What are the types of wages?

In labor relations, several dozen types of wages can be distinguished. In a private enterprise, the salary can be presented (clause 2 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of Russia dated December 24, 2007 No. 922):

- payments at a tariff or salary - for time worked;

- payments at piece rates;

- percentage of sales (commission);

- non-cash income;

- royalties;

- allowances, additional payments, bonuses, rewards for labor results;

- payments for special working conditions, etc.

In 2021, payroll in these types can be carried out using a wide range of methods. At the same time, these types of wages can be combined with each other in any way - in accordance with the wage system operating at the enterprise.

You can learn more about the use of various remuneration schemes in an enterprise in the article “Calculation of wages to employees - procedure and formula.”

If we talk about traditional payroll schemes, then these include (letter from the State Planning Committee of the USSR, the Ministry of Finance of the USSR, the State Committee for Prices of the USSR No. 10-86/1080, the Central Statistical Office of the USSR dated 06/10/1975 No. AB-162/16-127):

- a time-based scheme, which is based on the calculation of salary payments based on time worked;

- piecework scheme, which is based on the calculation of wages for work results measured objectively or assessed according to established criteria.

Let's study in more detail how wages are calculated within the framework of the 2 most common payment schemes - time-based and piece-rate.

ConsultantPlus experts explained how to calculate wages under other remuneration systems. Get trial access to the system and upgrade to the Ready Solution for free.

Calculation example

Let's look at a few typical payroll situations.

Example 1.

The employee's salary is set at 25 thousand rubles. This month he was given an additional bonus for replacing an absent employee and an additional amount of work of 50% of the salary. There are 21 work shifts in a month. From the 1st to the 15th there will be 11 work shifts.

The first advance payment is calculated as follows:

(25000 + (25000 × 50 %)) /21 × 11 = 19643 rubles.

Second payment “Salary”:

(25,000 + (25,000 × 50%)) / 21 × 10 = 17,858 rubles. (we calculate the remaining 10 shifts worked)

(19643 + 17858) × 13% = 4875 rubles (we calculate personal income tax from salary)

Minus 13% personal income tax, he will receive: 17858 - 4875 = 12983 rubles

Example 2.

Let’s take the same situation, but in the second half of the month the manager signed an order to provide bonuses to the team in the amount of 25% of the salary.

Then the second payment will be:

(25,000 + (25,000 × 50%) + (25,000 × 25%) – 19,643 (received in the first half of the month) = 24,107 rubles – 13% (personal income tax) = 20,973 rubles in hand.

Example 3.

Additionally, the employee worked 2 shifts overtime. When calculating the advance, overtime work is not taken into account, but at the end of the month they must be accrued and issued in the final payment. The advance will be the same as we discussed above, and the second payment will be larger due to the number of hours worked overtime. The following rule is used:

the hourly rate for the first two hours of such work increases 1.5 times, and subsequent hours are paid double.

Use a convenient online payroll calculator

How are wages calculated for time-based wages?

Time-based (time-based bonus) wages are most often found in the following 2 varieties:

- When the salary is calculated based on the employee’s monthly salary (supplemented in the prescribed manner with bonuses for labor results).

In this case, the following formula is used to calculate wages:

SALARY = (OP / RD) × OD,

Where:

SALARY - salary for the billing period;

OP - the employee’s official salary, supplemented by bonuses if any;

RD - the number of working days in the month that includes the billing period;

OD - days worked in the billing period.

Attention! Salaries must be paid at least twice a month (Article 136 of the Labor Code of the Russian Federation), therefore the billing period cannot exceed half a month (letter of the Ministry of Labor and Social Protection of Russia dated September 21, 2016 No. 14-1/B-911). In this case, salary accrual is displayed in the accounting registers on the last day of the month.

- When the salary is calculated based on the tariff rate per 1 hour or 1 day.

In this case, the following formulas are used to calculate wages:

- for hourly wages:

SALARY = NHT × PCH,

Where:

CHTS - hourly tariff rate under an employment contract,

OCH - the number of hours worked during the reporting period;

- for daily wages:

SALARY = DTS × OD,

where DTS is the daily tariff under the employment contract.

In both cases, the employee receives pay for weekends and holidays:

- when performing work on weekends and holidays - at a double tariff rate (Article 153 of the Labor Code of the Russian Federation);

- when resting on such days - in accordance with local regulations (Article 112 of the Labor Code of the Russian Federation).

In the scenario under consideration, salary calculation is carried out taking into account the fact that the employer is obliged to establish monthly standards (Articles 160, 162 of the Labor Code of the Russian Federation):

- by working hours;

- by production.

The basis for such standards may be, for example, standard indicators for the industry in which the employing company operates.

If the standards established by the employer are met, the employee in any case receives a salary no less than the minimum wage established in the constituent entity of the Russian Federation (Article 133 of the Labor Code of the Russian Federation).

Is it possible not to pay a salary to the director of a company? Find out the answer in ConsultantPlus by receiving free trial access to the system.

Now let’s talk about how wages are calculated under the piecework scheme.

Payroll in 2020

Innovations for 2021 regarding the calculation and payment of wages to employees are reflected in Federal Law No. 272-FZ of July 3, 2021 and relate to Article 136 of the Labor Code of the Russian Federation. Verbatim this article now reads like this:

Salaries are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued.

Following this rule, the employer is obliged to pay earned money to its employees at least twice a month with an interval of no more than 15 calendar days. The organization itself sets the payment schedule, but within a time period. At the same time, there is a need to fix these terms in a collective or employment agreement.

For example , an enterprise sets the date for issuing salaries on the 6th, then the advance must be paid no later than the 21st. If you issue an advance before this period, the requirement of the Labor Code regarding payment of the final payment for the month will be violated. The time gap will then be more than 15 days.

It is acceptable in large organizations to establish different dates for the payment of wages for structural divisions. For example, for workers in primary production, the payment schedule is defined as the 1st and 16th of each month, and for administrative workers - on the 5th and 21st.

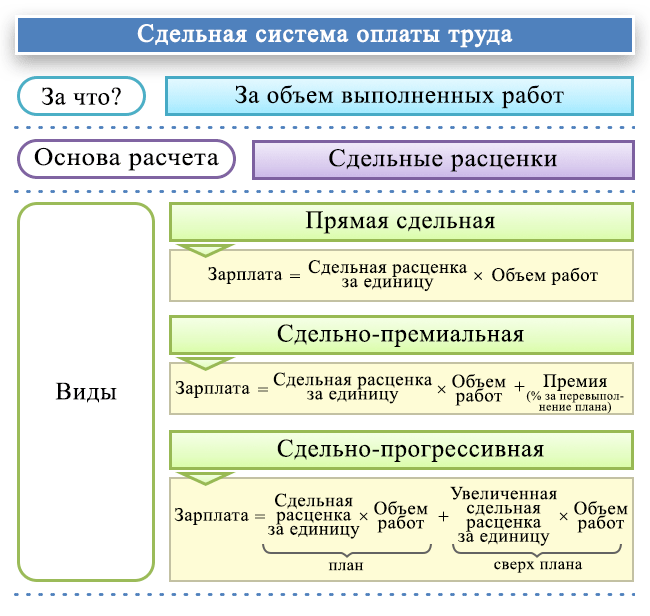

Payroll calculation under the piecework wage system: nuances

With piecework wages, as with the second option of time-based wages, which we discussed above, the employer also sets monthly standards for working time and output. Exceeding the relevant standards can increase piecework wages:

- Proportional to production.

Example

Electrical engineer Ivanov works at a television assembly plant. He receives a salary based on a piece-rate scheme, in which the employer has set a standard for assembling 2 televisions within 8 working hours. If it is completed, Ivanov receives 2,000 rubles (tariff: 1,000 rubles for 1 assembled TV).

For each subsequent assembled TV, Ivanov receives 1,000 rubles, regardless of the volume of production.

- Using a progressive scale.

Example

Machine operator Petrov works at a fastener production plant in the bolt production shop. He receives a piece-rate salary, according to which the employer sets a standard for production: 100 bolts within 8 working hours. When it is completed, Petrov receives 390 rubles (tariff - 3 rubles 90 kopecks for 1 bolt).

For every 50 additional bolts collected, Petrov receives 10 rubles apiece. For every 50 following them - 20 rubles. For each subsequent bolt - 30 rubles.

In some cases, a regressive scale may also be used. For example, when the production model of an enterprise requires employees to fulfill planned targets as accurately as possible without significantly exceeding them (as an option, in order to increase the efficiency of control over costs of raw materials).

A separate type of salary is the one that is paid during the employee’s business trip (Articles 139, 167 of the Labor Code of the Russian Federation). Let's study the specifics of its calculation.

Results

Changes related to the calculation and payment of salaries in 2019 are not global in nature.

They are due to such legislative innovations as the next increase in the minimum wage, the introduction of new paid days off for employees to undergo medical examination, etc. When calculating wages, one should also take into account the latest clarifications of Ministry of Labor officials on unclear issues of labor legislation (for example, their latest recommendations for calculating the amount advance payment). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Business trip on weekends: how is salary calculated?

How to calculate salary for weekends during a business trip? This problem is solved using the formula:

RVK = DT × RV × 2,

Where:

DT - the employee’s daily tariff in accordance with the accepted wage system (letter of the Ministry of Labor and Social Protection of Russia dated December 25, 2013 No. 14-2-337);

PB - days off worked.

The DT indicator can be directly determined in the employment contract or calculated using the formula:

DT = OKL / RDM,

Where:

OKL - salary (with allowances and bonuses, if provided for in the contract) for the month in which the person was on a business trip);

RDM - the number of working days in the corresponding month.

In addition to the salary in the form of average earnings, the posted employee is also paid a daily allowance.

You can find out how daily allowances are calculated in the article “Amount of daily allowances for business trips (nuances).”

New rules from Ministry of Labor officials on advances

The Ministry of Labor of the Russian Federation has recently been paying close attention to such monthly salary payments as advances. From the explanations and recommendations of officials it follows that:

- the amount of the advance cannot be determined arbitrarily and should not be too large (for example, 80% of the salary) or too small;

- it is impossible to set the amount of the advance in a fixed amount, the same for all employees;

- the advance must be calculated in proportion to the time worked;

- when determining the amount of the advance, you need to take into account the salary and bonuses for the time worked, the calculation of which does not depend on the final work for the month as a whole (for example, for night work, for combining positions, length of service, etc.);

- the calculation of the advance does not include incentive and compensation payments calculated depending on the fulfillment of the monthly time limit - they are included in the salary for the second half of the month (for example, payments for overtime work, work on a holiday or day off).

Officials see a violation of employee rights if the first and second parts of the salary are unreasonably different in size. The calculation of parts of the salary will not cause complaints from labor inspectors if it is carried out taking into account the days worked. In this case, there is no need to withhold personal income tax from the advance amount (letter of the Ministry of Labor of the Russian Federation dated 02/05/2019 No. 14-1/ОOG-549).

Find out the nuances of calculating and paying an advance from this publication .

Payroll and taxation in 2021

An employee’s salary, including those represented by vacation pay and travel allowances, is subject to:

- Personal income tax at the rate:

- 13% - if the employee has tax resident status;

- 15% - from 01/01/2021 for income exceeding 5 million rubles. in a year;

- 30% - if the employee does not have resident status.

In the case of applying a tax deduction, personal income tax at a rate of 13% is not charged on the part of the salary amount within the amount of the deduction. At a personal income tax rate of 30%, the deduction cannot be applied.

Personal income tax on wages is accrued at the moment it is recognized as income - on the last day of the month for which wages are calculated (clause 2 of Article 223 of the Tax Code of the Russian Federation). Withheld - at the time of payment. Transferred to the budget no later than the next business day after payment.

Thus, if an employee’s income is transferred before the end of the month, then personal income tax is withheld and transferred to the budget only from the next nearest payment.

- Contributions to social funds (the main part of which is collected through the mediation of the Federal Tax Service):

- to the Pension Fund;

- to the Social Insurance Fund (without the mediation of the Federal Tax Service, the fund collects contributions for injuries);

- in FFOMS.

Contribution rates are divided into standard, increased and reduced, which are established for certain categories of enterprises. Contributions are calculated on salary without deduction of personal income tax.

The deadline for paying all contributions is until the 15th day of the month for which the employee is paid.

New paid days off that you can't refuse

Starting from 01/01/2019, employers have a new obligation that affects the salary income of employees. According to Art. 185.1 of the Labor Code of the Russian Federation, they are ordered to release employees from work and pay them for days off necessary for undergoing medical examination:

- one day off every 3 years - for all employees, except pensioners and pre-retirees (employees with no more than 5 years left until retirement).

- two days off per year - for working pensioners and pre-retirees.

To receive a paid “dispensary” day off, an employee must:

- write a statement and agree with the employer on the date of legal (“dispensary”) absence from work;

- confirm the fact of undergoing medical examination with a certificate from a medical institution.

The employer formalizes the fact of granting a day off by order, reflects it in the working time sheet and pays in the amount of average earnings.