Who received a minimum wage increase from October 1

Lucky Muscovites. This year, the minimum wage in Moscow changed twice: from July 1 and from October 1 (PP No. 1177-PP dated September 10, 2019):

- from July 1st they raised it by 570 rubles. up to RUB 19,351;

- from October 1, the amount was increased by another 844 rubles. up to 20,195 rub..

The minimum wage in Moscow from October 1, 2021 is 20,195 rubles (approved by Moscow Government Decree No. 1177-PP dated September 10, 2019). In the Moscow region, the figure has not changed - 14,200 rubles (agreement on the minimum wage in the Moscow Region No. 41 of 03/01/2018).

The amount is adjusted depending on the cost of living, which legislators have the right to change quarterly. It is possible that it will soon be counted in the regions.

IMPORTANT!

In 2021, the total amount of money earned by an employee from a particular employer cannot be less than 11,280 rubles.

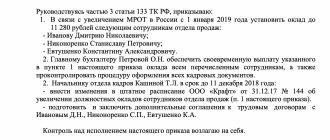

Justification for a mandatory salary increase - sample order

As mentioned above, in order to convince the boss to increase wages, you need to provide compelling arguments in your application.

Reasons for salary increase:

- Increase in job responsibilities.

- Hourly overtime.

- Training.

- The employee's services to the company.

- End of probationary period.

- Inflation, rising prices.

The manager, in turn, needs to clearly understand that for any employee, the most effective means of motivating him to work is monetary interest.

Insurance period for sick leave - we have written down all the information on this topic.

Do you need to post payroll entries correctly? Don't worry. All the details are in our article!

Tariff payment and non-tariff payment - what is the difference? You can read everything you need to know about her at this link.

Document the salary increase in administrative documentation. Let's look at how to do this using an example.

We invite you to read: Application to the court for installment payment on a loan: sample 2019

From January 1, 2021, the minimum wage is 11,280 rubles. If we have employees whose wages are below the minimum wage, then we are obliged to increase it.

You can do this in two ways:

- establishing a new monthly salary;

- establishing an additional payment up to the minimum wage.

To set a new salary amount, issue an order to increase it. The order is drawn up in any form indicating the reasons for the salary increase and new payment amounts.

What to do due to an increase in the minimum wage

Employers whose employees receive wages less than the minimum wage must increase it to the new established values. To do this, you will have to issue a sample order to increase wages and adjust the staffing table.

You need to understand that the salary may remain the same, since it is not the salary itself that is less than the minimum wage, but the total amount of the salary received by the employee, which includes:

- compensation payments, including allowances and additional payments;

- incentive payments (bonuses);

- reward for work.

What is the difference between a salary increase and indexation?

Before answering this question, let’s look at what we mean by a salary increase. It could be:

- mandatory indexation of wages (in cases established by law, for example, when the minimum wage is increased);

- voluntary salary increase by decision of the manager.

In the first situation, salaries must be indexed to employees whose payments for labor are below the level required by law. Moreover, under these circumstances, salary indexation is an obligation, not a right of the organization (Article 130 of the Labor Code of the Russian Federation, letter of Rostrud dated April 19, 2010 No. 1073-6-1). This is also confirmed by another norm - Art. 134 of the Labor Code of the Russian Federation, which states that employee salaries are subject to mandatory indexation due to rising consumer prices.

Ignoring this obligation is a reason for imposing fines on the violator under Art. 5.27 Code of Administrative Offences. Details are in the note “Rostrud: you can’t help but index wages!”

In the second case, the employer has the right to increase salaries at his discretion, both for all employees and selectively. As for the size of salaries, the legislation does not set any restrictions on voluntary salary increases.

IMPORTANT! Despite the fact that both procedures are aimed at increasing purchasing power, indexation and salary increases should be clearly separated: increasing salaries actually increases it, and indexation is only a way to protect the employee’s income from inflation.

At their core, these two concepts are close and quite similar - they both relate to the economic component of the employee’s labor. But there are also significant differences between them.

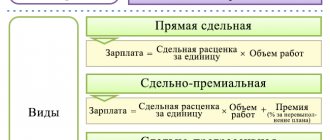

Salary is considered to be the unchanged base part of the salary, which is prescribed in the employment contract or an additional agreement to it.

Wages are a whole series of various accruals: salary, allowances for hazardous production, percentage of sales, bonuses, bonuses, etc. minus insurance payments to extra-budgetary funds. When wages increase, all parts of wages increase simultaneously.

We invite you to read: How to legally write off loan debts?

How to increase your salary due to an increase in the minimum wage

If the employee’s salary consists only of salary or tariff rate, the employer must correctly draw up documents to increase the established payments to the minimum wage. To do this, use a sample order to increase salaries for all employees or only those whose salaries do not reach the established minimum.

If the employer includes in the employee’s remuneration, in addition to the salary, other allowances or additional payments, either their amount or the salary (tariff rate) should be increased so that the total amount is at least 11,163 rubles.

To do this, an order should be issued to increase wages in connection with the increase in the minimum wage, which changes the staffing table. Here are instructions on how to do this:

- Issue an order to increase wages.

- Based on this order, make changes to the staffing table (established form T-3).

- Make changes to employment contracts regarding remuneration for labor.

Indexation coefficient

The minimum level of increase, as a rule, is equal to the level of the price increase indicator and assumes an increase in the income of workers once a year.

For example, an increase is carried out at the end of the quarter. The inflation rate in April was 0.33%, in May - 0.37%, in June - 0.61%. If an employee’s salary is 35,000 rubles, then for April it will be 100.33% of this amount. In May, respectively, 35,115.5 x 1.0037 = 35,245.43 rubles.

Thus, the salary will rise by 460 rubles. This is an example of retrospective indexing. When calculating the expected indexation, the price growth index published by Rosstat is used. Employee salaries increase by the percentage of inflation.

How to write an order for a salary increase

Many employers ask the question of how to draw up an order to increase wages or salaries. Keep the following in mind:

- There is no established template for an order to increase wages for employees.

- Registration takes place in accordance with the general requirements defined for this type of document.

An order to increase salary is issued on the institution’s letterhead. It indicates the date and place where it was compiled. The document is assigned a serial number. The text consists of a preamble and a main part. The preamble contains the basis for issuing a local act, if necessary, with reference to regulatory documents. The main part reveals the essence of the content.

The salary order is signed by the head of the institution. The order must be familiarized to all persons mentioned in it and those to whom it applies.

Preparing for an upward salary change

A salary increase may apply to a specific group of employees, is solely the will of the employer and always has an individual numerical value.

In other words, the head of the enterprise has the right, at his own discretion or based on the recommendations of the heads of structural divisions, to determine who, for what and by what amount to increase wages. As for indexation, the situation here is somewhat different - the norm for it is prescribed in the legislation of the Russian Federation, i.e. every employer is obliged to carry it out.

During indexation, the salary portion is subject to increase, while the amount of the increase is always fixed and applies to all employees of the enterprise. The purpose of indexation is to change wages in order to ensure the purchasing power of workers at an acceptable level, since it is known that due to inflationary processes it has a steady downward trend.

As a rule, increasing an employee’s salary does not require such significant and long-term preparation: the employer’s initiative is sufficient for this. Moreover, in practice, such an initiative, in turn, can be provoked by an employee’s proposal to increase the amount of his remuneration.

https://www.youtube.com/watch?v=ytpolicyandsafety

In large organizations, it is also common practice for the head of the department in which he works to request an increase in pay for a specific employee who demonstrates excellent results in his work. In this case, it is recommended that such a petition be made in writing so that it can be used when drawing up an order to change the salary according to the sample.

It should be borne in mind that current labor legislation requires two months' advance notice to the employee only if his official salary is planned to be reduced. Therefore, in a situation where the employer is preparing to increase his pay, compliance with the two-month period is not mandatory, but can be implemented.

In general, the specific date for the introduction of a new official salary is established by an additional agreement to the employment contract.

The next important stage in preparing for a salary change will be making changes to the staffing table in force in a particular organization. This is due to the fact that it is the staffing table that is the basis for calculating wages to specific employees in accordance with their positions.

Thus, changing the official salary without entering the relevant information into the schedule will be unlawful.

If we are talking about changing the salary of a specific employee, you should not indicate in the staffing table an increased salary for one of the representatives of the same job positions: this would be a violation of current legislation. In such a situation, it is necessary to supplement his job responsibilities with new functions or designate a different job title: this will be sufficient grounds for establishing a higher salary.

In all situations, changes to the staffing table must be formalized by an appropriate order signed by the manager. At the same time, in the sample order to change the remuneration of employees, it is necessary to clearly indicate which job positions the changes made concern. It is also important to indicate in which direction and by how much their salaries are changing, as well as from what date the listed changes come into force.

We invite you to familiarize yourself with: Sample lease agreement for non-residential premises (for the lessor) Sample agreements Procedural documents

Note! If we are talking about a salary reduction, the order must indicate that the recorded changes come into force in two months, that is, after the mandatory period for notifying the employee about such changes.

Is it possible not to raise wages?

The employer needs to understand that the increase in wages applies to those employees who work under an employment contract. Persons involved in cooperation under civil contracts (contracts, services) will not be able to count on an increase. In relation to such citizens, the employer is not obliged to fulfill the legal condition.

In other cases, the employer is obliged to increase pay, including:

- when working on a part-time basis;

- when working part-time (if, for example, a part-time worker performs half the normal working hours, the employer is obliged to pay him half the minimum wage).

If the salary of the organization’s employees is below the minimum wage, the employer will be fined. Fine amount:

- for a legal entity will be from 30,000 to 50,000 rubles, for a repeated violation - up to 70,000 rubles;

- the director will be given a warning or a fine in the amount of 1,000 to 5,000 rubles, if detected again - from 10,000 to 20,000 rubles. Additionally, disqualification is provided for a period of one to three years.