With the modern rhythm of life, it is not always convenient for an employee to devote the whole day to work, and to pay the head of the company a full salary. In this regard, the concept of “part-time work” has already become firmly established in our lives. The employee, during the allotted time, will try to demonstrate his maximum abilities and output in order to go home sooner, and the director will be able to save a lot, since payment is made for a specific period worked. We’ll tell you about calculating wages for part-time work, and give examples with amounts and postings.

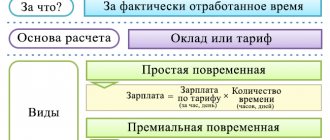

Payment methods, procedure and calculation formula

To learn how to correctly calculate the amount of payments, you need to clearly understand how a certain type of salary is calculated.

| Forms of payment | Calculation procedure |

| Time-based | Depends only on the amount of time worked, the amount of products produced does not affect this form of payment |

| Piecework | The calculation procedure is inversely proportional to the previous form. Payments are made only for the amount of work done, regardless of the time spent on it. |

In addition, the salary can be divided into:

Main:

- salary or piece income;

- bonuses for a job well done;

- other surcharges.

Additional:

- payment for required vacation and sick leave in case of incapacity for work;

- reimbursement of expenses incurred in connection with travel, accommodation and meals (for example, during business trips);

- bonus payments that are not part of the main employment agreement.

The established calculation formulas are applied depending on the forms of remuneration:

- For piecework wages, the following calculation is used: Salary = cost of production specified in the contract * volume of products produced for the period + accrued bonuses + other additional payments – income tax – other deductions.

- Time-based payment is calculated using the formula: Salary = salary amount / total number of working days * number of days actually worked + bonus amount - personal income tax - withheld amounts . Read also the article: → “Calculating salaries for employees (piecework, temporary payment, calculation example).”

The above formulas are relevant when the employment contract states that the terms of employment are part-time and the employee has worked the required hours.

Payroll calculation for part-time work

When an employee has not fully worked the required hours, the calculation algorithm will be different:

| Period | Formula |

| Calculation for less than a month | Salary for an incomplete month = the value obtained by calculation using the formula for the standard calculation of payments due / number of working days for a certain period * number of days actually worked. |

| Calculation for the day worked | Wages for one day = value obtained by calculation using the formula / number of working days in the period. |

| Calculation for the year worked | Average salary per day = amount of salary for the year / number of months / 29.3. |

| Calculation of wages with a vacation break | Wages, if there was a vacation in the billing period = employee’s salary / total number of working days in the period * number of days actually worked in the month. |

Calculation of wages at a salary rate at a rate of ½ or ¼:

- Salary at ½ rate = salary at full rate*0.5

- Salary at ¼ rate = salary at full rate *0.25

Calculation example No. 1. Employee Kovalev A.A. drawn up under an employment contract, rate - ½, from November 11, 2016 to the position of equipment sales manager. The full salary for this position is 25,000, according to the staffing table. Calculate wages for less than a month.

First you need to determine the number of working days and weekends that fell in November:

- workers - 21 days;

- weekend - 9 days.

From November 11 to November 30, the employee worked 14 days. Next, the calculation is carried out according to the formula: 25,000 / 21 * 14 = 16,666.67 rubles - wages for the period from November 11 to November 30. The rate of Kovalev A.A is ½, accordingly the amount of payment will be:

Salary for November = 16,666.67*0.5=8,333.34 rubles

Under piecework conditions, the calculation is much simpler. It is enough to know the amount of payment per unit of production and the quantity of goods sold.

Formula for calculating the “average” for part-time work

When calculating the average daily salary, two main formulas are used - one for calculating vacation pay and compensation for unused vacation, the second for other cases. For part-time workers, the calculation procedure is no different from that used for full-time employees.

For vacation pay

Provided that the billing period has been worked out in full and there are no excluded days in it, the following formula is used for vacation pay (clause Resolution No. 922):

Average daily earnings = Amount of earnings for 12 months of the billing period / (12 months x 29.3),

where 29.3 is the average monthly number of days (Article 139 of the Labor Code of the Russian Federation).

When a shorter period is taken for calculation, the salary for the corresponding number of months of the calculation period is taken, and instead of 12 months. divided by the selected number of months.

If any of the months is not fully worked, then the number of days in it is determined by dividing 29.3 by the calendar number of days of the month and multiplying the resulting number by the number of days actually worked in the month.

To calculate vacation pay, it is enough to multiply the average daily earnings by the number of vacation days.

For vacation in working days, the average value is determined by dividing earnings by the number of working days in a 6-day working week (clause 11 of Resolution No. 922).

Example 1

Engineer Selivanov was hired at Vesna LLC at a 0.5 rate, working 4 hours a day with a five-day work week. The salary of a full-time engineer is 40,000 rubles. In July 2021, Selivanov is going on vacation for 28 days. In the billing period, from July 2021 to May 2020, he received a salary of 20,000 rubles. for each month (salary 40,000 x 0.5 rate). Since in June 2021 the employee was sick for 7 days, the amount of June earnings was less - 15,000 rubles.

Benefits accrued on sick leave are not included in the calculation of the average. Considering that there are 30 calendar days in June, and the time worked by Selivanov accounts for 23 calendar days of June (7 were missed due to illness), the average daily earnings for vacation pay were calculated as follows:

(20,000 rub. x 11 months + 15,000 rub.) / (29.3 x 11 months + 29.3 / 30 days x 23 days) = 681.63 rub.

The amount of Selivanov’s vacation pay was:

RUB 681.63 x 28 days = 19085.64 rub.

Read more about calculating vacation pay for part-time work in our article.

For other cases

Average earnings for other cases are calculated using a different formula. For example, this value is used when paying:

- business trips;

- period of advanced training;

- donor days;

- additional days off to care for a disabled child;

- days of mandatory medical examination or medical examination;

- provided breaks for feeding the child;

- periods of performing public duties (participation in military training, serving as a jury in court, etc.).

To calculate the “average” for part-time work, it is enough to divide the amount accrued for the billing period by the number of days worked in the billing period.

Minimum payout amount

According to Article 133 of the Labor Code, if an employee has fully worked the time established by the employment agreement, the amount of his remuneration should not be lower than the minimum wage (minimum wage). For example, in 2021 this figure in Moscow is 17,561 rubles. Under working conditions at a rate of ½, wages cannot be less than 8,780.50 rubles, that is, in proportion to the established minimum:

Salary = 17,561*0.5 = 8,780.50 rubles

Calculation example No. 2. The Podsolnushko farm in the Krasnodar Territory had two employees in 2021: tractor driver Klyuev and driver Petrov. Klyuev is employed full-time and his salary is 11,000 rubles, Petrov works at a rate of ½ and his salary is 5,000 rubles. We will determine whether these payments in the prescribed amount do not violate labor laws.

The minimum wage in the Krasnodar region in 2021 was 10,366 rubles. Klyuev’s salary exceeds this value, and therefore management does not violate his rights. But in relation to Petrov, their actions are illegal, since his rate is ½, then the amount of payment should not be less than 5,183 rubles.

It is worth remembering that the minimum wage in different regions is set individually. The table shows how the indicators differ. It all depends on the different levels of inflation in different regions and on the established cost of living. Wages for part-time work may be less than the minimum wage, but only in proportion to the rate.

| Region | Minimum wage size in 2021 |

| Bryansk region | 7,500 rubles |

| Murmansk region | 13,650 rubles |

| Tyumen region | 7,700 rubles |

| Moscow | 17,300 rubles |

Pre-holiday days with part-time work

Labor legislation stipulates that the pre-holiday day should be shortened by one hour. Employees registered at 0.5 rate also have the right to use this privilege. This benefit does not apply to the category of workers whose work should not be interrupted. The employer, in turn, can compensate for unused benefits with payments or additional rest.

Pre-holiday days are the days before official holidays. Their list is established long before the start of the calendar year and is available in any information source, along with the production calendar. If an official holiday falls on a Monday, then Friday is not a pre-holiday day.

Which days are considered pre-holidays: (click to expand)

- This category includes workdays on the eve of a holiday. For example, if February 23 falls on a Monday, then Friday does not fall under this definition and cannot be a shortened day.

- Religious customs established in the respective regions are also considered federal holidays. For example, Parents' Day in the Krasnodar Territory has been a day off for many years, by decree of the governor. And in Moscow it’s an ordinary working day.

For part-time workers who doubt their rights, the labor code states: employees registered at ½ rate have the same advantages and benefits along with everyone else: the right to paid leave, accrual of seniority and others. Based on this, employees who work part-time also work an hour less, and proper documentation of this fact is mandatory:

- Drawing up an order establishing a working hours schedule, which will clearly define this range, taking into account the lunch break;

- Instead of 8 hours worked, the timesheet must indicate 7, and for part-time workers, instead of 4, enter the number 3.

Calculation of average earnings for part-time work

With reduced work, the number of hours worked decreases, and accordingly, the amount of income becomes lower. It is this factor that will primarily affect the average earnings. In general, the size of average earnings is influenced by:

- accrued salary or other accounted income (bonuses, allowances, additional payments, etc.) for a certain period;

- days worked in the pay period.

In calculating the average earnings for part-time work, the employer includes the amounts of payments provided for by the remuneration system (salaries in cash and non-monetary form, bonuses and additional payments to salaries, tariff rates, bonuses, regional coefficients, etc.), accrued on the basis of a contract concluded with employee of an employment contract. If an employee quit and then returned and found work with the same employer, payments only under the new contract are taken into account for the calculation.

To determine the amount, it does not matter when the part-time work regime was established. But the following rule applies: when calculating, amounts related to the billing period are taken.

Unaccounted payments

Some income cannot be included in the calculation of average earnings (clause 5 of Resolution No. 922). These include:

- child benefits, other social benefits;

- ]]>math help]]>;

- compensation for the use of personal property for business purposes, payment for food, travel to work, utilities, etc.;

- daily allowance;

- other payments not related to wages.

The time and corresponding accrued amounts for periods when:

- the employee retained his average earnings, accrued in cases specified by law (for example, to pay for business trips, vacations, while performing government duties, etc.), except for breaks to feed the child;

- the employee received disability benefits according to the BiR;

- the employee not participating in the strike was unable to work due to the strike;

- additional days off (paid) were provided to care for a disabled child, disabled since childhood;

- there was downtime for reasons beyond the employee’s control;

- the employee was released from work with or without pay (full or partial).