Subordinate to the “Goods” account (41).

Account type: Active.

Account type:

- Quantitative

- Tax

Analytics for account “41.01”:

| Subconto | RPM only | Total accounting | Accounting in currency |

| Nomenclature | No | Yes | No |

| Parties | No | Yes | No |

| Warehouses | No | Yes | No |

What is account 41 in accounting

41 account “Goods” is an account that shows the cost reflection of the material assets available to the organization, and their movement - receipt and write-off. 41 accounting accounts are used when maintaining accounting records for organizations engaged in the resale of various products (food, non-food stores), and catering establishments.

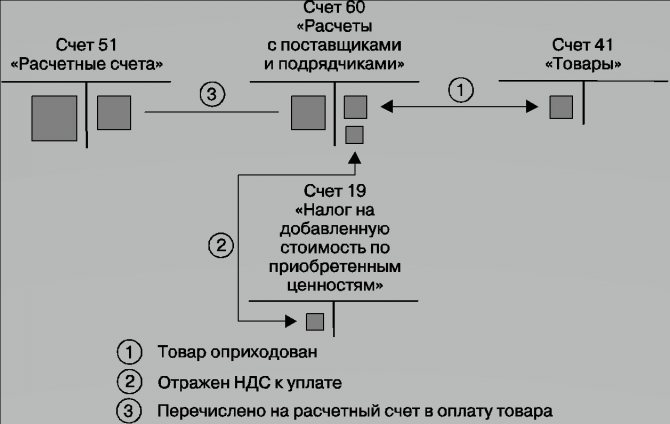

Scheme of goods movement at the enterprise

However, its use is possible in enterprises that carry out production activities. In this case, one of the subaccounts 41 is opened to account for products purchased for the purpose of sale, as well as for accounting for components, the cost of which is compensated separately by the buyer.

What applies to goods

A product is understood as the result of the financial and economic activities of an enterprise, which is subject to sale, operation or exchange. At the same time, goods in the general sense include not only manufactured material products, but also objects of civil rights, intangible property, work performed by the company or services provided.

In other words, goods are property assets of an organization that are produced directly for sale. This definition is specified in the Tax Code of the Russian Federation. The economic definition of a product is the result of labor, including works and services. All produced goods must have a certain consumer value and are intended for sale in order to exchange for other products or money.

Products include:

- material (material) products that have different physical characteristics and properties;

- services or intangible property (provision of services, results of mental work).

Tangible goods are the most common group. They are also called inventory assets, which are used directly for the purpose of further sale. At the same time, the materials themselves, which are purchased for the manufacture of goods, performance of work, provision of services, general production and general economic needs, are also inventory assets.

Accounting for such property is carried out at actual cost. The cost is formed from the costs of purchasing inventory items (money paid personally or transferred to the seller’s account), transportation costs, commission payments and other expenses.

What is it used for?

41 accounting accounts are used to reflect the cost of products intended for sale. The following types of expenses may be included:

- the cost of purchasing goods from the supplier;

- paid customs duties for clearing products at customs (if they crossed the state border);

- transport costs;

- payment to intermediaries;

- other expenses that are directly related to the purchase of goods.

Also, VAT may be included in the cost if the company operates under the simplified tax system.

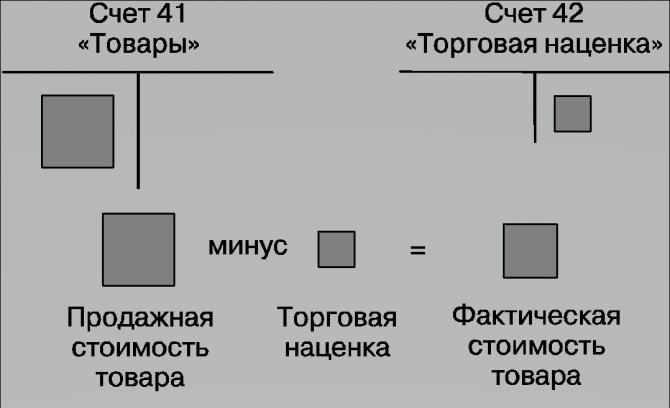

When retailing goods, they are taken into account in accounting in various ways:

- At purchase prices. In this case, the cost of the product includes its price minus indirect tax (VAT) and all expenses that the company incurred in purchasing it. These could be, for example, procurement costs or transport costs.

- At the selling price. In this case, the goods are recorded in accounts at cost, including trade margins. Only enterprises engaged in retail trade can keep records using this method. The trade margin is reflected in the account. 42 and is written off from there when the goods are sold.

Selling price

- At discounted prices. All goods are accepted at certain discount prices. The difference between the purchase price and the accounting price is reflected in the account. 15, and the goods are written off through the account. 16.

Important! The accounting method must be reflected in the accounting policy of the enterprise.

Methods of accounting for goods in a warehouse

Organizing the accounting of goods in an organization’s warehouse can be implemented in one of two ways:

- receipts, movements and write-offs are reflected at purchase prices;

- When reflecting transactions with goods in the warehouse, the selling price is used.

If an enterprise accounts for goods in a warehouse at the purchase price, then its cost in accounting is equal to the sum of the expenses incurred directly for the acquisition of goods and materials, and possible additional expenses (transport, consulting, commissions, etc.).

If a product is accounted for at its selling price, then its value in warehouse cards, in addition to acquisition costs, contains a trade margin.

Let's look at each of the methods of accounting for goods in a warehouse using an example.

Account 41. Accounting for goods at purchase prices

Factorial LLC issued a bank loan in the amount of 134,000 rubles. to purchase goods. The loan costs amounted to 1,750 rubles. Factorial LLC purchased goods from Magnit LLC (RUB 134,000, VAT RUB 20,441) and received it into the warehouse. Inventory and materials were written off from the warehouse upon their sale to Vulcan LLC (203,000 rubles, VAT 30,966 rubles). According to the accounting policy, Factorial LLC takes into account inventory items in the warehouse at the purchase price.

| Debit | Credit | Description | Sum | Document |

| 51 | 66 | Bank loan credited | 134,000 rub. | Bank statement |

| 41.1 | 60 | Purchased goods are included in the warehouse (excluding VAT) | RUB 113,559 | Packing list |

| 19 | 60 | VAT amount reflected | RUB 20,441 | Packing list |

| 68 VAT | 19 | Tax deduction reflected | RUB 20,441 | Invoice |

| 91.2 | 66 | Loan costs taken into account | RUB 1,750 | Banking agreement |

| 90.2 | 41.1 | The product is written off from the warehouse due to sale | RUB 113,559 | Sales Invoice |

| 62 | 90.1 | Reflected revenue from sales of inventory items | 203,000 rub. | Sales Invoice |

| 90.3 | 68 VAT | VAT amount reflected | RUB 30,966 | Invoice |

| 51 | 62 | The goods were paid for by Vulcan LLC | 203,000 rub. | Bank statement |

Read about other accounts used in postings in the articles: account 51 (current account), account 66, account 60 (accounting for settlements with suppliers), account 19, account 62 (writing off accounts receivable).

Account 41. Accounting for goods at selling price

Klimat LLC purchased goods (components for air conditioners) at a price of 138,000 rubles, VAT 21,051 rubles. for the purpose of subsequent implementation. Trade margin – 28% (RUB 32,746). VAT on sale – RUB 26,945. The total markup including VAT is RUB 59,691. The product was sold by Mercury LLC.

| Debit | Credit | Description | Sum | Document |

| 41.1 | 60 | The components are included in the warehouse (excluding VAT) | RUB 116,949 | Packing list |

| 19 | 60 | VAT amount reflected | RUB 21,051 | Packing list |

| 68 VAT | 19 | Tax deduction reflected | RUB 21,051 | Invoice |

| 60 | 51 | Payment for components has been made | RUB 116,949 | Payment order |

| 41.1 | 42 | Trade margin taken into account | RUB 59,691 | Calculation of markup |

| 90.2 | 41.1 | The product is written off from the warehouse due to sale (116,949 + 59,691) | RUB 176,640 | Sales Invoice |

| 90.2 | 42 | Reversal of the trade margin amount | RUB 59,691 | Sales Invoice |

| 62 | 90.1 | Reflected revenue from sales of inventory items | RUB 176,640 | Sales Invoice |

| 90.3 | 68 VAT | VAT amount reflected | RUB 26,945 | Invoice |

| 51 | 62 | The goods were paid for by Mercury LLC | RUB 176,640 | Bank statement |

In conclusion, we emphasize that each of the operations with goods in the warehouse must be confirmed by an appropriate document drawn up in accordance with legal requirements.

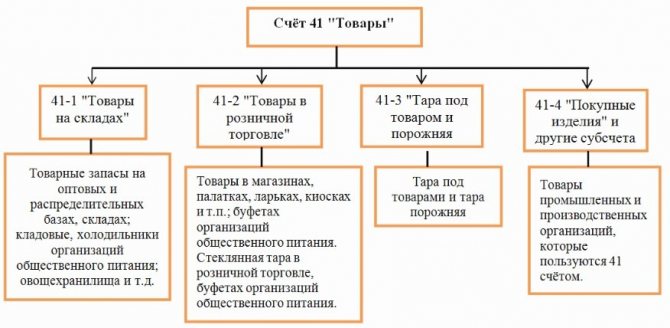

Existing subaccounts of account 41

According to the order approving the Chart of Accounts for the account. 41 you can open at least 4 sub-accounts for product classification:

- Account 41-01 - the subaccount takes into account products that are in the warehouse, base, or pantry.

- 41-02 - this subaccount reflects the presence and movement of material assets (including glassware) that are directly put up for sale in a store, kiosk, tent or stall.

- 41-03 - this subaccount takes into account all containers: currently occupied or empty, standing separately (except for glassware).

- 41-04 - this subaccount is used in organizations that conduct industrial or production activities. At 41-04, they take into account products that are purchased specifically for sale or when the cost of components for finished products is not included in the cost of the final product, but is reimbursed separately by buyers.

Accounting has the right to open other, additional sub-accounts to the account. 41 taking into account the specifics of the enterprise’s operations, if the need arises for more detailed account details.

Note! For account 41 analytical accounting can be maintained in the accounting department in the context of product names, places of their storage, as well as persons responsible for it.

Subaccounts 41

What is it needed for

Let's look at 41 accounting accounts (for dummies), because the topic of accounting for goods occupies a key place in the financial and economic activities of the organization.

Here goods are meant as a set of inventory items acquired by an enterprise for the purpose of further sale (clause 2 of PBU 5/01). Inventory and materials can also be transferred to the organization by other legal entities. Account 41 in accounting - “Goods”, is used by organizations on the basis of the chart of accounts approved by Order of the Ministry of Finance No. 94n dated October 31, 2000. Account 41 reflects only those inventory items that directly belong to the institution as property rights. All inventory items that are in storage or on commission and do not belong to the enterprise are accounted for off-balance sheet (accounts 002, 004).

Correspondence of account 41 with other accounts in accounting

Account 41 by debit corresponds with the accounts of the following sections:

- Section 2 - 15.

- Section 4 - 41, 42, 43.

- Section 6 - 60, 66, 67, 68, 71, 73, 75, 76, 79.

- Section 7 - 80, 86.

- Section 8 - 90, 91, 98.

For loan 41, correspondence goes through the following sections:

- Section 2 - 10.

- Section 3 - 20, 29.

- Section 4 - 41, 44, 45.

- Section 6 - 76, 79.

- Section 7 - 80.

- Section 8 - 90, 94, 97, 99.

Translation of goods into materials

In production and trading organizations, goods are often transferred to the category of materials. Such a movement is documented with the TORG-13 consignment note.

Example

Alpha purchased 920 meters of cable for sale in the amount of RUB 179,412. (VAT RUB 27,383). To carry out electrical installation work, 120 meters of cable were needed, so this amount of goods was converted into materials.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 41.01 | 60.01 | Goods have arrived | 152 029 | Packing list |

| 19.03 | 60.01 | VAT included | 27 383 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 27 383 | Invoice |

| 10.01 | 41.01 | Products translated into materials | 19 830 | Internal movement invoice |

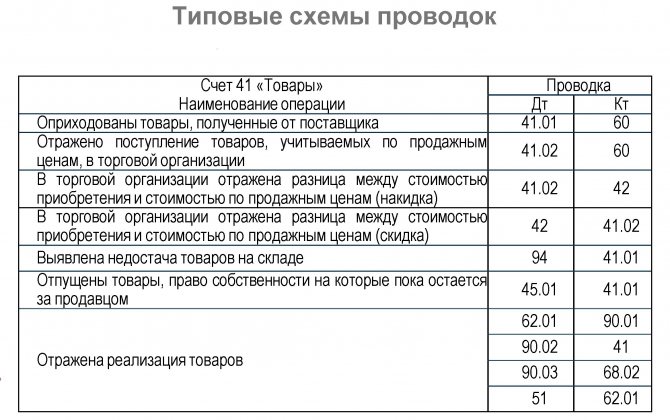

Accounting entries

Operations performed by debit 41 increase the quantity of goods (in value terms) located in warehouses or store shelves:

- When debiting an account. 41 posting Dt41 reverses the trade margin on returned products.

- Dt41 Kt15 reflects the acceptance of goods for accounting at discount prices.

Correspondence with Section 4 accounts reflects:

- Dt41 Kt41 - transfer of purchased goods for processing,

- Dt41 Kt42 - inclusion of trade margin in the price of products,

- Dt41 Kt43 - transfer of processed and manufactured products into the composition of goods.

Transactions under Section 6 reflect: Dt41 Kt60 - the cost of products received from suppliers and capitalized.

Cash flow diagram

- Dt41 Kt66 - the amount of accrued interest on loans and borrowings (short-term) used for the purchase of goods.

- Dt41 Kt67 - the amount of accrued interest on loans and borrowings (long-term) used for the purchase of goods.

- Dt41 Kt68 - inclusion of accrued taxes (VAT) in the price of products.

- Dt41 Kt71 - operation of capitalization of goods that were purchased by an accountable person.

- Dt41 Kt73 - the operation of accepting goods for accounting that were reimbursed by individuals.

- Dt41 Kt75 - the operation of accepting material assets into the warehouse that were received from the founder on account of his contribution to the authorized capital of the organization.

- Dt41 Kt76 - operations: acceptance of defective goods for accounting at the selling price; inclusion in the price of the goods the amount of costs for its insurance; accrual of remuneration to the customs broker for services provided.

- Dt41 Kt79 - the operation of accepting for accounting material assets that came from a separate division.

Section 7 transactions reflect:

- Dt41 Kt80 - the operation of accepting for accounting goods that were received from a partner on account of his contribution to the enterprise (under a simple partnership agreement).

- Dt41 Kt86 is the operation of accepting for accounting goods that arrived at the enterprise’s warehouse as targeted financing.

Section 8 transactions reflect:

- Dt41 Kt90 (for account 90 in the context of subaccount 90-2) - reversal of revenue from reimbursed products.

- Dt41 Kt91 (for account 91 in the context of subaccount 91-1) - the operation of accepting for accounting a commodity-resource that remains after the disposal of other assets.

- Dt41 Kt98 (for account 98 in the context of subaccount 98-2) - the operation of capitalizing products received free of charge on the basis of an act and an invoice.

Transactions made on credit account 41 lead to a decrease in material assets (and their value expression) in the warehouses and stores of the enterprise.

Dt10 Kt41 - a product originally intended for resale is converted into materials.

Under Section 3, correspondence is as follows:

- Dt20 Kt41 - transfer of products originally intended for resale to the needs of main production.

- Dt29 Kt41 - write-off of cost for the needs of service farms.

Correspondence under Section 4 is as follows:

- Dt44 Kt41 - write-off of the cost of goods that are used for commercial purposes when selling products.

- Dt45 Kt41 - transfer of material assets to a third party (without transfer of ownership) under an invoice.

Correspondence with Section 6 proceeds as follows:

- Dt76 Kt41 - return of damaged and defective goods to the supplier.

- Dt79 Kt41 - the operation of transferring material assets to separate units.

Transactions under Section 7 occur only on accounts. 80 - Dt80 Kt41. This operation reflects the process of transferring goods to a partner upon termination of a simple partnership agreement.

Correspondence with section 8 accounts occurs as follows:

- Dt90 Kt41 - write-off of cost of goods sold.

- Dt94 Kt41 - a reflection of the cost of products that were damaged, as well as in case of shortage during inventory.

- Dt97 Kt41 - write-off of products as deferred expenses.

- Dt99 Kt41 - write-off of the cost of goods in case of their loss in emergency situations.

41 An example of posting for dummies is considered in the case of receipt and sale of goods in a store. The organization received goods from the supplier in the amount of 100 pieces, at a price of 1,000 rubles/1 piece. The total cost of material assets was 100,000 rubles. Additionally, VAT amounted to 20,000 rubles. The trade margin for 1 piece of goods is 20 rubles. Thus, the accounting department will make the following entries:

The first stage is receiving the goods and carrying out preparatory operations before selling them:

- Dt41-01 Kt60 - posting to the enterprise warehouse - 100,000 rubles.

- Dt19 Kt60 - accounting for input VAT - 20,000 rubles.

- Dt68 Kt19 - acceptance for deduction of input VAT - 20,000 rubles.

- Dt41 Kt42 - calculation of trade margin - 2,000 rubles.

- Dt41-02 Kt41-01 - transfer of goods for sale in a store - 102,000 rubles.

Second stage - sale:

- Dt50 Kt90-01 - reflection of revenue for goods sold - 122,400 rubles.

- Dt90-03 Kt68 - calculation of VAT on goods sold - 20,400 rubles.

- Dt90-02 Kt41-02 - write-off of goods at their cost - 100,000 rubles.

- Dt90-02 Kt42-02 - write-off of trade margin, reversal - (-2,000) rub.

Organization of accounting of goods in the warehouse

A warehouse is a room that is specifically designed for storing materials and supplies. An organization's warehouse can be either an integral part of it or act as an independent structural unit. In the first case, the warehouse is used exclusively as one of the stages of the production process; in the second case, the warehouse can act as a separate object (for example, a retail outlet from which goods are sold).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

The technological process in a warehouse consists of several stages:

- acceptance of goods and materials (including preliminary preparation of goods for acceptance).

- placing goods in warehouses and ensuring their storage.

- preparing goods for release from the warehouse and its subsequent release.

Warehouse accounting at an enterprise can be organized using the varietal or batch method. In the first case, each type of product in the warehouse is accounted for separately. The basis for accounting for goods is a quantitative and cost accounting card (form TORG-28), which is drawn up when goods and materials arrive at the warehouse. With the varietal method, it is permissible to record several goods (for example, similar in price) in one TORG-28 card.

If an organization uses the batch method to record inventory in a warehouse, then the arrival and movement of goods is reflected by batch. The basis document for these operations is the batch list (form MX-10), which is drawn up when a batch of goods arrives at the warehouse and is filled in as it is written off.

Analysis of account 41 and card

Before you begin accounting for a commercial enterprise, you need to find out whether the account is 41 active or passive. Since it aggregates information about the property, cash and assets of the enterprise, therefore, it is an active account. At the account 41 the balance is only debit (positive), it cannot result in a negative balance. Debit account 41 reflects the receipt of goods, containers, materials or resources at the warehouse or store of the enterprise. Credit account 41 reflects the disposal of goods, a decrease in their value in accounting, due to sale, transfer to other needs, return to the supplier, write-off of defects or inventory shortages.

Account card 41

The card for account 41 is similar in content to a balance sheet and is used in accounting to verify the correct entry of data into the software. When this report is displayed, it becomes easy to track the appearance of information on the account, as well as verify the turnover and balance of the account. 41. The report can be generated by the program for any period, up to its generation for one shift.

Note! The count should not be confused. 41 in accounting and accounts. 41, opened at the Federal Treasury. The latter is required only for making payments under some government programs for which the company is the executor. Opening such a personal account is not mandatory for all enterprises, but is required only for some tender participants.

Thus, accounting for products intended for further resale must be carried out to correctly reflect changes in the assets of the enterprise. After all, information about it, as well as trade margins on it, have a direct impact on the formation of the enterprise’s profit.

https://www.youtube.com/watch?v=enPNNAytRJY

Accounting for transportation and procurement costs

Receiving goods, materials, fixed assets, obtaining services, and work is accompanied by certain costs, which include delivery costs and various procurement works; these costs are called transportation and procurement costs (TPP). Their accounting in accounting can be done in two ways.

Let's imagine a situation: a supplier delivers goods. He can bear the costs of delivering the goods, or he can pass them on to the buyer. In the latter case, the buyer needs to somehow take them into account in his accounting. If transportation and procurement costs are paid by the buyer, then the supplier, as a rule, highlights them as a separate line in the invoice. Also, transport and procurement services can be provided by a third-party organization, for example, delivery of goods will be carried out by a transport company, which will provide the buyer with documents indicating the amount for delivery.

The buyer, having received the goods and documents indicating the cost of delivery, must make certain entries in his accounting department.

Accounting for goods and materials can be done in two ways:

- included in the price of the goods

- included in selling expenses

In the first case, delivery costs are taken into account on account 41 and are included in the purchase price of the goods; in the second case, they are taken into account on account 44 “Sale expenses”.

Transport costs are included in the price of the goods

This method of accounting for goods and materials is not the most convenient and not the most widespread, but, nevertheless, it can be used.

Upon receipt, goods are taken into account as a debit to account 41. In this case, VAT is allocated separately from the cost of purchased goods.

Transportation and procurement costs for these goods are also debited to account 41; if their cost includes VAT, then the tax is also allocated to a separate sub-account for reimbursement from the budget.

Postings for accounting of goods and inventory in this case have the form:

| Debit | Credit | the name of the operation |

| 41 | 60 | The cost of the goods is reflected according to the supplier’s documents |

| 19 | 60 | VAT is allocated from the cost of goods |

| 41 | 60 | The cost of fuel and equipment is reflected |

| 19 | 60 | VAT is allocated from the cost of goods and materials |

| 68.VAT | 19 | VAT is deductible |

Accounting for different types of goods can be kept in different subaccounts of account 41. If several consignments of different goods came from one supplier, and the amount of goods and materials is total for the entire delivery, then when accepting the goods for accounting, it is necessary to determine the transportation costs for each consignment. To understand how to do this, consider an example:

Example:

The following goods were received from the supplier: 10 sofas in the amount of 300,000 and 5 cabinets in the amount of 200,000, with a total cost of 500,000. Delivery costs amounted to 20,000. The goods are accepted for accounting taking into account the TZR.

We calculate transportation costs for each batch of goods:

Sofa delivery costs = 20,000 * 300,000 / 500,000 = 12,000.

Shipping costs for cabinets = 20,000 * 200,000 / 500,000 = 8,000.

The cost of the sofas, taking into account the costs of their delivery, was 312,000, the price for 1 sofa was 31,200.

The cost of the cabinets, taking into account the costs of their delivery, was 208,000, the price for 1 cabinet was 20,800.

Transportation and procurement costs are reflected in selling expenses

Trade organizations whose main activity is the sale of goods have a special account 44 “Sales expenses”, the debit of which collects all the organization’s expenses, after which they are included in the cost of goods sold.

If an organization wants to take into account TZR separately, then for the amount of these expenses it makes the posting D44 K60 (76).

On account 44, as a rule, several sub-accounts are opened in accordance with the organization’s expenses. To account for transportation costs, a sub-account “TZR” is opened.

During the month, transportation costs are collected in the debit of account 44/TZR, after which at the end of the month they are included in the cost of goods sold for the month by writing off using posting D90/2 K44/TZR.

The amount of transportation expenses to be written off at the end of the month should be in proportion to the goods sold.

This amount can be calculated using the following formula:

TZR = debit balance of account 44/TZR * credit balance of account 41 / debit balance of account 41.

The balance is calculated by adding the turnover for the month to the initial (incoming) balance.

Let's look at an example:

Example:

The organization received goods worth 500,000. TZR amounted to 20,000. At the time the goods were accepted for accounting, goods worth 200,000 were in the warehouse. TZR on account 44 at the beginning of the month were equal to 12,000. During the month, goods worth 400,000 were shipped. What should the amount of TZR be written off from account 44?

TZR = (12,000 + 20,000) * 400,000 / (200,000 + 500,000) = 18,286.

It is this amount that will be written off at the end of the month using posting D90/2 K44/TZR.

An organization can use any method convenient for itself to account for transportation costs. The chosen method must be indicated in the accounting policy order.