Why is the average number of employees needed?

Information on this data is necessary for the tax service to determine the taxation procedure in each specific case, as well as for maintaining statistical documentation.

In case of failure to provide reporting information, the enterprise or entrepreneur faces a fine:

- If a legal entity or entrepreneur, the fine will be 200 rubles.

- If an official, then payment will need to be made in the amount of 300-500 rubles.

Average headcount when opening an LLC

Based on the name of the form, this report should be submitted to the Federal Tax Service only by companies that have employees, i.e. employers, however, the Ministry of Finance, in its letter dated February 4, 2014, indicated that enterprises that do not have employees are not exempt from providing information on this form.

In this regard, the list of organizations required to submit information on the average headcount includes:

- companies that have just registered with the tax office, regardless of the presence or absence of employees;

- individual entrepreneurs who are also employers;

- organizations that have entered into labor agreements with individuals;

- companies that do not have employees.

In other words, only individual entrepreneurs who do not have labor relations with individuals are exempt from providing this form.

The calculation of the average number of employees is carried out in accordance with the Instructions of Rosstat, approved by Order No. 428 dated October 28, 2013. This document presents a list of employees who must be included in the number of employees indicated in the reporting form. There is also a list of persons who are not taken into account in the calculation.

A lot of controversy arises when taking into account the number of employees, especially for newly created organizations where there is only a single founder. The whole problem is that the owner of the company does not have an employment contract and does not receive wages, and therefore is not an officially employed person. On the other hand, the founder performs all necessary administrative functions. The answer to this question is given in paragraph 80 of the Instructions, where it is written that the founder should not be taken into account when calculating the NPV.

This indicator applies only to employees hired under an employment contract, but not under a GPC agreement. In this case, the duration of the work under the employment contract does not matter.

When and where should information about the average number of employees be submitted?

To submit data, you must fill out a special form, the code of which is KDN 1110018. In the form field, you will need to fill in all the columns, except for those in which the tax officer will write. The basis for filling out the form is Procedure No. 1-T “Information on the number and wages of employees by type of activity,” which was approved by the Federal State Statistics Service dated October 9, 2006 No. 56.

The document is drawn up in two copies, since one is stored in the tax service, and the second is transferred to the owner of the enterprise or firm, but with all the necessary notes. You can always get the form to fill out directly from the tax office, or you can use special resources and download it electronically, but you need to pay attention to whether it complies with current standards.

A sample form is usually attached. Also, on the Internet you can use sites that will help you calculate the average number online. The prepared report can be submitted to the tax office electronically, but it is better to find out in advance whether they accept this option.

The completed form is sent to the district tax office where the entrepreneur was registered.

As for the deadlines, reports of this kind for the year are submitted before the twentieth day of the next year. For example, if you need to submit a report form for 2015, it will be accepted until January 20, 2021.

To calculate the average headcount for the year, you need to know this indicator specifically for each month. If the enterprise does not have registered workers, then the calculated indicator will accordingly be equal to zero. This also needs to be displayed in the report, since it was already said above that information is submitted by absolutely all entrepreneurs.

Calculation of the average number per year

After the number has been calculated for each month, the average number for the entire year is determined.

To do this, the values of all 12 months are added up, and the resulting number is divided by 12. The final figure is again rounded up or down.

Chg = ( Chs1 + Chs2 + … + Chs12 ) / 12, where

- Chs1 , Chs2 ... - the resulting average number for each month

If the company was registered during the year and did not work for the entire period, then the total amount is still divided by 12.

In addition to the annual number, for some reports it is necessary to determine the quarterly number on average. It is done in a similar manner, only the total of the indicators for the quarter is divided by three.

Who is included in the list of employees

The list includes:

- Regular workers;

- Seconded employees and those who went abroad for work-related issues, subject to continued salary.

- Employees on official sick leave.

- Employees with government credentials.

- Truants.

- Persons who are employed part-time or part-time. Time worked is calculated proportionally. An exception in such cases will be persons who, on a legislative basis, have the right to a shortened day - these are minors, employees working in hazardous conditions, nursing mothers, disabled people of groups I and II.

- Employees on a probationary period.

- People doing work from home.

- Students-interns working on TC.

- Temporary employees from other enterprises, if the first one does not maintain wages.

- Substitute specialists.

- Employees who are undergoing training, but at the same time receive payment for their work.

- Employees on vacation.

Calculation of the average number of part-time employees

First, you need to calculate the total number of hours worked by part-time workers. In this case, days spent on vacation or sick leave are counted by the number of hours worked on the last day preceding this event.

Then the average number of such employees is determined. To do this, the total amount of hours worked by them in a month is divided by the product of the number of days of work in a month and the number of working hours per day.

Chn = Chs / Rch / Rd , where:

- Hours - the total number of hours per month worked by part-time employees

- RF - the number of working hours per day, in accordance with the length of the working week, which is established in the company. So, if a 40-hour week is used, then 8 hours are set, 7.2 hours are set for a 32-hour week, 4.8 hours are set if the week is 24 hours long

- Рд - number of days of work in a month, in accordance with the calendar

Example. In March, the employee worked 24 days out of the entire month on a part-time basis. With a duration of 8 hours, this amounted to 4 hours a day.

Calculation: 24 days x 4 hours a day / 8 hour week / 24 = 96 / 8 / 24 = 0.5 The result is not rounded.

The procedure for calculating the average number of employees

The indicator required for reporting is calculated for the year of operation. The formula for calculating for the year is as follows: the amount of NCR for all months / 12 = NCR for the year. As you can see, for the final result it is necessary to know the values of the average headcount for each month of the year.

The average headcount for a month is calculated as follows: the total number of headcount according to the list of full-time employees for all calendar days/number of calendar days of the month being calculated. Holidays and weekends must be taken into account, and the number of workers on these days will be the same as the working day the day before. Those employees who are on a business trip, vacation, sick leave or time off are also taken into account.

Knowing the monthly indicator for the enterprise, you can calculate not only the annual average quantity, but also for the quarter. Accordingly, when calculating the quarterly indicator, figures for three accounting months are taken.

In practice, the result is often a fractional number. Since this value concerns living people, for obvious reasons no one will enter such a number into the finished report. In these situations, the school mathematics curriculum will come to the rescue. Rounding rules are used: if the decimal point is 5 or more, then one is added to the whole number. If it costs 4 or the value is less, then the integer value that was received remains the same.

For ease of calculation, first count the number of people who worked a full day, separately - part-time. Then the obtained values are summed up and further calculations are carried out.

Calculating the number of employees who have worked full time is not difficult. The situation is different for those who work part-time.

Accounting for such employees is kept in proportion to the time worked. Often the number of hours and days worked for such employees may not coincide very well for further calculations, since the average number is an integer value. For convenience, use the following formula:

The total number of man-hours worked per month / length of working day / number of working days according to the calendar in a given month. The resulting value is the average number of part-time employees. The length of the working day can be calculated by knowing the length of the working week. That is, the duration of the entire week is divided by the number of working days.

Having thus calculated the value for each month, the average number for the year is calculated. If, for example, the enterprise has operated for less than a full year, and this often occurs and concerns seasonal companies, then the number for each working month is calculated, but the resulting value is also divided by 12.

Carrying out these calculations is not such a difficult task. The whole problem comes down to precisely determining the list of workers who will be taken into account. This reporting can be carried out either by the entrepreneur himself or by an accountant at the enterprise.

Calculus principle

Quite often, newly minted accountants are interested in what the average number of employees is. It is quite simple to calculate: it is equal to the sum of the number of people on the list for each day, which is divided by the number of days. All days without exception are included in the calculation of the average headcount. On weekends and holidays, the number of people is indicated in the same way as the last working day.

To calculate this indicator, the accountant follows the following procedure:

- Determines the number of people on the payroll who are fully employed daily.

- Calculates the average number of full-time employees on a monthly basis.

- Calculates the number of hours not fully worked.

- Calculates the average number of part-time employees monthly.

- Calculates the average number of all employees on a monthly basis.

- Rounds the result to whole units.

- Having determined the average number of people per month, you can also determine it for any other period: six months, a year.

Important: the average headcount cannot be expressed in tenths, since it is subject to mandatory rounding.

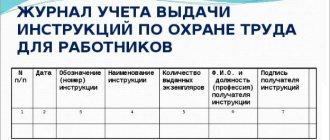

The following documentation is used to calculate data:

- orders for employment and dismissal;

- personal cards of workers;

- report card;

- transfer orders.

Nowadays, few accounting departments operate without special computer programs. Basically, all systems are automated, so this report comes out ready-made. But this does not relieve the responsibility of the responsible person of the obligation to provide the report correctly. An official may be punished for false information.

Recommendations for compiling the average number of employees:

Knowing the calculation formula, you should pay attention to a couple of nuances in this procedure:

- The required indicator is calculated according to the established algorithm, but all weekends and holidays are taken into account. The number of employees will be equal to the number that was recorded the day before, i.e. the previous working day.

- Those who are on paid leave, time off, business trips or official sick leave are also taken into account.

- The report form can be submitted either electronically or in handwritten form. No corrections or blots are allowed.

To calculate the reporting data, you will need the following documents:

- Orders that are signed for the hiring or dismissal of employees.

- Orders for approved leaves or transfers.

- Travel orders.

- Personal cards of all employees.

- Exit sheet.

- Payroll calculations.

- Statements of all payments.

Determining the number for each day of the month

First you need to find out the number of full-time employees in the company. On weekdays, this value is equal to the number of people with whom employment agreements have been signed, including those on business trips and on sick leave.

However, this volume does not take into account:

Important! The number of employees on a day off is considered the same as on the last working day before it. This means that an employee fired on Friday is included in the calculation on Saturday and Sunday. Companies that do not have a single employment contract put “1” for the billing month, taking their manager into account, even if he does not receive a salary.

The process of filling out the report form on the average number of employees

The form that is filled out to submit reports on the average headcount has a certain number of lines and columns that must be filled out.

They include the following information:

- Identification code of the entrepreneur or registered enterprise.

- Code of the reason for which it was registered. As a rule, this item is not filled out.

- Number of document pages – 001.

- Tax service to which reporting information will be transmitted.

- Tax identification code.

- Full name of the enterprise or full name of the individual entrepreneur (abbreviations are not allowed).

- Date of submission of this report.

- The directly calculated average number of employees.

- Last name, first name and patronymic of the report submitter, date, signature and seal of the enterprise.

Deadlines for submitting the average headcount report

Let us note once again that reporting is provided to both existing and new organizations. The reporting deadlines are as follows:

- For newly organized organizations (individual entrepreneurs are not included here) - no later than the 20th day of the month following the one in which the LLC was registered

- For operating organizations and entrepreneurs who have employees, information is provided once a year - before January 20 of the year following the reporting year.

- When liquidating an LLC or closing an individual entrepreneur, these reports must be submitted before the established date of deregistration or liquidation

The difference between the average number of employees and the average number of employees

Although the names of these two concepts are very similar, they have significant differences. The average number is a general indicator and includes the average number, as well as employees who performed work under additionally concluded contracts and external part-time workers.

Indicators and calculations for the average number are submitted in the form of statistical form No. P-4 “Information on the number, wages and movement of employees.” Also, another main difference between these two concepts is the method of calculation. Unlike the average number, the average number of employees is counted as a whole unit for each calendar day.

How to calculate the average headcount for the tax office?

The Federal Tax Service should submit data on those employees who are in one way or another on the employer’s payroll. Moreover, they are included in the calculation regardless of the fact of being at the workplace. Employees may be absent due to illness, vacation, or in connection with the performance of government duties. When included in the headcount, all persons are taken into account, maintaining the average salary. Only certain categories of persons are not subject to registration in the average tax list.

How is the average number of employees determined in the DAM 2021?

The SSC is calculated, as before, in the manner determined by Rosstat (clause 3.11 of the Procedure for filling out the DAM). The calculation methodology in 2021 has not generally changed - it is given in paragraphs -81 of Rosstat Order No. 711 dated November 27, 2019 (as amended on November 17, 2020).

To calculate the number (average payroll) in the DAM, it is necessary to determine the payroll composition of employees, which includes:

- employees under employment contracts who worked for at least 1 day in permanent, temporary, seasonal work (including internal part-time workers);

- owners of the organization who work and receive salaries in it.

Excluded from this list for calculating the SCH are employees who are on maternity leave during the billing period (except for those working part-time or at home), as well as student employees who were on additional leave without pay due to their studies, incl. upon admission to an educational institution.

The following are not included in the payroll:

- external part-time workers;

- performers under GPC agreements;

- persons transferred to another organization (if their salary is not retained) and sent to work abroad;

- employees sent for training (without work), receiving a stipend from the employer;

- persons who have entered into a student agreement (with a scholarship);

- employees who submitted a letter of resignation, stopped working before the expiration of the employer's warning period or without warning at all (are excluded from the SSC from the first day of absence from work);

- lawyers;

- military personnel performing military service;

- founders who do not receive a salary from the company.

Internal part-time workers, regardless of the number of rates and positions they hold, are counted as 1 person. The SSC includes as a whole unit employees who have been assigned reduced working hours by the employer or in accordance with the provisions of the law (for example, minors, disabled people of groups 1 and 2, etc.).