Characteristics of account 68

Based on the results of their economic activities, organizations and entrepreneurs must transfer part of their funds to the budget. The same responsibilities apply to individuals.

Tax accrual for legal entities reflects account 68 in the accounting department. Transactions for the payment of budget obligations are also formed by accounting account 68.

The records contain data on accrued and paid tax liabilities of the organization itself, reflect the status of taxes withheld from employees, and provide data on indirect taxes, including those declared for deduction.

Account 68 “Calculations for taxes and fees”

The size and frequency of tax payments are established by the current fiscal legislation. The Tax Code of the Russian Federation provides for settlements with budgets at the federal, regional and local levels. And in addition to tax obligations, companies are often required to pay specific fees. For example, state duty or local trade tax.

By order of the Ministry of Finance No. 94n, account 68 should be used in accounting to reflect calculations for state taxes and fees. In addition to dividing fiscal obligations by level of the recipient budget, taxes are divided into:

- Property. This type of tax is paid for the use of a specific type of property. For example, if a company operates transport, land, buildings, etc., then the company is obliged to pay a certain amount to the state. The size of property tax return is determined based on the volume of the tax base multiplied by the rate.

- Indirect. BUT, which are included in the cost of goods, works or services, should be classified as indirect. For example, this type of non-compliance includes value added tax, excise taxes, customs duties and duties.

- According to the result. These BUT are calculated based on the specific result of the economic activity of the subject for a certain period of time (calculation period). For example, corporate income tax. Calculation indicators for this type of non-commercial entity must coincide with declarations and other reports submitted to the Federal Tax Service.

Indicators 68 of the accounting account reflect not only the amount of accrued debt to the state, but also the amount of funds transferred to the budget system of the Russian Federation, and the amount of tax liabilities subject to refund or deduction.

OSNO and UTII

When calculating income tax, do not take into account the VAT amounts charged to customers upon the sale of goods (work, services, property rights) (clause 19 of Article 270 of the Tax Code of the Russian Federation).

Input VAT will also not affect the calculation of income tax. This is due to the fact that amounts of input tax presented by Russian counterparties are accepted for deduction (clause 1 of Article 171 of the Tax Code of the Russian Federation). However, there are exceptions to this rule. In some cases, input tax amounts must be included in the cost of purchased goods (work, services, property rights). In this case, the amount of VAT will be included in expenses when reflecting the cost of goods (work, services, property rights) in tax accounting.

When calculating income tax, take into account the restored amounts of VAT as part of other expenses associated with production and sales (paragraph 3, subparagraph 2, paragraph 3, Article 170 of the Tax Code of the Russian Federation). There are exceptions to this rule. When calculating income tax, do not take into account tax amounts recovered in the following cases:

- when transferring property, property rights to the authorized capital of another organization. This is due to the fact that the receiving organization accepts the restored input VAT for deduction (paragraph 3, subparagraph 1, paragraph 3, Article 170, paragraph 3, Article 270 of the Tax Code of the Russian Federation);

- upon shipment of goods (performance of work, provision of services, transfer of property rights), on account of which an advance payment (partial payment) was previously transferred, or upon return of an advance payment (partial payment) previously transferred on account of the shipment of goods (performance of work, provision of services, transfer property rights) (subclause 3, clause 3, article 170 of the Tax Code of the Russian Federation). This is due to the fact that when returning advances (partial payment), the organization does not incur expenses (Article 252 of the Tax Code of the Russian Federation), and when delivering as an advance payment (partial payment), the amount of VAT will be deducted (Article 171, paragraph 1 and 9, Article 172 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account when calculating income tax the amount of input VAT that cannot be deducted or included in the cost of purchased goods (work, services, property rights)?

No you can not.

Paragraph 1 of Article 170 of the Tax Code of the Russian Federation states that input VAT does not reduce the tax base for income tax. With the exception of input tax included in the cost of purchased goods (work, services, property rights). In this case, input VAT is taken into account when calculating income tax as part of the cost of goods (work, services, property rights).

If the requirements of Articles 171 and 172 of the Tax Code of the Russian Federation are met, input VAT can be deducted.

In other cases (if the tax cannot be deducted and included in the cost of purchased goods (work, services, property rights)), write off input VAT as expenses without reducing taxable profit.

For example, do this in the absence of invoices, without which input VAT is not accepted for deduction (clause 1 of Article 172 of the Tax Code of the Russian Federation).

– VAT is written off at the expense of the organization’s own funds.

Debit 99 subaccount “Fixed tax liabilities” Credit 68 subaccount “Calculations for income tax”

– a permanent tax liability is reflected from the written off amount of VAT.

In some cases, organizations using UTII must pay VAT (for example, if the organization erroneously allocated the tax amount in the invoice). However, the calculation and payment of VAT will not affect the calculation of UTII (Article 346.26 of the Tax Code of the Russian Federation).

If an organization combines a general taxation system and UTII, then organize separate accounting of income and input VAT amounts (clause 4 of article 170, clause 7 of article 346.26 of the Tax Code of the Russian Federation).

Do not take into account VAT amounts related to activities subject to UTII when calculating the amount of UTII. VAT amounts related to activities under the general taxation system should be taken into account in the manner prescribed for organizations applying the general taxation system.

We invite you to read: Until what date and year has free privatization been extended?

Account 68: tax postings

The Chart of Accounts and Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n) provide account 68 “Calculations for taxes and duties” to summarize information on settlements with the budget for taxes and duties. On the credit side of account 68, the accounting records reflect accrued or withheld amounts of taxes and fees, and on the debit side - amounts actually transferred to the budget or otherwise reducing the debt to it.

Analytical accounting for account 68 “Calculations for taxes and fees” is carried out by type of tax. This is achieved, as a rule, by opening separate sub-accounts to account 68.

Let us present in the tables the most typical accounting entries for the calculation of taxes or their withholding, as well as the reduction of tax debt to the budget (except for payment). Payment of taxes is reflected regardless of the type of taxes as follows:

Debit account 68 – Credit account 50 “Cash”, 51 “Settlement accounts”

In the case when the table shows several debited accounts, this means that the type of accounting entry depends on the characteristics of specific business transactions, the specifics of the organization’s activities and the provisions of its Accounting Policies for accounting purposes.

Postings for taxes and fees will be presented in the context of typical federal, regional and local taxes (Articles 13-15 of the Tax Code of the Russian Federation).

Calculations with the budget

Debit 68 subaccount “VAT calculations” Credit 51

– VAT paid.

Debit 51 Credit 68 subaccount “VAT calculations”

– the amount of VAT to be reimbursed is returned to the organization’s current account;

Debit 68 Credit 68 subaccount “VAT calculations”

– VAT amounts to be refunded are offset against the organization’s payments for other taxes.

This procedure follows from the Instructions for the chart of accounts (accounts 51, 68).

The tax accounting procedure for VAT depends on the taxation system that the organization uses.

Account 68 in accounting

Account 68 is credited for amounts according to tax returns or calculations in correspondence:

- Account 99 - for the amount of accrued income tax;

- Invoice 70 - for the amount of personal income tax;

- Accounts 20, 25, 26, 44 - for the amount of local taxes, transport tax, property tax, etc.;

- Accounts 90.3, 91.2, 76.AV - when calculating VAT for the reporting quarter;

- Invoice 51 - upon receipt of overpaid tax from the budget.

The debit of the account records the amounts of taxes actually transferred to the budget, including the amounts of VAT written off from account 19.

simplified tax system

As a general rule, organizations that use the simplified tax system do not pay VAT (Clause 2 of Article 346.11 of the Tax Code of the Russian Federation). Input VAT paid to suppliers is not accepted for deduction (subclause 1, clause 2, article 171 of the Tax Code of the Russian Federation). The amount of this tax may be taken into account when calculating the single tax (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

There are exceptions to the general rule. Simplified organizations are required to pay VAT in the following cases:

- when importing (clause 2 of article 346.11 of the Tax Code of the Russian Federation);

- if they conduct common affairs in simple partnerships, are trustees or concessionaires (clause 2 of article 346.11, article 174.1 of the Tax Code of the Russian Federation);

- if VAT is included as a separate line in invoices issued to customers. In this case, the presented amount of tax must be transferred in full to the budget (clause 5 of Article 173 of the Tax Code of the Russian Federation). But it is prohibited to include this amount in expenses when calculating the single tax (subclause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Change in deferred tax assets

The change in the value of IT recognized in accounting is determined as follows: Deductible temporary difference * Profit tax rate , where

They are recognized in the reporting period in which the recognized expenses (income) in accounting and tax accounting do not coincide.

The reason for the mismatch may arise due to the use of different methods, for example:

- In the case of using different methods for calculating depreciation of fixed assets;

- Recognized loss on sale of fixed assets. In accounting, a loss is reflected at a time, but in tax accounting, a loss is reflected over a certain period of time;

- Various ways to recognize business expenses in accounting and tax accounting;

- If, when accounting for expenses, the accrual method is used in accounting, and the cash method is used in tax accounting.

What does the debit of account 68 show?

The debit reflects information on transferring taxes to the budget or reducing tax liabilities in another way, for example, by deducting VAT. Thus, the debit accumulates the VAT amounts written off from account 19. The debit of account 68 shows (or rather, the final balance) that there is an overpayment of taxes. Let us dwell on the typical entries in the debit of account 68 in accordance with the chart of accounts approved by order of the Ministry of Finance dated October 31 .2000 No. 94n:

- Dt 68 Kt 50 (51, 52, 55) - payment of taxes in cash;

- Dt 68 Kt 19 - acceptance of VAT for deduction;

- Dt 68 Kt 66 (67) - tax debt is repaid through short-term (long-term) loans, for example, a budget payment was made through an overdraft.

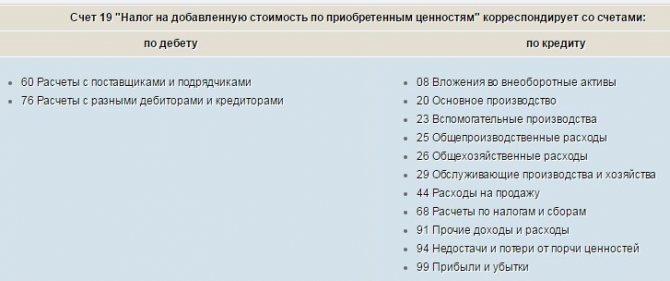

Account correspondence

Account 19 can participate in transactions with the following accounts.

Based on the debit of account 19, entries can be made to the credit of accounts:

- Account 60 - when accepting incoming VAT from a supplier for accounting;

- Account 76 - when accepting input VAT on other transactions that are not reflected in account 60.

Using the credit of the account, he can generate transactions with the debit of the following accounts:

- Account 08 - when writing off the amount of VAT that is not reimbursed from the budget for the costs of preparing a non-current asset for operation;

- Account 20 - when writing off the amount of VAT that is not reimbursed from the budget for the costs of main production;

- Account 23 - when writing off the amount of VAT that is not reimbursed from the budget for the costs of auxiliary production;

- Account 25 - when writing off the amount of VAT that is not reimbursed from the budget, general production costs;

- Account 26 – when writing off the amount of VAT that is not reimbursed from the budget for administrative (general business) costs;

- Account 29 – when writing off the amount of VAT that is not reimbursed from the budget for the costs of service and subsidiary farms;

- Account 44 – when writing off the amount of VAT that is not reimbursed from the budget for the costs of preparing goods for sale;

- Account 68 - when carrying out an offset with the output VAT tax;

- Account 91 - when writing off the amount of VAT that is not reimbursed from the budget, other expenses of the organization;

- Account 94 - when writing off the amount of VAT related to inventories that were recognized as a shortage, damaged, etc.;

- Account 99 - when writing off the amount of VAT related to inventories that were lost due to emergency events.

The deduction of VAT is reflected by standard posting Dt 68 (VAT) - Kt 19.

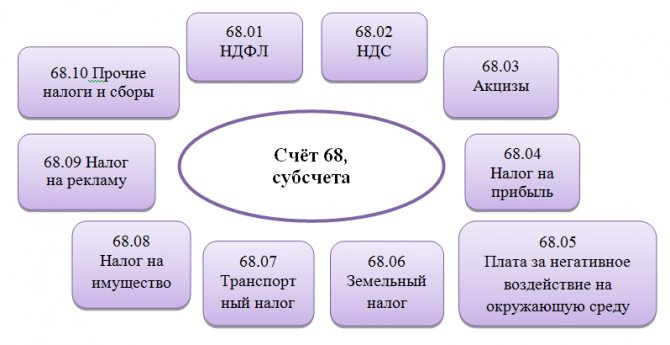

Subaccounts 68 “Calculations for taxes and fees”

Subaccounts under account 68 are used for taxes and fees paid by the company, depending on its chosen field of activity and tax regime. In this case, a separate sub-account is opened for each type of tax:

Additional sub-accounts can also be opened under account 68:

- 68.11 - UTII;

- 68.12 – simplified tax system;

- 68.13 – Trade fee.

Account 68 in accounting

Tax liabilities based on the results of economic activity are calculated using account 68. Each type of tax that an organization must transfer has its own subaccount.

According to the methods of calculation, the following types of taxes are distinguished:

- Property. They are paid for the ownership of any object - transport, land, property on the organization’s balance sheet. Taxes are calculated based on the value of the taxable base and do not depend on the results of the company’s activities.

- Indirect taxes are included in the cost of goods or services provided (VAT, excise taxes, customs duties). The final payer is considered to be the direct consumer.

- Taxes based on the results of economic activity. Calculated based on the profit received.

The credit of account 68 shows the accrued amounts that must be transferred to the budget. The data must coincide with the results of tax reporting - declarations, calculations. Debit 68 of account shows transactions to pay off debt or reduce the amount of tax liabilities.

Typical wiring

The main transactions for this account are presented in the table:

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

| Account Dt | Kt account | Wiring Description | A document base |

| 68 | 19 | Amounts of taxes actually transferred to the budget + VAT | Payment order |

| 68 | 50/51,52,55 | Payment of tax debts in cash or through a bank | Payment order |

| 70/75 | 68 | Personal income tax withheld from the income of employees or founders | Payslip |

| Based on settlement amounts for contributions to budgets | |||

| 99 | 68 | Income tax is reflected | Help-calculation |

| 70 | 68 | We reflect the amount of accrued personal income tax | Payslip |

| 90 | 68 | We reflect VAT, excise taxes, indirect taxes | Accounting information |

| 91 | 68 | We reflect financial results (operating expenses) | Certificate of calculation/Acceptance and transfer certificate |

Example 1. Postings to subaccount 68.01 “NDFL”

Let’s say that at the end of the month, at Osen LLC, an accountant assessed personal income tax on employee salaries in the amount of 107,256 rubles. Dividends were also paid to the founders, the tax amount was 65,123 rubles.

Postings for calculating personal income tax on account 68:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 70 | 68.01 | 107 256 | Personal income tax accrued on salary | Payslip |

| 75.02 | 68.01 | 65 123 | Personal income tax accrued on dividends | Tax card for personal income tax, accounting certificate |

| 68.01 | 51 | 107 256 | Personal income tax on wages transferred to the budget | Payment order |

| 68.01 | 51 | 65 123 | Personal income tax on dividends transferred to the budget | Payment order |

Example 2. Postings to subaccount 68.02 “VAT”

At Leto LLC based on the results of the 2nd quarter (core activities):

- VAT was charged in the amount of RUB 78,958;

- VAT accepted for deduction (advance) in the previous quarter in the amount of RUB 36,695 was restored;

- VAT on the sale of fixed assets amounted to RUB 7,959.

The accountant of Leto LLC reflected the accrual of VAT with the following entries:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 90.03 | 68.02 | 78 958 | VAT charged (sales) | Accounting information |

| 76 advance | 68.02 | 36 695 | VAT restored | Sales book |

| 91.02 | 68.02 | 7 959 | VAT charged (VAT) | Certificate of acceptance and transfer |

| 68.02 | 51 | 123 612 | The tax is transferred to the budget | Payment order |

Example 3. Postings to subaccount 68.04 “Income Tax”

To account for income tax calculations with the budget, subaccount 68.04.01 is used, and for tax calculations, a balance-free subaccount 68.04.02 is used, which is closed on account 68.04.01 at the end of the period.

Income tax is calculated on an accrual basis, taking into account advances of the reporting periods: quarter, 06 and 09 months and based on the results of the tax period - calendar year.

Let’s say that at the end of the reporting period, quarter, Vesna LLC made a profit, the tax on which amounted to 310,000 rubles. and was transferred to the budget.

The accountant of Vesna LLC generated the following entries for subaccount 68.04 “Income Tax”:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 99 | 68.04.02 | 310 000 | The amount of income tax accrued | Help-calculation |

| 68.04.01 | 51 | 310 000 | The tax amount is transferred to the budget | Payment order |

Reinstatement of input VAT

Debit 19 Credit 68 subaccount “Calculations for VAT”

– VAT previously accepted for deduction has been restored;

https://www.youtube.com/watch?v=ytcopyrightru

Debit 91-2 Credit 19

– the restored amount of VAT is written off.

An exception to this procedure is provided for the restoration of VAT on advances issued, when transferring property as a contribution to the authorized capital of another organization.

Situation: is it possible to take into account when calculating income tax the amount of input VAT recovered from shortfalls in excess of the norms of natural loss?

No you can not.

Losses of inventory items are recognized as economically justified only within the limits of natural loss norms (subclause 2, clause 7, article 254 of the Tax Code of the Russian Federation). There is no need to recover input VAT on such losses.

But excess losses of inventory and materials do not reduce taxable profit - such expenses of the organization are not economically justified and do not meet the criteria of paragraph 1 of Article 252 of the Tax Code of the Russian Federation. Consequently, the amounts of VAT that are recovered from the cost of goods (raw materials) lost in excess of the norms of natural loss should not be included in expenses when calculating income tax.

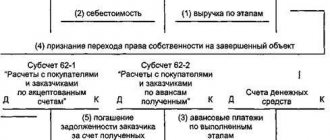

Situation: how can the buyer (customer) reflect in accounting the amount of input VAT presented by the supplier (performer) when transferring the advance payment (partial payment)?

Reflect VAT on a separate sub-account opened to account 76.

If the contract provides for advance payment (full or partial) for upcoming deliveries of goods (work, services), after receiving the advance, the seller (performer) is obliged to issue an invoice to the buyer (customer) for the amount received. He must do this within five calendar days after receiving the advance payment. This procedure is established by paragraph 3 of Article 168 of the Tax Code of the Russian Federation.

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances issued”

– VAT paid to the supplier as part of the advance payment is accepted for deduction.

Debit 19 Credit 60

– VAT on registered goods (works, services) is taken into account;

Debit 76 subaccount “Calculations for VAT on advances issued” Credit 68 subaccount “Calculations for VAT”

– VAT, previously accepted for deduction from the advance payment, has been restored;

Debit 68 subaccount “VAT calculations” Credit 19

– accepted for deduction of VAT on capitalized goods (works, services).

This order follows from the Instructions for the chart of accounts (accounts 19, 68, 60 and 76).

An example of reflecting input VAT in the buyer's accounting. The supply agreement provides for partial prepayment of goods

An agreement for the supply of goods was concluded between Alpha LLC (buyer) and Torgovaya LLC (seller). Alpha is a VAT payer and purchases goods for further resale.

According to the agreement, Hermes ships goods to Alpha on the terms of their partial advance payment. In March, Alfa transferred an advance in the amount of 118,000 rubles to the seller against the upcoming delivery. (including VAT – 18,000 rubles). In April, Alpha received goods supplied by Hermes. The cost of goods under the contract amounted to 236,000 rubles. (including VAT – 36,000 rubles).

The following entries were made in the buyer's account.

Debit 60 subaccount “Settlements on advances issued” Credit 51–118,000 rub. – an advance payment has been made towards the upcoming delivery of goods;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances issued” – 18,000 rubles. – VAT transferred to the supplier as part of the advance payment is accepted for deduction.

Debit 41 Credit 60 subaccount “Payments for goods” – 200,000 rubles. – goods are capitalized;

Debit 19 Credit 60 subaccount “Payments for goods” – 36,000 rubles. – VAT on goods received is taken into account;

https://www.youtube.com/watch?v=ytpressru

Debit 76 subaccount “Calculations for VAT on advances issued” Credit 68 subaccount “Calculations for VAT” – 18,000 rubles. – VAT previously accepted for deduction has been restored;

Debit 68 subaccount “Calculations for VAT” Credit 19–36,000 rub. – accepted for deduction of VAT on goods received;

Debit 60 subaccount “Payments for goods” Credit 60 subaccount “Settlements for advances issued” – 118,000 rubles. – the advance payment transferred to the supplier is credited;

Debit 60 subaccount “Payments for materials” Credit 51–118,000 rub. (236,000 rubles – 118,000 rubles) – the debt to the supplier is repaid.

An example of reflecting input VAT in the buyer's accounting. The supply agreement provides for full prepayment of the goods. After the advance payment is made, the contract is terminated

According to the agreement, Hermes ships goods to Alfa on the terms of full prepayment. In March, Alfa transferred an advance in the amount of 118,000 rubles to the seller against the upcoming delivery. (including VAT – 18,000 rubles). Hermes did not ship the goods on time. In May, the contract is terminated (due to non-compliance with its terms by the supplier). Hermes returns the advance payment to the buyer.

Debit 60 subaccount “Settlements on advances issued” Credit 51–118,000 rub. – full prepayment for the upcoming delivery of goods has been transferred;

Debit 51 Credit 60 subaccount “Settlements for advances issued” – 118,000 rubles. – the advance was returned by the supplier;

Debit 76 subaccount “Calculations for VAT on advances issued” Credit 68 subaccount “Calculations for VAT” – 18,000 rubles. – VAT, previously accepted for deduction, has been restored.

Situation: how to reflect in accounting the restoration of VAT when transferring property as a contribution to the authorized capital of another organization?

Organizations transferring and receiving property reflect the recovered VAT amounts differently.

Debit 58 Credit 19

– the amount of VAT recovered upon transfer of property as a contribution to the authorized capital of another organization is taken into account.

Debit 19 Credit 83

– VAT on property received as a contribution to the authorized capital of the organization is taken into account.

This point of view is reflected in the letter of the Ministry of Finance of Russia dated October 30, 2006 No. 07-05-06/262.

Advice: there are arguments that allow you to take into account VAT recovered when transferring property as a contribution to the authorized capital of another organization as part of other expenses (income). They are as follows.

This is what paragraph 16 of clause 11 of PBU 10/99 allows you to do.

We suggest you familiarize yourself with: How the buyer’s invoice is drawn up

Account 83 “Additional capital” takes into account:

- increase in the value of non-current assets during their revaluation;

- the amount of the difference between the sale and par value of shares when forming the authorized capital of a joint-stock company.

Debit 19 Credit 91-1

This is what paragraph 15 of clause 7 of PBU 9/99 allows you to do.

https://www.youtube.com/watch?v=ytcreatorsru

An example of how VAT recovery is reflected in accounting and taxation when transferring property as a contribution to the authorized capital of another organization

In February, Alpha LLC purchased materials in the amount of 47,200 rubles. (including VAT 18% - 7200 rubles). In the same month, the organization accepted input VAT on materials for deduction. In April, Alpha acquired a share in the authorized capital of Torgovaya LLC in the amount of 50,000 rubles. As a contribution to the authorized capital, the organization transferred the materials purchased in February.

Debit 10 Credit 60–40,000 rub. – purchased materials are taken into account;

Debit 19 Credit 60–7200 rub. – VAT on purchased materials is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19–7200 rub. – VAT on materials is accepted for deduction.

Debit 58 Credit 76– 50,000 rub. – acquired a share in the authorized capital of another organization;

Debit 76 Credit 10–40,000 rub. – materials were transferred to pay for a share in the authorized capital of another organization;

Debit 19 Credit 68 subaccount “VAT calculations” – 7200 rubles. – VAT previously accepted for deduction has been restored;

Debit 58 Credit 19– 7200 rub. – VAT recovered when transferring materials to pay for a contribution to the authorized capital of another organization is taken into account;

Debit 76 Credit 91-1– 10,000 rub. (50,000 rubles – 40,000 rubles) – income from the transfer of materials to pay for a share in the authorized capital of another organization is reflected.

Debit 68 subaccount “Calculations for income tax” Credit 99 subaccount “Permanent tax assets” – 2000 rubles. (RUB 10,000 × 20%) – a permanent tax asset is reflected.

Debit 19 Credit 60

Turnover balance sheet

A balance sheet (SAS) is an accounting document that contains information about the status of accounts as of the first day of the reporting period (month, quarter or year). It also contains information about the receipts and expenditures of funds at this time, as well as the status at the end of the reporting period. SALT can be monthly, quarterly and consolidated (12 months).

In the SALT for account 68, information is indicated on the balance at the beginning of the period for the debit and credit positions, the turnover of funds according to the instructions for their purpose, and then the results for D and Kt are summed up, with the subsequent withdrawal of the balance.

Features of accounting with examples and postings are presented below.

What to do if it is impossible to collect a claim

In certain cases, it is impossible to obtain amounts of penalties and fines. Such situations include:

- lapse of time;

- the court's decision;

- liquidation of the debtor;

- reaching agreement through negotiations.

The amounts of claims are written off from account 76 to the account of the reserve for doubtful debts or to financial results (clause 77 of the Accounting Regulations, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

Gamma LLC entered into a purchase and sale agreement for materials with Delta LLC for a total amount of 100,000 rubles. Delta LLC is not a VAT payer.

In accordance with the terms of the agreement, Gamma LLC transferred a 50% advance to:

Dt 60 Kt 51 - 50,000 rub. (advance paid).

After the materials were delivered to the buyer, it turned out that the goods were worth 10,000 rubles. defective. The seller received a claim for this amount:

Dt 76/2 Kt 60 - 10,000 rub. (a claim has been made).

The management of Delta LLC got acquainted with the buyer’s requirements and decided to satisfy them, but not in full, but only for the amount of 8,000 rubles, since the goods were worth 2,000 rubles. was not defective, the buyer’s comments to it were unfounded:

- Dt 51 Kt 76/2 — 8,000 rub. (received based on the submitted claim);

- Dt 60 Kt 76/2 — 2,000 rub. (a claim not satisfied by the seller has been written off).

Examples of wiring for dummies

Let's consider situations regarding the calculation and payment of various taxes

simplified tax system

| Debit | Credit | Type of transaction |

| 99 | 68/USN | An advance payment (tax) has been calculated according to the simplified tax system |

| 68/USN | 51 | Advance payment (tax) has been paid |

Personal income tax

| Debit | Credit | Type of transaction |

| 70 | 68/NDFL | Payroll tax withheld |

| 73 | 68/NDFL | Deduction made from financial assistance |

| 75 | 68/NDFL | Deductions were made from employee dividends |

| 84 | 68/NDFL | A withholding was made from dividends of a third party |

| 68/NDFL | 51 | Personal income tax transferred to the budget |

VAT on sales of goods

| Debit | Credit | Type of transaction |

| 41 | 60 | Purchased goods for resale |

| 19 | 60 | Incoming VAT reflected |

| 68/VAT | 19 | VAT credited |

| 62 | 90/1 | Product sold to buyer |

| 90/2 | 41 | Cost of goods sold written off |

| 90/3 | 68/VAT | VAT tax charged on the sale of goods |

| 68/VAT | 51 | Tax paid to the budget |

Commission agreements

Calculations under commission agreements are also carried out in accounting using account 76. In this case, analytical accounting is carried out for each agreement separately. The principal, the seller of goods, makes the following entries:

- Dt 45 Kt 41 - goods transferred to the commission agent;

- Dt 76 Kt 68 - allocated VAT on the advance received by the commission agent from the buyer;

- Dt 76 Kt 90 - revenue received by the commission agent;

- Dt 90 Kt 45 - sold goods are written off;

- Dt 90 Kt 68 - VAT is charged on the amount of revenue;

- Dt 68 Kt 76 - VAT on advance to be deducted;

- Dt 44 Kt 76 - the intermediary's commission is included in sales expenses;

- Dt 19 Kt 76 - VAT is allocated from the commission amount;

- Dt 68 Kt 19 - VAT on commission to be deducted;

- Dt 51 Kt 76 - money received from the commission agent.

NOTE! Revenue under such contracts is recognized in full, that is, it is not reduced by commission and additional fees. intermediary income.

For information on how to correctly account for VAT and prepare documents during intermediary transactions, read the article “How to prepare invoices when selling goods through an intermediary?” .

When concluding agency agreements, accounting is also maintained using account 76. You can read more in the article “Features of an agency agreement in accounting.”