In 2021, it is prohibited to pay wages less frequently than every 15 days (Part 6 of Article 136 of the Labor Code of the Russian Federation as amended by Federal Law No. 272 of October 3, 2021).

Below we discuss in detail what deadlines for the payment of wages, according to the Labor Code of the Russian Federation, should be set in 2021 so that the company is not fined and workers do not have questions.

Periods for issuing wages according to the Labor Code of the Russian Federation in 2021

In connection with the extreme amendments to the Labor Code of the Russian Federation, the employer is asking the following question: is it possible for a company to pay wages to different employees at different periods of time?

Additional Information

For example, a director owns a large company that consists of various divisions. Can an enterprise pay wages to workers from one department on the 21st and 6th, and to others on the 25th and 10th?

According to the Labor Code of the Russian Federation, the employer has the right to accrue salary and advance payments in 2021 to employees of the same company in different periods. However, the time interval between wages and advance payment is 15 days, and the last day of final payment is the 15th of the next month.

The Labor Code of the Russian Federation contains several points regarding this situation. And the above case falls under the 2021 rules, and ultimately does not violate the law.

The head of the company must always comply with the Labor Code of the Russian Federation. According to the labor code:

- Salaries must be paid by the 15th of the next month

- the gap between the advance payment and the rest of the salary must be 15 calendar days

Attention

When reflecting the terms of salary calculation in the employment contract, the director of the enterprise must indicate a specific date, and not time intervals.

If the manager of an enterprise plans to accrue salaries to employees on the 11th and 26th of each month, then these dates should be written in the contract. The wording “from 8 to 13 and from 24 to 29 of each month” is unacceptable.

You cannot indicate intervals instead of specific dates, because this violates clause 6 of Art. 136 Labor Code of the Russian Federation. Thus, by accruing 1 part of the salary on the 9th day, and the other on the 28th, the head of the company will violate the Labor Code of the Russian Federation on accruing salary once every 15 days, at least.

Norms and procedure for determining deadlines

The Labor Code of the Russian Federation and Federal Law No. 272 of July 3, 2021 on introducing adjustments to the laws of the Russian Federation to increase the responsibility of employers for violations of the labor code relating to the calculation of wages in 2018 regulates the procedure and periods for payment of wages.

Who sets the deadlines for accruing salary?

According to the Labor Code of the Russian Federation and Federal Law No. 272, the manager sets the date for issuing salaries to employees in 2018 independently.

Where should I indicate?

The manager of the company indicates the timing of the advance payment and the payment periods for the rest of the salary in the following documents:

- Labor contract. The employer prescribes salary accrual periods here. He can also prescribe the issuance periods, describe them in another act, and leave a link to the document in the contract

- Rules of routine. The head of the company must indicate the periods for calculating salaries in the rules of procedure, and in other documents leave a link to this provision. The fact is that all employees follow the rules of the work schedule, but the employment contract is followed only by a specific employee. There may not be a collective agreement in the company

- Collective agreement. In this document, the head of the enterprise indicates the point in which the periods for accrual of salary are entered. In such a situation, in the employment contract, the director of the company makes reference to a specific provision of the collective agreement.

When paying an employee his salary, the accountant indicates the following information on the pay slip:

- the main part of the salary, which is accrued for a specific month

- sizes and grounds of deductions, if any

- monetary compensation, vacation pay, severance pay, etc.

Advance payment payment terms in 2021

On October 3, 2021, the changes provided for by 272-FZ came into force. Some amendments to the law also apply to advance payments.

In 2021, an employer should know the following nuances:

- The salary must be issued to workers no later than 15 days from the date of payment of the advance

- Salary must be accrued once every 15 days

- The advance must be transferred to the worker on the 30th day of the reporting month - no later than

Important

In 2021, in the regulations, the head of the company sets any date for the transfer of the advance. The main thing is that such a date should be no later than the one mentioned above.

Terms of payment of salary upon dismissal

Art. 140 of the Labor Code of the Russian Federation states that the deadline for calculating wages in 2018 upon dismissal is the last day of work.

For your information

If the worker did not work on the day of dismissal, then the date of payment of the salary is considered to be the day that follows the day the worker’s request for payment was received.

Late payment of salary upon dismissal is punishable for the employer.

Art. 236 of the Labor Code of the Russian Federation establishes the obligation of the company, in case of late wages, to pay the worker a compensation payment, which is equal to 1/300 of the current discount rate of the Central Bank of the Russian Federation for each delay.

If the salary payment day falls on a weekend

In accordance with the Labor Code of the Russian Federation, salaries must be calculated at least every 15 days on the day specified in the company’s labor regulations and in the contract.

As a result, the day of accrual of the advance (for the first 15 days of the month) and the date of calculation must be specified in the agreement between the director of the company and the worker.

If this day is Saturday, Sunday or the day of any holiday in the Russian Federation, the salary payment must be made before this day (Part 8 of Article 136 of the Labor Code of the Russian Federation).

For your information

So, the day of payment for salary in a company is the 5th day of the month following the reporting month. In such a situation, the August 2021 PO should be issued to the employee on Friday, August 3, 2021. After all, August 5, 2018 is Sunday, and August 4, 2021 is Saturday.

Failure to comply with salary payment deadlines

According to Art. 236 of the Labor Code of the Russian Federation, for late payment of wages to workers in 2021 entails financial liability for the employer.

Increasing the amount of compensation

According to the current Labor Code of the Russian Federation, compensation for late payment of wages to an employee is several percent of the amounts that are not transferred to the worker on a specific day. From October 3, 2016, the amount of compensation has been increased.

Before the increase, the compensation payment was equal to 1/300 of the discount rate of the Central Bank of the Russian Federation for 1 overdue day.

After the increase, the compensation is equal to 1/150 of the discount rate of the Central Bank of the Russian Federation for 1 overdue day.

Increasing the amount of fines

The amount of fines for late payment of wages has increased since October 3, 2021.

For 2021, the amounts of fines are reflected in the table below: [td] Who can be fined

Source: https://buhuchet-info.ru/buhgalterskiy-uchet/2827-sroki-viplati-zarplaty-v-2018-godu.html

Minimum wage and living wage

The minimum wage is the amount of remuneration that an employee should have, provided that he has worked the existing standard of time per month.

This means that the company's management cannot pay wages less than this level, but only the same or more.

Its size is fixed by law and must be observed by all employers in the country. The minimum wage (minimum wage) is approved annually by relevant acts of the Government.

It is also used when calculating benefits paid for periods of incapacity, etc. Moreover, the minimum wage in 2018 is 9,489 rubles.

Minimum salary in 2021:

| Period | Amount of minimum wage, rubles |

| from January 1, 2021 | 9489,00 |

In addition, the President of Russia announced the possibility of establishing a new minimum wage indicator in 2021 from May 1, which will be fixed at the subsistence level of the 2nd quarter of 2017 - 11,163 rubles.

The subsistence level is the amount of income per person that he needs to maintain his standard of living. This indicator is determined by calculation and includes the cost of the consumer basket, as well as a certain list of services and payments made without fail. There are several types of it - for workers, for pensioners, for children.

The state needs this data to assess the existing standard of living, the income of segments of the population in the country, as well as to carry out planning when drawing up a budget. The subsistence minimum is approved in each individual region and is valid on its territory.

Attention! To implement social regulation in the country and establish social guarantees, the state uses two indicators - the minimum wage and the subsistence level.

The ideal is the equality of these two indicators, that is, the minimum wage cannot be less than the established subsistence level. In addition, it is the minimum wage that determines the validity of the current subsistence minimum.

This equality is planned to be achieved only in May 2021. But in this case, indicators for different time periods will still be used. The minimum wage will be in effect for 2021, and the subsistence minimum for the 2nd quarter of 2021.

Currently, the minimum wage is only a percentage of the cost of living.

Changes in the calculation of IPN, CO and OPV associated with an increase in the minimum wage

The main changes are related to the government initiative to increase the minimum wage in 2021 by 1.5 times:

- Minimal salary

in 2021 in Kazakhstan it is

42,500

tenge (in 2021 it was 28,284 tenge); - Minimum calculation indicator

—

2 525

tenge

Since many calculations are tied to these indicators, for example, tax deductions or minimum/maximum income for calculating social contributions, etc., an increase in the minimum wage by 150% automatically led to an increase in these indicators, which apparently was not intended.

In this regard, the Law of the Republic of Kazakhstan dated December 26, 2021 No. 203-VI

:

- Tax deductions (except for the standard tax deduction in the amount of 1 minimum wage)

have been transferred from the minimum wage to the minimum wage; - Income adjustments when calculating personal income tax have also been transferred from the minimum wage to the monthly calculation index;

- The income limits for calculating mandatory pension contributions, social contributions and compulsory medical insurance contributions have been changed (reduced by 1.5 times). At the same time, the minimum income accepted for calculating contributions and deductions remains the same.

Transfer of deductions for personal income from minimum wage to monthly calculation index

Since 2021, deductions provided for individual income tax and having established limits in the minimum wage (MSP) have been “transferred” to monthly calculation indicators (MCI).

This change did not affect the standard tax deduction provided in the amount of 1 minimum wage. In 2021, it is also provided in the amount of 1 minimum wage per month, but not more than 12 minimum wages per calendar year.

Also, the tax deduction for pension payments and savings insurance contracts has not changed. However, this type of deduction is not provided by the employer.

The table shows the established limits of deductions, as well as their values in tenge.

| Type of deduction | 2018 | Amount in tenge (rates for 2021) | 2019 | Amount in tenge (rates for 2021) |

| Standard deduction (for disabled people and WWII participants) | 75 minimum wage | 2 121 300 | 882 MCI | 2 227 050 |

| Standard deduction (for parents and caregivers of disabled children) | 75 minimum wage | 2 121 300 | 882 MCI | 2 227 050 |

| Tax deduction for medicine | 8 minimum wages | 226 272 | 94 MCI | 237 350 |

As you can see from the table, deduction limits have increased slightly in 2021.

Thus, when calculating wages for employees starting in 2021, it is necessary to apply and provide deductions taking into account the new established limits.

Healthy!

What personal income tax deductions are available in 2021?

Transfer of adjustments for personal income tax (IPN) from the minimum wage to the monthly calculation index

Employee income adjustments are set at .

Some of the adjustments provided are subject to caps that were previously set in minimum wages. From 2021, these amounts have been converted to monthly calculated indicators (MCI). At the same time, the size of adjustments in tenge underwent a slight increase.

| Type of adjustment | 2018 | 2021 edition | 2019 |

| Winning one lottery within 50% of minimum wage … | 0.5 minimum wage — 14 142 | Winning one lottery within 6 MCI … | 6 MCI – 15 150 |

| Payments in connection with the performance of public works and vocational training, carried out at the expense of budget funds and (or) grants, in minimum wage … | minimum wage – 28 284 | Payments in connection with the performance of public works and vocational training, carried out at the expense of budget funds and (or) grants, in 12 MCI … | 12 MCI – 30 300 |

| Income from personal subsidiary plots of each person engaged in personal subsidiary farming - for the year within 24 minimum wages … | 24 minimum wages – 678 816 | Income from personal subsidiary plots of each person engaged in personal subsidiary farming - for the year within 282 MCI … | 282 MCI – 712 050 |

| Payments within 8 minimum wages ... for each type of payment made by the tax agent during the calendar year: to cover an individual’s expenses for medical services (except for cosmetic services)…; in the form of providing financial assistance to an employee at the birth of his child...; for the burial of an employee or his family members, close relatives... | 8 minimum wages – 226 272 | Payments within 94 MCI ... for each type of payment made by the tax agent during the calendar year: to cover an individual’s expenses for medical services (except for cosmetic services)…; in the form of providing financial assistance to an employee at the birth of his child...; for the burial of an employee or his family members, close relatives... | 94 MCI – 237 350 |

| Income in the form of employer expenses for maternity leave, leave for employees who have adopted a newborn child (children), minus the amount of social benefits in case of loss of income in connection with pregnancy and childbirth, adoption of a newborn child (children) ), carried out in accordance with the legislation of the Republic of Kazakhstan on mandatory social. insurance, – within Minimum salary. .. | 1 minimum wage – 28 284 | Income in the form of employer expenses for maternity leave, leave for employees who have adopted a newborn child (children), minus the amount of social benefits in case of loss of income in connection with pregnancy and childbirth, adoption of a newborn child (children) ), carried out in accordance with the legislation of the Republic of Kazakhstan on mandatory social. insurance, – within 12 MCI … | 12 MCI – 30 300 |

When determining an employee’s taxable income, it is necessary to provide adjustments to personal income tax, taking into account the restrictions established for the current year.

Reducing the upper limits for OPV, CO, OSMS

When calculating mandatory pension contributions, social contributions and contributions to compulsory social health insurance, it is necessary to be guided by the limits applied to the objects of calculation.

So the upper limits were adjusted with a decrease in the size in the minimum wage by 1.5 times. At the same time, in tenge they remained at the same level.

The lower limits have not changed. For example, the lower limit for CO also remained at 1 minimum wage. However, due to the increase in the minimum wage indicator itself, the actual lower limit increased to 42,500 tenge.

| 2021 edition | Size 2018 | 2021 edition | Size 2019 | |

| CO | The monthly object of calculation of CO from one payer should not exceed 10 minimum wage … | 282 840 | The monthly object of calculation of CO from one payer should not exceed 7 minimum wage … | 297 500 |

| OPV | In this case, the monthly income accepted for calculating OPV should not exceed 75 minimum wage … | 2 121 300 | In this case, the monthly income accepted for calculating OPV should not exceed 50 minimum wage … | 2 125 000 |

| OSMS | Monthly object accepted for calculation deductions , should not exceed Monthly income accepted for calculating contributions , must be calculated based on the sum of all types of income of an individual and should not exceed | 424 260 | Monthly object accepted for calculation deductions , should not exceed Monthly income accepted for calculating contributions , must be calculated based on the sum of all types of income of an individual and should not exceed | 425 000 |

| OSMS (IP) | Object of calculus contributions Individual entrepreneur... is twice the | 56 568 | Object of calculus contributions Individual entrepreneur... is | 59 500 |

Thus, when calculating wages, as well as taxes, contributions and deductions from it, it is necessary to be guided by the new values of the upper and lower limits on income subject to taxation.

Healthy!

These changes were implemented in release 3.0.25 of the “1C: Accounting 8 for Kazakhstan” configuration .

Read more about these changes in the articles:

- Deductions and adjustments for individual personal income have been transferred from the minimum wage to the monthly calculation index, the limits for OPV, SO, and compulsory medical insurance have been reduced;

- What will change in 2021 due to an increase in the minimum wage (MW) by 1.5 times?

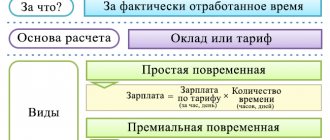

How to set your salary

The salary is determined by the administration and the employee as a result of negotiations and the conclusion of an employment contract between them. If a company advertises a vacancy, it already announces wages for this profession.

At the same time, the administration of the company is guided by the current staffing schedule in the organization, which establishes the forms and systems of remuneration in a particular organization. In addition, the employee must sign the Regulations on remuneration, bonuses, and, if available, the Collective Agreement.

Salary advance in 2021, new calculation

In August 2021, the Ministry of Labor issued clarifications on how exactly to determine the advance payment for the first half of the month.

Now only a certain list of payments needs to be included in the calculation:

- The amount of the advance is calculated based on the actual number of days that the employee worked from the 1st to the 15th of the month. For those days when he was sick or was on vacation, the advance is not credited.

- The calculation must include the employee’s salary, as well as those additional payments that do not depend on the results of work and the amount of time worked. For example, for work experience, for skill, etc.

- The calculation does not include bonuses for work results, as well as compensation payments, the determination of which is possible only after the end of the month (for example, for work on weekends).

Since February 16, the rules for issuing salaries have changed

VIDEO ON THE TOPIC: Sample of canceling a court order according to the new rules 2021!

It is important for you to receive only verified information. Editorial “Accounting. Pravo” particularly cares about the quality of materials and the rights of our experts, so we are forced to open the best articles only after registration. According to the rules, the interval between the terms of salary payment - advance payment and the main part - should not exceed 15 calendar days.

We will tell you in more detail about the timing of salary payments in the year, taking into account the latest changes, so that the company is not fined and the employees do not have questions.

Newsflash: Taxpayers waive expenses if employees make a lot. Salaries must be paid no later than 15 calendar days from the end of the month for which they were accrued. We will tell you how and what terms of salary payment are safer to set in a year, so as not to violate the requirements of the Labor Code.

The interval between payment dates in a year should not exceed 15 calendar days. At the same time, the company does not violate the new procedure established by the Labor Code of the Russian Federation if it pays the second part of the salary before the first day of the next month.

Download the production calendar for the year now. Giving out the first part of your salary on the 1st day and the second on the 1st of the next month is risky. In this case, workers will receive money less often than every half month. After all, the interval between the 1st and 10th days of the next month is 25 days, and this is already a violation.

The company will be fined 50 thousand. The court considers the fine legal, the decision of the Rostov Regional Court from the Table of taxes on wages per year in percentage. Thus, in order to determine the dates for the payment of wages in a year in accordance with the Labor Code of the Russian Federation, it is important to follow 2 simple rules: For example, you can set wage payment dates such that the gap between payment dates is at least 15 calendar days: the e and the 5th, the e and the e, etc.

Production calendar If you have decided on the deadlines, you need to write them down in the rules and one of the agreements - collective or labor. The old version of the Labor Code of the Russian Federation says that salary days are reflected in the labor regulations, collective agreement, employment contract. Documents are listed separated by commas. Rostrud believes that it is necessary to write terms in all three documents, a letter from And the court believes that it is possible only in one, for example, in the labor regulations, the appeal ruling of the St. Petersburg City Court dated October 3, 2018, the wording has changed.

Now the dates can be determined by “internal labor regulations, a collective agreement or an employment contract.” Based on the wording, paydays can be determined in one document. But Rostrud believes that there are two things: the rules and one of the agreements - collective or labor. Therefore, it is safer to do as officials believe. Even if the company has a collective agreement, it is worth determining the dates in the labor agreement.

For an employment contract, the terms of remuneration are a mandatory requisite of Art. The dates can be reflected not as exact ones, but as a reference to the Rules or the collective agreement:. It should be clear from the documents when the company issues both parts of the salary.

For example, for the first half of the month - on the 1st day of the current month, for the second - on the 1st day of the next month. It is risky to use the wording “from the 1st to the 1st”, “before the 1st”, “no later than the 1st”, a letter from the Russian Ministry of Labor dated With floating dates, it may turn out that the company issues money with an interval of more than half a month.

Then the company will violate the rules of the Labor Code. For this, a fine is possible, which the judges recognize as legal according to the appeal ruling of the Ulyanovsk Regional Court from

Features of setting wages

Let's consider the features of determining wages and its dependence on the minimum wage and other indicators.

Can it be less than the minimum wage or subsistence level?

The law specifically defines the minimum wage indicator so that the company administration cannot pay its employees less than this level if they have worked the full working time. This takes into account not only the minimum salary, but also various additional payments.

If the accrued salary is lower than the minimum wage, then it must be raised to this level, otherwise administrative measures will be applied to the company.

In addition, regional authorities have the right to set their own minimum wage, but not lower than the federal value.

Attention! If an employee does not work at full time, then he may receive an accrual amount less than the minimum wage. The most important thing is that when recalculated for the entire bet size, the value corresponds to or is higher than the minimum.

At this time, the Government is gradually increasing the minimum wage to the subsistence level, so that this is consistent with the provisions of the Labor Code of the Russian Federation. The figures are expected to be equal to May 1, 2021.

You might be interested in:

Business trip on a weekend - what you need to know before sending employees

In the future, the minimum wage will be taken at the cost of living, which was in effect in the 2nd quarter of the previous year. If this indicator decreases, the value of the minimum wage will remain at the same level.

If there is a regional coefficient

An employee can work in territories where special allowances are accepted for working in difficult conditions. They are determined using pre-approved regional coefficients. The list of such territories is fixed by law.

When calculating the amount of earnings, company management must take into account whether a separate minimum wage is applied in this territory or not.

If a separate minimum wage indicator has been adopted for a given region, then employee salaries must be compared with it.

If a separate minimum wage has not been established for this territory, then it is necessary to use the federal value, but adjusted by the regional coefficient. Then the salary of any employee should not be lower than this figure.

Calculation of personal income tax and minimum wage

The law determines that an employee should not be paid a salary lower than the current minimum wage.

However, when paying it, the employer, as a tax agent, is obliged to calculate and withhold personal income tax. After this operation, the actual amount in hand will be slightly less than the minimum wage.

The law does not define any additional benefits, other than standard deductions, due to the fact that the employee’s salary is equal to the minimum wage. It must be subject to personal income tax in the standard manner.

Is it possible to link wages to the staffing table?

The organization of remuneration at the company must be done so that the staffing table contains all positions with an indication of their salary. This also applies to those who work on a piece-rate payment system - for such, the planned earnings values must be indicated in the document.

However, when hiring a new employee, the amount of his earnings must be reflected both in the employment agreement and in the hiring order. And this should only be done digitally.

If the contract states that salaries are paid according to the staffing schedule, then this will be a reason to invalidate it. This is because salary information is mandatory for this document.

This kind of formulation can only be applied to additional payments - bonuses, additional payments, etc. However, in this situation, it is necessary to familiarize the employee with the documents, which stipulate the procedure for their payments (for example, the bonus regulations), against signature.

Is it possible to calculate wages in foreign currency and pay in rubles?

The Labor Code establishes that the labor agreement concluded between an employee and an organization in Russia must indicate the amount of remuneration in the national currency - rubles.

But in what currency the accrual should be made is not specified anywhere in the law. Therefore, he can make payments in foreign currency.

However, there is a pitfall here. The fact is that the salary is the amount of the employee’s earnings for the month, clearly indicated in the employment agreement. If the exchange rate falls, which will entail a decrease in the amount of wages paid, this may be regarded by the inspection authorities as a deterioration in working conditions, with management being held administratively liable.

When are payments made?

The Labor Code stipulates that the administration must pay salaries to its employees at least twice a month. At the same time, the exact dates on which this will happen must be fixed in internal documents. The period between issues cannot be more than 14 days.

bukhproffi

Important! Also, the deadline for issuing the advance should not be later than the 30th day of the month, and the second part of the salary - no later than the 15th day of the month following the settlement month.

Is it possible not to pay an advance?

The law determines that an employee must be paid a salary at least every 2 weeks. For violation of this provision, fines of up to 50 thousand rubles may be imposed.

This is precisely the employer’s obligation, and he has no right to violate it, even if the employee personally fills out an application with a request to give him earnings in one amount once a month.

In 2021, the Ministry of Labor issued a letter in which it indicated a case when an advance payment may not be paid to an employee. If he was absent from the workplace for the first 15 days (for example, he was on annual leave or sick), then the organization does not have to make the transfer, since only the time actually worked is taken into account.

Attention! However, if at least one day was worked in this period, then payment for it will need to be issued.

Changes in labor legislation from 2021

What changes in labor legislation from 2021 are important for HR workers? Will the Labor Code of the Russian Federation change? Will work books be cancelled? What new benefits should be paid in 2018? Will it be necessary to index wages for all employees? How will Rostrud inspections take place in the new year? How to prepare for submitting the SZV-STAZH annual report? Here is a list of the main changes.

The minimum wage was increased to 9,489 rubles

The minimum wage (minimum wage) from January 1, 2018 from 7,800 rubles was increased to 9,489 rubles (Federal Law of December 28, 2021 No. 421-FZ “On amendments to certain legislative acts of the Russian Federation in terms of increasing the minimum wage to subsistence level of the working-age population"). This amount is 1,689 rubles more. (9489 rub. – 7800 rub.).

The calculation of many payments depends on the new minimum wage, including temporary disability benefits, maternity benefits, child care benefits for up to 1.5 years, as well as numerous social benefits, the amount of which is tied to the minimum wage. See “Minimum wage rate from January 1, 2018.” In this article we will also talk about the new amounts of payments calculated from the new minimum wage.

The minimum wage will be gradually equalized to the subsistence level

From 2021, a gradual increase in the minimum wage to the subsistence level will begin.

It is planned to increase the minimum wage in two stages:

- from January 1, 2021;

- from January 1, 2021.

As a result, from January 1, 2021, the minimum wage is equal to the subsistence level. Moreover, they will take the value for the second quarter of the previous year.

From January 1, 2021, the minimum wage will increase to 9,489 rubles - this is 85 percent of the subsistence level of the working population for the second quarter of 2021. It will reach one hundred percent from January 1, 2021. It is expected that in 2021 the minimum wage will be 11,598 rubles, in 2021 - 11,946 rubles. Thus, the minimum wage for 2018–2020 will increase by 53 percent.

From January 1, 2021, wages need to be increased

The Labor Code of the Russian Federation establishes a guaranteed minimum wage to which an employee has the right to claim. In accordance with Art. 133 of the Labor Code of the Russian Federation, the monthly salary of an employee who has fully worked the required working hours during this period cannot be lower than the minimum wage

From January 1, 2021, the minimum wage will be increased to 85% of the subsistence level and will be 9,489 rubles per month. Accordingly, from January 1, 2021, an employer paying its employees the minimum wage is obliged to increase it to new values.

Sometimes the employer is also not required to adhere to the minimum wage. This is, for example, part-time work (Article 93 of the Labor Code of the Russian Federation) and part-time work (Article 284 of the Labor Code of the Russian Federation). In relation to such employees, the employer is not obliged to draw up any additional agreements in connection with an increase in the minimum wage.

In all other cases that are not directly specified in the Labor Code of the Russian Federation, employers cannot pay their employees wages below the minimum wage. Otherwise, they may be held accountable under Art. 5.27 Code of Administrative Offenses of the Russian Federation. The fine for paying wages below the minimum wage for legal entities ranges from 30,000 to 50,000 rubles. Repeated violation will increase the fine to 70,000 rubles.

Wage indexation from 2021: mandatory or not?

Many HR specialists have heard that starting from 2021, employers will be required to annually index the wages of their employees. Is it true?

Indeed, there is a bill in the State Duma that would provide for the indexation of earnings once a year in connection with rising consumer prices for goods and services. The indexation amount must not be lower than the inflation rate in a particular region. However, this bill has not yet been approved.

However, despite this, according to the Labor Code of the Russian Federation, ensuring an increase in the level of real wages already includes wage indexation in connection with rising consumer prices for goods and services.

State bodies, local governments, state and municipal institutions index salaries in the manner established by labor legislation.

The government planned to index the wages of employees of federal government institutions by 4 percent: in 2018 - from January 1, in 2021 and 2021 - from October 1. Funds are provided in the federal budget.

At the same time, commercial companies and individual entrepreneurs index salaries based on collective agreements, agreements, and local regulations. If such documents do not say anything about mandatory indexation since 2018, the employer is not obliged to index earnings.

Keep in mind that the Constitutional Court of the Russian Federation in its Ruling dated November 19, 2015 No. 2618-O noted that the Labor Code of the Russian Federation does not allow an employer not related to the public sector to evade salary indexation.

Indexation is aimed at ensuring an increase in the level of real salary content and its purchasing power.

By its legal nature, indexation is a state guarantee of remuneration for workers and must be provided to all persons working under an employment contract. Thus, the employer should not shy away from increasing wages.

However, the legislation does not establish the exact amount of indexation. Therefore, the indexation amount is determined at the discretion of the employer, taking into account the opinion of the trade union. The employer is not required to apply the official inflation rate.

Indexation for public sector employees from January 1, 2021

Order of the Government of the Russian Federation dated December 6, 2017 No. 2716-r provides for an increase in wages for public sector employees. According to the order, from January 1, 2021, wages of workers in the public sector of the economy employed in federal institutions will be increased by 4%.

This increase applies to all federal institutions - autonomous, budgetary and state-owned. Such institutions are taken away, including institutions of the social sphere and science, forestry, hydrometeorological service, veterinary medicine, employment services and others.

Special assessment of working conditions

Employers must complete a special assessment of working conditions by the end of 2018. According to Part 6 of Article 27 of the Federal Law of December 28, 2013 No. 426-FZ “On Special Assessment of Working Conditions,” all employers must, as a matter of priority, conduct a special assessment in workplaces with dangerous and harmful production factors.

At all other workplaces, including office ones, it is allowed to conduct a special assessment in stages. However, the last stage must be completed no later than December 31, 2021.

Thus, all companies and individual entrepreneurs that have hired employees are required to conduct a special assessment in 2021, and based on its results, indicate the class of working conditions in employment contracts

From 2021, labor inspectors will begin coming to inspections with questionnaires

From January 1, 2021, checklists will be used during routine inspections of employers. The questionnaires contain a closed list of questions for the company. Note that at first the new rules will only affect companies that have been assigned a moderate risk class by Rostrud.

And from July 1, 2021, this procedure will be extended to all employers. Reason: Decree of the Government of the Russian Federation dated September 8, 2017 No. 1084. Anyone can get acquainted with the questions and understand what exactly interests the inspectors.

And the “Electronic Inspector” on the online inspection.rf website will allow you to undergo a virtual check and understand your weaknesses (Order of Rostrud dated November 10, 2017 No. 655).

Source: https://blogkadrovika.ru/izmeneniya-v-trud-zakonodatelstva-2018/

Payroll taxation

The Tax Code establishes that if an employee receives income for performing work duties, then such payments must be subject to personal income tax. In this case, the obligation to calculate the tax, withhold it and pay it to the budget rests with the employer.

According to the law, there are several tax rates, but two are most often used:

- 13% – for Russian citizens;

- 30% - for foreigners, as well as those who stayed in Russia for less than 183 days per year.

The tax must be transferred to the budget the next day after the employee is paid. This does not take into account the method in which this payment was made - in cash or to a bank card. Personal income tax is transferred at the expense of the employee.

For sick leave and vacation pay, which are also part of an employee’s earnings, a different tax payment period is established. This must be done no later than the last day of the month in which the payment was made. This allows the organization not to make transfers every time, but to collect all amounts and send them in one payment at the end of the month.

Attention! The employer must also calculate insurance contributions to the funds - pension, social insurance and medical insurance - based on the amount of the employee's accrued salary. The total rate of all contributions is 30%. These amounts are transferred at the expense of the employer.

In some regions of the country, a reduced rate may be established. In addition, if the organization has workplaces with harmful or dangerous conditions, then additional contributions from 2% to 8% may be established for them.

You might be interested in:

Application for transfer of salary to a bank card: why it is written, how to write it correctly

Contributions must be transferred by the 15th day of the month following the month of salary calculation.

Based on what documents are salaries calculated and paid?

In order to document the calculation and payment of wages, many documents are used:

- A report card in the T-12 form is used in organizations to record the appearance of employees at their place, and actually confirms that the employee is fulfilling his duties. The form includes columns where you can directly calculate salaries.

- Timesheet in form T-13 - this type of timesheet is generated automatically using electronic means. As a rule, this document is used in companies with an electronic recording system for employee attendance.

- Statements according to forms T-49, T-51, T-53. Form T-49 includes all the necessary columns to calculate wages and then issue them. If you only need to make a calculation, then form T-51 is used. This is used, for example, if the payment is made to cards. Statement T-53 contains only columns intended for payment.

- Journal T-53a - used to register issued payroll statements.

- A personal account in the form T-54 and T-54a is issued for each employee at the beginning of each calendar year. This document records all accruals and deductions for the employee for each month.

- Calculation note in form T-60 - used to determine the amount of vacation pay to be paid;

- Calculation note in form T-61 - used to determine the amount that needs to be given to the employee upon his dismissal, including compensation.

- Cash settlement order (CSO) - used to issue wages from the cash register to one employee.

- Payment order - filled out to transfer wages to one employee or to a group at once through the bank. In the latter case, a register containing the amounts payable and bank card numbers must also be transferred to the bank.

Salary for December: payment and personal income tax

This document will save you from offensive fines and protect you from mistakes.

Relevance has been confirmed by BukhSoft program experts. Register, download and immediately use it in your work! In a year, according to the Labor Code of the Russian Federation, wages are paid 2 times a month. But what numbers to put in the documents? WATCH THE VIDEO ON THE TOPIC: Peculiarities of calculation and payment of wages

Now employees should be paid according to the new rules.

The employer must set a specific date for payment of wages, and not a time interval that includes several days. The timing of salary payments is prescribed in the internal labor regulations of the PVTR, a collective agreement or an employment contract. In order for your salary terms to comply with legal requirements, you also need to remember that salaries must be paid at least every half month. Therefore, taking into account this rule, wages must be paid: Employers whose payment terms do not meet the requirements of the Labor Code of the Russian Federation need to make changes to their internal documents. Sample order to change the terms of payment of wages. Changes in the terms of payment of wages reflected in the internal labor regulations are formalized by order. Moreover, if there is a trade union, it is necessary to take into account its opinion regarding changes in the terms of payment of wages.

Forms of salary payment

All features of payment of wages to employees are strictly indicated in the Labor Code. Thus, the normative act indicates that salaries to your employees can be given both in cash and in non-monetary form. If the issue is made in cash, then the amount can only be paid in Russian rubles.

Exactly how the employee will receive his earnings must be specified in the employment agreement with him. If there is no such clause in it, then the employee has the right to independently fill out an application addressed to the manager and write down in it exactly how he wants to receive the money he earned. The director cannot refuse such a request.

As a rule, in small companies salaries are paid in cash from the cash register. When receiving funds in hand, the employee must sign on the cash register or on the payroll. Funds that were intended for payment, but for some reason remained not issued, are returned to the current account. They must stay there for a period of time specified by law.

In large companies, salaries are most often paid by transfer to a plastic card. At the same time, the organization does not have the right to force an employee to use cards only from a specific bank. The employee has the right to fill out an application addressed to the director, in which he indicates the details for transferring wages. At the same time, the law gives him the right to change the bank at any time at will, to write a corresponding application no less than 5 days before the next transfer of funds.

Attention! The Labor Code allows the employee to be given part of their salary in kind (for example, in manufactured products). However, this can be done in no more than 20% of all accrued funds. In addition, the employee must fill out an application in which he expresses his desire to receive part of his salary in products - the employer himself does not have the right to impose this method of payment.

It is prohibited to issue salaries in the form of coupons or debt documents. It is also impossible to make payments in products the circulation of which is prohibited in the country or is subject to legal restrictions - alcohol, narcotic or poisonous products, weapons and ammunition, etc.

What other new items appeared in wage legislation in 2018?

Another article of the Labor Code, namely 136, which talks about the timing of remuneration, also underwent a slight clarification this year. Now this article says that although the specific date for payment of wages in any Russian organization is determined by the internal rules of the company itself, there is still a deadline by which it is necessary to pay out what employees have earned.

This date is the 15th calendar day after the end of the period for which the salary was accrued.

In the vast majority of cases, this means in practice that the salary for the previous month must be paid before the 15th of the next month, and the advance payment - before the 30th.

By the way, the rule according to which an employee must receive money twice a month (advance and salary) continues to apply.

Another rule that appeared in the spring directly prohibits Russian companies from imposing on their employees a bank card of a particular bank as a salary card. An employee has the right to choose which bank he wants to remain a client of in order to receive his salary into an account with that bank. Violation of this norm will result in a fine against the employer.

Payroll - Postings

The generation of entries for payroll for employees depends on what type of employees the calculation is made for.

| Debit | Credit | Operation |

| 20 | 70 | Salary for workers in main production |

| 23 | 70 | Salaries for auxiliary workers |

| 25 | 70 | Salary for general production workers |

| 26 | 70 | Salaries for employees with administrative functions (director, accountants and others) |

| 44 | 70 | Salaries of workers involved in trade |

| 91 | 70 | Salaries of employees who do not participate in production activities |

Payroll entries can be made in a single amount, or for each employee separately. For payments for vacations and sick leave from the organization’s funds, exactly the same entries are made.

Other types of accruals can also be performed:

| Debit | Credit | Operation |

| 96 | 70 | Vacation was accrued from reserve funds |

| 69 | 70 | Sick leave accrued from social insurance funds |

| 84 | 70 | The employee received financial assistance |

Along with the accruals, you must show the postings for deductions from wages:

| Debit | Credit | Operation |

| 70 | 68 | Personal income tax is withheld from the salary amount |

| 70 | 76 | Other deductions have been made (for example, alimony) |

Responsibility for non-payment of salaries and advances

If an employer does not pay wages to its employees, the law provides for several types of liability for this:

- Material. This amount is determined based on the amount of debt and the exact period for which the payment was delayed. Such a fine is calculated as 1/150 of the amount of unpaid wages for each day of delay. Such compensation must be calculated in any case, regardless of the reasons why the payment was not made.

- Administrative. It is imposed on the responsible persons, individual entrepreneurs or the entire company. The largest amount of such punishment is 50 thousand rubles, but it can be increased in case of repeated similar violations.

- Criminal. The most serious form of liability depends on the length of the delay. Awarded to the director of a company or entrepreneur. The maximum penalty is a fine of 500 thousand rubles or imprisonment for up to 3 years.