Calculating income tax in 1C Accounting 3.0 is not difficult if you know what settings need to be set in the program according to your accounting policy. Let's look at the nuances of calculating income tax in 1C 8.3 Accounting 3.0 step by step.

After reading the article you will learn:

- where to set up tax accounting in the program;

- how it is organized in 1C;

- How is income tax calculated?

- what records are generated in the program, if income tax is charged - postings in 1C 8.3.

Which accounting accounts are involved in the postings?

All operations for calculating taxes are displayed on the credit of account 68. To display the accrual of income tax, a special sub-account is opened for it.

When calculating profit taking into account the norms of PBU 18/02 (approved by order of the Ministry of Finance dated November 19, 2002 No. 114n), reduction to the general value of the desired value calculated in tax and accounting is observed. In order to link the differences that arise (temporary and permanent) when calculating income tax, various accounting entries are used. The appearance of these differences is due to the fact that not all expenses in tax accounting reduce taxable profit, but at the same time they are taken into account in accounting. It is for the purpose of subsequent correction of the profit calculated in accounting that it is necessary to take into account all the differences that arise.

Read more about the differences between accounting and tax accounting here.

Depending on what difference the taxpayer received during the reporting period (deductible or taxable), different entries are applied.

Reflection of income tax calculations in accounting

Until last year, all enterprises reflected income tax, which was calculated according to the rules established by the Tax Code of the Russian Federation. This tax was calculated using the following entry:

Debit 99

Credit 68 subaccount “Calculations for income tax”

income tax payable to the budget has been assessed.

However, PBU 18/02 fundamentally changed this order. Now, before you reflect the amount of “real” tax on account 68 “Calculations for taxes and fees,” you have to calculate the tax on accounting profits. To do this, the tax rate is multiplied by the amount indicated on line 140 of the Profit and Loss Statement (Form No. 2). PBU calls this tax a conditional expense. The conditional expense is reflected in the accounting records as follows:

Debit 99 subaccount “Conditional income tax expense”

Credit 68 subaccount “Calculations for income tax”

a conditional income tax expense is reflected.

PBU 18/02 also introduced such a concept as conditional income. It is formed when a loss is made in accounting. Essentially, it is a “tax” on the loss. True, as the Russian Ministry of Finance explains, conditional income is shown in accounting only if, according to tax accounting data, you have made a profit. In this case, you need to make the following entry:

Debit 68 subaccount “Calculations for income tax”

Credit 99 subaccount “Conditional income tax expense”

conditional income tax income is reflected.

But the financial statements must also show the amount of tax that our company actually owes to the budget. In PBU 18/02 this tax is called the current income tax.

In accounting and for tax purposes, income and expenses are defined differently. Consequently, the income tax calculated according to accounting data and according to the rules of the Tax Code of the Russian Federation will be different. Therefore, the amount of conditional (that is, “accounting”) tax, which was reflected in the credit of account 68 “Calculations for taxes and fees,” is adjusted to the amount of the current tax. To do this, several calculations are made to calculate the amount of income tax that the organization actually pays. However, first you have to calculate the amounts:

permanent tax liability;

deferred tax asset;

deferred tax liability.

Calculation of permanent tax liability. To do this, you need to multiply the amount of permanent differences by the income tax rate. What are permanent differences? These are expenses that are taken into account for accounting purposes, but are not included in expenses when calculating income tax. These include:

amounts that the organization spent in excess of the norms established in the Tax Code of the Russian Federation (this applies to daily allowances, compensation for the use of personal transport, entertainment expenses, insurance costs);

the cost of the property transferred free of charge and the costs associated with such transfer;

a loss carried forward if the period during which it can reduce taxable profit has expired, etc.

PBU 18/02 states that permanent differences should be reflected in analytical accounting. How to organize it? PBU 18/02 says nothing about this. I found the answer to this question in the magazine “Glavbukh”. The following options are offered:

You can open special sub-accounts for those asset and liability accounts in which permanent differences are formed.

You can keep analytical records in separate registers (for example, in spreadsheets). And finally, an organization that maintains separate tax accounting has the right to calculate permanent differences in accounting statements.

A permanent tax liability increases the contingent income tax of the reporting period. In accounting it is reflected by the following entry:

Debit 99 subaccount “Income Tax”

Credit 68 subaccount “Calculations for income tax”

a permanent tax liability is reflected.

Calculation of deferred tax asset. You need to multiply the amount of deductible temporary differences by the income tax rate. Deductible temporary differences arise when:

the amount of depreciation accrued in accounting exceeds that calculated according to tax accounting rules;

commercial and administrative expenses are written off differently in accounting and for tax purposes;

a loss is carried forward, which reduces taxable income in subsequent reporting periods;

overpayment of income tax is not returned to the organization, but is counted against future payments;

an enterprise using the cash method in accounting includes the cost of materials in costs that have not yet been paid, etc.

In general, due to deductible temporary differences in the reporting period, the “accounting” income tax will be less than the “tax” tax.

Deductible temporary differences also need to be reflected separately, in analytical accounting.

Calculation of deferred tax liability. We multiply the amount of taxable temporary differences by the income tax rate. In particular, you experience taxable temporary differences if:

the amount of depreciation accrued in tax accounting is greater than that calculated according to accounting rules;

We accrued interest on the loans issued monthly, and the debtor repaid them in a lump sum. In this case, the difference arises if we applied the cash method;

interest on loans and amount differences in tax accounting are included in non-operating expenses, and in accounting in the cost of fixed assets or materials (if a loan was taken to purchase this property);

In accounting, costs are reflected as deferred expenses, but in tax accounting they are written off immediately.

Separate analytical accounting of taxable temporary differences is also organized.

Reflection of tax assets and tax liabilities.

The deferred tax asset is reflected in the accounting records in the reporting period when the deductible temporary difference arose. In this case, you should use synthetic account 09 “Deferred assets”. The following wiring is done:

Debit 09

Credit 68 subaccount “Calculations for income tax”

deferred tax asset is reflected.

As deductible temporary differences decrease, deferred tax assets also decrease. This is reflected like this:

Debit 68 subaccount “Calculations for income tax”

Credit 09

deferred tax asset is repaid.

However, such an entry can be made only if the organization received taxable profit in the reporting period.

What if the organization sold or transferred for free use the fixed asset with which the deferred tax asset is associated? In this case, the remaining amount of the asset is written off as follows:

Debit 99

Credit 09

the amount of the deferred tax asset was written off in connection with the disposal of the asset.

Deferred tax liabilities are also reflected in accounting in a separate synthetic account. This is account 77 “Calculations for deferred tax liabilities.” You need to record in your accounting:

Debit 68 subaccount “Calculations for income tax”

Credit 77

deferred tax liability is taken into account.

As with deferred tax assets, deferred tax liabilities are reduced as taxable temporary differences are settled. In accounting, this operation is reflected by the following entry:

Debit 77

Credit 68 subaccount “Calculations for income tax”

deferred tax liability has been settled.

If the item to which the taxable temporary difference relates is disposed of. Then the deferred tax liability is written off as follows:

Debit 77

Credit 99

the amount of deferred tax liability is written off.

Having calculated these amounts and reflected them in accounting, we adjust the conditional expense (income tax income as follows:

| + conditional expense (-conditional income) for income tax | + permanent tax liability | + deferred tax asset | — deferred tax liability | = current income tax |

Now all organizations are required to compare income and expenses reflected in accounting and tax accounting in order to identify the differences between them. And so on for each operation.

So, at the end of the reporting period, account 68 “Calculations for taxes and fees” reflects the amount of conditional income tax expense. We also included the amounts of tax assets and liabilities there.

Thus, the current income tax is indicated on the credit of account 68.

Synthetic accounting of settlements with the budget is kept in journal order No. 8. (Appendix 1). In which, in addition to account 68, the following accounts are kept: 19 “Value added tax on acquired assets”, 69 “Calculations for social insurance and security”, 73 “Settlements with personnel for other operations”, 75 “Settlements with founders”, 76 “Settlements with various debtors and creditors”. In the journal order No. 8, the turnover on the credit of these accounts is given according to the data of the corresponding primary accounting documents, statement No. 8 and transcript sheets.

Analytical data on this account are provided in transcript sheets (Appendices 2, 2a, 2b).

We reflect SHE

If, when calculated in tax accounting, the profit value is higher than the same indicator in accounting, then a deductible difference arises, which means there is a deferred tax asset.

SHE = Svr * NS, where:

OTA - deferred tax asset;

Свр — amount of temporary difference;

NS is a tax rate that is equal to 20% (17% is paid to the regional budget, and 3% to the federal budget).

To be reflected in accounting, the following correspondence is made:

Dt 09 - Kt 68 - accrual of ONA.

Examples of when SHE and IT arise can be found in the Typical Situation from ConsultantPlus. Learn the material by getting trial access to the system for free.

Reflecting IT

If the accounting profit is greater than the tax profit, then a deferred tax liability arises.

This can be reflected in accounting using the following correspondence:

Dt 68 - Kt 77 - accrual of IT.

If a situation arises when temporary differences remain outstanding for some reason, the following entries are made to write them off:

To write off a deferred tax asset by posting income tax - Dt 91 - Kt 09

To write off deferred tax liability - Dt 77 - Kt 91.

Accounting for PNR and PND

Fixed tax expenses arise if, based on the results for the reporting period, the value of profit in tax accounting is greater than in accounting.

PNR = Prp * NS, where

PNR - permanent tax expense;

Note! PNR and PND were previously called PNO (permanent tax liability) and PNA (permanent tax asset). In connection with amendments to PBU 18/02, their names were changed.

Prp - constant difference (positive);

NS is the tax rate, which is equal to 20%.

The accounting entries for income tax in this case will be as follows:

Dt 99 - Kt 68 - accrual of constant tax expense.

In a situation where profit is less in tax and not in accounting, accordingly, the constant difference turns out to be negative. A permanent tax income arises.

Income tax is reflected in accounting entries as follows:

Dt 99 – Kt 68 - accrual of conditional tax expense.

The value is equal to the profit in accounting multiplied by the tax rate.

The loss resulting from the operation, which is also multiplied by the tax rate, constitutes conditional income, and is displayed as follows:

Dt 68 – Kt 99.

The calculated profit in tax accounting, multiplied by the tax rate, is the current income tax. There is no need to create correspondence to display it.

As a result of the operations performed, the financial result for income tax becomes equal to the current tax value.

For small businesses, income tax entries look like this: Dt 99 – Kt 68.

Check whether you are taking into account fixed tax expenses/income correctly using tips from ConsultantPlus. If you don't have access to the system, get a free trial online.

You can learn more about tax incentives for income tax in our article “What incentives for corporate income tax are established for 2021 - 2021?”

General procedure for calculating (accruing) income tax and advance payments

In general, income tax is calculated as follows.

For transactions taxed at the basic rate of 20%, income tax payable at the end of the year is calculated as the product of the tax base and the tax rate minus advance payments (clause 1 of Article 286, clause 1 of Article 287 of the Tax Code of the Russian Federation):

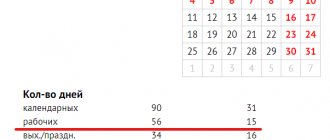

If an organization pays quarterly payments and does not pay monthly payments, it deducts only the amount of the 9-month advance payment.

If an organization pays monthly advance payments based on actual profits, it deducts the advance payment for 11 months (clause 1 of Article 287 of the Tax Code of the Russian Federation).

What advance payments of income tax are paid?

During the year, advance payments for income tax are paid (clause 2 of Article 286, clause 1 of Article 287 of the Tax Code of the Russian Federation).

Advance payments are paid in one of three ways (clauses 2, 3 of Article 286 of the Tax Code of the Russian Federation):

quarterly;

monthly for the profit of the previous quarter and quarterly;

monthly based on the actual profit received.

The calculation of advance payments for income tax is similar to the determination of income tax at the end of the year. It is calculated as the product of the tax base and the tax rate minus previous advance payments for this year (clause 1 of Article 286, clause 1 of Article 287 of the Tax Code of the Russian Federation).

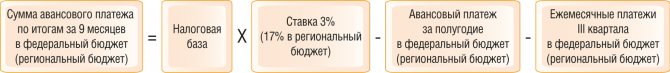

Let us explain this by calculating the advance payment based on the results of 9 months. The organization pays monthly advance payments during the reporting period at a basic rate of 20%:

Tax (advance payments) at the basic rate of 20% is calculated in separate amounts for the federal and regional budgets (clause 1 of article 284, clause 1 of article 286 of the Tax Code of the Russian Federation).

See also:

How to calculate quarterly advance payments for income taxes

How to calculate monthly advance payments for income tax based on actual profits

Monthly and quarterly advance payments of income tax paid during the quarter

An example of calculating income tax at the end of the year

The taxable profit of the Alpha organization at the end of the year amounted to 1,500,000 rubles.

The amount of the advance payment calculated based on the results of 9 months amounted to 120,000 rubles:

to the federal budget - 18,000 rubles;

to the regional budget - 102,000 rubles.

Monthly advance payments for the fourth quarter were accrued in the total amount of 60,000 rubles:

to the federal budget - 9,000 rubles;

to the regional budget - 51,000 rubles.

1. The amount of tax calculated at the end of the year for the Alpha organization will be 300,000 rubles. (RUB 1,500,000 x 20%), including:

to the federal budget - 45,000 rubles. (RUB 1,500,000 x 3%);

to the budget of a constituent entity of the Russian Federation - 255,000 rubles. (RUB 1,500,000 x 17%).

2. The total amount of the advance payment for 9 months and monthly payments in the fourth quarter amounted to 180,000 rubles. (RUB 120,000 + RUB 60,000), including:

to the federal budget - 27,000 rubles. (RUB 18,000 + RUB 9,000);

to the budget of a constituent entity of the Russian Federation - 153,000 rubles. (RUB 102,000 + RUB 51,000).

3. The amount of tax that must be transferred to the budget at the end of the year by the Alpha organization will be 120,000 rubles. (RUB 300,000 - RUB 180,000), including:

to the federal budget - 18,000 rubles. (45,000 rubles - 27,000 rubles);

to the budget of a constituent entity of the Russian Federation - 102,000 rubles. (RUB 255,000 - RUB 153,000).

If you pay a trading tax, you can reduce the amount of calculated income tax by the amount of the trading tax paid since the beginning of the year. The tax is reduced in the part that is credited to the budget of the constituent entity of the Russian Federation (clause 10 of Article 286 of the Tax Code of the Russian Federation).

In addition, the amount of calculated income tax, which is subject to credit to the budget of a constituent entity of the Russian Federation, can be reduced by an investment tax deduction, as well as by tax amounts paid outside the Russian Federation (clause 1 of Article 286.1, clause 3 of Article 311 of the Tax Code of the Russian Federation ).

See also: How to reduce income tax on trading fees

If the amount of tax calculated at the end of the tax period is less than the amount of advance payments calculated during the tax period, then you do not pay tax at the end of the tax period (clause 1 of Article 287 of the Tax Code of the Russian Federation).

Results

The application of PBU 18/02 often raises questions. But once you clearly understand the concepts of ONO, ONA, PNR and PND discussed above, you can easily cope with bringing the balance in account 68 to the amount of income tax shown in the declaration.

See also: “What is the procedure and deadlines for paying income tax (postings)?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Account 68 “Calculations for taxes and fees” - subaccounts, postings

Accounting for calculations of taxes and fees is carried out on account 68, which reflects the accrual of taxes and their payment to the budget. In accordance with the applicable tax regime, an organization can open the necessary sub-accounts on account 68 according to the types of taxes paid.

Subaccounts of account 68 “Calculations for taxes and fees”

In particular, for the calculation and payment of personal income tax (abbreviated as personal income tax or income tax, as people like to call it), a subaccount 68.1 is opened.

Accrual, payment, deductions, restoration and other transactions with value added tax (VAT) are reflected in subaccount 68.2.

If an organization pays excise taxes, then a subaccount 68.3 is opened to account for them.

Organizations on the general taxation system that pay income tax open a subaccount 68.4 to record it.

If an organization owns vehicles on which transport tax is paid, then subaccount 68.7 is used.

To account for tax paid on the property of organizations, subaccount 68.8 is used.

If an organization is a payer of the single tax on imputed income (UTI) for certain types of activities, then a subaccount 68.11 is opened to reflect calculations for UTII.

And single tax payers under the simplified taxation system open a subaccount 68.12.

If an organization pays any other types of taxes: water, mineral extraction, etc., then it can open additional sub-accounts on account 68.