Payment order for penalties in 2021 - 2021 - sample

Depending on what served as the basis for the payment, filling out this field will vary:

- In case of voluntary payment of penalties (the basis of the PP), there will be 0 here, because penalties do not have a frequency of payment, which is inherent in current payments. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.08.2021 - penalties for August 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

Read about filling out field 107 in your personal income tax payment form here.

If you pay the fine yourself, enter 0 in fields 108 “Document number” and 109 “Document date”.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

Below we present in the table the current main BCCs for 2021 for income tax.

| TYPE OF NDFL | KBK IN 2021 |

| Personal income tax on employee income | 182 1 0100 110 |

| Penalties for personal income tax on employee income | 182 1 0100 110 |

| Personal income tax fines on employee income | 182 1 0100 110 |

| Tax paid by individual entrepreneurs on the general taxation system | 182 1 0100 110 |

| Penalties for personal income tax paid by individual entrepreneurs on the general system | 182 1 0100 110 |

| Penalties for personal income tax paid by individual entrepreneurs on the general system | 182 1 0100 110 |

What are the BCCs for personal income tax for 2021: table taking into account changes

In a new way, two details of the recipient of funds (the Federal Treasury body) should be filled in in payment orders for transfers to the budget:

- In field 15 - the bank account number of the recipient of the funds (the number of the bank account included in the single treasury account - UTS). Until 01/01/2021 this field was left empty.

- in field 17 - the new account number of the territorial body of the Federal Treasury (TOFK), recommended from 01/01/2021, mandatory from 05/01/2021.

The tax is paid by the taxpayer independently or by another person on his behalf (clause 1 of Article 45 of the Tax Code of the Russian Federation) in the currency of the Russian Federation (clause 5 of Article 45 of the Tax Code of the Russian Federation).

In case of non-payment or incomplete payment of the tax within the established period, the tax is collected in the manner prescribed by Articles 46, 47, 48 of the Tax Code of the Russian Federation.

| Payment Description | KBK |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| Income tax for individual entrepreneurs “for oneself” | 182 1 0100 110 |

| Payment by an individual (not an individual entrepreneur) | 182 1 0100 110 |

| Penalties for personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| Penalties paid by individual entrepreneurs “for themselves” | 182 1 0100 110 |

| Penalties paid by an individual (not an individual entrepreneur) | 182 1 0100 110 |

| Fines for non-payment of personal income tax by a tax agent | 182 1 0100 110 |

| Fine for personal income tax (individual entrepreneur “for oneself”) | 182 1 0100 110 |

| Personal income tax fine for an individual (not an individual entrepreneur) | 182 1 0100 110 |

By Order of the Ministry of Finance dated October 12, 2020 No. 236n, new budget classification codes were introduced from January 1, 2021. They apply to personal income tax, calculated at an increased rate of 15%, on income exceeding 5 million rubles per year. This tax must be paid separately.

| Payment | KBK |

| Personal income tax at an increased rate of 15% | 182 1 0100 110 |

| Tax penalties at an increased rate of 15% | 182 1 0100 110 |

| Tax penalties at an increased rate of 15% | 182 1 0100 110 |

In 2021, filling out and submitting personal income tax reports on time is not enough if you need funds to pay income taxes to be taken into account in the budget in accordance with their purpose.

To do this, you must fill out a payment order to the Federal Tax Service in accordance with all official requirements. Otherwise, the organization and the federal treasury itself may simply not see the transferred funds. Then you will have to:

- clarify all payment details;

- check details;

- look for the mistake made.

Nobody says that the amounts paid will be lost. However, sometimes legal entities and individual entrepreneurs with staff, as a safety net, have to re-transmit the required amount in order to avoid troubles with relations with the Federal Tax Service.

The main regulatory document defining the procedure for filling out payment slips is Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n (Appendix 2). Let's look at the main points.

- Detail 104 indicates the KBK (20-digit budget classification code), which can be found from the list approved by the Ministry of Finance for the corresponding year. It should be noted that, according to paragraph. 7 p. 4 sec. II of the same order, for fines the income subtype code 3000 is used (14–17 digits of the code).

- for a fine related to income tax credited to the federal budget: 182 1 0100 110;

- fine related to income tax credited to the regional budget: 182 1 0100 110;

- fine related to personal income tax: 182 1 0100 110.

For the KBK for paying fines for all types of taxes, see the Ready-made solution from ConsultantPlus.

Remember that the BCC for arrears, penalties and fines for the same tax are different, which means you need to issue separate payments to pay them.

- In detail 105, OKTMO is filled in - the code of the territory of the municipality where funds from paying fines are collected.

- Requisite 106 - value of the payment basis - 2 letters. In case of payment of a fine, the letters TR are used (which means a requirement when the tax office issued this document under Article 69, 101.3 of the Tax Code of the Russian Federation).

- Props 107 (tax period) has a value of 0.

- Detail 108 indicates the requirement number; the symbol No. does not need to be inserted.

- Indicator 109 contains the date of the document, the number of which is reflected in detail 108, in the format “DD.MM.YYYY”.

- Detail 110 has not been filled in since January 1, 2015 (this is due to the fact that clause 11 of Order No. 107n was canceled by Order of the Ministry of Finance No. 126n dated October 30, 2014).

- The “Code” detail indicates a unique accrual identifier (UIN); it must be contained in the tax demand that it made for payment of fines. If this code is not present, then 0 is entered.

The employer (including legal entities) is obliged, when paying wages, to calculate personal income tax from it and act as a tax agent, withholding the tax and transferring it to the budget (clause 1 and clause 2 of Article 226 of the Tax Code of the Russian Federation). As a general rule, personal income tax must be withheld upon actual payment of wages to the employee (clause 4 of article 226 of the Tax Code of the Russian Federation).

Deadline for payment of personal income tax on salary

Personal income tax from an employee’s salary must be transferred to the budget no later than the working day following the day of its payment (clause 6 of article 6.1, clause 6 of article 226 of the Tax Code of the Russian Federation).

From 2021, tax contributions can be clarified if the bank name and the recipient's account are correct. The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

From February 6, 2021, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

Taxes, unlike contributions, are calculated and paid rounded to whole rubles.

To answer the question of how to fill out a personal income tax payment order correctly in 2021 so that the funds can reach their intended destination, you need to be aware of some nuances:

- On line 101, each applicant must indicate their own status. This can be an ordinary individual (13) or a tax agent (02). If this individual entrepreneur transfers tax for himself, his status is 09.

- For line 104, it is important who exactly pays the tax and what its status is: a tax agent, an individual or a merchant for himself.

- If an organization has separate divisions, then the tax must be transferred to the location of each of them (its own checkpoint, OKTMO, another Federal Tax Service). From payments under civil law contracts, “isolated companies” also deduct personal income tax according to their details. A similar procedure is established for merchants with personnel on a patent or imputation.

From 01/01/2021, in the payment slip for the transfer of taxes and insurance contributions, you need to fill out 2 columns in a new way related to the recipient of the funds - the Federal Treasury. From October 2021, an updated list of payment grounds should be applied when repaying debts for past periods. In addition, a new BCC has been introduced for personal income tax on the income of an employee or founder, which during the year exceeded 5 million rubles.

FIELDS 17 AND 15

Such a payment order has both similarities with a regular one (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. We will dwell on the latter in more detail, and then we will provide a sample payment slip for penalties for personal income tax 2021.

The first difference is KBK (props 104). For tax penalties there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100.

The second difference between a payment order for penalties is detail 106. The following options are possible:

- If you have calculated the penalties yourself and pay them voluntarily. In this case, the basis will have a tax code, that is, voluntary repayment of debt for expired tax periods in the absence of a requirement from the Federal Tax Service.

- If you pay at the request of the Federal Tax Service. In this case, the base will have the form TP.

- You transfer based on the inspection report. This is the basis of payment to AP.

The third difference is detail 107. Its value depends on what served as the basis for the payment:

- For voluntary payment – “0”. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.02.2018 - penalties for February 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

If you pay penalties yourself, enter 0 in fields 108 and 109.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, a claim), and do not put the “No” sign.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

From 01/01/2021, personal income tax payments must be filled out in a new way - the changes concern the introduction of new accounts and clarification of information about taxpayers. To clarify the recipient of the funds - the Federal Treasury, in connection with the transition to a new procedure for treasury services and a new system of treasury payments, the rules for filling out two fields have changed:

- for field 17 - it indicates the new account number of the territorial body of the Federal Treasury (TOFK);

- for field 15 - it indicates the account number of the bank - the recipient of the funds, which is part of the single treasury account - UTS. Until 2021, when paying taxes and contributions, field 15 was left blank.

From 10/01/2021, an updated list should be applied - the purpose of payment when paying personal income tax when repaying debts for previous periods.

Please indicate the amount in full rubles. The rule applies: transfer taxes to the budget in full rubles, rounding kopecks according to the rules of arithmetic: if less than 50 kopecks, discard them, and if more, round to the nearest full ruble.

All fields are required. The date and amount of the write-off are indicated in numbers and in words. Payment orders are numbered in chronological order.

Each field is assigned a separate number. Let's look at the rules in more detail.

Such a payment order has both similarities with a regular one (it states the same status of the payer, indicates the same details of the recipient, the same income administrator), and differences. We will dwell on the latter in more detail, and then we will provide a sample payment slip for penalties for personal income tax.

The first difference is KBK (props 104). For tax penalties, there is a separate budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100.

IMPORTANT! KBK for transferring penalties: 182 1 0100 110.

The second difference between a payment order for penalties is detail 106. The following options are possible:

- If you have calculated the penalties yourself and pay them voluntarily. In this case, the basis will have a tax code, that is, voluntary repayment of debt for expired tax periods in the absence of a requirement from the Federal Tax Service.

- If you pay at the request of the Federal Tax Service. In this case, the base will have the form TP.

- You transfer based on the inspection report. This is the basis of payment to AP.

The third difference is detail 107. Its value depends on what served as the basis for the payment:

- For voluntary payment – “0”. If you are listing penalties for one specific period (month, quarter), it is worth indicating it, for example, MS.02.2018 - penalties for February 2021.

- When paying at the request of tax authorities (basis of TR) - the period specified in the request.

- When repaying penalties according to the verification report (the basis of the AP), they also put 0.

If you pay penalties yourself, enter 0 in fields 108 and 109.

In all other cases, in field 108, provide the document number - the basis for the payment (for example, claims), do not put the “No” sign in this case.

In field 109, indicate:

- date of requirement of the Federal Tax Service - for the basis of payment TR;

- the date of the decision to bring (refusal to bring) to tax liability - for the basis of an administrative agreement.

The Ministry of Finance of Russia, by order No. 236n dated October 12, 2020, introduced new budget classification codes from January 1, 2021. They are intended for the transfer of personal income tax at an increased rate of 15% on income over 5 million rubles per year. Here are three new CBCs:

- for tax transfer - 182 1 0100 110;

- for transferring penalties - 182 1 0100 110;

- for payment of fines - 182 1 0100 110.

What does the 2021 payment order consist of?

A payment order created to generate and reflect the amount required for the payment of taxes, fees and contributions for the purpose of insuring employees of an enterprise is carried out on form 0401060. Each field has a separate number. It is necessary to fill out the document, guided by the KBK for paying tax deductions and making contributions, which is carried out in 2021.

At the same time, in 2021 the following features should be taken into account:

- It is impossible to apply the BCCs in force in 2021; for example, the BCCs for contributions to the Pension Fund are outdated.

- The data on line 110 in the PDF has also changed.

In 2021, the information to be filled in regarding contributions and tax amounts is the same:

1. Paragraph 1 describes the name of the organization.

2. Next, the numbering of the form is indicated, which corresponds to the All-Russian standard-classifier of management documents, approved back in 1993.

3. In column 3, enter the payment number, which is written not in words, but in numbers.

4. Clause 4 consists of the date the notification was completed. Here you need to follow these rules:

- if the document is submitted on paper, the full date is entered, following the format DD.MM.YYYY;

- The electronic version involves recording the date in the format of the credit institution. The day is indicated by 2 digits, the month by two, and the year by four.

5. In paragraph 5, record one of the values: “urgent”, “by telegraph”, “by mail” or another indicator determined by the bank. You can leave the column empty if the bank allows it.

6. In paragraph 6, write the payment amount. In this case, rubles are written in words, and kopecks are listed in numbers. Rubles and kopecks are not reduced or rounded. If the amount to be paid is a whole amount and does not have small change, then pennies separated by commas may not be recorded. In the “Amount” line, the amount is set, followed by the equal sign “=”.

7. Clause 7 contains the amount to be paid, determined in numbers. Rubles are separated from change using a dash sign “–”. If the number is an integer, then an equal sign “=” is placed after it.

8. Paragraph “8” contains the name of the payer; if it is a legal entity, you need to write the name in full, without abbreviations or abbreviations.

9. In paragraph 9, enter the number of the payer’s account registered with the banking institution.

10. Contents of clause 10: name of the bank and address of its location.

11. Point 11 shows the bank code identifying the institution where the payer of taxes and contributions is served.

12. Paragraph 12 consists of the correspondent account number of the taxpayer’s bank.

13. Clause 13 determines the bank that will receive the transferred funds. Since 2014, the names of Bank of Russia branches have changed, so check this issue on the official website of the financial institution.

14. Point 14 consists of the bank identification code of the institution receiving the money.

15. In column 15 you should write down the number of the corresponding bank account to which contributions are transferred.

16. Line 16 contains the full or abbreviated name of the enterprise receiving the funds. If this is an individual entrepreneur, write down the full last name, first name and patronymic, as well as legal status. If this is not an individual entrepreneur, it is enough to indicate the citizen’s full name.

17. Column 17 records the account number of the financial institution receiving the money.

18. Props 18 always contains the encryption “01”.

19. As for detail 19, nothing is recorded here unless the bank makes a different decision.

20. 20 props also remain empty.

21. Line 21 requires determining the order of the amount to be paid in a figure corresponding to legislative documents.

22. Requisite 22 presupposes a classifier code for the amount to be paid, whether it be contributions or tax deductions. The code can consist of either 20 or 25 digits. The details exist if they are assigned by the recipient of the money and are known to the taxpayer. If an entrepreneur independently calculates how much money he should transfer, there is no need to use a unique identifier. The institution receiving the money determines payments based on the numbering of TIN, KPP, KBK, OKATO. Therefore, we indicate the code “0” in the line. The request of a credit institution is considered illegal if, when recording the TIN, you need to additionally write information about the code.

23. Leave field 23 blank.

24. In field 24, describe the purposes for which the payment is made and its purpose. It is also necessary to indicate the name of goods, works, services, numbering and numbers used in documents according to which payment is assigned. These can be agreements, acts, invoices for goods.

25. Requisite 43 includes affixing the IP seal.

26. Field 44 consists of the signature of an authorized employee of the organization, manager or corresponding authorized representative. To avoid misunderstandings, the authorized representative must be entered on the bank card.

27. Line 45 contains a stamp; if the document is certified by an authorized person, his signature is sufficient.

28. Requisite 60 records the taxpayer’s TIN, if available. Also, those who recorded SNILS in line 108 or the identifier in field 22 can enter information in this line.

29. The recipient’s TIN is determined in detail 61.

30. In line 62, the employee of the banking institution enters the date of submission of the notification to the financial institution related to the payer.

31. Field 71 contains the date when money is debited from the taxpayer’s account.

32. Field 101 records the payer status. If the organization is a legal entity, write down 01. If you are a tax agent, enter 02. Coding 14 applies to payers who settle obligations with individuals. This is just a small list of statuses; a more complete one can be found in Appendix 5 to the order of the Ministry of Finance of Russia, which was issued in November 2013 and registered in the register under number 107n.

33. Field 102 consists of the checkpoint of the payer of contributions and taxes. The combination includes 9 digits, the first of which are zeros.

34. Field 103 – checkpoint of the recipient of funds.

35. Line 104 indicates the BCC indicator, consisting of 20 consecutive digits.

36. Props 105 shows the OKTMO code - 8 or 11 digits, they can be recorded in the tax return.

37. In detail 106, when making customs and tax payments, record the basis of the payment. TP is indicated if the payment concerns the current reporting period (year). ZD means the voluntary contribution of money for obligations occurring in past reporting periods, if there are no requirements from the tax office for payment.

Where can I get a complete list of possible values? In paragraph 7 of Appendix 2 and paragraph 7 of Appendix 3 to the order of the Ministry of Finance of Russia, issued in 2013.

If other deductions are made or it is impossible to record a specific indicator, write “0”.

38. Requisite 107 is filled in in accordance with the purpose of the payment:

- if taxes are paid, the tax period is fixed, for example, MS 02.2014;

- if customs payments are made, the identification code of the customs unit is indicated;

- you need to deposit money in relation to other contributions - write “0”.

39. Payment of tax contributions involves entering a paper number, which serves as the basis for the payment.

40. What data is recorded in field 109?

- if tax revenues and deductions to the customs authorities are to be paid, determine the date of the paper that is the basis for the payment, pay attention to the presence of 10 digits in the encoding (the full list of indicators can be found in paragraph 10 of Appendix 2 and paragraph 10 of Appendix 3 to the order of the Ministry of Finance of Russia, registered in November 2013);

- if other money is transferred to state budget funds, write “0”.

- In field 110 there is no longer a need to fill in the type of deductions.

How to fill out a personal income tax payment form

The main change concerns individual entrepreneurs, notaries, lawyers and heads of peasant farms. From October 1, 2021, payer status codes “09”, “10”, “11” and “12” will no longer be valid. Instead, the taxpayers listed above will indicate code “13,” which corresponds to individual taxpayers.

Also, some of the codes will be deleted or edited. New codes will be added:

- “29” - for politicians who transfer money to the budget from special election accounts and special referendum fund accounts (except for payments administered by the tax office);

- “30” - for foreign persons who are not registered with the Russian tax authorities, when paying payments administered by customs authorities.

From October 1, the list of payment basis codes will decrease. Codes will disappear:

- “TR” - repayment of debt at the request of the tax authorities;

- “AP” - repayment of debt according to the inspection report;

- “PR” - debt repayment based on a decision to suspend collection;

- "AR" - repayment of debt under a writ of execution.

Instead, you will need to indicate the code “ZD” - repayment of debt for expired periods, including voluntary. Previously, this code was used exclusively for voluntary debt closure.

Also, from October 1, the code “BF” will be removed - the current payment of an individual paid from his own account.

This field indicates the document number that is the basis for the payment. Its completion depends on how field 106 is filled in.

The new code for the basis of payment in the four invalid cases is “ZD”. But despite this, the deleted codes will appear as part of the document number - the first two characters. Fill out the field in the following order:

- “TR0000000000000”—number of the tax office’s request for payment of taxes, fees, and contributions;

- “AP0000000000000” - number of the decision to prosecute for committing a tax offense or to refuse to prosecute;

- “PR0000000000000” - number of the decision to suspend collection;

- “AR0000000000000” – number of the executive document.

For example, “TR0000000000237” - tax payment requirement No. 237.

The procedure for filling out field 109 changes to pay off debts for expired periods. When specifying the “ZD” code, you need to enter in the field the date of one of the documents that is the basis for the payment:

- tax requirements;

- decisions to prosecute for committing a tax offense or to refuse to prosecute;

- decisions to suspend collection;

- writ of execution and initiated enforcement proceedings.

Information about the purpose of payment

In line 18 we put the code for the payment order (01), terms, purpose of payment in the form of a code, priority. There are special symbols to fill out the queue:

- 1 to transfer payment for damage to property, alimony;

- 2 for payment of wages, benefits;

- code 3 does not apply;

- 4 for payment to non-state funds and the tax service (fines, taxes, duties);

- code 5 for entering amounts according to executive documents;

- code 6 is not currently used.

As you can see, code 4 must be used for a tax payment order.

Box 24 contains additional information on the purpose of payment.

How to fill out a payment order for taxes and contributions in 2021

The basis for the payment indicated in the payment document for penalties depends on whether it is made voluntarily or according to a document issued by the Federal Tax Service:

- The voluntary nature of the payment will be indicated by the letters ZD entered in field 106. Their presence allows you not to make other notes related to the basis of the payment (about the payment period, number and date of the document), and limit yourself to putting numbers in the fields intended for them (107–109) 0. If the amount paid can be linked to a specific tax period, then in field 107 you can make a link to it in the format MS.05.2021 or KV.02.2021.

- Documents drawn up by the Federal Tax Service regarding penalties are divided into: Request for payment. According to it, in field 106 you should enter the letters TR, and in the fields following it - the payment period specified in the request (field 107), the request number (field 108) and its date (field 109).

- Checking act. For it, the letters AP will appear in field 106 and, just like for the demand, you will need to enter the payment deadline specified in the act, the act number and its date in lines 107–109.

Based on the basis of the payment, the order of payment will be determined (letter of the Ministry of Finance of Russia dated January 20, 2014 No. 02-03-11/1603):

- for voluntary payment, the number 5 should be entered;

- payment according to a document issued by the Federal Tax Service - number 3.

The tax period for which payment is made may be additionally indicated in the purpose of the payment.

The 2021 sample payment slip for penalties for personal income tax, which we have provided, was created for the most common type of these payments - for penalties paid voluntarily by the tax agent. Let us recall that the voluntary payment of penalties accompanying the additional payment of tax when updating previously filed reports exempts the tax agent from a fine for failure to transfer tax amounts on time if such an error is identified by the tax agent before it is discovered by the tax authority (Clause 2 of Article 123 of the Tax Code of the Russian Federation).

When issuing a payment order for VAT penalties in 2021, on the contrary, originator code 01 will be used by legal entities much more often than code 02, which characterizes the tax agent. Individual entrepreneurs working with VAT will use code 09, and they will use it more often than the tax agent code.

Otherwise, the execution of a payment invoice for VAT penalties will not differ from the document created for personal income tax penalties.

As mentioned above, the 2021 payment order for penalties on insurance premiums regulated by the Tax Code of the Russian Federation must be drawn up according to the same rules that apply to other tax payments subject to the Tax Code. To indicate the status of the compiler of such a document, legal entities will use code 01, and individual entrepreneurs will use code 09 (when paying contributions both for their employees and for themselves).

\r\n\r\n

There are innovations for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. The changes concern field 101 (the status of the payment originator is entered in it).

\r\n\r\n

Until October 2021, when filling out field 101, these individuals must select one of the following values:

\r\n\r\n

- \r\n\t

- “09” - individual entrepreneur who pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “10” - a notary engaged in private practice, paying taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “11” - a lawyer who has established a law office that pays taxes, fees, insurance premiums and other payments administered by the tax authorities;

- “12” is the head of a peasant (farm) enterprise who pays taxes, fees, insurance premiums and other payments administered by the tax authorities.

- “13” is an “ordinary” individual.

\r\n\t

\r\n\t

\r\n\t

\r\n\t

\r\n

\r\n\r\n

Starting in October 2021, the values "09", "10", "11" and "12" will be removed. Instead, the value remains, the same for all individuals (“ordinary”, individual entrepreneurs, lawyers, etc.) - “13”. Changes were made by order No. 199n.

When filling out the recipient's details, you need to take into account changes in two fields. Innovations are associated with the transition to a new treasury service and treasury payment system.

- Field 17: the account number of the territorial body of the Federal Treasury (TOFK) is changed;

- Field 15: starting from January 2021, it is necessary to indicate the account number of the recipient's bank (the number of the bank account included in the single treasury account (STA)). In 2021 and earlier, this field was not filled in when paying taxes and contributions.

A clear rule will come into effect in the event that the accounting department deducts money from an employee’s salary to pay off debts to the budget. Next, the withheld amount is transferred to the treasury by a separate payment order. In such a payment in the field “TIN of the payer”, from July 17, 2021, it is strictly prohibited to indicate the identification number of the employing company. Instead, you need to put the TIN of the employee himself (amendments made by Order No. 199n).

Until October 2021, in payments issued when repaying debts for expired periods, in field 106 you can, if necessary, specify one of the following values:

- “TR” - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

Filling out a payment order in 2021: sample

- Corporate income tax

- Value added tax

- Single tax when applying the simplified tax system

- Tax when applying the patent system

- Property tax

- Transport tax

- Insurance premiums

- Personal income tax

- Unified agricultural tax

- A single tax on imputed income

- Land tax

Taxpayers will have to correct several details at once. Changes to a tax payment order mainly apply to the recipient's account:

- in the name of the recipient's bank, the name of the corresponding treasury account is added through the “//” sign (field “13” of the order);

- a different BIC will be indicated (field “14”);

- a new detail is added - the recipient’s bank account number (field “15”);

- In field “17” the treasury account number is entered.

The Federal Tax Service warned that the recipient's bank account number, which is an integral part of the treasury account, is a mandatory detail. Previously, taxpayers did not fill out field “15”.

Before providing a sample payment order for taxes for 2021, we remind you that the document also indicates:

- details of the payer (TIN, KPP, if necessary - address of an individual, current account number, BIC and correspondent account of the taxpayer's bank);

- details of the recipient (TIN, KPP, in the name - territorial FK and in brackets the Federal Tax Service, administering this budget payment).

According to the order of the Ministry of Finance of Russia dated September 14, 2020 No. 199n, new rules for indicating information in payment orders will come into force in 2021. In particular, for foreign organizations or individuals that are not registered with the Federal Tax Service, it is allowed to indicate “0” instead of the Taxpayer Identification Number.

Let’s figure out which details in the “payment” for personal income tax are considered key, and what points require special attention:

| Details that are the same for legal entities and individual entrepreneurs | |||

| № | Payment order field to be filled in | Information to be entered | How to fill out |

| 1 | 22 | Code | The specified value depends on the type of payment:

|

| 2 | 105 | OKTMO code |

|

| 3 | 106 | Basis of payment |

|

| 4 | 108 | Document Number | Number of the document serving as the basis for payment of personal income tax:

|

| 5 | 109 | Document date |

|

| 6 | 110 | Payment type | Not filled in |

Details that may differ for organizations (their branches) and individual entrepreneurs:

| № | Payment order field to be filled in | Information to be entered | How to fill out |

| 1 | 8 | Payer | Individual entrepreneurs indicate the following information:

|

Information about banks and the Federal Tax Service in the payment order

First, you need to fill out in detail information about the taxpayer’s bank and the payee’s bank (tax office).

- Lines 10 and 13 indicate information about the payer and recipient banks. You must provide the name of the banking organization, location, bank identification code and data on correspondent accounts.

- In cells 61 and 103 you need to write the TIN and KPP of the local tax service.

- Line 16 indicates the recipient of the payment. First, write the general name of the organization for the region “UFK MF RF for the city ...”, and then fill in the specific division of the tax inspectorate in brackets.

How to fill out a payment order for penalties in 2021

The rules for filling out payment orders are regulated by the Central Bank of Russia and the Federal Tax Service of the Russian Federation. The established procedure for processing documents must be strictly followed.

Important!

To correctly fill out a personal income tax payment order, you need to remember 2 points. Firstly, there are some differences in filling out the document for individual entrepreneurs and organizations. Secondly, the most important point is to correctly fill out the key details.

Here is a sample payment order for personal income tax in 2021 for legal entities. The document looks like this:

Error:

An individual entrepreneur, when filling out a personal income tax payment order for his employee, indicated code “09” in field 101.

Code “09” is indicated by individual entrepreneurs only if they pay personal income tax on their own income (i.e. for themselves). When a payment is made for an employee, the individual entrepreneur acts not as an entrepreneur, but as a tax agent, and therefore the code “02” is entered in field 101 of the payment order.

Error:

In field “107” of the payment order, an individual entrepreneur, when paying personal income tax for himself, indicated the frequency of payment as GD (annual payment), and instead of the other characters he put a dash, because I thought that in the case of an annual payment made once per period, everything is clear.

In any case, even if a payment period of 1 year was selected, in field “107” it is necessary to indicate the periodicity (year - YD) as the first 2 characters, then put a dot, 4-5 characters - 00, then a dot, 7- 10 characters – the year for which personal income tax is paid. For example, the annual payment for 2021 will be entered in the payment order as “GD.00.2021”.

Question:

What value should an organization indicate in field 109 of a personal income tax payment order if legal entities never file a personal income tax return?

Answer:

The value is set to “0”.

Question:

How to fill out field 110 “Payment type” of a personal income tax payment order?

Answer:

According to the Instructions of the Bank of Russia dated November 6, 2015 No. 3844-U, this field of the payment document is not filled in.

From January 1, 2021, a change is provided for individual payers who are not individual entrepreneurs. Order of the Ministry of Finance dated September 14, 2021 No. 199n updated the rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

Previously, in order for inspectors to be able to determine who the payment came from, an individual had to indicate his TIN. Instead of the TIN, you could fill out field 108 “Number of the document that is the basis for the payment”, or enter the UIN in field 22 “Code” (in the absence of a UIN, it was possible to indicate the address of residence or stay).

Now, if you do not have a TIN and UIN, you can indicate the series and number of your passport or SNILS.

Personal income tax

Personal income tax is a tax on persons receiving income that is subject to taxation. It can be paid by both residents and non-residents of the Russian Federation.

Personal income tax is paid through a bank, online on the website of the Russian Federal Tax Service or by means of a payment order. Personal income tax for a tax agent must be paid upon receipt of cash amounts, or before the next day after the tax is withheld (if payment is received in kind). Individuals pay personal income tax-3 until July 15, personal income tax-4 for the six months - until July 15, for the 3rd quarter - until October 15, for the year - until January 15 of the next year.

Directory of Payment Orders 2021

From July 17, 2021, the rule for filling out a payment order will come into effect, when the employer deducts money from the employee’s salary to pay off the debt to the budget and transfers the withheld amount to the budget.

In the payment receipt, in the “Payer’s INN” field, you must indicate not the company’s INN, but the employee’s INN. This change is also provided for by Order of the Ministry of Finance dated September 14, 2021 No. 199n.

Repayment of debt for previous periods - fields 106, 108, 109

From October 1, 2021, changes will be introduced to the procedure for providing information when repaying debts for expired periods (also Order of the Ministry of Finance dated September 14, 2021 No. 199n).

Until October 1, 2021, in field 106 “Basis of payment” of the payment order, you can specify one of the following values:

- “TR” - repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions);

- “PR” - repayment of debt suspended for collection;

- “AP” - repayment of debt according to the inspection report;

- “AR” - repayment of debt under a writ of execution;

- “ZD” is the voluntary repayment of debt for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority to pay taxes (fees, insurance contributions).

According to the changes, the values “TR”, “PR”, “AP” and “AR” no longer need to be specified in field 106. There remains a single value for all the listed cases, which must be entered in field 106 - “ZD”.

And the codes “TR”, “PR”, “AP” and “AR” go to field 108 “Document number”.

For example, if money is transferred on the basis of a request from a tax authority to pay a tax (fee, insurance premiums), in field 108 write first TP and then, without a space, the request number for 13 acquaintances. If this is a writ of execution (executive proceedings), then in field 108 write AR and the document number, etc., in the same order.

In field 109 “Date of payment basis document” you will need to indicate the dates of the documents on the basis of which the money is transferred (demand, decision, etc.).

According to tax legislation, penalties are charged for late payment of taxes, as well as advance payments thereon. If the company does not transfer the fine on time, its account may be blocked. Since the payment of penalties is given a certain period specified in the tax requirement and in case of its violation, a notification is sent to the bank about blocking the account and writing off the required amount.

It is the employer who is responsible for the completeness of the amount and compliance with the deadline for its payment, and if payment is delayed, he will be charged a penalty, and this fine will need to be paid indicating a separate code. The penalty itself is a sanction that is established when there is a delay in payment of already withheld personal income tax.

If the payment has not been received by the budget, then the payment cannot be clarified, and the tax agent’s obligation to transfer personal income tax is considered unfulfilled (for example, if the money has not been received by the budget system due to an error in the Federal Treasury account number). In this case, the tax agent must:

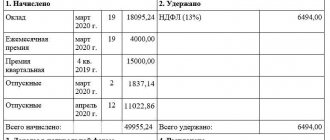

In these two situations, it is considered that the receipt of income occurred on the last day of the month. Tax is also paid on sick leave and vacation pay and must be remitted by the deadline of the last day of the month in which they were issued to the employee. Today, tax agents present personal income tax reports not only for the year, but also for each quarter.

According to current legislation, in 2021, income tax for employees must be paid no later than the day following the date of payment to employees. For example, if an employer issued wages for February 2021 on March 1, then personal income tax should be withheld on March 1 and transferred before March 4 (since March 2 and 3 are days off).