Obtaining a certificate from the employer

Most citizens resort to this method; it is the simplest and most convenient. You don’t really need to run anywhere, and everything will go by quickly.

If you have a question about how to write an application for 2-NDFL, it is better to contact your immediate supervisor. Each company has its own mechanism for submitting an application and issuing a completed certificate.

The standard process looks like this:

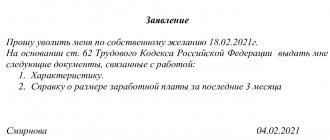

- Submitting an application to the accounting department. The forms are usually provided by the organization. You can write an application in free form; a sample is available on the Internet. If the accounting department is located remotely or even in another city, then employee requests are usually accepted by email.

- Processing of the application is fast, a certificate can be issued even on the same day. You will receive it directly from the accounting department, or the document will be transmitted remotely if the place of work is remote from the head office. It all depends on the internal regulations of the company you work for.

If you have a question about the application form for 2NDFL, it is better to contact your immediate supervisor.

In the application, you must indicate for what period you need salary data. Banks usually ask to provide 2-NFDL for the last six months or a year.

Obtaining a 2-NFDL certificate through State Services

If you have an account on the Government Services website, you can use it. Personal income tax information is tax information, so data on a citizen’s salary can be found through State Services.

It will be even more convenient; you don’t need to deal with accounting issues, write an application and waste time. The request is sent from the Federal Tax Service website, but user authorization goes through State Services.

The system will provide a file for downloading, you can give it to the bank or print it

How to get a document online:

- Log in to the taxpayer’s personal account on the Federal Tax Service website and log in through State Services. An important point - only a verified account is suitable.

- After logging in, you need to go to the My Taxes section, then Additional Information and Income Information.

- Next you need to indicate the period for which you need a 2nd personal income tax certificate. You should also select the desired employer from the proposed list (tax agent).

- Help will be generated immediately, the system will provide a file for downloading. This file can be submitted to the bank for consideration of the loan application.

Is a written request for a document always necessary?

Every working Russian can request and receive a document under the code 2-NDFL, without indicating the reasons why it is needed.

The rules for issuing it are set out in Article 62 of the Labor Code of the Russian Federation and Ch. 23 Tax Code of the Russian Federation.

It is provided upon the first request of the taxpayer, regardless of whether he contacted the employer orally or in writing.

However, the applicant must note that the advantages of a written application are as follows:

- the date of filing the application is indicated, which is the starting point for the three-day period for issuing the certificate;

- allows you to avoid many unpleasant moments, because the employer may deny that the employee contacted him;

- simplifies the employee’s actions when appealing a refusal to issue a certificate through other authorities.

You should always protect yourself with a written request. Although most employers issue a certificate without creating problems for employees at their first request.

And in the event of dismissal of an employee, the management administration is obliged to issue such a document on the day the employee is paid, even without his personal application.

Find out how financial assistance is reflected in the 2-NDFL certificate from our article. What to do if a new job requires a 2-NDFL certificate? Is this legal? Find out here.

How to write an application for the issuance of personal income tax certificate 2 at the Federal Tax Service itself

If your personal account on the tax service website is not available to you, you can contact the Federal Tax Service office directly. But you need to contact the department where your employer is registered. So, check this information first.

Find out the reception time for citizens of the branch you need and visit it, taking your passport with you. You will be given an application form to fill out on site. After this, the certificate will be issued within 3 days; you will need to visit the Federal Tax Service again with your passport.

Important! Keep in mind that organizations submit information about 2-NDFL to the Federal Tax Service once a year before April 1. Therefore, the certificate obtained in this way may be incomplete.

Check the branch address and opening hours in advance

So, we recommend that you apply for 2-NDFL either directly to your employer, or receive the document through your personal account on the Federal Tax Service website. In these cases, the certificate will be complete.

A sample application for 2-NDFL can be found on the Internet. But in fact, it is rarely needed. If you order a certificate through an employer, application forms are provided to employees as standard.

In what cases is a certificate needed?

The demand for the document under code 2-NDFL is quite high, because it confirms the receipt of official income by an individual.

Most often, a certificate is asked to provide in the following cases:

- when receiving credit finance from banking institutions;

- for a mortgage (when drawing up an agreement to borrow funds for the purchase of residential premises);

- during employment at a new enterprise;

- when applying for a tax deduction in the following circumstances: payment for studies; acquisition of living space; receiving paid treatment; other expenses.

For all organizations, there are the following grounds for issuing such a certificate for a taxpayer:

| Where is it served? | Legal basis | Procedure for providing a certificate |

| To the tax authorities for each citizen who received profit during the past tax period | Reporting standards are set out in clause 2 of Article 230 of the Tax Code of the Russian Federation | The maximum filing deadline is March 31 (inclusive) of the following year following the end of the reporting period. |

| It is provided to the tax service for those persons from whose income personal income tax was not withheld | According to the text set out in paragraph 5 of Article 226 of the Tax Code of the Russian Federation. | Within a month from the date of occurrence of obligations |

| To the taxpayer at his request | Personal written or oral request from an employee (including former employees) | The document must be issued within 3 working days from the date of receipt of the application |

What does the 2-NDFL certificate contain?

This is a document whose type is regulated. That is, no matter where you work, no matter how you order the certificate, it will still have the same appearance.

A 2-NDFL certificate is issued to the employee; it reflects the amount of his salary and how much taxes were withheld from this income. Based on this information, the bank will determine the applicant’s real income level, that is, after tax. Salary, bonuses, vacation pay, sick pay - all this is reflected in certificate 2 of the personal income tax.

The document must include the date of its issue, information about the taxpayer, and his passport details. The following is a table indicating income: each line is a separate calendar month. If the certificate was ordered 6 months in advance, 6 months will be completed accordingly.

Types of income may be different, so the form contains the line Income Code. This will indicate the source of the amount received, for example, it could be a salary, financial assistance to an employee, sick leave payment, etc.

Please check with the bank about the valid validity period of the certificate. Usually this is 14 or 30 days from the date of issue.

Results

An application for issuing a 2-NDFL certificate is submitted to the employer in any form (if the company has not developed a special application form).

It is necessary to indicate information about the applicant (full name, passport data, address, etc.), as well as for which years the 2-NDFL certificate is needed and the number of its copies. The application is completed by the personal signature of the applicant and the date of its preparation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Do banks always ask for proof of income?

But they pay off with the terms of the loan. Not all loans are issued with a certificate of income. If for some reason you cannot document your income, then you can find a simplified loan program.

But keep in mind that programs for which the client does not bring a complete package of documents cannot be profitable, and the amounts issued for them are always small. By issuing money in this way, the lender takes a risk, which is where higher rates arise - this is how the bank covers possible risks of non-repayment.

In fact, by issuing a loan without an income certificate, the bank takes the applicant’s word for it. The client indicates information about his work and salary in the application form, and the bank takes this into account when considering.

If we are talking about a salary client of a bank, he always takes out a loan without 2-personal income tax. Information about his income is already in the financial organization’s database.

Employer's liability for non-delivery

The landlord does not have the right to refuse to issue an income certificate to an employee or former employee. Violation of legal requirements may subject the employer to penalties.

But the law will be on the employee’s side not from the point of view of violation of tax law, but from the point of view of non-compliance with labor legislation, which obliges the employer to provide the employee with documents confirming his income.

A citizen has the right to file a complaint with the labor inspectorate. Based on the results of consideration of the appeal, the employer may be subject to an administrative penalty in the form of a fine.

Judicial practice on this issue is quite extensive. According to the decision of the Supreme Court, the violator may be imposed penalties in the amount of:

- for officials and individual entrepreneurs – from 1000 to 5000 rubles;

- for legal entities - from 30,000 to 50,000 tr.

Tax legislation does not oblige employers to issue certificates in Form 2 of personal income tax, but in accordance with the Labor Code of the Russian Federation, the landlord must provide the citizen with information about income upon request, within the period established by law.

Why is it better to get a loan with 2-personal income tax?

If you have the opportunity to bring this document to apply for a loan, do not ignore it. Only if you have a complete set of documentation can you count on good lending conditions.

The benefits of having a certificate are as follows:

- increased bank loyalty. The level of trust in such clients is definitely higher, so the likelihood of a positive response will also be more serious;

- opportunity to get a decent amount. Without certificates, borrowers receive a maximum of 80,000-100,000 rubles. Without them, you can borrow even 1,000,000 rubles. But here, in any case, everything will depend on the level of solvency of the citizen. They still won’t give out more than he can afford;

- reduced rate. The certificate reduces the bank’s credit risks, so it will set low interest rates under the program.

The only negative aspect of applying for a loan with a 2-NDFL certificate is that the process is more drawn out. You need to order a certificate and wait for it. Review of applications for such loans usually takes 2-3 business days. That is, you won’t get a loan quickly. Without any certificates, you can take it in literally 1 hour.

Many banks allow you to replace 2-NDFL with other forms of income confirmation. This may be a certificate in the form of a bank or obtaining information from the Pension Fund of the Russian Federation, if the client has access to State Services. The second option is generally the most convenient of all methods of confirming the borrower’s income level.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Why fill out 2 personal income taxes?

Certificate 2 of personal income tax is a reporting form that reflects all taxable types of remuneration of an employed citizen for a certain period, and the deductions provided. The document generated at the end of the year reflects the tax base and the amount of personal income tax paid within the calendar year.

The employer is required by law to generate 2 personal income taxes for all employees at the end of the reporting period, since he acts as a tax agent and is obliged to report to the Federal Tax Service for taxes paid to the state budget.

For an employee or non-working citizen, this form of reporting may be required in different situations:

- The most common reason for providing information about income and taxes paid is to apply for a bank loan, including a mortgage.

- Receiving a tax deduction, regardless of the basis for its provision: treatment, purchase of housing, paid training, etc.

- When applying for a new job. The landlord may request a certificate in Form 2 of personal income tax to summarize the deductions already provided and the total income for the tax period.

- To obtain a visa.

- To calculate vacation pay and temporary disability benefits.

- When applying for benefits, state benefits, subsidies, etc.

- When adopting or registering guardianship.

Obtaining a certificate of the established form is permissible only if the citizen has taxable income.

For example, if a non-working person is registered with the Central Employment Service and receives unemployment benefits, government agencies cannot issue him 2 personal income taxes. In this situation, an individual can request a certificate about the amount of benefits.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya