Why notification is required

The procedure for remuneration (salary, additional payments, allowances) is an essential condition of the employment contract, therefore changing it without first notifying the employee and obtaining consent is unacceptable. It is necessary to inform the employee about upcoming transformations in order to:

- find out whether he is ready to work in new conditions;

- comply with the procedure established by Art. 74 Labor Code of the Russian Federation;

- document the employee’s consent or disagreement to work under new conditions.

Before sending a notification, it is necessary to make changes to the wage regulations or to another document that establishes the system for making payments in the organization.

Change of salary payment deadlines: notification

Keep in mind that if an employee refuses to sign an additional agreement to the employment contract, the employer may recognize the change in salary terms as a change in organizational working conditions. In this case, the employer needs to notify each employee in writing about the upcoming change in the timing of salary payment. The employer must do this no later than 2 months before making changes.

If the employee does not agree with the innovations, then theoretically such an employee can be dismissed with payment of severance pay in the amount of two weeks’ average earnings (Article 74, paragraph 7, part 1, Article 77, Article 178 of the Labor Code of the Russian Federation).

Form and content

The labor legislation does not have an approved sample of an employee’s notification of changes in wages, so we recommend that you draw up the document yourself in free form and, in accordance with Part 2 of Art. 74 of the Labor Code of the Russian Federation, indicate in it:

- reasons for switching to a new system and why the old one cannot be preserved;

- what exact changes will occur in payment for work (you can quote specific provisions of the document that established the new wage payment system);

- from what date will the organization apply the new payment scheme;

- what will happen, in accordance with Art. 74 of the Labor Code of the Russian Federation, if the employee agrees or refuses to work under new conditions.

Changes to the wage regulations

Issues of settlements with personnel are regulated not only by employment contracts, but also by local regulations of the enterprise. In this case, the nuances of wage calculation are displayed in detail in the instructions or regulations on remuneration, which the employee is introduced to before signing the employment contract.

The convenience of the provision is, first of all, that there is no need to spell out everything in the employment contract every time; it is enough to make references to the clauses of the main document. This saves time and resources. For example, it was necessary to rework the remuneration system by introducing new (or eliminating existing) criteria of efficiency, effectiveness, complexity, tension, or something else. The wording can be voluminous and include formulas, calculations, presentation procedures, etc. Writing this every time in each employee’s employment contract may not be entirely convenient: there is a lot of paper, and you can make mistakes if you retype it every time. And if you simply refer to the new point of the provision, then this saves both effort and nerves and minimizes possible errors.

It’s another matter when the question arises of how to formalize changes to the payment regulations. In this case, the administration makes an order to change the wage regulations. Is it necessary to warn employees about the amendments being made? Of course, because this issue is an essential condition of the employment contract.

How to make changes to your organization's benefit regulations

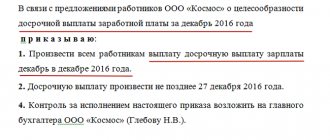

For example, salary payment dates change. In this case, an order is drawn up in free form, in which the following must be stated:

- basis (what caused the changes);

- timing (when the new rules come into force);

- instructions to responsible persons for delivering notifications to employees about upcoming changes;

- who will be responsible for carrying out the order itself.

Deadlines for issuing salaries: order to change the date

» Directory » Doing business » Forms and documents

According to the laws established today, payment for the work of personnel is carried out twice a month, with an interval of two weeks. The internal documentation of the enterprise indicates the date when the payment was made.

Quite often, the administration of the enterprise uses special orders that set deadlines for payment of wages. Below, we propose to consider the rules for drawing up such documents, and we will tell you how to set a new payment deadline.

The commented law provided for changes to Article 136 of the Labor Code of the Russian Federation

Previously, the Labor Code of the Russian Federation did not consider the timing of payment of wages. However, in two thousand and sixteen, this provision was revised.

According to the decree of October 3, salary payment must be made by the fifteenth day of each month. In this regard, many organizations where payment of wages is carried out later must draw up a report on changes in payment terms.

The order on the timing of payment of wages in accordance with the established procedure must contain the exact date of payment.

Let's look at what else this document should contain:

- name and details of the enterprise;

- date of writing the document;

- place where the document was written;

- type of form;

- table of contents.

The completed order must be certified by the signature of the head of the enterprise and a seal.

According to the new resolution, documents such as the Regulations on Remuneration, the employment contract and internal regulations must indicate specific deadlines for issuing payment.

If this documentation does not contain a clearly established framework, then the above documents need to be completely redone.

To summarize all of the above, we can say that today, when drawing up an order for calculating wages, you should indicate a specific date, and not an approximate period, as was previously allowed.

Important! If there is a need to change the deadline for issuing a salary, the enterprise administration must notify each employee. Such notices will be provided in writing. It should also be taken into account that such documents are drawn up in advance (at least two months from the date of payment).

"Closed Joint Stock Company "Pyramid" INN 0000000000

Marketing department employee D.B. Potapov

Notification

on amendments to the employment agreement

JSC "Pyramid" brings to your attention that according to the current rules of legislation, based on changes dated October 3, 2016 under Article No. 136 of the Labor Code, the data of the employment agreement (dated March 23, 2021 No. 90-Employment Agreement) has been corrected. From October 1, 2021 of the year, clause 6.4 of the Employment contract shall be explained in the following wording: “The advance payment is issued on the 21st of the current month. Payments are made on the 7th day of the month following the previous one.”

Chief: I.T. MikhailovIntroduced to: D.B. Potapov."

In each organization this date is determined individually

According to article of law No. 136 of the Labor Code, the administration of the enterprise is obliged to enter into an additional agreement with the staff if the timing of payment of wages does not meet the requirements in the above article. If there is a collective document, such changes are formalized in one act.

In the case of individual contracts, it is necessary to prepare additional agreements for each employee. In the event that a company employee refuses to sign the above act, the administration has the right to dismiss the employee.

This rule is spelled out in the seventy-fourth and one hundred and seventy-eighth articles of the Employment Agreement.

“Additional consent No. 6k to the labor agreement dated May 15, 2007 No. 26

On amendments to the employment agreement, according to the new law of the Labor Code

Voronezh November 20, 2016

In accordance with the requirements specified in Article No. 136 of the Labor Code, the parties agreed on changes to the clauses of the labor agreement in order to bring them into line with the amendments, namely to clarify clause No. 5.7 as follows:

- Other terms of the previously concluded employment agreement remain unchanged.

- This agreement comes into force on October 1, 2016.

- This document was drawn up in several copies for each party.

- Each copy has equal legal force.

Set the following dates for payment of wages:

- for the first half of the month worked – the sixteenth day of the current month;

- for the second half of the month worked - the first day of the month following the current one.”

The details of each party must be specified below, and the completed document must be certified by the seal of the organization. It should also be noted that with a fixed period for salary payment in the collective agreement, this procedure has a number of its own features.

When making amendments to a collective agreement, a special commission must be created, consisting of representatives of the personnel and management of the enterprise. At the meeting, details and details of the future agreement are discussed.

Only after such a meeting is held, the act itself is drawn up, in which various amendments are indicated.

The legislation clearly states that every employee must receive a salary at least twice a month

The initial task of the accounting department employees is to check current standards for compliance with the new requirements set out in the amendments to the Labor Code. If the current documentation complies with the established form, then no additional changes are required.

If inconsistencies are discovered, an appropriate order should be prepared, where new dates will be prescribed. When setting new payroll dates, the wishes of the staff should be taken into account. If there is a trade union company in the organization, it is necessary to obtain its consent.

In most cases, the management of the enterprise tries to issue salaries on the first days of the month.

Due to changes in the law, many organizations are wondering whether it is possible to issue wages earlier than the deadline. This approach is often practiced and is not considered illegal.

This situation does not imply the imposition of penalties on the management of the company. Once the deadline for issuing wages has been agreed upon, an order must be prepared.

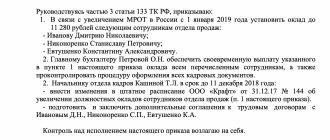

"Closed Joint Stock Company "Zima"Order No. 231

September 09, 2021 Omsk

About making edits

To bring changes and amendments into conformity with the standards specified in Article No. 136 of the Labor Code

Introduce the necessary amendments to the order of Zima CJSC dated June 21, 2015 No. 5 “On labor regulations”, setting out paragraph 4.9 as follows: The amendments made will take effect from October 1, 2021.

To the head of the accounting department - chief accountant Valieva T.V. make payments for work within the period specified below.

Employees of Zima CJSC are paid for their labor activities twice a month:

- For the first part of the month – the nineteenth day of the current month;

- For the second part of the month - the fourth day of the month following the current one.

Head: Tarasov P.D.”

If the company has a large staff, it is necessary to attach an employee familiarization sheet to this order.

We invite you to familiarize yourself with: Debt on penalties to the tax office

If the employer has the desire, he can pay his subordinates at least every day at the end of the shift

Changing the deadlines for payment of wages without notification, as well as failure to pay on time, is a crime. In this situation, such violations may entail administrative or criminal liability.

In case of violation, the organization must provide financial compensation to the employee. The amount of compensation previously amounted to one three hundredth of the refinancing rate.

Today, this amount is one hundred and fiftieth of the key rate.

The resulting number should be multiplied by the amount of wages. The result obtained is the amount of compensation per day of delay. Compensation to an employee for violation of payment terms for work activities may exceed the given figures if this nuance was specified in advance in the employment contract. In this case, the reason for the delay in financial payment is not taken into account.

Amendments to the current Legislation have significantly increased the amount of additional financial compensation to an employee. In case of systematic violations by the enterprise administration, high financial penalties are provided. These circumstances are discussed in detail in the Labor Code.

For the first delay in payment of finances, the amount of the fine in relation to individual entrepreneurs and organizations ranges from 1,000 to 5,000 rubles, and from 30,000 to 50,000 rubles, respectively. Otherwise, the tax authorities have the right to stop the company’s activities for three months.

It should also be noted that such responsibility rests with the official. If there are violations, the amount of penalties ranges from 10,000 to 20,000 rubles.

In addition, a warning is issued to the official. In case of repeated non-compliance with the rules, the fine varies from 20,000 to 30,000 rubles.

In addition, tax authorities may issue a ban on holding a position for a period of three years.

Salaries cannot be paid less than twice a month.

The current law of the Labor Code also provides for situations where delays in issuing wages to employees entail serious consequences.

When necessary

It is important to understand that notification to an employee is a mandatory document when making adjustments to wages. Thus, only when the organizational basis of the enterprise’s activities or the technological process of labor changes, the manager has the right to adjust the employee’s salary downwards.

To do this, you must first provide your subordinate with a notice of changes in wages (a sample for 2021 will be later in the article). Such a document is drawn up in free form. It aims to achieve agreement on both sides.

How to apply

The current legislation does not provide for a mandatory form of notification of changes in wages. The 2021 sample of this document is drawn up on the company’s letterhead in a free format. It must indicate:

- polite address to the employee - with the first and patronymic (if any);

- message about changes in salary;

- the date of possible commencement of the new terms of labor relations;

- information about the reason for the salary change;

- confirmation of the employee’s consent to the new conditions (his signature is required);

- date of notification;

- manager's signature.

Keep in mind: in the document on behalf of the head of the organization, all these positions must be indicated.

Order to change the terms of payment of wages

An order on wages - a sample of it may be needed to establish or correct the timing of wage payments. You will learn everything about how to issue such orders and what the consequences are if the dates for issuing salaries are not recorded in your local documents in our article.

Labor Code of the Russian Federation on the timing of salary payments

Sample order on the timing of payment of wages

What to do if the deadlines for paying salaries are not fixed anywhere?

Notification of changes in salary payment deadlines The Labor Code of the Russian Federation does not establish deadlines for familiarizing existing employees with newly adopted or amended local regulations. In Art.

22 of the Labor Code of the Russian Federation only states that the employer is obliged to familiarize employees, upon signature, with the adopted local regulations directly related to their work activities.

By virtue of this norm, the employee must also be familiarized with changes in local regulations against signature. Consequently, employees should only be familiarized with the new edition of the internal labor regulations and regulations on remuneration against signature.

Thus, the legislation does not provide for the obligation to notify employees about these changes at least two months before the date of such changes or for any other period.

The procedure for making changes to the PVTR The procedure is quite simple:

- An order to amend the PVTR is generated.

- If there is a trade union body, it is required to obtain its opinion.

- Each employee gets acquainted with the changes against signature (they can be placed in the Rules themselves on a separate sheet, in the attached fact sheets to the Rules or in a special journal).

Collective Agreement The following steps are followed:

- A commission of company representatives and employees is assembled;

- Negotiations are held during which the dates for issuing salary money are agreed upon;

- An additional agreement to amend the collective agreement is formed based on the results of negotiations;

- The additional agreement is signed by representatives of the two parties.

Employment contract The procedure is complicated by the fact that you need to work with each employee separately.

This document is drawn up in any form. Order on the timing of payment of wages: sample 2021 The employer is obliged to notify the employee of his intention to make changes to the current contract in terms of the timing of payment of wages, based on the entry into force of amendments to the current legislation.

Notification of changes in payment terms Example of a notification of changes in salary payment terms Notification of changes to the current employment contract must be sent to the employee at least two months prior to the changes themselves.

In the notification, the manager indicates his intention to make clarifications to the employment contract, based on the adopted amendments to the law. Formation of deadlines for payment of wages The document is certified by the signature of the head and the seal of the institution.

In particular, this applies to changes in the employment contract for reasons related to: Changes in organizational or technological working conditions Changes in the employment contract for reasons related to changes in organizational or technological working conditions include, for example:

- changes in equipment and production technology (for example, the introduction of new equipment, which led to a reduction in the employee’s workload);

- structural reorganization of production (for example, exclusion of any stage of the production process);

- other changes in organizational or technological working conditions that led to a reduction in the employee’s workload.

Order on the timing of payment of wages It is not allowed to set a period of several days as payment deadlines, for example, from the 21st to the 24th of the current month for the first 15 days.

In Russian labor legislation, great attention is paid not only to the correct calculation of wages to employees, but also to the timeliness of their issuance.

To do this, the accounting department of each enterprise must pay its employees earned money on predetermined days. This is required by the Labor Code in force in our country.

Based on his articles, the management of the enterprise usually issues an “Order on the timing of payment of wages.” The sample and rules for its preparation should not contradict the labor laws that are currently in force throughout Russia. How to draw up a document Art.

136 of the Labor Code of Russia states that issues relating to the conditions for employees to receive monetary payments can be reflected in a collective or individual labor contract, as well as in the general internal labor regulations (hereinafter referred to as PVTR).

In employment contracts with employees, the days for payment of wages are not established, but there is a reference to the internal labor regulations and the regulations on remuneration of the organization, where these terms are specified. Experts from the GARANT Legal Consulting Service told us how to notify employees about changes in the timing of salary payments on 10.10.

2016 Troshina Tatyana, expert of the Legal Consulting Service GARANT We are introducing a change in the timing of salary payments By virtue of part six of Art. 136 of the Labor Code of the Russian Federation, wages are paid at least every half month on the day established by the internal labor regulations, collective agreement, or employment contract. As follows from Art. Art.

We invite you to familiarize yourself with: Terms for agreeing on the transfer of vacation with the employer

This issue, according to the law, is regulated by internal labor regulations, a collective agreement or an employment contract. Currently, these documents are in part six of Art.

We believe that the amendment introduced by the legislator indicates the right of the parties to the labor relationship to record information about the date of payment of wages in any of three documents: in the internal labor regulations, in the employment contract or in the collective agreement.

So, for such persons you need to take both SZV-M and SZV-STAZH! {amp}lt; ... When paying for “children’s” sick leave, you will have to be more careful. A certificate of incapacity for caring for a sick child under 7 years of age will be issued for the entire period of illness without any time limits. But be careful: the procedure for paying for “children’s” sick leave remains the same! {amp}lt; ...

Based on this, the employer must issue cash to employees at least twice a month.

Moreover, the first transfers must be made no later than fifteen calendar days from the moment the period for which the corresponding payments are provided ends.

The second part of the salary is issued on any of the remaining days until the end of the current month. But sometimes some companies consider it inappropriate to divide wages into parts and invite their employees to write appropriate statements requesting adjustments to the payment plan.

And perhaps the most important question that worries everyone, from an accountant to an ordinary employee, is when it is necessary to pay wages and how often it is necessary to do this.

Since it is legally established that in the event of a delay in wages and other due payments to an employee, the organization may be fined, and in some cases may be required to pay appropriate compensation.

Note! In connection with the latest changes in the Labor Code of the Russian Federation (which entered into force on October 3), wages must be paid no later than 15 calendar days after the end of the period for which they were accrued.

Order on the timing of payment of wages: features In order to transfer wages to an employee, you first need to determine in what time frame this must be done. According to the law, wages must be paid 2 times a month.

Attention

Add to favoritesSend by mail Order on wages - a sample of it may be needed to establish or correct the timing of salary payments.

You will learn everything about how to issue such orders and what the consequences are if the dates for issuing salaries are not recorded in your local documents in our article.

136 of the Labor Code of the Russian Federation, employers set the deadlines for paying wages independently, but with the obligatory observance of two conditions: payments are made at least 2 times a month and no later than 15 calendar days from the end of the period for which wages were accrued. IMPORTANT! If the “payday” day falls on a weekend, the money is issued the day before.