Examples of invoice 45 – Goods shipped

| Contents of business transactions | Account correspondence | more details |

| Transfer of materials to a third party | Dt 45 Kt 10Account 10 – Materials (Active) | |

| Transfer of animals to a third party | Dt 45 Kt 11Account 11 – Animals for growing and fattening (Active) | |

| Transfer of products (works, services) of the main production to third parties | Dt 45 Kt 20 | |

| Transfer of semi-finished products of own production to third parties | Dt 45 Kt 21Account 21 – Semi-finished products of own production (Active) | |

| Transfer of products (works, services) of auxiliary production to third parties | Dt 45 Kt 23Account 23 – Auxiliary production (Active) | |

| Transfer of products from service industries and farms to third parties (without transfer of ownership) | Dt 45 Kt 29Account 29 – Service industries and farms (Active) | |

| Transfer of products to third parties | Dt 45 Kt 29Account 29 – Service industries and farms (Active) | |

| Transfer of goods to third parties | Dt 45 Kt 41Account 41 – Goods (Active) | |

| goods are transferred for sale to an intermediary organization | Dt 45 Kt 41Account 41 – Goods (Active) | |

| Transfer of finished products to third parties | Dt 45 Kt 43Account 43 – Finished products (Active) | |

| Finished products shipped | Dt 45 Kt 43Account 43 – Finished products (Active) | |

| Inclusion in the cost price of valuables transferred without transfer of ownership of sales expenses associated with the shipment of products (goods) | Dt 45 Kt 44 Account 44 – Selling expenses (Active), 60 Account 60 – Settlements with suppliers and contractors (Active-passive) | |

| Inclusion in the cost of values of values transferred without transfer of ownership rights, costs separated by divisions, allocated to separate balance sheets | Dt 45 Kt 79 Account 79 – On-farm settlements (Active-passive) | |

| Inclusion in the cost of values transferred without transfer of ownership of amounts payable to third parties (for example, for insurance) | Dt 45 Kt 76-1Account 76-1 – Calculations for property and personal insurance (Active-passive) | |

| Inclusion in the cost of goods (products) transferred to third parties without transfer of ownership of the corresponding share of the costs of their sale | Dt 44Account 44 – Selling expenses (Active) Kt 45 | |

| Reflection of shortages of material assets previously reflected as goods shipped | Dt 94 Account 94 – Shortages and losses from damage to valuables (Active-passive) Kt 45 | |

| Reflection of losses of goods shipped due to emergency circumstances (natural disasters, fires, accidents, nationalization, etc.) | Dt 99Account 99 – Profits and losses (Active-passive) Kt 45 | |

| Reflection of debts of various debtors and creditors for goods shipped (for example, an insurance company - in the event of an insured event) | Dt 76-1Account 76-1 – Calculations for property and personal insurance (Active-passive) Kt 45 | |

| Reflection of the transfer of goods shipped to separate divisions allocated to a separate balance sheet | Dt 79-1Account 79-1 – Settlements for allocated property (Active-passive) Kt 45 | |

| Reflection of the transfer of goods shipped under a property trust management agreement | Dt 79-3Account 79-3 – Settlements under a property trust management agreement (Active-passive) Kt 45 | |

| implementation | Dt 90-2Account 90-2 – Cost of sales (Active-passive) Kt 45 |

Here you can add your version of the Accounting transaction and after verification we will add it to the site. Thank you for your cooperation Dt Kt

Spam protection. Please enter number twenty-one:

« Return to Chart of Accounts

The following accounting tests are associated with the score '45'

Questions and discussion

There are no comments on this matter yet.

Explanatory note: Dt=Debit, Kt=Credit

Operations under commission agreements

A commission agreement is an agreement under which one party (the commission agent) undertakes to sell the goods of the other party (the principal) for a fee. Goods received for sale are the property of the principal.

The subject of the agreement can be either a one-time transaction or several transactions of the same type.

Goods transferred from the principal to the commission agent are recorded separately in accounting. For this purpose, the principal uses account 45 “Goods shipped”.

Example of operations under a commission agreement

For example, let’s consider a situation where the organization LLC “Sigma” transfers goods for sale worth 300,000 rubles to the commission of the organization LLC “Delta”.

Postings for shipment of goods from the consignor's warehouse

| Dt | CT | Operation description | Sum | Document |

| 45 | 41 | The cost of goods has been written off | 300000 | Invoice TORG-12 |

| 45 | 44 | The cost of goods is increased by production costs | 15000 | |

| 90.2 | 45 | The cost of goods is written off | 315000 | Commissioner's report |

Shipment without transfer of ownership

Let’s say LLC “Sigma” sold a fixed asset (building) to LLC “Omega” at an initial cost of 1,200,000 rubles and accrued depreciation of 700,000 rubles.

The sales amount was 3,500,000 rubles.

The peculiarity of the sale of buildings and structures is that they are not physically shipped or transported anywhere. The transfer of ownership is registered in the Unified State Register of Real Estate.

- Until ownership passes, Sigma cannot recognize revenue from the transaction. At the time of shipment, the fixed asset is written off from account 01 to 45;

- At the time of transfer of ownership, the residual value of the fixed asset is written off to expense account 91.2.

Postings for shipment before transfer of ownership

| Dt | CT | Operation description | Sum | Document |

| 01 disposal of OS1 | 01 | Write-off of fixed asset value | 1200000 | Transfer certificate OS-1 |

| 02 | 01 disposal of fixed assets | Write-off of accumulated depreciation | 700000 | Transfer certificate OS-1 |

| 45 | 01 disposal of fixed assets | Write-off of the residual value of the object as expenses after the transfer of ownership | 500000 | Implementation Act |

Postings after registration of ownership

| Dt | CT | Operation description | Transaction amount | Document |

| 91.2 | 45 | The residual value of the transferred object is written off | 500000 | Transfer certificate OS-1 |

| 62.01 | 91.1 | The amount of sale of the object is reflected | 3500000 | Implementation Act |

What is considered a product in accounting?

This is an object that belongs to the category of inventories, but is purchased specifically for subsequent resale, and not for use. This distinguishes it from raw materials, materials or products manufactured for further use. It is understood that it must be profitable, that is, it must be sold at a higher price than purchased (which is not always possible in practice - due to various circumstances). When reflected on accounts, it is not so important what status its owner is in: it can be either a legal entity or an individual, an international concern or a private entrepreneur.

Account 45 in accounting

Account 45 in the chart of accounts is active, therefore, the shipment and transfer of goods or finished products to commission is reflected as a debit, and their cost as a credit:

Goods are accounted for at cost, which includes:

- actual production cost;

- expenses for shipping products or goods, partial write-off.

Analytical accounting for account 45 is carried out according to:

- types of products or goods shipped;

- their location.

What is it used for?

41 accounting accounts are used to reflect the cost of products intended for sale. The following types of expenses may be included:

- the cost of purchasing goods from the supplier;

- paid customs duties for clearing products at customs (if they crossed the state border);

- transport costs;

- payment to intermediaries;

- other expenses that are directly related to the purchase of goods.

Also, VAT may be included in the cost if the company operates under the simplified tax system.

When retailing goods, they are taken into account in accounting in various ways:

- At purchase prices. In this case, the cost of the product includes its price minus indirect tax (VAT) and all expenses that the company incurred in purchasing it. These could be, for example, procurement costs or transport costs.

- At the selling price. In this case, the goods are recorded in accounts at cost, including trade margins. Only enterprises engaged in retail trade can keep records using this method. The trade margin is reflected in the account. 42 and is written off from there when the goods are sold.

Selling price

- At discounted prices. All goods are accepted at certain discount prices. The difference between the purchase price and the accounting price is reflected in the account. 15, and the goods are written off through the account. 16.

Important! The accounting method must be reflected in the accounting policy of the enterprise.

Basics of accounting in trade

Watch on youtube || on INTUIT quality: high

The presentation for this lecture can be downloaded here.

Purpose of the lesson:

consider the basic provisions of accounting for goods and accounting in trade organizations.

General provisions

If an organization purchases a computer in order to use it for production purposes, we will consider this computer as a fixed asset. And if the same computer is purchased for the purpose of resale, we will deal with the goods. Organizations that sell various goods are trading organizations. Everything we will talk about here applies primarily to them. However, organizations for which trade is not their main activity can also purchase something for resale.

The procedure for accounting for goods in organizations whose main profile is not the sale of purchased goods is regulated by Section 5 of Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n “On approval of guidelines for accounting of inventories.”

In particular, in accordance with paragraph 217 of the Order, organizations that carry out trading activities along with other types of activities are called “non-trading organizations”. In accordance with paragraph 218 of the Order, non-trading organizations can sell goods purchased by the organization specifically for sale.

In accordance with paragraph 229 of the Order, revenue from the sale of goods in non-trading organizations is taken into account in the same way as the rules established for finished products.

Features of accounting for goods are regulated by PBU 5/01 “Accounting for inventories”.

The following accounts are used to record goods and related transactions:

- 41 "Products"

- 42 “Trade margin”

- 44 “Sales expenses”

- 45 “Goods shipped”

Accounting for goods can be formalized both by primary documents developed by the organization independently, and by primary accounting documentation in accordance with Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132 “On approval of unified forms of primary accounting documentation for accounting of trade operations.” In particular, the following general forms of accounting documentation used in trade have been approved:

- TORG-1 “Act of acceptance of goods”

- TORG-2 “Act on the established discrepancy in quantity and quality when accepting inventory items”

- TORG-3 “Act on established discrepancies in quantity and quality when accepting imported goods”

- TORG-4 “Act of acceptance of goods received without a supplier’s invoice”

- TORG-5 “Act on the receipt of packaging not specified in the supplier’s invoice”

- TORG-6 “Act on container curtain”

- TORG-7 “Logbook of registration of inventory items that require a curtain of containers”

- TORG-8 “Order - selection list”

- TORG-9 “Packaging label”

- TORG-10 “Specification”

- TORG-11 “Product label”

- TORG-12 “Consignment note”

- TORG-13 “Invoice for internal movement, transfer of goods, containers”

- TORG-14 “Invoice and invoice (for small retail trade)”

- TORG-15 “Act on damage, damage, scrap of inventory items”

- TORG-16 “Act on write-off of goods”

- TORG-17 “Incoming group plumb line”

- TORG-18 “Logbook for the movement of goods in a warehouse”

- TORG-19 “Consumption plumb line (specification)”

- TORG-20 “Act on part-time work, sub-sorting, repacking of goods”

- TORG-21 “Act on sorting (sorting) of fruits and vegetables”

- TORG-22 “Act on control (selective) inspection of eggs”

- TORG-23 “Commodity magazine of a small retail trade worker”

- TORG-24 “Act on re-measuring fabrics”

- TORG-25 “Act on markdown of flaps”

- TORG-26 “Order”

- TORG-27 “Logbook of fulfillment of customer orders”

- TORG-28 “Card of quantitative and cost accounting”

- TORG-29 “Commodity report”

- TORG-30 “Report on containers”

- TORG-31 “Accompanying register of documents delivery”

There are other forms of documents used when selling goods on credit (their codes begin with the name KR), when accounting for transactions in commission trade (their codes begin with KOMI), when accounting for transactions in public catering (their codes begin with OP).

Receipt of goods

When goods arrive at a trade organization, its acceptance is handled by a financially responsible person or a special commission, depending on the size of the organization and the scope of work. The receiving party checks the compliance of the delivered goods with the accompanying documents. If these data coincide, the goods are included in the following accounting entry:

D41 K60

— goods have arrived from the supplier

If the trading organization is a VAT payer and VAT on goods received is highlighted in the invoice, the following entry is made:

D19 K60

— the amount of input VAT on accepted goods. As you already know, input VAT recorded on account 19 can be deducted.

Payment of the supplier's invoice is reflected in accounting as follows:

| D60 K51 - supplier’s invoice paid by bank transfer |

| D60 K50 - supplier’s invoice paid in cash |

Goods in trade organizations can be accounted for at purchase prices - this procedure is used in wholesale and retail trade organizations, and at sales prices - this procedure can be used for retail organizations that sell goods at a premium. The method of valuing goods is determined in the accounting policy of the organization.

If goods are accounted for at sales prices, upon receipt of goods, together with the previous ones, the following entry is made:

D41 K42

- the amount of the trade margin. The size of the trade margin is determined by the internal documents of the organization.

It should be noted that account 42, in which information about the trade margin is stored, is a contractual account to account 41. That is, the trade margin is not reflected in the organization’s balance sheet, it only reduces the indicator of account 41. Therefore, the balance sheet indicators of the balance of goods for account 41 in the organization’s balance sheet contain information about goods at purchase prices. On account 42, in addition to markups, discounts on the cost of goods can also be taken into account.

Reasons for writing off goods from the warehouse

The most common is a sale that is carried out on a paid basis to a counterparty under a previously concluded agreement. Although there are other implementation options, including:

- with the involvement of an intermediary;

- with access to the national (in our case, the domestic Russian) market;

- with export and payment in rubles (or their dollar or euro equivalent).

The list of other common reasons:

- withdrawal to pay for ownership (full or its share) in the authorized capital of any enterprise;

- exchange for other items;

- disposal for use in the course of its production activities;

- theft, damage, shortage;

- gratuitous transfer;

- force majeure circumstances.

Accounting with the seller (transfer of ownership upon payment)

Postings to account 45:

- Debit 45 Credit 43 or 41 - Finished products or goods shipped to the buyer.

- Debit 45/VAT or 76/VAT credit 68/VAT - VAT has been accrued for shipped products. (VAT is accrued since VAT must be accrued to the buyer on shipments). (In 1c, to account for VAT on shipped goods, an account is provided 76/OT)( 76/VAT is reflected in the balance sheet in the line other current assets.)

- Debit 51 Credit 62-Payment received from buyer.

- Debit 62 Credit 90-1-Accrued revenue from sales.

- Debit 90-2 Credit 45-Write off the cost of finished products or goods.

- Debit 90-3 Credit 76/VAT or 45/VAT - VAT reflected.

Example:

01/01/2019-Shipped goods to the buyer in the amount of 100,000 rubles at cost. The sale price is 150,000 rubles. Wh VAT

01/15/2019-The buyer paid the invoice.

Transfer of ownership of the goods after payment.

Solution:

01,01,2019:

1) Debit 45 Credit 41-100,000 rubles - The cost of shipped goods has been written off.

2) Debit 76/VAT Credit 68/VAT-25,000 rubles (150,000/120*20) - VAT is charged on goods shipped.

15,01,2019:

3) Debit 51 Credit 62-150,000 rubles - Payment received from the buyer including VAT.

4) Debit 62 Credit 90-1-150000 -Proceeds from the sale are reflected.

5) Debit 90-2 Credit 45-100,000 rubles - Cost of goods sold is written off.

6) Debit 90/VAT credit 76/VAT-25000 VAT is reflected.

Buyer's accounting

Based on the supplier’s (seller’s) invoice, the goods are received depending on the purpose of its purchase:

Debit 41 (08, 10) Credit 60 – Reflects the debt of the buyer to the seller (supplier) of goods.

Based on the invoice of the seller (supplier), VAT is allocated:

Debit 19 Credit 60 – VAT payable to the supplier is taken into account;

Debit 60 Credit 50 (51) – The debt to the seller (supplier) has been repaid.

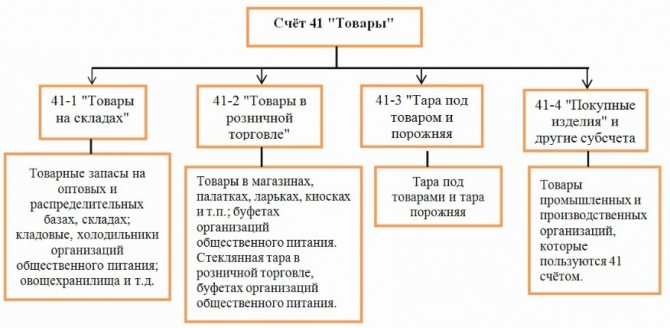

Existing subaccounts of account 41

According to the order approving the Chart of Accounts for the account. 41 you can open at least 4 sub-accounts for product classification:

- Account 41-01 - the subaccount takes into account products that are in the warehouse, base, or pantry.

- 41-02 - this subaccount reflects the presence and movement of material assets (including glassware) that are directly put up for sale in a store, kiosk, tent or stall.

- 41-03 - this subaccount takes into account all containers: currently occupied or empty, standing separately (except for glassware).

- 41-04 - this subaccount is used in organizations that conduct industrial or production activities. At 41-04, they take into account products that are purchased specifically for sale or when the cost of components for finished products is not included in the cost of the final product, but is reimbursed separately by buyers.

Accounting has the right to open other, additional sub-accounts to the account. 41 taking into account the specifics of the enterprise’s operations, if the need arises for more detailed account details.

Note! For account 41 analytical accounting can be maintained in the accounting department in the context of product names, places of their storage, as well as persons responsible for it.

Subaccounts 41

Tax accounting when exporting goods

VAT

Operations for the sale of goods for export are subject to VAT at a rate of 0% (clause 1 of Article 164 of the Tax Code of the Russian Federation). To apply a zero rate, you need to confirm the fact of export of goods outside the Russian Federation. The list of supporting documents is given in Art. 165 Tax Code of the Russian Federation. It depends on where the goods are exported: to the EAEU countries or outside the EAEU territory.

When exporting outside the territory of the EAEU, the following documents will be required.

- Copy or original of the export contract (agreement). If the contract provides for several deliveries with the execution of separate documents, then it is not necessary to submit it for each shipment. It is enough to attach a notification with the details of the document with which you previously sent the contract.

- Customs declarations (their copies or registers) with marks from Russian customs.

They must be submitted to the tax office along with VAT returns no later than 180 calendar days from the date of registration by customs.

If tax authorities see inconsistencies in the main documents, they may request additional ones - transport, shipping documents and others. They must be submitted within 30 calendar days of the request.

When exporting to the EAEU countries, the following documents will be required.

- Copy or original of the export contract (agreement).

- Application for import of goods and payment of indirect taxes from your foreign buyer (copy or electronic register).

The deadline for submission to the Federal Tax Service is no later than 180 calendar days from the date of shipment of goods.

If you are late with export confirmation, you must pay VAT at general rates. To do this, follow these steps:

- Issue an invoice with VAT of 10 or 20%.

- Register it in the additional list of the sales book for the quarter in which the goods were shipped.

- During the same period, submit an updated declaration.

In addition to VAT, you will have to pay a penalty, which will arise due to the fact that you calculated the tax after the goods were shipped.

The right to confirm export will remain with you for three years from the end of the quarter in which the goods were shipped.

If you do not want to collect a package of documents, you can refuse the preferential rate of 0% and apply the general rate of 10% or 20%. To do this, submit a free form application to the tax office. The deadline for submission is until the 1st day of the quarter from which you plan to abandon the zero rate . After refusal, it cannot be used for at least 12 months .

But when exporting goods to the EAEU countries, you will not be able to refuse the zero rate, since in this case you need to be guided by the Treaty on the Eurasian Economic Union. It, unlike the Tax Code of the Russian Federation, does not provide for refusal.

The tax that you paid when purchasing exported goods (input VAT) can be taken as a deduction (clause 3 of Article 172 of the Tax Code of the Russian Federation).

The procedure for deducting VAT depends on the applicable tax rate and the type of goods exported. Thus, paid VAT amounts can be reimbursed in the usual manner prescribed in Art. 176 and art. 176.1 of the Tax Code of the Russian Federation, if you:

- refused the 0% rate;

- export non-commodity goods registered on July 1, 2016;

- export goods that are considered raw materials, but are not included in the List, approved. By Decree of the Government of the Russian Federation No. 466 of April 18, 2021

In this case, all the conditions necessary for the deduction must be met - the tax is presented by the supplier, the goods are used for activities subject to VAT, are accepted for registration, and a correctly executed invoice or universal transfer document is received.

For the export of primary goods, the right to deduct VAT arises in one of two moments.

- On the last day of the quarter in which documents were collected to confirm the preferential rate of 0%.

- On the day of shipment of the goods, if the fact of export of goods from Russia has not been confirmed. In this case, you need to apply the general VAT rates - 10% or 20%.

Legal entities and individual entrepreneurs who work in special modes or have received an exemption from VAT under Art. 145-145.1 of the Tax Code of the Russian Federation, do not charge VAT and do not apply a 0% rate.

Income tax

In tax accounting, export proceeds from the sale of goods are reflected as income from sales. What date to reflect income depends on the chosen method of accounting for income and expenses.

- Accrual method - income is taken into account on the date of sale of goods (transfer of ownership), regardless of the fact of payment. As of this date, foreign currency must be converted into rubles to determine the amount of income (with the exception of the advance payment - it is calculated at the rate of the Central Bank of the Russian Federation on the date of receipt).

- Cash method - income is recognized upon receipt of money in a foreign currency account. The amount is determined by converting the received foreign currency into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of receipt of payment.

With the accrual method, exchange rate differences may arise due to fluctuations in foreign currency exchange rates, which are taken into account as follows:

- positive - as part of non-operating income;

- negative - in non-operating expenses.

With the cash method of accounting, there will be no exchange rate differences. Prepayment, if provided for by the contract, is included in income on the date of receipt.

Under the accrual method, advances and prepayments (including partial) are not recognized as income for income tax purposes. In this case, if the goods are exported on the basis of 100% advance payment, there will be no exchange rate difference.

When calculating income tax, income from the export of goods can be reduced by the costs associated with their acquisition and sale. To do this, as when implementing on the territory of the Russian Federation, they must be:

- economically justified;

- documented;

- aimed at generating income.

In the “My Business Professional Accountant” service, exchange rate differences and taxes during export are determined automatically. To reflect the revenue, it is enough to issue an invoice in the service, and to close the transaction, a closing document. Try it: it's convenient and saves a lot of time!

Examples of transactions and postings on account 45

Example. Accounting for goods accepted for commission under account 45

Let’s say that LLC “Leto” and LLC “Vesna” entered into a commission agreement for the sale of goods with a cost of 30,000 rubles. According to the terms of the agreement, the selling price of goods is 59,000 rubles, incl. VAT – 9,000 rubles, and commission – 10%.

In the accounting of Leto LLC, the following entries are made to account 45 for accounting for consignment goods:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 45 | 41 | 30 000 | Goods shipped | TTN, Invoice |

| 76 | 68 VAT | 9 000 | VAT calculation | TORG-12, Invoice |

| 76 | 90.01 | 59 000 | Reflection of sales proceeds | Commissioner's report + primary documentation |

| 90.02 | 45 | 30 000 | Write-off of cost of goods sold | Bank account statement, Accounting certificate |

| 76 | 68 VAT | 9 000 | VAT (reversal) | Invoice |

| 90.03 | 68 VAT | 9 000 | VAT accrual on revenue | |

| 51 | 76 | 59 000 | Receipt of funds from Vesna LLC | Bank statement |

| 44 | 60 | 5 000 | Calculation of remuneration for Vesna LLC | Certificate of completion of work, Invoice |

| 19 | 60 | 900 | VAT on remuneration is taken into account | |

| 68 VAT | 19 | 900 | Tax deduction | Invoice, Accounting statement, Purchase book |

| 60 | 51 | 5 900 | Remuneration has been paid | Payment order |

| 90.02 | 44 | 5 000 | Write-off of the remuneration amount | Certificate of completion |

| 90.09 | 99 | 15 000 | Reflection of the financial result from the sale of goods (profit) | Accounting information |