Regulatory framework for primary documents

To reflect any business transaction in accounting, it is necessary to have a correctly executed primary document, as stated in paragraph 1 of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. Next we read in paragraph 4 of Art. 9 of this law, that the forms of primary documents must be developed and approved by the organization. Thus, the use of unified forms of primary documents is optional, with the exception of certain cases. The only obligatory condition is the presence of certain details in the document. On the other hand, there is no ban on the use of unified forms of documents, so the head of the organization must independently determine which forms of primary documents should be used:

- unified forms;

- independently developed forms with mandatory details;

- a combination of the first two options.

The decision made must be fixed in the accounting policy and the forms of primary documents used by the organization must be attached to it.

Payroll for payroll: free

This document is intended to reflect salaries paid to employees in cash. For workers whose wages are transferred to bank cards, such a payroll is not prepared (see Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1).

The document is drawn up in 1 copy, signed by the head of the company and the chief accountant. Then it is transferred to the cashier.

Usually, the standardized form T-53, approved by the above-mentioned resolution of the State Statistics Committee, is used for its registration, although from 01/01/2013 the use of a unified form is not mandatory for private organizations, so they can independently develop the appropriate form. At the same time, the form compiled by the organization using its own template must still comply with the requirements imposed by law for primary accounting documents (see Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

The form of the standardized form of the salary payment sheet can be found at the link: Salary payment sheet according to the T-53 form - sample.

Rules for drawing up primary documents

Let us next consider the primary documents on wages that must be used when accounting for settlements with employees. The article will provide unified forms. They can be processed in accordance with the needs of the enterprise’s accounting department, leaving in any case the mandatory details listed in clause 2 of Art. 9 of Law 402-FZ:

- Title of the document;

- date of document preparation;

- name of the economic entity that compiled the document;

- content of the fact of economic activity;

- the value of the natural or monetary measurement of the fact of economic activity, indicating the units of measurement;

- the name of the position of the person who performed the transaction and is responsible for its execution.

Primary documents on wages can be drawn up both on paper and in electronic form. In the second case, they must be signed with an electronic digital signature.

Use funds in your current account with Sberbank

You can give permission to the bank to write off amounts from the current account according to the registers. Then you won’t have to generate payment orders yourself—the bank will promptly do it for you.

Indicate the type of payment in the register

When creating a register in Sberbank Business Online, you need to select the Type of enrollment (salary, child benefit, or other). Then the type of payment will be indicated in the statement of the organization’s current account, the recipient will receive a corresponding SMS notification, and in the statement of his account he will see the amount with the appropriate explanation.

Salary payments have a positive effect on the recipient's credit potential. The cost of the enrollment operation also depends on the type of payment.

! If a certain amount must be recovered from the recipient of the payment under enforcement proceedings, then the amount of recovery directly depends on what funds were received into the recipient’s account. Therefore, it is important to indicate that alimony or other immune funds are being paid in accordance with the requirements of the Federal Law on Enforcement Proceedings.

! If the payment is made to a nominal account (see Article 37 of the Civil Code), then according to the terms of such an account, some types of payments cannot be credited to it.

! For some types of payments when conducting a currency transaction on the register, additional supporting documents may be required, so their use in currency transactions on the registers is not provided.

Pay attention to the recipient's details

The recipient of funds for distribution according to the register is the bank. In the payment order to the register, in the Recipient's account , the bank's correspondent account must be indicated, which can be found on the bank's website or in the agreement. The name of the recipient indicates the name of the bank division with which the salary or social contract was concluded.

Pay attention to the amounts of documents

The amounts of the payment order to the register and the register itself must match.

Pay attention to the register and contract numbers

It is important to correctly indicate the type of payment; the register number must be indicated along with the keyword. The bank will quickly figure out which register corresponds to this payment order. The number of the current agreement must be indicated without spaces and in a form understandable to any person or computer program.

Let's consider the correct example for register No. 123 on wages, where the text that you need to pay special attention to is highlighted in green.

Payment of wages for February 2021 according to register 123 under agreement 12345678 dated 12/12/12 to employees’ bank accounts

Use (parentheses)

If you need that when returning a partially uncredited amount according to the register (if there are discrepancies in the full names of recipients, closed accounts, etc.), part of the text of the original document is retained in the payment document, then indicate the necessary information in parentheses at the beginning of the payment purpose text: (l/c 12345678910) Payment of wages for February 2021 according to register 123 under agreement 12345678

The return in this case will look like this: (l/c 12345678910) Return according to register 123 under agreement 12345678

Complete currency transactions correctly

If your organization makes payments to the accounts of non-resident individuals or is a non-resident, then when drawing up payment orders in the purpose of payment, the code of the type of operation must be indicated before the text in the format {VO_____}, where the code of the type of operation is indicated in place of the space (for more details, see. Appendix 1 to Bank of Russia Instruction No. 181-I dated August 16, 2017).

For example, the purpose of payment when paying wages may look like this: {VO70060} Salary according to register 12 according to contract 12345678

Before processing the register, the bank checks the transaction type code. If it corresponds to the type of payment (credit) specified in the register, then credit to the recipients’ accounts will be carried out successfully. Otherwise, corrections will be required in the purpose of the payment or an indication of a different type of payment in the register and re-sending them to the bank. If, according to the agreement, a bank generates payment orders for you to the registers, then in the statement of the organization’s account the debiting of funds from the register will be reflected in the purpose of payment indicating the type of transaction code that corresponds to the type of credit you have chosen in the register. In this case, not all types of payments can be selected in the registers. If your organization is not a budget or credit organization, resident and non-resident recipients must be listed in different registers.

Time sheet and calculation of wages

The employee is paid based on the amount of time he works.

To record it, use form No. T-12 “Working time sheet and calculation of wages” or form No. T-13 “Working time sheet”. The T-12 form contains data on actually worked and unworked time based on sick leave, certificates, applications, orders.

The title page indicates the name of the organization, the date of preparation and document number, the reporting period and codes for indicating worked and unworked time in the accounting table.

Section 1 “Working Time Accounting” consists of 17 columns and is intended to reflect information about attendance and absence from work for one calendar month. Filled in for each employee: his/her full name, personnel number, then on the dates of the month in columns 4 and 6 in the top line a code indicating attendance at work or the reason for absence is indicated, in the bottom line - the number of hours worked that day, overtime hours are marked with a fraction. Columns 5 and 7 are intended to reflect the sum of days of visits and hours actually worked for each half-month. In the columns of the missing numbers of the month, put the sign “X”.

According to the rules, you can fill in the cells for all days of the month, and only for days other than a regular working day (vacation, sick leave), leaving the cells of a regular working day empty.

Section 2 “Payment payments to personnel” consists of two pages. The third page of the timesheet is intended to reflect each type of payment for the month for each employee.

The fourth page of the report card summarizes information about attendance at work for the organization as a whole for each day of the month. Download an example of filling out the T-12 form.

Form T-13 represents only the title page and section 1 for recording working hours of Form T-12. Then it is assumed that the accountant keeps records of salaries in other registers.

Payroll

The following block of primary documents for payroll accounting:

- payroll statement (form T-49);

- pay slip (form T-51);

- payroll (form T-53).

IMPORTANT! It is necessary to reflect the amounts of accrued wages only in unified forms.

As the names indicate, form T-49 is a combination of forms T-51 and T-53, so the accountant draws up either one payroll sheet, or a payroll sheet and a payroll sheet.

The payroll sheet is used to calculate and pay wages in cash from the company's cash desk. It contains the number and date of compilation, signatures of the manager and chief accountant, the total amount of payment to all employees, as well as the start and end dates for the payment of wages from the cash register - this period is equal to five working days.

The statement contains information about the personnel number, position, tariff rate and hours worked for each employee. The accountant enters into it all accrued amounts for all types of payments, as well as all deductions for the period for which funds are paid to the employee. This can be either an advance, or wages, or vacation pay, and so on.

At the end of the statement, information about the amount paid and deposited (if any), the signature of the responsible person and the number of the cash receipt order for which the payment was made are entered.

The far right column is filled in by employees of the organization, where they sign to confirm receipt of funds from the cash register. Amounts not received within five days are deposited.

Sample payslip.

Payroll sheet

Another name for this document is a payroll sheet, and the standard form T-51 has also been approved for it (optional for use by private companies). This document is used to calculate the amount of payment to the employee (both advance payment and full salary payment).

IMPORTANT! If the company uses a payroll sheet (both in the standard form T-49 and in a free format), then form T-51 is not filled out.

The preparation of such a document is carried out in relation to all employees, including the transfer of salaries to plastic card accounts, in contrast to the above-mentioned forms T-53 and T-49, which are drawn up only for employees who receive wages in cash .

A sample of the standardized form can be found at the link below: Payroll - Form T-51: Sample.

If an organization independently develops a payroll sheet form, it must adhere to the requirements established by Art. 9 of the Law “On Accounting” in relation to primary accounting documentation.

Data in the payroll is entered on the basis of information from primary documentation for recording production, hours actually worked (see also the article How to create a schedule for recording employee working hours?) and other documents.

Payroll and payslip

If employees receive wages on bank cards, then only a payslip is drawn up in form T-51.

What other documents are needed in this case, we will consider below. If an accountant calculates wages in a different register, you can only prepare a payroll.

The pay slip in Form T-51 reflects only calculations for each employee. Here you will find an example of filling.

At the beginning of the payroll, you must indicate the date of receipt of funds at the cash desk for issuance to employees and the end date of issuance.

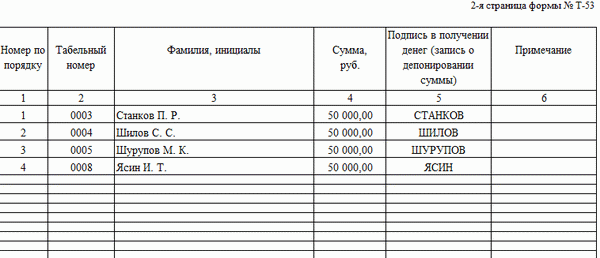

The payroll in form T-53 reflects the amount of payments to each employee, their receipt of receipt of the specified amount, and also at the end of the statement - the total paid and deposited amount, as well as the number of the cash order for payment of wages, sample at the link.

If an accountant uses a statement in the T-53 form in his work, he needs to draw up a register of issued statements in the T-53a form, where the serial number of the payroll and the amount paid on it are entered. The register is compiled for one calendar year. Here is an example of filling out the form.

Sample summary payroll statement

This type of documentation is used to control the flow of funds from wages and is convenient for preparing financial statements.

A unified form of the summary statement has not been approved, so each organization draws it up independently, taking into account the purposes of use.

Typically, the information reflected in the summary statement includes:

- monthly accruals for each employee (including bonus, advance payment and other accruals);

- deductions for the same period in relation to each employee;

- amounts of contributions to extra-budgetary funds, etc.

Also, depending on the purpose of compiling the summary statement, the following parameters can be recorded in it:

- form of employment;

- names of employees' positions;

- number of hours worked;

- stage of work execution;

- amount of payment per unit of working time, etc.

Thus, the summary statement demonstrates beginning and ending balances, turnover with detail by employees, account cards, posting reports and primary documentation.

This is important to know: 50 years of work experience: what are the benefits?

A sample of such a document can be downloaded from the link provided: Salary summary sheet - sample.

So, the payroll is intended to calculate the amounts of wages to be issued/transferred to employees’ cards, and the payroll is intended to record the amounts of wages paid. There is also a payroll that combines the previous 2 forms.

A sample statement for the payment of wages can be drawn up either according to the standardized T-53 form or in free form, containing all the attributes necessary for the primary accounting documentation. The pay slip (form T-51) can be prepared in a similar way.

Personal accounts of employees

For each employee of the organization, the accountant must maintain a personal account in form T-54, which reflects the employee’s personal data: full name, tax identification number, SNILS, marital status.

It also contains data about work at a given enterprise: date of entry, transfers, dismissals, changes in wages, vacations, and so on. Every month, the accountant enters into the personal account data on the amount of time worked by the employee, the amounts accrued to him for all types of payments, all deductions from wages, and data on sick leave.

The last columns contain information about the final amount to be paid for each month, as well as about the debt to the employer or, conversely, to the employee.

Sample employee account.

How to fill it out correctly

The key rules for drawing up documents are enshrined in Resolution of the State Statistics Committee No. 1 of 2004. Let us determine the procedure for drawing up using form No. T-53 as an example.

We start filling out with the title page. First of all, we register the name of the organization, then enter the name of the structural unit. Now we indicate the payment deadline.

We indicate the amount due for issuance first in words and then in numbers. Then the title page is signed by the director and chief accountant of the company, indicating the full name. We indicate the date of signing.

This is important to know: Compensation for rest and wellness of teaching staff

We write down the document number, the date of its formation (drawing up) and the billing period for which the information was reflected.

We proceed to filling out the tabular part of the form. Here we first indicate the record number in order, then enter the employee’s personnel number. Last name and initials, as well as the amount to be paid. The employee must sign for receipt nearby.

After filling out the table, the results are summed up. Certified by the signature of the cashier and the responsible accountant.

Payslips

The law obliges the employer to issue pay slips to employees along with their wages, which clearly indicate what the amount received by the employee consists of.

Salaries are received at least twice a month, however, it is more reasonable to issue a pay slip once, when paying wages for the month, and not when paying wages for the first half of the current month, since in the second case the calculation indicated in the slip may be incomplete and does not reliably reflect the origin of the amount paid. The payslip does not have a regulated form, so the organization must independently develop it, based, for example, on forms T-12 or T-51. Or create your own form entirely, which should be fixed in the accounting policy. The payslip must indicate all parts of the salary: salary, bonus, allowances, bonuses, sick leave payments, and so on. It is necessary to indicate all deductions: personal income tax, alimony, fines, etc. As a result, the amount to be paid should be obtained, which the employee receives in his hands along with the pay slip.

The payslip, upon agreement with the employee, can be issued both in paper form and electronically, by sending it to the employee’s email.

Salary project

At the moment, the most common way to receive wages is to transfer it to the employee’s bank card.

This can happen either individually or on an ongoing basis and for all employees at the same time. There are two options for receiving money on a card: transferring it to each employee separately or registering a salary project with a credit institution. To receive wages on a bank card, the employee must write a statement about this and attach to it the card details for transferring funds.

If the organization has entered into an agreement with a credit institution on a salary project, then the employee signs an application for the issuance of a card within the framework of this project or writes an application attaching the details of the card he already has.

If the employee does not want to receive wages on the card, he does not sign any statements and continues to receive money at the organization’s cash desk.

The method for employees to receive wages on a bank card or at the organization’s cash desk must be specified in the collective, labor agreement or in an additional agreement to it.

Other primary documents

In addition to the listed main primary documents, these include the following documents, which are compiled to reflect the facts of economic activity that are directly related to payroll calculation:

- an employment contract with an employee, where the system and amount of remuneration must be specified;

- orders for transfer to another position or salary changes;

- applications and orders for all types of vacations, since the time spent on vacation affects the calculation of wages;

- orders for payment of bonuses and bonuses;

- certificates of incapacity for work;

- applications and orders for business trips;

- applications and orders for hiring and dismissal, as well as for payment of various types of compensation upon dismissal;

- other documents directly related to the calculation or affecting the amount of wages of each employee of the organization.

***

An organization has the right to develop primary documents for payroll accounting independently or use standardized forms. They can be issued either in paper or electronic form, signed with an electronic signature. It is important to make payroll calculations accurate and as transparent as possible for the employee. For this purpose, detailed calculation forms are used, taking into account all the features of working conditions and pay slips issued to employees, which reflect all the steps of the calculation.

Source: legal and tax portal People's Adviser