Vacation is a paid period of vacation that is provided to all employees who have performed their job function for 11 months.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The law stipulates that an employee can go on “vacation” before the expiration of this period. So, he is able to exercise his right to leave after 6 months.

Some categories of workers may take it earlier. Thus, a minor employee has the right to go on vacation before the expiration of the six-month period.

Vacation payments are calculated based on average earnings. This indicator is multiplied by the number of days. This way you can calculate the amount of vacation pay.

Labor laws provide minimum guarantees for workers. In particular, the legal act stipulates that the average monthly salary cannot be lower than the minimum wage.

This indicator is approved annually at the state level. It increases as inflation rises.

Minimum wage regulatory framework in 2021

Based on Art. 3 Federal Law No. 82 dated June 19, 2000 “On the minimum wage”, the minimum wage is a conditional amount of funds that is used to regulate salary payments to employees, as well as to calculate the volume of social security for various groups of the population. The use of minimum wages for other purposes that contradict the current legislation of the Russian Federation is strictly prohibited.

Based on Art. 1 Federal Law No. 82 dated June 19, 2000 the minimum wage is fixed in federal legislation. Starting from 01/01/2020 The minimum wage is 12,130 rubles.

Since the beginning of 2021, there have been significant changes in relation to the minimum wage, according to which this indicator is correlated depending on the cost of living (ML) for able-bodied citizens in the Russian Federation as a whole.

Based on Art. 133 of the Labor Code of the Russian Federation, the monthly earnings of a subject who has fully complied with a given production standard cannot be lower than the minimum wage. At the same time, some subjects of the federation have the right to establish a local minimum wage level, based on the provisions of Art. 133.1 Labor Code of the Russian Federation. However, the local minimum wage cannot be lower than the state level.

What is the fine for non-indexation of vacation pay due to an increase in minimum wage?

× — — Contents: This indicator is approved annually at the state level. Content:

- How to calculate vacation pay in 2021 if an employee receives a minimum wage

- Indexation of vacation pay when salaries increase

- Wage indexation up to minimum wage when calculating vacation pay 2021 video

- Is vacation pay indexed when salary increases?

- Minimum salary and vacation pay - calculation procedure

- Indexation of vacation pay when changing minimum wages in 2021

- We take into account changes in minimum wages in our work

- Rules for calculating vacation pay when increasing employee salaries

Indexation of vacation pay when salaries increase From March 19 to April 5, 2021 - for 19 days - the amount will be 9970 rubles.

(4271 × 1.23 × 19). The total amount of payments will be 13,810 rubles. (3940 + 9970). Federal Law, if the cost of living when calculated in the next quarter of the year decreases, this will not affect the minimum wage. The minimum wage will remain at the same level.

Here are some examples:

- The regional agreement on the minimum wage in the Novosibirsk region dated November 29, 2016 No. 10 from January 1, 2021 in the region established a minimum wage for employees of public sector organizations in the amount of 9,030 rubles, and for employees of non-budgetary organizations (except for agricultural organizations) – in the amount of 10,000 rubles.

- The regional agreement on the minimum wage in St. Petersburg for 2021 (concluded in St. Petersburg on September 12, 2016 No. 310/16-C) established the minimum wage in the amount of 16,000 rubles. Moreover, according to clause 1.1 of this document, the tariff rate (salary) of a 1st category employee should not be less than 13,500 rubles;

If, after changing the federal minimum wage, the regional minimum wage is still higher, the employer should not change the salaries of employees.

For your information: Regional minimum wage At the same time, one

Situations in which wages may be less than the minimum wage

In practice, the question often arises about additional payment up to the minimum wage, how to pay extra correctly, and also how this amount should be calculated. First of all, you need to understand that wages can be lower than the minimum wage on legal grounds. In particular, legal conditions in which the employee’s final earnings or salary (which are different categories) are less than the minimum wage level are:

- Based on Art. 133.1 of the Labor Code of the Russian Federation, if the company has not joined the regional agreement on establishing the local minimum wage level, the wage may be below the minimum. The fact that the company does not join the regional agreement is expressed by sending written objections to local authorities within the first 30 days from the date of coverage of the proposal.

- An employee’s salary can be fixed below the minimum wage only under one condition: if the subject consistently receives incentive bonuses (bonuses), compensation and/or additional payments.

The considered categories cannot be increased to the minimum wage level by multiplying by regional coefficients. It is assumed that the increase by the coefficient occurs due to the fact that the amount of funds assigned to the employee is higher than the minimum wage.

- The subject did not complete the required amount of work or did not fulfill the temporary quota (the requirement to fulfill the plan is fixed in Article 133 of the Labor Code of the Russian Federation). At the same time, it is important to understand that certain categories of citizens (for example, people with disabilities) have the legal right to work shorter working hours.

- An employee may receive a final payment in an amount less than the minimum wage upon deduction of personal income tax from the amount in question. The need for earnings to achieve the minimum wage level is fixed for the initial salary amount.

What to include in the calculation

According to Art. 133, 133.1 and 135 of the Labor Code, remuneration involves a rate or salary and various types of additional payments, including compensation for work in conditions different from the norm, bonuses and incentives. Accordingly, in a monthly calculation, an additional payment to an employee up to the minimum wage may consist of amounts additional to the salary (tariff). For example:

- bonus for length of service;

- bonus for qualifications and professionalism;

- bonuses;

- additional payment for night work;

- additional payment for work on holidays and days off.

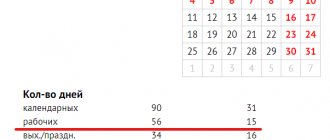

It is important that the “minimum wage” includes holidays and weekends if the employee worked within working hours. If attracted beyond the standard time, the accrual is added to the minimum amount.

Recording working hours for calculating additional payments up to the minimum wage

Additional payment to the minimum wage level is made based on the time actually worked by the employee. Based on Art. 91 of the Labor Code of the Russian Federation, working hours include those periods during which the person carried out labor activities in accordance with the recorded job responsibilities. The standard working time per week is 40 hours.

It is important to take into account that there are a number of separate categories of employed citizens for whom the temporary weekly work rate is reduced. For example, for persons with disabilities, minor citizens, for subjects working in hazardous conditions, etc.

Based on Art. 92 of the Labor Code of the Russian Federation, the standard working time per week for persons aged 16 to 18 years is 35 hours. This means that it will be enough for such an employee to work 35 hours a week for the salary to be at least at the level of the minimum wage.

In addition, based on Art. 93 of the Labor Code of the Russian Federation, every company employee has the right to work on a part-time basis. In these circumstances, based on Part 3 of Art. 93 of the Labor Code of the Russian Federation, the calculation of wages for an employee will be carried out by the employer in proportion to the period actually worked. In this case, the minimum wage will also be taken into account in proportion to the time worked. This means, for example, that an employee working at 0.5 rate must receive at least half of the minimum wage.

General procedure for calculating vacation pay

Note!

Calculation of vacation pay for a worker is carried out on the basis of his actually accrued salary and the time he worked for the 12 calendar months preceding the month in which the vacation began (paragraph 3 of Article 139 of the Labor Code of the Russian Federation). This method determines the average salary. This rule applies to any mode of work of the employee. To calculate the average daily earnings (hereinafter - SDZ), the resulting value should be divided by 29.3. Next, the SDZ for the billing period must be multiplied by the number of calendar days of vacation.

If the leave was granted in working days, then the SDZ is calculated as the quotient of the amount of accrued wages for the billing period and the number of working days according to the calendar of a 6-day working week.

For more details on calculating SDZ, read ready-made solutions and expert advice in the ConsultantPlus system. We recommend signing up for a 2-day free trial to log in.

Additional payment up to the minimum wage

Based on Art. 129 of the Labor Code of the Russian Federation, remuneration is the amount of funds paid, which includes the employee’s salary, his bonus payments, allowances and compensation funds due for unusual working conditions (for example, temporary performance of third-party duties or work in hazardous conditions).

This determines the fact that the comparison of the minimum wage volume and the final amount of the employee’s remuneration must be carried out taking into account all additional charges of the subject, in addition to the salary. A similar situation is recorded in Letter of the Ministry of Finance of the Russian Federation No. 03/03306/1/768 dated November 24, 2009. Also, the indicated legislative act considers the situation when an employee was deprived of a bonus, which brought the salary to a level below the minimum wage. In such conditions, the employer must provide the subordinate with additional payment up to the minimum wage.

However, there is an exception to the above statement that is valid for employees of the Far North. In particular, based on the Review of judicial practice, decided by the Supreme Court of the Russian Federation on February 26, 2014, the salary is correlated with the minimum wage without taking into account local allowances for experience in a special climate and local increasing coefficients.

The wages of employees of budgetary entities should also not be lower than the minimum wage. At the same time, the amount of remuneration for work compared with the minimum wage does not take into account payment for overtime work, sick leave, financial assistance and bonuses for anniversary events. Additional payment to the minimum wage in a budgetary institution is carried out in the same manner as in commercial organizations - on the basis of an order from the manager of the institution.

The amount of vacation pay, according to the Labor Code of the Russian Federation, is calculated from the employee’s average monthly earnings and cannot be lower than the minimum wage. Additional payment up to the minimum wage when calculating vacation pay is calculated using the following formula:

((minimum wage established by law for the vacation period / number of days in a month of the vacation period) * duration of vacation) - the amount of vacation pay.

Additional payment up to the minimum wage for external part-time workers is carried out on a general basis. External part-time work means simultaneous employment in two companies. One place of work is permanent, and the second involves working in your free time. Based on Art. 285 of the Labor Code of the Russian Federation, payment for external part-time workers must be made on the basis of time worked. That is, a subject who works in a second job at 0.5 rates must receive at least half of the minimum wage. In the event that the payment for combined work does not reach the required level, the employer of the subject’s second job is obliged to provide an appropriate additional payment.

An additional payment up to the minimum wage for an incomplete month worked will be due only if the calculated earnings for the time actually worked are below the minimum wage level, also calculated in proportion to the period worked. If, for example, the subject worked 11 days out of 22, the minimum amount of funds will be 50% of the minimum wage.

Indexation for salary increases

If there is a salary increase, then the answer to the question of whether vacation pay needs to be indexed will depend on the moment the decision was made:

- during the billing period - in this situation, the amount of income received in the billing period is multiplied by the increase factor;

- in the month when the employee goes on vacation - the same rule as in the first case;

- while the employee is on vacation - additional payment is made only for the period that begins from the moment the decision is made to increase the salary.

The procedure for making additional payments to the minimum wage

Based on the provisions of Art. 133 of the Labor Code of the Russian Federation, calculation and issuance of additional payments up to the minimum wage are the responsibility of the employer. The head of the company can use the following methods of ensuring additional payment:

- adding the amount of additional funds to a bonus, financial assistance or any other payment due to a subordinate. This refers to any payment, the amount of which may vary based on the manager’s decision. Publication of additional documents is not required;

- drawing up a separate order from the manager.

It is important to note that there is no regulated form of the Order in question. Such paper should be drawn up in free form, however, taking into account the organization’s requirements for the preparation of official documents (indication of all details, the need for a seal and signature of the manager, etc.). Based on Federal Law No. 402 dated December 6, 2011. Official orders of the manager must contain:

Company name.- Document's name.

- Date of paper formation.

- Passport and professional information about the employee.

- Designation of the amount of additional payment up to the minimum wage, as well as the day of its issuance (often coincides with the day of payment of wages).

- The reason for issuing this document. The most common basis is Art. 133 of the Labor Code of the Russian Federation, or a reference to a regional agreement that regulates the level of the minimum wage in a specific federal subject.

- Designation of responsible employees for the execution of the order.

- Manager's signature and company stamp.

It may also be necessary to make adjustments to the employment agreement with a subordinate. So, based on Art. 57 of the Labor Code of the Russian Federation, the terms of remuneration for labor are essential aspects of the employment agreement. At the same time, based on Art. 72 of the Labor Code of the Russian Federation, if such aspects are adjusted, this must be documented.

Practice shows that drawing up additional agreements whenever it is necessary to issue an employee an additional payment up to the minimum wage is an unproductive operation. Therefore, the head of the company often includes a clause in advance in the Regulations on remuneration, according to which, if the final earnings are below the current minimum wage level, employees are entitled to additional funds. The specific amount of funds is calculated individually, depending on the amount of the employee’s salary and the current level of the minimum salary.

Calculation of the amount of additional payment up to the minimum wage, examples

The process of how to calculate an additional payment up to the minimum wage is most appropriately presented using a specific example.

Thus, A.P. Vasnetsov’s salary is 7,500 rubles. The amount of his bonus is 40% of his salary. Vasnetsov fulfilled the temporary norm for the reporting month, upon which he is entitled to payment of salary and bonus in full. There is no regional agreement on establishing a separate minimum wage in a federal entity, so an indicator fixed at the federal level is used.

The final amount of payments is 7,500 + 40% = 10,500 rubles. From 01/01/2020 in the Russian Federation the minimum wage is 12,130 rubles. The additional payment will be: 12.130 – 10.500 = 1630 rubles.

If a similar situation had occurred in April 2021, the manager would not have been obliged to provide Vasnetsov with additional payment, since the minimum wage until May 2021 was 9,489 rubles.

Vacations: indexation in connection with an increase in the minimum wage and not only

→ The article from the magazine “MAIN BOOK” is relevant as of June 8, 2021. CONFERENCE At the end of May, we held an online conference on our website about the rules for granting vacation and calculating vacation pay. Here are our experts' answers to the most interesting questions.

You can familiarize yourself with the materials of the online conference: → Conferences → Calculation of vacation pay in 2021: rules and nuances

When and on the basis of what documents do you need to pay extra vacation pay up to the minimum wage?

— It all depends on what salary the employee had in the billing period.

From May 1, 2021, the average monthly salary of an employee who has worked the full working hours during the billing period and fulfilled his job duties cannot be less than the federal minimum wage - 11,163 rubles. (hereinafter referred to as the Regulations); If the salary during the billing period was below 11,163 rubles, then there is a high probability that you will have to pay extra vacation pay.

Even if at the time of payment of vacation pay the salary is higher than the minimum wage.

Follow this algorithm. Step 1. Calculate the employee’s average daily (hourly) earnings using the following formula: Step 2. Calculate the employee’s average monthly earnings for the billing period. Keep in mind that this is done only for comparison with the minimum wage. It is determined by the following formula: Step 3. Compare the employee’s average monthly earnings from step 2 with the amount of 11,163 rubles: •if the average monthly earnings from step 2 is more than 11,163 rubles.

or equal to this amount, then calculate vacation pay based on the employee’s average daily earnings (from step 1); •if the average monthly salary from step 2 is less than 11,163 rubles, then pay vacation pay based on the monthly amount of 11,163 rubles: If we assume that the employee goes on vacation from 06/01/2018 for 28 calendar days, then the amount of vacation pay for June, calculated based on the minimum wage, should be at least 10,418.80 rubles.

(RUB 11,163 / 30 days x 28 days).

Is indexation and increase in the minimum wage expected in 2021?

› Article current as of: November 2021 Should we expect an increase in the minimum wage in 2021? The latest changes to the minimum wage took place in January 2021.

A federal law was adopted, on the basis of which the minimum wage was equated to the subsistence level. Compliance with this condition will provide citizens with sufficient purchasing power necessary to maintain an acceptable standard of living. Articles on the topic (click to view)Chairman of the State Duma Committee on Labor, Social Policy and Affairs veterans Yaroslav Nilov supported the proposal of the Ministry of Labor of the Russian Federation to increase the minimum wage (minimum wage) from 2021. In his opinion, due to the current situation with changes in the cost of food and medicine, it is necessary to revise the minimum wage upward. Nilov also believes that people who receive wages at this level should be exempt from income tax. He explained that when the budget for the next year is introduced, the so-called near-budget package is also introduced, which regulates certain parameters. “The minimum wage is limited to calculating the cost of the consumer basket and the cost of living. This is how the annual recalculation and increase in the minimum wage take place,” RT quotes him. It has become known how the salaries of public sector employees will increase in 2021.

The indexation of salaries of employees of state organizations will be 4.3%. The corresponding order was signed by Russian Prime Minister Dmitry Medvedev. The document was published on the official portal of legal information. “Federal state bodies, federal state institutions - the main managers of federal budget funds, including those in charge of federal state institutions, take measures to increase from October 1, 2021.

by 4.3 percent of the wages of employees of federal government, budgetary and autonomous institutions provided from the federal budget,” the government order says. Salaries of public sector employees will be indexed from October 1.