Payroll

Settlements with company personnel for wages are accumulated in account 70. This account is passive, since all calculated amounts of employee earnings are taken into account on a loan. This is done on the last date of the month. And on the 1st day of each next month, the credit balance is reported to employees.

Account analytics is carried out for each employee using personal accounts (cards) in the T-54(a) form.

You will find the current form and the procedure for filling it out in the article “Unified form No. T-54a (personal account (SVT)).”

The amount of accrued salary is posted to the appropriate expense accounts depending on the department in which the employee is registered. Postings in each specific case can be as follows: Dt 20 (23, 26, 44) Kt 70.

If an employee was engaged in the construction or repair of fixed assets, then his earnings should be reflected in the entry: Dt 08 (07) Kt 70.

When calculating sick leave, the calculated amount should be included in debit 69, since it is not an expense of the enterprise and is reimbursed from the budget using the social insurance fund: Dt 69 Kt 70.

Important! The employer pays for the first 3 days of illness of the employee.

Account 23.

Account 23 “Auxiliary production” is intended to summarize information about the costs of production that are auxiliary (auxiliary) for the main production of the organization. In particular, this account is used to account for production costs that provide:

Related articles: — Postings on account 15 — Postings on account 60 — Postings on account 91- service with various types of energy (electricity, steam, gas, air, etc.);

- transport services; repair of fixed assets;

- production of tools, dies, spare parts;

- building parts, structures or enrichment of building materials (mainly in construction organizations);

- construction of (temporary) non-title structures;

- extraction of stone, gravel, sand and other non-metallic materials;

- logging, sawmilling; salting, drying and canning of agricultural products, etc.

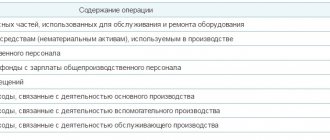

The debit of account 23 “Auxiliary production” reflects direct costs associated directly with the production of products, performance of work and provision of services, as well as indirect costs associated with the management and maintenance of auxiliary production, and losses from defects. Direct costs associated directly with the production of products, performance of work and provision of services are written off to account 23 “Auxiliary production” from the credit of inventory accounts, settlements with employees for wages, etc. Indirect costs associated with the management and maintenance of auxiliary production, are written off to account 23 “Auxiliary production” from accounts 25 “General production expenses” and 26 “General business expenses”. If appropriate, production maintenance costs can be taken into account directly on account 23 “Auxiliary production” (without prior accumulation on account 25 “General production expenses”). Losses from defects are written off to account 23 “Auxiliary production” from the credit of account 28 “Defects in production”.

The credit of account 23 “Auxiliary production” reflects the amounts of the actual cost of products completed by production, work performed and services rendered. These amounts are written off from account 23 “Auxiliary production” to the debit of the accounts:

- 20 “Main production” - when releasing products (works, services) to the main production;

- 29 “Service industries and farms” - when releasing products (works, services) to service industries or farms;

- 90 “Sales” - when performing work and services for third parties;

- 40 "Output of products (work, auxiliary production" at the end of the month shows the cost of work in progress.

Analytical accounting for account 23 "Auxiliary production" is carried out by type of production.

Classification of production costs

All costs that arise in a manufacturing company can be divided into two groups: direct and indirect (overhead).

A specific list of types of expenses that belong to a particular group is determined by the organization itself and enshrined in its accounting policies. But, as a rule, direct costs include:

- Raw materials and materials.

- Equipment depreciation.

- Workers' wages and insurance premiums accrued on them.

Overhead costs can also be divided into two groups:

- General production.

- General economic (managerial).

The first group relates to the costs of managing the production process, and the second – to the management of the enterprise as a whole.

For example, the salary of a shop manager or foreman is general production costs, and the remuneration of a director or chief accountant is general economic costs.

Wiring Dt 20 Kt 23

As can be seen from the example, by adding the posting Dt 23 Kt 23 to the postings Dt 20 Kt 23, we reflected the transfer of the results of the auxiliary production to the main production process. This transfer is the main purpose of any auxiliary production. Accordingly, Dt 20 Kt 23 is the main entry, including the cost generated in auxiliary production in the cost of the main product of the enterprise.

Learn more about the formation of turnover and balance on account 20 from the article “Main production in the balance sheet (nuances)”.

Examples of using account 73 in accounting

Example 1. Accounting for a loan to an employee in account 73

On December 1, employee Petrova A.S. A loan in the amount of 70,000 rubles was issued. for a period of 1 year at 6%. The loan is repaid with salary deductions in the amount of RUB 6,000. monthly. The Central Bank refinancing rate was 10%.

Let's make the calculation:

- Interest - 70,000 rubles. * 6% / 366 days a year * 31 calendar days = RUB 355.74;

- Material benefit – 70,000 rubles. * (2/3 * 10% - 6%) / 366 days a year * 31 calendar days = 39.53 rubles;

- Personal income tax – 39.53 * 35% = 13.84 rubles.

The solution to the example with postings to account 73 in the table:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description |

| December 01 | 73.01 | 51 | 70 000 | The loan amount was issued to the current account |

| December 03 | 73.01 | 91.01 | 355,74 | Interest accrued |

| December 10 | 51 | 73.01 | 355,74 | The employee paid the interest |

| 31th of December | 70 | 68 | 13,84 | Personal income tax accrued on material benefits |

Example 2. Accounting for compensation for the use of a personal car in account 73

Employee Petrov E.P. by agreement with the employer, uses his personal car for business trips. The amount of monthly compensation is set at 2,000 rubles. (within the normal range - 1,200 rubles and 800 rubles in excess of the norm).

Solution to the example with postings to account 73:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description |

| Accounting | ||||

| December 01 | 44 | 73.03 | 2 000 | Compensation awarded for the use of a personal car |

| 31th of December | 73.03 | 50 | 2 000 | Compensation paid |

| If PBU 18/02 is applied | ||||

| WELL | 44 | 73.03 | 1 200 | Compensation within normal limits |

| ETC | 44 | 73.03 | 800 | Compensation above the norm |

Important! Personal income tax is not charged on amounts of compensation for the use of personal property, and these amounts are also not subject to insurance premiums (clause 3 of Art.

217 of the Tax Code of the Russian Federation).

Example 3. Shortages were identified during inventory

The trading company Tele Systems Fon LLC carried out an inventory of goods in warehouses as of December 1. As a result of the inventory, a shortage totaling 5,000 rubles was identified. The amount within the limits of natural loss norms was written off as business expenses - 4,000 rubles, the rest - to the guilty parties.

Solution to the example with postings to account 73:

| date | Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| Write-off of losses | |||||

| December 01 | 94 | 41 | 5 000 | Shortage identified | Certificate of write-off of goods TORG-6 |

| December 01 | 44 | 94 | 4 000 | The shortfall was written off as business expenses within the normal limits. | |

| December 01 | 73.02 | 94 | 1 000 | The shortage is written off to the responsible person |

Account 70 in accounting: “settlements with employees for wages”

Depending on their form (cash, non-cash, in kind), postings are made: D 70 K 50 - payment of wages from the cash register D 70 K 51 - transfer of wages to the employee’s card D 70 K 90 - products issued against wages If the salary is in the organization’s cash register not received on time, it must be deposited. To do this, the posting is made: D 70 K 76.4 - wages deposited D 76.4 K 50 - previously deposited wages were issued at the request of the employee According to the law, wages are paid at least twice a month. Temporary disability benefits are paid on the day of payment of wages established by the internal regulations of the organization, vacation pay - within three days before the employee goes on vacation, and payment upon dismissal - on the last day of performance of work duties by the employee. Deductions on account 70.

Calculation of wages for personnel in the 1C system

You can correctly calculate your salary in the 1C: Salary and Personnel program if you follow a certain sequence of arrangement of all the required data in the information base. The calculation results are entered into the payroll sheet. Some organizations issue wages using cash receipts issued for each worker. To avoid mistakes, users of the 1C system are recommended to calculate all the numbers in the payslip and issue money according to the required documents.

To draw up a payslip in the 1C program, you need to open the “Reports” menu and select the appropriate item. The document can be compiled for the enterprise as a whole or for a specific division, as well as for a group of employees. The procedure for reflecting data in the pay slip:

- The serial number of the entry is entered in column No. 1.

- Columns No. 2-5 contain information about the employee. It can be viewed from the “Directories” section (personnel number, last name and initials, position or profession, tariff rate or salary).

- Based on the working time sheet, data on the number of days actually worked in the period is entered in column No. 6, and data on the number of days worked on holidays and weekends is entered in Column No. 7.

- Information about accruals for the current month by type of payment is displayed (section No. 8-12), as well as the calculation of deductions from the amount.

- Column No. 13 indicates the amount of tax payable this month.

- Data is entered on other deductions from the worker’s salary (column No. 14): loan repayment, alimony, union membership dues, etc.

- Column 15 sums it up.

- Column No. 16 shows the company’s debt (employee’s debt) based on the results of previous calculations.

- If there is a difference between the totals of columns No. 12 and No. 15, it is shown in column No. 18 “Amount to be paid.”

The article examined in detail account 70 “Settlements with employees for wages”. Knowing its features, young specialists will be able to correctly perform the required financial transactions.

Which accounts does account 70 correspond to?

Account 70 corresponds with many expense accounts. For convenience, we have collected everything in a table.

| Account 70 corresponds by debit with | Account 70 corresponds for the loan with |

|

|

What are auxiliary productions?

At manufacturing enterprises with a complex technological process structure, there are almost always workshops and divisions that perform functions that are assistive in relation to the main production cycle.

Examples include:

- own transport fleet;

- repair and commissioning department;

- energy management;

- workshop for the production of special equipment and tools.

All such divisions also produce products or provide services, but the main consumer of their products (services) is the enterprise itself. More precisely, they are needed to carry out the main production process of the enterprise.

A separate account 23 is intended for accounting for auxiliary production. Analytics on it is carried out by divisions of auxiliary production and types of costs. The specificity is that the account is also intended to account for the production process and cost calculation, so most of the item analytics that may be present on account 20 “Main production” will find their place on account 23 “Auxiliary production”.

Unlike accounting for main production (on account 20), the cost of production of auxiliary production formed on account 23 is not transferred to separate accounts intended for further accounting of finished main products (accounts 40, 43). The cost of auxiliary production is written off immediately to the credit of account 23.

For example, if one auxiliary division produces something for another auxiliary division, a posting is made Debit 23 Credit 23 for the subaccounts of the corresponding divisions.

Important! Some of the products of auxiliary production can be sold externally. In this case, the cost of sales is also reflected by posting Dt 90 (91) Kt 23, bypassing the accounts for accounting for finished products of the main production.