19.07.2019

1

1139

4 min.

When going on a legally required vacation after a hard year of work, a person receives a payslip from which he sees that his vacation pay is less than his salary. Is this an accounting error or is there another reason? The answer to this question may be surprising. We will consider all the information on this problem in the article.

Example 1.

If we are talking about an employee who works 5 working days a week and at the same time:

goes to work regularly and does not take long unpaid leaves.

does not take sick leave (or very few of them).

does not go on business trips (or they are rare and short-term).

receives the same salary every month.

then in order to understand how much vacation pay he will receive, he just needs to take the amount of his salary and divide by 29.4, and then multiply by the number of vacation days.

Let’s say the salary of such an employee is 50,000 rubles. “clean”, i.e. this is the amount that he receives monthly “in hand” (the salary in this case will be 57,471.26 rubles)

Then the price of a vacation day will be 1,700.68 rubles. (50,000 / 29.4), and the amount of vacation pay for 7 calendar days is 11,904.76 rubles. (1,700.68 * 7).

If an employee saves vacation pay (not all companies provide this opportunity to employees), then he can take 5 days of vacation (from Monday to Friday) and then the amount of vacation pay will be 8,503.40 rubles. Thus, an employee can “save” vacation days, but at the same time lose in payments.

Below in Table No. 1 we calculate the price of a working day and the difference between a working day and a vacation day in accordance with the production calendar for 2013.

Table No. 1

In Table No. 2, we calculate how much an employee will receive if he takes a week’s vacation in each month in 2013. From the number of working days for each month, we subtract 5 working days that the employee would normally miss when taking a 7-day vacation and calculate the amount of payments (salary + vacation pay) he will receive.

Table No. 2

As can be seen from Table No. 2, the most “profitable” months for a vacationer are:

- April,

- July,

- August,

- October,

- December.

In September, the employee will remain “with his own people”, while vacation during all other months promises losses.

Calculation of average earnings

Average earnings are calculated in accordance with the provisions:

Article 139 of the Labor Code of the Russian Federation,

Decree of the Government of the Russian Federation dated December 24, 2007. No. 922 “On the peculiarities of the procedure for calculating average wages.”

When calculating the average salary, all types of payments (regardless of their sources) provided for by the company’s remuneration system are taken into account. Such payments include:

1. Salary, including bonuses and coefficients:

by salary, tariffs, piecework, as a percentage of revenue, etc.,

including in non-monetary form (payment for meals for employees, etc., if this is provided for by the remuneration system).

2. Bonuses and other remunerations related to remuneration for labor.

3. Other types of payments related to wages.

Please note: All other types of payments that do not relate to wages do not participate in the calculation of average earnings. For example, the following are not included in the calculation:

For example, the following are not included in the calculation:

bonuses for holidays (for example, bonuses for the New Year, March 8, etc.).

benefits and other social payments (maternity pay, sick pay, etc.).

present.

material aid.

other payments not related to wages.

In any mode of operation, the calculation of the average salary is based on the actual:

salary accrued to the employee,

for the 12 calendar months preceding the period during which the employee retains his average salary.

Please note: A calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive). When calculating average earnings, time and amounts accrued during this time are excluded from the calculation period (clause 5 of Resolution No. 922), if:

When calculating average earnings, time and amounts accrued during this time are excluded from the calculation period (clause 5 of Resolution No. 922), if:

The employee was paid the average salary (including when on a business trip).

The employee was on sick leave or maternity leave and received appropriate benefits.

The employee was provided with additional paid days off to care for disabled children and people with disabilities since childhood (4 days off, paid by the Social Insurance Fund from the federal budget).

In other cases, the employee was released from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation.

If in the previous 12 calendar months:

the employee was not paid,

no days actually worked (for 12 months or a longer period),

then the average earnings are determined based on the amount of wages actually accrued for the 12 calendar months preceding the calculated 12 months (clause 6 of Resolution No. 922). If an employee is on maternity leave, the average earnings for calculating vacation pay will be calculated based on the salary that the employee received before going on maternity leave and parental leave.

If the employee in the previous 24 months:

no salary accruals,

no days actually worked,

then the average earnings are determined based on the amount of wages accrued for the days actually worked in the month in which it is calculated (clause 7 of Resolution No. 922).

That is, if an employee has only recently entered the service and has not yet worked for 24 months or was on parental leave for up to 3 years, the average earnings will be calculated based on the current salary.

If the employee:

no salary accruals for the previous 24 months,

there are no actual days worked in the previous 24 months,

there are no salary accruals in the month in which average earnings are calculated,

then the average salary is determined based on the tariff rate or salary established for him (clause 7 of Resolution No. 922). Usually - based on the salary specified in the employment contract or staffing table.

The procedure for calculating vacation pay

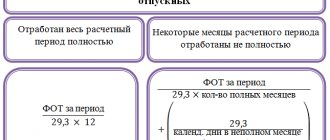

Vacation pay is calculated not on the basis of monthly salary, but on the basis of the number of calendar days in a month and average earnings per day. Mathematically, it looks like this: PO×SDZ=O, where PO is the duration of vacation (in days), SDZ is the average daily earnings, O is vacation pay.

To calculate the average daily earnings of accountants, they use another formula: SDZ = (GD/12)/29.3, where GD is the annual income (all salaries for the year are summed up and divided by 12 months). The resulting amount is divided by 29.3 - the standard average number of calendar days per month. The result will be the employee’s average daily earnings.

Average daily earnings are calculated according to Article 139. To do this, all types of material payments for the employee’s labor provided by the enterprise are taken into account. These include:

- the salary itself;

- bonuses for good work;

- business trips;

- other remunerations that are related only to the employee’s work activities.

The following are not taken into account:

- Holiday Awards;

- Financial aid;

- Present;

- Days when the employee left at his own expense;

- Payments or benefits not related to the employee’s work (maternity leave, sick leave, in honor of an anniversary).

Attention! If a woman went on maternity leave or maternity leave, then the average daily earnings are calculated based on the salary she received before her departure.

14 days before the employee officially goes on vacation, the accounting department issues an order to this effect and a payslip, which already indicates the amount of vacation pay. Money is paid a maximum of 3 days before the person leaves. For failure to comply with these deadlines, the employer may be subject to a fine.

The table shows when is the best time to take a vacation. The year 2019 is taken as a basis.

| 2019 | Work days | Salary | Price per day of work | Price per day of rest | Difference |

| January | 17 | 65 thousand | 3823,53 | 2210,88 | 1612,65 |

| February | 20 | 65 thousand | 3250,00 | 2210,88 | 1039,12 |

| March | 20 | 65 thousand | 3250,00 | 2210,88 | 1039,12 |

| April | 22 | 65 thousand | 2954,55 | 2210,88 | 743,67 |

| May | 18 | 65 thousand | 3611,11 | 2210,88 | 1400,23 |

| June | 19 | 65 thousand | 3421,05 | 2210,88 | 1210,17 |

| July | 23 | 65 thousand | 2826,07 | 2210,88 | 615,19 |

| August | 22 | 65 thousand | 2954,55 | 2210,88 | 743,67 |

| September | 21 | 65 thousand | 3095,24 | 2210,88 | 884,36 |

| October | 23 | 65 thousand | 2826,07 | 2210,88 | 615,19 |

| November | 20 | 65 thousand | 3250,00 | 2210,88 | 1039,12 |

| December | 22 | 65 thousand | 2954,55 | 2210,88 | 743,67 |

The price for 1 day of work was calculated as follows: 65000/17 = 3823.53 rubles (for January), and for 1 day of rest as follows: 65000/29.4 = 2210.88 rubles. It turns out that the most profitable months to travel are April, July, August, October and December. Then the difference between salary and vacation pay will be the least noticeable. And in January, when there are already public holidays, it is not profitable to take a vacation as well.

About the payment procedure

The Labor Code of the Russian Federation has defined clear criteria regarding the payment of vacation pay. Article 136 states that the vacationer is given funds on the eve of weekends or holidays if the payment coincides with this time. Restricting the rights of a worker contradicts the norms of the Labor Code of the Russian Federation. Issuing payments later than the start of vacation is regarded as a complication of the employee’s situation.

There are situations when a worker submits a written application with a request to receive payments 1 day before the rest. This is also a deviation from the legal norm.

A 90-day suspension may apply here. Repeated violations of labor laws can lead to disqualification for up to 3 years and even criminal punishment in accordance with Art. 145.1 of the Criminal Code of the Russian Federation.

A recording of the webinar on calculating vacation pay can be viewed here:

When is the best time to go on vacation and how should vacation pay be calculated? If everything is done correctly, then the accruals will be high, and after the rest there will be something left to get from the accounting department.

Let's look at it with an example. First, let’s remember what the average salary is made up of: salary, northern and regional coefficients and other payments for time worked. Each organization has its own. Let’s say it turns out to be 15 thousand rubles. This is the average monthly salary. To understand what the amount of vacation pay will be, you need to: divide the average monthly salary by 29.3. This is the average number of days worked per month for calculating vacation pay. This will be your daily earnings. It must already be multiplied by the number of vacation days. That is, on average you will receive 16 thousand rubles in your hands. This is the case if the full period is worked during the year.

If over the past 12 months an employee has been on sick leave, taken days without pay, used days off to donate blood, and so on, it is important to understand: the average monthly earnings will decrease, which means vacation pay will become less. Another important point in the upcoming vacation is how much the salary and advance payment numbers coincide with vacation days

Accounting workers assure that it is more profitable to go on vacation three to five days after salary. Unless of course this conflicts with the vacation schedule.

Another important point in the upcoming vacation is how closely the salary and advance payment numbers coincide with vacation days. Accounting workers assure that it is more profitable to go on vacation three to five days after salary. Unless of course this conflicts with the vacation schedule.

Another piece of good advice from the accounting staff is that taking vacations on holidays is not profitable. Undoubtedly, you will be able to relax more. Because vacation will shift to holidays. But in fact, the days worked when you go back to work will be less, and accordingly, the money in your salary will be less than that.

Accountants recommend using this reminder when planning your vacation:

- Try to get sick less and not miss work;

- Go on vacation a few days after payday;

- Do not take vacation on holidays;

- Save. Because vacation pay is the same salary for the duration of your vacation.

WATCH THE PROGRAM IN FULL

Salary after vacation in Russian legislation - Labor Code of the Russian Federation and its principles

The principles of legal regulation of the calculation and payment of wages after vacation are disclosed in the legal provisions of the Labor Code of the Russian Federation:

- Article 21 gives every worker the right to timely payment of wages in full, as well as to receive annual paid leave.

- Article 22 regulates the rights and obligations of the employer, and the latter includes both providing workers with wages, providing them with vacations and implementing other labor legislation.

- Article 114 establishes the obligation to provide workers with annual leave while preserving their average earnings and job during the leave period.

- Article 128 regulates the concept of unpaid leaves and the mandatory retention of the employee’s workplace during them.

- Article 136 is devoted to the procedure and timing of payment to workers of the wages due to them.

How to avoid small holidays

On the eve of the May holidays, most people plan a vacation lasting up to two weeks at the beginning of the coming month. What is the price of the holiday in the months where m.

On the eve of the May holidays, most people plan a vacation lasting up to two weeks at the beginning of the coming month. What is the price of vacation in months where there are many holidays, and is it possible to reduce losses during such periods, our expert, Ph.D. in Economics, Alexander Pyatinsky, said in his column.

Less than salary

To understand why the amount of vacation pay is always less than wages, you need to know the main difference in their payment:

— wages are usually calculated on working days (for the time actually worked);

— vacation pay is always calculated by calendar days.

That is, five working days on vacation are always cheaper than five days worked.

What else is worth remembering about vacation payments:

— vacation pay is paid minus income tax;

— in general, the calculation of vacation pay does not include travel allowances, daily allowances, bonuses for holidays (anniversaries, birthdays and New Years), vacation pay from the previous vacation, sick leave and any social benefits, gifts, financial assistance, allowances and compensation;

— if during the year there was an increase in salaries for individual employees (and not for the department or company as a whole), then there will be no indexation recalculated for the previous 12 months;

— some bonuses are not included in the calculation of vacation pay in full, but partially;

- a collective agreement or internal local acts of the company, at the discretion of the employer, can establish other periods and calculation rules, if they do not worsen the employee’s situation (read - increase the amount of vacation pay or the number of vacation days);

— months in which there are few working days (usually January and May) are the worst for an employee to receive vacation pay (since working days in these months are paid more expensive).

Many employees, when going on vacation, think that vacation pay is in addition to their salary. Then, vacation pay is paid instead of wages, and not along with it. So it turns out that when returning from vacation, the employee still has to work for half a month before the first honestly earned advance (aka salary for the first half of the month) or salary for the second half of the month.

Where and how else can you “earn” vacation pay, more profitably than from your colleagues:

- each honestly worked month adds 2.33 days to the calendar vacation, if more than half the month is worked, then 2.33 is already considered earned;

- in order to earn vacation, according to labor legislation, you must honestly work for at least six months, however, do not forget that 14 calendar days a year at your own expense are also included in the length of service, which gives you the right to annual paid vacation;

— not everyone knows that by adding some conditions to the employment contract, you can increase your annual leave. For example, if you specify that an employee has irregular working hours, then you are guaranteed an additional three calendar days to the 28 available. By the way, vacation days exceeding 28 calendar days can, in most cases, be replaced by monetary compensation at the request of the employee.

The following will help avoid unexpected losses:

- it is not necessary to take off the vacation declared at the end of the year before drawing up the vacation schedule. It can be changed or moved in agreement with management;

— you shouldn’t fall for HR’s fairy tales that your vacation will be burned if you don’t take it off;

— you can switch from labor relations to civil law (in most cases, the amount for the civil process is fixed);

- when concluding an employment contract, do not agree to the format - salary plus bonus, since it is not clear whether the bonus is included in the calculation of average earnings or not.

And lastly, if you think that our country has a short vacation, then remember that the Japanese have a 14-day vacation, and Americans only ten...

On Monday, September 10, the ruble broke the records of March 2021 against both the dollar and the euro. The exchange rate against the dollar exceeded 70.565 rubles, and against the euro it reached almost 82.

Israel is famous for its exciting excursion program, luxurious beaches of the Red Sea, vibrant diving, healing waters of the Dead Sea, ray.

Alexander Babitsky, Fr., spoke about the state of yachting in Russia, amateur regattas and the cost of sailing in an interview with DailyMoneyExpert.

For me, a headset is not so much a pleasant gadget as a necessary one. At least in order to spend 40 minutes on the way to work and back from the village.

Smart subscription to new materials

2017 Publishing House Daily Money Expert

How to earn. How to save. How to spend it. Russia, St. Petersburg, st. Tipanova, 38

general information

All employees have the right to annual paid leave. To do this, a person only needs to work for 6 months at one enterprise. If necessary, management may grant a person leave earlier than the specified period (Article 122 of the Labor Code of the Russian Federation). The total duration of vacation for the year is 28 days, including weekends and holidays.

For some categories of workers it may be higher. This depends on working conditions, place of residence, etc. If an employee takes vacation after six months of work, then he can only count on 14 days. It follows from this that for a month of work (at least 15 working days) a subordinate is given 2.33 days of rest.

By law, a subordinate has the right to share his vacation. The main thing is that one part of it should be at least 14 days. This section must be agreed upon with management. For example, an employee writes a statement indicating the start and end dates of vacation.

The payment is accrued no later than 3 days before going on vacation. Therefore, if registration of this period is carried out at the request of an employee, then he is obliged to write it 2 weeks before the start. If the manager is notified of the employee’s desire to exercise his right to rest later, he will not have time to complete all the calculations. To avoid problems, the subordinate must agree that he will receive the money later. Money can be issued in cash at the cash desk or transferred to a person’s bank card.

While a person is on vacation, all his labor rights are preserved. The employer cannot fire him, reduce his salary, etc. Dismissal can only be carried out in extreme cases, for example, during the liquidation of the company. Even in this case, the employee should be warned about the upcoming closure of the organization no later than 2 months in advance.

Help: an employee can count on vacation compensation.

But here you need to take into account a number of nuances. You can only receive a refund for days that exceed the specified period. Let’s say that if a person has a vacation of 33 days, then he can receive compensation only for 5 days (33-28 = 5). But this rule does not apply to some workers. These are pregnant employees, minor workers, etc. He will have to take the rest of the time off. Compensation for the entire vacation can only be received upon dismissal.

For the performance of labor duties, subordinates are paid wages. In addition, they can count on additional payments. And we are talking not only about bonuses, but also about the so-called vacation pay. This is a certain encouragement that all employees without exception receive. And the question often arises, why vacation pay is slightly less than salary?

This is important to know: When can you take a second vacation after the first?

Vacation pay and salary. How to go on vacation without going broke

Both on the Internet, in print publications, and in legal systems, there are many information materials that teach accountants how to correctly calculate vacation pay for employees in certain cases. Our material is intended for the employees themselves, for whom quite often the very procedure for calculating vacation pay and, accordingly, the estimated amount of vacation payments due to them is a mystery shrouded in darkness.

Not all employees, for example, are aware that vacation can lead to significant financial losses if taken in months such as January and May. Therefore, although it may be reasonable to add a few days of vacation to public holidays, such a choice may not be financially beneficial for the employee at all.

Below we will look at the theoretical aspects of calculating vacation payments, as well as make calculations that clearly demonstrate when it is profitable to take a vacation and when it is not at all.

This is especially true in light of the upcoming May holidays - many people prefer not to work on May 6, 7 and 8, but to take vacation on these days and get a full spring break as a result. But not everyone realizes how much it will cost them.

In addition, we will try to shed light on the confusing system of transferring weekends and their difference from holidays for the purpose of providing leave.

How to calculate salary after vacation and when it is paid

The question of how to calculate wages after a vacation is relevant for many Russian employees, and in particular for employees of the accounting department, personnel department and managers. After all, violation of the established procedure for paying wages after a vacation can lead to extremely negative consequences for the employer, including both fines and the need to provide compensation to employees if their rights are violated in any way. However, Russian legislation gives a fairly accurate answer to the questions under consideration, and knowledge of it will allow you to avoid making the most common mistakes.

This is important to know: Who is entitled to and how the advance is paid after the vacation

Can the amount of vacation pay be higher than wages?

Preparing for the next paid break from work, people want to use this period of time with some benefit. It turns out that there is self-interest in the months with the largest number of working days. This means that the employee receives vacation pay along with wages for the time worked, and the amount for vacation is more than earnings.

In the event of a salary decrease, the employee will also receive more than the salary if the vacation is used soon after the decrease. Under such circumstances, more months with high salaries fall into the billing period. It is more useful for an employee to delay rest if he has had a salary increase.

When transferring an employee to part-time work, a similar situation arises.

Important! Such manipulations are acceptable in an organization where a strict vacation schedule is not established. A significant amount of bonus received during the settlement stage will work to the advantage of the employee

Even going on a long legal vacation on Saturday is more profitable than starting your vacation on Monday

A significant amount of bonus received during the settlement stage will work to the benefit of the employee. Even going on a long legal vacation on Saturday is more profitable than starting your vacation on Monday.

Why were vacation pay less than salary?

There may be several reasons for this.

Firstly, if during the last year a specific employee’s salary was increased (that is, not for the whole company or department, but for this particular employee), the current salary will be higher than vacation pay. Let us illustrate this with an example.

The second reason is that during the billing period the employee worked part-time for some time, but now works full-time. Then the amounts actually accrued to the employee will be included in the calculation, but working part-time will not affect the number of calendar days taken into account.

The third reason is that the employee himself asked not to include “borderline” weekends in his vacation. For example, I wrote a statement from Monday not to Sunday, but to Friday. The Labor Code does not prohibit doing this. Having received less vacation pay because of this, he will have more days of rest.

What is vacation

Every employee has the right to rest. Optimal organization of time will ensure fruitful returns, both financially and in production terms. The laws regulating labor activity contain definitions and procedures for applying the main points of interaction between employers and employees. The Labor Code of the Russian Federation can be called one of the important books of every manager (hereinafter referred to as the Code). Knowledge and correct application of the provisions contained therein will ensure comfortable relations between participants in the labor process.

What is a vacation? This is the legal right of an employee to take a break from his duties for a certain period of time. Maintaining your position and salary are positive aspects of the leave. The law provides for certain payments during rest periods, which depend on the size of the employee’s salary.

General concepts

The legislation regulates the labor activities of citizens and also guarantees compulsory annual leave. Section 19 of the Labor Code of the Russian Federation is devoted to this topic (all links to articles below are taken from it). Article 114 establishes the employee’s right to rest. He does not need to beg for vacation days, since they are due to him by law. According to the same article, while the employee is on vacation, his workplace, position and salary remain assigned to him. And the vacation itself is paid for by the employer.

Article 115 establishes the minimum number of annual vacation days. There must be a minimum of 28. Representatives of certain professions (doctors, teachers, employees of enterprises with increased danger or harmfulness) have the right to longer rest.

This period does not include public holidays. They are added to the total number of days as they carry over into the work week.

Vacation days that have not been used are not canceled, but accumulated. The employee can use them at his own discretion. But if a worker does not take rest for 2 years, then his employer may be fined because of this (based on Article 124).

The boss has the right to compensate the employee for his unspent rest days with money, only in certain cases:

- Dismissal. The last salary will also consist of compensation for the remaining days.

- Vacation longer than 28 days. Money is paid only for days beyond the mandatory 28.

Having settled in a new job, an employee has the right to take rest (in whole or in parts) only after working the first 6 months. By this time, he will have accumulated 14 days of rest (since 1 month worked is equal to 2.33 days of rest). This rule applies for the first working year. Starting next year, vacation can be taken at any time.

Attention! Before the employee retires, the accountant will calculate his average daily earnings and, based on them, calculate vacation pay.