Salary advance, how to calculate it in a new way in 2020

The wording “from 8 to 13 and from 24 to 29 of each month” is unacceptable. You cannot indicate intervals instead of specific dates, because this violates clause 6 of Art. 136 Labor Code of the Russian Federation. Thus, by accruing 1 part of the salary on the 9th day, and the other on the 28th, the head of the company will violate the Labor Code of the Russian Federation on accruing salary once every 15 days, at least.

The norms and procedure for determining the deadlines of the Labor Code of the Russian Federation and Federal Law No. 272 of July 3, 2016 on introducing adjustments to the laws of the Russian Federation to increase the responsibility of employers for violations of the labor code relating to the calculation of wages in 2021 regulates the procedure and periods for payment of wages. Who sets the deadlines for accruing salary? According to the Labor Code of the Russian Federation and Federal Law No. 272, the manager sets the date for issuing salaries to employees in 2021 independently. Where should I indicate? The manager of the company indicates the timing of the advance payment and the payment periods for the rest of the salary in the following documents:

The amount of advance payment for wages according to the Labor Code of the Russian Federation 2021

The advance can be paid both using cash receipts and using a special payroll. The form of this document is approved by the State Statistics Committee, but can be developed by an economic entity independently. The unified form T-53 is easy to fill out and contains all the necessary details.

How to issue a payment document? The statement can be compiled both for the entire organization and for a separate division of the enterprise. Each payroll has a serial number and is recorded in a special journal. The title page of the T-53 statement form indicates the name of the economic entity and structural unit if the payment is made for a separate section, workshop, and so on.

The column “corresponding account” indicates the number of the accounting account to which the expenses will be allocated (20, 44, etc.).

To set deadlines, it is enough to add a separate paragraph to one of the specified documents, which will contain wording on what dates the employees of the enterprise will receive earnings for the 1st and 2nd part of the month. The company must determine convenient days for issuing funds, taking into account Article 136:

Examples of possible payment terms:

Specific dates are determined by the employer at its own discretion.

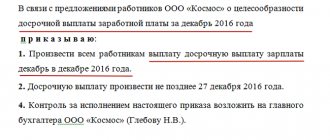

However, we believe that the most logical thing to do during this period is not to issue the final payment for December 2021, but to make another interim payment - an “unscheduled advance.” And in January 2021 (within the period established by the documents) it will be possible to make the final payment, pay the “balances” and withhold personal income tax. The employer does not face a fine for issuing wages ahead of time.

It doesn’t matter for what reason the organization violated the regularity of payments - due to upcoming weekends and holidays or just like that. This opinion is shared by the Ministry of Labor in letter dated December 6, 2021 No. 14-1/B-1226. Example: Salary of Petrenko N.V. is 30,000 rubles. The employment contract stipulates that the advance payment is paid on the 25th, and the second part of the salary is paid on the 10th. December 25, 2021 Petrenko N.V. paid an advance for December in the amount of 15,000 rubles.

The amount of the advance payment due to the employee is not a mandatory condition of the employment contract, unlike the terms of remuneration (Articles 57, 129, 135, 136 of the Labor Code of the Russian Federation). Therefore, if this condition was not included in the employment contract, then there is no need to carry out the procedure for changing the terms of the employment contract, including notifying employees two months in advance (https://www.1kadry.ru/#/document/161/52210 ). At the same time, if the organization has a representative body of employees, then when making changes to the wage regulations, the opinion of such a body should be taken into account (https://www.1kadry.ru/#/document/130/50355/). If there is no representative body in the company, then it is enough to issue an appropriate order and familiarize employees with the new edition of the regulation (Article 22 of the Labor Code of the Russian Federation).

Dana777 About the site Discussions regarding the operation of the site. Here you can ask questions about how to use this or that service. Moderators Skate, luna198, Evgeniy K. 517 5135 February 20, 2020 - 15:25 Iren_V Vacancies & HR resumesForum section where vacancies/resumes for/from are posted personnel workers.Moderators Skate, Assol, luna198, Evgeniy K., Tesh, Friday, KtoTam, Chertik, Tetris 6 10 20 Mar, 2021 - 19:05 grop0787 MARK ALL FORUMS AS READSEE WHO IS ON THE FORUM NOW Our users left messages: 2683970Last registered user: grop0787 Currently there are 89 visitors to the forum, of which 1 are registered, 0 are hidden and 88 are guests [Administrator] [Moderator]The most visitors (811) were here on Oct 07, 2015.

Supplement to minimum wage

Additional payment up to the minimum wage for an incomplete month worked is not made due to the employee being underemployed.

The payment is calculated in proportion to the time worked. If for a month an employee receives, taking into account all allowances, an amount greater than or equal to the minimum wage, there will be no questions from the labor inspectorate to the employer. If the employee’s salary, taking into account all allowances, is less than the minimum value, an additional payment must be made. Additional payment up to the minimum wage is made on the basis of an order. Such an order can be uniform for all employees whose income is below the minimum wage. Based on this, the accountant will calculate the additional payment.

https://www.youtube.com/watch?v=ytadvertise

The amount of the surcharge is the difference between the minimum wage and the employee’s salary. For example, locksmith Ivanov’s salary (for fully worked hours) is 9,000 rubles. The minimum wage in 2021 is 11,280 rubles. The difference between the minimum wage and Ivanov’s salary is 2,280 rubles - this is the amount of the surcharge.

After the missing part of the money is added to Ivanov, the accounting department will deduct the income tax, the amount of which in this case is 1,466.40 rubles. In total, Ivanov will receive 9813.60 rubles. This, of course, is less than the minimum wage, but personal income tax is withheld from wages in any case. And the inspectors will look at the amount before taxes. For employees of St. Petersburg, the personal income tax for the minimum wage will be 2,340 rubles, or 15,660 rubles in hand.

Additional payment up to the minimum wage in a budgetary institution has its own nuance. Its essence is this: if your organization is funded from the federal budget, then its location is not important. It can be located in Moscow, St. Petersburg or any other city, the minimum wage in each case will be federal. The calculation formula is exactly the same as in the case of commercial organizations, but the figure is smaller (due to the use of a federal indicator).

The work of a part-time worker is remunerated in proportion to the time worked. There is an indication of this in Art. 285 Labor Code of the Russian Federation. In this case, wages cannot be lower than the minimum wage, calculated in proportion to the time worked.

Lucky Muscovites. This year, the minimum wage in Moscow changed twice: from July 1 and from October 1 (PP No. 1177-PP dated September 10, 2019):

- from July 1st they raised it by 570 rubles. up to RUB 19,351;

- from October 1, the amount was increased by another 844 rubles. up to 20,195 rub..

The minimum wage in Moscow from October 1, 2021 is 20,195 rubles (approved by Moscow Government Decree No. 1177-PP dated September 10, 2019). In the Moscow region, the figure has not changed - 14,200 rubles (agreement on the minimum wage in the Moscow Region No. 41 of 03/01/2018).

The amount is adjusted depending on the cost of living, which legislators have the right to change quarterly. It is possible that it will soon be counted in the regions.

In 2021, the total amount of money earned by an employee from a particular employer cannot be less than 11,280 rubles.

Employers whose employees receive wages less than the minimum wage must increase it to the new established values. To do this, you will have to issue a sample order to increase wages and adjust the staffing table.

You need to understand that the salary may remain the same, since it is not the salary itself that is less than the minimum wage, but the total amount of the salary received by the employee, which includes:

- compensation payments, including allowances and additional payments;

- incentive payments (bonuses);

- reward for work.

If the employee’s salary consists only of salary or tariff rate, the employer must correctly draw up documents to increase the established payments to the minimum wage. To do this, use a sample order to increase salaries for all employees or only those whose salaries do not reach the established minimum.

If the employer includes in the employee’s remuneration, in addition to the salary, other allowances or additional payments, either their amount or the salary (tariff rate) should be increased so that the total amount is at least 11,163 rubles.

To do this, an order should be issued to increase wages in connection with the increase in the minimum wage, which changes the staffing table. Here are instructions on how to do this:

- Issue an order to increase wages.

- Based on this order, make changes to the staffing table (established form T-3).

- Make changes to employment contracts regarding remuneration for labor.

We invite you to familiarize yourself with: Sample report on defective goods

Many employers ask the question of how to draw up an order to increase wages or salary. Keep the following in mind:

- There is no established template for an order to increase wages for employees.

- Registration takes place in accordance with the general requirements defined for this type of document.

An order to increase salary is issued on the institution’s letterhead. It indicates the date and place where it was compiled. The document is assigned a serial number. The text consists of a preamble and a main part. The preamble contains the basis for issuing a local act, if necessary, with reference to regulatory documents. The main part reveals the essence of the content.

The salary order is signed by the head of the institution. The order must be familiarized to all persons mentioned in it and those to whom it applies.

The employer needs to understand that the increase in wages applies to those employees who work under an employment contract. Persons involved in cooperation under civil contracts (contracts, services) will not be able to count on an increase. In relation to such citizens, the employer is not obliged to fulfill the legal condition.

In other cases, the employer is obliged to increase pay, including:

- when working on a part-time basis;

- when working part-time (if, for example, a part-time worker performs half the normal working hours, the employer is obliged to pay him half the minimum wage).

If the salary of the organization’s employees is below the minimum wage, the employer will be fined. Fine amount:

- for a legal entity will be from 30,000 to 50,000 rubles, for a repeated violation - up to 70,000 rubles;

- the director will be given a warning or a fine in the amount of 1,000 to 5,000 rubles, if detected again - from 10,000 to 20,000 rubles. Additionally, disqualification is provided for a period of one to three years.

Let us say right away that there is no sample order for a salary increase in connection with an increase in the minimum wage in the law. There is neither a mandatory nor a form recommended by officials for such a form.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

This means that each employer will have its own sample order to increase wages in connection with an increase in the minimum wage. It is prepared in accordance with the rules and customs of document flow accepted within the organization.

The main thing is that in the order you refer to the regulatory framework (although formally this is not necessary):

- to the article of the Federal Law on increasing the minimum wage from January 1, 2019 (if you increase only to the federal minimum wage);

- regional agreement on the new minimum wage from January 2021 (if you increase the minimum wage to the regional one).

It is also possible in the order to increase wages and increase the minimum wage from January 1, 2021, to provide a link to the general internal regulatory act of the enterprise, which regulates the remuneration of personnel. For example, the Regulations on remuneration.

We invite you to familiarize yourself with: Sample objection to a court order of a magistrate judge

Also, in the order to increase wages in connection with the increase in the minimum wage, it is necessary:

- list full name employees who were promoted (preferably with positions and personnel numbers);

- so that the date of the salary increase is not later than the date of entry into force of the Federal Law on increasing the all-Russian minimum wage and/or the start date of the regional agreement with the updated “minimum wage”;

- indicate the new final salary amount (for all employees at once or separately if there is a difference in the amounts);

- list with whom to prepare additional agreements for salary increases (the list of persons must match those who received the increase).

At the end, the order is signed by the director of the organization. Visas for a personnel officer, accountant, or lawyer will not be superfluous.

Current legislation guarantees payment of wages in an amount not less than the current minimum wage to each employee of budgetary and commercial enterprises. This is stated in the text of paragraph 7 of Article 133 of the Labor Code of the Russian Federation. In this case, it is necessary to take into account some features:

- If we are talking about an employee of a company located in the Far North region (or in an area equivalent to it), the salary should not be lower than the minimum wage even before it is increased by the regional coefficient and additional payment for long work experience. That is, the salary of a worker in the Far North will always be higher than the minimum wage, taking into account the bonus and the regional coefficient.

- The salary should already include all amounts due to the employee (direct salary, various additional payments and allowances, compensation, bonuses) at the time of comparison with the minimum wage.

- The minimum wage is established not only at the federal, but also at the regional level by decision of the authorities of the constituent entity of the Russian Federation. Moreover, the regional (republican, regional, regional) minimum wage cannot be lower than the federal one.

Before issuing an order to increase wages, it is necessary to carry out the following procedures regarding personnel records:

- Familiarize employees with the text of the additional agreement to the employment contract and sign it. Since the amount of remuneration is one of the most important aspects of the contract/agreement with the employee, it is necessary to agree on its new amount.

- Next, you will need to change the existing staffing table (if required) or completely update it.

Follow the link to view a sample ⇒ Order to increase wages in accordance with the new minimum wage.

Despite the fact that there is no standard form for an order to increase wages in connection with an increase in the minimum wage level, the text of the Order must certainly indicate the following points:

- details and title of the document;

- information about the employee in respect of whom management issues an order (full name, job title, structural unit of the enterprise);

- the amount of the allowance;

- the date on which the additional payment will be made;

- a list of persons responsible for the execution of this order (with signatures indicating their familiarization with the order);

- signature, its transcript and initials of the authorized person;

- As a basis for a salary increase, the fact that the current salary does not correspond to the current minimum wage must be indicated.

Online magazine for accountants

The only thing that must be strictly observed is the presence of an original signature of the head of the organization or a person authorized to endorse such papers. In addition, the order is usually signed by the employees responsible for its implementation and those whom it directly concerns.

The signatures of the latter indicate that they are familiar with the order. There is no strict need to stamp an order now: various types of cliches and stamps can only be used when this norm is established in the internal documents of the company.

In general, seals and stamps are no longer required for use (including by legal entities). Usually the order is written in one original copy, but if necessary, additional copies can be made (for example, for presentation to the personnel department and accounting department).

Enter the site

It boils down to the fact that one document is quite enough. Moreover, according to Rostrud, PVTR is a priority, since their standards apply to all personnel, and the easiest way to make changes to this document is an order. We draw up an order to change the terms of advance payment. An order to change the terms of advance payment fixed in the PVTR is drawn up in free form. Include:

How to change the advance amount?

If any additional papers are attached to the document, they must be noted in a separate paragraph. How to correctly draw up an order Both the information part of the document and its execution are not subject to any special requirements by the law, therefore it is permissible to write an order both on a simple blank sheet of A4 or A5 format, and on the company’s letterhead, printed or handwritten.

Sample advance order

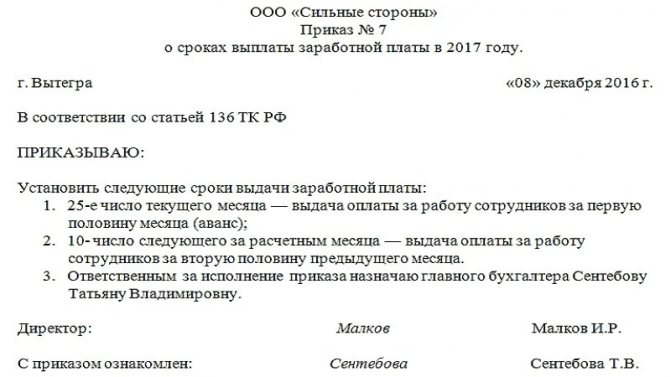

It should be noted that if the dates of payment of wages in fact comply with the norms of the Labor Code of the Russian Federation, but are not documented anywhere, this may also subject the company and its director to administrative fines: from 30 tr. rub. up to 50 tr. rub.. – for the company itself and from 1t. R. rub. up to 5t. R. rub. - for its leader. How to document the timing of payment of wages The specific day of payment, according to the Labor Code of the Russian Federation, must be prescribed in a collective, individual employment contract or in the Internal Labor Regulations and recorded in the order of the manager. If the organization has a trade union, its opinion should also be taken into account when setting the date. Who draws up the order An order on the timing of payment of wages is written on behalf of the director of the company by any employee authorized to draw up administrative documentation.

Deadlines for issuing salaries: order to change the date

- Other terms of the previously concluded employment agreement remain unchanged.

- This agreement comes into force on October 1, 2016.

- This document was drawn up in several copies for each party.

- Each copy has equal legal force.

Set the following dates for payment of wages:

- for the first half of the month worked – the sixteenth day of the current month;

- for the second half of the month worked - the first day of the month following the current one.”

The details of each party must be specified below, and the completed document must be certified by the seal of the organization. It should also be noted that with a fixed period for salary payment in the collective agreement, this procedure has a number of its own features.

Otherwise, if the deadlines are not met, she risks being punished.

7 Moscow — CALL

7 St. Petersburg — CALL

8 ext.849 – Other regions – CALL

It's fast and free!

Transfer of salary payment numbers is allowed, but within the limits approved by law.

The main thing is that the new terms comply with Art.

RF, must be prescribed in a collective or individual employment contract or in the Internal Labor Regulations and recorded in the order of the manager. If the organization has a trade union, its opinion should also be taken into account when setting the date.

An order on the timing of payment of wages is written on behalf of the director of the company by any employee authorized to draw up administrative documentation. This could be the head of a structural unit, secretary, legal adviser, etc.

It is important that, after formation, the order is submitted to the director of the enterprise for signing - without his autograph it will not acquire legal force and can easily be challenged with the help of a labor inspectorate or court.

All orders issued in an organization must have some kind of written basis.

Moreover, this applies even to those cases when salaries are issued on the same dates month after month, but they are not specified in local documents.

How to fix the situation? Of course, put the necessary documents in order, and if for some reason they are still missing, do the following:

- If possible, retroactively republish an incorrect document, but only if doing so does not cause any discrepancies with your other documentation. Unfortunately, this is not always possible.

- If changes are made to the collective agreement, it is necessary to assemble a commission consisting of representatives of both parties - both the employees and the employer.

That is, the notification should describe how much was accrued, how much was withheld, what part of the amount is a bonus, vacation pay, sick leave, and how much, ultimately, is payable in person.

As for receiving money, the regulatory act in question provides for two options for transferring funds to an employee:

- In hand, at the place of work;

- By transfer to a banking institution to the employee’s current account.

On October 3, 2021, Federal Law No. 272-FZ came into force, providing for certain innovations to the current legislation regarding the timing of salary calculations.

The innovations directly affected Art.

Accounting professional press For those accountants who prefer to work with primary sources.

Guarantee of professionalism and personal responsibility of the expert and author.

It must be said that according to statistics, most employers already issue salaries before the 15th of the next month. However, the local regulations of the enterprise (IP) and contracts listed above may not contain these conditions.

Therefore, if necessary, employers should make appropriate changes to them.

In accordance with the law, the break between the issuance of an advance and a salary should be no more than fifteen days.

- By law, the employer is required to set a specific deadline for the payment of wages. By law, the employee is notified of new deadlines for the payment of wages (changes).

- If there is a need to adjust the timing of salary payments, then the execution of the changes depends on the specific document in which your salary deadlines are recorded.

- The results of the negotiations of this commission are formalized in an additional agreement to the collective agreement.

- After the adoption of this law, information of this kind appeared in some media: “legislators have banned the payment of bonuses to employees” or “they will be fined for paying bonuses.”

But is this really so? How does the new law affect the payment of bonuses?

What will change in the work of an accountant? Let's figure it out.

The procedure for making changes to the PVTR The procedure is quite simple:

- An order to amend the PVTR is generated.

- If there is a trade union body, it is required to obtain its opinion.

- Each employee gets acquainted with the changes against signature (they can be placed in the Rules themselves on a separate sheet, in the attached fact sheets to the Rules or in a special journal).

Collective Agreement The following steps are followed:

- A commission of company representatives and employees is assembled;

- Negotiations are held during which the dates for issuing salary money are agreed upon;

- An additional agreement to amend the collective agreement is formed based on the results of negotiations;

- The additional agreement is signed by representatives of the two parties.

Employment contract The procedure is complicated by the fact that you need to work with each employee separately. The organization plans to change the deadlines for paying wages for office employees; for the driving staff, the deadlines remain the same. The deadlines are specified in employment contracts, PVTR, and regulations on remuneration.

Do office employees need to be notified of changes in deadlines, and if so, how much time in advance? How to make changes to the PVTR, the regulations on remuneration, should all employees or only office workers (those affected by the changes) be familiarized with the changes? How long does it take to sign additional agreements to employment contracts with employees? Thank you!

In accordance with paragraph. 5 hours 2 tbsp.

“Closed Joint Stock Company “Pyramid” INN 0000000000 Marketing department employee D.B. Potapov

Notification

on amendments to the employment agreement

CJSC "Pyramid" brings to your attention that according to the current rules of legislation, based on changes dated October 3, 2016 under Article No. 136 of the Labor Code, the data of the employment agreement (dated March 23, 2021 No. 90 - Labor Contract) has been corrected. From October 1, 2021, clause 6.4 of the Employment Agreement will be amended as follows: “The advance payment is issued on the 21st of the current month. Payments are made on the 7th day of the month following the previous one.”

We invite you to read: Dismissal due to violation of labor discipline

Chief: I.T. Mikhailov Acquainted: D.B.

An order on the timing of payment of wages is drawn up when the management of the enterprise, following the norm prescribed in the law of the Russian Federation, sets a specific date for the payment of wages to employees. In each organization, this date is determined individually, based on the capabilities, needs and operating conditions of the company.

An order on wages - a sample of it may be needed to establish or correct the timing of wage payments. You will learn everything about how to issue such orders and what the consequences are if the dates for issuing salaries are not recorded in your local documents in our article.

Labor Code of the Russian Federation on the timing of salary payments

Sample order on the timing of payment of wages

What to do if the deadlines for paying salaries are not fixed anywhere?

» Directory » Doing business » Forms and documents

According to the laws established today, payment for staff work is carried out twice a month, with an interval of two weeks. The internal documentation of the enterprise indicates the date when the payment was made.

Quite often, the administration of the enterprise uses special orders that set deadlines for payment of wages. Below, we propose to consider the rules for drawing up such documents, and we will tell you how to set a new payment deadline.

The commented law provided for changes to Article 136 of the Labor Code of the Russian Federation

Previously, the Labor Code of the Russian Federation did not consider the timing of payment of wages. However, in two thousand and sixteen, this provision was revised.

According to the decree of October 3, salary payment must be made by the fifteenth day of each month. In this regard, many organizations where payment of wages is carried out later must draw up a report on changes in payment terms.

The order on the timing of payment of wages in accordance with the established procedure must contain the exact date of payment.

Let's look at what else this document should contain:

- name and details of the enterprise;

- date of writing the document;

- place where the document was written;

- type of form;

- table of contents.

The completed order must be certified by the signature of the head of the enterprise and a seal.

According to the new resolution, documents such as the Regulations on Remuneration, the employment contract and internal regulations must indicate specific deadlines for issuing payment.

If this documentation does not contain a clearly established framework, then the above documents need to be completely redone.

To summarize all of the above, we can say that today, when drawing up an order for calculating wages, you should indicate a specific date, and not an approximate period, as was previously allowed.

Important! If there is a need to change the deadline for issuing a salary, the enterprise administration must notify each employee. Such notices will be provided in writing. It should also be taken into account that such documents are drawn up in advance (at least two months from the date of payment).

"Closed Joint Stock Company "Pyramid" INN 0000000000

Marketing department employee D.B. Potapov

Production calendar

The employer can make additions to local regulations as follows: You can find additional information about fixing the dates of wage payments in the organization in the appendix to the answer below. Details in the materials of the Personnel System: Situation: Is it necessary to reflect the place and date of payment of wages in all documents: Labor regulations, collective and employment agreements, or is it sufficient to reflect only in one of them No, not necessarily.

Payment of wages to employees occurs in the manner established by the Labor Regulations, collective agreement, employment contract (paragraph 5, part 2, article 57, parts 4, 6, article 136 of the Labor Code of the Russian Federation). The wording used in Article 136 of the Labor Code of the Russian Federation, when all documents are listed separated by commas, indicates the equivalence of the documents for the purpose of fixing the place and term of payments.

Belarus, Lida #6[314801] September 22, 2011, 13:28 So the order will sound like this: Veras LLC 00.00.0000. No. 125 Minsk In connection with the payment of the advance, I ORDER: 1. Chief accountant Ivanova A.A. pay an advance for the month of September to the following employees of the enterprise: 1.1.

Petrov I.I. — engineer, technical maintenance department, 250,000 rubles; 1.2. Sidorov K.I. - turner, technical maintenance department, 150,000 rubles 2. The payment must be made to the chief accountant of the enterprise before September 30, 2011 3. The HR specialist should submit the order for signature by the Director. The visas have been familiarized with the order. I would like to draw the moderator’s attention to this message because: A notification is being sent... demusolj [e-mail hidden] Belarus, Lida #7[314860] September 22, 2011, 14:41 Why are you, dear ones, silent? I want to draw the moderator’s attention to this message, because: A notification is being sent... At our enterprise, this is how it is done.....an employee writes a statement in which he indicates: I ask you to issue an unscheduled advance on wages.... Then the manager issues the so-called VISA or resolution…. and this statement is submitted to the accounting department without an order. And if you have a trading company with a cash register, they can pay you directly at the cash register. I want to draw the moderator’s attention to this message, because: A notification is being sent... demusolj [e-mail hidden] Belarus, Lida #3[314395] September 21, 2011, 10:53 Is there a link to the document so that I don’t need an order? They won’t believe it! I want to draw the moderator's attention to this message because: A notification is being sent...

Employer's liability

- the employee got a job at the company as a part-time worker;

- the employee works part-time (or on a part-time basis).

Although in the listed cases it is permissible to approve wages that are inferior in size to the current minimum wage, the actual salary paid must be calculated in the appropriate proportion of the minimum wage. That is, in such a situation, wages will directly depend on the current minimum wage.

Let's look at an example. A shopping center cleaner works at 0.5 wages. Accordingly, starting from May 1, 2021, the minimum wage for her will be no less than: 11,163 rubles. X 0.5 = 5581 rubles 50 kopecks.

We invite you to read: Collection of state duty by court decision

An employee is hired by a budget organization on a full-time basis. His salary includes only salary and bonus - no coefficients, allowances or additional payments are provided. The official salary is 6,500 rubles, and the bonus is 1,700 rubles. In total, the employee receives 8,200 rubles monthly. From May 1, 2021, the following amount must be paid additionally: 11,163 – 8,200 = 2,963 rubles.

The employee was employed in one of the commercial companies in Moscow. The company is a party to a regional agreement regarding the payment of wages not lower than the minimum wage established in the capital (currently equal to 17,300 rubles). The employee's salary consists of the official salary (13,700 rubles) and bonus (2,250 rubles). The amount of additional payment up to the minimum wage will be: 17,300 – 13,700 – 2,250 = 1,350 rubles.

The employee carries out labor activities in a company located in an area equivalent to the regions of the Far North. In this regard, his salary increases by a regional coefficient equal to 1.2. There are no agreements on approval of wages not lower than the regional minimum wage; all companies are guided by the federal minimum wage.

The employee is also entitled to a 10% bonus for long work experience. The official salary is 7,500 rubles. Let's calculate the amount of additional payment up to the minimum wage: 11,163 – 7,500 rubles = 3,663 rubles. And only after calculating the additional payment can you calculate the full amount of wages, taking into account coefficients and allowances: 11.163 11.163 x 0.1 11.163 x 1.2 = 11.163 1116.3 13.395.6 = 25.674.9 rubles.

About additional payment up to the minimum wage for employees of companies in Moscow and St. Petersburg, as well as for part-time workers, read the article ⇒ “Additional payment up to the minimum wage from 2021.”

https://www.youtube.com/watch?v=ytpress

Answer: Yes, the Ministry of Finance of the Russian Federation gave clarifications on this topic in its Letter dated November 24, 2009 No. 03-03-06/1/768.

Question No. 2: Is it necessary to recalculate salaries in connection with an increase in the federal minimum wage, if it is still lower than the regional one, on the basis of which salaries were calculated earlier?

Answer: No, there is no need to recalculate. When conducting a comparative analysis, the regional minimum wage must be taken into account, since the enterprise must be a party to the minimum wage agreement for the constituent entity of the Russian Federation.

According to Art. 133 of the Labor Code of the Russian Federation, the employer does not have the right to pay employees a salary below the minimum wage. Compliance with legislation is monitored by:

- representatives of the Tax Service;

- employees of the Social Insurance Fund;

- prosecutors;

- Labor Inspectorate specialists.

If this rule is violated, the company may be fined 30,000–50,000 rubles. The employer may be subject to a sanction in the form of deprivation of the right to occupy management positions for 3 months. If the violation is repeated, the punishment will be a ban on carrying out activities for 3 years.

Sample personnel order for payment of an increased advance to an employee

And in accounting, this statement with the manager’s resolution is added to the report. I want to draw the moderator’s attention to this message because: A notification is being sent... #10[376035] August 14, 2012, 9:30 am Of course, the order was drawn up clumsily, the norms and requirements for issuing administrative documents were not met. OK! My question is different! What type of orders (for main activities or for personnel: l or k) does this order for the payment of an advance apply to? I want to draw the moderator's attention to this message because: A notification is being sent...

"First Last (2)" In order to reply to this topic, you need to log in or register.

Changes in the Labor Code on the timing of salary payment According to changes in the timing of salary payment, the employer must set a specific date for the payment of wages, and not the period during which the salary must be paid. Moreover, this date must be no later than 15 calendar days from the end of the period for which the salary was accrued. The timing of payment of wages must be fixed in the internal labor regulations (ILR), a collective agreement or an employment contract. Changing the terms of salary payments: how to set the correct dates In order for your salary terms to comply with legal requirements, you also need to remember that salaries must be paid at least every half month (Article 136 of the Labor Code of the Russian Federation).

Order on the timing of payment of wages

The employer, on his own initiative, wants to pay the employee his salary for December ahead of schedule - December 29, 2021. On this day Petrenko N.V. will transfer another “interim advance” in the amount of 14,500 rubles. Another 500 rubles (final payment) will be transferred to the employee on January 10, 2021.

Thus, by January 10, 2021 Petrenko N.V. will receive his full salary: 30,000 rubles (15,000 + 14,500 + 500). Moreover, the employee will receive most of it before the New Year. It is, in principle, possible to make the final payment for December 2021 in December, but it is not very logical. Moreover, this may require the accountant to recalculate in the future. The fact is that the logic is lost - the month has not yet ended, and the accountant has already drawn up a time sheet and accrued wages. In our opinion, this should not be done.

Based on this, the employer must issue cash to employees at least twice a month. Moreover, the first transfers must be made no later than fifteen calendar days from the moment the period for which the corresponding payments are provided ends. Here, each enterprise independently decides which date to choose from the two-week period allowed by law. This may be the fifth, tenth or fifteenth of the month following the reporting month. In this matter, management is given free choice. The second part of the salary is issued on any of the remaining days until the end of the current month. But sometimes some companies consider it inappropriate to divide wages into parts and invite their employees to write appropriate statements requesting adjustments to the payment plan.

Salary payment deadline in 2021: changes to the employment contract

According to article of law No. 136 of the Labor Code, the administration of the enterprise is obliged to enter into an additional agreement with the staff if the timing of payment of wages does not meet the requirements in the above article. If there is a collective document, such changes are formalized in one act. In the case of individual contracts, it is necessary to prepare additional agreements for each employee.

“Additional consent No. 6k to the labor agreement dated May 15, 2007 No. 26

On amendments to the employment agreement, according to the new law of the Labor Code

Voronezh November 20, 2016

The details of each party must be specified below, and the completed document must be certified by the seal of the organization. It should also be noted that with a fixed period for salary payment in the collective agreement, this procedure has a number of its own features. When making amendments to a collective agreement, a special commission must be created, consisting of representatives of the personnel and management of the enterprise.

The legislation clearly states that every employee must receive a salary at least twice a month

Notification of changes in salary payment deadlines The Labor Code of the Russian Federation does not establish deadlines for familiarizing existing employees with newly adopted or amended local regulations. In Art.

22 of the Labor Code of the Russian Federation only states that the employer is obliged to familiarize employees, upon signature, with the adopted local regulations directly related to their work activities.

By virtue of this norm, the employee must also be familiarized with changes in local regulations against signature. Consequently, employees should only be familiarized with the new edition of the internal labor regulations and regulations on remuneration against signature.

Thus, the legislation does not provide for the obligation to notify employees about these changes at least two months before the date of such changes or for any other period.

Employment contract The procedure is complicated by the fact that you need to work with each employee separately.

This document is drawn up in any form. Order on the timing of payment of wages: sample 2021 The employer is obliged to notify the employee of his intention to make changes to the current contract in terms of the timing of payment of wages, based on the entry into force of amendments to the current legislation.

Notification of changes in payment terms Example of a notification of changes in salary payment terms Notification of changes to the current employment contract must be sent to the employee at least two months prior to the changes themselves.

In the notification, the manager indicates his intention to make clarifications to the employment contract, based on the adopted amendments to the law. Formation of deadlines for payment of wages The document is certified by the signature of the head and the seal of the institution.

In particular, this applies to changes in the employment contract for reasons related to: Changes in organizational or technological working conditions Changes in the employment contract for reasons related to changes in organizational or technological working conditions include, for example:

- changes in equipment and production technology (for example, the introduction of new equipment, which led to a reduction in the employee’s workload);

- structural reorganization of production (for example, exclusion of any stage of the production process);

- other changes in organizational or technological working conditions that led to a reduction in the employee’s workload.

Order on the timing of payment of wages It is not allowed to set a period of several days as payment deadlines, for example, from the 21st to the 24th of the current month for the first 15 days.

In Russian labor legislation, great attention is paid not only to the correct calculation of wages to employees, but also to the timeliness of their issuance.

We invite you to familiarize yourself with: Sample order on expiration of an employment contract

To do this, the accounting department of each enterprise must pay its employees earned money on predetermined days. This is required by the Labor Code in force in our country.

Based on his articles, the management of the enterprise usually issues an “Order on the timing of payment of wages.” The sample and rules for its preparation should not contradict the labor laws that are currently in force throughout Russia. How to draw up a document Art.

136 of the Labor Code of Russia states that issues relating to the conditions for employees to receive monetary payments can be reflected in a collective or individual labor contract, as well as in the general internal labor regulations (hereinafter referred to as PVTR).

In employment contracts with employees, the days for payment of wages are not established, but there is a reference to the internal labor regulations and the regulations on remuneration of the organization, where these terms are specified. Experts from the GARANT Legal Consulting Service told us how to notify employees about changes in the timing of salary payments on 10.10.

2016 Troshina Tatyana, expert of the Legal Consulting Service GARANT We are introducing a change in the timing of salary payments By virtue of part six of Art. 136 of the Labor Code of the Russian Federation, wages are paid at least every half month on the day established by the internal labor regulations, collective agreement, or employment contract. As follows from Art. Art.

This issue, according to the law, is regulated by internal labor regulations, a collective agreement or an employment contract. Currently, these documents are in part six of Art.

We believe that the amendment introduced by the legislator indicates the right of the parties to the labor relationship to record information about the date of payment of wages in any of three documents: in the internal labor regulations, in the employment contract or in the collective agreement.

So, for such persons you need to take both SZV-M and SZV-STAZH! {amp}lt; ... When paying for “children’s” sick leave, you will have to be more careful. A certificate of incapacity for caring for a sick child under 7 years of age will be issued for the entire period of illness without any time limits. But be careful: the procedure for paying for “children’s” sick leave remains the same! {amp}lt; ...

Based on this, the employer must issue cash to employees at least twice a month.

Moreover, the first transfers must be made no later than fifteen calendar days from the moment the period for which the corresponding payments are provided ends.

The second part of the salary is issued on any of the remaining days until the end of the current month. But sometimes some companies consider it inappropriate to divide wages into parts and invite their employees to write appropriate statements requesting adjustments to the payment plan.

And perhaps the most important question that worries everyone, from an accountant to an ordinary employee, is when it is necessary to pay wages and how often it is necessary to do this.

Since it is legally established that in the event of a delay in wages and other due payments to an employee, the organization may be fined, and in some cases may be required to pay appropriate compensation.

Note! In connection with the latest changes in the Labor Code of the Russian Federation (which entered into force on October 3), wages must be paid no later than 15 calendar days after the end of the period for which they were accrued.

Order on the timing of payment of wages: features In order to transfer wages to an employee, you first need to determine in what time frame this must be done. According to the law, wages must be paid 2 times a month.

Attention

Add to favoritesSend by mail Order on wages - a sample of it may be needed to establish or correct the timing of salary payments.

You will learn everything about how to issue such orders and what the consequences are if the dates for issuing salaries are not recorded in your local documents in our article.

136 of the Labor Code of the Russian Federation, employers set the deadlines for paying wages independently, but with the obligatory observance of two conditions: payments are made at least 2 times a month and no later than 15 calendar days from the end of the period for which wages were accrued. IMPORTANT! If the “payday” day falls on a weekend, the money is issued the day before.

Labor legislation defines the obligation of organizations to set a certain number of salary payments.

This can be done in labor and collective agreements or in the internal regulations of the company.

- for the first half of the month (advance) - no later than the 30th of the current month (for February - no later than the 28th or 29th (Rostrud Information);

- for the second half of the month - no later than the 15th day of the next month.

Sample order for payment of advance payment and wages

It doesn’t matter for what reason the organization violated the regularity of payments - due to upcoming weekends and holidays or just like that. This opinion is shared by the Ministry of Labor in letter dated December 6, 2021 No. 14-1/B-1226. Example: Salary of Petrenko N.V. is 30,000 rubles.

The employment contract stipulates that the advance payment is paid on the 25th, and the second part of the salary is paid on the 10th. December 25, 2021 Petrenko N.V. paid an advance for December in the amount of 15,000 rubles. Therefore, taking into account this rule, as well as the innovation, wages must be paid:

For example, wages for the first half of October 2021 must be paid no later than October 28, 2016 (October 30 is a Sunday; accordingly, wages must be paid on the last working day before this weekend (Article 136 of the Labor Code of the Russian Federation)), and wages for the second half of October employees must receive it no later than November 15, 2016. Changes in the terms of payment of wages in 2016: do all employers need to change the dates of payments? Employers whose terms of payment of wages comply with the new requirements of the Labor Code do not need to change anything.

Unified form

In accordance with the current Law of December 6, 2011 No. 402-FZ, the use of unified forms when drawing up “personnel” orders is not mandatory. But it is more convenient to use as a basis the order forms No. T-11 approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1 (if the bonus is paid to one employee) or according to Form No. T-11a (if the bonus is paid to several employees).