How does IR work?

The procedure for conducting an inventory is regulated by Methodological Recommendations, which were approved by Order of the Ministry of Finance No. 49 of June 13, 1995.

The IC operation scheme consists of the following stages:

- formation - the IC is formed by an order issued and signed by the head of the organization or a person authorized by him;

- checking the availability of valuables, recording the results in inventories and verifying the data obtained with those stated in the organization’s documents; if more is revealed than stated in the documents, a surplus is recorded; if less, a shortage is recorded;

- holding a final meeting of the EC, at which inventory records are reviewed and the results obtained are analyzed; the results of the meeting are documented in writing, this document is approved by the head of the company.

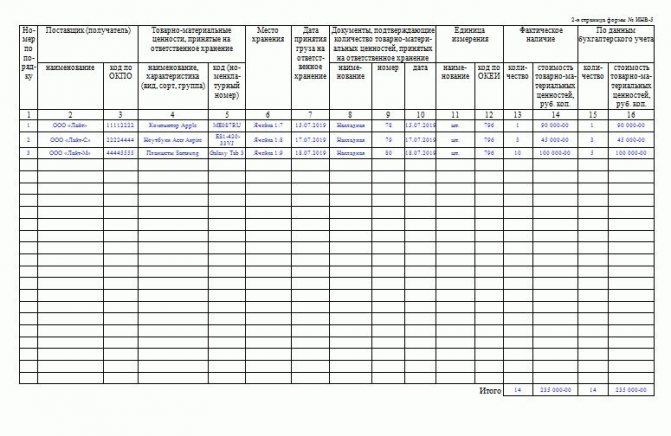

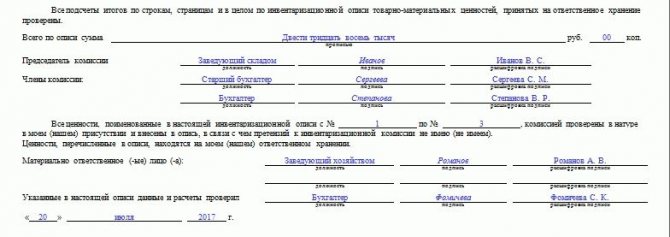

Here is a sample of filling out the commission’s conclusion in the inventory list:

We draw up the inventory results: is a protocol necessary?

Is it necessary to draw up an inventory protocol if an order has been drawn up, inventory records and there are no accounting discrepancies?

The cases, timing and procedure for conducting an inventory, as well as the list of objects subject to inventory, are determined by the economic entity, with the exception of the mandatory inventory. Mandatory inventory is established by the legislation of the Russian Federation, federal and industry standards (clause 3 of Article 11 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”, hereinafter referred to as Law N 402-FZ). Cases of mandatory inventory are currently established in clause 27 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 N 34n. The requirement to conduct an inventory of property is contained, in particular, in Art. 561 of the Civil Code of the Russian Federation (upon the sale of an enterprise), in the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”.

In turn, the procedure for conducting an inventory of property and financial obligations of an organization and recording its results are defined in the Methodological Instructions, which were approved by Order of the Ministry of Finance of Russia dated June 13, 1995 N 49 (hereinafter referred to as the Instructions).

Inventory results are documented in primary accounting documents compiled according to unified forms approved by resolutions of the State Statistics Committee of Russia dated 08/18/1998 N 88 and dated 03/27/2000 N 26 (in this regard, please note that from 01/01/2013, that is, from the date of entry into force Law N 402-FZ, forms of primary accounting documents contained in albums of unified forms of primary accounting documentation are not mandatory for use (in this regard, see the information of the Ministry of Finance of Russia dated December 4, 2012 N PZ-10/2012). the forms of primary accounting documents must be approved by the head of the economic entity upon the recommendation of the official entrusted with accounting (part 4 of article 9 of Law N 402-FZ).However, when developing forms, you can use unified forms approved by the State Statistics Committee of Russia as a sample. mandatory details, the procedure for approval, preparation and correction of primary documents are contained in Art. 9 of Law No. 402-FZ).

In particular, these include the “Inventory inventory of inventory items” (form INV-3), used to reflect data on the actual availability of inventory items in storage locations and at all stages of their movement in the organization, “Comparison sheet of inventory inventory results material assets" (form INV-19), compiled to reflect the results of the inventory of goods and materials, for which deviations from accounting data were identified.

The final data of the inventory results are summarized in the statement of records of the results identified by the inventory (Form N INV-26).

At a meeting based on the results of the inventory, the Inventory Commission analyzes the identified discrepancies, and also proposes ways to eliminate the detected discrepancies in the actual availability of valuables and accounting data (clause 5.4 of the Instructions).

The meeting of the inventory commission is documented in a protocol, which records the conclusions, decisions and proposals based on the results of the inspection of the state of the warehouse and ensuring the safety of inventory items.

In addition, the protocol provides information about inventories subject to markdown, indicating the reasons for the damage and the persons responsible for it.

This is interesting: Application for securing a claim sample

At a meeting of the inventory commission, the final inventory act is approved.

The inventory results are approved by order of the head of the organization.

The minutes of the meeting of the inventory commission are mentioned in paragraph 5.3 of the Instructions. In particular, this norm establishes that “the protocols of the inventory commission must provide comprehensive explanations of the reasons why such a difference is not attributed to the perpetrators. “That is, there may be an opinion that a protocol is drawn up only if discrepancies are detected.

Indeed, regulations do not establish the need to draw up such a document. However, according to some authors (Carrying out an inventory. Documentary basis for writing off the amounts of identified shortfalls in the absence of culprits. (I.D. Yutskovskaya, M.A. Maslennikova, “New in Accounting and Reporting”, No. 5, March 2008 .)), “the need to draw up such a protocol is confirmed by the mention of it in Art. 323 subsection “Accounting and reporting” section “Accounting and reporting” part 1 “Documents generated in management activities” of the “List of standard documents generated in the activities of state committees, ministries, departments and other institutions, organizations, enterprises indicating storage periods.”

In addition, the minutes of meetings of inventory commissions are mentioned in the “Methodological recommendations for obtaining audit evidence in a specific case (inventory). “In this case, the authors come to the conclusion that “inventory lists, acts and collation sheets (documents recording certain facts of economic activity) are primary documents, and the protocol is a kind of summary document certifying the results of the work of the inventory commission, which records the conclusions and solutions. The protocol form can be developed by the organization independently. "

In our opinion, in the absence of discrepancies in accounting, this fact may be reflected in the minutes of the final meeting of the inventory commission.

In turn, we believe that the absence of this document in the situation under consideration does not entail any negative consequences for the organization.

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

Tax audits are becoming tougher. Learn to protect yourself in the Clerk's online course - Tax Audits. Defense tactics."

Watch the story about the course from its author Ivan Kuznetsov, a tax expert who previously worked in the Department of Economic Crimes.

Come in, register and learn. Training is completely remote, we issue a certificate.

What is reflected in the protocol

The list of what to write in the conclusion of the inventory commission is as follows:

- name of company;

- the composition of the EC, indicating the positions of its members and the chairman;

- results: whether the result corresponds or does not correspond to that stated in official documents, whether there are shortages or surpluses;

- when deficiencies or surpluses are identified, the fact of requesting explanations from the responsible person and the content of the explanations, if the EC received any, are recorded;

- conclusions and decisions made, including the need to approve the deficiency or surplus and assign responsibility to a certain person.

Components of the form

The inventory has several pages. The first is introductory, it contains a part with a receipt, the second and subsequent elements are presented in the form of a table. At the conclusion, the signatures of the responsible persons are affixed.

First part of the form

Fundamentally important points are indicated at the beginning. In the form of a small table on the far right side of the sheet, the form numbers according to OKUD, OKPO, the code of the type of activity of the organization, the document number and the date of its preparation, two dates: the beginning and end of the inventory are listed (even if it was carried out on one day, indicating both identical ones is mandatory), type of transaction performed and accounting account number. The last two columns are filled in by the accountant after the signatures of the commission members and consideration by the manager.

Also, separate lines are left for the full name of the organization (abbreviations to LLC, OJSC, individual entrepreneur, etc.) and the name of the division are acceptable. The latter, in the vast majority of cases, is a warehouse under some serial number, since the INV-5 form is the most common in warehouse policy.

Important point! At the top, the basis for the inventory must be indicated. This may be an order, notification or order from the head of the company as a whole or its division.

In any case, the inventory process must be carried out under the guidance and knowledge of the persons concerned. This fact must have documentary evidence.

Part with receipt

On the first sheet of the document there is a receipt from the financially responsible person stating that by the time the inventory began, all the primary reporting documents necessary for this had been submitted to the accounting department, and goods and materials (inventory assets) had been capitalized and accepted for safekeeping.

This is interesting: How to write a statement to a district police officer against neighbors, sample

Also, at the beginning of the verification process, all material resources written off from accounts must be indicated in the disposal papers. It is undesirable for them to actually be in the warehouse itself to avoid misunderstandings.

The receipt must also indicate the date of its signature and the deadline for removing the remaining material assets.

The second part of the form is tabular

The information is very compactly placed in the table. Using the latter is extremely convenient. The form was formed in the 90s, but still remains relevant. The rows of the table are filled in as the actual availability of inventory items in the warehouse is compared with the data in existing documents. The columns should contain the following information:

- The sequence number of the line.

- Name and OKPO code of the supplier or recipient.

- Nomenclature number of the product, its grade, type or group, full name.

- Storage location (usually the cell or location number is indicated).

- The date when the goods were accepted for responsible warehousing.

- Name, number and date of the document that indicates the receipt of goods and materials at the warehouse (for example, invoice 25 dated August 23, 2019).

- The unit of measurement of the purchased goods and the code of this unit according to OKEI (g, kg, l, pcs., etc.).

- How much inventory material actually exists, total quantity and cost.

- How much goods are available according to currently maintained accounting records.

If the last two columns of the same column are not identical, then this is a defect of the accountant or storekeeper (or other person financially responsible for the product being described). The INV-5 form is convenient precisely because it is possible to illustrate this kind of discrepancy.

Final part

When the inventory is nearing completion, the chairman of the commission and all its members must review the compiled table and put their signatures at the end of the inventory list of inventory items accepted for safekeeping. The signatures will indicate that the availability of goods, their actual quantity and cost have been verified.

Important! Separately at the end, the total amount of all inventory items is indicated in numbers and words.

The financially responsible person puts his signature after all members of the commission as a sign that he has no complaints about their work and agrees with the data provided. The form leaves space for the signatures of two such MOLs, but there may be more. Below the signature of the responsible person is usually the signature of the accountant who verifies the calculations made in the document.

Work of the inventory commission

After the actual availability of the organization’s property has been verified, inventories and acts have been completed, all materials are transferred for further consideration to the members of the EC. The EC meeting is documented in minutes, in which the following information must be indicated:

- The result of an inventory count can be either a surplus or a shortage. In the absence of shortages and surpluses, this fact is also recorded.

- Indicate the main reasons for the identified surpluses and shortages (natural loss, re-grading, theft, etc.).

- Conclusion IR.

- Action plan to eliminate identified shortcomings and omissions.

Minutes of the meeting of the inventory commission (sample)

Why draw up a protocol based on the results of the inventory? Having completed the inventory, the commission analyzes the identified discrepancies and shortcomings, proposes plans for eliminating them and optimizing the work process. The minutes of the meeting of the inventory commission should include conclusions based on the results of the activities carried out, and proposals based on the results of the inspection.

It is worth noting that it is not necessary to draw up a protocol of the inventory commission (we will provide a sample at the end of the article); the decision to fill it out remains at the discretion of the manager. If inventories and inventory reports reflect information about the actual availability of property and liabilities, then the protocol of the inventory commission is a summary document that sums up the work of the commission, contains an analysis of the data obtained, conclusions and proposals (for example, if a shortage is identified, were financial explanations received? -responsible persons who were found guilty of the shortage, etc.).

It is advisable to record the result of the inventory in the protocol, although its absence will not entail negative consequences for the company. However, if there are deficiencies, the protocol can become an important document proving the legality of collecting damages from the perpetrators.

There is no single form of the document; the inventory protocol can be drawn up independently. The protocol should reflect the following information:

- The name of the enterprise where the inventory was carried out;

- Date of completion of the protocol;

- The protocol of the inventory commission contains the composition of the commission members, indicating their positions and full names;

- Results of the inventory: were any shortages or surpluses identified?

- If deficiencies are identified, it is necessary to record in the protocol whether written explanations were requested from financially responsible persons, what conclusions the commission came to regarding guilt, etc.;

- The inventory protocol in the final part reflects the conclusions of the commission based on the results of the inspection, proposals on measures that need to be taken to eliminate negative consequences.

The protocol is signed by all members of the commission. Of course, depending on the results of the inventory and the problems identified during the inspection process, the content of the main part of the document, as well as its volume, will differ. An example of an inventory commission protocol is given below - you can use it when drawing up your document. You should not make the protocol too voluminous - the document should reflect the established facts of surpluses/shortages, their reasons, ways to overcome identified deficiencies, etc.

The signed protocol is transferred to the head of the company, who, taking into account the opinion of the commission, makes the final decision based on the results of the inventory.

Sep 10, 2019adminlawsexp

vote

Article rating