How to start transferring wages to an employee’s card if neither the head of the organization nor his accountant has encountered this issue? At first glance, it seems that everything is simple here, but in fact there are a number of “pitfalls” that an inexperienced manager and accountant of an organization may encounter. Let’s try to illuminate this problem by presenting in the form of step-by-step instructions the process of registering and making payment of wages to an employee’s card.

Accounting for salary transfers to a card

Accounting for employee remuneration transactions is extremely simple. The entries that the accountant must make depend on how the transfer occurs . Let's consider the entries that a specialist must make when transferring money in the table.

| Method of receiving funds | Wiring | Explanation |

| Salary project | D76 K51 | Transferring funds to salaries from a current account |

| D70 K76 | Transferring money to employee cards | |

| Receipt of money directly to employee cards | D70 K51 | Transferring salary from a current account to an employee’s card |

Let's give an example. Employee Ivanov A.V. a salary of 20,000 rubles was accrued. The money is transferred directly to the employee’s card. The accountant will make accounting entries:

D20 K70 - a salary of 20,000 rubles was accrued.

D70 K68/NDFL – personal income tax withheld 2600 rubles.

D70 K51 – transfer of funds to the card 17,400 rubles.

D68/NDFL K51 – NDFL sent to the budget 2600 rubles.

Making a payment

If an employee participates in a salary project and needs to transfer salary to a bank account in which all employee salary cards are open, the payment is reflected by the following entries: debit 76 credit 51, debit 70 credit 76. In the event that the employee wished to transfer the salary to his individual account in another bank, the payment is reflected by posting debit 70 credit 51.

You also need to take into account the costs associated with transferring salaries to cards, which are borne by the organization. The costs of issuing a bank card for a specific employee or employees are reflected in debit 91 credit 51. The costs of annual maintenance of employees' plastic cards are debit 60 (76) credit 51. And finally, the bank commission for transferring salaries is debit 91 credit 60 (76). If these expenses are borne by the employee, this is carried out: debit 73 credit 76, or debit 70 credit 73.

Advantages and disadvantages

With the development of information technology, companies are increasingly trying to organize wage payments using bank cards.

Today, this method is widespread among business entities and is considered quite convenient.

However, it has both positive and negative features.

For employee

The attitude towards non-cash payments is ambiguous and depends on the specific life situation.

For example, if a levy is placed on an employee’s account, the funds received may be withdrawn to repay it.

On the other hand, to receive a reward you do not need to waste time visiting the organization’s cash desk, and many people find this convenient.

The table below summarizes several of these pros and cons:

| + | — |

| Reduces the likelihood of using gray schemes | Payment delay due to technical failure |

| Increases solvency to obtain a loan | Queue at terminals for cash transactions |

| The procedure for obtaining loans is simplified | Loss of access to funds as a result of account blocking |

For the employer

It is a widespread practice among companies to make payments to staff through the use of plastic cards. This allows you to reduce costs and simplify the procedure for transferring money.

At the same time, in order to establish a system of non-cash payments with subordinates, you will have to make some efforts:

- obtain written consent from each employee;

- make the necessary changes to the company’s local regulations;

- conclude an agreement with the credit institution , which specifies the procedure for opening accounts for employees and issuing plastic cards to them;

- collect and submit the necessary package of documents to the financial institution;

- pay a commission for carrying out transactions;

- make transfers in accordance with the norms of the Labor Code of the Russian Federation so that the money arrives to employees within the time limits established by law;

- for each employee, draw up a payslip containing information regarding the total amount of payment, its components, as well as all kinds of accruals and deductions;

- fulfill obligations to withhold personal income tax no later than the day funds are written off from the company’s account and send the tax to the budget within 24 hours after the transfer of salaries to employees.

You will find a sample order for bonuses for employees (2018) in our article. You can find out about depriving an employee of a bonus here.

Personal income tax

One of the questions that worries employers when switching to non-cash payments with employees is: at what point do they need to pay personal income tax, before transferring money to cards or after?

Personal income tax must be transferred on the same date on which the salary payment slip is transferred to the bank (Letter of the Ministry of Finance of Russia No. 03-04-06/43711 dated 01.09.2014). There is no need to pay the tax ahead of schedule, since the tax office may consider that the company paid the tax from its own funds, and therefore it should not be considered tax. In this case, you will need to return the mistakenly transferred amount, and then pay it again. Otherwise, the company faces a fine of 20% of the tax (

How to conclude an agreement with a bank?

In order to start paying their employees on cards, the employer needs to enter into an agreement with the bank . Each banking organization has its own lists of required documents, but if you take the average list, it looks like this:

- List of company employees who will transmit salary information to the bank on electronic and paper media. In the future, powers of attorney will be issued to these employees.

- Register of persons, company employees, who sign statements . It is necessary to provide samples of signatures and seals.

- A complete list of employees , certified by the signature of the responsible person and with the company seal.

- Agreement for opening and servicing accounts using a plastic card. The contract may be general, or it may be for each employee individually.

- Statement of commitment signed by each employee to issue a card and open an account.

- Copies of employee passports , signed by the head of the company and certified by the seal of the enterprise.

- Schedule of salary payments. It must also be approved and certified by the head of the company.

If the company does not have its own bank account, then along with the above documents, it will need notarized copies of the following papers:

- articles of association;

- memorandum of association;

- card with sample signatures;

- certificate of state registration of the company;

- minutes of the meeting of founders on the creation of a legal entity;

- TIN of the company;

- a letter from the Rosstat department at the location of the company about registering organizations and assigning codes according to certain classifiers.

In addition to them, you will need documents that confirm the rights of the director and chief accountant of the company to put their signatures on papers from the bank, and the organization’s questionnaire.

After accepting all documents, the bank opens accounts and issues cards to all employees.

The bank representative gives the finished envelopes to the company representative against receipt.

On the appointed days, the bank transfers funds to the accounts and then to the cards of the organization’s employees.

How often can an employee change credit institution?

There are no restrictions on the number of changes to a credit institution by an employee. The bank is changed on the basis of an application indicating the bank details, as well as the employee’s account number.

There are restrictions only on the timing of filing this application. It must be written and submitted to the employer up to 5 days before the salary payment date.

Important! The employer can change the credit institution at his discretion. To do this, he must write an application indicating the details of another bank. But in this case, the employee bears all expenses for maintaining the card.

Choosing a bank to issue a card

Relations in the field of payment of wages are regulated not only by the Labor Code. Along with Article 136 of the Labor Code of the Russian Federation, Law No. 333-FZ of November 4, 2014 is in force, which regulates the procedure for paying remuneration to employees for work.

The employee independently, at his own discretion, chooses the bank through which he wishes to receive his money.

| IMPORTANT! It does not matter at all whether a citizen gets a new job or, while working for a company, decides to change the bank that serves him. In any case, the employer does not have the legal right to refuse to transfer money to the card of the selected bank |

The same position is enshrined in the Information message of Rostrud dated March 25, 2021. It should be remembered that if an employer opens a card for an employee in a “convenient” bank, then, according to paragraph 1 of Article 846 of the Civil Code of the Russian Federation, the employee may not use such an account.

If an employee is already working at the enterprise and decides to change the credit institution servicing him, then the application must be submitted to the director at least 5 days before the date of accrual.

One more nuance. All public sector employees are required to use exclusively MIR cards to receive wages. When using such cards, it does not matter which bank issued it.

Normative base

According to the Labor Code of the Russian Federation, remuneration for the performance of labor functions is in monetary form in the currency of the Russian Federation.

Payment in another form is permitted if the requirements below are met:

- the method of calculation is fixed in the local act of the company;

- there is a corresponding statement from the employee;

- there are no contradictions with current legislation.

Thus, in order for the transfer of wages to an employee’s card to be legal, it is necessary to adhere to the following algorithm:

- fix the possibility of non-cash payment methods in an employment or collective agreement;

- enter into a bank account agreement allowing the credit institution to carry out the client’s orders regarding financial transactions;

- Agree with the employee on the details for transferring funds.

Obligations are not considered repaid on time if the money was sent without the written permission of the employee.

In this case, the employer is subject to sanctions established by law:

- collection of financial compensation calculated at the refinancing rate;

- administrative liability in the form of a fine or disqualification.

Advantages of transferring salary to a card

Receiving your salary by bank transfer has a number of advantages compared to cash. The advantages of the non-cash method of salary transfer include the following:

- There is no need to stand in line at the cash register to receive your salary, wasting your time.

- The employee does not need to ensure that large sums of money are kept at home.

- Credit institutions often provide such clients with lower interest rates when applying for a loan.

The disadvantage of this method of receiving salaries is that it is somewhat difficult to withdraw money from the card. This especially applies to older segments of the population, who are wary of new technologies and are not always able to understand the intricacies of using ATMs.

The employee does not want to receive payments on the card

Despite the fact that receiving salaries on a card is convenient and quite safe, some employees want to receive their money as before - through the organization’s cash desk.

According to paragraph 2 of Article 1 of the Civil Code of the Russian Federation, an employer cannot impose its will on an employee. Accordingly, it is impossible to force an employee to issue a card. Even if the organization has a salary project, you will have to adapt to the wishes of each employee if a compromise is not found that suits both parties.

Basic information

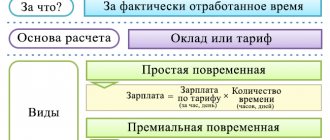

Remuneration is understood as remuneration calculated depending on the specialty, the specifics of the functions performed, their quantity, as well as various allowances of a compensatory and incentive nature.

The dates for the transfer of funds are determined by a local document of the organization or an internal agreement drawn up taking into account current regulations:

- payments are made at least twice a month;

- the advance is issued until the end of the current period

- full payment is due by the 15th;

- if the salary date coincides with a day of rest or a day off, obligations to the employee must be fulfilled the day before.

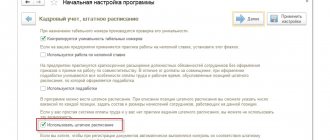

The method of transferring funds must be established in the employment or collective agreement.

At the same time, for an agreement signed directly with an employee, unilateral adjustment is possible only in the event of significant changes in the totality of production factors.

Changes must be notified two months before they come into force.