is to fix deadlines in local acts of the organization, for example, routine rules. In isolated cases, the employer can calmly indicate new terms for its payment with an appropriate order for early payment of wages. Then you will need to notify each employee against signature.

Material liability

The Labor Code establishes financial liability for delays in payments under employment contracts.

Firstly, for delays in payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer is obliged to pay him interest (monetary compensation). Interest is paid for each day of delay, starting from the next day after the due date for payment until the day of actual settlement, inclusive.

In case of incomplete payment of wages or other payments on time, the amount of interest is calculated from the amounts actually not paid on time. This follows from the provisions of Article 236 of the Labor Code of the Russian Federation.

The employer bears its financial responsibility if the terms of payment of amounts due to the employee under the employment contract are violated.

note

The company is not liable under Article 236 of the Labor Code of the Russian Federation for delays in paying a former employee wages awarded by the court. This rule applies only within the framework of labor relations (determination of the Supreme Court of the Russian Federation dated September 30, 2021 No. 58-KG19-5).

Secondly, an employer who has delayed payment of wages is obliged to compensate for damage caused to employees in connection with the performance of their labor duties, as well as to compensate for moral damage in the manner established by labor legislation (Article 22 of the Labor Code of the Russian Federation). The amount of compensation can be determined by the parties, and if no agreement is reached, by the court.

note

These two payments are compensatory and are not subject to personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation).

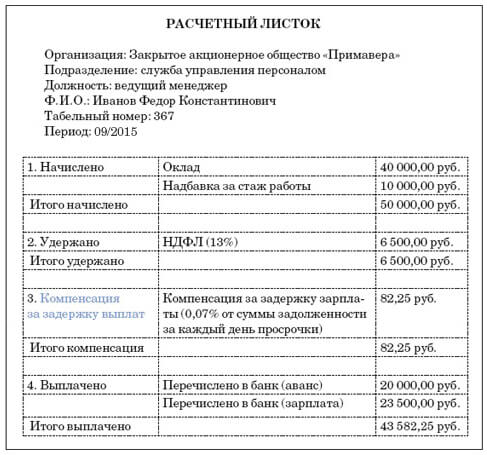

Calculation and methods of salary payment

We remind you that salaries are issued only personally to the employee within the previously specified time frame.

You should not forget to attach a reporting document to payments - a payslip, which is also issued personally to the employee by the responsible employee. The payslip must indicate all components of wages, including salary, vacation pay, bonuses or fines, etc.

In the Russian Federation, salaries must be paid in rubles.

But in some cases it can be issued in the form of a natural product. This can only be done with the permission of the employee . This may require a separate agreement.

The number of natural forms with which you can pay an employee cannot include:

- alcohol;

- weapon;

- ammunition;

- other toxic or chemical substances.

Despite this assumption, no more than 20% of the total salary can be paid in natural products.

It is important to remember that the company should not have any debt obligations to the employee on the day of issuing the funds due to him. It is prohibited to use promissory notes, bonds, coupons and other forms of similar documentation as a method of payment.

Salaries are currently paid not only through banks, but also “the old fashioned way” through a cash register. To receive his earned funds, the employee will need to go to the company’s cash desk, where he will be told the amount of money and will be counted in his presence.

In front of the cashier, you can, if necessary, count the money received, after which you will need to sign the receipt receipt . The employer will need to withdraw the corresponding amount from the company's current account.

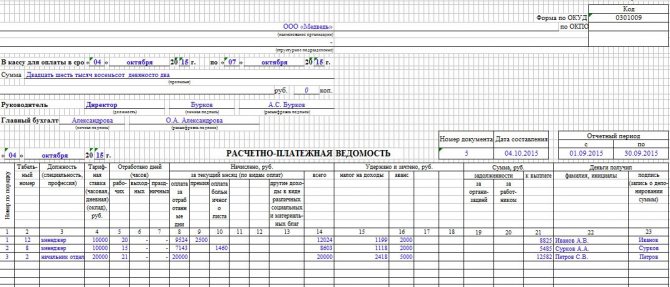

(The picture is clickable, click to enlarge)

As for transferring salaries to bank cards, the most common system is concluding special agreements with credit institutions to serve employees of the organization and issue them cards from this bank. To do this, a certificate is sent to the bank about the terms of payment of wages in this enterprise.

A sample certificate of salary payment deadlines can be found here.

If an employee wishes to receive funds on a card from another bank, he will need to write a special application . In this case, when making a transfer to another bank, the employer will need to pay a commission, since he does not have the right to issue less funds than is fixed in the employment contract.

Read our article on how to apply for a salary transfer to a bank card.

Order to change the terms of payment of wages

An order on wages - a sample of it may be needed to establish or correct the timing of wage payments. You will learn everything about how to issue such orders and what the consequences are if the dates for issuing salaries are not recorded in your local documents in our article.

Labor Code of the Russian Federation on the timing of salary payments

Sample order on the timing of payment of wages

What to do if the deadlines for paying salaries are not fixed anywhere?

Notification of changes in salary payment deadlines The Labor Code of the Russian Federation does not establish deadlines for familiarizing existing employees with newly adopted or amended local regulations. In Art.

22 of the Labor Code of the Russian Federation only states that the employer is obliged to familiarize employees, upon signature, with the adopted local regulations directly related to their work activities.

By virtue of this norm, the employee must also be familiarized with changes in local regulations against signature. Consequently, employees should only be familiarized with the new edition of the internal labor regulations and regulations on remuneration against signature.

Thus, the legislation does not provide for the obligation to notify employees about these changes at least two months before the date of such changes or for any other period.

The procedure for making changes to the PVTR The procedure is quite simple:

- An order to amend the PVTR is generated.

- If there is a trade union body, it is required to obtain its opinion.

- Each employee gets acquainted with the changes against signature (they can be placed in the Rules themselves on a separate sheet, in the attached fact sheets to the Rules or in a special journal).

Collective Agreement The following steps are followed:

- A commission of company representatives and employees is assembled;

- Negotiations are held during which the dates for issuing salary money are agreed upon;

- An additional agreement to amend the collective agreement is formed based on the results of negotiations;

- The additional agreement is signed by representatives of the two parties.

Employment contract The procedure is complicated by the fact that you need to work with each employee separately.

This document is drawn up in any form. Order on the timing of payment of wages: sample 2021 The employer is obliged to notify the employee of his intention to make changes to the current contract in terms of the timing of payment of wages, based on the entry into force of amendments to the current legislation.

Notification of changes in payment terms Example of a notification of changes in salary payment terms Notification of changes to the current employment contract must be sent to the employee at least two months prior to the changes themselves.

In the notification, the manager indicates his intention to make clarifications to the employment contract, based on the adopted amendments to the law. Formation of deadlines for payment of wages The document is certified by the signature of the head and the seal of the institution.

In particular, this applies to changes in the employment contract for reasons related to: Changes in organizational or technological working conditions Changes in the employment contract for reasons related to changes in organizational or technological working conditions include, for example:

- changes in equipment and production technology (for example, the introduction of new equipment, which led to a reduction in the employee’s workload);

- structural reorganization of production (for example, exclusion of any stage of the production process);

- other changes in organizational or technological working conditions that led to a reduction in the employee’s workload.

Order on the timing of payment of wages It is not allowed to set a period of several days as payment deadlines, for example, from the 21st to the 24th of the current month for the first 15 days.

In Russian labor legislation, great attention is paid not only to the correct calculation of wages to employees, but also to the timeliness of their issuance.

To do this, the accounting department of each enterprise must pay its employees earned money on predetermined days. This is required by the Labor Code in force in our country.

Based on his articles, the management of the enterprise usually issues an “Order on the timing of payment of wages.” The sample and rules for its preparation should not contradict the labor laws that are currently in force throughout Russia. How to draw up a document Art.

136 of the Labor Code of Russia states that issues relating to the conditions for employees to receive monetary payments can be reflected in a collective or individual labor contract, as well as in the general internal labor regulations (hereinafter referred to as PVTR).

In employment contracts with employees, the days for payment of wages are not established, but there is a reference to the internal labor regulations and the regulations on remuneration of the organization, where these terms are specified. Experts from the GARANT Legal Consulting Service told us how to notify employees about changes in the timing of salary payments on 10.10.

2016 Troshina Tatyana, expert of the Legal Consulting Service GARANT We are introducing a change in the timing of salary payments By virtue of part six of Art. 136 of the Labor Code of the Russian Federation, wages are paid at least every half month on the day established by the internal labor regulations, collective agreement, or employment contract. As follows from Art. Art.

We invite you to familiarize yourself with: Terms for agreeing on the transfer of vacation with the employer

This issue, according to the law, is regulated by internal labor regulations, a collective agreement or an employment contract. Currently, these documents are in part six of Art.

We believe that the amendment introduced by the legislator indicates the right of the parties to the labor relationship to record information about the date of payment of wages in any of three documents: in the internal labor regulations, in the employment contract or in the collective agreement.

So, for such persons you need to take both SZV-M and SZV-STAZH! {amp}lt; ... When paying for “children’s” sick leave, you will have to be more careful. A certificate of incapacity for caring for a sick child under 7 years of age will be issued for the entire period of illness without any time limits. But be careful: the procedure for paying for “children’s” sick leave remains the same! {amp}lt; ...

Based on this, the employer must issue cash to employees at least twice a month.

Moreover, the first transfers must be made no later than fifteen calendar days from the moment the period for which the corresponding payments are provided ends.

The second part of the salary is issued on any of the remaining days until the end of the current month. But sometimes some companies consider it inappropriate to divide wages into parts and invite their employees to write appropriate statements requesting adjustments to the payment plan.

And perhaps the most important question that worries everyone, from an accountant to an ordinary employee, is when it is necessary to pay wages and how often it is necessary to do this.

Since it is legally established that in the event of a delay in wages and other due payments to an employee, the organization may be fined, and in some cases may be required to pay appropriate compensation.

Note! In connection with the latest changes in the Labor Code of the Russian Federation (which entered into force on October 3), wages must be paid no later than 15 calendar days after the end of the period for which they were accrued.

Order on the timing of payment of wages: features In order to transfer wages to an employee, you first need to determine in what time frame this must be done. According to the law, wages must be paid 2 times a month.

Attention

Add to favoritesSend by mail Order on wages - a sample of it may be needed to establish or correct the timing of salary payments.

You will learn everything about how to issue such orders and what the consequences are if the dates for issuing salaries are not recorded in your local documents in our article.

136 of the Labor Code of the Russian Federation, employers set the deadlines for paying wages independently, but with the obligatory observance of two conditions: payments are made at least 2 times a month and no later than 15 calendar days from the end of the period for which wages were accrued. IMPORTANT! If the “payday” day falls on a weekend, the money is issued the day before.

Are vacation pay issued along with salary or not?

By law, vacation payments must be made no later than 3 days before the start of the vacation.

An amount is issued calculated in accordance the employee’s average monthly income The employer has 3 options for transferring money to the employee in this situation:

- for the period of time worked along with vacation pay. Optional;

- according to the established schedule;

- do not provide wages during vacation, but make payments after the end of this period on the next payday.

Further payment of wages is proceeding as usual.

Formation of salary payment deadlines

Any work must be voluntary and paid. These are the fundamental norms of labor law. The ultimate goal of any work activity is reward in the form of wages.

The algorithm that employers should follow when issuing wages is set out in the Labor Code of the Russian Federation, namely in Article 136 of this legislative act.

This material describes the timing of payment of wages, as well as what changes in this area occurred last year and what the degree of responsibility for non-compliance with the requirements of the law is.

Article 136 of the Labor Code of the Russian Federation

Article 136 of the Labor Code of the Russian Federation

The procedure for how salaries should be calculated is described in detail in this article. In particular, the document defines the terms within which the payment of funds due to hired workers must be carried out:

- The employer is required to pay wages within a period of time not exceeding half a month;

- The maximum time interval during which the salary must be paid should not exceed 15 days from the date of completion of the period subject to payment;

- If a day off or holiday falls on the date of actual payment of wages, payments to employees are made the day before;

- Vacation pay must be paid to the employee no later than 3 days before the start date of the vacation.

In addition, in accordance with the content of the article, the employer is obliged to inform employees about all components of the accrued salary in writing.

That is, the notification should describe how much was accrued, how much was withheld, what part of the amount is a bonus, vacation pay, sick leave, and how much, ultimately, is payable in person.

As for receiving money, the regulatory act in question provides for two options for transferring funds to an employee:

- In hand, at the place of work;

- By transfer to a banking institution to the employee’s current account.

On October 3, 2021, Federal Law No. 272-FZ came into force, providing for certain innovations to the current legislation regarding the timing of salary calculations.

The innovations directly affected Art. 136 of the Labor Code of the Russian Federation, given above.

The previous version of this document stipulated that wages should be paid at least twice a month, or rather, every half month.

Taking into account the amendments, remuneration for the period worked must be paid no later than within 15 days elapsed from the end of this period. At first glance, everything is clear, understandable and quite logical. But changes designed to protect the interests of workers, to some extent, infringe on them. Bonuses become a stumbling block.

Many organizations have a bonus wage system that serves as an incentive for the entire production process.

It is not uncommon for the amount of bonus remuneration to exceed the amount of salary, which is equally good for the company’s management, who pay for real performance indicators, and for employees, who receive remuneration adequate for the efforts made.

But the bonus must be included in the total salary, and, therefore, bonuses must be paid no later than 15 days from the end of the bonus period.

Example of an order to change the terms of payment of wages

If, before the adoption of the amendments, the institution had other rules for calculating wages, for example, the dates for issuing advance payments and salaries were not indicated accurately, but in a time range of several days, then from October 2021, managers were required to make changes to local regulations. Documents in which exact deadlines must be entered include:

- Set of internal labor regulations (hereinafter referred to as the Rules);

- Collective agreement;

- Employment contracts.

Changes to the Rules are made based on the issuance of an order. An order to change the timing of payment of wages is drawn up on the organization’s letterhead, or on a regular A4 sheet, which indicates the name of the institution, the name of the document, registration number and date of writing.

The deadlines for the payment of wages must be specified in the employment contract with the employee. Agreements concluded earlier than 03.10.2016

We invite you to familiarize yourself with: Loan from the founder with personal income tax interest

, require adjustments in terms of clarifying the timing of salary calculations.

The employer is obliged to notify the employee of his intention to make changes to the current contract in terms of the timing of payment of wages, based on the entry into force of amendments to the current legislation.

Example of a notice of change in salary payment terms

Notification of changes to the current employment contract must be sent to the employee at least two months prior to the changes themselves. In the notification, the manager indicates his intention to make clarifications to the employment contract, based on the adopted amendments to the law.

Example of an additional agreement

Changing the terms of the current employment contract occurs by drawing up an additional agreement on changing the terms of payment of wages.

This document indicates the dates on which the amounts due to the employee will be paid.

Such an additional agreement will be an annex to the existing contract, being an integral part of it, and in itself, without an employment contract, the additional agreement has no legal force.

The Federal Law of October 3, 2016 provides for the application of penalties to managers who deviate from complying with the requirements of the law.

For a single violation of the terms of payment of wages, an individual entrepreneur may be fined in the amount of 1000-5000 rubles (or a warning issued), and for an organization the amount of the fine will be 30000-50000 rubles.

If the precedent is repeated, an individual entrepreneur is subject to a fine of 10,000-30,000 rubles, and a legal entity - 50,000-100,000 rubles. It should be noted that the amount of the fine can be multiplied by the number of employees in respect of whom wages were delayed.

After dismissal and layoff, when should payment be made?

If circumstances are such that the company undertakes a reduction in staff or number of employees, the entrepreneur is obliged to pay severance pay to the laid-off worker.

On the final day of work, also known as the day of dismissal, the earned amount, bonus and other accruals are paid. On the same day, compensation for unused vacation is also provided.

As for severance pay, it is issued in the amount of average monthly earnings for 2 months after the employee is laid off.

If an employee registers with the Employment Employment Center within 2 weeks after the layoff and, 2 months after the dismissal, provides a certificate stating that he is still not employed, the employer is obliged to pay benefits for the third month.

If enterprises practice using 13 salaries , you can get it, even if the dismissal occurred in the middle of the year.

Payment of money of a deceased employee to his relatives

In the event of the death of an employee, the employment contract automatically terminates , and the employer must pay all debts to the employee to the relatives of the deceased.

This includes his immediate family - parents, spouses and children.

Persons claiming to receive money from a deceased employee will need to provide documents confirming relationship .

The divorce certificate will not be accepted because the owner is no longer the active spouse.

In case of bankruptcy of a company

If a company is on the verge of bankruptcy, management is obliged to warn all its employees and the employment center (employment center) about this 2 months before laying off staff.

The employer will need to make all the same payments to employees as during layoffs. Despite the fact that during bankruptcy the organization has debts to creditors, the priority requires first making payments in favor of employees .

Debts to employees are divided into 2 types:

- Registered. Debts incurred before a business filed for bankruptcy.

- Current. Debt obligations arising after the commencement of bankruptcy proceedings.

Certificates of arrears of wages and absence of arrears of wages

The purpose of the certificate of arrears of wages is to certify on the part of the employing organization the fact of the existence of arrears to the employee, as well as to confirm the specific amount of such arrears.

What payments are due to employees dismissed during the bankruptcy of an enterprise? Read more

This certificate may be required:

- An employee of a bankrupt company. In this case, the certificate is submitted to the arbitration manager to include the employee in the register of creditors.

- An employee of a company that is delaying or not paying wages - to present it to the court, and then to the bailiffs in order to collect the accumulated debt. On this topic, our articles on the links Peculiarities of consideration of labor disputes regarding wages and What is the statute of limitations for wages?

- The organization itself filing for bankruptcy. In this case, the certificate serves to take into account the total debt of the organization to creditors and is taken into account when assessing the volume of property intended to satisfy the claims of creditors of such an organization (for example, the decision of the Vologda Region AS dated June 14, 2017 in case No. A13-4034/2017).

Thus, the mentioned certificates, properly executed, play in court the role of one of the proofs of the fact of debt, along with, for example, protocols, inspection reports, certificates of the labor dispute commission (for more details about this document and the procedure for issuing it, read our article at the link Certificate of the labor dispute commission - sample), balance sheets, etc.

You may also find the ConsultantPlus material “What to do if there is a long delay in salary payment?” useful. If you do not yet have access to the ConsultantPlus system, you can obtain it free of charge for 2 days.