Income tax: payment order in 2021

All organizations carrying out entrepreneurial activities are required not only to report to the tax office on the profits received, but also to make timely payments to the relevant budgets. To report, you must provide the Federal Tax Service with a calculation in the form of a tax return for income tax and explanations for it (if necessary).

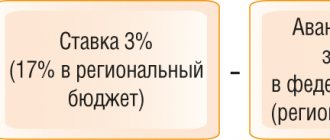

The settlement document for payment, as in previous years, is a payment order (or simply “payment order”). Although the tax is at the federal level, it should be paid according to different budgets:

- federal;

- regional.

IMPORTANT!

In 2021, 17% is transferred to the regional budget, and 3% to the federal budget, provided that the organization does not have benefits for the use of reduced rates (Article 284 of the Tax Code of the Russian Federation).

To pay, the organization must fill out two settlement documents: one to the federal budget, and the second to the regional budget. The main differences in the details are the purpose of payment and the budget classification code, which are determined by Order of the Ministry of Finance of Russia No. 132n.

What is it for?

To pay the tax fee, enterprises calculate it, submit a declaration, and then issue a payment to the budget to transfer money to the regional and federal budgets. Companies pay income taxes through monthly or quarterly advance payments. The regional budget receives 17% of the profit, and the federal budget receives 3%. Such indicators are applied from 2021 to 2021, according to Article 284 of the Tax Code of the Russian Federation. In this regard, accountants fill out not one payment order for income tax 2021, but two - they indicate different budget classification codes:

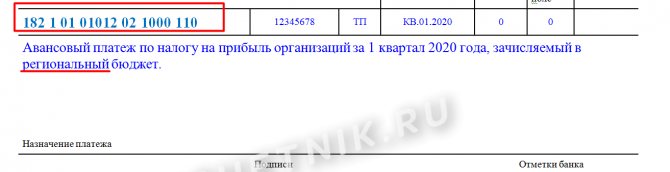

- the federal budget corresponds to 182 1 0100 110;

- regional — 182 1 0100 110.

In addition, starting from 2021, new BCCs have been introduced to reflect the income tax of international holding companies (Order of the Ministry of Finance No. 26n dated 03/06/2019):

- 182 1 0100 110 - for transfer to the federal budget;

- 182 1 0100 110 - to the regional budget.

Last dates for payment of income tax

The deadlines and procedure for payment are specified in the Tax Code in Articles 287 and 289. The last date depends on the methods for calculating advances.

If the organization carries out monthly calculations, then the deadline is until the 28th day of the month following the reporting month.

For quarterly - until the 28th day of the month following the reporting quarter.

For the final tranche for the year, the payment deadline is March 28 of the year following the reporting year.

If the deadline falls on a holiday or weekend, then the obligations are fulfilled on the next working day. This feature is established in paragraph 7 of Art. 6.1 Tax Code of the Russian Federation.

How to fill out a payment order

Here are instructions on how to fill out the fields of a payment order for income tax, and what you should pay special attention to.

| Payment field number | Meaning |

| 3 and 4 “Document number and date” | Prepare the document no later than the tax payment deadline to avoid penalties from the Federal Tax Service. Set the numbering in a chronological manner, otherwise the bank will return the payment document. |

| 6 and 7 “Document amount” | Enter the amounts in words in field 6 and in numbers in field 7. To transfer tax payments to the Federal Tax Service, follow the rounding rule, in accordance with clause 6 of Art. 52 of the Tax Code of the Russian Federation and letter of the Federal Tax Service dated May 19, 2016 No. SD-4-3/8896. That is, if the amount is less than 50 kopecks, we do not take it into account; 50 kopecks or more, we round up to the full ruble. Example: 1000.49 rub. — payable 1000 rubles, 1000.51 rubles. — payment is 1001 rubles. |

| 8-12 “Information about the payer” | Fill in the name of the organization, INN and KPP, current (personal) account, name of the bank (credit organization), details (bank, credit organization). |

| 13-17 “Information about the recipient” | Enter the same data as the recipient, in our case the details of the Federal Tax Service. |

| 21 "Sequence" | Set the value to 5, in accordance with Art. 855 of the Civil Code of the Russian Federation. |

| 22 "UIN" | Record 0 because this is a current payment and there is no special value set for it. |

| 24 “Purpose of payment” | Write down:

|

| 101 “Payer status” | Indicate 01, since the organization is a direct taxpayer of payments administered by tax authorities (based on Appendix No. 5 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013). |

| 104 “Budget classification code” | In accordance with the order of the Ministry of Finance dated July 1, 2013 No. 65n, set the following indicators:

|

| 105 "OKTMO" | Here, indicate OKTMO, determined by the location of the Federal Tax Service, to which the taxpayer is attached. |

| 106 “Basis of payment” | Reflect the current payment using the “TP” code, determined according to clauses 7 and 8 of Appendix No. 2 of Order No. 107n of the Ministry of Finance dated November 12, 2013. |

| 107 “Tax period” | Set the indicator taking into account the method of transferring tax payments:

|

| 108 “Basic document” | Enter 0 as this is a current payment. |

| 109 “Date of foundation document” | For annual calculation, indicate the date of preparation of the declaration; for monthly or quarterly advance calculation - 0. |

| 110 "Information" | There is no data to fill out field 110, leave the field blank. |

Land tax

See also:

- Accountant's calendar for the first quarter of 2021 for payment of taxes and fees

- Rules for filling out payment orders from 2021 in 1C

- In 2021, the rules for filling out budget payments are changing globally

- Document Payment order

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C: Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Did the article help? Rate it

Loading…

Step-by-step filling out the income tax payment form

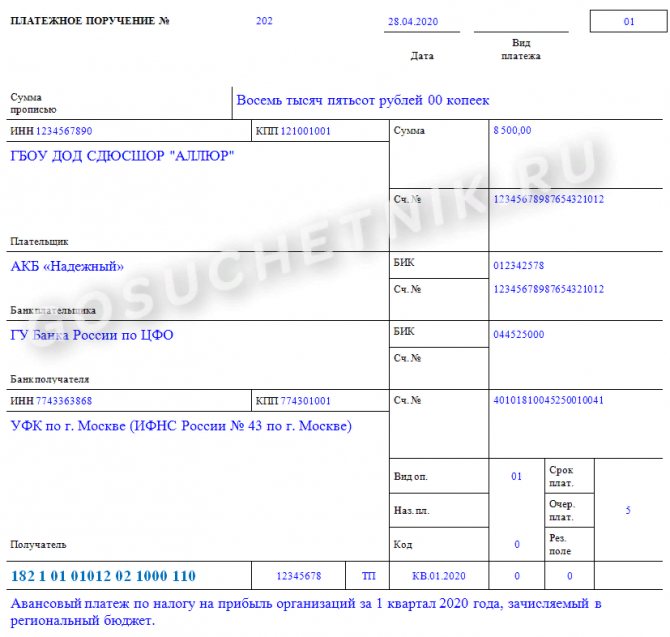

Let's look at how to correctly fill out a payment order for income tax using an example.

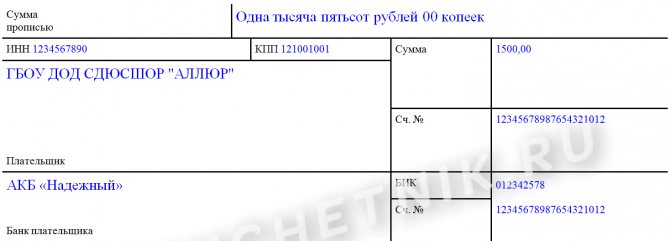

GBOU DOD SDYUSSHOR "ALLUR" for the first quarter of 2021 received a profit in the amount of 50,000.00 rubles. When calculating income tax, organizations should transfer to the budget:

- federal - 1,500.00 rubles (50,000.00 × 3%);

- regional - 8,500.00 rubles (50,000.00 × 17%).

We generate payment orders for each budget level (amount). We fill out the payment order step by step:

Step 1. Fill in the date and number of the payment order, observing the chronological order, then set the payer status.

Step 2. Enter the payer's details and amounts (in numbers and words).

Step 3. We enter the details of the payee of the Federal Tax Service in the payment order.

Step 4. Fill in the tax fields, order of payment, UIN, payment purpose.

For the federal budget.

For the regional budget.

Sample payment order for the federal budget:

Sample payment order for the regional treasury:

How to fill out a payment order for payment of advance payments for income tax

The procedure for filling out a payment order for the payment of advance payments for income tax is similar to the rules for filling out a payment order when transferring taxes. But there are features of filling out some fields depending on what kind of advance payments you make - monthly advance payments during the quarter, quarterly or monthly advance payments based on actual profit.

How to fill out a payment order for payment of monthly advance payments for income tax during the quarter

When filling out a payment order for payment of monthly advance payments of income tax during the quarter, please pay attention to filling in the following fields.

Field 107 “Tax period” must be filled in as follows (clause 8 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n):

- in the 1st and 2nd digits, indicate the monthly payment code “MS”, since the tax is paid per month;

- in the 4th and 5th digits reflect the number of the month based on the results of which the advance payment is transferred;

- In the 7th – 10th digits indicate the year for which the payment is being made.

In the 3rd and 6th characters you need to put dividing points.

For example: “MS.04.2018”.

In field 24 “Purpose of payment” it is necessary to make a textual explanation that will allow you to determine the payment as accurately as possible (clause 13 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n, Appendix No. 1 to Bank of Russia Regulation N 383-P).

For example, “Monthly advance payment of income tax paid to the federal budget of the Russian Federation in February.”

The remaining fields are filled in in the general order.

How to fill out a payment order for payment of quarterly advance payments for income tax

When filling out a payment order for the payment of quarterly advance payments for income tax, pay attention to filling in the following fields.

Field 107 “Tax period” must be filled in as follows (clause 8 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n):

- in the 1st and 2nd digits, indicate the quarterly payment code “KV”, since the advance payment is paid per quarter;

- in the 4th and 5th digits reflect the number of the quarter based on the results of which the advance payment is transferred;

- In the 7th – 10th digits indicate the year for which the payment is being made.

In the 3rd and 6th characters you need to put dividing points.

For example: “KV.01.2018”.

In field 24 “Purpose of payment” it is necessary to make a textual explanation that will allow you to determine the payment as accurately as possible (clause 13 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n, Appendix No. 1 to Bank of Russia Regulation N 383-P).

For example, “Advance payment of income tax for the first quarter of 2018, credited to the budget of a constituent entity of the Russian Federation.”

The remaining fields are filled in in the general order.

How to fill out a payment order for monthly advance payments based on actual profit

When filling out a payment order for monthly advance payments based on actual profit, pay attention to filling in the following fields.

Field 107 “Tax period” must be filled in as follows (clause 8 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n):

- in the 1st and 2nd digits, indicate the monthly payment code “MS”, since the tax is paid per month;

- in the 4th and 5th digits reflect the number of the month based on the results of which the advance payment is transferred;

- In the 7th – 10th digits indicate the year for which the payment is being made.

For example: “MS.05.2018”.

In field 24 “Purpose of payment” it is necessary to make a textual explanation that will allow you to determine the payment as accurately as possible (clause 13 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n, Appendix No. 1 to Bank of Russia Regulation N 383-P).

For example, “Advance payment of income tax based on the actual profit received for payment for May 2021, credited to the federal budget.”

The remaining fields are filled in in the general order.

Responsibility for failure to pay taxes on time

Tax authorities distinguish between the types of violations for which penalties are provided. If obligations are not paid in full or there is no payment, the organization will be fined 20% of the amount not received to the relevant budget. The fine will be issued on the basis of clause 1 of Art. 122 of the Tax Code of the Russian Federation.

If Federal Tax Service employees discover an understatement of the base for calculating payments between interdependent companies, the fine will be 40% of the underestimated tax amount, but not less than 30,000 rubles. Grounds - clause 1 of Art. 129.3 Tax Code of the Russian Federation.

If an organization forgets to include income from a controlled foreign company in the tax base, it will be fined 20% of the unaccounted tax liability, but not less than 100,000 rubles (Article 129.5 of the Tax Code of the Russian Federation).

For deliberate understatement of income, a fine will be imposed under paragraph 3 of Article 122 of the Tax Code of the Russian Federation - in the amount of 40% of the unpaid tax.

The tax agent will be fined for failing to withhold and transfer taxes to the budget, for example on dividends. A fine will be issued on the basis of Article 123 of the Tax Code of the Russian Federation - in the amount of 20% of the amount of the unwithheld tax liability.