It is not clear to everyone whether it is necessary to dismiss the director during the liquidation of the company, since he is the manager and himself deals with the termination of contracts with hired employees. The director also needs to be fired - according to the standard scheme, as with other employees, since he also acts on the basis of an employment contract. The founder must do this; this process begins with his orders.

When an LLC is liquidated, the powers of the director actually cease from the moment the liquidator begins work. Therefore, the founder needs to draw up documents regarding dismissal in a timely manner.

How to fire the CEO if the company is liquidated?

Before moving on to the details of the dismissal of the director of an LLC due to the liquidation of the company, it is necessary to familiarize yourself with the stages of this procedure.

The standard scheme for liquidating a company is as follows:

- Organizing and holding a meeting of the company's founders. The reasons why it is necessary to liquidate the enterprise are considered, this topic is discussed in detail.

- Making a decision at a meeting. The founders make an appropriate decision, after which a liquidation commission is created.

- Notification of the Federal Tax Service. A corresponding notification is sent to the government structure in a timely manner - within 3 days from the date of the decision to liquidate the LLC.

- Work of the liquidation commission. Its members represent the interests of the organization in various structures.

- Liquidation. Completion of final measures by the liquidation commission.

The subtleties of the procedure for dismissing the director of an LLC during liquidation depend on who the director is.

Below are explanatory instructions on how to correctly complete the termination of an employment contract.

During liquidation, all employees are subject to dismissal, including pregnant women - how to fire a pregnant woman when closing an enterprise?

Step-by-step instructions for dismissal

If the manager is an employee

In this case, termination of the employment contract is carried out in the following steps:

- Step 1. Warning about upcoming dismissal. This step must be completed within a certain time frame - 2 months before termination of the employment contract.

- Step 2 Notification of the Federal Tax Service. This stage is carried out in a similar time frame specified in the previous paragraph.

- Step 3. Read the order. Before signing an order prepared by management, the director studies its contents. Only after this he puts his signature on the document. This procedure is carried out no later than 1 day before dismissal due to liquidation.

- Step 4. Entering the relevant data into the labor documentation.

- Step 5. Payment of funds to be credited to the employee’s account.

- Step 6. Payment of average monthly earnings. Carried out within 2 months. If certain conditions are met, this period can be extended to 3 months.

After analyzing this information, we can come to the conclusion that the dismissal of the director of an LLC, who is an employee, is carried out in the same way as the dismissal of any other employee.

If the manager is a member of the liquidation commission, he is subject to the rules of Articles 178 and 180 of the Labor Code of the Russian Federation. His dismissal is carried out in the same way.

After liquidation, the powers vested in the company are transferred to the members of the liquidation commission. It may include a dismissed director. However, he does not have the right to perform the official duties previously assigned to him.

If the director is the only participant in the LLC

The director of an LLC can simultaneously be the sole founder of the company. In such a situation, the dismissal of a manager during liquidation includes the following steps:

- Step 1. Making a decision on liquidation.

- Step 2. Sending a notification to the Federal Tax Service.

- Step 3. Issuing an order.

- Step 4. Entering data into the work book.

- Step 5. Representing the interests of the organization in the relevant authorities.

- Step 6. Carrying out liquidation.

There are no significant differences from the standard situation in which the director is an employee. The only and important difference is the fact that all these steps are carried out by the director independently.

What is the date for termination of the contract?

The exact date of liquidation of the company is determined after every employee of the company, including the director, is notified of the upcoming event.

If the decision to liquidate a company is made at a meeting of its founders, based on the results of the procedure, a corresponding Protocol is drawn up, which must contain the date of liquidation. In a situation where the director is the only founder, a special Decision is drawn up.

The dismissal of the general director must correspond to the date of liquidation of the organization.

The date of the last working day in the liquidated company, entered in the work book, must coincide with the date specified in the Decision or Protocol.

Required documents

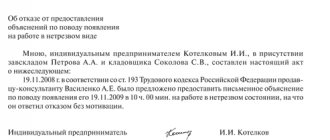

It is important to formalize the dismissal of the director of a company during its liquidation correctly. There are documents that must be completed. One of these is notification.

Notice to employee

The notification contains the following information:

- information about the company – name, organizational and legal form;

- document's name;

- initials and position of the employee in whose name the notice is drawn up;

- information about the decision to liquidate and a document confirming this fact;

- reason for dismissal and reference to the article of the legislative act regulating it;

- date of termination of the employment relationship;

- date of registration of documentation.

In the notification, the director must leave his personal signature confirming that the director has familiarized himself with the information specified in the form. There is no unified template for filling out an alert, so it is drawn up in free form.

It is equally important to pay attention to the period within which the director must receive notice. According to the established rules of the labor legislation of the Russian Federation, the manager must be familiar with information about the liquidation of the company 2 months before the upcoming event.

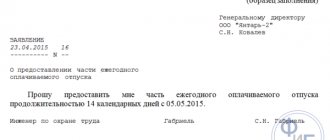

Another mandatory document is the order. To complete it, you must use the unified form T-8. The order reflects the following information:

- company data – name, legal form, OKUD and OKPO code;

- serial number of the order and the date of its execution;

- personnel number, position and initials of the employee;

- date of dismissal;

- reference to the article of the legislative act in accordance with which the dismissal is carried out;

- documentary basis for termination of the employment contract;

- position, initials and signature of the employer.

As in the case of a notice, the director, when studying the order, must leave his signature on it. It will indicate that the employee has familiarized himself with the information specified in it.

.

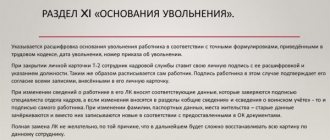

How to make an entry in the work book?

Regardless of the reason for dismissal, when this action is performed, the responsible employees make a corresponding entry in his work book. The document contains the following information:

- date of entering information into the document;

- main part. Includes information about the dismissal and its reason;

- grounds for termination of an employment contract.

The work record must also contain the seal of the company that left the entry on it. If a director is dismissed due to the liquidation of the LLC, the employment record can be formulated as follows: “Dismissed due to the liquidation of Romashka LLC, on the basis of clause 1 of Art. 81 Labor Code of the Russian Federation."

In the work book this entry looks like this:

| № | 01.11.2019 | Dismissed due to the liquidation of the enterprise, part 1, article 81 of the Labor Code of the Russian Federation. HR specialist, full name, signature | Order No. 123 of 09/01/2019 |

Regulations

The current standard - clause 1 of Article 81 of the Labor Code of the Russian Federation “Dismissal in connection with the liquidation of an enterprise” serves as the basis for the dismissal of a director from the position of head of a company upon its liquidation.

Art. 61 of the Civil Code of the Russian Federation contains an indication of the impossibility of succession by other persons of the rights and obligations of a liquidating legal entity (exceptions are provided for by the Federal Law) and the grounds for termination of activities.

Comments under Article 81 of the Labor Code of the Russian Federation indicate the possibility for a former employee to challenge dismissal under this article in court. According to paragraph 28 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2, when a dismissed employee applies to the court with a corresponding claim, the enterprise is obliged to confirm the termination of its activities.

Additionally

Law No. 14 of the Federal Law “On LLC” establishes that the charter of such a structure initially specifies the officials who will be part of the commission for carrying out the termination procedure.

What payments are due to the manager?

Upon dismissal during the liquidation of an LLC, the director of the company is entitled to receive appropriate payments. In this case, the fact on what basis he works in the company plays a role.

If the director dismissed due to the liquidation of the LLC is an employee, he is subject to the information reflected in Articles 181 and 279 of the Labor Code of the Russian Federation and is entitled to payment of severance pay.

The documents indicate that the minimum payment upon liquidation must be equal to 3 times the average monthly salary of the employee.

The maximum amount of payments of this nature is not regulated. Therefore, the employer, if possible, can increase it.

If the director is the only founder of the LLC, he is not subject to the provisions of Article 279 of the Labor Code. In this case, he can formalize his dismissal at his own request, in connection with liquidation. You can also be guided by the information reflected in Article 181 of the Labor Code of the Russian Federation.

Compensation amount

When a director is dismissed during liquidation, he is entitled to compensation. Its size depends on the circumstances, whether it was specified in the contract or not.

If the amount of compensation was not specified in the employment contract (or in a local document), it will be 3 average monthly salaries (minimum). This is regulated by the Labor Code (Articles 181, 279). In any case, compensation is paid in accordance with the law.

You should ensure that you can fire the head of the company correctly and on time. Otherwise, it may complicate the liquidation process. Also, when closing, you must take care of the timely payment of compensation, since the manager may file a lawsuit. Then the amount may increase in accordance with the moral damage caused.

Is it possible to terminate an employment contract at will upon liquidation of an LLC?

The director of an LLC, like any other employee, in the event of liquidation, can resign at his own request. Most often, the reason for the need to terminate an employment contract with an employer is due to the fact that the employee finds a new job.

The hired director of an LLC is subject to the same rights as ordinary specialists. His dismissal at his own request during liquidation is carried out according to the standard scheme.

The director and, in one person, the sole founder can also be dismissed at his own request. In addition, he can become a liquidator.

How to fire a manager at your own request - step-by-step instructions.

Enrollment in labor

The work book is drawn up in strict compliance with the “Rules for maintaining and storing work books, producing work book forms and providing them to employers,” which are approved by Decree of the Government of the Russian Federation dated April 16, 2003 No. 22.

The entry in the document must contain a link to the minutes of the meeting of founders (it is the basis for entering information into the document) in the column “Name and number of document”.

In the column “Employment information” you must indicate the reason for termination of the work agreement. This could be Art. 278 of the Labor Code of the Russian Federation in the case when the reason for the liquidation of the organization is bankruptcy, or clause 1 of Article 81 of the Labor Code of the Russian Federation, which comes into force upon termination of the functioning of the business structure.

conclusions

Liquidation of a company is the termination of the existence of a company without the right to transfer its responsibilities to a third party. When carrying out this procedure, the entire staff of working citizens, including the director of the LLC, is dismissed.

When terminating an employment contract with a manager, it is important to follow certain tactics. It is necessary to notify the relevant government agencies and the employee himself within the time limits established for this at the legislative level.

If desired, employees, including the director, can terminate the employment contract at their own request. In this case, you should adhere to the standard technology of action.