How to calculate your salary for January:

- Determine the number of working days in a month.

- Calculate the time actually worked by the employee.

- Find out the estimated cost per unit (day, hour) and multiply it by the employee’s actual workload for the reporting period.

The number of working days in January 2021 with a normal five-day work schedule is 15. We go to work only on the 11th. All this raises many questions about the procedure for calculating and paying wages.

The wage regulations of each employer indicate how much the salary is in January if the employee is on a salary: if he has worked all the working days according to the production calendar, then he receives the full salary, which is established in the employment contract. It is unlawful to reduce an employee’s income because the number of working days in this month is fewer than in others.

If an employee has not worked fully for a month

If the employee is absent from the workplace, payment in January at the tariff is made only for the time worked. In this case, the monthly salary should be divided by 15 (the number of working days) and multiplied by the number of days actually worked.

And here is how wages are calculated for hourly wages for January in 2021: the hourly rate is multiplied by the number of hours worked. It should be remembered that due to the fact that this month in 2021 there are only 15 working days, wages for one day are much higher than for the rest. Absence from the workplace is extremely unprofitable for an employee and will lead to a decrease in wages.

New calculation of vacation pay in 2021: example of calculation and new rules

Example 5. It also happens that an employee decides to go on vacation without working a single day in the position he received. Of course, such a situation is quite rare and occurs during an emergency, but an accountant must know how to behave in such cases. The calculation is quite easy: all the accountant needs to do is take the salary or current tariff plan as a basis and substitute the numbers into well-known formulas.

To calculate vacation pay, you should include in the calculation the entire salary that was accrued for the designated period and divide it by the total number of days in the period worked. From March 12 to March 29, Vasily worked for 19 calendar days. To find out the number of days in the worked period, we need to apply the already known formula: 19: 31 * 29.3 = 17.95 days.

We recommend reading: Funded pension after death

Procedure for payment of wages

As a rule, not only the calculation of wages raises questions, but also the procedure for its payment.

For many organizations, payday for December falls on holidays. If your pay day falls on any day of the New Year holidays, then wages must be paid to employees no later than December 31, 2020, that is, on the last day of work before the long weekend (Article 136 of the Labor Code of the Russian Federation). If the December advance was paid between December 28 and December 31, then the salary for December is transferred after the end of the New Year holidays, but no later than January 15, 2021. Letters from the Ministry of Labor explain how wages are paid in January 2021: if the advance was transferred from the 16th to the 30th or 31st, then the payment for the second half is sent from the 1st to the 15th of the next month (letters No. 14-2/ОOG-1663 dated 12.03 .2019, No. 14-1/B-911 dated 09/21/2016).

The amount of the advance in January 2021 is lower than in other billing periods. This is due to the fact that the first half of this month accounts for only 5 working days.

For example, if an employee’s salary is set at 40,000 rubles, then for the first half of the month he will receive (40,000/15) * 5 = 13,334 rubles. In February, he will receive his second salary for January 2021 - for the second half of the month. Due to the coronavirus, the New Year's schedule may be changed.

Irina Kostevich - about how to compare salaries for December and January

The transition of public sector workers in Belarus to new wage conditions from January 1, 2021 still remains a resonant topic in society: people receive pay slips, do calculations and ask questions, although press conferences and direct lines have already taken place and continue to take place. To clarify the most pressing issue in January - the amount of wages for this month - BELTA correspondent turned directly to the Minister of Labor and Social Protection Irina Kostevich.

Specialists from the Ministry of Labor and the Minister personally participated in monitoring the level of accrued wages of workers, calculated from January 1, 2021, in order to exclude facts of its reduction at the time of the introduction of new wage conditions. “Starting from December 2021, weekly monitoring has been organized in all regions of Belarus to assess whether budget organizations are ready to switch to new wage conditions. We have already visited about 1.5 thousand organizations. Let me make a reservation right away: these monitoring are not aimed at identifying violations and bringing the perpetrators to justice. On the contrary, they are aimed, first of all, at providing methodological assistance to the accounting services of payroll organizations, clarifying issues related to the specifics of the activities of this particular organization . "

– Irina Kostevich emphasized.

Budgetary organizations have already begun calculating wages to employees for January 2021 under new conditions. For clarity, Irina Kostevich explained this issue using the example of specific employees of a gymnasium and a health care institution in Minsk, who visited this week.

Calculation of December and January teacher salaries

The gymnasium has the following deadlines for payment of wages: advance payment - on the 19th day of the current month, wages and bonuses - on the 4th day of the month following the reporting month. The bonus for December 2019 was paid on December 31.

In accordance with the legislation in force until January 1, 2020, funds in the amount of 20% of the planned wage fund and savings from funds allocated for wages were allocated for the payment of bonuses in gymnasiums. The specific amounts of the bonus, the procedure and conditions for its payment are determined in the regulations approved by the head of the institution. Namely: all employees are paid a basic bonus of 7% (except for the manager, whose bonus amount is determined by a higher management body). The remaining funds for bonuses are distributed according to the decision of the manager. In this case, the employee’s personal contribution to the overall results of the gymnasium’s activities is taken into account.

The volume of bonuses due to savings in the organization is insignificant: monthly about Br70-80 (paid to individual employees in individual months). In 2021, the bonus was paid in the month following the reporting month.

Starting from 2021, a change has been made to the bonus regulations, which determines the deadline for paying bonuses in the current month. Therefore, the pay slips of employees for January of this year reflect the accrual of bonuses for the current month - January.

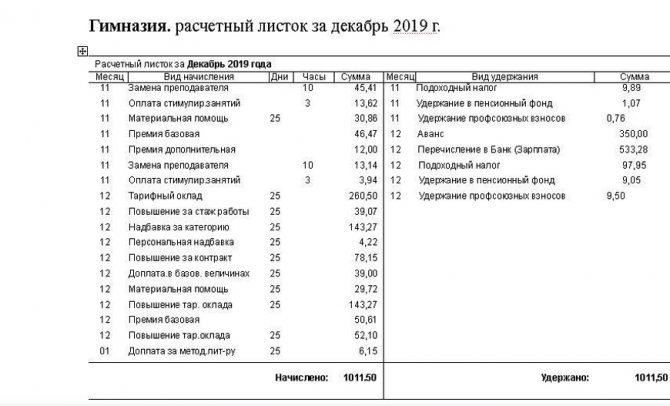

Thus, the payslip for December 2021 for a teacher of the first qualification category with a teaching load of 27.25 hours per week is as follows:

It reflects some payments for November 2021 (month 11), including bonuses (basic Br46.47 and additional Br12, totaling Br58.47). If we subtract the amounts of payments accrued for November (Br165.44), as well as the amount of financial assistance in December (Br29.72), which is not included in wages, and take into account the bonus for December paid in the same month (Br50.61 ), then the salary of this teacher for December was Br816.34.

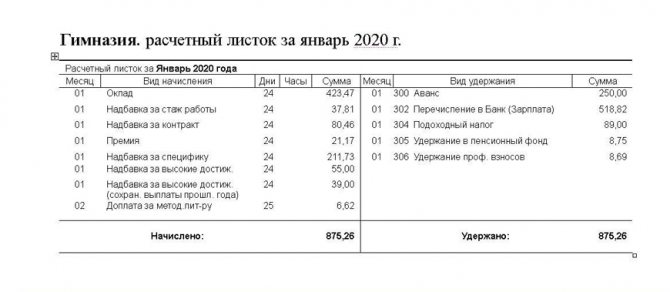

On the payslip for January 2021, the same teacher will see the following payments:

The salary accrued for January will be Br875.26, i.e. Br58.92 more than in December 2019. This is an increase in salary for a specific teacher at a specific gymnasium. But this does not mean that all teachers will receive a similar increase. The main thing is to prevent wages from falling.

The Ministry of Labor noted the specifics of the activities of general secondary education institutions. In the second half of the academic year (from January 1), some teachers may have a reduction in the number of teaching hours due to changes in curricula. Thus, their accrued wages for January will correspondingly decrease compared to December.

Calculation of December and January salaries of a doctor

In this institution, the advance is paid on the 20th of the current month, the salary is paid on the 5th of the month following the reporting month, the bonus is paid on the 20th of the month following the reporting month (simultaneously with the advance payment). Accordingly, the bonus for December 2021 was paid on January 20, 2020.

Previously, in health care institutions, funds were allocated for the payment of bonuses in the same way as in gymnasiums - in accordance with previous legislation. The specific amounts, procedure and conditions for payment of the bonus are determined in the regulations approved by the head of the institution.

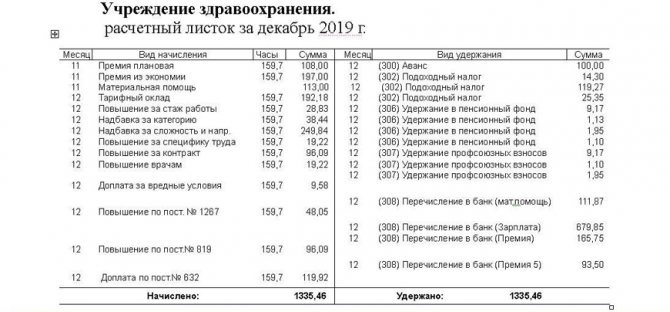

As an example, the payslip for December 2021 of a cardiologist with the first qualification category is given.

Since in this case the bonus is paid a month later, the bonus for November, paid in December, must be included in the salary amount for December. But this employee was paid two bonuses in December: a planned one (at the rate of 20%) and a bonus due to savings on wages. Accordingly, in order to compare the salary level before and after the introduction of changes, it is necessary to use the accrued salary of a cardiologist for December minus financial assistance and bonuses from savings. It will be Br1025.46 (Br1335.46 minus Br113 and minus Br197).

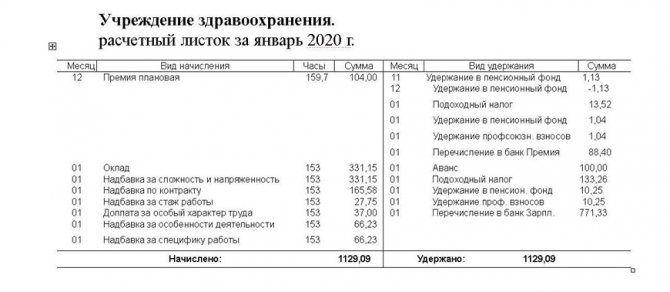

In the payslip for January 2021, the same cardiologist will see the following changes:

As you can see, the January salary of a cardiologist is Br1129.09 - taking into account the planned bonus for December 2021, paid in January of this year (Br1025.09 plus Br104). It is necessary to take into account that in February this specialist will receive a planned bonus for January in the amount of 5%.

Thus, the salary of a cardiologist for January 2020 is higher than the salary for December of the previous year by Br103.63.

The healthcare sector also has its own specifics that affect the size of salaries. It is related to the number of hours worked at night and over the established working hours in any given month.

Irina Kostevich also noted a feature of 2021: employees of budgetary organizations will receive an additional social payment. We are talking about a one-time payment for health improvement, which is issued, as a rule, when going on vacation at the rate of 0.5 salary. In addition, employees retain the right to receive financial assistance. From January 1, funds in the amount of 0.3 of the average monthly salary of employees are allocated for these purposes, while previously it was 5% of the planned wage fund of full-time employees. Each budgetary organization independently determines the procedure, conditions and amounts of financial assistance (and from the new year, a lump sum payment for health improvement). At the same time, one must understand that financial assistance is not a mandatory payment. It is provided at the request of employees in cases of unforeseen financial difficulties and other cases provided for by the relevant regulations.

Ekaterina Knyazeva,

BELTA

Minimum wage from the new year

Article 133 of the Labor Code of the Russian Federation establishes that the salary of an employee who has worked for a full month should not be less than the minimum wage, which is established by Federal Law No. 82 of June 19, 2000. The minimum wage is regularly revised. In 2021, the minimum wage is 12,130 rubles, and from 01/01/2021 it will be raised by 262 rubles. — up to 12,392 rub. (Order of the Ministry of Labor No. 542n dated August 28, 2020).

Many employers believe that the minimum wage affects how the salary is calculated in January - they should be guided by this value when paying. However, this is not entirely true. Article 133.1 of the Labor Code of the Russian Federation allows regions to establish local minimum wages at a level not lower than the federal one. In some regions it significantly exceeds the federal level:

If the regional minimum wage is established on the territory of a constituent entity of the federation, the employer is guided by it when paying the labor of its employees. In order not to apply the regional minimum wage, it is necessary to send a reasoned refusal to the State Service for Labor and Employment within 30 days after the publication of the appeal to employers.

Thus, organizations should check how wages are calculated in January and whether they correspond to the minimum wage established not only at the federal level, but also in the region.

How to correctly calculate your salary according to the new minimum wage in 2021

The minimum wage is the basic category for calculating wages in many enterprises, especially in the manufacturing sector. Most salaries are calculated based on the minimum wage based on microeconomic indicators. Thus, for large enterprises, when creating an accounting policy, it is easier to index wages based on the economic situation.

The minimum wage amount is not taxed as a minimum income. The minimum wage is used in numerous calculations and is considered the basic characteristic from which all enterprises base their payroll and social assistance. Let's look into the details of how to correctly calculate the salary according to the new minimum wage, which in 2021 is 11,163 rubles.

Salaries of public sector employees in January 2021

If an employee of a budgetary institution has worked the first month of 2021 in full, he will receive remuneration for work at the tariff (salary) in full. Algorithm for how public sector employees are paid salaries in January in 2021: Advance payment for the first half of the month - on time. Salary for the second half of the month - 15 days after the advance, at the beginning of February.

If an employee of a budgetary institution was called to work during the New Year holidays, the employer will pay him at least double the amount or provide an additional day off - at the employee’s choice (Article 153 of the Labor Code of the Russian Federation). An employee may be hired to work on holidays only with the written consent of the employee.

How to calculate if an employee worked on holidays

The January holidays will last from the 1st to the 8th, with the addition of two days off - January 9th and 10th - for those on a five-day vacation. Workers on a six-day workday go to work on Saturday, 01/09/2021. If the employee had to work on holidays, the employer is obliged to pay an increased amount for the work or provide an additional day of rest.

According to Art. 153 of the Labor Code of the Russian Federation, payment for work on weekends and holidays is made at least double the amount.

IMPORTANT!

If the employee has chosen an additional day of rest, he will still have to calculate additional pay for work on holidays.

The accountant worked during the January holidays, from the 4th to the 6th. No time off was provided; the entire month was worked. Here's how to calculate your salary for January 2021, taking into account holidays:

- Determine the accountant's salary: 45,000 rubles.

- Find out the cost of one holiday: 45,000 / 15 days. × 2 = 6000 rub.

- Calculate additional payment for holidays: 6000 × 3 days. = 18,000 rub.

Total income will be 45,000 + 18,000 = 63,000 rubles.

If the employee worked only half of the holiday, then calculate the additional payment based on the actual time worked.

Let's change the conditions of the example and make a calculation for the accountant if he took three days off. Let's look at how wages are calculated for January, taking into account holidays:

- We calculate the additional payment for work during the New Year holidays: 18,000.

- We calculate the salary: 45,000 / 15 days. × 16 days = 48,000.

- We determine the total January income: 18,000 + 48,000 = 66,000.

IMPORTANT!

If an employee only worked half a day on a holiday, he is entitled to a full day of rest. Such clarifications are contained in the letter of Rostrud No. 731-6-1 dated March 17, 2010.

Salary calculator in the Republic of Kazakhstan

Hello! Thanks for your question. When calculating social tax, deductions for mandatory pension contributions are not applied. Social tax is 9.5% of the salary and the amount of social contributions is deducted from the result. I also tried to calculate it using your method - it turned out to be 2,442 tenge, but not 2,146.25, but this is also incorrect, do not forget that the OPV deduction is not needed here. Also note that according to the SN there is a lower limit for calculating tax - 1 minimum wage (42,500 tenge). That is, if you calculate taxes based on payment of 40,000, then the tax will still be 9.5% of (42,500.00) - 1,487.50 = 2,550. I hope I answered your question in detail.

Hello. I read all the comments looking for an answer to my question, but I couldn’t find it. The calculator is really very thoughtfully implemented. Respect to the author and developer. The essence of the situation is this: I am the director. My employees receive different salaries, depending on the position and complexity of the work. I rechecked all my manual calculations in your calculator - everything is the same, with the exception of SN with a salary of 42,500 tenge (minimum wage). I made the calculation manually as follows: (42500 (salary) - 4250 (OPV) - 0 (90% adjustment for personal income tax)) * 0.095 - 1487.5 (CO) = 2,146.25, i.e. the final tax due for payment was 2,146.5 tenge. The calculator gave the following result: CH 9.5% of (42,500.00) – 1,487.50 = 2,550. The difference is 403.5 tenge. There were thoughts that I made a mistake somewhere, but in some services the result comes out like mine, and in others - like yours. In general, I got confused only in calculating the SN for a salary of 42,500 tenge. I hovered over the numbers, as indicated above in many responses to comments, to see the calculations of the calculator, but did not see them. When hovering, the inscription is duplicated. Please explain which calculation is correct and which is not. Thank you.

How to calculate salary using formula

The Labor Code does not establish rules for calculating parts of the salary, but referring to the explanations of the Ministry of Labor, we can conclude that the calculation of the first part includes not only the salary, but also all allowances and additional payments established for the employee. The monthly amount is distributed in proportion to the days worked.

To calculate the advance:

- The number of days worked in this part of the month is determined. If the employee was on vacation or sick leave, then these days are not taken into account in the calculation.

Take into account all charges. This includes salary, bonuses, additional payments, including for the additional amount of work that was established this month, night shifts, etc. Using only the salary amount for calculation will entail the imposition of fines on the employer.

The following accruals are not taken into account when generating the advance calculation:

- A monthly bonus, which is awarded based on the results of work for the month.

- Payments that are of an incentive nature based on the results of work for the month.

The formula for calculating wages for the period that the employee actually worked in the current month is as follows:

(Salary + Additional payments and allowances + Bonus payments) / Number of working days in a month × Days worked

For each monthly payment, the accounting department calculates deductions, minus which the amount will be given to the employee. The standard deduction is personal income tax, amounting to 13% of income. Additionally, amounts for writs of execution and trade union dues can be deducted from the salary.

Bonus payments can be established after the first payment of earnings due. Then they will be calculated in the usual way and the second payment, the so-called final payment for the month, will be the difference between the calculated salary for the entire month using the bonus and the first payment (usually called an advance).

Calculation of vacation pay in 2021 in a new way

Salary accrued to teachers of primary and secondary vocational education institutions for hours of teaching work in excess of the established and (or) reduced annual teaching load for the current academic year, regardless of the time of accrual

As required by labor legislation, the employer is obliged to annually create a vacation schedule (Article 123 of the Labor Code of the Russian Federation). Half a month before the start of the vacation in accordance with the schedule, the employee must be reminded in writing about the upcoming paid break from work.

Payroll calculation in 2021: step-by-step calculation procedure with formulas and examples

Article 136 establishes payment terms - no less than every 15 days. The exact date is determined in accordance with the clauses of the labor regulations at the enterprise, clauses of the collective agreement and the contract between the employer and his employee.

Payroll form T-51 Payroll T-53 - designed to provide salary not only to employees of the enterprise, but also to hired workers. The main difference from the previous statement is that T-53 does not indicate the number of actual working hours.