Regulatory framework for primary documents

To reflect any business transaction in accounting, it is necessary to have a correctly executed primary document, as stated in paragraph 1 of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Next we read in paragraph 4 of Art. 9 of this law, that the forms of primary documents must be developed and approved by the organization. Thus, the use of unified forms of primary documents is optional, with the exception of certain cases. The only obligatory condition is the presence of certain details in the document. On the other hand, there is no ban on the use of unified forms of documents, so the head of the organization must independently determine which forms of primary documents should be used:

- unified forms;

- independently developed forms with mandatory details;

- a combination of the first two options.

The decision made must be fixed in the accounting policy and the forms of primary documents used by the organization must be attached to it.

Rules for drawing up primary documents

Let us next consider the primary documents on wages that must be used when accounting for settlements with employees. The article will provide unified forms. They can be processed in accordance with the needs of the enterprise’s accounting department, leaving in any case the mandatory details listed in clause 2 of Art. 9 of Law 402-FZ:

- Title of the document;

- date of document preparation;

- name of the economic entity that compiled the document;

- content of the fact of economic activity;

- the value of the natural or monetary measurement of the fact of economic activity, indicating the units of measurement;

- the name of the position of the person who performed the transaction and is responsible for its execution.

Primary documents on wages can be drawn up both on paper and in electronic form. In the second case, they must be signed with an electronic digital signature.

Time sheet and calculation of wages

The employee is paid based on the amount of time he works.

To record it, use form No. T-12 “Working time sheet and calculation of wages” or form No. T-13 “Working time sheet”. The T-12 form contains data on actually worked and unworked time based on sick leave, certificates, applications, orders.

The title page indicates the name of the organization, the date of preparation and document number, the reporting period and codes for indicating worked and unworked time in the accounting table.

Section 1 “Working Time Accounting” consists of 17 columns and is intended to reflect information about attendance and absence from work for one calendar month. Filled in for each employee: his/her full name, personnel number, then on the dates of the month in columns 4 and 6 in the top line a code indicating attendance at work or the reason for absence is indicated, in the bottom line - the number of hours worked that day, overtime hours are marked with a fraction. Columns 5 and 7 are intended to reflect the sum of days of visits and hours actually worked for each half-month. In the columns of the missing numbers of the month, put the sign “X”.

According to the rules, you can fill in the cells for all days of the month, and only for days other than a regular working day (vacation, sick leave), leaving the cells of a regular working day empty.

Section 2 “Payment payments to personnel” consists of two pages. The third page of the timesheet is intended to reflect each type of payment for the month for each employee.

The fourth page of the report card summarizes information about attendance at work for the organization as a whole for each day of the month. Download an example of filling out the T-12 form.

Form T-13 represents only the title page and section 1 for recording working hours of Form T-12. Then it is assumed that the accountant keeps records of salaries in other registers.

Payroll

The following block of primary documents for payroll accounting:

- payroll statement (form T-49);

- pay slip (form T-51);

- payroll (form T-53).

IMPORTANT! It is necessary to reflect the amounts of accrued wages only in unified forms.

As the names indicate, form T-49 is a combination of forms T-51 and T-53, so the accountant draws up either one payroll sheet, or a payroll sheet and a payroll sheet.

The payroll sheet is used to calculate and pay wages in cash from the company's cash desk. It contains the number and date of compilation, signatures of the manager and chief accountant, the total amount of payment to all employees, as well as the start and end dates for the payment of wages from the cash register - this period is equal to five working days.

The statement contains information about the personnel number, position, tariff rate and hours worked for each employee. The accountant enters into it all accrued amounts for all types of payments, as well as all deductions for the period for which funds are paid to the employee. This can be either an advance, or wages, or vacation pay, and so on.

At the end of the statement, information about the amount paid and deposited (if any), the signature of the responsible person and the number of the cash receipt order for which the payment was made are entered.

The far right column is filled in by employees of the organization, where they sign to confirm receipt of funds from the cash register. Amounts not received within five days are deposited.

Sample payslip.

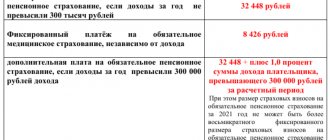

Deadlines for paying taxes on payroll

In 2021, a single date for transferring personal income tax from wages was introduced. Now it needs to be transferred to the budget no later than the day after the employee’s salary is paid. It doesn’t matter exactly how it was made - on a card, from a cash register or any other. However, this rule does not apply to sick leave and vacation pay.

For these two types of payments, income must now be transferred no later than the last day of the month in which they were made. This makes it possible not to pay taxes to the budget for each employee, but with one payment for everyone at once.

Failure to pay taxes on time may result in penalties. They are calculated taking into account 1/300 of the refinancing rate for each overdue day.

Important! Salary contributions in 2021, which include pension, medical, social insurance and injuries, must be paid no later than the 15th day of the month following the reporting month. If this time falls on a weekend or holiday, the deadline is transferred to the first working day after the rest.

Payroll and payslip

If employees receive wages on bank cards, then only a payslip is drawn up in form T-51.

What other documents are needed in this case, we will consider below. If an accountant calculates wages in a different register, you can only prepare a payroll.

The pay slip in Form T-51 reflects only calculations for each employee. Here you will find an example of filling.

At the beginning of the payroll, you must indicate the date of receipt of funds at the cash desk for issuance to employees and the end date of issuance.

The payroll in form T-53 reflects the amount of payments to each employee, their receipt of receipt of the specified amount, and also at the end of the statement - the total paid and deposited amount, as well as the number of the cash order for payment of wages, sample at the link.

If an accountant uses a statement in the T-53 form in his work, he needs to draw up a register of issued statements in the T-53a form, where the serial number of the payroll and the amount paid on it are entered. The register is compiled for one calendar year. Here is an example of filling out the form.

Description of the formula, example

Payroll formula

Piecework wages and salaries require the use of different formulas.

Based on salary, the formula will look like this:

ZPO = part of the salary / number of working days for the period * number of days worked + bonus – personal income tax – withheld funds

The piecework system has the following formula:

Salary = piece rates * quantity of products produced + bonuses + additional payments – personal income tax – other deductions

As an example, here are the following conditions:

- The employee has a salary of 20 thousand.

- Advance payment is made on the 11th of each month.

- The basic salary is paid on the 3rd.

- It is necessary to determine the remuneration based on the results of July.

- One month consists of 10 days off, as well as 21 working days.

There are 7 working days left before the advance payment.

20,000/ 21 * 7 = 6667. We should receive this amount on the first of the month.

Basic salary: 20,000/21*(21-7) = 13,333.

Personal accounts of employees

For each employee of the organization, the accountant must maintain a personal account in form T-54, which reflects the employee’s personal data: full name, tax identification number, SNILS, marital status.

It also contains data about work at a given enterprise: date of entry, transfers, dismissals, changes in wages, vacations, and so on. Every month, the accountant enters into the personal account data on the amount of time worked by the employee, the amounts accrued to him for all types of payments, all deductions from wages, and data on sick leave.

The last columns contain information about the final amount to be paid for each month, as well as about the debt to the employer or, conversely, to the employee.

Sample employee account.

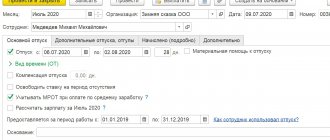

How to calculate sick leave benefits

Here you also need to calculate the average daily earnings, but the algorithm for calculating it will be different than in the case of vacation pay.

First you should calculate the so-called average earnings. In general, it is determined for two calendar years preceding the year of onset of the disease. So, if sick leave is issued in 2021, then we calculate the average earnings for 2021 and 2021. Average earnings include all payments to the employee for which insurance premiums were calculated. In particular, vacation pay and quarterly bonuses are included in the average earnings, but sick leave and maternity leave are not included.

Then you need to calculate your average daily earnings. To do this, take the average earnings and divide by 730. Multiply the resulting amount by the percentage corresponding to the insurance period. If the experience is 8 or more years - 100%. If the experience is from 5 to 8 years - by 80%. If the experience is less than 5 years - by 60%. As a result, we will receive the amount of daily temporary disability benefits. It should be multiplied by the number of calendar days of illness. The result of this multiplication will be the final benefit amount.

IMPORTANT

The rule applies from April 2021. If the temporary disability benefit calculated for a full calendar month is less than the minimum wage (RUB 12,130), then sick leave is paid in the amount of the minimum wage for a full calendar month. Then the amount of the daily benefit is the minimum wage divided by the number of calendar days of the month in which the illness occurs. The total benefit is the daily benefit multiplied by the number of calendar days of sickness in each calendar month. If a regional coefficient is introduced, then the minimum wage is determined taking into account this coefficient (for more details, see: “Sick leave in 2021: the temporary procedure for calculating benefits was made permanent”).

Maternity benefits have their own specifics. We calculate average earnings as described above, but average daily earnings differently. The difference is that we divide the average earnings not by 730 days, but by the number of calendar days in the two previous years minus the days when the woman was on sick leave, maternity leave, or child care leave; as well as additional paid days off to care for disabled children and days when a woman was released from work according to the laws of the Russian Federation with full or partial retention of her salary. We always multiply the resulting amount by 100%, regardless of the insurance period.

Calculate your salary and benefits according to current rules Calculate for free

Starting in 2021, the following system will be introduced in all regions. The employee receives temporary disability benefits for the first 3 days from the employer, for all other days - directly from the Social Insurance Fund. The BIR benefit in full is directly from the FSS (see “Starting from 2021, in all regions of Russia, benefits will be paid directly from the FSS”).

You can read more about the accrual of sick leave in the article “Payment of sick leave in 2021.”

Payslips

The law obliges the employer to issue pay slips to employees along with their wages, which clearly indicate what the amount received by the employee consists of.

Salaries are received at least twice a month, however, it is more reasonable to issue a pay slip once, when paying wages for the month, and not when paying wages for the first half of the current month, since in the second case the calculation indicated in the slip may be incomplete and does not reliably reflect the origin of the amount paid. The payslip does not have a regulated form, so the organization must independently develop it, based, for example, on forms T-12 or T-51. Or create your own form entirely, which should be fixed in the accounting policy. The payslip must indicate all parts of the salary: salary, bonus, allowances, bonuses, sick leave payments, and so on. It is necessary to indicate all deductions: personal income tax, alimony, fines, etc. As a result, the amount to be paid should be obtained, which the employee receives in his hands along with the pay slip.

The payslip, upon agreement with the employee, can be issued both in paper form and electronically, by sending it to the employee’s email.

Salary taxes paid by the employee

Personal income tax

According to the Tax Code of the Russian Federation, an employee’s income, which includes almost all payments provided for in a concluded employment contract, must be subject to personal income tax. The responsibility for calculation and payment rests with the employer, who acts as a tax agent. That is, he deducts taxes from wages before paying them.

There are two rates that are used to determine the salary tax for a resident - 13% and 35%. The first is mainly used to calculate income tax on wages received by an employee; it also calculates tax on income received from dividends (until December 1, 2015, income from dividends was calculated at a rate of 9%). The second applies if an employee receives gifts or winnings in an amount exceeding 4,000 rubles.

For non-residents, that is, persons arriving in the Russian Federation for less than 180 days, a tax rate of 30% should be used.

Attention! An organization or individual entrepreneur, as a tax agent, must calculate and pay personal income tax on the income received by citizens, after which reporting is provided - once a year 2-NDFL and quarterly 6-NDFL.

There are currently no other payroll taxes.

Tax deductions

The Tax Code of the Russian Federation allows an employee to take advantage, if available, of the following deductions when calculating tax:

- Standard - provided for children, as well as in certain cases for the employee himself;

- Social - this deduction represents a reduction in the tax base by the amount of expenses for education, treatment, etc.;

- Property - a person can use it when buying or selling property (car, house, apartment, etc.);

- Investment – it can be used when performing transactions with securities.

These standard tax deductions are applied after the company has paid personal income tax to the budget and do not affect the tax base when calculating taxes on an employee’s salary.

Standard deduction for children in 2021

The main benefit when calculating personal income tax is the standard deduction for children. Its size depends on their number, as well as the child’s health condition:

- 1400 rubles for the first;

- 1400 rubles for the second;

- 3000 rubles for the third and subsequent children;

- 12,000 rubles (trustees 6,000 rubles) for each disabled child under 18 years old or up to 24 years old when receiving full-time education.

For example. The employee has two children in the family, whose age does not exceed 10 years. The monthly income is 20 thousand rubles. If you do not apply the deduction, then the personal income tax will be 20 thousand rubles. * 13% = 2600, respectively, he will receive 17,400 rubles in his hands. However, by writing an application for the use of deductions, he has the right to reduce the tax base on his salary by 2,800 rubles for two children.

Applying deductions we get the following:

The base for calculating income tax will be 20,000 – 2800 = 17,200, so the personal income tax in this case will be 17,200 * 13% = 2,236 rubles. The employee's savings will be 364 rubles. In some cases, the employer pays the income tax itself without collecting these amounts from the employee, so it is always worth using this benefit.

If the employee is a single parent, then the amount of this deduction is doubled.

Important! These benefits can be used as long as the employee’s cumulative earnings from the beginning of the year do not exceed 350,000 rubles. In a month where this amount exceeded the permissible threshold, the deduction is not applied. From the beginning of next year, the base for deductions is calculated from scratch. To receive it, the employee must write to the employer an application for a tax deduction for children.

Income tax benefits for the employee himself:

- 500 rubles per month are provided to Heroes of the USSR and Russia, participants in combat operations, war veterans, Leningrad siege survivors, prisoners, disabled workers of groups 1 and 2; as well as persons who took part, were evacuated during the Chernobyl accident, etc.

- 3000 rubles - to victims of radiation exposure, disabled people of the Second World War and other military operations.

Attention! Read more about child tax credits and how to get them here.

Salary project

At the moment, the most common way to receive wages is to transfer it to the employee’s bank card.

This can happen either individually or on an ongoing basis and for all employees at the same time. There are two options for receiving money on a card: transferring it to each employee separately or registering a salary project with a credit institution. To receive wages on a bank card, the employee must write a statement about this and attach to it the card details for transferring funds.

If the organization has entered into an agreement with a credit institution on a salary project, then the employee signs an application for the issuance of a card within the framework of this project or writes an application attaching the details of the card he already has.

If the employee does not want to receive wages on the card, he does not sign any statements and continues to receive money at the organization’s cash desk.

The method for employees to receive wages on a bank card or at the organization’s cash desk must be specified in the collective, labor agreement or in an additional agreement to it.

Other primary documents

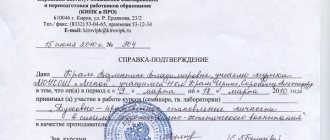

In addition to the listed main primary documents, these include the following documents, which are compiled to reflect the facts of economic activity that are directly related to payroll calculation:

- an employment contract with an employee, where the system and amount of remuneration must be specified;

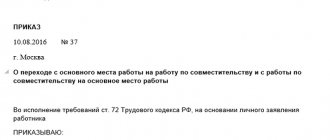

- orders for transfer to another position or salary changes;

- applications and orders for all types of vacations, since the time spent on vacation affects the calculation of wages;

- orders for payment of bonuses and bonuses;

- certificates of incapacity for work;

- applications and orders for business trips;

- applications and orders for hiring and dismissal, as well as for payment of various types of compensation upon dismissal;

- other documents directly related to the calculation or affecting the amount of wages of each employee of the organization.

***

An organization has the right to develop primary documents for payroll accounting independently or use standardized forms. They can be issued either in paper or electronic form, signed with an electronic signature. It is important to make payroll calculations accurate and as transparent as possible for the employee. For this purpose, detailed calculation forms are used, taking into account all the features of working conditions and pay slips issued to employees, which reflect all the steps of the calculation.

Source: legal and tax portal People's Adviser

Salary: calculation rules

The organization separately establishes the procedure by which remuneration for labor activity is calculated. The main thing is that the employee himself studies the relevant rules in advance.

Worth considering:

- Tax transfers.

- Social and other types of similar payments.

- Rewards and penalties.

- Payment system.

The employer must independently transfer insurance and pension fees.

There are the following factors that determine the correctness of the calculations:

- total amount of earnings;

- due to study leaves;

- due to plant downtime;

- due to forced absences;

- due to undergoing advanced training courses.

Each employee has the right to at least a minimum remuneration if he is officially employed and has a full time limit. This minimum is called the minimum wage. It depends on what the current minimum living wage is.