Reasons for a director's business trip

The purposes of a business trip of the head of an organization may be the following:

- meetings with future contractors, implementation of new business ideas;

- opening new company representative offices in other cities or even countries;

- work related to the opening of a new project, participation in negotiations with contractors, conclusion of contracts with them;

- settlement of controversial issues that arose as a result of inspections of branches or separate divisions by state control authorities.

The documented basis is always a properly executed memo.

The purposes of the business trip are also indicated in the business trip order.

Registration of the director's business trip and necessary documents

The general director, who is not at the same time the founder of the company, is exactly the same employee as the rest. The only difference is that he is the legal representative of the employer in relations with other employees. Therefore, the procedure for processing his business trip will have only slight differences from the registration of a business trip for an ordinary employee.

So, the order of registration is as follows:

- A memo is written by the manager about being sent on a business trip. This paper is considered the basis for issuing a travel certificate and order.

- An order is drawn up to send the employee on a business trip in the T-9 form. It states the purpose of the trip, duration, place and other important information.

- The order is registered in the order register, the employee gets acquainted with the document and puts his signature in the register as a sign of consent.

- A travel certificate is issued in form T-10. Organizations do it on their own initiative, since it is not required by law. It is prescribed only for internal control.

- The general director, like any other employee, is given an advance to pay for travel-related expenses.

- Not necessarily, but you can record the fact that an employee goes on a trip in the logbook for employees going on business trips. The company has the right to provide for the presence and maintenance of such a journal at its own discretion.

- After an employee, and in this case the general director, has gone on a business trip, the days spent on the trip are noted in the time sheet.

- Upon return, the employee provides a report on the funds spent in connection with the business trip. Checks and receipts confirming expenses are attached to the expense report.

IMPORTANT! A sample order for sending the head of an organization on a business trip from ConsultantPlus is available here

Documents must be drawn up correctly; the fate of the company’s taxable base will depend on this (subclause 12, clause 1 of Article 264 of the Tax Code of the Russian Federation). For example, if the order is issued later, it turns out that the number of days on a business trip will be taken into account by accountants in a smaller amount, and then the amount of expenses in the tax base will also be less than the actual amount (which the general director received in his hands when he had already gone on the trip).

Therefore, it is so important to comply with the deadlines for drawing up primary documentation. All nuances are indicated in Resolution of the State Statistics Committee of the Russian Federation No. 1 of January 5, 2004.

How is the CEO's business trip arranged?

How is the CEO's business trip arranged? Is it necessary to issue an order in Form No. T-9 or is it better to issue it on official letterhead with the words “I am leaving on a business trip for...”? How to formalize the transfer of authority from a manager to an acting director?

08/01/2008 The question is answered by Demura I., leading lawyer of MedBusinessConsulting LLC.

The duality of the legal status of the general director is manifested in the fact that his activities are regulated by the provisions of not only labor, but also civil legislation.

Let us recall that the concept of a business trip is disclosed in Article 166 of the Labor Code of the Russian Federation. This is a trip of an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. In this case, we must not forget that the employer is an individual or organization that has entered into an employment relationship with an employee. The general director (unless he is also the founder of the company) is not an employer. He is the same as an employee, only as a management body and an authorized person he is the legal representative of the employer in relations with other employees.

When registering a business trip for a director, the same unified forms are used, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1, as when sending other employees on business trips, namely:

- order (instruction) to send an employee on a business trip (form No. T-9);

- travel certificate (form No. T-10);

- official assignment for sending on a business trip and a report on its implementation (form No. T-10a).

As you know, these documents are signed by the head of the organization. But then it turns out that if the need arises for a business trip, the general director sends himself there? Yes exactly.

The right to issue administrative documents in an organization is enshrined in its charter. Its leader initially has this right. In addition, the head of the organization delegates the right to sign documents, including orders, to his deputies and other persons, which must be formalized by the relevant legal act, which will be mentioned in more detail below. However, this does not deprive the director of the right to sign.

Now let’s briefly talk about the features of filling out travel documents.

An order (instruction) to send an employee on a business trip (Form No. T-9) is used to record and send the manager on a business trip. Filled out on the basis of the office building, signed by the general director of the organization or a person authorized by him to do so.

The official assignment and the report on its implementation (form No. T-10a) are signed and approved by the head of the organization himself. Upon returning from a business trip, the general director draws up a report on the work performed during the business trip, which is submitted to the accounting department. The statement of work reflects the main results of the trip in a concise written report and confirms the production nature of the expenses.

A travel certificate (Form No. T-10) is a document certifying the time spent on a business trip in the territory of the Russian Federation or a CIS country, upon entry into which, according to intergovernmental agreements, a mark on crossing the state border is not affixed. The travel certificate is issued in one copy based on the order to be sent on a business trip and handed over to the general director. At each destination, notes on the time of arrival and departure are made on the travel certificate, which are certified by the signature of the responsible official and the seal. After returning from a business trip, the certificate is provided to the accounting department along with the director’s advance report and documents confirming production expenses. A travel certificate may not be issued if the manager must return from a business trip to his place of permanent work on the same day on which he was sent. When traveling abroad, a travel certificate is not issued.

Before the trip, the director is also given an advance for travel expenses, according to which, upon returning from a business trip, he submits to the accounting department a report according to the unified form No. AO-1, approved by the State Statistics Committee on August 1, 2001.

An important point that should be paid special attention to is the transfer of powers to an interim CEO when the latter is on a business trip. In most cases, this employee is the Deputy General Director. If the director does not have a deputy, then these responsibilities can be assigned to another employee. A sample of an order issued to temporarily assign the duties of the general director to a deputy or other employee is given in Example 1.

For performing the duties of an absent employee without release from his main job, additional payment is due (Article 151 of the Labor Code of the Russian Federation).

If the Deputy General Director or another employee determined by the order will not perform all the functions of the General Director, but only part of them, then the terms of his powers must be clearly established in the order (instruction). Otherwise, he will perform those functions that are defined for the general director by the organization’s charter and the legislation of the Russian Federation.

The procedure for temporarily replacing the general director is prescribed in the company's charter and in employment contracts with the general director and his deputy. If the company’s charter does not spell out the entire replacement procedure, then a separate order is issued. If the duties of an employee to whom the director delegated his powers during a business trip do not include the function of substitution and he is not relieved of his main job, then the performance of duties can be entrusted to him with written consent (Article 60.2 of the Labor Code of the Russian Federation). In this case, you should conclude an additional agreement with the employee to the employment contract, in which you need to specify all the responsibilities for the position being replaced, set the replacement period, and also determine the amount of additional payment. You can arrange a replacement through a temporary transfer to another job to replace a temporarily absent employee (Article 72.2 of the Labor Code of the Russian Federation). The need to draw up an additional agreement does not disappear, however, during the transfer period, the agreement states: “Before the general director goes to work.” There is no need to make an entry in the work book in either case.

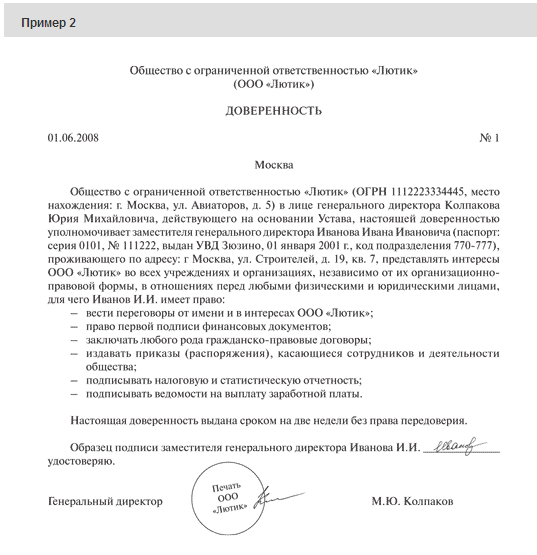

In addition, during the absence of the general director, it is necessary to issue a power of attorney indicating the powers transferred to the person (see Example 2). A power of attorney is a concept of civil law and, in accordance with Article 185 of the Civil Code of the Russian Federation, is a written authority issued by one person to another person for representation before third parties. A power of attorney is issued for a period of no more than three years, and if the period is not specified, it is valid for one year from the date of issue. The person who issued the power of attorney may revoke it at any time. And the person to whom the power of attorney was issued has the right to refuse it at any time (Part 1 of Article 188 of the Civil Code of the Russian Federation).

The power of attorney, as well as the order, must reflect only those powers that the director entrusts to his deputy to exercise.

In addition, to be able to sign financial documents, it is necessary to have a sample signature of the person replacing the general director on the bank card. This must be taken care of in advance.

The acting general director, regardless of whether he is a deputy or another employee, must sign documents on his own behalf indicating his position according to the staffing table. Handwriting "I.O." in front of the director's surname in documents and your signature is unacceptable, since the position “acting” does not exist. The powers of this or that employee are delegated officially, on the basis of legal documents, so the signature and transcript of the signature must match.

The position is not filled free of charge. According to Article 151 of the Labor Code of the Russian Federation, the acting employee of a temporarily absent employee is entitled to additional payments, the amount of which is established by agreement of the parties to the employment contract.

The current clarification of the State Committee for Labor of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated December 29, 1965 No. 820/39 “On the procedure for payment of temporary substitution”, in part that does not contradict the Labor Code of the Russian Federation, states that the temporary worker is paid the difference between his actual salary and the official salary of the replaced employee . In this case, it must be taken into account that subparagraph “a” (paragraph 3) and paragraph 4 of paragraph 1 of the specified clarifications that the difference in salaries is not paid to the full-time deputy or assistant general director, as well as to the chief engineer who replaces the absent manager, is now don't work. These points were canceled by the Ruling of the Supreme Court of the Russian Federation dated March 11, 2003 No. KAS03-25 as infringing on the rights of employees and contradicting Article 151 of the Labor Code of the Russian Federation. Thus, any employee, including a full-time deputy general director, for whom replacing an absent manager is a direct obligation under the contract, must be paid extra for temporarily performing the duties of a manager.

Assignment of responsibilities

In cases where the manager is absent from the workplace, and in this case, went on a business trip, his powers are transferred to another employee in order to fulfill the duties of the director: signing contracts, orders, etc. The choice of such an employee may depend on the decision of the manager. But in most cases, such an employee becomes the one who is registered in the organization’s statutory documentation (Article 53 of the Civil Code of the Russian Federation).

As a rule, these are the following employees:

- Deputy Director;

- head of HR department;

- head of any division or department;

- co-founder, if any;

- accountant.

What to consider when assigning the duties of the General Director to another employee:

- The employee begins to perform new duties that are additional to the main ones, so this fact must be agreed upon with the employee. New responsibilities and payment features must be specified in an additional agreement to the employment contract.

- To transfer the right to sign, it is necessary to issue a power of attorney (Article 185 of the Labor Code of the Russian Federation). Its duration can be any, but, as a rule, it corresponds to the period of the business trip.

- The employee's written consent must be obtained.

- An order is issued to transfer the powers of the manager for a certain period.

Attention! If the employee was vested with the authority of a manager before the latter’s business trip was arranged, then he has the right to sign all documents related to the trip.

Transfer of powers during the absence of the director

It was previously mentioned that when the director of the company leaves, part of his functions are assigned to an employee who is appointed as the acting director. This person is vested with a certain list of rights in relation to the company’s employees and material assets, which he will have to use during the period of his manager’s official trip. The executive officer is assigned responsibilities for carrying out certain personnel activities, for interacting with subordinates, and for performing other actions that are necessary for the operation of the enterprise as usual. As a rule, such an official may be:

- Vice president;

- Head of the HR department of the organization;

- Head of another structural unit;

- Co-founder, if there is one;

- Chief accountant of the company.

A corresponding power of attorney is issued to the acting person on behalf of the boss, an order is issued on the transfer of powers, and written consent to carry out this procedure is requested from the employee himself.

No rating yet

Founder's business trip

There are situations when it is necessary to send the founder on a business trip. More precisely, the trip must be registered as a business trip, because the founder is traveling on company business, and the expenses must be taken into account as travel expenses. But he is not an employee of the company, so he cannot be sent on a business trip (Article 166 of the Labor Code of the Russian Federation) and money cannot be given on account. If this rule is neglected, the tax office may have questions.

How to pay for the founder's business trip ?

To arrange a business trip for the founder (and at the same time write off expenses in tax accounting, not withhold personal income tax and receive a VAT deduction), you can use three methods.

Employment contract

The first way is to conclude a fixed-term employment contract with the founder and hire him for a position (for example, assistant director) with a minimum salary. Then you can arrange a business trip according to all the rules: with payment for accommodation and daily allowance.

Important! The employment contract must specify the responsibilities related to the business trip: participation in negotiations, preparation for concluding transactions, etc. The salary in this case should not be lower than the minimum wage.

Civil contract

The second way is to conclude a civil law agreement for each “business trip”. Such an agreement must specify specific tasks: what it must do, what result it must obtain.

The contract can be of two types: provision of services and assignments (it is concluded if it is necessary to sign any documents during the trip; a power of attorney is also drawn up for the right to sign documents on behalf of the company).

If a GPA is concluded, the company must reimburse the founder for the costs of this trip or buy tickets, pay for accommodation, etc. In the first case, personal income tax and insurance premiums are not charged for compensation of costs; this amount is included in the tax expenses of the organization. All expenses must be confirmed by the primary source; VAT cannot be deducted, because Only the founder will appear in the documents.

If the company itself pays for travel and accommodation, then VAT deduction will be possible, because documents will be issued in the name of the company.

Cash for the trip is not issued on account, but simply from the cash register as funds necessary for the implementation of the GAP. The cash receipt order must indicate the date and number of this agreement.

Without an agreement

There is no need to conclude any agreements if the trip is related to a transaction, the conclusion of which requires the presence and approval of the founder. There are types of transactions that a director cannot enter into independently:

- large (these are transactions with property worth more than 25% of the value of the enterprise’s property);

- with interest;

- which are stated in the LLC charter as requiring approval.

If the reason for the trip is one of these transactions, then the Federal Tax Service will not doubt the justification of the costs of the trip (Article 252 of the Tax Code of the Russian Federation). Typically, such expenses are considered as other or non-operating expenses.

Since the funds were not used to pay the founder’s personal expenses, but to pay the company’s expenses, payment of personal income tax and insurance premiums is not required. VAT can be deducted.