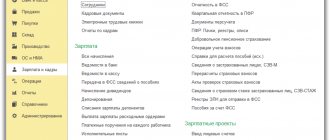

To provide financial assistance you must:

- Download

,

print

and

fill out the application form

for financial assistance. The application must be filled out in person, in one hand, with a pen of the same color. Blots, cross-outs and the use of corrective means are not allowed. The reason for the appeal is indicated in accordance with the Regulations for the provision of social benefits to employees of St. Petersburg Electrotechnical University "LETI". - Scans of the completed application

and all necessary documents (in accordance with the list of documents)

must be sent by mail - Approval of an application, if it is impossible to endorse it in person, is carried out remotely (scans of approvals from the head of the department and the trade union organizer must be sent by email

- The package of documents agreed upon by email (original application and supporting documents) must be submitted to the Social Work Department at a pre-agreed time by personal application (room 3429) or by leaving documents during the distance learning period at the checkpoint of building 5 (Prof. Popova St., d.5) in the Social Work Department Folder.

You can get additional information and ask questions by contacting the Social Work Department: phone e-mail

What is financial assistance for treatment?

Let's start with the concept of “material assistance”. This may include additional cash payments in addition to wages and bonuses. The payment of financial assistance is not stipulated in the labor legislation of the Russian Federation, but the employer can make it on his own initiative.

All provisions relating to such payments must be spelled out in the internal regulations of the organization or in the collective agreement. Namely, the size and conditions for the provision of financial assistance.

So, in order to pay financial assistance, a reason - that is, a circumstance that would require additional support. For example, financial assistance is provided for the birth of a child, in the event of losses due to force majeure, or in the event of illness of an employee or his relative.

However, if an employee needs financial assistance for one reason or another, know: payment of financial support is right , not an obligation. Of course, in most cases, management pays its employees additional funds for social support, but there are also opposite situations.

One-time financial assistance to an employee in case of his treatment (including the purchase of medicines)

One-time financial assistance to an employee in the event of his treatment (including the purchase of medicines, medical devices, payment for transportation to medical institutions, with the exception of payment for dental services) is provided in the amount of up to 30,000 rubles.

(taking into account work experience at St. Petersburg Electrotechnical University "LETI", treatment costs and average salary for the last three months) no more than 1 time in 5 years.

In especially severe cases (oncology, progressive disease, etc.), by decision of the commission, financial assistance can be provided once every 3 years.

List of required documents:

- documents confirming expenses, in accordance with the doctor’s prescription (referral), with a statute of limitations of no more than 1 year before the date of filing the application with the OSR;

- certificate of the employee’s average salary for the last three months.

To get better for the holidays

Local regulations of an enterprise (organization) may provide financial assistance to employees going on vacation.

Such a payment is characterized as covering part (or all) of a trip to a sanatorium-resort treatment or rehabilitation.

The amount of this type of financial assistance is determined at the discretion of the employer.

A collective labor agreement or an individual TD may establish a systematic procedure for making the payment provided - annually before the main part of the employee’s vacation (at least two weeks in a row).

One-time financial assistance to an employee whose children are entering first grade

One-time financial assistance to an employee whose children are going to first grade is provided to one of the parents (an employee of St. Petersburg Electrotechnical University "LETI") in the amount of 6,000 rubles

for each child who is a first-grade student, if an application for financial assistance is submitted to the OSR in the current calendar year.

List of required documents:

- a copy of the child(ren)'s birth certificate;

- certificate of study in first grade or a copy of the student ID.

Can I get it due to an employee’s illness?

Organizations (enterprises) are developing local documents that may provide for the payment of additional amounts of money to employees as material assistance of a compensatory or social nature.

Financial assistance refers to incentive bonuses and its transfer is carried out by decision of the company’s management, based on the employee’s application.

The list of grounds in connection with which workers can apply for payment of financial assistance must be contained in a collective labor agreement, regulations on social payments and allowances, or another act of similar effect.

The main reasons are usually:

- significant material damage suffered by the employee due to reasons beyond his control;

- the birth of children in the employee’s family;

- funeral costs for close relatives of the employee;

- in connection with significant dates (for example, an anniversary) or the conferment of labor awards;

- the need for expensive treatment due to illness, etc.

In this case, assistance in connection with treatment can be provided from the Trade Union Committee, of which the employee is a member, or directly from the employer’s net profit.

It is also important that financial assistance can be issued both for the treatment itself and for rehabilitation and recovery, or as compensation for costs associated with receiving medical services.

Not only a current employee, but also persons who previously had an employment relationship with the organization (enterprise), including pensioners, can apply for this type of benefit.

How to get swearing support from an employer?

The procedure for receiving the submitted payment by an employee must be prescribed in the same local acts that indicate that employees have the right to apply for it.

The legislator has established that financial assistance is paid based on an application from the employee.

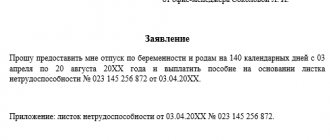

Such a document is drawn up by an employee in any form in compliance with the requirements for its content (name of the enterprise to whose management it is sent, information about the applicant himself, indication of the reason for the need for additional funds and its details).

You can complete the application by hand or in printed form using an electronic digital signature. It is mandatory for the employee to attach documents confirming the existence of the grounds for which he is applying for payment of financial assistance.

If the reason for needing benefits is the need for treatment, medical certificates should be attached to the employee’s application, as well as receipts for payment for medical services already received.

The document is submitted to the accounting department of the enterprise (organization) and is reviewed by management, who makes a decision on making the payment or refusing it.

Sample application

employee applications for financial assistance in connection with treatment and recovery - .

Taxation - are personal income taxes and contributions subject to tax?

Due to the fact that material assistance relates to the income of employees, tax legislation provides for its taxation with insurance contributions and personal income tax.

The Tax Code of Russia provides for a total limit amount of financial assistance paid in one annual reporting period, for which insurance premiums cannot be charged.

The size of such a limit is 4 thousand Russian rubles.

It is important that the reason underlying the employee’s application for benefits does not matter.

The legislator also provided a number of grounds for which financial assistance is not subject to taxation:

- the birth of a child in an employee’s family, the death of a close relative or the employee himself;

- natural disasters causing significant material damage;

- if the applicant has become a victim of an act of terrorism.

Thus, insurance premiums are charged for financial assistance for treatment. However, it should be borne in mind that if the amount is 4 thousand rubles, then there is no need to deduct tax from it.

If the benefit amount exceeds 4 thousand rubles, insurance premiums are charged only from the amount exceeding the specified monetary amount.

Important! Personal income tax is not charged on financial assistance for treatment if the source of its deduction is the net profit of the organization (enterprise), it is of a one-time nature, and the grounds specified by the employee in the application for payment are confirmed by official documents.

Taxation of financial aid for treatment

Issues of taxation of personal income tax and insurance contributions for financial assistance for treatment of an employee are regulated by Art. 217 and art. 422 of the Tax Code.

In accordance with Art. 207 of the Tax Code of the Russian Federation, namely clause 1, an must pay personal income tax on payments received.

Based on Art. 419 and art. 420 of the Tax Code of the Russian Federation, the employer independently pays insurance premiums from funds paid to the employee.

In general , financial assistance for the treatment of an employee is not subject to personal income tax and insurance premiums are not charged on it - according to clause 1 of Art. 422 and art. 217 of the Tax Code of the Russian Federation, if the amount of financial assistance does not exceed 4 thousand rubles during one calendar year.

There is a nuance - if the employer paid for the employee’s treatment directly to the medical institution. And when an employer applies OSNO, he may not be subject to personal income tax on amounts spent on the treatment of an employee. This follows from paragraph 10 of Art. 217 of the Tax Code of the Russian Federation (see letters of the Ministry of Finance dated March 16, 2020 No. 03-04-06/19819, dated January 24, 2019 No. 03-04-05/3804).

At the same time, these payments are subject to insurance premiums in full in accordance with the established procedure.

But employers using special regimes (under which they do not pay income tax) will have to calculate both contributions and personal income tax from medical assistance for treatment according to the general rules - with a usual deduction of no more than 4,000 rubles.

Law on Payments for Injury to Health

The employer is obliged to compensate for harm caused to employees in connection with the performance of their labor duties, in the manner and under the conditions established by the Labor Code of the Russian Federation, federal laws and other regulatory legal acts (Article 22 of the Labor Code of the Russian Federation).

If health is damaged as a result of an accident at work or an occupational disease, the employee is reimbursed for the costs of medical, social and professional rehabilitation (Article 184 of the Labor Code of the Russian Federation).

The procedure for compensation for harm caused to the life and health of an employee during the performance of his duties under an employment contract is established by Federal Law No. 125-FZ of July 24, 1998 (hereinafter referred to as Law No. 125-FZ).

According to Law No. 125-FZ, employees are considered insured persons in the compulsory social insurance system (Clause 1, Article 5 of Law No. 125-FZ). According to paragraph 1 of Article 8 of this law, the insured person is entitled to:

- temporary disability benefits due to an industrial accident;

- one-time insurance payment;

- monthly insurance payments;

- compensation for additional expenses for medical, social and professional rehabilitation.

The sick leave benefit is calculated and paid by the company, and then the expenses are reimbursed by the Federal Social Insurance Fund of the Russian Federation. The victim receives all other payments directly from the regional branch of the fund.

Terms of payment help for treatment

As we have already said, financial assistance is paid for various reasons. And one of them is the need for employee treatment.

Financial assistance for treatment is issued subject to certain conditions:

- this payment is purely social and is of a targeted nature;

- the payment is in no way related to the main salary;

- is prescribed in the local regulations of the enterprise.

We noted above that not only an ill employee, but also an employee whose close relative .

Turning to Art. 2 of the Family Code of the Russian Federation, we note that close relatives include:

- parents;

- children (including adopted children);

- brothers and sisters (including adopted ones);

- older generations - that is, grandparents in relation to their grandchildren.

Financial assistance for treatment may be eligible if an employee or close relative:

- receives (or has received) paid medical services;

- purchased expensive drugs with a prescription from a doctor;

- bears other expenses that are directly related to treatment.

The employer can:

- Compensate the employee for funds already spent based on submitted supporting documents.

- Participate in concluding an agreement with a medical institution and pay bills on your own.