Documenting

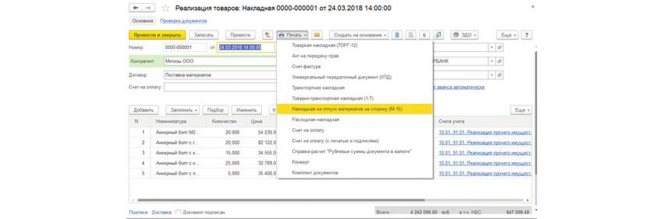

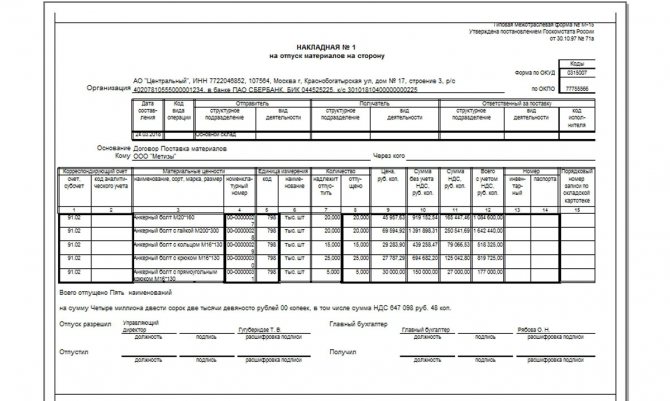

For the sale of materials, fill out an invoice for the release of materials to the third party (form No. M-15) or a consignment note (form No. TORG-12).

When transporting materials to the buyer by road, additionally fill out a consignment note (Form No. 1-T). Such rules are established by paragraph 120 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n. If a specialized organization is involved for transportation purposes, then also issue a consignment note, which is equivalent to a contract for the carriage of goods (clause 2 of article 785 of the Civil Code of the Russian Federation, article 8 of the Law of November 8, 2007 No. 259-FZ, clause 6 of the Rules, approved by Decree of the Government of the Russian Federation of April 15, 2011 No. 272). If the organization is a VAT payer, issue an invoice to the buyer (clause 3 of Article 168 of the Tax Code of the Russian Federation).

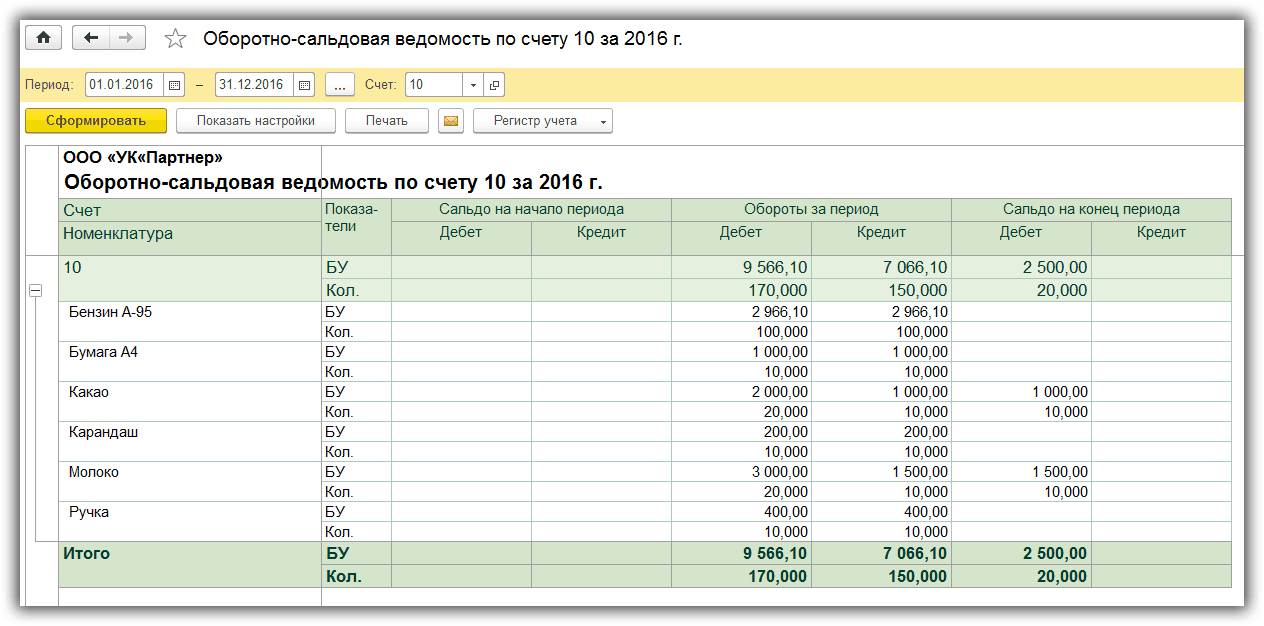

We check accounting entries

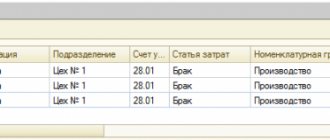

As a rule, the sale of inventories is not one of the main activities of organizations. To account for income and expenses from this operation, account 91 “Other income and expenses” is used. Postings for writing off the cost of retired materials generated by the sales document in 1C: Accounting 8 may look like this:

Fig. 12 Checking accounting entries

To fully reflect the business transaction, we present the entire set of transactions in the VAT payer organization.

- The cost of material assets sold is written off as other expenses:

- D91.02 (by types of other expenses) – K 10 (by types of materials, storage locations).

- The buyer's revenue from the sale of material assets is reflected:

- D62.01 (by counterparty, agreement) – K 91.01 (by types of other income).

- VAT accrued on the sale of material assets:

- D90.03 – K 68.02.

The sale of any type of inventory is confirmed by standardized printed forms of documents. The sale is accompanied by an invoice for the release of materials to the third party in form M-15; it can be generated from the sales document:

Fig. 13 Invoice for issue of materials to the side

Fig.14 M-15

Accounting

In accounting, income and expenses associated with the sale of materials are classified as other income and expenses (paragraph 6, paragraph 7, PBU 9/99, paragraph 5, paragraph 11, PBU 10/99). Record the sale using the following entries:

Debit 91-2 Credit 10

– the cost of materials sold is written off;

Debit 91-2 Credit 23 (20, 60...)

– expenses related to the sale of materials are written off (for example, transportation costs);

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT is charged on sales (if the transaction is subject to this tax);

Debit 62 (76, 73...) Credit 91-1

– sales of materials are reflected (as of the date of transfer of ownership).

Transfer of title after shipment

If the contract provides for a special procedure for the transfer of ownership (later shipment), then reflect the sale of materials in accounting using account 45 “Goods shipped.” The postings in this case will look like this:

Debit 45 Credit 10

– materials were transferred to the buyer;

Debit 45 Credit 23 (20, 60...)

– expenses related to the sale of materials are written off (for example, transportation costs);

Debit 76 Credit 68 subaccount “VAT calculations”

– VAT is charged on the cost of shipped materials (if the operation is subject to this tax);

Debit 91-2 Credit 45

– the cost of materials was written off as of the date of transfer of ownership (sales), including costs associated with the sale;

Debit 62 (76, 73...) Credit 91-1

– sales of materials are reflected (as of the date of transfer of ownership);

Debit 91-2 Credit 76

– VAT is reflected on sales proceeds.

Sale of materials: list of possible transactions

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| The first event is the shipment of materials | ||||

| 91.02 | 10 | 187 000 | Materials are written off from the enterprise's warehouse at their actual cost. Write-off of materials is carried out using three methods: - by weighted average; - FIFO; - by the actual cost of each unit | Vacation invoice |

| 62.01 | 91.01 | 250 000 | Revenue from the sale of materials is shown. The selling price is specified in the sales contract | Invoice, sales contract |

| 91.02 | 68.02 | 45 000 | The VAT amount for the purchase and sale of materials transaction is displayed (250,000 * 18% = 45,000) | Invoice |

| 51 (50) | 62.01 | 250 000 | Payment received for shipped material | Bank statement |

| 91.09 | 99 | 18 000 | Profit received from the sale of materials (250,000 – 45,000 – 187,000 = 18,000) | |

| The first event is the buyer's prepayment | ||||

| 51 | 62.02 | 100 000 | Advance payment received from buyer | Bank statement |

| 76.AB | 68.02 | 18 000 | A tax liability has been accrued on the amount of the prepayment received (100,000 * 18% = 18,000) | Invoice, bank statement |

| 91.02 | 10 | 144 000 | Materials are written off from the enterprise's warehouse at their actual cost. Write-off of materials is carried out using three methods: - by weighted average; - FIFO; - by the actual cost of each unit | Vacation invoice |

| 62.01 | 91.01 | 200 000 | Revenue from the sale of materials is shown. The selling price is specified in the sales contract | Invoice, sales contract |

| 91.02 | 68.02 | 36 000 | The VAT amount for the purchase and sale of materials transaction is displayed (200,000 * 18% = 36,000) | Invoice |

| 62.01 | 62.02 | 100 000 | Settlement of previously received prepayment | Accounting certificate-calculation |

| 68.02 | 76.AB | 18 000 | Offsetting VAT on the prepayment amount (100,000 * 18% = 18,000) | |

| 51 (50) | 62.01 | 100 000 | The remaining amount of money for the shipped material has been received | Bank statement |

| 91.09 | 99 | 20 000 | Profit received from the sale of materials (200,000 – 36,000 – 144,000= 20,000) |

Methods for assessing materials

To determine the price of materials being written off (i.e., the amount that is written off from account 10), use one of the methods for valuing them:

- at the cost of each unit of inventory;

- FIFO;

- at average cost.

The choice of method for estimating the cost of written-off materials is fixed in the accounting policy for accounting purposes.

Such rules are established by paragraph 73 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Is it possible to reclassify materials into goods and vice versa?

Question: An organization purchases materials for production. Some of these materials are not used. Is it possible to move them from account 10 to account 41 and sell them as goods? Does the organization have the right to sell materials purchased for production? And is it possible to perform the reverse operation: to use in production goods intended for sale?

Answer: An organization can reclassify materials recorded on account 10 into goods recorded on account 41, and vice versa. The organization has the right to sell materials purchased for production.

Rationale: Materials listed on account 10 “Materials” and goods reflected on account 41 “Goods” belong to the same category of assets - inventories <*>.

As a rule, materials recorded on account 10 are considered inventories, i.e. inventories used in production <*>. In turn, goods posted to account 41 are assets that are recognized as the organization’s reserves and are acquired for the purpose of further sale, i.e. intended for sale <*>.

However, the owner organization has the final say on how to use said assets.

Over time, the direction of their use may change due to various circumstances. Thus, an asset purchased for sale (goods), but not sold due to, for example, lack of demand, can be used in production, management, etc. Conversely, an asset purchased for production purposes or the needs of the organization can be sold.

In this regard, by decision of the manager, the organization can reclassify assets: transfer assets from account 10 to goods in account 41 and, conversely, include goods from account 41 in materials in account 10. This business operation is documented with a primary accounting document, for example, an act on transfer of goods into materials (materials into goods). Such a document must contain mandatory details <*>.

Note It should be noted that in Appendices 10, 24 to Instruction No. 50 there is no entry: D-t 41 - K-t 10. However, if an organization carries out business operations in the course of its activities, the correspondence of accounts for which is not established by Instruction No. 50, has the right to make entries based on the content of the business operation <*>.

Thus, the reclassification of assets in our situation will be recorded in the following entries:

| Contents of operation | Debit | Credit |

| The transfer of an asset from materials to goods is reflected | 41 | 10 |

| The transfer of an asset from goods to materials is reflected | 10 | 41 |

At the same time, I would like to draw attention to the following. If an organization needs to sell materials, it is not necessary to reclassify them. You can simply show the implementation from count 10 <*>.

Read this material in ilex >>*

*following the link you will be taken to the paid content of the service

Deviations from book value

If an organization accounts for materials using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets,” when they are sold, the amount of deviations from the accounting value of materials must be written off. This must be done at the end of the month, when the cost of materials received for the month and the amount of deviations from it will be known. To do this, it is necessary to determine the average percentage of deviations related to written-off materials using the formula:

| Average percentage of deviations related to write-off materials | = | The balance of deviations in cost at the beginning of the month + The amount of deviations for materials received during the month ______________________________________________________________________ | × | 100% |

| Cost of the balance of materials at the beginning of the month (in accounting prices) + Cost of materials received during the month (in accounting prices) |

After calculating the average percentage, determine the amount of cost variances that is written off to the cost of materials sold. To do this, use the formula:

| The amount of variances written off to the cost of materials sold | = | Average percentage of deviations related to write-off materials | × | Accounting value of materials written off |

In accounting, document this transaction by posting:

Debit 91-2 (45) Credit 16

– part of the deviations in the cost of materials is written off (at the end of the month) if the organization uses accounting prices.

This procedure is provided for in paragraph 87 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

The procedure for paying taxes when selling materials depends on the taxation system that the organization uses.

Postings for receipt and disposal of materials

There are several ways for materials to enter an organization: acquisition for a fee, acceptance as a contribution from the founders, production of materials, free receipt, etc.

Depending on the method of receipt, the following postings for materials appear in accounting.

| Debit | Credit | Contents of operation |

| 10 | 60, 76 | Receipt of the invoice from the supplier; Wholesale supply of goods is carried out under a sales contract |

| 10 | 71 | Acquisition of inventories by an accountable person |

| 10 | 75 | Founder's contribution; the estimated value of the property must be agreed upon with the person contributing the property |

| 10 | 91 | Reflected gratuitous receipt; In this case, the market value of the material is taken as the amount. A similar posting is made when taking into account materials received during the dismantling of fixed assets |

If upon receipt the cost of the material includes VAT, then its amount is reflected in a separate line.

Example 3

Motiv LLC purchased a batch of paper (100 packs) for office needs using an invoice for a total amount of 18,000 rubles, including VAT 20% of 3,000 rubles. The organization made the following entries:

| Debit | Credit | Amount, rub. | Contents of operation |

| 10.6 | 60 | 15 000 | A batch of paper has arrived |

| 19.3 | 60 | 3 000 | The amount of input VAT is reflected |

| 68.2 | 19.3 | 3 000 | VAT amount accepted for refund |

| 60 | 51 | 18 800 | Payment was made to the supplier through a bank account |

For more information on the formation of VAT when purchasing inventories, see the material “How is VAT recorded on purchased assets?” .

If an organization applies a tax regime that excludes the use of VAT (for example, the simplified tax system), then the entire cost of materials should be credited to account 10. In this case, VAT does not apply to refundable taxes, but is taken into account when determining the cost price.

The release of inventories to third parties can be carried out for the following number of reasons:

| Debit | Credit | Contents of operation |

| 20, 23, 25, 26, 29, 44 | 10 | Issue from a warehouse for production or general business needs of the organization; transfer is carried out using limit-fence cards or requirements-invoices |

| 94 | 10 | The gratuitous write-off of materials as a result of damage or theft is reflected. As a rule, a lack of food supplies is identified as a result of an inventory; an act of write-off of materials is drawn up |

| 99 | 10 | The materials were lost due to a natural disaster; the transaction is reflected using a write-off statement |

| 91 | 10 | Reflection of the transfer (sale) of materials to the third party; actual cost is used |

BASIC: income tax

When calculating income tax, proceeds from the sale of materials are recognized as income from sales (Article 249 of the Tax Code of the Russian Federation). Determine the date of receipt of revenue depending on the chosen accounting method:

- under the accrual method, the moment of receipt of income is the date of transfer of ownership of materials (clause 3 of Article 271 of the Tax Code of the Russian Federation);

- under the cash method, revenue is recognized at the time of receipt of payment for shipped materials (clause 2 of article 273 of the Tax Code of the Russian Federation). The advance payment (advance payment) received from the buyer (customer) is also included in income at the time of receipt (clause 2 of Article 273, subclause 1 of clause 1 of Article 251 of the Tax Code of the Russian Federation). This rule applies despite the fact that the materials have not yet actually been transferred to the buyer (clause 8 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98).

Revenue from the sale of materials can be reduced in tax accounting:

- for expenses associated with the sale of materials sold (these include costs of storage, packaging, maintenance and transportation) (subclause 3, clause 1, article 268 of the Tax Code of the Russian Federation);

- on the price of acquisition (creation) of these materials according to tax accounting data (subclause 2, clause 1, article 268 of the Tax Code of the Russian Federation).

When selling materials, determine their cost, included in expenses, based on the actual costs of their acquisition or creation (subclause 2, clause 1, article 268 of the Tax Code of the Russian Federation). This means that FIFO and average cost valuation methods cannot be used in this case.

If materials are sold that are received free of charge and (or) as a result of repair, modernization, reconstruction, technical re-equipment, liquidation (full or partial) of fixed assets, or identified as surplus during inventory, then the costs can take into account their market value at which they were recorded as part of non-operating income (clause 2 of article 254 of the Tax Code of the Russian Federation).

Recognize expenses in the form of cost of materials sold:

- when calculating income tax using the accrual method at the time of transfer of ownership to the buyer (sale) (clause 1 of Article 272 of the Tax Code of the Russian Federation);

- when calculating income tax using the cash method during the period when two conditions are met: the materials are paid to the supplier and sold, that is, payment is received from the buyer (clause 3 of Article 273, subclause 3 of clause 1 of Article 268 of the Tax Code of the Russian Federation). For more information about this, see How to take into account income and expenses when selling purchased goods for income tax purposes.

BASIS: VAT

Proceeds from the sale of materials are subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). For more information about this, see How to calculate VAT on the sale of goods (work, services).

Situation: how can an organization’s accounting on OSNO reflect the receipt and use (write-off) of materials obtained as a result of disassembling a sample product? The order for further production of this product has been cancelled.

When calculating income tax, non-operating income must include the cost of materials received during the dismantling (dismantling, liquidation) of fixed assets being taken out of service (Clause 13, Article 250 of the Tax Code of the Russian Federation). At the same time, the list of non-operating income is open. Therefore, the cost of materials (parts) obtained during dismantling of property that is not a fixed asset, within the meaning of Article 250 of the Tax Code of the Russian Federation, should also be taken into account as part of non-operating income.

Such income must be reflected at the time the materials (parts) arrive at the warehouse (when drawing up an invoice in form No. M-11) (subclause 1, clause 4, article 271, clause 2, article 273 of the Tax Code of the Russian Federation). Include the property obtained as a result of disassembly into income at market value, which is determined according to the rules of Article 105.3 of the Tax Code of the Russian Federation (clause 5 of Article 274 of the Tax Code of the Russian Federation).

When using (recycling, scrapping) materials (parts) obtained from disassembling a sample of finished products, the following must be taken into account. In expenses when calculating income tax, you can take into account the value of property received during the dismantling and disassembly of fixed assets being decommissioned (paragraph 2, paragraph 2, article 254 of the Tax Code of the Russian Federation). At the same time, materials obtained during dismantling of property that is not a fixed asset are not subject to these standards. Upon receipt of such materials, the organization has no expenses for the acquisition of property that could be taken into account when determining its value in accordance with the provisions of Article 254 of the Tax Code of the Russian Federation. Thus, with the further use (disposal, scrap metal) of materials (parts) obtained during disassembly of a sample product, it is impossible to take their cost into account when calculating income tax.

A similar position is reflected in letters of the Ministry of Finance of Russia dated October 21, 2009 No. 03-03-05/188 and the Federal Tax Service of Russia dated November 23, 2009 No. 3-2-13/227.

Advice : in order to take into account the cost of materials obtained during disassembly of a sample of finished products during their further sale (sale as scrap metal) when calculating income tax, carry out an inventory.

Capitalize the materials (parts) obtained as a result of disassembly as surpluses identified during the inventory (clause 20 of Article 250 of the Tax Code of the Russian Federation). Then, with the further sale of such materials (parts), the cost at which they were capitalized can be taken into account in expenses when calculating income tax (paragraph 2, paragraph 2, article 254, subparagraph 2, paragraph 1, article 268 of the Tax Code of the Russian Federation) .

The costs that the organization incurred when disposing of a sample of finished products are also not taken into account when calculating income tax. This is due to the fact that expenses that reduce taxable profit must meet the criteria established in paragraph 1 of Article 252 of the Tax Code of the Russian Federation. In particular, they must be produced for an activity aimed at generating income. The costs of recycling parts obtained from disassembling a sample of finished products, the production order of which has been cancelled, cannot be considered aimed at generating income. The financial department holds a similar opinion in a similar situation (letter of the Ministry of Finance of Russia dated March 2, 2010 No. 03-03-06/1/105).

The amount of “input” VAT previously accepted for deduction from the cost of parts that the organization subsequently disposes of (sells for scrap metal) must be restored (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation). This is because the parts are used in VAT-free transactions:

- disposal of property for reasons not related to sale (free transfer) (Articles 39 and 146 of the Tax Code of the Russian Federation);

- sale in Russia of scrap and waste of ferrous and non-ferrous metals (subclause 25, clause 2, article 149 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated August 16, 2006 No. 03-1-03/1562).

Therefore, the amount of “input” tax on the cost of materials (parts) obtained from disassembly and subsequently written off for scrap (sold as scrap) needs to be restored. In a similar situation, regulatory agencies hold a similar opinion (letters of the Ministry of Finance of Russia dated March 18, 2011 No. 03-07-11/61, dated September 1, 2008 No. 03-07-07/84, dated November 1, 2007 No. 03-07-15/175 and the Federal Tax Service of Russia dated November 20, 2007 No. ШТ-6-03/899).

An example of reflecting the sale of materials in accounting and taxation

Alpha LLC sells 100 packs of over-purchased A4 paper. The actual cost of these materials is 60 rubles. per pack. The sales price for 100 packs under the contract is 9,440 rubles. (including VAT - 1440 rubles). Alpha calculates income tax using the accrual method. She evaluates materials in accounting based on the actual cost per unit of inventory. The organization maintains accounting for the cost of materials without using accounts 15 and 16. In the city where the organization is registered, retail trade has not been transferred to UTII.

Alpha's accountant made the following entries in accounting:

Debit 62 Credit 91-1 – 9440 rub. – sales of materials are reflected;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 1440 rubles. – VAT is charged;

Debit 91-2 Credit 10 – 6000 rub. (60 rubles/piece × 100 pieces) – the cost of the issued paper is written off;

Debit 91-9 Credit 99 – 2000 rub. (9440 rubles – 1440 rubles – 6000 rubles) – profit from the sale of paper is reflected.

When calculating income tax, Alpha's accountant took into account income in the amount of 8,000 rubles. (9440 rubles – 1440 rubles) and expenses in the amount of 6000 rubles.

The cost of materials sold is written off at accounting prices.

{amp}gt;

accounting {amp}gt; Accounting for the disposal of materials from the organization to the outside How do materials leave the organization? Just as in the case of fixed assets, materials can be disposed of as a result of sale, gratuitous transfer (donation), as well as when materials are contributed to the authorized capital of another enterprise.

In this article we will look at the full cycle of accounting for materials in 1C Accounting 8.3: from program settings to writing off materials.

All materials in accounting are on the tenth account. Depending on their type, a specific subaccount is selected. If you go to the accounting chart of accounts, you can see that they have a subaccount “Nomenclature”. The same in our situation, warehouses with shipments are also displayed there.

The accounting account can be set both for a specific item item and for the group as a whole. Typically, a “Materials” group is created for such purposes. In our case, we set its score to 10.01.

The figure below shows an example of the rules for determining accounting accounts for the “Nails” item. In the first line of the tabular part, you see that the account 10.01 will be applied to all items that are included in the “Materials” group, including our nails.

The very first action when organizing materials accounting in 1C 8.3 is to reflect their receipt. You can find this document in the “Purchases” menu by clicking on the “Receipts (acts, invoices)” hyperlink.

Our receipt document will have the type of transaction “Goods (invoice)”. In the header we indicate that our organization “Roga LLC” purchases materials from . We will take into account all purchased goods in the main division.

Next, fill out a table where you need to list all purchased goods with their prices and quantities. This can be done either manually or in semi-automatic mode (with display of balances) using the “Selection” button.

In our case, the accounting account was entered correctly everywhere - 10.01 due to the fact that all these positions are in the corresponding nomenclature group. This document allows you to manually edit accounts in the table itself if necessary.

Let's go through the document and look at the postings. Here everything was formed correctly. All materials went to account 10.01 with the corresponding subaccounts.

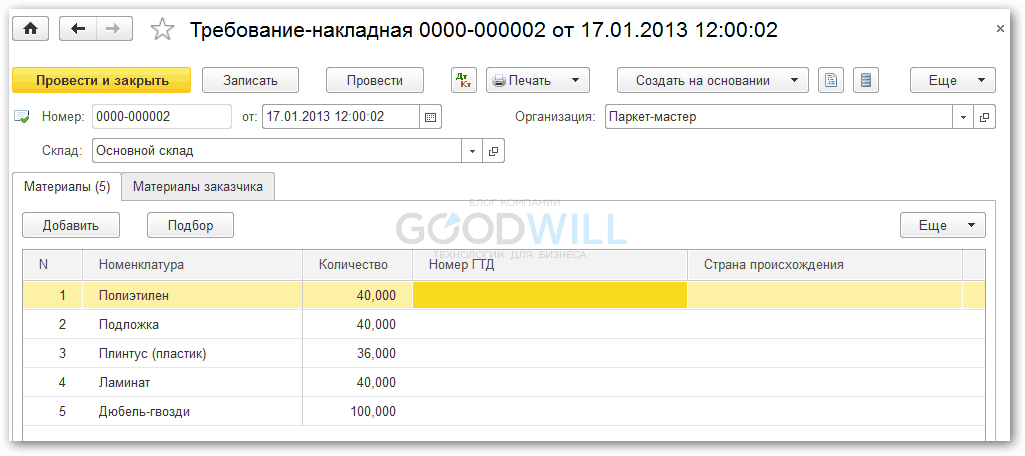

We will produce something from previously received materials. To do this, the program needs to reflect the transfer of materials to production and write them off as costs. The “Request-invoice” document performs these actions. You can find it in the “Production” or “Warehouse” menu.

In the header of the document we will indicate our organization and warehouse. In the tabular part on the “Materials” tab we list three items: boards, varnish and nails. If you want cost accounts to be different for items, check the “Cost account on the “Materials” tab” flag.

In this case, the “Cost Account” tab in the document will disappear and this tab will display columns in which you indicate this data, but for each specific item separately. In this example, all materials will have a single account.

Let's move on to the next tab, on which we will indicate a single account for all transferred item items: 20.01. We will also indicate here that the costs will be attributed to the production department and indicate the cost item.

In this example, we will not fill out the last tab – “Customer Materials”. Let's assume that we produce only from our own materials without involving third parties.

After posting the document, we can open its postings and verify that they are formed correctly.

This procedure is provided for in paragraph 87 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n. The procedure for paying taxes when selling materials depends on the taxation system that the organization uses.

Info

BASIC: income tax When calculating income tax, proceeds from the sale of materials are recognized as income from sales (Article 249 of the Tax Code of the Russian Federation). Determine the date of receipt of revenue depending on the chosen accounting method:

- under the accrual method, the moment of receipt of income is the date of transfer of ownership of materials (clause

3 tbsp. 271

Tax Code of the Russian Federation);

- under the cash method, revenue is recognized at the time of receipt of payment for shipped materials (clause 2 of article 273 of the Tax Code of the Russian Federation).

The advance payment (advance payment) received from the buyer (customer) is also included in income at the time of receipt (clause 2 of Article 273, subclause 1 of clause 1 of Article 251 of the Tax Code of the Russian Federation).

Important

At the same time, the organization develops and approves accounting prices, for example, average purchase prices or planned costs. It is at these accounting prices that materials are debited to account 10.

To reflect the actual cost, additional account 15 “Procurement and acquisition of material assets” is used. The actual cost of the valuables received is reflected in the debit of account 15 in correspondence with the account.

60, while wiring D15 K60 is performed. If the organization is a VAT payer, then the tax amount is allocated to account 19, and the materials are charged at cost without VAT. After this, the materials are credited directly to account 10, but at accounting prices, and posting D10 K15 is performed.

Capitalize the materials (parts) obtained as a result of disassembly as surpluses identified during the inventory (clause 20 of Article 250 of the Tax Code of the Russian Federation). Then, with the further sale of such materials (parts), the cost at which they were capitalized can be taken into account in expenses when calculating income tax (para.

2 p. 2 art. 254, sub. 2 p. 1 art. 268

Tax Code of the Russian Federation). The costs that the organization incurred when disposing of a sample of finished products are also not taken into account when calculating income tax. This is due to the fact that expenses that reduce taxable profit must meet the criteria established in paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

In particular, they must be produced for an activity aimed at generating income.

This employee must check the actual quantity with that indicated in the accompanying documents (bill of lading, delivery note). In addition, the condition of the received valuables, their serviceability, and expiration date are checked. If discrepancies in quality or quantity are detected, a discrepancy report is drawn up in form M-7, the completed report, along with the claim, is sent to the supplier for the return of the valuables or for their replacement. When receiving materials from a supplier, their cost is entered in the debit of account 10 in correspondence with the account for accounting settlements with suppliers.

In general, the posting for the receipt of materials has the form D10 K60. If the buyer organization is a VAT payer, then VAT is allocated from the cost indicated in the accompanying documents by posting D19 K60, after which it is sent for deduction with posting D68.VAT K19.

VAT 91,525. Delivery cost was 6,000, including VAT 915 rubles. 3,000 cubic meters of parquet were put into production.

These transactions must be reflected on the balance sheet. Note: (How VAT is calculated from the amount can be found in the article: “How to calculate VAT. VAT tax rates.”). Transport and procurement work is accounted for on account 10 of the TZR subaccount. Working on the receipt of materials when purchasing the amount of the debate loan is the name of the operation 600,000 60 51 paid the value of the parquet parquet was capitalized excluding VAT VAT 6000 60 51 Paid delivery 5085 10 Sub -account TZR 60 Countns for delivery of Parquet 915 19 60 Distilized Materials for production 360000 20 10 TZR subaccount TZR written off for production TZR are written off once a month in one transaction.

When calculating the single tax, the Alpha accountant: - included 59,000 rubles in expenses in January. (including 50,000 rubles - the cost of 1,000 reams of paper, 9,000 rubles - VAT paid to the supplier when purchasing 1,000 reams of paper); - in March, included in income the proceeds from the sale of 100 reams of paper in the amount of 9,440 rubles. UTII An organization may have materials that: – were purchased externally; - were produced by the organization itself.

When selling materials that were purchased externally, an organization can apply UTII, but only in retail trade. As an object of taxation when calculating UTII, take into account imputed income (clause

1 tbsp. 346.29

Attention

Tax Code of the Russian Federation). For more information about this, see How to calculate the amount of UTII payable to the budget. When selling materials of your own production (manufacturing), UTII cannot be used.

This follows from paragraph 12 of Article 346.27 of the Tax Code of the Russian Federation.

The materials themselves are delivered to the warehouse at cost excluding VAT. It is worth recalling that in order to allocate VAT and send it for reimbursement from the budget, you need to receive an invoice from the supplier with the allocated tax amount.

Only if this document is available, the buyer has the right to allocate VAT to a separate account. The buyer pays the received and capitalized materials to the supplier in cash or non-cash funds, and postings D60 K50 or D60 K51 are reflected.

Upon receipt, materials can be received in two ways:

- at actual cost;

- at discounted prices.

Let's look at each of these methods in more detail. Capitalization of materials at actual cost This is the method of accounting that is most often found in enterprises.

At the same time, the organization sums up all the costs associated with the acquisition of valuables, and debits this amount to account 10. Materials located in the warehouses of the enterprise are not only subject to write-off for production, but also, if necessary, they can be sold externally. Let's look at how to reflect in transactions the sale of materials from account 10 on prepayment, as well as in the case of initial shipment and subsequent payment for materials.

Sales of materials: main nuances and features When selling materials, they are written off at sales prices, which are agreed upon by the parties in advance. Taxes are calculated and paid in accordance with the requirements of current legislation. When they are sold, an invoice is drawn up for the release of materials to the third party.

simplified tax system

If an organization applies a simplification, income from the sale of materials increases the tax base for the single tax (Clause 1 of Article 346.15, Article 249 of the Tax Code of the Russian Federation). Recognize income in the period in which it is paid. The date of receipt of income is the day the debt to the organization is repaid (the day money is received in a bank account or cash register, receipt of property, etc.). If a bill of exchange is received as payment, recognize income at the time it is paid or transferred by endorsement to a third party. This is stated in paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation.

If an organization pays a single tax on the difference between income and expenses, it can take into account the cost of materials as expenses immediately after actual payment (subclause 1, clause 2, article 346.17, clause 2, article 346.16, clause 1, article 252 of the Tax Code of the Russian Federation ). After the organization has decided to sell the materials, they acquire the status of goods (Clause 3 of Article 38 of the Tax Code of the Russian Federation). Therefore, include the proceeds from the sale of materials in the calculation of the tax base (clause 1 of Article 346.15 and clause 1 of Article 249 of the Tax Code of the Russian Federation). How revenue is determined, see What income is subject to a single tax under the simplified tax system.

An example of how sales of materials are reflected in accounting and taxation. The organization applies a simplification and calculates tax on the difference between income and expenses

In January, Alpha LLC purchased 1,000 packs of A4 paper for printing brochures. The cost of one pack is 59 rubles. (including VAT – 9 rubles). In the same month, payment was made to the supplier in full.

In February, Alpha used 500 reams of paper to print brochures.

In March, Alpha sells 100 packs of purchased paper. The actual cost of these materials is 59 rubles. per pack (including VAT - 9 rubles). The sales price for 100 packs under the contract is 9,440 rubles. "Alpha" evaluates materials in accounting at the actual cost of a unit of inventory. The organization maintains accounting for the cost of materials without using accounts 15 and 16.

Alpha's accountant made the following entries in the accounting.

In January:

Debit 10 Credit 60 – 59,000 rub. (1000 packs × 59 rubles) – paper is capitalized;

Debit 60 Credit 51 – 59,000 rub. – payment is transferred to the supplier for the purchased paper.

In February:

Debit 20 Credit 10 – 29,500 rub. (59 rubles × 500 pcs.) – paper is written off as an expense based on the materials consumption report.

In March:

Debit 62 Credit 91-1 – 9440 rub. – sales of 100 packs of A4 paper are reflected;

Debit 91-2 Credit 10 – 5900 rub. (59 rubles/piece × 100 pieces) – the cost of the issued paper is written off;

Debit 91-9 Credit 99 – 3540 rub. (9440 rubles – 5900 rubles) – profit from the sale of paper is reflected;

Debit 51 Credit 62 – 9440 rub. – payment has been received from the buyer for the sold paper.

When calculating the single tax, the Alpha accountant: - included 59,000 rubles in expenses in January. (including 50,000 rubles - the cost of 1000 reams of paper, 9000 rubles - VAT paid to the supplier when purchasing 1000 reams of paper); – in March, included in income the proceeds from the sale of 100 packs of paper in the amount of 9,440 rubles.

Sales of materials

Materials located in the warehouses of the enterprise are not only subject to write-off for production, but also, if necessary, they can be sold externally. Let's look at how to reflect in transactions the sale of materials from account 10 on prepayment, as well as in the case of initial shipment and subsequent payment for materials.

When selling materials, they are written off at selling prices that are agreed upon by the parties in advance. Taxes are calculated and paid in accordance with the requirements of current legislation.

When they are sold, an invoice is drawn up for the release of materials to the third party. The basis for its preparation is a contract or an issued invoice. If, when selling materials, an operation is carried out to transport them, then an additional waybill is drawn up.

When selling materials, account 91 is used, which allows you to summarize the amount of income from non-operating activities. It has several sub-accounts:

- other income (91-1);

- other expenses (91-2);

- balance of other income and expenses (91-3).

Get 267 video lessons on 1C for free:

- Invoice in form M-15, which authorizes the release of materials to the outside;

- An invoice and a sales contract are the basis for payment by the buyer;

- Consignment note – drawn up when carrying out cargo transportation of sold materials;

- Bank statement – confirms the receipt of funds.

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| The first event is the shipment of materials | ||||

| 91-02 | 10 | 187 000 | Materials are written off from the enterprise's warehouse at their actual cost. Write-off of materials is carried out using three methods: - by weighted average; - FIFO; - by the actual cost of each unit | Vacation invoice |

| 62-01 | 91-01 | 250 000 | Revenue from the sale of materials is shown. The selling price is specified in the sales contract | Invoice, sales contract |

| 91-02 | 68-1 | 45 000 | The VAT amount for the purchase and sale of materials transaction is displayed (250,000 * 18% = 45,000) | Invoice |

| 51 (50) | 62-01 | 250 000 | Payment received for shipped material | Bank statement |

| 91-09 | 99 | 18 000 | Profit received from the sale of materials (250,000 – 45,000 – 187,000 = 18,000) | |

| The first event is the buyer's prepayment | ||||

| 51 | 62-02 | 100 000 | Advance payment received from buyer | Bank statement |

| 76-AV | 68-2 | 18 000 | A tax liability has been accrued on the amount of the prepayment received (100,000 * 18% = 18,000) | Invoice, bank statement |

| 91-02 | 10 | 144 000 | Materials are written off from the enterprise's warehouse at their actual cost. Write-off of materials is carried out using three methods: - by weighted average; - FIFO; - by the actual cost of each unit | Vacation invoice |

| 62-01 | 91-01 | 200 000 | Revenue from the sale of materials is shown. The selling price is specified in the sales contract | Invoice, sales contract |

| 91-02 | 68-2 | 36 000 | The VAT amount for the purchase and sale of materials transaction is displayed (200,000 * 18% = 36,000) | Invoice |

| 62-01 | 62-02 | 100 000 | Settlement of previously received prepayment | Accounting certificate-calculation |

| 68-2 | 76-AV | 18 000 | Offsetting VAT on the prepayment amount (100,000 * 18% = 18,000) | |

| 51 (50) | 62-01 | 100 000 | The remaining amount of money for the shipped material has been received | Bank statement |

| 91-09 | 99 | 20 000 | Profit received from the sale of materials (200,000 – 36,000 – 144,000= 20,000) |

Details Category: Selections from magazines for an accountant: 10/13/2014 00:00

Most companies have assets that meet the criteria for fixed assets and whose value does not exceed RUB 40,000. for a unit. These are tools, overalls, various equipment, etc.

Such objects are most often included in inventories (MPI) on the basis of paragraph 5 of PBU 6/01 “Accounting for fixed assets”. In this case, the value of the asset is reflected in account 10 “Materials”. Then, after commissioning, they are written off to one of the “cost” accounts (for example, account 26 or account 44).

At the same time, the cost of the object is reflected in the debit of the off-balance sheet account intended for accounting for inventory and household supplies in operation. This is necessary to control the safety of the asset, its movement between workshops, departments, etc.

DEBIT 62 CREDIT 91 subaccount “Revenue” - shows the proceeds from the sale of the asset; DEBIT 91 subaccount “Expenses” CREDIT 68 - VAT is charged on the sale of the asset; DEBIT 51 (or 50) CREDIT 62 - revenue received from the buyer

In tax accounting, it is also necessary to reflect income from sales and show them in the income tax return.

As for expenses in the form of the purchase price of a sold asset, they should not be shown either in accounting or tax accounting. The fact is that these costs were already taken into account at the time of transfer to operation, and repeated reflection will lead to a distortion of the tax base and financial results.

In practice, many accountants are not limited to the above entries. They create an additional operation, the essence of which is to restore previously written-off values on the balance sheet.

This is done due to the fact that a number of accounting programs do not provide for a standard transaction for the sale of “off-balance sheet” property. And in order to carry out such an implementation, one would have to create postings manually, which is extremely undesirable.

In addition, without a standard operation, the program cannot automatically generate a shipping invoice, and you have to issue this document yourself.

Therefore, in order to “deceive” the program, the asset is first debited to account 10 again, and only after that the sale is completed.

DEBIT 10 CREDIT 91 subaccount “Income” – 0.01 rub. — the asset is capitalized for sale;

DEBIT 91 subaccount “Expenses” CREDIT 10

– 0.01 rub. — the cost of the asset is written off

As a result, the program allows you to easily sell an object that is included on the balance sheet along with other materials. At the same time, all necessary transactions are created and a printed form of the shipping invoice is generated.

Companies that have the 1C Accounting 8 program installed also use the above technique, namely, they restore the “off-balance sheet” asset in account 10.

But they cannot do this with all assets, but only with regard to special clothing and special equipment. Such objects are returned to balance using the document “Return of materials from operation.”

If we are talking about inventory or household supplies, then return from use is not provided for them.

The only way that helps solve the problem is to use the “Sales of goods and services” document.

When creating it, in the “Account Account” tab, you should indicate the off-balance sheet account from which you want to write off the asset (as a rule, this is account MTs04). In the “Income Account” tab, you need to put account 91.01.

Then, using this document, a posting will appear in accounting reflecting the receipt of income in the form of revenue for the sold object. At the same time, the object will be written off to the credit of an off-balance sheet account.

Here it is necessary to take into account one important nuance. When selling, the program must write off the same asset that was previously put into use.

To achieve this, when creating the “Sales of goods and services” document, the accountant must indicate the transfer document for operation as the second subconto to the MTs04 account. This can be done in manual adjustment mode.

Please note: there is no need to create the documents “Return of materials from service” and “Receipt of goods”.

Maintain accounting and tax records in a web service

| ★ Best-selling book “Accounting from Scratch” for dummies (understand how to do accounting in 72 hours) purchased by {amp}gt; 8000 books |

Materials are sold at market value including VAT. If the sale of materials is of a one-time nature, the income received from the sale of materials should be attributed to account 91 “Other income and expenses.” Details about the features of this account are written here. Expenses that accompanied the process of selling materials are also recorded in account 91.

The primary document on the basis of which the sale of goods occurs is the invoice for the release of materials to the third party, form M-15.

In accounting, entries to reflect income and expenses associated with the sale of materials are reflected on the basis of an invoice form M-15, as well as an invoice with allocated VAT and payment documents confirming the fact of payment from the buyer.

D62 K91/1 - revenue from the sale is reflected; D91/2 K68.VAT - VAT is charged on materials sold; D91/2 K10 - the cost of materials sold is written off; D91/9 K99 - the financial result from the sale is reflected; D51 K62 - payment received from buyer.

This means that employers who pay their employees at the minimum wage must raise their wages from May 1. {amp}lt; ... Absence from work is not always absenteeism. The employee fell ill, but did not warn the employer about it and does not get in touch. In such a situation, can the employer count the employee as absenteeism with all the ensuing consequences? {amp}lt;

UTII

An organization may have materials that:

– purchased externally;

- were produced by the organization itself.

When selling materials that were purchased externally, an organization can apply UTII, but only in retail trade. When calculating UTII, take into account imputed income as an object of taxation (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). For more information about this, see How to calculate the amount of UTII payable to the budget.

When selling materials of your own production (manufacturing), UTII cannot be used.

This follows from paragraph 12 of Article 346.27 of the Tax Code of the Russian Federation.

For more information, see:

- Who has the right to apply UTII;

- What types of retail trade are covered by UTII.