General characteristics of account 43

Finished products (GF) are products received at the organization’s warehouse that have gone through the entire production process and comply with accepted standards and technical specifications. GP is accounted for in account 43. Let's consider the general characteristics of account 43.

Account 43 is active, i.e. the balance on this account can only be recorded as a debit.

GP refers to material reserves, therefore, when forming a balance, the balance of account 43 is reflected in the asset. SOEs are accounted for in cost and quantitative terms. This allows you to increase the accuracy of accounting and provide control over the availability and movement of products.

Two sub-accounts can be opened for account 43, depending on the accounting method adopted. Finished products are reflected in the accounts at planned (subaccount 43.1) or at actual cost, taking into account deviations (43.2).

The planned cost is calculated using standard costs for the production of products or the provision of services. The actual one can be determined only after the end of the reporting period based on the actual expenses incurred by the enterprise.

The organization itself determines how it will keep records of GPs. This method is fixed by order and prescribed in the company’s accounting policy.

Typical transactions for account 43

Account 43 correspondence

Account 43 corresponds in debit with the accounts of production (20, 23, 29), production output (40), internal expenses (79), authorized capital (80) and other income and expenses (91). Such postings indicate the acceptance of finished products for accounting.

For the loan, account 43 corresponds with the accounts of production (20, 23, 29), materials (10), general production, general and commercial expenses (29, 26, 44), defects in production (28), shipped goods (45), settlements - with debtors and creditors and intra-economic (76, 79), authorized capital (80), sales (90), shortages and losses from damage to valuables (94), deferred expenses (97), profits and losses (99). With similar postings, finished products are written off from account 43.

Postings to account 43

When accepting finished products for accounting, the accountant makes the following posting options:

| Dt | CT | Content | A document base |

| 43 | 20, 23, 29 | Receipt of GP from any production to the warehouse | Purchase Invoice |

| 43 | 79 | Receipt of GP from any division of the enterprise | Transfer and Acceptance Certificate |

| 43 | 98 | Accounting for GP as a discount for the buyer | Packing list |

| 43 | 80 | The entry of a state enterprise as a contribution to the authorized capital | Minutes of the board's decision |

Postings for writing off the cost of finished products from the balance sheet:

| Dt | CT | Content | A document base |

| 45 | 43 | Shipment of GP to third parties | Transfer and Acceptance Certificate |

| 80 | 43 | Transfer of a state enterprise under a simple partnership agreement | Transfer and Acceptance Certificate |

| 94 | 43 | Write-off of GP when a shortage is detected | Commission report, Inventory sheet |

| 44 | 43 | GP consumption for commercial purposes | Expense report |

| 97 | 43 | The cost of the GP used to perform the work is written off as deferred expenses. | Work contract |

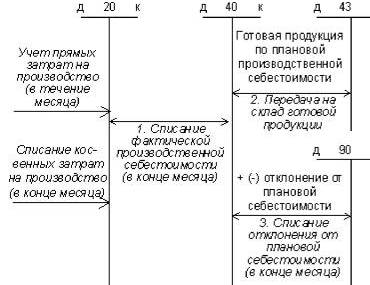

The accounting scheme for finished products looks like this:

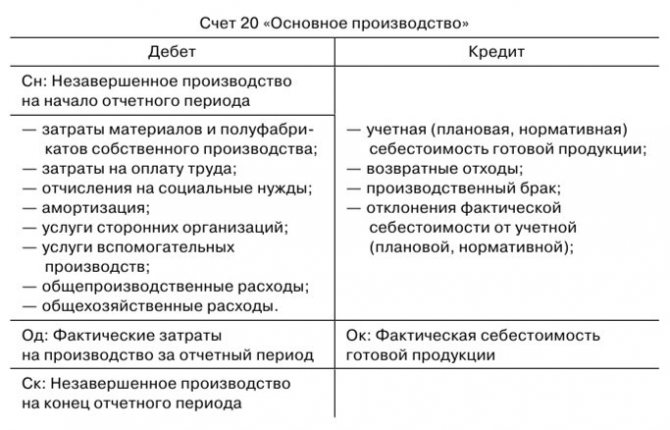

What is account 20 in accounting

Account 20 is one of the registers in Section III of the Chart of Accounts. It summarizes information about the costs associated with the production of products (works, services).

Expenses

The main function of account 20 “Main production” is calculation, since it describes the economic process of manufacturing a product and collects all information about the costs of its production. Also, using an account card, you can track information about the movement of property in the enterprise.

The difference between this register and the others in accounting is that its balance at the end of the reporting period is not calculated using a formula, but is entered manually. This is due to the fact that cost information is collected on the account over a period of time (at least a month). Until the end of the period, the exact cost of the goods is unknown, since it includes many components - depreciation, wages for workers and management, utilities, transportation costs.

Thus, at the end of the reporting period (and necessarily at the end of the year), the account. 20, like production shops, is subject to inventory to identify work in progress. After this, the amount spent on the production of finished products (actual cost) is calculated, which is written off using one of the methods adopted by the enterprise’s accounting policy.

Accounting for finished products at planned cost

When accounting for production results at standard cost on account 43, finished products are reflected at planned, predetermined prices. Their calculation is carried out before the start of the production process. In order to record the actual cost and subsequently determine the deviation of different prices from each other, use the 40th account. In this case, postings to account 43 “Finished products” are made in the following order:

- When transferring products to the warehouse, accounting is carried out at standard cost, which is reflected in the credit of account 40: Dt “Finished products” Ct “Product output”.

- As products are sold, its standard cost is written off to the financial result: Dt “Cost of sales” Kt “Finished products”.

- At the end of the month, the accountant calculates the actual cost of production of products received into the warehouse. The resulting value is included in Dt 40: Dt “Product Output” Kt “Main Production”.

- By comparing credit turnovers (normative value) with debit turnovers (actual value), it is easy to determine the deviation of one price from another. Having determined it, the amount is written off when the actual cost is exceeded by posting Dt “Cost of sales” Ct “Product output”. If the standard cost exceeds the actual cost, then the reversal method is used. The posting looks the same, but the amount is written with a negative sign.

Keeping records of products ready for sale at standard prices has a number of advantages. During the period, the assessment remains unchanged and predetermined. This facilitates planning and reporting processes, especially in mass production environments.

Definition of business transactions

A business operation (HO) means a specific act that led to transformation:

- the composition of the organization’s property or the procedure for its placement;

- sources that form the property mass of a business entity;

- company budget;

- fixed and reserve funds;

- ownership structures.

Note. Any significant change is controlled by creating an accounting entry. To record data, documents are used that have become the basis for the implementation of management.

Business transactions reflected in accounting affect the capital of a legal entity. This impact takes the form of a decrease or increase in the assets and liabilities of the enterprise. However, no manipulations should upset the balance of a business entity.

Figure 1. Balance sheet items

What does wiring Dt 43 Kt 43 mean?

Posting Debit 43 Credit 43 means changes in finished goods within account 43. But this movement does not affect the order in which account 43 balances are reflected in the balance sheet.

For more information about the procedure for reflecting finished products in the balance sheet, read the article “How finished products are reflected in the balance sheet.”

Such internal wiring Dt 43 Kt 43 is needed only for analytical accounting of the types of finished products and their components.

3-room apartment for sale

And in order to divide finished products into packaged and not, they began to carry out according to different nomenclature. Although it is possible to sell from 21 accounts? It turns out that we now have incorrect accounting? kalerisha 06-12-2011, 11:16:44 Release part of the finished product for subsequent processing in the packaging workshop as a semi-finished product of your own production (account 21), after carrying out work in the packaging workshop, release the finished product (account 43) according to the new nomenclature, writing off to its cost is the cost of the packaging workshop. And if we start posting unpackaged products on account 21, then packaging costs should already be reflected on account 20, do I understand correctly? Egor2014 06-12-2011, 12:00:29 And if we start posting unpackaged products on account 21, then packaging costs should already be reflected on account 20, do I understand correctly? You have divided the products into 2 types of items (conventionally - packaged and unpackaged).

D20.23K43- Reflects the use of finished products for the needs of the main production (auxiliary production) D79K43- Reflects the transfer of finished products to structural divisions of the organization D90K43- Writes off the actual cost of sold finished products D91K43- Writes off the cost of finished products for operating expenses D94K43- Reflects the amount of shortages and damage finished products identified as a result of the inventory D43K40- Reflection of the release of finished products at standard (planned) cost D50K51- Receipt of cash to the cash desk from the organization's current account D50K60- Receipt of cash to the organization's cash desk from suppliers (contractors) D50K62- Receipt of cash funds to the organization's cash desk from buyers (customers) D70 K 50- Reflects the issuance of funds from the cash register to pay employees, bonuses, etc.

What is “finished product”?

To carry out accounting operations, it is necessary to clearly understand what is hidden behind the term “finished products”. These are assets included in the inventory, which are the final result of production and are intended for sale. At the same time, they are properly modified, are fully equipped and meet all the requirements put forward by customers. These can be either individual products or semi-finished products. Some of the finished products are sometimes sent to the needs of the enterprise itself.

Do not confuse finished products with goods. These are also assets within the inventory, but only those that were acquired for sale from other companies or individuals. persons, and not produced independently. Goods are accounted for separately.

When to take an inventory

Inventory is carried out before drawing up annual financial statements, but this is not the only case when it is necessary (clause 3 of article 11 of Federal Law dated December 6, 2011 No. 402-FZ (hereinafter referred to as the Accounting Law), clause 27 of the Regulations, approved by Order Ministry of Finance dated July 29, 1998 No. 34n). For example, an inventory must be carried out regularly to identify food products, medicines and other goods with an expired shelf life (clause 4 of article 5 of the Law of the Russian Federation of 02/07/1992 No. 2300-1).

If an inventory is not carried out in the cases established by law or is carried out untimely, for example after the dismissal of a financially responsible person, then the company:

- will not be able to bring the resigned employee to financial responsibility (Determination of the Judicial Collegium for Civil Cases of the Armed Forces of the Russian Federation dated May 7, 2018 No. 66-KG18-6);

- will not be able to take into account losses from shortages as part of tax expenses (Articles 252, 265 of the Tax Code of the Russian Federation, Resolution of the Ninth Arbitration Court of Appeal dated November 1, 2018 No. 09AP-51247/2018).

33. Analytical and synthetic accounting of finished products

Within a month, the warehouse received GP at planned prices in the amount of 750,000 rubles. The amount of costs for the production of GP recorded on account 20 is 900,000 rubles. The balance of the work in progress is estimated at RUB 120,000. The planned cost of products sold is 500,000 rubles.

Solution:

Actual cost: 900,000D 20 – 120,000WIP = 780,000 rub.

Then the amount of deviations for GP transferred to the warehouse during the reporting month: 780,000 fact. cost price of goods received at the warehouse – 750,000; standard cost of goods received at the warehouse = 30,000.

Percentage of deviations for GP: (5,000 deviation at the beginning + 30,000 deviation for the period) / (240,000 planned prices at the beginning + 750,000 planned prices for the period) = 3.54%.

Amount of deviations attributable to shipped products: 500,000 planned cost of shipped * 3.54% deviation percentage = 17,700 =>

The actual cost of shipped products will be: 500,000plan. selfest. +17 700 off. = 51 7700.

The balance of GP at the end of the month at actual cost is 507,300, including:

Planned cost: 240,000 at the beginning of the month. + 750,000 yield within a month. – 500,000sold = 490,000.

Amount of deviations: 5,000beginning of month. + 30,000 per period – 17,700 per shipment. products = 17,300

490 000 + 17 300 = 507 300.

Account entries:

| D43 K20 | 750 000 | Released from GP production at planned cost |

| D43 off. K20 | 30 000 | The deviation of the actual cost from the planned cost is reflected |

| D90 K43 | 500 000 | The planned cost of the GP was written off |

| D90 K43otkl. | 17 700 | Deviations of actual costs from planned costs attributable to products sold were written off |

Using count 40

According to D 40, the actual production cost of products is taken into account in correspondence with cost accounts, and according to K 40 - the planned cost of the state enterprise, which is written off in D 43.

At the end of the month, when the actual cost of production is fully formed, a comparison of debit and credit turnover on account 40 reveals the amount of deviations of the actual cost from the planned one.

If the debit turnover on account 40 exceeds the credit

, i.e.

the actual cost exceeds the planned cost and there is an overrun

, then an entry is made for the amount of the deviation:

D90 K40 .

If the credit turnover on account 40 is greater than the debit turnover

, i.e.

the actual cost is less than the planned cost, there is a saving

, then an entry

D90 K40 .

Thus, account 40 is closed monthly and has no balance at the end of the month.

Account entries:

D43K40 – planned accounting prices

D40K20 – actual cost

D90K40 - excess of actual cost over planned or

D90K40 – excess of planned cost over actual

EXAMPLE:

Balance of GP in the organization's warehouse at the beginning of the month: 240,000 rubles. at planned prices. Within a month, GP was received at the warehouse at planned prices for 750,000 rubles. The amount of production costs recorded in the account is 20 - 900,000 rubles. The balance of the work in progress is 120,000 rubles. The planned cost of goods sold is 500,000 rubles.

Solution:

| D20 K10,02,70,69 | 900 000 | Costs of the current period are reflected |

| D43 K40 | 750 000 | Accepted for accounting of state enterprises at planned accounting prices |

| D40 K20 | 780 000 = 900 000 – 120 000 | The actual cost of the GP is reflected |

| D90 K43 | 500 000 | Planned cost of goods sold is written off |

| D90 K40 | 30,000 = 780,000D40 – 750,000K40 | The amount of identified deviation is included in the cost of production |

The main disadvantage of using count 40

– imaginary simplicity, deviations are written off entirely, without distribution => by 1 rub. sold may cost 30,000 rubles. deviations => the tax office will not be happy, so for tax accounting purposes it is better to keep records without using 40 accounts.

ORGANIZATION OF GP ACCOUNTING IN WAREHOUSES AND IN ACCOUNTING

The transfer of the GP to the warehouse is formalized by a primary document, which confirms the fact that the WIP object has been transferred to the GP category. As a rule, the M-11 form is used.

The entire GP is submitted for reporting to the financially responsible person.

Primary accounting documents received at the warehouse during the month and grouped by storage location and type of state of enterprise are sent to the accounting department, where they are checked and taxed ( taxation is the monetary valuation of transactions that are recorded in primary documents in physical units). After this, on their basis, the accounting department draws up a state production statement, which is necessary for operational control of the daily implementation of the production plan in the context of product names in quantitative and cost terms, incl. and on a cumulative basis over the course of a month or other reporting period accepted by the enterprise.

Date: 2015-10-18; view: 167; Copyright infringement

| Did you like the page? Like for friends: |

What is reflected in the score 41

41 accounting account is an account that records goods purchased for resale. Posting Dt 41, Kt 41 shows information about the movement of inventory items (hereinafter referred to as goods and materials) related to:

- with their acquisition;

- moving;

- sale;

- other movements both within the organization and outside it.

In accordance with the instructions for the chart of accounts given in the order of the Ministry of Finance of Russia “On approval of the chart of accounts for accounting financial and economic activities” dated October 31, 2000 No. 94n (hereinafter referred to as the chart of accounts), Dt 41, Kt 41 are used by organizations operating in the field :

- catering;

- trade;

- production.

Depending on the type of activity in the chart of accounts, the following recommendations are given for the use of subaccounts to account 41:

- 41.01 - to reflect information about inventory items in a warehouse or catering storerooms;

- 41.02 - for goods and materials in retail trade and public catering;

- 41.03 - for information on containers for catering and trade;

- 41.04 - for inventory items in production.

You can find options for accounting for goods in transit and the corresponding wiring diagram in ConsultantPlus. Trial access to the legal system is free.

At the same time, the organization can approve its own sub-accounts that are unique to it, the use of which may differ from those recommended. They will need to be recorded in the organization's working chart of accounts.

You will learn more about the chart of accounts from the article “Working chart of accounts - sample 2020”.

Results

Posting Debit 41, Credit 41 reflects transactions with purchased goods that are purchased for the purpose of further resale.

At the same time, for trade organizations, the use of Dt 41, Kt 41 in correspondence with various accounts for wholesale and retail trade when accounting for purchase prices will be similar. Reflection of sales prices is typical only for retail. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What counts in the 20 count?

Account 20 is used to account for the following costs:

- production of products from agricultural and industrial enterprises, as well as subsidiary farms;

- costs of repair work, maintenance of cars and other vehicles;

- costs of organizations providing transport services;

- costs of construction, installation and design and survey work;

- costs of performing research and development work;

- costs of catering organizations;

- salaries of key and administrative personnel;

- depreciation of production equipment;

- amounts of payments for renting premises and paying for utilities;

- other expenses related to the activities of the production enterprise.

Debit 20 reflects all direct costs associated with the manufacture of products (performance of work and provision of services), costs of auxiliary production, indirect costs, as well as losses from defects. Credit 20 reflects the amount of the actual cost of goods, the production of which has already been completed, or work performed and services rendered.

Counting scheme 20

When determining the type of account 20 - whether it is active or passive - you need to understand the following: since the company cannot consume more raw materials and materials than it was written off for, therefore, debit turnover on the account. 20 will always be more credit. And this means that the count. 20 - active. Balance (remaining) according to account. 20 at the end of the month reflects the amount of work in progress costs.

Synthetic and analytical accounting on account 43

When accounting for finished products on synthetic account 43 at the actual production cost in analytical accounting, the movement of its individual items can be reflected at accounting prices (planned cost, selling prices, etc.) highlighting deviations of the actual production cost of products from their cost at accounting prices.

Such deviations are taken into account for homogeneous groups of finished products, which the organization forms based on the level of deviations of the actual production cost from the cost at the accounting prices of individual products.

When writing off finished products from account 43, the amount of deviations of the actual production cost from the cost at prices accepted in analytical accounting is determined by percentage - as the ratio of deviations for the balance of finished products at the beginning of the reporting period and deviations for products received at the warehouse during the reporting period month, to the cost of these products at discount prices.

The amounts of deviations of the actual production cost of finished products from their cost at accounting prices related to shipped and sold products are reflected in the credit of account 43 and the debit of the corresponding accounts with an additional or reversal entry - depending on whether it is an overexpenditure or a saving.

Analytical accounting of turnover in account 43 is carried out by storage locations and individual types of finished products.

Also see “How to calculate the volume of products sold: formula and analysis.”

Accounting for finished products at actual cost. We use count 43

Let's use an example to consider transactions in which the cost of a GP is accounted for at the actual price.

JSC Meloman produces sound equipment for cafes and restaurants. Based on the results of April 2015, Meloman JSC:

- produced a batch of audio equipment - 152 units;

- main production costs amounted to 1,347,200 rubles;

- assembly costs amounted to 143,100 rubles.

The accountant of Meloman JSC made the following entries in the accounting:

| Debit | Credit | Description | Sum | Document |

| 20 | 10, 70, 69… | The amount of costs for the production of a batch of audio equipment is taken into account (main production) | 1,347,200 rub. | Invoices, certificates of completed work, salary slips, etc. |

| 23 | 10, 70, 69… | The amount of costs for assembling a batch of audio equipment is taken into account | 143,100 rub. | Invoices, certificates of completed work, salary slips, etc. |

| 20 | 23 | Equipment assembly costs are included in the cost of production | 143,100 rub. | Costing |

| 43 | 20 | A batch of audio equipment produced in April 2015 was received at the warehouse of Meloman JSC. | 1,490,300 rub. | Purchase Invoice |

Finished products in warehouse: invoice and accounting rules

Recording of transactions involving finished products is carried out using 43 accounts. Debit balances on it indicate that the enterprise has a certain stock of products released from production. Credit turnover shows the disposal of consignments. Analytics separates accounting data by storage location.

When finished products are delivered to the warehouse, the posting looks like:

D43 – K20 (23, 29).

The entry is made on the basis of the invoice. The transfer of products from the warehouse is formalized by crediting account 43 in correspondence with debiting 45, 80, 44. If shortages are detected, account 94 will be debited for their amount.

For example, Faya LLC produces kefir. In January, 2500 liters of kefir product were produced. At the same time, expenses were incurred by the main production department in the amount of 17,500 rubles, and by the auxiliary unit - 8,000 rubles. At the end of the technological cycle, the finished products were delivered to the warehouse. Reflection of all transactions in accounting:

- D20 – K10 (70, 69) – the amount of basic production expenses is shown in the amount of 17,500 rubles.

- D23 – K 10 (70, 69) – expenses incurred by the auxiliary workshop are reflected: 8,000 rubles.

- D20 - K23 - costs of the auxiliary workshop are included in the production cost estimate of 8,000 rubles.

- Finished products are credited to the warehouse - postings are made between D43 and K20 in the amount of 25,500 rubles. (17,500 + 8,000).

Ways in which the cost of finished goods can be taken into account

After the completion of the production process, the finished products are transferred to the warehouse. This process is formalized with appropriate documents. Typically this is an internal movement invoice, but other options are possible.

Finished products must be valued in monetary terms. On account 43, finished products can be accounted for at the following prices:

- actual;

- normative;

- wholesale;

- free vacation pay;

- free retail.

Actual prices are formed from the real costs of production. All costs from the credit of account 20 and other cost accounts are written off to the debit of account 43. Actual prices can be full and reduced, the only difference is that the reduced price does not include overhead costs. The method is suitable for producing products in small batches. The only negative aspect of such an assessment is the delayed formation of the exact price.

When estimating in standard prices, prices are used that were calculated before the start of production. The most important advantage is that the cost does not change over time. It is also a disadvantage if costs are subject to significant fluctuations. Therefore, this method is most suitable for mass production with a constant nomenclature.

Wholesale prices are based on the size of wholesale supplies and are calculated based on actual prices using trade margins. They are used in the production of large quantities of goods for one consumer.

A free selling price, on the contrary, is needed for “piece” production of products.

Free retail is established for products that will be sold through retail sales channels.

Each of the considered accounting methods is good under certain conditions. Accounting must analyze the current situation and suggest the best way. The prices used to account for finished products at a particular enterprise must be specified in the accounting policy.

It must reflect the following fundamental points:

- how the cost of production is calculated;

- How is the cost of the finished product taken into account?

What amounts should not be included in account 43?

Not all products that have passed the production stages are subject to inclusion in the finished product list. It is worth remembering a few exceptions, in the event of which the registration of a receipt to account 43 “Finished products” will be incorrect:

- the amount of services provided and work performed externally (the cost is written off immediately from account 20 to debit 90);

- products that are handed over to customers immediately “on the spot” and are not documented in an acceptance certificate (reflected in the number of work in progress);

- products purchased for the purpose of completing your own products or further resale (accounted for in account 41).

Care when organizing accounting on account 43 will allow you to avoid mistakes that in the future may distort the results of calculations of cost and sales totals.

/postings

Main production" (posting D20 K23).

- Indirect costs, that is, those associated with the management and maintenance of production, are written off from the credit of accounts 25 “General production expenses” and 26 “General expenses” (entries D20 K25 and D20 K26).

- Defects in production are products, parts and work that do not meet established quality standards and cannot be used for their intended purpose. We’ll talk more about manufacturing defects in this article. For now, I’ll just say that defects are taken into account in account 28 “Defects in production” and written off as a debit to the account. 20 “Main production” (posting D20 K28).

- Accounts 23 “Auxiliary production”, 25 “General production expenses”, 26 “General expenses” are not always used by the enterprise. These are intermediate, auxiliary accounts; they are convenient to use in large production.

Count 20 - main production

Info

Therefore, it is logical to release part of the unpackaged product as a finished product, and part as a semi-finished product. For a semi-finished product, distribute the costs of the packaging department, for example, as direct ones.

Produce packaged items as finished products. It is logical to use account 20 for the expenses of the packaging department.

It is incorrect to use account 44 when producing products. 21 counts have nothing to do with it either - the author will just have it as he wrote

Egor, “2 types of nomenclature (conditionally - packaged and unpacked).” Neval 06-12-2011, 12:54:01 ... It is incorrect to use 44 accounts in the production of products... Why is this all of a sudden? It is a mistaken opinion to consider 44 accounts acceptable only in trade.

Examples of using account 20 in accounting

To understand how to work with the 20 account, you need to consider several examples of its use for dummies and how to close an account using one of the methods - direct.

For example, a company produces bicycles. Within a month, 20 pieces were made and 10 of them were sold at 6,000 rubles per piece. The planned cost was 4,000 rubles/piece.

The amount of production costs amounted to 100,000 rubles, of which:

- material costs - 60,000 rubles;

- depreciation - 2,000 rubles;

- wages and contributions - 38,000 rubles.

Based on this information, the accounting department will make the following entries:

- Dt20 Kt10 - write-off of materials for main production - 60,000 rubles.

- Dt43 Kt20 - production - 80,000 rubles.

Sales of finished products:

- Dt62 Kt90-01 - income (revenue) from sale - 72,000 rubles.

- Dt90-03 Kt68 - VAT calculation - 12,000 rubles.

- Dt90-02 Kt43 - write-off of planned cost - 40,000 rubles.

Payroll:

- Dt20 Kt70 - salary accrued - 29,230 rubles.

- Dt70 Kt68 - personal income tax charged - 3,800 rubles.

- Dt20 Kt69 - insurance premiums accrued to budgetary organizations - 8,770 rubles.

Scheme for closing the reporting period:

- Dt20 Kt02 - depreciation - 2,000 rubles.

- Dt43 Kt20 - transfer of products to the warehouse at actual cost - 120,000 rubles.

- Dt90-02 Kt43 - cost adjustment - 40,000 rubles.

As a result, in the account card you can check the correctness of the postings and write-offs of costs and products.

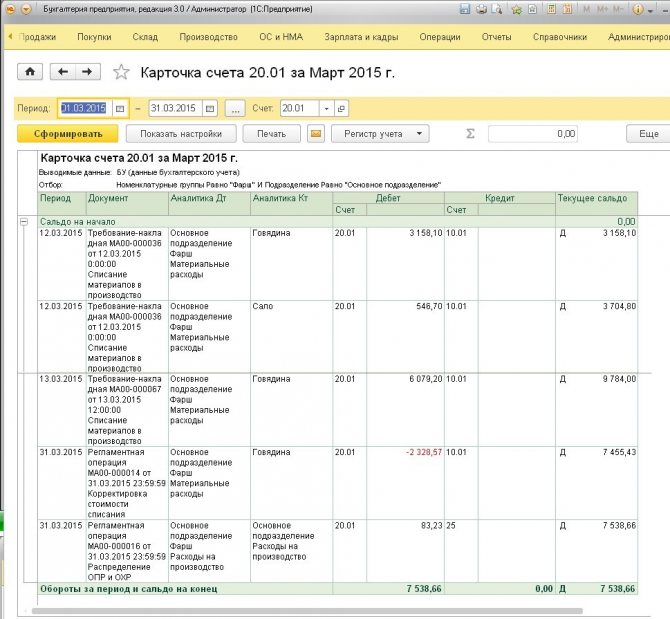

Account card 20

Complete and correct accounting of the costs of manufacturing goods on account 20 will help the company’s accounting department collect all costs in one place. Closing an account is somewhat difficult, however, with the help of automated accounting systems, the process can not only be simplified, but also an analysis of intermediate results - an assessment of the movement of enterprise assets - can be carried out to monitor the correctness of entering information.

Debit 43 Credit 20

Finished products. Primary production

- In industrial production sectors: The transfer of finished products from the workshop to the warehouse is reflected as products to be sold. Carried out according to a) actual (production) or b) accounting (planned, standard) cost, based on invoices and other documents on the internal movement of inventories.

- If finished products are received at the warehouse at accounting prices (planned or standard cost, also known as the Standard-cost method), then this posting reflects the amount of deviations of the actual cost from the planned/standard cost, in case of overexpenditure (in case of savings - the same posting, reversal ). It is carried out on the basis of an accounting certificate accompanied by properly prepared justifications.

Wiring diagrams:

Option A. If finished products are delivered to the GP warehouse at actual (production) cost

- Dt 20 Kt 02, 05, 10, 68, 69, 70, etc. – direct production costs;

- Dt 20 Kt 23 – write-off of expenses of auxiliary production;

- Dt 43 Kt 20 – finished products are delivered to the finished products warehouse; Balance Dt 20 – products at the WIP stage.

- Dt 90.2 Kt 43 – write-off of finished products for sale, at actual cost;

- Dt 62 Kt 90.1 – invoice presented to the customer;

- Dt 90.3 Kt 68 – VAT

- Dt 90.9 Kt 99 – financial result.

The cost of finished products at the time of transfer from the workshop to the warehouse is, as a rule, unknown, and, therefore, during mass production, its receipt at the actual cost at this moment is almost impossible.

The posting diagram, reflecting the production and sale of finished products with their capitalization at the actual (production) cost, can be considered acceptable only for the order-based costing method.

Option B. If finished products are delivered to the GP warehouse at standard/planned cost. Scheme without using count 40

- Dt 20 Kt 02, 05, 10, 68, 69, 70, etc. – direct production costs;

- Dt 20 Kt 23 – write-off of expenses of auxiliary production;

- Dt 43 Kt 20 - finished products are delivered to the finished products warehouse, where they are capitalized at the accounting (planned or standard) cost; Next, at the end of the month, a calculation is made of the deviations of the actual value from the accounting value and the corresponding amount is written off with an additional entry:

- Dt 43 Kt 20 - in case of overexpenditure, or the same entry in red reverse in case of savings. Balance Dt 20 – products at the WIP stage.

- Dt 90.2 Kt 43 – write-off of finished products for sale, at actual cost;

- Dt 62 Kt 90.1 – invoice presented to the customer;

- Dt 90.3 Kt 68 – VAT

- Dt 90.9 Kt 99 – financial result.

For information on how to account for products at standard/planned cost using account 40, see the diagram in the commentary to Prov. Dt 40 Kt 20. For information on how work and services are taken into account at actual cost, see the commentary to Prov. Dt 90.2 Kt 20.

Reference. As accounting prices for finished products, in accordance with clause 204 of the Guidelines for accounting of inventories, approved. By Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n, the following may be applied:

- actual production cost;

- standard cost;

- negotiated prices;

- other types of prices.

After completing the full technological cycle of material processing, the enterprise receives finished products. It is checked for compliance with quality standards, after which the finished product is transferred to the warehouse. Financially responsible persons must ensure its safety in storage areas. To confirm the absence of theft, damage to products, and compliance with accounting data, an inventory is carried out.

3-room apartment for sale

D04 K08- Acceptance for accounting of acquired and/or created intangible assets D20,23,25,26,29,44 K04- Write-off of expenses for work, the results of which are used for the production or management needs of the organization, as expenses by type of activity D05K04- Write-off amounts of accrued depreciation upon disposal of intangible assets D05 K05- Transfer of accrued depreciation amounts on intangible assets D79 K05- Taking into account depreciation amounts on intangible assets when they are returned by branches D05 K79- Write-off of accrued depreciation on transferred intangible assets D90.91 K05 - Accrual of depreciation charges for intangible assets D08 K10 - The cost of materials D10 K08 was written off - Spare parts received as a result of modernization, reconstruction, etc. were capitalized.