Early pension in case of staff reduction: size in 2021

The person himself expresses a desire for such registration, but recommendations are made to him by the Employment Center.

If he considers that there is a suitable work activity, including education or similar to his former place of work, then he may not receive permission. In the case when an early pension is issued, it is not paid continuously, but until retirement age is reached. Then you need to go to the Pension Fund and switch to regular insurance payments. A labor pension is provided to all citizens who have reached a certain age and have the necessary insurance coverage. This is due to the fact that due to health conditions, many people can no longer provide for themselves. That is why such payments are made to the budget every year. Retirement in the country occurs when a man turns 60 years old and a woman turns 55 years old. The minimum experience today is five years. Moreover, next year it will be 6 years old, and by 2024 it will grow to 15 years.

Early retirement in case of layoffs in 2021, latest news

Pension reform today remains one of the most discussed issues that concern citizens of the Russian Federation. The changes will affect the rules for old-age and early retirement, which will come into effect in 2021. At the end of September 2021 V.V. Putin announced several changes to the ongoing reform and clarified who is entitled to early pensions in 2021.

Mothers with many children will be able to retire early in 2021. Each child reduces the age threshold for a woman. That is, if a mother has three children, she has the right to submit documents for calculating benefits at 57 years old, four - 56. If a woman has five or more children, she can receive insurance benefits already at 50 years old.

Pension of military personnel dismissed due to redundancy

When reducing the number or staff of employees, the employer does not say goodbye to the employee on the last day of work, since labor legislation provides for certain payments even after several months after dismissal. And if everything is clear and understandable with ordinary workers, then what about retired workers, since they are already socially protected by the state by assigning them a pension? In this regard, questions arise: is the average salary of pensioners retained during the third month after dismissal, what cases are considered exceptional for maintaining earnings?

Military personnel - citizens who performed military service under a contract, have a total duration of military service of less than 15 years and were dismissed from military service upon reaching the maximum age for military service, health conditions or in connection with organizational and staffing events without the right to a pension, for One year after dismissal, payment of salary according to military rank is maintained.

Taking early retirement due to staff reductions: legal advice

To start receiving a state-issued old-age pension, several conditions are required. Firstly, this is recognition of the laid-off employee as unemployed. Secondly, his achievement of insurance coverage. For women this is twenty years, and for men - 25. Thirdly, the age of the dismissed woman must reach 53 years, and for men - 58 (that is, there should be no more than two years left until retirement). The desire of the dismissed employee to receive an early old-age pension is also important.

- a record of dismissal due to staff reduction present in the work book;

- the citizen must be registered with the regional employment office as seeking an opportunity to work in a required position;

- he should not refuse the proposed work options more than twice.

Payments from a previous employer

To start receiving a state-issued old-age pension, several conditions are required. Firstly, this is recognition of the laid-off employee as unemployed. Secondly, his achievement of insurance coverage. For women this is twenty years, and for men - 25. Thirdly, the age of the dismissed woman must reach 53 years, and for men - 58 (that is, there should be no more than two years left until retirement). The desire of the dismissed employee to receive an early old-age pension is also important.

In order for a citizen to be recognized as unemployed, a number of conditions are also necessary:

- a record of dismissal due to staff reduction present in the work book;

- the citizen must be registered with the regional employment office as seeking an opportunity to work in a required position;

- he should not refuse the proposed work options more than twice.

The law obliges the former employer to make payments of average earnings received at the enterprise to an individual who has been laid off within two months.

What else does early retirement entail when being made redundant?

Then, after this period has expired, the citizen has the right to register with the employment department and receive a special benefit. Its amount for the first three months is 75 percent of the average monthly salary, for the next four months - 60 percent, for the remaining five months - 45.

The amount of this benefit cannot be set higher or lower than those levels provided by the government of the Russian Federation. However, the criteria for calculating benefits are periodically revised depending on the economic situation in the country. These payments are made by the Pension Fund, which is replenished from the budget of the country or region.

When retiring early due to layoffs in the Voronezh region, for example, the insurance period is taken into account.

To start receiving a state-issued old-age pension, several conditions are required. Firstly, this is recognition of the laid-off employee as unemployed. Secondly, his achievement of insurance coverage. For women this is twenty years, and for men - 25. Thirdly, the age of the dismissed woman must reach 53 years, and for men - 58 (that is, there should be no more than two years left until retirement). The desire of the dismissed employee to receive an early old-age pension is also important.

- a record of dismissal due to staff reduction present in the work book;

- the citizen must be registered with the regional employment office as seeking an opportunity to work in a required position;

- he should not refuse the proposed work options more than twice.

The law obliges the former employer to make payments of average earnings received at the enterprise to an individual who has been laid off within two months.

Then, after this period has expired, the citizen has the right to register with the employment department and receive a special benefit. Its amount for the first three months is 75 percent of the average monthly salary, for the next four months - 60 percent, for the remaining five months - 45.

The amount of this benefit cannot be set higher or lower than those levels provided by the government of the Russian Federation. However, the criteria for calculating benefits are periodically revised depending on the economic situation in the country. These payments are made by the Pension Fund, which is replenished from the budget of the country or region.

The calculation of old-age pensions is regulated by Article 8 of the Federal Law “On Insurance Payments”. The law states that such accruals are due to every citizen of Russia, subject to the following requirements:

- reaching retirement age;

- length of service required for minimum payments;

- the minimum permissible number of accumulated pension points.

Now we will give detailed explanations for each point. According to current legislation, the retirement age of Russian citizens is 60 and 55 years old, for males and females, respectively. Please note that there is a possibility that the retirement age will increase in the future.

To count on an old-age pension, the insurance period must be at least 6 years. By 2024, the numbers will increase to 15 years.

Here you need to clarify what is taken into account:

- actual transfers to the pension fund made by the employer;

- periods when a citizen did not work:

- service in the armed forces;

- maternity leave to care for a child;

- receiving unemployment benefits;

- after registration at the city employment center.

Important!

Pension points or personal coefficient are set at 6.6. In the future, it is planned to increase the coefficient annually to 30 points. Considering the current economic situation in the country, a reduction in staff or a complete cessation of the company’s activities is far from uncommon. Such manipulations primarily affect people of pre-retirement age. For obvious reasons, such a citizen is unlikely to be able to get another job with a commensurate salary and working conditions.

Those who find themselves in this situation have two options:

- Registration at the labor exchange.

- Registration of early pension.

The second option looks more attractive, but early processing of the required transfers is possible if certain requirements are met.

In particular:

- The applicant officially receives unemployed status;

- The insurance period is 25 and 20 years for men and women, respectively;

- There are no more than 24 months left until the retirement age established by law;

- The labor exchange cannot offer suitable vacancies.

We invite you to familiarize yourself with: Wheel bearings and their sizes for trucks Important!

The last item on the list often becomes impossible to achieve. Employment centers constantly offer job seekers vacancies. If a person himself refuses the proposed options, early retirement becomes impossible. It should be noted that a citizen’s actual work experience may be below the legally established threshold. This condition is relevant for professions associated with special working conditions.

To start receiving a state-issued old-age pension, several conditions are required. Firstly, this is recognition of the laid-off employee as unemployed. Secondly, his achievement of insurance coverage. For women this is twenty years, and for men - 25. Thirdly, the age of the dismissed woman must reach 53 years, and for men - 58 (that is, there should be no more than two years left until retirement). The desire of the dismissed employee to receive an early old-age pension is also important.

In order for a citizen to be recognized as unemployed, a number of conditions are also necessary:

- a record of dismissal due to staff reduction present in the work book;

- the citizen must be registered with the regional employment office as seeking an opportunity to work in a required position;

- he should not refuse the proposed work options more than twice.

The law obliges the former employer to make payments of average earnings received at the enterprise to an individual who has been laid off within two months.

What else does early retirement entail when being made redundant?

Then, after this period has expired, the citizen has the right to register with the employment department and receive a special benefit. Its amount for the first three months is 75 percent of the average monthly salary, for the next four months - 60 percent, for the remaining five months - 45.

The amount of this benefit cannot be set higher or lower than those levels provided by the government of the Russian Federation. However, the criteria for calculating benefits are periodically revised depending on the economic situation in the country. These payments are made by the Pension Fund, which is replenished from the budget of the country or region.

When retiring early due to layoffs in the Voronezh region, for example, the insurance period is taken into account.

Within the framework of the legislation, in accordance with Article 32 of the Law of the Labor Code of April 19, 1991, citizens of the Russian Federation receive the right to early retirement if they are laid off from their jobs for reasons that do not depend on them. Registration of early retirement will be completely legal.

But what should a citizen who has been laid off early do? After all, if you find yourself unemployed at this age, it is very difficult to get a new job, since employers often do not want to hire older people. This explains why legislative norms provide for early retirement when an employee of pre-retirement age is laid off.

Immediately after a full-time employee has been laid off according to the employer’s initiative, he receives an average monthly salary for another two months. If during this time he was unable to find a new job and was registered with the employment service, then he is officially assigned the status of an unemployed person, and he begins to receive his social benefits.

To retire due to layoffs, a person who is at pre-retirement age should write a statement about this to the employment authorities. Immediately after receiving such a document, the citizen’s request to provide him with an early pension payment is considered and an appropriate decision is made.

If it turns out to be positive, the employment service will issue a written proposal for early retirement. As soon as this happens, it will need to be sent to the Russian Pension Fund, where the application will also be considered. The time allotted for these actions is one month, otherwise the paper may be invalidated.

When reducing the Labor Code of the Russian Federation, it is provided that the employee is given wages for the last month of his work, and, in addition, compensation is provided for unused vacation, if any. In addition, Article 178 of the Labor Code of the Russian Federation provides for special payments as part of the reduction of an employee in 2021:

- Firstly, we are talking about severance pay, which is issued in the amount of average monthly earnings. This also applies to those who immediately take a new job. What other payments are due when an employee is laid off?

- Secondly, the average monthly salary at the time of employment is paid. According to the standard scheme, payment is made within two months. Severance pay in such a situation is included in the same payment. In some situations, someone who is being laid off has the right to receive an average salary for the third month. This applies to those who were registered with the employment service within two weeks from the date of layoff. However, within three months he was unable to find a new job. The employment center decides whether to pay the average salary for the third month or not.

- Thirdly, compensation is provided for early dismissal at work. In connection with general rules, the administration is obliged to inform staff about the necessary procedure two months in advance. But with mutual agreement, the employee has the right not to wait for the expiration of the due date and to resign earlier. In this case, for the time from the day following the layoff until the expiration of two months, he is entitled to compensation. It is calculated based on the employee’s average earnings. These are all payments when an employee is laid off.

Legal Aid Center

This is a basic list of documentation; the Pension Fund has the right to require additional information and documents. Calculation rules It is almost impossible to independently calculate the amount of early pension provision associated with staff reduction, since it is calculated in each case individually.

After receiving all the certificates from the employment center, unemployment payments stop, as the person has grounds to register for retirement. If a positive answer is received, the citizen is awarded a pension and loses his unemployed status.

Early retirement due to staff reduction in 2021

The last two indicators change annually due to indexation. For disabled people of group 1, workers in the Far North, for dependents and in a number of other cases, a fixed payment is provided in an increased amount. In addition, if the amount of early pension provision is less than the pensioner’s subsistence level (PMP) established in the region, then the applicant will also be assigned a social supplement to the subsistence level by the Pension Fund.

- failure to reach the required age (retirement age minus 2 years), lack of insurance coverage or pension points;

- the applicant retains the average salary from his last place of work;

- payment of unemployment benefits is suspended or its amount is reduced;

- the applicant has refused a job offered by the employment center three or more times within a year.

We recommend reading: How to Get a Free Plot of Land from the State

Early pension for the unemployed in case of staff reduction in 2021

Condition 2 - reaching the age two years before the age giving the right to an old-age insurance pension, including one assigned early. Consequently, the right to early retirement, as a general rule, begins when men reach the age of 63 years, for women - 58 years. If you have the right to a preferential pension - 58 years for men, 53 for women.

- inconsistency of the employee with the position held or the work performed due to insufficient qualifications confirmed by certification results;

- repeated failure by an employee to perform labor duties without good reason, if he has a disciplinary sanction;

- a single gross violation of labor duties by an employee:

- absenteeism, that is, absence from the workplace without good reason throughout the entire working day (shift), regardless of its duration, as well as in the case of absence from the workplace without good reason for more than four hours in a row during the working day (shift) ;

- the appearance of an employee at work (at his workplace or on the territory of an organization - employer or facility where, on behalf of the employer, the employee must perform a labor function) in a state of alcohol, narcotic or other toxic intoxication;

- disclosure of secrets protected by law (state, commercial, official and other) that became known to the employee in connection with the performance of his job duties, including disclosure of personal data of another employee;

- committing at the place of work theft (including small) of someone else's property, embezzlement, intentional destruction or damage, established by a court verdict that has entered into legal force or a decision of a judge, body, official authorized to consider cases of administrative offenses;

- violation of labor safety requirements by an employee established by the labor safety commission or the labor safety commissioner, if this violation entailed serious consequences (work accident, accident, catastrophe) or knowingly created a real threat of such consequences;

- commission of guilty actions by an employee directly servicing monetary or commodity assets, if these actions give rise to a loss of confidence in him on the part of the employer;

- failure by the employee to take measures to prevent or resolve a conflict of interest to which he is a party, failure to provide or submit incomplete or unreliable information about his income, expenses, property and property obligations, or failure to provide or provision of knowingly incomplete or unreliable information about income, expenses, property and property obligations of their spouse and minor children, opening (having) accounts (deposits), storing cash and valuables in foreign banks located outside the territory of the Russian Federation, possession and (or) use of foreign financial instruments by an employee, his spouse and minor children;

- the commission by an employee performing educational functions of an immoral offense incompatible with the continuation of this work;

- making an unjustified decision by the head of the organization (branch, representative office), his deputies and the chief accountant, which entailed a violation of the safety of property, its unlawful use or other damage to the property of the organization;

- a single gross violation by the head of the organization (branch, representative office) or his deputies of their labor duties;

- the employee submits false documents to the employer when concluding an employment contract.

We recommend reading: OKVED that fall under UTII in 2021

Calculation of pension upon reduction

- He already has the required work experience, namely, for men it is 25 years, and for women - 12.

- The citizen is considered unemployed.

- There is no real possibility of further employment for him.

- He has no more than two years left before his main retirement.

In this regard, based on their individual data, each laid-off person must remember that it is necessary to calculate the early pension in advance and submit documents for it when unemployment payments stop or become lower than the amount of this early pension. It is also worth remembering that early pension provision and pension upon reaching a certain age are most often different.

How to apply for early retirement if you are downsizing in 2021 - terms and conditions

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: Moscow and region St. Petersburg and region

All regions of the Russian Federation Consultation is free!

- The employee has insurance experience: at least 20 years for women, and at least 25 years for men. These figures may be changed downward if the person worked under special working conditions that provide the right to early retirement.

- The citizen has official unemployed status.

- Lack of employment opportunities. As a rule, people of pre-retirement age are not in great demand among employers. Firstly, most of them prefer to hire representatives of the younger generation. Secondly, the likelihood of a retired employee leaving his job is quite high, therefore, the time required for his full training may be wasted.

- There should be no more than two years left before a citizen reaches retirement age.

Dismissal of a pensioner due to staff reduction in 2019

And since it is not at all easy for an older worker to find a job on the eve of a pension at another enterprise, a special program is provided at the legislative level to protect citizens of this category.

Increasing the age of working-age citizens for their retirement in old age is still not a reason for citizens to lose the right to work. All Russian citizens have this right, with the exception of some minors and disabled people.

Early old-age pension in case of staff reduction, rules of appointment and calculation procedure

To be able to retire early after a layoff, certain conditions must be met. This includes the fact that a person’s working experience should be optimal, and for men this is 25 years, and for women 20. Additionally, however, it is taken into account in what conditions the work was carried out, since if they were not the easiest, then the temporary Rules may be reduced. The appointment framework additionally takes into account that after a layoff a person must register with the employment center, where he must receive Additional status. An unemployed person must have some problems finding another job, and the age must also be such that there are less than two days left before official retirement.

Quite often situations arise when, during staff reductions, employees whose age is near retirement are fired, since they no longer have two years left before their official retirement. In this case, a special early pension is assigned when staffing is reduced; however, certain rules and requirements must be followed during this process.

Early retirement in case of staff reduction in 2019: how to apply for a pension benefit

Employers understand that such an employee will soon quit, so it is easier to hire a young and promising employee than an experienced but elderly one. Federal Law No. 1032-1 “On Employment of the Population in the Russian Federation” contains information on the possibility of transferring pension payments during the period when a person has already become unemployed and the corresponding period has not yet arrived.

In 2021, a serious reform should take place, providing for an increase in the retirement age. The same applies to the total length of service and points indicating the contributions of a citizen of the Russian Federation to the state treasury.

Rules for early retirement in case of staff reduction

It is worth noting that any trusted person can handle the registration of an early pension. If this occurs, this person must have a power of attorney and a document that confirms his identity.

- for women it is mandatory to have a total work experience of 20 years or more, for men - from 25 years or more. Either you have the necessary length of service in the relevant types of work, which gives you the right to early retirement;

- an applicant for an early pension must be registered as unemployed;

- lack of employment opportunities;

- the applicant has no more than 2 years left before reaching retirement age;

- An entry in the work book indicates dismissal as a result of staff reduction.

We recommend reading: Inaction of employees of the Ministry of Internal Affairs article

General information

Dismissal during a layoff is unpleasant news for people of any age.

But for older workers it is also a significant psychological trauma. To reduce the negative consequences of such a situation, the government of the Russian Federation developed and approved law number 1032-1 (Article 32, paragraph. Dismissal during a layoff is unpleasant news for people of any age. But for older workers it is also a significant psychological trauma. To reduce the negative consequences of such a situation, the government of the Russian Federation developed and approved a law numbered 1032-1 (Article 32, paragraph 2), which regulates the receipt of early pensions in this case.

Dismissal during a layoff is unpleasant news for people of any age. But for older workers it is also a significant psychological trauma. To reduce the negative consequences of such a situation, the government of the Russian Federation developed and approved a law numbered 1032-1 (Article 32, paragraph 2), which regulates the receipt of early pensions in this case.

Calculation of early pension in case of reduction

“The company where I work is being liquidated. I am 6 months short of retirement age. It is unlikely that you will be able to find a job at this age. I heard that there is a provision for early retirement. Please clarify the law on this issue.” N. T. ILYIN (Kursk).

Financial support for the Pension Fund of the Russian Federation for organizing the payment of early old-age pensions to individuals who have confirmed their right to receive it comes from the Federal budget.

How to apply for early retirement if you are downsizing in 2021 - terms and conditions

The amount of the basic monthly payment is 40% of the salary for the first five years, if the soldier has served at least 15 years. For each year over 15 years, 3% of the salary is added. If the total military service does not reach 15 years, then the average salary for the last year is taken into account and paid within a year after dismissal. Early dismissal for all reasons allows a serviceman to contact the employment service and receive unemployed status. Receiving benefits, scholarships for the duration of training in a new specialty, taking courses and special training - this opportunity is provided for discharged military personnel who do not receive a long-service military pension.

Both the early pension assigned in connection with the layoff and the old-age insurance pension are identical. It’s just that the first of them, due to current circumstances, begins to be paid 1-2 years earlier than retirement age.

Calculation of early pension in case of reduction

Quite often, situations arise when, during staff reductions, employees whose age is pre-retirement are fired, since they have no more than two years left before their official retirement. In this case, a special early retirement pension is granted when staffing is reduced, but during this process certain rules and requirements must be observed.

An early pension when an employee is laid off at pre-retirement age can be granted if no more than two years remain until retirement age. Other conditions listed below must also be met.

Insurance experience

The insurance period is the total period during which a citizen worked or was engaged in other activities when contributions were made to the Pension Fund. Other activities of citizens are also taken into account. This is military service, studying in secondary educational institutions and universities, staying on sick leave, caring for a young child or a disabled person who is a family member, etc.

In the event that the total length of service is greater than that required to apply for an early old-age pension, two weeks are added “on top” for each year, when the citizen can count on state benefits. The total period of payment of this benefit is no more than two years.

We suggest you read: Income tax on pensions in Russia: is it taken?

In what cases is it possible to take early retirement following a layoff?

The insurance period is the total period during which a citizen worked or was engaged in other activities when contributions were made to the Pension Fund. Other activities of citizens are also taken into account. This is military service, studying in secondary educational institutions and universities, staying on sick leave, caring for a young child or a disabled person who is a family member, etc.

In the event that the total length of service is greater than that required to apply for an early old-age pension, two weeks are added “on top” for each year, when the citizen can count on state benefits. The total period of payment of this benefit is no more than two years.

In what cases is it possible to take early retirement following a layoff?

The insurance period is the total period during which a citizen worked or was engaged in other activities when contributions were made to the Pension Fund. Other activities of citizens are also taken into account. This is military service, studying in secondary educational institutions and universities, staying on sick leave, caring for a young child or a disabled person who is a family member, etc.

In the event that the total length of service is greater than that required to apply for an early old-age pension, two weeks are added “on top” for each year, when the citizen can count on state benefits. The total period of payment of this benefit is no more than two years.

How is early redundancy pension calculated?

From the article you will learn:

- how a pensioner is dismissed at the initiative of the employer;

- Do pensioners have benefits upon dismissal based on staff reduction;

- How to formalize dismissal due to retirement.

Working pensioner: rights and restrictions First of all, we will determine which employees can be recognized as pensioners and whether it is possible to dismiss a working pensioner at the initiative of the employer in a special manner. Download documents on the topic: Order on termination of an employment contract (dismissal) due to the employee’s voluntary dismissal. Increasing the retirement age in Russia In addition to the requirements for length of service, such employees are subject to conditions on reaching a certain age and having the required number of pension points;

- belonging of a citizen to special socially significant categories listed in paragraphs.

Early retirement in case of redundancy

After receiving all the certificates from the employment center, unemployment payments stop, as the person has grounds to register for retirement. If a positive answer is received, the citizen is awarded a pension and loses his unemployed status. What documents are required Documentation that must be submitted for early retirement when reducing staff in 2021:

The issuance of a proposal to assign a pension for the period before the age giving the right to an old-age pension is accepted by the employment service body in the absence of employment opportunities for the citizen. Judicial practice in resolving disputes between citizens when refusing to issue an early retirement pension often tends to confirm the legality of decisions of government bodies. The courts indicate in their decisions that sending citizens to an old-age pension early is not one of the state-guaranteed social protection measures to support citizens, and the right to make decisions on issuing an offer for an old-age pension early is granted to the employment service and is not of a declarative nature.

Assignment of early pension payments and premature layoffs

The main reason for granting a citizen the right to apply for early state support by the district department of the employment department is the inability to find a job. Having received the consent of the citizen, this department issues a recommendation for processing pension payments ahead of schedule in writing.

With this document, the dismissed employee can contact the social security department of his district.

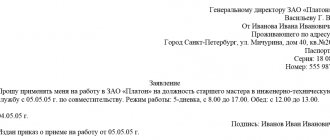

The package of documents for early retirement must contain the following:

- A recommendation issued to a dismissed employee by the employment department, which states that he is unemployed.

- Application for early pension payments.

- Passport. If we are talking about citizens who do not have Russian citizenship, then this must be a residence permit.

- Citizen's work book.

- His military ID (if any).

- SNILS.

- Documents certified by the Pension Fund, which record the amounts and periods of monetary contributions to this fund.

- A certificate signed by the director and chief accountant, with the seal of the organization in which the citizen worked, containing information on average earnings for any five consecutive years.

- Depending on the situation, you will need to attach some other documents to this package.

In case of layoff, early pension is issued at the employment center.

The main reason for granting a citizen the right to apply for early state support by the district department of the employment department is the inability to find a job. Having received the consent of the citizen, this department issues a recommendation for processing pension payments ahead of schedule in writing.

With this document, the dismissed employee can contact the social security department of his district.

The package of documents for early retirement must contain the following:

- A recommendation issued to a dismissed employee by the employment department, which states that he is unemployed.

- Application for early pension payments.

- Passport. If we are talking about citizens who do not have Russian citizenship, then this must be a residence permit.

- Citizen's work book.

- His military ID (if any).

- SNILS.

- Documents certified by the Pension Fund, which record the amounts and periods of monetary contributions to this fund.

- A certificate signed by the director and chief accountant, with the seal of the organization in which the citizen worked, containing information on average earnings for any five consecutive years.

- Depending on the situation, you will need to attach some other documents to this package.

We invite you to read: Land tax in 2021 for individuals and legal entities - tax on the sale of land

In case of layoff, early pension is issued at the employment center.

The main reason for granting a citizen the right to apply for early state support by the district department of the employment department is the inability to find a job. Having received the consent of the citizen, this department issues a recommendation for processing pension payments ahead of schedule in writing.

- A recommendation issued to a dismissed employee by the employment department, which states that he is unemployed.

- Application for early pension payments.

- Passport. If we are talking about citizens who do not have Russian citizenship, then this must be a residence permit.

- Citizen's work book.

- His military ID (if any).

- SNILS.

- Documents certified by the Pension Fund, which record the amounts and periods of monetary contributions to this fund.

- A certificate signed by the director and chief accountant, with the seal of the organization in which the citizen worked, containing information on average earnings for any five consecutive years.

- Depending on the situation, you will need to attach some other documents to this package.

Early retirement in case of staff reduction

Hello! My mother turns 54 in August, she was laid off from her job due to downsizing from a food company where she worked for 33 years. Can she count on early retirement? And what you need to do?

The local division of the employment service can send your mother for early retirement in the event of dismissal due to staff reduction or staff reduction and when there are less than 2 years left until retirement age and if there is at least 20 years of insurance experience (your mother has 33 years). To do this, the mother must register with the employment service as unemployed, and if a suitable job is not found for her, she may be given a referral to the pension fund to assign an old-age labor pension. The amount of the assigned pension will be calculated for everyone in the generally established manner, but the Employment Fund will finance the payment of the pension until the mother turns 55 years old.

Early pension for the unemployed

First of all, a citizen must register with the municipal employment center. This is a mandatory condition to confirm your unemployed status.

If there are less than 2 years left before the statutory retirement age, the labor exchange employees themselves will offer the applicant to arrange early payments. Let us note that the procedure is possible with the consent of the citizen, on the basis of a personally drawn up written application to the Pension Fund.

Having received the application, employment center specialists prepare the following documents:

- proposal to the Pension Fund for early pension payments;

- an extract about the periods of work that are included in the insurance period.