Home / Labor Law / Payment and benefits / Wages

Back

Published: 03/08/2016

Reading time: 5 min

0

4769

At any time, an employee is faced with a situation where, for one reason or another, he cannot withdraw his earnings from the employer .

This could be due to the employee’s serious illness, being involved in an accident, or simply due to vacation. In our article we will analyze in detail what a deposited salary is, how it is calculated and where and under what conditions this salary is received.

We will also shed light on other issues of interest to working people.

- What it is?

- In what cases may it be necessary to deposit wages?

- Shelf life

- How to release deposited wages Employee actions

- Accountant Actions What is a payroll escrow notice?

Reasons for depositing salary amounts

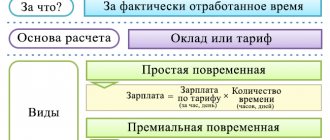

The inability of the employee to receive the required salary on time obliges the employer to save (deposit) the amount. Late receipt of wages or part thereof may be caused by a person’s absence from the workplace due to vacation, illness, or business trip. Deposition is made only in case of cash payments; when transferring funds to salary project cards, the presence of an employee is not required.

Funds are issued according to payroll or settlement statements. The storage of funds received from the bank for settlements with employees cannot exceed 5 days, taking into account the date of receipt. An enterprise may set a shorter period for settlements with employees. Receipt of amounts for the payment of wages is made from the current account to the cash desk or from current receipts when such a possibility is approved in the cash register limit.

What categories of workers can be issued

Anyone can have this salary.

For many, the question arises about which category of employees can receive deposited wages.

In fact, a specialist from any company can receive such a salary. Moreover, this will not depend on anything: age, length of service, work experience, position and other features do not matter.

In any organization where salaries are paid in cash, an employee can receive a deposited salary.

However, it is worth noting that you cannot deposit your salary at your personal request or on purpose.

There is no point in this - the employer is not responsible for failure to pay funds on time in the absence of the employee, in addition, no penalties or other compensation in favor of the employee are provided here.

Thus, any employee can receive a deposited salary if circumstances are such that it was not possible to pay it on time.

Documents used in accounting for deposited amounts

Accounting for transactions is carried out using documentary forms of a standard unified sample. A number of documents, such as cash orders, statements, and cash books, are not developed independently.

| Document | Description |

| Payroll records | Settlement and payment form No. T-49 and payment form No. T-53 are used |

| Account cash warrant | RKO form No. KO-2 |

| Receipt cash order | PKO form No. KO-1 |

| Cash book | Form No. KO-4 is used |

Commercial enterprises develop their own register forms and books for recording deposited wages. Form OKUD 0504048 is often used as an accounting book, and registry form OKUD 0504047, established for budget document flow.

Drawing up a register of deposited amounts

If there is an unclaimed balance on the statement, the cashier makes an entry opposite the recipient's last name in the place where the signature “deposited” was entered. At the end of the payment statement, the amounts actually paid to employees and subject to deposit are indicated. Based on the transaction performed, the cashier must draw up a register of deposited amounts or make an entry in a previously opened document.

The register indicates:

- Enterprise data used in internal circulation.

- Date of document creation.

- The issuance period for which the balance of uncollected funds arose.

- Number and date of the statement on which the payment was made.

- Information about the employee - position, full name, personnel number.

- Amount deposited.

- The resulting total for the registry.

- Information about the cashier who performed the transaction.

- Information about the cash settlement service for which the depositor is issued.

The register is signed by an official of the cash register and certified by the chief accountant. Based on the register data, an expenditure cash order is drawn up for the issuance of funds from the cash register.

There is currently no requirement to compile a register, but businesses continue to use the form to simplify accounting and control over deposited amounts. If there is no register in the document flow, the data is recorded in the accounting book. The journal calculates the debit and credit balances at the end of the month.

Storage of funds deposited by the cashier

The deposited amount is sent to the bank to prevent the occurrence of an excess cash balance. If the cash register limit allows the deposit of the amount, the cashier may hold the deposited amount in cash. Enterprises that have not approved the limit, but have the obligation to apply restrictions to the cash balance at the end of the day, are required to hand over the deposited amounts to the bank. Without approval of the limit, there is no balance at the end of the day.

A free procedure for managing cash funds and their movement is established for individual entrepreneurs and small enterprises. Refusal to use the limit must be confirmed by order. As part of the simplified management of cash transactions, the following is provided:

- There is no need to approve a cash limit.

- Availability of funds in the cash register in the amount necessary for turnover without limiting the amount.

- Possibility of conducting cash transactions without documentation.

In enterprises that have the right to have no cash limit, the storage location of the deposited amount is determined depending on the production need at the cash desk or in the current account.

The procedure for receiving and features of payment of DPZ

The employer is obliged to pay unpaid wages upon request of the employee. He can apply orally or in writing. When applying in writing, you must write a statement addressed to management.

If limits allow, the deposited amount can be stored in the cash register at the enterprise. If the limits are exceeded, these funds are sent back to the banking organization.

According to the regulations, the cash register limit is the maximum permitted amount of money that can be left in the cash register at the end of working hours.

The manager sets the cash limit independently, taking into account the instructions of the Central Bank of the Russian Federation.

If the money is in the cash register, then it can be returned to the employee without any problems upon first request. If the limits are exceeded, the employee can receive his salary along with the next planned payments. But if he insists on immediate return, then the organization sends a request to the bank to transfer the required amount of money.

Next, after the money is received, the cashier issues a settlement settlement in the name of the employee to pay the unpaid salary. The accountant must maintain a book of deposits, which should reflect the numbering of orders and dates. The consumables must be signed by the manager and the chief accountant and left to be stored at the enterprise.

The employer is obliged to issue the DPZ in full. If some amount is withheld, the employee can go to the labor inspectorate. This process is regulated by the Labor Code. After 3 months of overdue wages, the court will accept the claim.

The procedure for claiming deposited amounts

The balance of funds received by the cashier in the amount of the total amount to be issued according to the statement and not claimed within the established period is deposited. The amount can be received by the employee after the expiration of time, provided:

- Appeals to the cashier for the issuance of funds. You can receive the required amount the next day after submitting the request or on the day established by the organization. A deferment is required to receive funds from the bank. When storing the deposited amount at the cash desk, payment is made immediately upon request, unless the company has determined separate payment days.

- Compliance with limitation periods. The employee has the right to receive the required funds within 3 years - the general period established for submitting financial claims. After the deadline, the unclaimed amount is taken into account as part of the enterprise’s other income.

The amount is issued according to a cash receipt order. RKO data is entered into the book of accounting of deposited amounts. It is allowed to approve the deadlines for issuing deposited wages with the conditions stipulated in the internal documents of the enterprise. The company has the right to set the payment deadline on the day of payment of wages, advance payment or other separate date.

What it is?

Deposited salary is a type of remuneration when a working employee was unable, for some of various reasons, to receive the funds earned on time.

In other words, this is cash that was not paid to the employee, but arrived on time at the disposal of the entrepreneur or employer, in general.

If we look at the origin of the word, the word “deposit” can be accurately translated as “storage.” The word itself has its roots in French and comes from the word “depot”, which means “storage” or “warehouse”.

An employee may face escrowed wages only if

if he receives the earned funds directly through the cash register, and not through a bank card. In the latter case, the employee receives funds automatically through the accounting department of the enterprise or company, rather than going to the cashier to get them.

It is also worth considering that issuing salaries through the cash register is beneficial for small businesses , because having a small number of employees, using the services of a bank is simply financially unprofitable; it is easier to pay employees by issuing earnings through the proceeds at the cash register. But there are cases when an employee, for one reason or another, was unable to withdraw funds, and this is where escrow comes into play.

Deadlines for salary payment transactions

Receipt of wages in the absence of an employee can be carried out by proxy by any representative. A document is considered legally valid subject to notarization. In special situations, certification of the document by the head doctors of medical institutions and heads of places of detention is allowed. When receiving amounts, the representative must present a passport proving his identity.

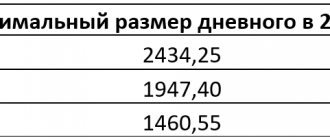

| Condition for the employee to receive amounts | Term and period of operation |

| Salary payment date | Established by the enterprise with the date fixed in the employment or collective agreement |

| Period of storage of amounts at the cash desk after the date of issue | Approved by the enterprise within 5 days, taking into account the day of issue |

| Delivery of the remaining amounts on the statement | On the last day of payment of wages |

| Possibility of receiving the deposited amount | On the day established by the enterprise or, in the absence of a specific date, if possible, the amounts are received at the cash desk |

| Deadline for claiming amounts by the employee | 3 years, calculated from the date of due payment of wages |

How to deposit a fired employee's salary

You cannot write off the deposited salary of a fired person before the statute of limitations expires. In this case, the standard 3 years work (Article 196 of the Civil Code).

The limitation period from Art. 392 of the Labor Code is not relevant if a person did not come for payment upon dismissal and did not provide information about an account with a credit institution for the transfer of funds.

The limitation period starts from the day the salary is deposited - that is, from the day that follows the day of dismissal of the employee if he is absent on the day of dismissal (under the terms of Part 1 of Article 140 of the Labor Code of the Russian Federation).

If neither the employee himself nor his authorized representative has requested a deposited salary within 3 years, for tax purposes it must be included in non-operating income (according to clause 18 of Article 250 of the Tax Code of the Russian Federation).

In the financial statements, debt is written off in the debit of account 76 “Settlements with various debtors and creditors”, subaccount “Settlements on deposited amounts” and in the credit of account 91 “Other income and expenses”, subaccount “Other income”.

Taxation when depositing wages

Insurance contributions to funds are calculated in the amount of the established salary and transferred to the budget regardless of the fact of payments. The procedure for withholding personal income tax is different. When taxing deposited amounts, a contradiction in legislative norms is revealed.

When wages are deposited, there is no actual payment to the employee, which does not allow the tax to be withheld and transferred no later than the day following receipt of the amounts. The tax agent's obligation does not arise until the payment is made to the employee or his representative. Transferring personal income tax to the budget at the expense of the enterprise is not allowed.

When determining the date of transfer of withheld tax, a discrepancy arises between the terms:

- Payment of tax to the budget is carried out no later than the day following the date the employee receives income (clause 6 of Article 226 of the Tax Code of the Russian Federation).

- The payment date is set by the enterprise.

- Receipt from the bank of the amount for settlements with employees is made on the day of payment of wages.

- No more than 5 days are allowed to complete the calculation.

- The cashier can learn about the appearance of the deposit on the last day allotted for settlements. The tax has already been paid on the 5th day after payment.

The deadline for personal income tax payment occurs before the deposit is due. Excessively calculated tax is taken into account in the amounts of the next payment.

What to do if no one comes to collect your salary?

As we mentioned above, if the employee or his authorized representative does not show up to collect the wages with a receipt, the wages are deposited after a few days. Based on the legislation of the Russian Federation, the accountant is obliged to return funds to the company’s bank account within the prescribed period.

A one-time payment from the funded part of the pension - find out how to get it in our expert material. You can learn about the correct registration of a pension here.

Read all the details about raising the retirement age in this article.