Completing section 1

Let us recall that in Sect.

1 of the calculation indicates the amounts of accrued income, calculated and withheld tax, generalized for all individuals, on an accrual basis from the beginning of the tax period at the appropriate tax rate. When filling out this section, tax agents make the following mistakes: 1) filling out section 1 without a cumulative total . This directly contradicts clause 3.1 of the Procedure ;

2) inclusion in line 020 “Amount of accrued income” of income not subject to personal income tax . In accordance with clause 3.3 of the Procedure, this line should reflect the amount of accrued income generalized for all individuals on an accrual basis from the beginning of the tax period. At the same time, income not subject to personal income tax in accordance with Art. 217 of the Tax Code of the Russian Federation , are not reflected in the calculation ( Letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11/ [email protected] );

3) reflection in line 070 “Amount of tax withheld” of tax amounts that will be withheld only in the next reporting period . Such an error, as a rule, is made when indicating personal income tax on wages that were accrued in one reporting period and paid in another (for example, when paying wages for March in April). Taking into account the fact that tax is withheld from wages upon direct payment, in relation to the example given, the amount of tax should be indicated in the report for the half-year, and not in the report for the first quarter;

4) indication in line 080 “Amount of tax not withheld by the tax agent” of the tax, the obligation to withhold and transfer which has not yet occurred . In accordance with clause 3.3 of the Procedure, line 080 of the calculation indicates the total amount of tax not withheld by the tax agent, cumulatively from the beginning of the tax period in cases where the tax agent does not have the opportunity to withhold the calculated amount of tax.

According to the explanations provided by the Federal Tax Service in Letter No. BS-4-11 / [email protected] (question 5), this line reflects the total amount of tax not withheld by the tax agent from income received by individuals in kind and in the form of material benefit in the absence payment of other income in cash.

Thus, if the amount of tax withheld in the next reporting period (submission period) is reflected on line 080, the tax agent should submit an updated calculation for the corresponding period;

5) reflection in line 080 of the difference between accrued and withheld tax . Such filling out of this line is erroneous and will be recognized by the tax authorities as a violation of the procedure for filling out the calculation and non-compliance with the explanations of the Federal Tax Service.

Legal basis

Remuneration of employees of an organization is an obligation, not a right of the employer, which is regulated by labor legislation. Transfer deadlines are approved by internal local documents:

- collective agreement;

- internal labor rules;

- labor contracts and agreements.

The head of the company does not have the right to make decisions on changing them. If the payment of wages is untimely for more than 14 days, most individuals have the right to resign after a written warning from management in accordance with Article 142 of the Labor Code. In addition, if labor inspectors and tax officials establish the fact of a delay, penalties may be applied to the employer for unpaid wages in accordance with the administrative code.

For repeated cases - up to criminal punishment. This does not depend on what remuneration system is used in the organization. Sanctions can be applied even for delaying advance payments to employees.

It is important! In case of delay, the employer is obliged to pay the company employees monetary compensation, which is tied not to the salary, but to the key rate of the Central Bank.

Letter No. BS-4 11/9194 contains an explanation of how to correctly reflect the indicators in 6-NDFL in case of delay in payment of wages.

If employee salaries are accrued but not paid: how to fill out 6 personal income taxes

Completing section 2

According to clause 4.1 of the Procedure in section.

2 calculations indicate the dates of actual receipt by individuals of income and tax withholding, the timing of tax transfer and the amounts of income actually received and withheld tax generalized for all individuals. The Federal Tax Service has repeatedly explained that in section. 2 calculations reflect only those transactions that were carried out during the last three months of the reporting period ( letters dated July 21, 2017 No. BS-4-11/ [email protected] , dated January 16, 2017 No. BS-4-11/499 , dated May 22, 2017 No. BS-4-11/9569 ). For example, when filling out the calculation for 2021 in its section. 2 reflects transactions performed in October, November and December 2021.

Despite this, some tax agents continue to fill out section. 2 calculations on an accrual basis from the beginning of the year, which is a gross violation .

In accordance with clause 4.2 of the Procedure, when filling out section. 2 calculations, blocks from lines 100 - 140 are filled out separately for each tax payment deadline, including in cases where different types of income have the same date of actual receipt, but different tax payment deadlines. This is indicated in letters of the Federal Tax Service of the Russian Federation dated 03/18/2016 No. BS-4-11/ [email protected] , dated 05/11/2016 No. BS-4-11/8312 . For example, on May 31, 2017, wages for May and vacation pay for June were paid. Despite the fact that the date of actual receipt of the said income on the basis of Art. 223 of the Tax Code of the Russian Federation recognizes one day - 05/31/2017, data on it is included in section. 2 calculations in separate blocks due to the fact that the timing of tax transfers for these incomes is different:

– for vacation pay, the tax payment deadline falls on 05/31/2017;

– for wages – as of 06/01/2017.

The Federal Tax Service in Letter No. GD-4-11/ [email protected] ( clause 19 ) also notes that (wages, holiday pay, sick leave, etc. into separate groups is a violation of the procedure for filling out the calculation .

When filling out lines 100 - 140 for various types of income, the most common mistakes are incorrectly indicating the date of actual receipt of income (line 100), the date of tax withholding (line 110) and the deadline for transferring tax (line 120) . Next, we’ll look at how to correctly fill out such lines.

Procedure for filling out 6-NDFL

Payments received by an employee within the framework of an employment relationship with a legal entity or individual entrepreneur are subject to personal income tax. According to the Tax Code of the Russian Federation, this tax on the income of a hired individual is withheld and paid to the budget by the employer, acting as a tax agent for personal income tax.

Until 2021, the employer reported on the amounts of income tax withheld and paid to the treasury for employees once a year.

This is a 2-NDFL report for each employee, which must be submitted to the Federal Tax Service by April 1 of the year following the reporting year.

The employer could not pay wages or violate its duties as a tax agent - Federal Tax Service inspectors did not have enough information to track violations throughout the year.

In order to control the transfer of tax, a new form has been introduced - 6-NDFL, which will have to be submitted quarterly to all legal entities and entrepreneurs with employees (clause 2 of Article 230 of the Tax Code of the Russian Federation). The form was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/450.

6-NDFL includes information about the employer, amounts of income and tax deductions, dates of actual receipt of income, tax withholding and transfers to the budget. Report 6-NDFL consists of 3 parts: title page, section 1 and section 2.

General rules for filling out form 6-NDFL

Let's look at the procedure for filling out 6-NDFL. If you are submitting a report not through TKS, then you can only use a pen with black, blue, or purple ink for handwriting. It is prohibited to correct errors with a proofreader.

Information is entered into the report lines from left to right, starting from the leftmost cell; empty cells should have a dash.

Income amounts are filled in in rubles and kopecks, and the tax amount is only in rubles, kopecks are rounded. Filling out 6-NDFL-2016 occurs separately for each OKTMO.

The sheets are numbered consecutively, starting from the first.

How to fill out 6-NDFL: title page

Legal entities indicate the TIN and KPP, entrepreneurs indicate only the TIN, and put dashes in the “KPP” field. If you are submitting 6-NDFL for the first time in this period, then the “Adjustment Number” is 000. If you are submitting an updated declaration, then the field corresponds to the serial number of the adjustment (001, 002, etc.).

The presentation period contains a digital code:

- for the report for the first quarter – 21;

- for half a year – 31;

- for 9 months – 33;

- per year - 34.

Tax period – the year of filling out form 6-NDFL. In the “Submitted to the tax authority” field, you must indicate the tax office code. The field “At location (accounting) (code)” includes one of the following:

- 120 – at the place of residence of the individual entrepreneur;

- 320 – at the place of business of the individual entrepreneur (when using PSN and UTII);

- 212 – at the place of registration of the Russian legal entity;

- 212 – at the place of registration of the largest taxpayer;

- 220 – at the location of a separate division of a Russian legal entity.

The tax agent indicates the abbreviated name in the field of the same name in accordance with the charter.

An individual who is a tax agent enters his full name in full according to his passport data.

On the first sheet you also need to write down the OKTMO of the enterprise, its telephone number and the number of pages contained in the 6-NFDL calculation.

Next, you need to indicate who confirms the information specified in the calculation:

- 1 – the tax agent himself;

- 2 – representative of the tax agent (if the report is submitted by a representative, you must indicate the details of the document confirming the authority).

The “Date and Signature” column is signed by the person who confirms the information in the report. The lower right quarter of the title page is intended only for the tax inspector's notes.

How to fill out 6-NDFL correctly: section 1

The amounts in section 1 are indicated from the beginning of the year on an accrual basis.

- On page 010, the accountant fixes the income tax rate. If the employer pays income at different personal income tax rates, a separate section 1 is needed for each rate;

- Page 020 contains the amount of accrued income, taking into account payments within the framework of labor relations, dividends and sickness benefits;

- On page 025, dividends are shown as a separate amount;

- Page 030 – amount of tax deductions;

- Page 040 – amount of calculated tax (that is, 13% of the difference between accrued income and tax deductions);

- Page 045 – personal income tax on dividends;

- Page 050 contains information about the fixed advance payment that the company pays for a foreign worker on a patent;

- The number of employees must be indicated on page 060 - all persons who received payments from the employer during the reporting period must be taken into account;

- On page 070, the accountant will indicate the amount of tax withheld, and the money that the tax agent did not withhold from the employee must be indicated on page 080;

- For the amount of tax that the employer returned to the employee, page 090 is intended.

Read more: Dividends in 6 personal income taxes 2021 example of filling

What questions may arise when filling out 6-NDFL in section 1? Some accountants believe that the amount of property deduction received by the employee from the employer should be indicated on page 090. Federal Tax Service in a letter dated March 18, 2016.

No. BS-4-11/4538 explained that this line is intended to return excessively withheld amounts in accordance with Art. 231 Tax Code of the Russian Federation. The tax deduction has already been counted in the indicators line 040 and line 070; it cannot be counted again on line 090.

Should there be equality between page 040 and page 070? No, if you have carryover income: for example, a March salary issued in April. Since the salary was accrued in March, the tax on it is included in line 040.

And the company will deduct it from the employees and transfer it only in April. The indicator on page 070 will be less than the indicator on page 040, tax authorities will not consider this an error (letter of the Federal Tax Service dated March 15, 2016 No. BS-4-11/4222).

A similar situation occurs with July, September and December payments to employees.

How to fill out form 6-NDFL: section 2

The second section provides information on the amounts that the employer transferred to employees over the last 3 months. Income must be indicated in accordance with the dates of receipt in accordance with the Tax Code of the Russian Federation:

| Income | Date of receipt of income | Tax withholding date | Deadline for transferring personal income tax |

| Salary | Last day of the month | Salary payment at the end of the month | The next working day after salary payment at the end of the month |

| Vacation pay | Pay day | Payment day (page 100 and page 110 are the same) | Last day of the month in which accrued |

| Sick leave | Pay day | Pay day (page 100 and page 110 are the same) | Last day of the month in which accrued |

| Compensation for unused vacation upon dismissal | Pay day | Pay day (page 100 and page 110 are the same) | Next business day after payment |

- Page 100 – day of receipt of income. In this case, the salary does not need to be divided into an advance payment and the final payment - the full monthly payment is indicated

- Page 110 – tax withholding date

- Page 120 – date no later than which personal income tax must be transferred to the budget

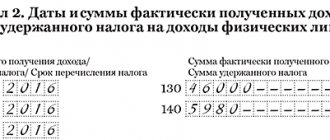

- Page 130 – contains the amount of income actually received

- Page 140 – shows the amount of personal income tax withheld.

Each type of payment must be reflected on separate lines 100-140 in chronological order. If they are missing, then add another sheet of 6-NDFL - section 1 does not need to be duplicated in it.

Procedure for submitting 6-NDFL

Taxpayers must submit report 6-NDFL quarterly. The entire next calendar month after the end of the reporting period is given for preparation. For the reporting year, 6-NDFL must be submitted no later than April 1 of the following year.

Deadlines for submitting 6-NDFL in 2021:

| Reporting period | Deadline |

| For the first quarter |

Payment of wages

In accordance with paragraph 2 of Art. 223 of the Tax Code of the Russian Federation , when receiving income in the form of wages, the date of actual receipt of such income is recognized as the last day of the month for which income was accrued for work duties performed in accordance with the employment agreement (contract).

If the employment relationship is terminated before the end of the calendar month, the date of actual receipt of income in the form of wages is considered to be the last day of work for which the income was accrued.

According to the general rules established by paragraph 4 of Art. 226 of the Tax Code of the Russian Federation , tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment. These rules apply to all types of payments, with the exception of income received in kind and in the form of material benefits, for which specific tax withholding rules are established.

Based on clause 6 of Art. 226 of the Tax Code of the Russian Federation , from income in the form of wages, tax agents are required to transfer the amounts of calculated and withheld personal income tax no later than the day following the day of payment of such amounts.

When indicated in Sect. 2 when calculating the deadline for transferring tax, it is necessary to take into account the rules for postponing the deadlines defined in clause 7 of Art. 6.1 of the Tax Code of the Russian Federation : in cases where the last day of the period falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the day of expiration of the term is considered to be the next working day following it.

Salary for November 2021 in the amount of 100,000 rubles . paid on November 30, 2017. The personal income tax amount was 13,000 rubles .

In Sect. 2 calculations for 2021, these transactions will be reflected as follows:– line 100 indicates November 30, 2017;

– on line 110 – November 30, 2017;

– on line 120 – 01.12.2017;

– on line 130 – 100,000;

– on line 140 – 13,000.

The date of actual receipt of income in the form of wages is recognized as the last day of the month for which the taxpayer is accrued income for the performance of labor duties in accordance with the employment agreement (contract), regardless of whether the specified date falls on a weekend or a non-working holiday ( letter of the Federal Tax Service of the Russian Federation dated May 16. 2016 No. BS-3-11/ [email protected] ).

Next, we note the features of filling out Section. 2 calculations in the case when wages are accrued in one reporting period and paid in another.

Accrued income, as well as the tax calculated on it, are included in the calculation for the corresponding reporting period if the date of their actual receipt falls within this period. The amount of taxes withheld and transferred is included in the calculation only if the period for their withholding and transfer also does not extend beyond the reporting period ( letters of the Federal Tax Service of the Russian Federation dated May 16, 2016 No. BS-3-11/ [email protected] , dated February 12, 2016 No. BS-3-11/ [email protected] ).

For example, wages for June 2021 were paid on 07/03/2017.

In this case, in Sect. 2 calculations: a) for the first half of 2021, line 130 reflects the amount of accrued wages, indicating on line 100 the date 06/30/2017;b) for nine months of 2021 it is indicated:

– on line 110 – 07/03/2017;

– on line 120 – 07/04/2017;

– on line 140 – the amount of tax withheld.

Operations that began in one calendar year and completed in another calendar year are reflected in a similar manner.

Do not confuse the date of actual tax remittance and the deadline for its remittance. Therefore, even if you transferred the tax to the budget ahead of schedule, in line 120 of section. 2 calculations, it is necessary to indicate the exact date, no later than which the tax amount must be transferred ( letter of the Federal Tax Service of the Russian Federation dated January 20, 2016 No. BS-4-11 / [email protected] ).

Main nuances

Notes on the law

According to the explanations of the Federal Tax Service under paragraph two of Article 230 of the Tax Code of the Russian Federation, tax agents must send calculations of personal income tax to the tax authorities at the place of registration. persons who were calculated and withheld for a certain period. Such periods are considered to be the first quarter, six months, and nine months, and the filing deadline is set at the last day of the month that follows the reporting month.

In this case, the report must be submitted in a form approved by the Federal Tax Service. It is called 6-NDFL, which was introduced in 2021. The first section contains general data on a cumulative basis, and section 2 contains information on the dates of payments and transfers of taxes.

If the tax agent indicates an operation in one period, but completes it in another, then it must be entered into the declaration after completion. This also applies to situations where wages were delayed. If wages were accrued on March 3, and the tax on them was paid on March 4, then this is reflected in the first section of 6-NDFL for the first quarter.

At the same time, the agent most often does not indicate such information in the second section. It will be indicated when paying salaries to employees based on the results of the six months. According to the Tax Code, the date of actual receipt of income is the last day of the month in which income was accrued, but not necessarily its payment.

According to the Code, tax agents must withhold accrued tax from the taxpayer’s income itself at the time of actual payment. And the transfer of amounts of withheld tax is made when paying wages, no later than the next day after that. The same applies to disability benefits, caring for a sick child, as well as vacation funds.

Possible problems

According to the Labor Code, the employer is obliged to pay out the money earned in full, observing the deadlines.

Specific payment time frames are indicated in:

- Labor Code of the Russian Federation;

- collective agreement;

- internal rules of the enterprise;

- employment contracts.

For the employer, the result of late payment of funds may be quite unpleasant; for example, regulatory authorities may be interested in the reasons for this. Moreover, the question is possible both with regard to personal income tax from the tax authorities, and to the observance of the rights of workers from labor inspectors.

In the event of a delay in wages, employees can stop the work process, having previously given a warning to their superiors, after two weeks of non-payment, which is guaranteed by Article 142 of the Code. But even if the employee takes such measures, he will receive his average earnings for the entire time he is waiting for the debt.

Also, after the debt, the company will need to pay monetary compensation, which is calculated at the rate of the Bank of Russia. And inspectors can expect fines related to violation of Article 5.27 of the Administrative Code. And if the delay in wages has reached a critical level, criminal prosecution under Article 145.1 of the Criminal Code is possible.

Partial non-payment of money may also result in criminal liability. Since the laws are imperfect, this measure was unpopular, but recently it has become increasingly common in court decisions.

Vacation pay

In accordance with paragraphs.

1 clause 1 art. 223 of the Tax Code of the Russian Federation, the date of actual receipt of income in the form of vacation pay is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties. According to paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, tax agents are required to withhold the accrued amount of tax directly from the taxpayer’s income upon their actual payment, taking into account the specifics established by this paragraph.

When paying income to a taxpayer in the form of vacation pay, tax agents are required to transfer the amounts of calculated and withheld tax no later than the last day of the month in which such payments were made ( clause 6 of Article 226 of the Tax Code of the Russian Federation ).

The employee of the institution goes on vacation from 06/01/2017.

The amount of vacation pay for June 2021 (RUB 7,000) was paid to the employee on May 25, 2017. The amount of personal income tax calculated from vacation pay was 910 rubles. In Sect. 2 calculations for the first half of 2021, this operation will be reflected as follows:– line 100 indicates 05/25/2017;

– on line 110 – 05.25.2017;

– on line 120 – 05/31/2017;

– on line 130 – 7,000;

– on line 140 – 910.

The order of reflection in Sect. 2 calculations of operations for paid vacation with subsequent dismissal are explained in the Letter of the Federal Tax Service of the Russian Federation dated May 11, 2016 No. BS-3-11 / [email protected] Let’s assume that vacation payment was made on March 15, 2017.

In this case, in Sect. 2 calculations for the first quarter of 2021, such an operation will be reflected as follows: – line 100 indicates 03/15/2017;

– on line 110 – 03/15/2017;

– on line 120 – 03/31/2017;

– on lines 130, 140 – the corresponding total indicators.

6-NDFL in case of delayed wages: how to reflect it in documents

Form 6-NDFL is submitted quarterly by an entrepreneur who hires employees and pays them income. The responsibility to calculate personal income tax from income falls on the employer, since he assumes the status of a tax agent.

The reporting shows when and in what quantity payments were provided to employees, as well as what tax was withdrawn from them. Sometimes it happens that an employer cannot pay wages on time.

How to fill out 6-NDFL when wages are delayed, we will consider below.

How to show a delay in 6-NDFL

In order to avoid difficulties in the future, it is worth considering in detail filling out 6-NDFL when wages are delayed.

The date of the month on which salaries are calculated is the date on which the employee actually received income. This indicator does not depend on whether the employer made the payment on time or not.

Late payment of wages will affect the time of calculation and transfer of tax to the treasury. The tax can only be calculated at the moment when the payment is actually made.

The transfer of the tax amount will take place on the working day following the day the employee actually receives wages.

For example, wages for April were accrued. The actual payment according to the law should take place on April 30, but due to the prevailing circumstances it was made on May 14. In this case, there is no place to withdraw the tax amount from earlier than May 14, because the employee had no income at all during this time.

And it is also not possible to transfer the tax amount to the treasury earlier than May 15, which will be reflected in 6-NDFL.

A conscientious employer may charge compensation for delayed wages. If this happens, then this procedure is not indicated in 6-NDFL, since compensation is not subject to personal income tax and is not even included in the list of deductions.

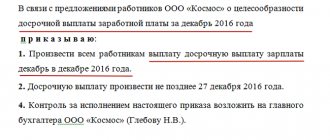

A good example

Let's consider this example for a better understanding of how to fill out 6-NDFL when wages are delayed:

The tax agent had a difficult financial situation and was unable to pay his employee Petya’s salary for May.

Peter’s salary is 40,000 rubles, and the interest rate is 13%, which also shows 6-personal income tax.

The amount of tax that must be calculated from Petya’s income is 40,000*13%=5,200.

So, the salary was calculated for May, and paid on June 16. How to reflect this situation in 6-NDFL?

- Line 100 – the date of receipt of income – shows 05/31 (the month for which wages were calculated).

- Line 110 – the date of the actual withdrawal of the tax amount, that is, when Peter received his salary in his hands – 16.06.

- Line 120 – when the tax was transferred – 17.06 – a non-working day, which means we indicate 19.06.

- Line 130 shows the amount of actual income - 40,000 rubles.

- Line 140 - displays the amount calculated at the tax rate for payment to the budget - 5,200 rubles.

Thus, Peter paid these 5,200 from his 40 thousand. The employer acted as a tax agent, and Peter himself is a taxpayer.

Peter's employer, being a good person, calculated him 5,000 rubles in compensation for the delay, but this amount in 6-NDFL in case of delayed wages can not be shown as income, since it is not subject to tax.

Interesting video about filling out this type of reporting:

Employer's payment obligations

The Labor Code, in order to protect workers who are hired to perform work on contractual terms, obliges the employer to pay wages. Moreover, he must pay it within a strictly specified time frame.

The amount of the salary, as well as the timing of its payment to the employee, are stipulated in the contract signed by the employee, in the rules within the corporation, in employment contracts, as well as directly in the Labor Code.

An employee who has not received the income due to him for work performed for 2 weeks in a row may notify the employer of the suspension of work. Moreover, the wait for the due payments must also be paid. The calculation will be based on the employee’s average earnings.

6-NDFL in case of delayed wages, this fact reflects what tax authorities, and then labor inspectors, will probably be interested in. The employer will be legally obliged to:

Therefore, paying your employees for their work is entirely in the interests of the employer himself. Delays in payment of wages occur for the following reasons:

- Difficult financial condition of the hiring company.

- The employer has doubts about the quality of the work performed.

- Due to other considerations of the employer or deliberate non-payment.

It should be noted that some not entirely honest employers, having paid 50% of wages, believe that this way they will be able to get rid of responsibility. This is wrong. Partial non-payment of wages may also result in criminal liability, as can complete non-payment.

So, 6-NDFL is designed to display all the income that is received by employees, as well as the timing of their receipt and the timing of withholding taxes from them, which is directly reflected in the 6-NDFL form.

Payment for services provided under a civil contract.

The date of actual receipt of income in the form of remuneration for the provision of services under a civil law agreement is the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (clause 1, clause 1, article 223 of the Tax Code RF).

Tax agents are required to withhold the accrued amount of tax on the specified income upon their actual payment (clause 4 of Article 226 of the Tax Code of the Russian Federation). The amounts of calculated and withheld tax on the specified income must be transferred to tax agents no later than the day following the day the income is paid to the taxpayer.

It is worth noting that in the case where the certificate of completion of work (services rendered) is signed in one month, and the remuneration is paid in another month, the calculation is completed upon payment of such remuneration (Letter of the Federal Tax Service of the Russian Federation No. BS-4-11 / [email protected] ) .

On 02/05/2017, a civil contract was concluded with an individual to carry out construction work.

The acceptance certificate for works (services) under a civil contract was signed in March 2021, and the remuneration in the amount of 20,000 rubles. the individual was paid for the provision of services under this agreement in April 2021 (04/06/2017). The amount of calculated personal income tax was 2,600 rubles. This operation is to be reflected in Section. 1 and 2 calculations for the first half of 2021. At the same time, in Sect. 2 you must specify:– on line 100 – 04/06/2017;

– on line 110 – 04/06/2017;

– on line 120 – 04/07/2017;

– on line 130 – 20,000;

– on line 140 – 2,600.

Salaries for September were paid in October

For the 1st-3rd quarter, the form must be submitted to the tax office no later than 31.10. We will fill out the form if there is a delay in the transfer of earned funds. In the first section, all indicators are reflected as a cumulative total from the beginning of the year. Data on accrued amounts is indicated here, regardless of the date of payment.

In the second section, you should indicate data only for the third quarter: income that was paid to individuals and taxes transferred to the treasury. If the delayed salary was paid in October, this should be indicated in the lines:

For example, consider the option when wages for the 09th month in the organization were accrued in the amount of 270 thousand rubles, deductions from wages in the amount of 13% amounted to 35.1 thousand rubles. According to the collective agreement, the salary date is the 7th of the next month. Wages for August were paid with a delay only on September 27. Fill out the form line by line:

- 100 – September 30;

- 110 – September 27;

- 120 – September 28;

- 130 – 270 thousand rubles;

- 140 – 35.1 thousand rubles.

If wages are paid late in installments, income tax amounts should be withheld from each transfer to employee cards. This is explained in the letter of the Ministry of Finance No. 03-04-06/ 43 479 dated July 25, 2021. In reporting 6 personal income tax, filling out lines 100-140 should be completed in several blocks for each delay repayment date separately.

If employees' salaries were paid earlier than the end of the month: 6 personal income tax details of filling out

Sick leave payment

The date of actual receipt of income in the form of temporary disability benefits is the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation ).

Tax agents are required to withhold tax from benefits upon their actual payment ( Clause 4 of Article 226 of the Tax Code of the Russian Federation ). At the same time, tax agents are required to transfer the calculated and withheld tax when paying the taxpayer income in the form of temporary disability benefits (including benefits for caring for a sick child) no later than the last day of the month in which such payments were made ( clause 6 of Article 226 of the Tax Code of the Russian Federation ).

The employee was on sick leave from June 5 to June 9, 2017.

The benefit was paid on June 15, 2021 after the presentation of a certificate of temporary incapacity for work. In Sect. 2 calculations of 6-NDFL, these transactions will be reflected as follows:– on line 100 – 06/15/2017;

– on line 110 – 06/15/2017;

– on line 120 – 06/30/2017;

– on lines 130, 140 – the corresponding total indicators.

It is worth noting that the reflection of transactions on payment of sick leave in the calculation is reflected upon the fact of payment of benefits. If income in the form of temporary disability benefits is accrued in one reporting period and paid in another, such income, as well as the tax calculated on it, are reflected in section. 1 and 2 calculations in the period in which the benefit was paid ( Letter of the Federal Tax Service of the Russian Federation dated 01.08.2016 No. BS-4-11 / [email protected] ).

The temporary disability benefit accrued to the employee for June 2021 was transferred on July 5, 2021.

This operation is to be reflected in Section. 1, 2 calculations for nine months of 2021. At the same time, when filling out section. 2 calculations, the operation to pay benefits in July is reflected as follows:– on line 100 – 07/05/2017;

– on line 110 – 07/05/2017;

– on line 120 – 07/31/2017;

– on lines 130, 140 – the corresponding total indicators.

Since the benefit was actually transferred in July, the grounds for reflecting this operation in lines 020 and 040 of section. 1 calculations for the first half of 2021 are missing. The presence of values in the specified lines will be considered an error ( clause 9 of Letter No. ГД -4-11/ [email protected] ).

Tax payment deadline

The employer's obligation to transfer personal income tax to the budget arises for the taxpayer only on the day of payment of the second part of the income. The tax is not considered paid if it reaches the treasury before the day of the month for which the salary was accrued.

In addition, you should pay attention to filling out line 120 of 6-NDFL in case of a full delay in wages. If personal income tax is transferred to the treasury on the day the income is transferred, this line should reflect the actual date of transfer of withheld tax amounts. Otherwise, this may be regarded as providing false information.

Compensation due to delayed payment of wages should not be reflected in Form 6-NDFL. Firstly, this is not recognized as income according to the Tax Code of the Russian Federation, Article 217, paragraph 3. Secondly, it is not considered a deduction for tax purposes.

Withheld tax, but forgot to pay: how to fill out 6 personal income taxes in such cases