Procedure for collecting taxes from wages

It cannot be said that 2021 has seen dramatic changes in this matter. The accrual procedure itself remained at the same level. It includes:

- health insurance contributions and to the Russian pension fund (mandatory payments);

- replenishment of the social insurance fund (SIF);

- payment of income tax (personal income tax payers);

- payment to other extra-budgetary funds.

The annual change in the minimum wage affects the calculation of insurance premiums, since it directly depends on it: both the amount of payments and the size of the maximum base grow. As a result, in simple terms, all gross wages after paying taxes and contributions turn into net wages, which are handed over to the labor collective. The total amount of the complex of deductions is about 33%, but it can be a little less or a little more.

Reporting to the Pension Fund and statistical authorities

1. Resolution of the Pension Fund Board of January 11, 2017 No. 3p approved the following reporting forms:

- SZV-STAZH “Information on the insurance experience of insured persons”;

- EDV-1 “Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records”;

- SZV-KORR “Data on the adjustment of information recorded on the individual personal account of the insured person”;

- SZV-ISH “Information on earnings (remuneration), income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person.”

According to paragraph 2 of Art. 11 of Federal Law No. 27-FZ [5], the insurer annually, no later than March 1 of the year following the reporting year (except for cases where other deadlines are provided for by this law), submits information about each insured person working for him (including persons who have entered into civil contracts). of a legal nature, for remuneration for which insurance premiums are charged in accordance with the legislation of the Russian Federation on taxes and fees) information in the SZV-STAZH form together with the EDV-1 form.

Please note that policyholders will be required to submit these 2021 forms for the first time no later than March 1, 2021.

2. Order No. 772 of Rosstat dated November 22, 2017 approved instructions that are valid from January 1, 2021. This order also approved a new form P-4 “Information on the number and wages of employees.” Please note that the frequency of submission of this report (monthly or quarterly) depends on the average number of employees of the organization.

Despite the fact that form P-4 was approved by the new Rosstat Order No. 772 , the procedure for filling it out remains the same.

Personal income tax in 2021

Personal income tax in 2021 ranges from 9 to 35% of the amount of income received. This rate depends on the type of remuneration received. All tax residents standardly pay to the budget an amount equal to 13% of their salary. The figure, it should be noted, is one of the lowest in Europe today.

Let's look at the question of who pays this tax and who does not. The Tax Code understands the following categories of citizens as payers:

- residents of the Russian Federation (having citizenship);

- non-residents of the Russian Federation;

- stateless persons.

This should include individual entrepreneurs, as well as children, on whose behalf their legal representatives should act. If a citizen has Russian citizenship, he is not necessarily considered a tax resident. This concept includes persons staying in the country for 183 days or more within 12 consecutive months.

Important! Even if a citizen is not a resident, but he has income in Russia, he must pay personal income tax.

Rates for 2021 are set at:

- 13% for income of tax residents;

- 30% for income of non-tax residents.

The taxpayer is not the employer, but the citizen himself who receives the income. The organization where he works undertakes the obligation to calculate this amount and transfer it to the budget.

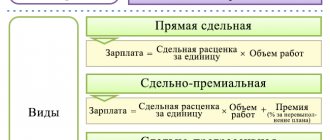

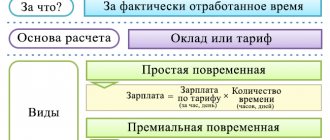

Payroll

Let us turn to the Resolution of the Constitutional Court of the Russian Federation dated December 7, 2017 No. 38-P . The question of whether the regional coefficient and percentage premium are included in the minimum wage has not yet been legally regulated. For a long time, the RF Armed Forces expressed its opinion on this matter, based on where the workers directly work:

- the wages of workers who work in the regions of the Far North and equivalent areas should be set at no less than the minimum wage, after which a regional coefficient and a percentage increase for length of service in these areas and areas must be applied. The arbitrators referred to the fact that Art. 315 of the Labor Code of the Russian Federation establishes: wages in the regions of the Far North and equivalent areas are carried out using regional coefficients and percentage increases in wages ( Review dated 02/26/2014 , definitions dated 07/29/2011 No. 56-B11-10 , dated 06/24/2011 No. 3‑B11-16 );

- if employees work in areas with special climatic conditions that do not belong to the regions of the Far North and equivalent areas, the amount of the monthly salary paid to the employee, including the regional coefficient and percentage bonus, may be equal to the minimum wage. In this case, the arbitrators referred to Art. 146 of the Labor Code of the Russian Federation , which establishes that the labor of workers engaged in work in areas with special climatic conditions is paid at an increased rate, thereby not violating the requirement of Part 3 of Art. 133 of the Labor Code of the Russian Federation : the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage ( Definition dated 08.08.2016 No. 72‑KG16-4 ).

As for the Constitutional Court of the Russian Federation, in Resolution No. 38-P it explained the following: the minimum wage is recognized as a general guarantee provided to workers regardless of the location in which labor activity is carried out ( Part 3 of Article 37 of the Constitution of the Russian Federation ). According to Part 1 of Art. 133 of the Labor Code of the Russian Federation, the minimum wage is established simultaneously throughout the entire territory of the Russian Federation without taking into account the natural and climatic conditions of various regions of the country. Thus, the regional coefficient and percentage bonus accrued in connection with work in areas with special climatic conditions, including in the Far North and equivalent areas, are not included in the minimum wage.

For setting wages in a smaller amount than determined by labor legislation, administrative penalties are provided. According to paragraph 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, non-payment or incomplete payment on time of wages or other amounts within the framework of labor relations, if these actions do not contain a criminal offense, or the establishment of wages in an amount less than that provided for by labor legislation shall entail a warning or the imposition of an administrative fine:

– for officials – from 10,000 to 20,000 rubles;

– for legal entities – from 30,000 to 50,000 rubles.

Payments to health insurance funds

The theory that free medical care has been preserved in Russia is not correct. Of course, the state allocates part of the funds for the development of medicine, however, the funds also receive large amounts of contributions from employers. Compulsory insurance is implemented through the following funds:

- territorial compulsory medical insurances and their branches;

- federal compulsory medical insurance.

The employer enters into an agreement with the fund to insure its employees and makes a mandatory contribution. An individual entrepreneur is also required to do the same. 5.1% is the amount that is often transferred based on the salary level.

Transfers to the pension fund

Most recently, the funded part of the pension was “frozen”. This measure will continue in 2021. Below is a table indicating the amount of contributions to pension and other funds for different categories of taxpayers. Today, the interested party has the opportunity to choose where 16% of these transfers will go, which constitute insurance premiums. There are few options:

- send everything to the insurance part of the pension (if the citizen has not written an application, this action is performed by default);

- send 10% to the insurance portion, and the rest to savings.

Deadlines for paying taxes to funds in 2021 for yourself

For payment of fixed payments there is only 1 legally established period. It corresponds to December 31 of the accounting year (clause 2 of Article 432 of the Tax Code of the Russian Federation), i.e. the fixed payment (as well as the fixed part of the payment to the Pension Fund, which also contains a variable component) must be paid in the year of its accrual. However, the number and volume of payments that can be made against this payment during the year are not limited in any way.

For the variable component of the calculation of contributions for the Pension Fund, a different deadline applies, the last date of which is set as April 1 of the year occurring after the end of the calculation year.

These deadlines will not be observed only if the payer ceased activity in the accounting year. In such a situation, he will have to pay contributions within 15 calendar days from the date (clauses 4, 5 of Article 432 of the Tax Code of the Russian Federation):

- deregistration of a self-employed person who is not the head of a peasant farm;

- submission by the head of the peasant farm of a report on contributions to the Federal Tax Service, for the submission of which he is also given no more than 15 calendar days.

Taking into account the transfers allowed by law, the deadlines for payment of contributions by self-employed persons in 2021 will be as follows:

The variable part of the payment to the Pension Fund, accrued for 2021, will need to be paid already in 2021 - no later than 04/01/2019.

Transfers to the social insurance fund

The amount of contributions to this fund depends on the harmfulness of production. The standard deduction amount remained at the same level as last year and amounted to 2.9% of wages. However, as can be seen from the general table (listed below), the rate may vary depending on the category of payer and type of insurance. When issuing sick leave or maternity leave for an employee, the employer is closely connected with the Social Insurance Fund. It is from the fund that both sick leaves are paid.

Additionally, social insurance has established rates for accident insurance. The rate is determined individually depending on the type of activity of the enterprise. Its size varies from 0.2 to 8.5%.

Important! The social insurance fund does not provide for payments from individual entrepreneurs. This type of payment applies only to organizations.

However, individual entrepreneurs can transfer a voluntary payment regarding insurance in case of temporary disability or maternity. This payment amounts to 2158.99 rubles for the current year.

Table of taxes and contributions

Let's look at a summary table of tax payments and contributions to the payroll, which will make it easier to perceive a large amount of information.

| Taxpayer category | Income tax Resident/non-resident | FSS Injury/illness or maternity/with payments over RUB 718,000. for the year on an accrual basis | Pension Fund From standard payments/from amounts over RUB 796,000. for the year on an accrual basis | Health insurance |

| Individual entrepreneur for himself | 13% (of income)/- | -/2,158.99 rub. (voluntary contribution)/- | RUB 19,356.48 (with income less than 300,000 rubles); If they are higher, an additional 1% of the excess income is paid (payment limit RUB 154,851.84 per year) | RUB 3,796.85 |

| Payers with the status of residents of the cities of Crimea plus Sevastopol, Vladivostok | 13%/30% | From 0.2 to 8% (according to the established risk class)/1.5%/0% | 6%/10% | 0,1% |

| Payers with the status of residents of territories of rapid socio-economic development | 13%/30% | From 0.2 to 8% (according to the established risk class)/0%/0% | 14%/10% | 0% |

| Pharmacies and entrepreneurs with a pharmaceutical license; Charitable foundations with a simplified taxation system; Companies with simplified taxation system engaged in processing; Individual entrepreneur with a patent | 13%/30% | From 0.2 to 8% (according to the established risk class)/0%/0% | 20%/10% | 0% |

| Other individual entrepreneurs | 13%/30% | From 0.2 to 8% (according to the established risk class)/2.9%/0% | 22%/10% | 5,1% |

| Other companies not involved in science | 13%/30% | From 0.2 to 8% (according to the established risk class)/2.9%/0% | 22%/10% | 5,1% |

We remind you that the indicated interest rate is calculated based on the salary level. If a foreign citizen works at the company, contributions for him may differ depending on his citizenship.

Calculation of taxes and contributions

Let's consider an example of calculation from the amount of wages before tax. Let’s say a citizen has a salary of 47,000 rubles. The calculation is:

- 13% of personal income tax is withdrawn from this income and 6,110 rubles are transferred to the budget;

- the employer additionally transfers 22% to the Pension Fund - 10,340 rubles;

- in the Social Insurance Fund, 2.9% is also contributed by the employer in the amount of 1,363 rubles, as well as 0.2% insurance against occupational diseases - 94 rubles;

- 5.1% to the health insurance fund - 2,397 rubles.

It is already known that next year there will be significant changes in the control over the transfer of compulsory insurance contributions. The administration will be handled by the Federal Tax Service.

Post Views: 113

One comment on ““Payroll taxes in 2021: table””

- Marina:

02/20/2018 at 09:40

Good afternoon. The employer sent a salary offer: the payroll is set, such and such an amount, taking into account all tax payments. Does this mean the amount before taxes? Or after paying taxes, in your hands?

Answer

Certain categories of taxpayers

Taxation of income of some categories of citizens is calculated according to different tariffs. These include individual entrepreneurs (IP), foreigners, stateless persons, and refugees.

entrepreneurs who do not make payments to other individuals (clause 2, clause 1, Article 419 of the Tax Code) began to pay mandatory government fees according to a new principle. If previously the rate was calculated based on the minimum wage, now this category of citizens is obliged to pay fixed amounts, which must be paid at the end of the calendar year. They are defined in Article 430 of the Tax Code of the Russian Federation, clause 1. and make up:

- for pension insurance - 26,545 rubles, if the annual income does not exceed 300 thousand rubles;

- for compulsory medical insurance 5,840 rubles.

Workers who do not have Russian citizenship are divided into several categories of taxpayers who pay personal income tax depending on their status. These include:

- Highly qualified foreign workers. They pay an income tax of 13%.

- Foreign citizens working on a patent. They pay the tax themselves in a fixed amount.

- Employees are citizens of the EAEU. Specialists who come from the countries of the Eurasian Economic Union pay an income tax at a rate of 13%.

- Citizens with official refugee status pay personal income tax of 13%.

In all other cases, foreign citizens, as non-residents of the Russian Federation, pay a tax of 30%.

Preferential rates on insurance premiums

Employers in some organizations can count on reduced amounts of insurance premiums, a full list of which is given in Article 427 of the Tax Code of the Russian Federation. These include:

Don't miss: Benefits for people with disabilities

- Individual entrepreneurs using the patent taxation system, non-profit and charitable organizations using the simplified taxation system, pharmaceutical companies using UTII do not make insurance contributions at all.

- Business companies using the simplified tax system, whose activities fall into the categories set forth in Article 427 of the Tax Code, paragraph 1, paragraph 5, deduct 20% for pension insurance and are exempt from other payments.

- Residents of special economic zones (Article 427 of the Tax Code, clause 1, clause 2) contribute 13% to the pension fund, 2.9% to the Social Insurance Fund, and 5.1% to compulsory medical insurance.

- Preferential tariffs apply to residents of certain economic zones (Republic of Crimea, Vladivostok, Kaliningrad region).