Rules and length of service for vacation and calculation of vacation pay

There are certain provisions governing when an employee goes on vacation and the accrual of payments to him during his vacation. Everything must be taken into account so as not to accidentally violate the law and not disadvantage the employee.

New 2021 rules for calculating vacation pay

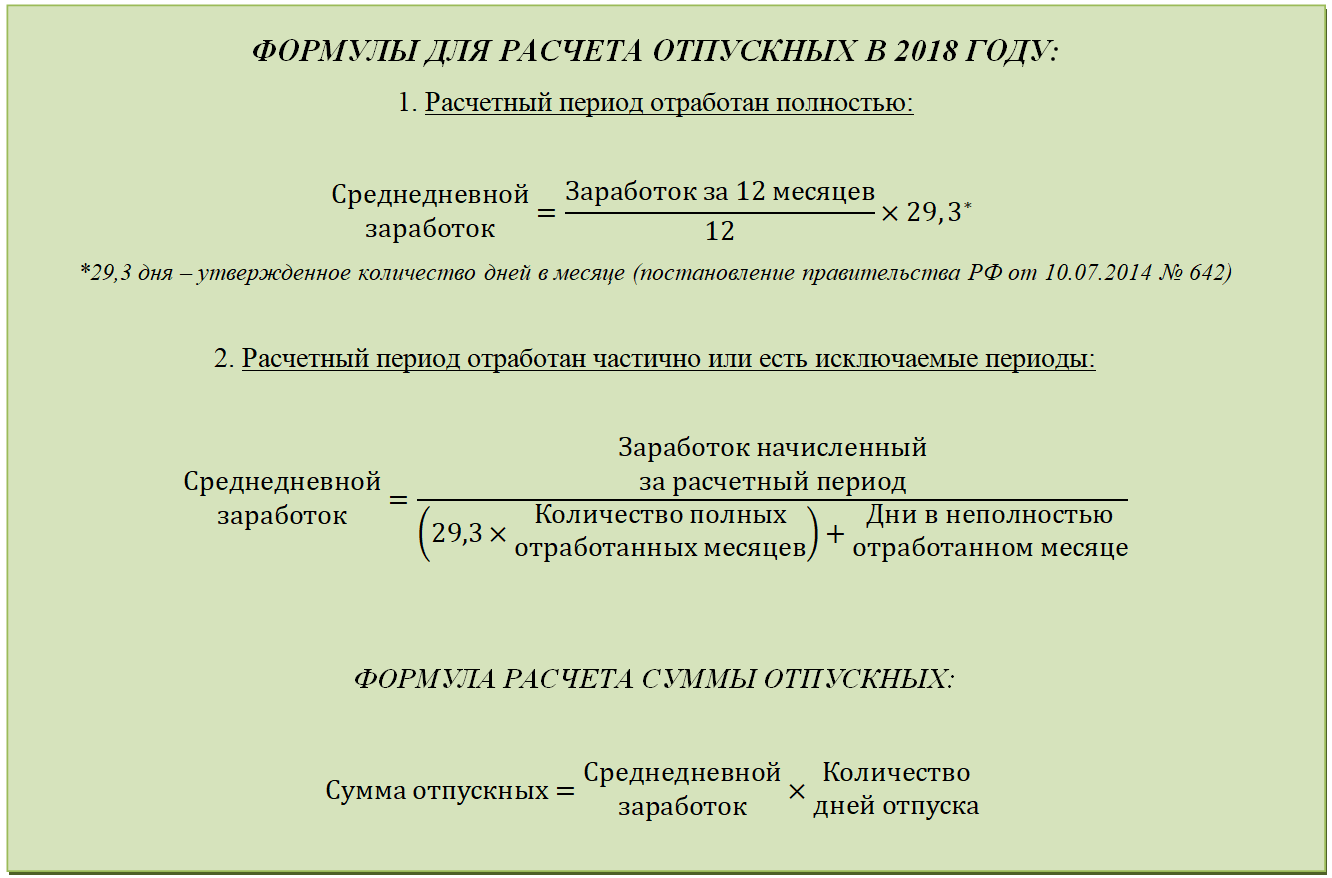

The system for calculating the amount due to an employee upon retirement for 28 (or more) days has long been established. In 2021, no new rules for calculating vacation pay have been created. As before, the process is regulated by Article 139 of the Labor Code of the Russian Federation and paragraph 4 of Decree of the Government of the Russian Federation of December 24, 2007 No. 922. The formula remains as follows:

Vacation pay = Average earnings per day * Number of vacation days

As before, when calculating vacation pay, it is necessary to take into account all the employee’s income related to the remuneration system. That is, wages, allowances, bonuses and additional payments. There is no need to take into account amounts assigned other than wages (for example, financial assistance or sick leave).

How long do you need to work for vacation?

In order to obtain this right, an employee must continuously work in the organization for at least 6 months. After this, he can request the standard 28 days for rest, or split this period into two or more parts.

The length of service includes only time worked under an employment contract. If an employee worked under a civil contract, then this time is not taken into account in the length of service. That is, such an employee does not have the right to leave until he switches to an employment contract and works under it for six months.

The following have the right to receive leave without working for 6 months (“in advance”) without the consent of the employer:

- minors;

- those who are going on maternity leave or have just returned from it;

- who have adopted a child under 3 months of age.

Other employees can also go on vacation “in advance,” but this will require an agreement with the employer. But you can only get annual paid leave in this way - other types (educational, maternity leave, etc.) are assigned only upon presentation of the relevant document.

At the same time, at any time convenient for the employee, leave can be taken by:

- husbands if their wives are on maternity leave;

- veterans and “Chernobyl victims”;

- husbands/wives of military personnel;

- part-time workers, provided that they also received vacation at their second job;

- heroes of the USSR, Socialist Labor, Russian Federation, holders of the Order of Glory or Labor Glory (full);

- honorary donors of the Russian Federation;

- exposed to radiation during testing of nuclear weapons at the Semipalatinsk test site;

- working in the Far North (or in regions equivalent to it), provided that they accompany a minor to enter a university or college in another region.

Attention! When calculating length of service, not the calendar year, but the working year is taken into account. If an employee was hired by the organization on March 1, 2018, then only on September 1, 2021 (after 6 months from hiring) he gets the opportunity to go on vacation.

The main nuance of the timing of vacation pay in 2021 is how to count three days before it starts

Indeed, three days can be understood in different ways. This can be three calendar or three working days. The difference is sometimes very significant. If, for example, the vacation begins on January 10, then this is only the second working day of the year, and then payment should occur almost two calendar weeks before the start of the vacation, back in December.

But even in a normal situation, the period can increase to five calendar days, if we understand the norm of the labor code as three calendar days.

In fact, of course, we are talking about three calendar days, and this is how accounting departments always interpret it when paying vacation pay. However, even here there is not always a correct understanding of how to count these three days.

Most often, when paying vacation pay in Russia (provided that they are paid correctly at all, before the employee goes on vacation), accountants or heads of organizations are guided by the fact that the first day of vacation must be included in the three-day period before the start of the vacation.

For example, if an employee goes on vacation on August 10, then vacation pay is paid on August 7. Another common practice is for an employee to go on vacation on Monday, and then vacation pay is paid on the previous Friday.

Rostrud even gave approximately the same explanations, but in 2021 it finally became clear that such practices violate labor laws.

Employee's rights to leave

Every employee has the right to rest. It must be provided by the employer every year and paid in accordance with the law. This right does not depend on where a person works, how his place of work is organized, and so on. Moreover, both an ordinary employee and a part-time employee, a seasonal worker and any other can take advantage of the leave. Except for those who have entered into a civil contract with the employer (for example, a contractor).

The right to maintain a position and average earnings

One of the main responsibilities of an employer to an employee going on vacation is to maintain his level of earnings and position. The boss does not have the right to send an employee on a walk without paying him vacation money (based on average earnings), or to fire him while he is on vacation.

It is worth remembering that vacation at your own expense is not paid for by the employer. If the period exceeds 14 days, all subsequent days away from the workplace will not be included in the length of service required to take a well-deserved annual rest.

Right to use vacation

An employee has the opportunity to rest for 28 days after working for at least 6 months for one organization. He can take it at any time after six months of accrual of experience, without violating the approved vacation schedule. But you can take time off “in advance” (before reaching six months), if the employer agrees to this.

In the case when a person works part-time, he has the right to receive leave from both jobs at once in accordance with Art. 286 Labor Code of the Russian Federation. Even if he has not been on one of them for 6 months yet, in this case the boss must provide the rest “in advance.”

An employee cannot be recalled from vacation if he does not agree to it. If agreed, the “non-time off” days still remain with the employee, and in the event of dismissal, the employer must compensate for them. In addition, even if the employee wishes, the following categories of citizens cannot return from vacation earlier:

- minors;

- pregnant women;

- working in dangerous or harmful conditions.

It is worth remembering that according to Art. 114 of the Labor Code of the Russian Federation, annual paid leave is not only an employee’s right. This is his direct responsibility. You can't refuse a vacation. It can be transferred to the next calendar year at your own request (in some cases regulated by the Labor Code of the Russian Federation and internal regulations of the organization). But only once - you can’t not go on vacation twice in a row. The employer has the right to consider a voluntary refusal to take leave a disciplinary violation and apply appropriate sanctions to the employee.

In this case, annual leave can be divided into two parts (or more, if the number of days allows) so that one of them is at least 14 days.

Right to extend leave

In some cases, the employee has the opportunity to slightly increase the rest period. Such situations include:

- Illness during vacation (if confirmed by a sick leave certificate, does not apply to the illness of an employee’s child).

- Performing government duties while on vacation.

You can also obtain permission for additional days of rest in other situations provided for by law and internal agreements/regulations of the organization. The list of such situations still remains open, so it is worth checking with the employer about a specific precedent.

Accountable income

The accountant’s task is to determine the amount of a citizen’s income for the base period. According to the law, the calculation of average earnings for vacation includes:

- wages in cash or in kind (including those paid in products);

- commissions;

- interest on the company's profits, if their payment to the employee is provided for in the contract;

- bonuses, allowances;

- northern" coefficients;

- other labor payments due to the specialist.

Please note that the calculation of average earnings for vacation pay does not include benefits provided for by law, for example:

- sick leave payments;

- maternity benefits;

- material assistance;

- compensation for food, travel, etc.

Accruals are excluded for those periods when the specialist did not actually fulfill the job duties assigned to him (was on a business trip, on other vacations, participated in collective bargaining, donated blood, etc.).

Current regulations provide for indexation of average earnings when calculating vacation pay. This means that if a specialist’s salary was increased, an increasing factor is applied to the income of the base period before this date.

Compensation for unused vacation

In some cases, an employee has the right to receive money instead of vacation directly (or part thereof). But not all of them. It is impossible not to go on vacation, receiving instead a certain amount in addition to your salary.

An employee may request money in lieu of vacation if he:

- He quit without taking the required time off (Article 127 of the Labor Code of the Russian Federation).

- He does not want to rest for more than 28 days and is ready to write a statement so that the remaining vacation days are replaced with money (Article 126 of the Labor Code of the Russian Federation). But only on the condition that the annual leave is more than 28 days, and the employee is an adult and not a pregnant woman.

Employees who have worked for at least 11 months without a 28-day vacation can count on full compensation upon dismissal. Moreover, if the vacation was postponed, you must work 23 months to receive compensation for 56 days. But, if an employee is discharged as a result of entering active military service or due to a reduction, liquidation or suspension of the enterprise, its reorganization, then the minimum threshold for receiving full compensation for 28 days is reduced to 5.5 months. To receive money for 56 days, such an employee must work 18 months with the transfer of vacation from the first year.

If the employee worked for less than 11 months and quit for any other reason, then he has the right to proportional compensation according to the months worked. To do this, you need to divide the number of vacation days by 12 months.

When calculating length of service, just as in the case of obtaining the right to leave, working months/years are taken into account, not calendar ones. That is, to obtain the right to 100% compensation, 28 days in case of dismissal must be worked, for example, from March 1, 2021 to February 1, 2019 (11 months).

The second option covers almost all citizens with extended or additional leaves - be they for disability, seasonal (teachers) or for other reasons. Only “Chernobyl victims” and those working in harmful/dangerous conditions are not subject to this rule (additional leave).

In addition, two annual holidays cannot be combined to obtain compensation for anything greater than 28 days. Because each of them is taken into account separately. But if both exceed 28 days (let’s say 32 days each), then you can request to pay an additional 4 days from each period. But this right of the employee is not the obligation of the employer. Therefore, the latter has the right to refuse payment of money and send the applicant to “walk” for the prescribed number of days.

Attention! You cannot receive compensation for a vacation of no more than 28 days (even if it was not taken last year) in money! This is a serious violation that will lead to a fine for the employer under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

When should vacation pay be paid in 2021, taking into account the latest changes?

On January 23, 2021, the Perm Regional Court found that the correct interpretation of Article 136 of the Labor Code of the Russian Federation regarding the timing of vacation pay is as follows. Three full calendar days must pass between the start date of the vacation and the day it is paid. If vacation starts on Monday, then paying it on the previous Friday is a delay in the payment of vacation pay, and the organization should be fined.

This was precisely the essence of the case that was considered by the court in Perm at the beginning of this year. The organization challenged the administrative fine from regulatory authorities regarding the timing of payment of vacation pay. The employee’s vacation pay was paid in the usual sense of the wording “three days before,” and this turned out to be a violation.

Moreover, the organization additionally referred to the fact that the agreement with the employees specified a different period for payment of vacation pay. The court declared this part of the agreement illegal, since the company's internal documents cannot violate the Labor Code.

Thus, if an employee goes on vacation on Monday, this vacation must be paid no later than the previous Thursday. If the start date of the vacation is August 10, then vacation pay must be paid no later than the 6th.

In a word, if we talk about the everyday understanding of deadlines, then vacation pay must be paid four days before the start of the vacation. Three full days must pass between the date of payment and the first day of rest. This is exactly how the court interprets it today.

How employers cheat with vacation

In connection with the crisis, organizations and entrepreneurs often seek to reduce costs for employees, getting maximum output from them. In this case, illegal methods are often used. How to avoid being deceived when calculating vacation pay or vacation?

Failure to provide full leave

An employer may not send an employee on vacation at the time allotted to him (according to the application and/or schedule), especially if the employee has not worked the full pay period. The authorities may motivate this by the fact that he has not yet “earned” a full term.

This is not true. After 6 months of continuous work, according to Art. 122 of the Labor Code of the Russian Federation, a person already has the right to a full 28-day rest.

Incomplete payment of vacation money

In some cases, management may try to save on vacation pay by paying only part “upfront” and the other part later. This is an illegal decision, since the full amount due to the employee going on vacation must be paid at least three days before the start of the vacation.

According to Art. 124 of the Labor Code of the Russian Federation, even if part of the money has not been paid, the employee has the right to demand that annual paid leave be postponed. But at the same time, the employer can pay vacation pay in installments, starting long before the employee’s rest time.

Payment of part of the vacation pay after the start of the vacation is allowed only in one case - if the employer is not yet able to calculate the exact amount (for example, if part of the employee’s exact earnings for the last working month is not yet known, since the vacation begins on the 1st day of the new month).

No indexation of vacation pay in case of salary increase

An organization may simply “forget” to index the average salary for the billing period if the salary was raised. But, according to clause 16 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922, when rates are increased in the cases provided for in the clause, it also entails a recalculation of vacation pay.

Accountants especially suffer from such “forgetfulness” in relation to women on maternity leave. And this is a direct violation of Art. 132 of the Labor Code of the Russian Federation, being an infringement in the field of remuneration

How long should vacation pay be paid by law in 2018?

All issues related to annual leave for employees are regulated by the Labor Code. Thus, Article 114 of the Labor Code of the Russian Federation guarantees the very right to vacation and states that the amount of vacation pay should be equal to the average salary of the employee for the period of time during which the vacation lasts.

Other nuances that affect vacation are discussed in the following articles of the Labor Code, up to Article 128.

As for the payment of vacation pay, it is discussed in Article 136. The law says that payment for vacation is made “no later than three days before its start.” The norm is formulated exactly this way, and its correct interpretation is very important, otherwise the organization risks large fines in the event of an inspection or an employee’s appeal to regulatory authorities.

How to correctly calculate vacation pay: calculation examples

To get the total amount that the organization is obliged to pay to the employee before his leave, it is necessary to calculate the average earnings. It includes all types of payments, regardless of their sources - additional payments, bonuses for labor, bonuses for length of service and conditions, and so on. You can get it from the actual time worked and wages for the last 12 calendar months.

The calculation of vacation pay does not take into account sick leave and payments for disability, travel allowances, financial assistance, compensation for wages and food.

So, to get the amount of vacation pay, you need to carry out several manipulations. For example, in the calculations, let’s take an employee who was not sick and did not take vacation at his own expense, and whose average annual earnings (AE) is 360 thousand rubles.

To begin with, calculate the employee’s average monthly earnings (ASM). To do this, earnings for the year must be divided into 12 months. In formula form it looks like this:

SMZ = SZ / 12

where, SMZ is the average monthly salary of an employee ; SMZ is the average salary for the year

SMZ = 360,000 / 12 SMZ = 30,000 rubles.

Now that the average monthly earnings are known, we can calculate the employee’s average daily earnings. To do this, you need to divide the SMZ by a factor of 29.3 (the average number of days in a month):

SDZ = SMZ / 29.3 SDZ = 30,000 / 29.3 SDZ = 1023.89 rubles.

where, SDZ is the employee’s average daily earnings

That is, an employee earns almost 1,024 rubles per day. Now, in order to calculate the amount of vacation pay (OTP) due to him, you need to multiply this amount by the number of days of vacation (Days):

OTP = SDZ * Days OTP = 1023.89 * 28 OTP = 28668.92 rubles.

where, OTP is the amount of vacation pay

An employee who goes on vacation after honestly working 12 months will receive exactly this amount of vacation pay.

It is worth remembering that vacation pay must be paid no later than three calendar days before the first day of rest. This includes weekends and holidays. In this case, vacation pay is necessarily taxed!

In case the employee has not worked for 12 months

Sometimes it happens that an employee wants to go on vacation without working the full pay period (12 months by default). In this case, the employee did not work out the entire pay period. And it is necessary to calculate his vacation pay based on the number of calendar days he worked. For example, a person worked for 6.5 months (KM) and during this time received 195 thousand rubles (SZ).

It is necessary to calculate how many days the employee worked in full months (DPM). To do this, you need to multiply the fully worked months (OM) by the average number of days in them (the generally accepted coefficient is 29.3):

DPM = OM * 29.3 DPM = 6 * 29.3 DPM = 175.8 days.

where, DPM is the number of days worked in full months

After this, you need to find out how many days the employee worked in an incomplete month (DNM). To do this, it is necessary to divide the coefficient 29.3 by the total number of days in the month not fully worked (CD) and multiply by the number of days worked in the month (ODM). Let's say an employee worked half of February in a non-leap year.

DNM = 29.3 / CD * ODM DNM = 29.3 / 28 * 14 DNM = 14.65 days.

where, DNM is the number of days worked in an incomplete month KD is the total number of calendar days of this month ODM is the number of days worked in the month

Now it’s time to calculate how many days the employee worked in total (OD). To do this, you need to add up both of the resulting results - days in full (DPM) and incomplete (DNM) months.

OD = DPM + DNM OD = 175.8 + 14.65 OD = 190.45 days.

where, OD is the sum of days worked

After this, it is enough to calculate the average daily earnings (ADE). To do this, in this case, you need to divide your earnings for 6.5 months by the number of days worked:

SDZ = 195,000 / 190.45 SDZ = 1023.89 rubles.

where, SDZ - average daily earnings

And multiply the average daily earnings by the number of vacation days (Days, standard - 28 days) to get the amount of vacation pay (OTP):

OTP = SDZ * Days OTP = 1023.89 * 28 OTP = 28668.92 rubles.

where, OTP is the amount of vacation pay

The employee must receive this amount when going on vacation, provided that he has worked an incomplete pay period. Using the same principle, you can recalculate vacation pay for those employees who were sick or on unpaid leave. It is enough to recalculate each month in which days were missed, using the formula for DNM, and add the results obtained with the number of days in fully worked months.

Upon dismissal

If an employee does not take his allotted leave upon dismissal, he has the right to compensation for this time in cash.

Let's say an employee worked for 11 months, after which he decided to quit. At the same time, he did not go to rest. In this case, the amount of compensation (AC) is calculated based on the average daily earnings (ADE) for the billing period, multiplied by the number of non-vacation days (ND).

Let’s say an employee who has worked for two years resigns, transferring the rest from the first year to the next. In this case, he is entitled to 56 days of vacation. During the last billing period, he earned 360 thousand rubles (according to the calculations above, he receives 1023.89 rubles per day). Then you will need to pay:

SK = SDZ * ND SK = 1023.89 * 56 SK = 57337.84 rubles.

where, SK - amount of compensation ND - number of days not taken off

Such compensation is due to a person who has never taken a vacation in two years and decided to quit.

Maternity and annual leave

Maternity leave can be combined with annual leave, combining them in two options:

- First annual, then immediately – sick leave for pregnancy and childbirth, followed by maternity leave.

- Immediately after the end of parental leave for a child under 3 years of age, the annual leave begins. But in this case, the period of parental leave is reduced to 1.5 years.

In both cases, the amount of vacation payments is calculated in exactly the same way as for planned annual leave.

Even if it was taken after maternity leave, the amount of vacation payments must be calculated based on the average salary of the last working (not maternity leave!) year. Therefore, it makes no difference in what combination you use maternity leave and vacation - the amount will be the same. The only difference is time.

When salary changes

If the company’s salary was raised before the employee’s vacation, it is necessary to recalculate the average earnings on the basis of which vacation pay is calculated.

First you need to calculate the salary increase factor (SIC). To get it, you need to divide the new salary (NO) by the old one (SO). Let’s assume that the employee’s old salary was 25,000 rubles, and the new one was 30,000 rubles. In this case, the coefficient will be as follows:

KPO = NO / SO KPO = 30000 / 25000 KPO = 1.2

where KPO is the salary increase coefficient

After this, you can recalculate (index) the employee’s average earnings. There are three options:

- The salary increased in the billing period (RP). In this case, you need to multiply all payments from the beginning of the RP to the month in which the salary increased by the resulting KPO coefficient.

- The salary increased after the end of the pay period, but before the first day of vacation. The entire average salary of the RP is multiplied by a coefficient.

- The salary increased when the employee had already gone on vacation. The portion of vacation pay remaining at the time of introduction of new salaries is multiplied by a coefficient.

After indexing according to one of the three options, you will get the exact amount of vacation pay that the employee going on vacation should receive.

How to correctly calculate vacation pay: procedure and calculation rules, what has changed in 2021

In modern society, employees are entitled to leave in almost every state. But its duration differs in different countries. Russian legislation in this regard is one of the most loyal.

The length of paid leave varies from country to country

In the Labor Code (LC) of the Russian Federation, issues of the duration of leave, extension or division of it into parts are established in Chapter 19. The duration of work in the company, sufficient to receive leave, is also regulated there.

Number of vacation days

Article 115 of the Labor Code gives each employee the right to rest for 28 calendar days once a year. If these days include public holidays, they are excluded from the calculation and the vacation becomes slightly longer.

For certain professions and industries (Article 120 of the Labor Code of the Russian Federation), longer vacations or days added to the main vacation are provided.

Table: who is entitled to additional annual leave

| Name | Base | Number of additional calendar days of vacation |

| Irregular working hours | Art. 119 Labor Code of the Russian Federation | 3 |

| Working conditions were found to be harmful or dangerous as a result of a special assessment | Art. 117 Labor Code of the Russian Federation | at least 7 |

| Work in the Far North | Art. 321 Labor Code of the Russian Federation | 24 |

| Work in areas equated to the regions of the Far North | Art. 321 Labor Code of the Russian Federation | 16 |

| General practitioners who have worked continuously for 3 years | Decree of the Government of the Russian Federation of December 30, 1998 N 1588 | 3 |

| Disabled people | Art. 23 Federal Law of November 24, 1995 N 181-FZ | basic leave up to 30 calendar days |

| Certain categories of employees at the discretion of the employer | Part 2 Art. 116 Labor Code of the Russian Federation, local regulations | by employer's decision |

| Due to occupational illness | pp. 10 paragraph 2 art. 17 Federal Law of July 24, 1998 N 125-FZ | for the entire period of treatment and travel time to the place of treatment and back |

| Junior medical staff caring for HIV-infected people | Decree of the Government of the Russian Federation of December 30, 1998 N 1588 | 14 |

| Air traffic controllers | Resolution of the USSR Ministry of Labor No. 11 of May 29, 1991 | up to 33 working days |

| Donors | Art. 186 Labor Code of the Russian Federation | 1 day for each day of blood donation (if not used immediately) |

| Astronauts | Government Decree No. 455 of May 17, 1993 | annually up to 45, after the flight - additionally - 30 days |

| Persons exposed to radiation | Law 2-FZ dated 10.01.02 | 14 |

| Municipal employees | Law 25-FZ of 03/02/07 | up to 30 everyone |

| Prosecutors, investigators, scientific and teaching staff of the department | Law 2202–1 of January 17, 1992 | 30 |

| Teaching staff at different levels | Decree of the Government of the Russian Federation of May 14, 2015 N 466 | Duration of vacation - 42 or 54 days by groups of employees |

| Health care workers at risk of contracting tuberculosis | Order of the Ministry of Health, Ministry of Defense, Ministry of Internal Affairs, Ministry of Justice, Ministry of Education, Ministry of Agriculture and Federal Border Guard Service of May 30, 2003 No. 225/194/363/126/2330/777/292 | 14 |

| Health care workers involved in mental health care | Resolution of the Ministry of Labor dated 07/08/93 No. 133 | 30 |

| Workers in mining operations for exploration and extraction of uranium, beryllium, thorium ores in nuclear energy | Resolution of the USSR State Committee for Labor of 02/05/91 No. 24 | from 7 to 42 days by employee category |

| Metallurgical and mining workers | Resolution of the USSR State Committee for Labor of 02/05/91 No. 23 | 28 |

| Coal, oil shale and mine construction workers | Resolution of the Council of Ministers of the USSR and the All-Russian Central Council of Trade Unions dated 07/02/90 No. 647, Resolution of the State Labor Committee of the USSR dated 02/05/91 No. 27 | from 7 to 14 |

| FFOMS employees | Order of the Federal Compulsory Medical Insurance Fund dated 01.09.09 No. 196 | from 6 to 21 by personnel category |

| Electric power industry workers with harmful and difficult working conditions | Resolution of the USSR State Labor Committee of 02/05/91 No. 25 | from 7 to 14 by personnel category |

| Workers in construction, reconstruction, technical re-equipment and major repairs of underground structures | Resolution of the USSR State Committee for Labor of 02/05/91 No. 26 | from 7 to 14 by personnel category |

| Workers extracting and transporting salt | Decree of the USSR State Committee for Labor of 03/01/91 No. 56 | from 7 to 14 by personnel category |

| Workers in the extraction and transportation of non-metallic minerals | Resolution of the USSR State Committee for Labor of 02/05/91 No. 28 | from 7 to 28 by personnel category |

| Employees of internal affairs bodies | Decree of the Government of the Russian Federation dated January 23, 2001 No. 48, Order of the Ministry of Internal Affairs dated December 28, 2007 No. 1236 | 15 |

| Customs officers | Law of July 21, 1997 No. 114-FZ, art. 36 | vacation 30 calendar days excluding travel to the place of vacation and back |

| Ministry of Emergency Situations employees | Law of August 22, 1995 No. 151-FZ Art. 28 | from 30 to 40 days depending on experience |

| Athletes and coaches | Article 348.10 of the Labor Code of the Russian Federation | 4 |

| Judges | Law of June 26, 1992 No. 3132–1 Art. 19 | 30 working days and additionally taking into account experience in law: 5–10 years - 5 rubles. d., 10–15 years - 10 rub. d., more than 15 years - 15 rubles. d. |

Leave time

To receive leave for the first time at a new place of work, you must work for at least six months.

The Labor Code provides for categories of employees who can receive leave without working for six months. This:

- workers under 18 years of age;

- women before going on maternity leave or immediately after maternity leave;

- employees who adopted a child (children) under the age of 3 months.

Typically, vacation days are set on a schedule, which allows employees to plan their vacation, and the employer to avoid critical gaps in business when too many employees go on vacation at the same time.

Leave for minors and those working in hazardous conditions must be granted annually. The rest are prohibited from not being released for two years in a row (Article 124 of the Labor Code of the Russian Federation). Cash compensation is allowed to replace only part of the annual leave exceeding 28 days (Article 126 of the Labor Code of the Russian Federation). An employee can use the next vacation all at once or in separate parts (Article 125 of the Labor Code of the Russian Federation). The only condition: one part of the vacation during the year should not be shorter than 14 calendar days.

A non-standard case is when an employee fell ill while on vacation, consulted a doctor and filed for sick leave. Then he can stay on vacation longer by as many days as he was officially ill (Article 124 of the Labor Code of the Russian Federation). In this case, the vacationer can agree with the employer to transfer the vacation days that he was sick to another period.

Formula for calculating the amount of vacation pay

Calculation of amounts to be included in vacation pay must be carried out in accordance with Art. 139 Labor Code of the Russian Federation. We start by determining the average daily earnings. For this:

- the amount of all accruals of payment to the employee for work activities for each of the 12 months preceding the month the vacation begins is taken;

- the resulting amount is divided by 12 months and the average monthly number of calendar days. This number is fixed at 29.3 days;

- if the year is not fully worked, all earnings are summed up and divided by the number of days. It is calculated as follows: the number of full months worked is multiplied by 29.3,

- to this is added the number of days worked in partial months.

Special formulas are used to calculate vacation pay

Average daily earnings are multiplied by the number of vacation days. This will be the amount of vacation pay. Income tax is calculated from it, and what remains after deducting the tax will be payment for the days of the next vacation, which the employee will receive before leaving.

If the calculation is carried out for an employee from a category of personnel for whom, according to the Labor Code of the Russian Federation, the duration of vacation is determined in working days (for example, these are judges), then the amount of accrued pay is divided by the working days of the six-day working week established by the working calendar for the same 12 months.

Please note that from May 1, 2021, the procedure for calculating vacation pay for low-paid employees who received monthly earnings less than the minimum wage has changed. For such workers, vacation pay should be calculated not on the basis of actual earnings, but on the basis of daily earnings calculated from the current minimum wage.

From May 1, the minimum wage became 11,163 rubles. It is important that for all those going on vacation, the average monthly earnings used to calculate vacation pay must, from May 1, be no lower than the newly established minimum wage amount. This is provided for in clause 18 of the Regulations approved by Decree No. 922 of the Government of the Russian Federation dated December 24, 2007. If a vacationer’s monthly earnings were less than the new minimum wage and his vacation began after May 1, 2021, he received vacation pay in April based on the previously valid minimum wage, then he should be given an additional payment to his vacation pay taking into account the new minimum wage.

Video: vacation pay - calculation, accrual, payment

What income is taken into account when calculating vacation pay?

Income included in vacation pay is subject to the rules for calculating average wages. They are defined in the Decree of the Government of the Russian Federation of December 24, 2007 N 922 “On the specifics of the procedure for calculating average wages.”

When calculating vacation pay, all amounts that are included in the wage system are taken into account:

- salary;

- payment for piecework;

- payments of interest from the sale of goods or provision of services, commissions;

- bonuses according to the bonus regulations;

- regular bonuses (regional, for length of service, qualifications, hazardous working conditions, etc.);

- royalties and royalties;

- wages paid in non-monetary form.

Bonuses accrued per month are included in full, and quarterly or annual bonus payments are first divided by the number of days of the bonus period, and then multiplied by the days of the bonus period worked by the employee in the months included in the calculation of vacation pay.

There are amounts that are not included in the calculation of vacation pay:

- social benefits and material assistance (payment for food, recreation, training);

- compensation payments, for example, payment for cellular communications, travel, etc.

Video: calculating vacation pay according to the law

How are vacation pay calculated upon dismissal?

Art. 127 of the Labor Code of the Russian Federation gives each employee the right (except for those whom the employer dismisses for actions reflected in Article 81 of the Labor Code of the Russian Federation, for example, absenteeism or theft) to declare in writing that he intends to resign, having previously taken unused vacation days. Then the day of dismissal is considered the last day of vacation.

An employee may withdraw his resignation letter. But he has the right to do this only before going on vacation and if another person has not already been hired in his place.

If an employee simply resigns for any reason provided for by the Labor Code, the accountant, when making calculations, additionally accrues payment for vacation days that the employee did not use.

Preparation for calculating vacation pay begins with determining the number of vacation days already used by the employee over the last working year. The number of unspent vacation days is calculated by dividing the duration of the vacation by 12 and multiplying the result by the number of months remaining until the end of the employee’s working year. They calculate payment for unused days using the same formulas as if they were simply providing vacation. Vacation pay is paid to the employee simultaneously with full payment upon dismissal.

If a situation arises when an employee, before dismissal, spent more vacation days than corresponds to the part of the working year he worked, then upon dismissal, the amount of vacation pay for the overused days is deducted from the employee’s full pay.