We learn to draw up expense reports using examples (1C: Accounting 8.3, edition 3.0)

Lessons on 1C Accounting 8 >> Bank and cash desk

2016-12-08T12:30:37+00:00

| Is the article outdated and in need of revision? |

In my observation, for novice accountants, preparing expense reports is a significant challenge at first.

Today we will look at the basics of this matter, as well as the most popular cases from life. We will perform all experiments in 1C: Accounting 8.3 (edition 3.0).

So, let's begin

It’s not for me to tell you that 71 accounts are responsible for settlements with accountable persons in the accounting department:

The issuance of assets is reflected to the employee as a debit to this account, and write-offs are reflected as a credit.

Well, for example, they gave out 5000 against a report from the cash register:

| Dt 71 Kt 50 5000 |

The employee reported on the use of these funds, for example, to pay for general business expenses... well, for example, for electricity:

| Dt 26 Kt 71 5000 |

Why did I say assets ? This is because we can give the employee:

- Cash (from the cash register through cash register)

- Non-cash funds (transfer from the organization's current account to the employee's card account)

- Financial documents (for example, plane tickets for a business trip)

Let's look at each of the examples listed above.

How long should expense reports be kept?

In accordance with Part 1 of Art. 29 of Federal Law No. 402-FZ, advance reports must be stored for 5 years after the reporting period. Each organization chooses the procedure for storing expense reports independently. As a rule, advance reports with attached supporting documents are filed in chronological order or quarterly.

Please note that the Central Bank has amended Directive No. 3210-U (Central Bank Directive No. 5587-U dated October 5, 2020), thereby simplifying the rules for issuing money for reporting.

These changes came into force on November 30, 2020:

- in the application for the issuance of accountable money, it is not necessary to indicate the amount of the advance and the period for which the accountable amounts are issued. You can also issue one order for several cash payments to one or more employees.

- The organization and individual entrepreneur have the right to independently set the deadline within which the accountable must submit an advance report.

- Even those employees who have not reported on past amounts received are entitled to receive funds. The requirement that an employee must account for previously issued amounts was removed from clause 6.3 of the Central Bank Instructions No. 3210-U dated March 11, 2014.

- Also, starting from 2021, accountable money can be transferred to an employee’s salary card. But then the details of the salary card to which the money is transferred must be reflected in the director’s order, or the employee must write them down in the application for reporting. And so that the tax authorities do not decide that this is an employee’s salary and do not require personal income tax to be calculated from the accountable amount, payment orders will need to be filled out in a special way. In field 24 “name of payment”, specify that the transferred funds are accountable. For example, you can make entries such as: advance payment for business needs or advance payment for travel expenses, and so on.

Thus, issuing sums of money for reporting can turn into a headache for the company if simple but strict legal requirements are not followed.

Issuance of monetary documents

A monetary document can be, for example, a plane ticket that an organization purchased for an employee who is going on a business trip.

After purchase, this ticket is accounted for as the debit of account 50.03:

When issuing this ticket to an employee for reporting (before a business trip), the accounting department draws up the document “Issue of monetary documents”:

And on the “Cash Documents” tab this very ticket is indicated:

The posting turned out like this (the ticket was written off from account 50.03):

I will specifically mention:

- We have the right to issue reports only to employees of the organization - persons with whom we have concluded an employment or civil law contract.

- The list of such persons is approved by a separate order of the head.

- The same order stipulates the maximum period within which the employee must report to the accounting department; if an employee goes on a business trip, this period is automatically extended until his return.

How to take into account an electronic ticket in an advance report

Payment for goods and services via the Internet is increasingly becoming part of our daily lives. Nowadays, no one can be surprised by online orders of pizza or sushi at home, cheap “overseas” goods, payment by card for telephone and utilities, etc. Electronic tickets have not been left out either.

Now you don’t have to go across the whole city to the train station and stand in stuffy lines for hours. Just 5-10 minutes of time, Internet, bank card - and a plane or train ticket is in your pocket. Or rather, by email. Organizations are also happy to take advantage of innovations by paying for tickets directly from their bank account.

However, despite the simplicity of such purchases, there are several rules that an accountant should remember when entering an electronic ticket into an employee’s expense report, making accounting entries and deducting VAT. What is an electronic ticket, what documents are needed to recognize expenses and how to correctly draw up an advance report, we will discuss in this article.

The content of the article:

1. What are e-tickets

2. In what case does an electronic ticket confirm expenses?

3. What to do if the ticket is lost

4. Is it possible to take into account electronic tickets in a foreign language?

5. VAT on air tickets and in the advance report

6. Electronic ticket in the advance report

7. Accounting for electronic tickets with an example

8. Accounting for tickets when purchased by an employee

So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not clear, there is a gear at the bottom of the video, click it and select 720p Quality)

We will discuss the topic of electronic tickets in more detail than in the video later in the article.

What are e-tickets

First of all, let’s figure out what is hidden under the concept of “electronic ticket”. A ticket is a document certifying the conclusion of a contract of carriage (clause 2 of Article 786 of the Civil Code). The form of the ticket is approved in the manner prescribed by transport charters and codes. An electronic ticket exists in electronic digital form.

Forms of electronic travel documents have been approved:

- For railway transport: order of the Ministry of Transport of Russia dated August 21, 2012. No. 322

- For aviation: order of the Ministry of Transport of Russia dated November 8, 2006. No. 134

When purchasing an electronic ticket, both railway and air tickets, the automated information system generates a statement, which is issued to the passenger or transmitted electronically via the Internet to e-mail if the payment was made via the Internet:

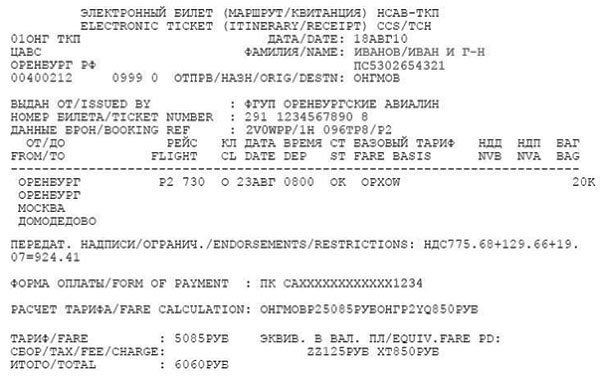

- — for aviation, this statement is called an itinerary/receipt ;

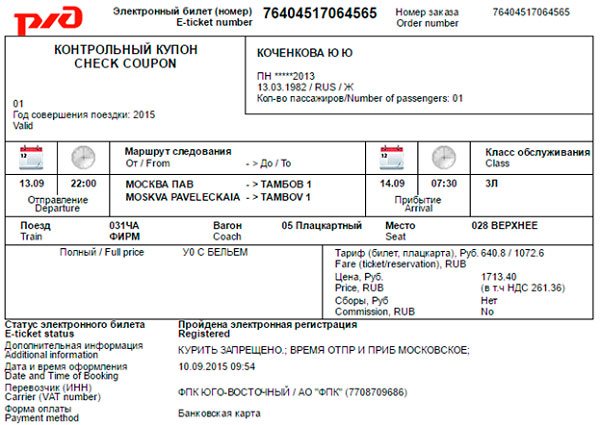

- — for railway transport — control coupon .

The itinerary receipt and control coupon contain complete information about the transportation. Including information about the route, fare and total cost of transportation, similar to a paper ticket. You can see what the route/receipt looks like in the figure below.

And this is what a control coupon for rail transportation looks like.

It is the control coupon and route/receipt that is commonly called an “electronic ticket.” In essence, the control coupon and route/receipt is an extract from the automated control system for passenger transportation in railway transport and aviation. In fact, this is only part of the ticket. The itinerary/receipt and control coupon are documents of strict accountability:

- clause 2 of Order of the Ministry of Transport of Russia No. 134 of November 8, 2006

- clause 2 of Order of the Ministry of Transport of Russia N 322 of August 21, 2012

In what case does an electronic ticket confirm expenses?

So, you have an electronic ticket. Now you need to decide whether travel expenses can be recognized on this basis. Firstly, expenses for an employee’s travel on official business for the purpose of calculating income tax are taken into account as part of travel expenses - paragraph 12, paragraph 1, Article 264 of the Tax Code, and they are classified as other expenses associated with production and sales. Secondly, we should not forget that the requirement of paragraph 1 of Article 252 of the Tax Code on economic justification and documentary evidence has not been canceled.

The purchase of a ticket for railway or air transport only indicates the fact of the conclusion of an agreement between the carrier and the passenger. But an agreement is only an intention; in itself it does not confirm the fact that a business transaction actually occurred. Therefore, it is no wonder that the accountant has a question: what documents must be available to confirm travel expenses?

For accounting, expenses are confirmed by primary documents, which are drawn up in accordance with the requirements of Article 9 of Law No. 402-FZ “On Accounting”. The Tax Code does not contain a list of mandatory documents that can be used to confirm travel expenses.

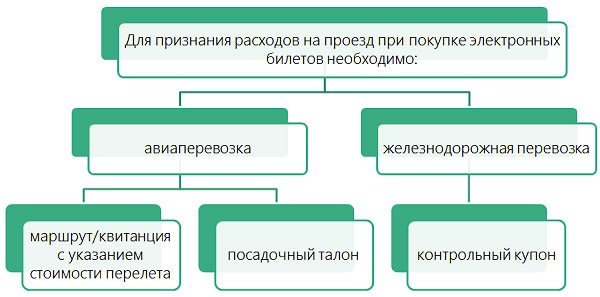

Based on the latest clarifications from officials, we can conclude that in order to recognize travel expenses when purchasing electronic tickets, it is necessary:

- For air transportation:

- itinerary/receipt (printout of an electronic document on paper) indicating the cost of the flight - will confirm the costs of purchasing a ticket;

- boarding pass , which is issued upon check-in for a flight, will confirm the flight on the route indicated on the ticket.

Explanations on this issue are provided in letters from the Ministry of Finance:

Letters from the Ministry of Finance:

from 05/18/15 No. 03-03-06/2/28296

from 04/06/2015 No. 03-03-06/19229

from 01/29/2014 No. 03-03-07/3271

from 01/14/2014 No. 03-03-10/438 (sent to the tax authorities for guidance by letter of the Federal Tax Service dated February 5, 2014 N GD-4-3/1897)

2. For rail transportation:

- control coupon.

Letter from the Ministry of Finance dated August 25, 2014. No. 03-03-07/42273

What to do if your ticket is lost

It happens that due to carelessness or simply by accident, an employee has lost documents. It’s easier with a route/receipt or a control coupon - you can simply print them out again from the file received by email after the purchase. What to do with your boarding pass?

In any case, you do not have the right to compensate the employee if he has the itinerary/receipt or control coupon; you are not entitled to travel expenses. But you won’t be able to do without additional documents if you want to take expenses into account when taxing.

In this case, you should contact the carrier or its representative and obtain a certificate containing the information necessary to confirm the flight (letter of the Ministry of Finance of Russia dated May 18, 2015 No. 03-03-06/2/28296). Otherwise, it will not be possible to take into account expenses.

If you do not have a boarding pass or certificate, then do not include the cost of the flight in your expenses. Also, during the inspection, auditors may add additional insurance premiums to the cost of the ticket. However, additional assessment of contributions can be challenged in court: resolution of the Federal Antimonopoly Service of the Ural District dated June 17, 2014. No. Ф09-3145/14.

As for personal income tax, officials believe that if you lose your boarding pass, the route/receipt is enough not to withhold personal income tax (Letter of the Ministry of Finance dated 03/21/2011 No. 03-04-06/6-49, dated 03/06/2012 No. 03-04 -06/3-57). Why this conclusion of officials does not work for income tax remains a mystery...

In order for employees to be more attentive to the safety of their boarding pass, in the internal local act dedicated to business trips, state that providing them for the advance report is mandatory.

If an employee bought train tickets through the terminal, lost the control coupon, but has a boarding pass in his hands, which contains information about the trip and its cost, then such expenses can be taken into account (Letter of the Ministry of Finance dated April 14, 2014 No. 03-03-07/16777 )

These are all the documents that will be required to confirm travel expenses. It is not necessary to require a cash receipt or bank statement from the employee. The Ministry of Finance stopped insisting on their availability since the end of 2013.

Is it possible to take into account electronic tickets in a foreign language?

Electronic tickets can also be issued in a foreign language. According to clause 9 of the Regulations on accounting and financial reporting in the Russian Federation (Order of the Ministry of Finance dated July 29, 1998 No. 34n), such primary documents must have a line-by-line translation into Russian . Does this mean that in this case it is possible to take into account electronic tickets only if absolutely everything is transferred? Not at all.

Let's see what needs to be translated:

- Details that are necessary to recognize income tax expenses, i.e. mandatory details of primary accounting documents under Article 9 of Law No. 402-FZ “On Accounting”.

- Details necessary for applying a VAT deduction, in accordance with clause 2 of Article 169 of the Tax Code (seller, buyer, name of goods (work, services), their cost, tax rate and tax amount).

Everything else (for example, baggage transportation rules, conditions for applying the tariff) does not need to be translated: letters from the Ministry of Finance dated December 9, 2015. No. 03-07-14/71801, dated 04/10/2013 No. 03-07-11/11867, dated 10/01/2013. No. 03-07-15/40623, dated 04/10/2013 No. 03-07/11/11867, dated 09.14.2009 No. 03-03-05/170.

In addition, in a letter dated December 9, 2015. No. 03-07-14/71801 The Ministry of Finance indicated that not only professional translators, but also employees of the taxpayer can make a translation, if this is part of their job responsibilities. It will not hurt to take into account e-tickets and include their cost in expenses.

VAT on air tickets and in the advance report

As mentioned above, the route/receipt and control coupon are strictly accountable documents. Therefore, when printed on paper, they meet all the conditions for deducting the VAT included in their price. But there is one very important condition - the amount of tax must be highlighted in these documents as a separate line , i.e. a specific tax amount must be indicated.

The latest clarifications on this issue are given in letters from the Ministry of Finance dated January 30, 2015. No. 03-07-11/3522, dated 10/14/2015. No. 03-07-14/58804, dated 07/30/14. No. 03-07-11/37594.

According to controllers, if the VAT amount is not highlighted as a separate line in issued electronic tickets, then it will not be possible to accept it for deduction. And then the entire cost of the ticket, together with VAT, is included in other expenses in accordance with paragraph 12, paragraph 1, Article 264 of the Tax Code (letter of the Ministry of Finance dated January 10, 2013 No. 03-07-11/01).

This VAT can be deducted only in the tax period when the advance report is approved, on the basis of which they are included in expenses (clause 7 of Article 171 of the Tax Code). Despite the fact that the trip could actually have been made in the previous tax period. And such a deduction cannot be carried forward to subsequent periods.

However, even in the case when VAT is not highlighted as a separate line, in court there is a chance to defend the right to deduction, for example, the resolution of the Federal Antimonopoly Service of the East Siberian District dated November 27, 2012. No. A19-5831/2012.

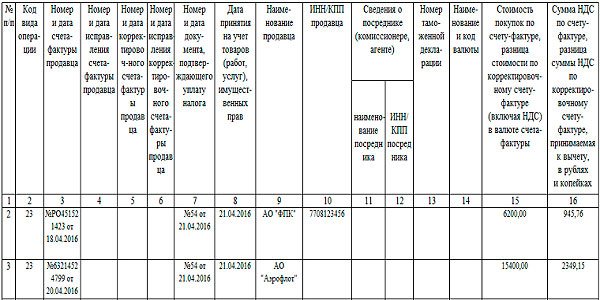

To receive the deduction, the ticket must be registered in the purchase book on the date the advance report is approved. In the date and invoice number column, the ticket number and the date of its issue are recorded. This date may also refer to the previous tax period.

In column 2 of the purchase book, enter the code for deductions for these transactions - 23 (letter of the Federal Tax Service dated January 22, 2015 No. GD-4-3/794).

If the route/receipt and control coupon do not indicate the carrier’s INN and checkpoint, then when filling out column 10 of the purchase book, a dash is placed (letter of the Ministry of Finance dated May 28, 2015 No. 03-07-11/30876, letter of the Federal Tax Service dated August 18, 2015. No. GD-4-3/14544).

Difficulties with input tax deductions can also occur if your company purchases tickets through an intermediary. The fact is that agents often issue an invoice for the cost of tickets and indicate the amount of VAT on it.

It is not right. After all, the intermediary in this case should not draw up an invoice for transportation services. Read about this in the letters of the Russian Ministry of Finance dated October 12, 2010. No. 03-07-09/45, dated 03/10/2009 No. 03-07-09/06, dated 05/16/2005 No. 03-04-11/112, Federal Tax Service of Russia for Moscow dated 08/31/2009 N 16-15/090448.1, dated 01/10/2008 N 19-11/603. Therefore, VAT deduction is possible only on the basis of a BSO, that is, a travel document.

So, if the VAT amount is not highlighted in the travel document, you will not be able to deduct the tax, even if the agent provided you with an invoice. If the VAT amount is indicated on the ticket, register this document in the purchase book, and not the intermediary’s invoice.

Now that we have determined in which case the organization has the right to deduct, we will look at how to reflect VAT on air tickets in the expense report.

We reflect the electronic ticket in the advance report

So, we have determined what documents must be available to recognize expenses. Now it's time to create an expense report. We will not analyze the entire form of this document here; we will only look at the features that you need to know when reflecting an electronic ticket in the advance report.

Firstly, if an organization bought a ticket at its own expense and then issued it to an employee, then the issued ticket will be reflected as an advance in the advances/overruns block. Those. there will be the cost of the issued ticket along with VAT, and if money was also issued, then they too.

Secondly, information about the ticket used for travel is reflected on the 2nd page of the advance report. It contains the date and number of the electronic ticket, the name of the expense (in our case, it is a ticket for a specific route) and also indicates the amount of expenses.

Accounting for electronic tickets with an example

Having reflected the electronic ticket in the advance report, we smoothly move on to drawing up accounting entries. To do this, we will consider separately the situations when tickets for an employee are purchased by the organization itself, and when they are purchased by an employee of the enterprise. Accounting for electronic tickets, namely posting, depends on this.

If an organization purchases tickets by bank transfer, then they arrive before they are issued to the employee in account 50.3 “Cash documents”, despite the fact that they are electronic. Information about the electronic ticket is entered into the Cash Documents Journal.

This account takes into account the entire amount, including VAT, because It is unlawful to deduct VAT on air tickets before drawing up an advance report. When receiving a ticket from the carrier and issuing it to an employee, you cannot immediately write off its cost as expenses, because the employee has not yet used the ticket and has not gone on a business trip.

Example

Employee of Chaika LLC Vorobiev V.V. sent from Moscow on a business trip to Novosibirsk. For an employee, an electronic plane ticket on the Moscow-Novosibirsk route was purchased through an intermediary for non-cash payment, the cost is 8,250 rubles, incl. VAT 750 rub. A service fee in the amount of 590 rubles was also paid, incl. VAT 90 rub.

Debit 50-3 – Credit 60 – in the amount of 8250 rubles. – ticket has been posted

Debit 26 – Credit 60 – in the amount of 500 rubles. – reflected service fee

Debit 19 – Credit 60 – in the amount of 90 rubles. – VAT on service fee is included

Debit 68 - Credit 19 - in the amount of 90 rubles. – VAT on service fees is accepted for deduction

The ticket is then issued to the employee:

Debit 71 – Credit 50-3 - in the amount of 8250 rubles.

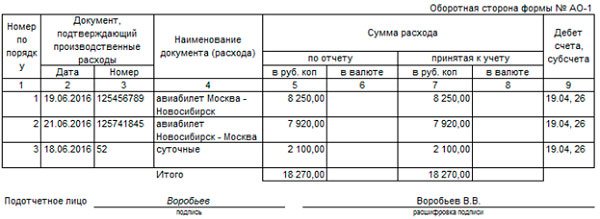

After returning from a business trip, the employee drew up an advance report, attaching the itinerary/receipt and boarding pass (we assume that VAT is highlighted on a separate line in the electronic ticket):

Debit 26 – Credit 71 – in the amount of 7500 rubles. – ticket costs written off

Debit 19 – Credit 71 – in the amount of 750 rubles. – VAT is allocated from the ticket price

Debit 68 - Credit 19 - in the amount of 750 rubles. – VAT on the ticket is deductible

Accounting for tickets when purchased by an employee

If an employee purchases electronic tickets independently, then the accounting for electronic tickets will be similar, because in fact, only the transactions associated with the expense report remain. Yes, and do not forget to give an advance to the employee before the business trip. He is not obliged to go on a trip at his own expense!

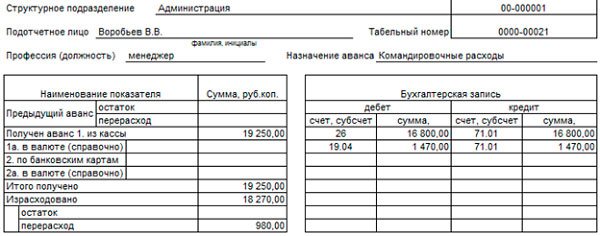

Example (continued)

Let’s assume that the return ticket on the Novosibirsk-Moscow route is from Chaika LLC employee V.V. Vorobiev. acquires independently. For these purposes, before the trip, he was given an advance from the cash register in the amount of 11,000 rubles.

Debit 71 – Credit 50 – in the amount of 11,000 rubles. – an advance was issued for travel expenses

The employee attached the itinerary/receipt and boarding pass to the prepared advance report. The ticket price was 7920 rubles, incl. VAT 720 rub.

Debit 26 – Credit 71 – in the amount of 7200 rubles. – ticket costs written off

Debit 19 – Credit 71 – in the amount of 720 rubles. – VAT is allocated from the ticket price

Debit 68 - Credit 19 - in the amount of 720 rubles. – VAT on the ticket is deductible

The daily allowance for a business trip for 3 days amounted to 2,100 rubles, and the employee returns the rest of the advance to the organization’s cash desk:

Debit 26 - Credit 71 - in the amount of 2100 rubles. – daily allowance accrued

Debit 50 - Credit 71 - in the amount of 980 rubles. – the unspent balance is deposited into the organization’s cash desk.

How to generate an advance report with an air ticket in the 1C: Accounting program 8 ed. 3.0, watch the video tutorial:

Does your company use electronic tickets? What difficulties did you encounter when taking them into account? Do you find them more convenient than paper forms? Please share in the comments!

You can also download Letters from the Ministry of Finance, which were mentioned in the text of the article.

How to take into account an electronic ticket in an advance report

Employee reports

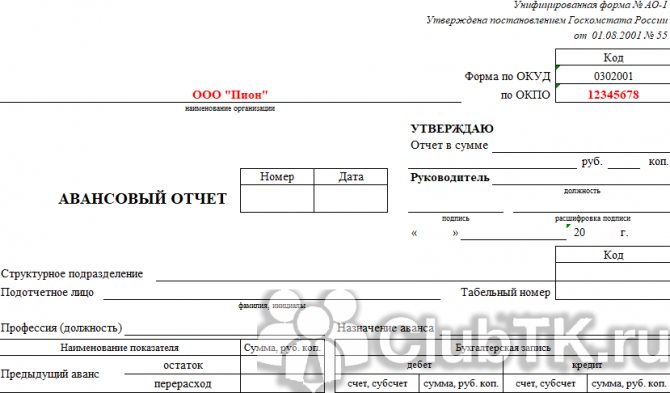

But assets are given to an employee for a reason, but to fulfill a certain official assignment. Therefore, the moment comes when the employee must report to the accounting department in form AO-1.

This is a printed form that indicates:

- everything that we gave to the employee for reporting

- everything he spent this money on (or didn’t spend it, or maybe there was an overspending)

- Supporting documents (checks, invoices, acts, tickets...) are attached to this form.

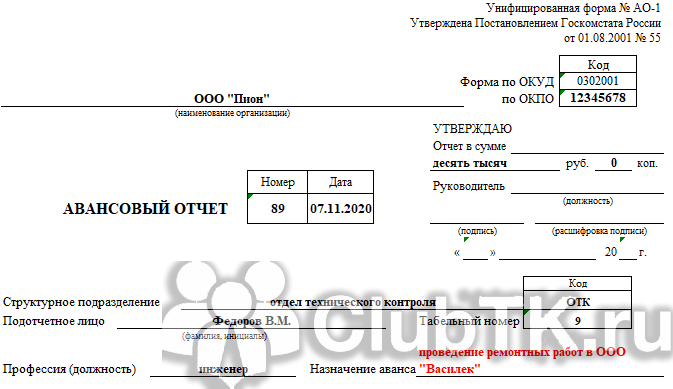

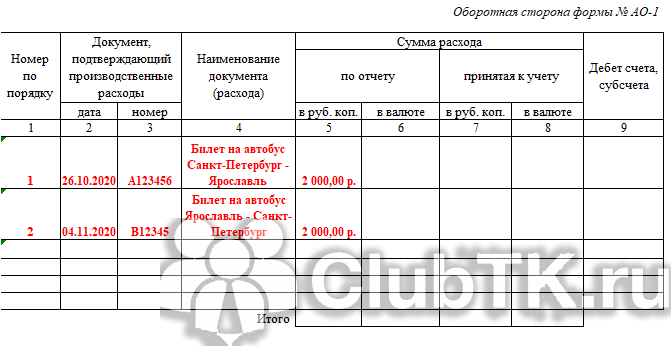

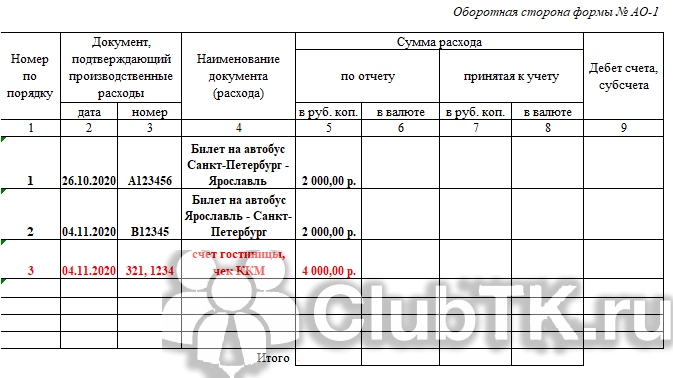

Here is an example of the AO-1 form:

This report (AO-1) is compiled by the employee together with the accounting department and approved by the manager. At the very bottom, the number of documents and sheets on which they are attached to the report is indicated (checks are usually pasted in whole packs onto A4 sheets).

So, in order to print such a report (AO-1), write off debt on 71 accounts from an employee, and also accept expenses in the top three, there is the document “Advance report”:

Let's briefly go through his bookmarks:

Filled out by employee

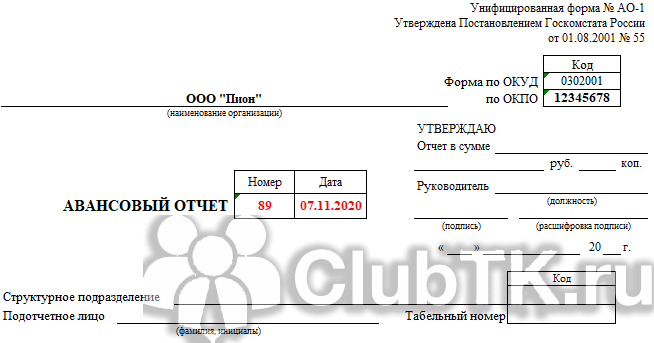

Filling out the advance travel report form begins with the header.

1. We indicate the name of the organization and the eight-digit OKPO code.

2. In the “number” and “date” columns we enter the corresponding details.

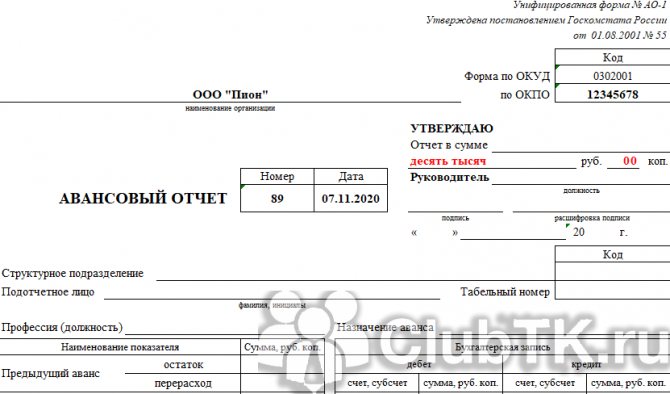

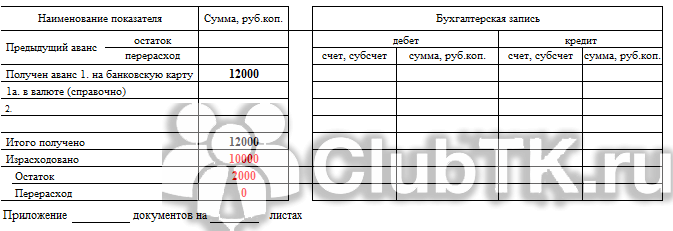

3. In the “Amount Report” column, indicate the amount that the employee spent on the business trip. For example, he was given 50,000 rubles, and he spent 60,000, then in this column he indicates 60,000. Or vice versa, 50,000 was given, and 20,000 was spent, then they report 20,000 rubles. In our example, 10,000 rubles were spent.

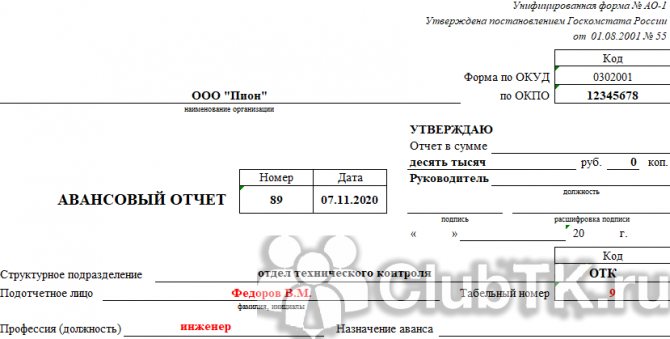

4. Enter the name of the structural unit and its code (if it exists).

5. We indicate the last name, first name, patronymic of the person reporting, his personnel number and position.

6. In the “Purpose of advance payment” column, enter the purpose of the trip.

Let's move on to the left side of the table located on the front side of the form.

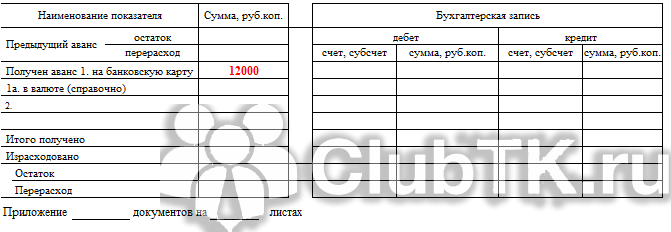

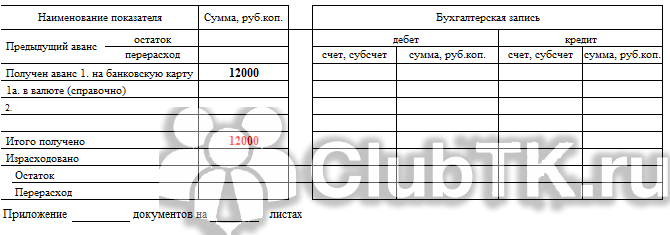

7. In the column “Advance received...” we indicate the details of the cash receipt order and the amount issued. If the money was transferred to the card, indicate only the amount.

8. In the “Total received” column we indicate how much we received in total.

9. Next, the employee specifies how much he spent, listing the balance of funds that should be returned, or overspending.

We proceed to filling out the back side of the advance report form. Let's assume that an employee traveled to and from his business trip by bus, lived in a hotel (meals were included in the cost of accommodation), and walked to his place of work on a business trip (the hotel is near the place of work).

10. In the first line we enter the details of travel tickets.

11. Enter information about confirmation of hotel accommodation.

12. Enter information about the amount of daily allowance issued.

13. In the “Total” column we enter the amount of funds spent, which must correspond to the amount for which the advance report is submitted (see point 3).

After the employee enters all the necessary information in the columns and columns, he signs the advance report, attaches to the form No. AO-1 all the documents he has, to which he referred, numbers them, enters information about the number of attachments in the appropriate section of the form ( located on the front side) and transfers this entire package to the accounting department.