Who is a disabled citizen

- monthly compensation funds for persons living in the Russian Federation who look after residents with group 1 disabilities, disabled children under the age of majority and elderly citizens who require third-party care in accordance with the decision of a medical institution or who have reached the age of 80 years, amount to 500 rubles

- Compensatory payments are assigned to the pension allocated to the disabled population while caring for them in the order established for the payment of appropriate benefits.

- Compensatory funds are assigned to citizens performing care , in the sovereignty of family ties and cohabitation with a disabled person.

- compensatory payments are established and carried out by the department that distributes and pays pensions to disabled persons.

We recommend reading: The spouses of an Italian citizen and a French citizen who are on a business trip in Argentina have a child and receive citizenship

Question regarding a disabled heir

c) a person who received from the deceased for a period of at least a year before his death - regardless of family relations - full maintenance or such systematic assistance that was for him a constant and main source of livelihood, regardless of receiving his own earnings, pensions, scholarships and other payments. When assessing the evidence presented in support of being a dependent, the ratio of the assistance provided by the testator and other income of the disabled person should be assessed.

We recommend reading: Sample complaint to the clinic

Where in the law is the term disabled? I really need it

In current legislation, the concept of dependency is defined in the Law “On Labor Pensions in the Russian Federation”. In accordance with sub. 3 p. 2 art. 9 of the said Law, persons should be recognized as dependents of the testator if they were fully supported by him or received assistance from him, which was for them a constant and main source of livelihood (the definition of dependency in Article 9 is given in relation to the conditions for assigning a labor pension under case of loss of a breadwinner and, it seems, should be used with good reason in determining the right of inheritance of a disabled dependent). In the absence of relevant documents, this fact can be established in court (clause 2 of Article 264 of the Code of Civil Procedure of the Russian Federation) using, in particular, witness testimony. The testator's dependent condition is legally significant if it occurred for at least a year before his death. “Until his death” is to be understood in the sense of “immediately before death,” i.e., the dependent estate must continue uninterrupted for a year until the date of the testator’s death.

The calculation of temporary disability benefits raises numerous questions among accountants. It is not uncommon for employees to claim multiple sick days without a break in illness, and the accountant needs to determine whether the disability is continuous. After all, the correctness of the calculation of benefits depends on this.

The author uses practical examples to examine situations in which disability is considered continuous.

To correctly calculate temporary disability benefits, we will determine continuity.

Disability is considered continuous if:

– the period of release of the employee from work according to certificates of incapacity for work lasts continuously;

– during the specified period, no circumstances occurred that affected the amount of the benefit;

– during the same period, no new case of temporary disability occurred.

These conditions must be met simultaneously, otherwise the disability is considered interrupted.

In case of continuous disability, benefits are assigned in the general manner: in the amount of 80% of the average daily earnings for the first 12 calendar days of incapacity and 100% of the average daily earnings for subsequent calendar days.

When the period of incapacity for work is interrupted, benefits are calculated separately for each certificate of incapacity for work issued.

Let's consider practical situations when disability is considered continuous, and in which cases it is interrupted.

Situation 1. Assignment of benefits for 2 certificates of incapacity for work

An employee of the organization works on a 5-day workweek schedule with days off on Saturday and Sunday.

He submitted 2 certificates of incapacity for work to the accounting department:

– the first sheet is associated with a general disease – for the period from July 25 to July 29 (5 calendar days);

– second (domestic injury) – from August 1 to August 16, 2021 (16 calendar days).

Days off for the employee are July 30 and 31.

Contributions to the Social Security Fund were paid for the employee for more than 6 months.

In this situation, the condition according to which the disability is considered continuous is not met. Work is interrupted on the days of July 30 and 31 (Saturday and Sunday), even if these days are weekends. Therefore, we will assign benefits separately for each certificate of incapacity for work.

We will calculate the amount of benefits for each case of release from work.

1. Calculation of benefits for a certificate of incapacity for work from July 25 to July 29.

Data on the employee’s earnings and calendar days worked are given in table. 1*:

___________________ * Payments in the period accepted for calculating benefits are given in denominated amounts.

Let's calculate the allowance.

Step 1: Determine your billing period.

The amount of average daily earnings for calculating employee benefits is determined for the 6 calendar months preceding the month in which the right to benefits arose (hereinafter referred to as the calculation period) (clause 21 of Regulation No. 569**).

___________________ ** Regulations on the procedure for providing benefits for temporary disability and pregnancy and childbirth, approved by Resolution of the Council of Ministers of the Republic of Belarus dated June 28, 2013 No. 569 (hereinafter referred to as Regulation No. 569).

In this case, the pay period for the employee is from January 1 to June 30, 2021 (6 months preceding the month in which the disability arose).

Step 2. Calculate the number of calendar days taken to calculate average earnings.

The number of calendar days of the billing period into which earnings are divided does not include the following calendar days:

– labor and social leave;

– temporary disability;

– downtime is not the fault of the employee;

– exemption from work in accordance with the law in other cases.

Since there are no days in the calculation period that are excluded from the calculation, we take 182 calendar days (31 days of January + 29 days of February + 31 days of March + 30 days of April + 31 days of May + 30 days of June).

Step 3. Calculate your average daily earnings to calculate benefits.

The amount of average daily earnings is determined by dividing the amount of earnings taken into account for calculating benefits for the billing period by the number of calendar days of this period (clause 22 of Regulation No. 569).

For the purpose of calculating employee benefits, earnings include types of remuneration for which, according to the law, mandatory insurance contributions are charged. The exception is one-time payments.

Bonuses and other payments are included in earnings for the month in which they are paid. The month of their payment is considered to be the month on which they fall according to the personal account, payroll (clause 24 of Regulation No. 569).

Average daily earnings will be: 3,861.00 / 182 days = 21 rubles. 21 kopecks

Step 4. Calculate the amount of temporary disability benefits from July 25 to July 29, 2021.

As a general rule, temporary disability benefits are assigned in the amount of 80% of the average daily earnings for the first 12 calendar days of incapacity and in the amount of 100% of the average daily earnings for subsequent calendar days of continuous temporary disability.

Therefore, we assign benefits for days certified by the first certificate of incapacity for work in the amount of 80%.

The temporary disability benefit will be: 21.21 × 5 days × 80% = 84 rubles. 84 kopecks

2. Calculation of benefits for a certificate of incapacity for work from August 1 to August 16.

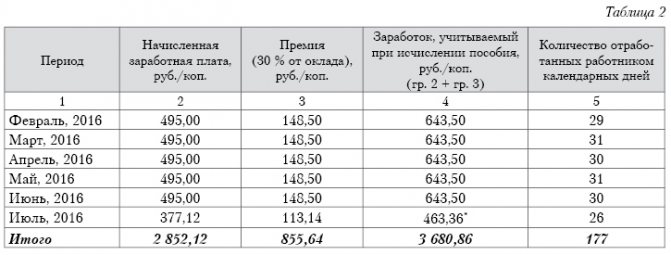

We present data on earnings for the billing period for calculating benefits for the second certificate of incapacity for work (see Table 2):

_____________ * Salaries for July accepted for calculation include:

– wages accrued for 16 working days in July (from July 25 to 29 the employee had temporary disability on the first certificate of incapacity for work) – 377 rubles. 12 kopecks (495.00 / 21 working days × 16 days worked);

– bonus in the amount of 86 rubles. 24 kopecks (113.14 / 21 × 16).

For reference: the bonus, like wages, is calculated in proportion to the time worked. When calculating benefits, we again take into account the accrued bonus in proportion to the days actually worked.

We will calculate benefits for the second certificate of incapacity for work.

Step 1. Determine the billing period for the second certificate of incapacity for work.

The employee's pay period is from February 1 to July 31, 2021 (6 months preceding August).

Step 2. Calculate the number of calendar days taken to calculate average earnings.

From the number of calendar days worked by the employee in the billing period, we exclude 5 calendar days of temporary disability under the first certificate of incapacity for work. Thus, 177 calendar days are taken into account.

Step 3. Calculate your average daily earnings to calculate benefits.

Average daily earnings will be: 3,680.86 / 177 = 20 rubles. 80 kop.

Step 4. Calculate the amount of temporary disability benefits from August 1 to August 16, 2021.

The temporary disability benefit will be:

(20.80 × 12 days × 80%) + (20.80 × 4 days) = 199.68 + 83.20 = 282 rubles. 88 kop.

For reference: the decision to award benefits in connection with an injury is made by the benefits assignment commission created in the organization and is documented in a protocol (Appendix 2 to Regulation No. 569).

Situation 2. Assignment of maternity benefits based on a certificate of incapacity for work issued the day after the end of incapacity for work due to a general illness

An employee of the organization presented 2 certificates of incapacity for work. The first was issued in connection with a general illness from July 28 to August 3, 2016 (7 calendar days). On August 4, the next certificate of incapacity for work begins in connection with pregnancy and childbirth, lasting 126 calendar days.

Disability is considered interrupted, since temporary disability benefits and maternity benefits are independent types of state social insurance benefits.

Temporary disability benefits for the first certificate of incapacity for work are calculated from wages for the period from January 1 to June 30, 2021. The benefit is assigned for 7 calendar days of incapacity for work in the amount of 80% of average daily earnings.

The maternity benefit is determined from the average daily earnings calculated for the period from February 1 to July 31, 2021. The maternity benefit is assigned in the amount of 100% of the average daily earnings for calendar days certified by a certificate of incapacity for work (clause 16 of Regulation No. 569).

Situation 3. Assignment of benefits for continuous disability

The employee submitted 2 certificates of incapacity for work to the accounting department at his place of work:

– first (domestic injury) – for the period from August 9 to August 16;

– second (general disease) – for the period from August 17 to August 23.

The employee’s disability is considered continuous, since all conditions are met simultaneously (the disability was not interrupted, circumstances affecting the amount of benefits did not occur during the specified period, as well as a new case of temporary disability).

The benefit is assigned for 15 calendar days (from August 9 to August 23) from the average daily earnings calculated for the period from February 1 to July 31. The benefit amount will be 80% of average daily earnings for the first 12 calendar days, and 100% for the remaining 3 calendar days.

Situation 4. Assignment of benefits upon the occurrence of a new case of temporary disability

An employee of the organization was issued a certificate of incapacity for work due to a general illness from July 27 to August 2. From August 3 to August 8, he cared for a sick child (8 years old), which is confirmed by the corresponding certificate of incapacity for work.

The incapacity for work is considered interrupted because a new case of incapacity for work has occurred.

For the purpose of benefits in connection with a general illness, the calculation period is from January to June 2021, and the amount of the benefit is 80% of the average daily earnings for each calendar day of incapacity.

Child care benefits are assigned for 6 calendar days in the amount of 100% of average daily earnings calculated from February to July 2021.

The concept of disability in the legislation of the Russian Federation

Thus, in relation to inheritance legal relations, persons recognized as disabled should be classified as disabled if there is a limitation of the ability to work of the III, II or I degree, and if the disability was established in accordance with the procedure in force before the publication of the resolution of the Ministry of Labor and Social Development of the Russian Federation dated 30 March 2004 N 41 “On approval of forms of certificate confirming the fact of disability, extracts from the certificate of examination of a citizen recognized as disabled, issued by institutions of the State Service for Medical and Social Expertise, and recommendations for filling them out” * (141) - persons recognized disabled people of groups I, II or III.

Definition of disability by law

disabled citizens - disabled people, including people with disabilities since childhood, disabled children, children under the age of 18, as well as over this age, studying full-time in basic educational programs in organizations engaged in educational activities, including in foreign organizations located outside the territory of the Russian Federation, if the referral for training was made in accordance with international treaties of the Russian Federation, before they complete such training, but no longer than before they reach the age of 23 years, who have lost one or both parents, and children of a deceased single mother, citizens from among the small peoples of the North who have reached the age of 55 and 50 years (men and women, respectively), citizens who have reached the age of 65 and 60 years (men and women, respectively), who are not entitled to a pension provided for by the Federal Law “On Labor Pensions in the Russian Federation” Federation";