Practice shows that, in addition to paying for the work itself, contractors often require the customer to reimburse them for expenses incurred during the execution of the contract. As a rule, we are talking about the travel and accommodation costs of the contractor’s or performer’s employees who work on the customer’s premises. This is not prohibited by law, but in order to eliminate the negative consequences of such actions for both parties, it is important to correctly draw up an agreement and determine its price. Otherwise, both the customer and the contractor may “suffer” from taxation.

How is a business trip arranged at the expense of the host party?

All transactions related to the business activities of the company must be reflected in documents - primary documentation forms, which are then stored by an accounting employee. A business trip is precisely one of these events, and therefore it must be properly formalized.

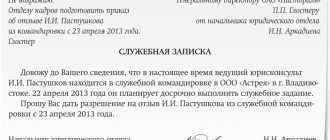

When an enterprise sends an employee on a business trip, the following mandatory documents are drawn up:

- official assignment (on a unified form T-10a);

- travel certificate (on the unified form T-10);

- order of the head of the company or his order to send an employee on a business trip (in form T-9 or T-9a).

Although labor legislation obliges employees' managers to pay them for travel expenses, there are no specific guidelines regarding methods and procedures for financing business trips.

Due to the fact that the methods for compensating an employee’s travel expenses are not defined by law, both the direct employer and the organization to which the employee went to perform any duties can reimburse the expenses. To provide the employee with guarantees of payment for his work, before the trip he signs an agreement with the employer, which will indicate which company will have to pay the money and what specific costs will be reimbursed.

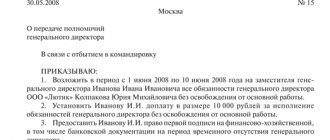

The manager's order to send a subordinate on a trip must contain information about the source of funding for the trip. In the case of payment for the trip at the expense of the enterprise to which the employee will go, it is stated that the business trip is at the expense of the receiving party.

Basic provisions

In many cases, the reimbursable expenses that the contractor insists on are expenses associated with the travel of its employees.

In this regard, the question arises: can the customer compensate for the travel expenses of the contractor organization without prejudice to himself? Let us answer right away that the obligation for such compensation in accordance with the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation) does not arise, since labor legislation provides for compensation for travel and accommodation expenses only for “our” employees sent on a business trip (Articles 166, 168 Labor Code of the Russian Federation). Therefore, if an organization, as the receiving party, compensates for travel and accommodation of “foreign” employees, including foreign organizations, then this compensation is the right of this organization, and not an obligation.

According to Art. 247 of the Tax Code of the Russian Federation, the object of taxation for corporate income tax is the profit received by the taxpayer. At the same time, for the purposes of applying Chapter 25 of the Tax Code of the Russian Federation, income received, reduced by the amount of expenses incurred, is recognized as profit for Russian organizations that are not members of a consolidated group of taxpayers.

In accordance with paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation).

Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer.

Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented costs are those supported by documents:

issued in accordance with the legislation of the Russian Federation; executed in accordance with business customs applied in the foreign country in whose territory the relevant expenses were incurred; indirectly confirming the expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

Thus, when including certain costs as expenses in order to determine the tax base for corporate income tax, their economic justification, direct relationship with activities aimed at generating profit, and their documentary evidence are of decisive importance.

How is a business trip paid for at the expense of the host party?

Before sending employees on a business trip, the company must include a clause determining the amount of payment for travel in local regulations and the collective agreement.

The employee must receive payment for travel expenses on time and in full when he provides the host company with documentation of expenses, including payment documents for housing (rental agreement or receipts for payment of a hotel room), train or plane ticket. If the contract stipulates payment of any other expenses during your stay on a business trip, you will need to collect more paperwork.

According to the approved rules, an employee cannot claim daily payments in an amount greater than 700 rubles per day . However, if we are talking about a trip abroad, the daily allowance increases significantly - up to 2.5 thousand rubles per day .

Per diem – payment for all days, without exception, spent by an employee on a business trip, taking into account weekends, holidays, periods of travel and forced stops.

Even if the host party undertakes to pay for the business trip, the employee’s employer still pays him some amounts. The receiving enterprise will pay the cost of travel to the destination and for the rental of residential premises, and the employee’s supervisor will pay:

- salary for the entire period of stay on a business trip in the amount of the average monthly salary;

- compensation of daily expenses for all days of travel, including compensation of expenses incurred with the permission of the employer (for paperwork, for mobile communication services).

While an employee of an enterprise is on a business trip, he cannot be fired, deprived of his position or workplace. The position is retained for the time spent en route to the destination and back.

Work agreement

As mentioned, the ability to take compensation amounts into account for tax purposes depends on the contractual relationship.

Let us remind you that in accordance with Art. 709 of the Civil Code of the Russian Federation, the price in the contract includes compensation for the contractor’s costs (for example, travel expenses of the contractor organization associated with the performance of work), as well as the remuneration due to him. In this case, the parties must take into account that the contract price can be: fixed, which takes into account all the contractor’s expenses, including planned expenses for sending workers; floating, which consists of two parts: remuneration for payment of the cost of work and the compensation amount of expenses, determined in fact and confirmed by documents.

In the first option, the amount received by the contractor from the customer represents the proceeds from the work, while the VAT payer contractor is obliged to present the VAT amount to the customer by issuing him the appropriate invoice. For a customer who has paid for the contractor’s work, the entire amount under the contract is included in the costs, and VAT is deductible in full.

The disadvantage of this option is that the planned amount of travel expenses included in the established contract price may be significantly less than the actual one, and accordingly the contractor will receive less income than expected.

The second option is more profitable, as it allows the contractor to take into account his expenses in the amount of actual costs. Since compensation payments qualify as a component of the contract price, both the contractor and the customer do not incur financial losses in terms of either profit or VAT.

For the contractor, both amounts received are income, on which he pays VAT in the general manner, and the customer takes these amounts into account as expenses, and he receives a VAT deduction in full.

Arranging a business trip at your own expense

The law does not provide for the possibility of sending an employee on a business trip at his own expense; however, employers often break the law and compensate the employee’s expenses after his return from the trip.

As in the general case, the employer must issue an order, draw up a job assignment and issue a travel certificate (if such documents are provided for by the company’s internal regulations). Before the trip, the employee does not contact the accounting department to receive money to pay the average monthly salary, daily allowance and compensation for his future expenses. All payments will be made upon return.

Required documents for obtaining a visitor visa

To obtain a guest visa, you will need to attach the following documents to the invitation:

- A copy of the Swedish citizen's passport. If the invitation is issued by a temporary resident, then a photocopy of the residence permit is made. A photocopy of the first page of the passport is attached to the completed form.

- Documents confirming the degree of relationship with a foreigner. It is worth considering that all attached documents must correspond to the information entered in the application form, otherwise the invitation will be invalid. Certificates are attached only if the invitation is issued for relatives.

Example of a visa to Sweden

If the invitation is issued to obtain a business visa, then the following information must be included in the application form:

- Address and name of the organization/enterprise.

- The name of the Swedish citizen who filled out and issued the invitation.

- Passport details of a Swedish citizen/temporary resident.

- Purpose of the trip to the state.

- Estimated length of stay.

Common mistakes

Error: An employee who was on a business trip abroad did not spend all the money given to him and returned part of the funds to the employer in rubles.

Comment: Reimbursement for travel expenses abroad for work is paid in the foreign currency of the country where the employee is sent. If there is money left, the employee returns it to the company’s cash desk, also in foreign currency.

Error: The employer sent the employee on a business trip at the expense of the host party, without offering to draw up an agreement to pay for the costs that the employee would incur during the trip.

Comment: As a guarantee, the employee must be provided with an agreement on payment for the trip by the host party for signature.

From a letter to the editor:

“An employee of our organization, by order of the head, is sent to Moscow (Russian Federation) from April 3 to April 8, 2017.

According to the director’s order, the employee will undergo a short-term internship on April 4, 5 and 6 at the organization that supplies us with software. During the internship, the host party provides the trainees with lunch. On April 7, the employee is scheduled to meet with buyers of our products. The employee leaves Minsk on April 3 at 23:10 and arrives in Moscow on April 4 at 8:13. Returns to Minsk on April 8 at 7:15, departure from Moscow on April 7 at 21:56. Tickets for rail travel to and from the place of business travel were purchased by the organization in a non-cash manner.

Please explain how much an advance should be given to an employee?

Sincerely, accountant Irina Konstantinovna"

Dear Irina Konstantinovna, let’s calculate the amount of advance payment that you will need to pay to the posted worker before leaving on a business trip, together.

The basis for the calculation and payment of funds to posted workers is the order (instruction) of the employer to send the employee on a business trip (clause 2 of the Instruction on the procedure and conditions for providing guarantees and compensation for business trips abroad, approved by the resolution of the Ministry of Labor and Social Protection of the Republic of Belarus dated July 30, 2010 No. 115; hereinafter referred to as Instruction No. 115).

If an employee is sent abroad at the invitation of a foreign organization, then the relevant order (instruction) of the employer indicates the conditions of the business trip in accordance with the corresponding invitation: living expenses, provision of living quarters, travel, etc. (Clause 2 of Instruction No. 115).

An advance payment to a posted employee is issued in foreign currency and (or) Belarusian rubles before leaving on a business trip. The employer is obliged to reimburse the employee for expenses (clause 8 of Instruction No. 115):

– on travel to and from the place of business travel;

– for renting residential premises;

– accommodation outside the place of residence (daily allowance);

– other expenses incurred by the employee with the permission or knowledge of the employer.

In the situation you described, the posted worker must be paid an advance in the amount of $713. The advance payment calculation is given in the table.

So, we calculate the daily allowance for the time a posted employee is abroad in foreign currency, including the day of departure from the Republic of Belarus and the day of arrival in the Republic of Belarus according to the standards established for the state to which the employee is sent on a business trip. The day of departure (departure) from the Republic of Belarus is considered the day of departure (departure) of passenger transport with which the employee is sent on a business trip from Belarus. Day of arrival – the day of arrival of the specified transport in Belarus according to travel documents. When transport departs before 24:00, the day of departure (departure) is considered the current day, and from 0:00 o’clock and later – the next day (parts one and two, paragraph 22 of Instruction No. 115).

The standards for payment of travel expenses for business trips abroad are determined by Resolution of the Ministry of Finance of the Republic of Belarus dated January 30, 2001 No. 7. In particular, the daily allowance rate for a short-term business trip to Moscow is $30 for each day of stay. If the receiving party undertakes fully or partially the costs associated with providing the posted worker with food, transportation and foreign currency for personal expenses, the sending party does not pay the daily allowance to these persons in full, with the exception of the time spent en route (clause 25 of Instruction No. 115).

For example, if the receiving party, in accordance with the invitation, bears the costs of providing the posted worker with food, transportation and foreign currency for personal expenses, the sending party does not pay daily allowances to these persons, with the exception of the time spent on the road (part one, paragraph 25 of Instruction No. 115). During the time a posted worker is on the road, daily allowances are paid in full.

If the receiving party bears the costs of providing business travelers with food and transportation, but does not pay them foreign currency for personal expenses, the sending party pays daily allowance in the amount of 15% of the norm established for the state to which the worker is sent on a business trip (part three p. 25 Instructions No. 115).

Example 1

The receiving party provides accommodation, food and travel with its own transport

The employee was sent on a business trip to Yekaterinburg from March 10 to 16, 2021. According to the letter, the receiving party provides accommodation, food and travel with its own vehicles while in Yekaterinburg. The posted worker left Minsk on March 10, 2021 at 08:15 and arrived in Yekaterinburg on March 10 at 19:10, left Yekaterinburg on March 15 at 20:30 and arrived in Minsk on March 16 at 08 :10.

Daily allowance must be paid:

– from March 11 to March 15, 2021 – in the amount of 15% of the norm for Russia, i.e. $4.5 ($30 × 15%);

– for March 10 and 16 – in the amount of USD 30.

If the receiving party bears the cost of providing the posted worker with one meal, the daily allowance is paid in the amount of 70% of the norm established for the state to which the worker is sent on a business trip (part four, paragraph 25 of Instruction No. 115).

Example 2

The host pays for the room, including the cost of breakfast

An employee is sent on a business trip to Klaipeda (Lithuania), for whom the host party pays for hotel accommodation. Breakfast at the hotel is included in the accommodation bill.

Daily allowance is paid in the amount of 70% of the norm. For Lithuania, the daily allowance rate is 30 euros. Thus, the employee must pay a daily allowance at the rate of 21 euros (30 euros × 70%) for each day of stay on a business trip when the host party pays for one meal.

Please note that hotel room rates often include breakfast. However, now I was talking about a situation where hotel accommodation is paid for by the receiving party and not the sending party. If the sending party pays for the accommodation, the daily allowance is calculated differently.

Example 3

The employee paid for hotel accommodation, breakfast was included in the price.

An employee of the organization, upon returning from a business trip to Klaipeda, submitted checks for hotel accommodation to the accounting department. Breakfast is included in the room rate.

Daily allowances are paid in full. Expenses for renting accommodation, including breakfast, are reimbursed within the limits established by law. The costs of booking hotel rooms, as well as the cost of breakfast included in the invoice for renting accommodation, are reimbursed to the posted employee within the limits of the cost of renting accommodation. At the same time, the procedure for reimbursement of daily allowances does not depend on the cost of breakfast included in the bill for renting residential premises (clause 15 of Instruction No. 115).

Thus, in this situation, the employee will be paid a daily allowance in the amount of 30 euros for each day of stay in Lithuania.

If the receiving party provides food for posted workers at its own expense, but does not provide transport or does not pay expenses associated with travel in public transport of the host country from the place of residence to the place of work, and does not pay foreign currency to these persons for personal expenses, the sending party pays daily allowance in the amount of 30%, and when paying foreign currency for personal expenses - 15% of the norm established for the state to which the employee is sent on a business trip (part two of clause 25 of Instruction No. 115).

Example 4

The receiving party pays foreign currency for the personal expenses of the posted worker

An employee of the organization is sent to Ganzhou (China). In accordance with the invitation, the receiving party provides the posted worker with three meals a day at its own expense, and also pays the worker funds for personal expenses.

Per diem is paid in the amount of 7.5 US dollars (50 US dollars × 15%).

Example 5

The receiving party does not pay foreign currency for the personal expenses of the posted worker

An employee of the organization is sent to Ganzhou (China). In accordance with the invitation, the receiving party provides the posted worker with only three meals a day at its own expense.

Per diem is paid in the amount of $15 ($50 × 30%).

As you can see, Irina Konstantinovna, when calculating daily allowance in cases of full or partial payment by the receiving party of the traveler’s expenses, you need to know what expenses the receiving party bears. I did not consider an advance payment for rent, because in the situation you described it does not raise any questions.

Sincerely yours, Olga Pavlovna