Payment procedure

Norm Art. 141 of the Labor Code of the Russian Federation states that it is necessary to pay the wages of a deceased employee , but payments are not limited to one salary.

According to the general rule of payments in connection with dismissal, the employee, in addition to salary, must also be paid compensation for unused vacation. This provision also applies in the event of death.

Funds are transferred to close relatives who submit the appropriate application to the head of the organization.

Sequencing

The payment algorithm itself is as follows:

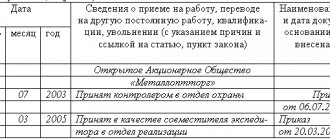

- Drawing up an Order to terminate an employment contract and personnel documents.

This act is issued in the unified form T-8, but a company letterhead can also be used as a basis.

The main difference from the usual termination or termination of an employment relationship will be that the Order will not have the employee’s signature.

The date of dismissal is the day of the employee's death. The same applies to personnel documents (work book and personal card).

There is no need to require relatives to sign, but the employer may ask them to pick up the work book. In this case, relatives provide a written statement.

Reference. If none of the relatives come for the work book, the organization must store it together with the personal card for 75 years (Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558).

- Receiving an application from the relatives of the deceased for payment of his salary.

Family members of a deceased employee must apply in writing to the head of the organization to receive his wages accrued until the employee’s death. More details about the procedure and deadlines are below.

The amount of money must be paid within 1 week from the moment the manager receives the application (Article 141 of the Labor Code of the Russian Federation).

- Calculation of payment.

As mentioned above, wage balances and compensation for unused vacation are accrued as payments, but provided that the employee did not go on vacation in advance until the end of the working year. In this case, the employer does not have the right to collect the amount of debt from relatives or withhold a percentage of the remaining salary (clause 4, part 2, article 137 of the Labor Code of the Russian Federation).

The salary includes all bonuses, additional payments (for example, for work at night or “for harmfulness”), allowances (for example, the northern coefficient, etc.).

In addition to the above payments, relatives of a deceased employee may be paid:

- temporary disability benefits (if an employee died while on sick leave) - issued only to family members with whom the deceased lived together;

- maternity benefits (for employment and child care), if the employee died during the specified leave;

- travel expenses if the employee died during a business trip;

- financial assistance to relatives, provided that such payment is provided for by local acts of the organization or a collective agreement.

Important! Also, the relatives of the deceased must be paid a funeral benefit. In accordance with Part 2 of Art. 10 Federal Law of January 12, 1996 No. 8, this payment is the responsibility of the employer.

For example, from February 2021, the amount, taking into account indexation, is 5,946 rubles 47 kopecks (Resolution of the Government of the Russian Federation of January 24, 2019 No. 32).

Deposit

Depositing refers to the process of reflecting the salary in accounting as not received by the employee.

This also applies to the situation with deceased employees.

According to general rules, you can receive such a salary:

- on the day of the next issue;

- on a day specifically established by a local act of the organization as the period for receiving deposited salaries;

- upon the written application of the employee himself on the day specified by him (provided that such an amount is in the cash register).

The basis for issuing the deposited salary of a deceased employee is a written statement from his relatives. In this case, the general rule applies, according to which the amount must be issued within 1 week from the date of application.

Overdue

An employer who has not paid the deceased employee’s wages and compensation within 1 week from the date of receipt of the application will bear financial and administrative liability (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Financial liability, in accordance with Art. 236, is to charge interest for each overdue day. The amount of the penalty cannot be less than 1/150 of the rate of the Central Bank of the Russian Federation.

To whom and when is it paid?

First of all, it is necessary to determine the list of persons who are entitled to receive payments for a deceased relative. First of all, close relatives can claim this right (Article 14 of the RF IC):

- spouse);

- children (natural or adopted);

- parents (adoptive parents);

- siblings;

- Grandmothers and grandfathers.

Other relatives (aunts or uncles, nephews, stepfather or stepmother, stepson or stepdaughter, etc.), in the absence of the above, also have the right to apply to the employer for payment.

In addition to relatives, his disabled dependents also apply for wages.

In accordance with Art. 1183 of the Civil Code of the Russian Federation, family members were required to live together with the deceased, while this rule did not apply to disabled dependents.

They may also be relatives of the deceased who lived separately but depended on his earnings, for example, disabled parents.

Labor legislation does not determine the priority.

Important! Practice advises employers to pay wages to the relative (dependent) who submitted the application first.

The employer is not obliged to somehow divide the payment amount between relatives if several applications are submitted.

Deadline

In accordance with paragraph 2 of Art. 1183 of the Civil Code of the Russian Federation, relatives who lived with a deceased employee or dependents have the right to contact the employer within 4 months from the date of death of the employee .

If an application was not submitted within this period, the employer, in accordance with paragraph 3 of Art. 1183 of the Civil Code of the Russian Federation, payments are transferred to the inheritance estate. The employer must transfer it to the notary's deposit.

Relatives who submitted an application after 6 months must also be sent to a notary, since the salary will now be issued not in order of priority (who filed the application first), but in the order of legal or testamentary inheritance.

Documents and application procedure

First of all, a written application is required from relatives or dependents. It is drawn up in writing and must contain all the information necessary for the employer to confirm the existence of a relationship (dependency of the applicant).

- Statement header.

The applicant must submit the application to the deceased's employer. Thus, the following are indicated:

- full name of the organization;

- Name and position of the manager.

It is also necessary to provide information about the applicant himself:

- FULL NAME;

- passport details;

- address and contact details.

- Main part.

In the main part, it is necessary to express a request to transfer wages and other amounts due that were not received by the employee (full name, position) due to death. You must also indicate:

- who is the applicant’s relationship to the deceased (with reference to a document confirming relationship/dependency, as well as with reference to a document confirming cohabitation);

- details to which the amount should be transferred.

- List of documents attached to the application.

The application must include a list of attached documents.

To confirm your rights you will need:

death certificate (court decision declaring a citizen dead);- applicant's passport;

- a document confirming the relationship (birth certificate, marriage certificate, etc.);

- a document confirming that relatives live together (extract from the house register or a single housing document).

If, in addition to wages, the applicant requires a funeral benefit, the following must be attached to the documents:

- death certificate (not certificate) in form 33, issued by the registry office;

- a check or other document confirming payment for funeral services.

The application must contain the date of its submission and the signature of the applicant with a transcript.

List of documents

— The employer is obliged to demand from the person contacting him:

- a document confirming the fact of death of the deceased employee (death certificate);

- application in any form with a request for payment of funds. It also makes sense to indicate exactly how the applicant would like to receive what is due (cash or non-cash);

- identification document of the applicant;

- a document confirming the relationship with the deceased employee or the fact of being dependent on the deceased on the day of death. As a rule, these are marriage registration certificates (for spouses); birth certificates (for children and parents); certificates of family composition (to confirm the fact of cohabitation with the employee) and other documents.

— What to do if the relatives of the deceased have not received their wages?

— If there are no persons entitled to receive the money or they have not contacted the employer within six months (from the date of the employee’s death), the money is inherited in the general manner.

Maxim SERGEENKO

How to calculate salary not received by the date of death?

Let's consider the main payments that a relative of a deceased employee will receive.

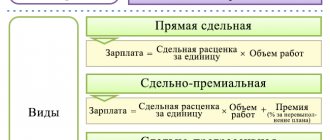

- Salary balances.

Calculated using the formula:

Balances = (Salary + bonuses + other allowances) x (Number of days worked until death / Number of days in a month).

Supplements and additional payments for special working conditions (work at night or on weekends, northern coefficient, etc.) are also added to the salary.

- Compensation for unused vacation.

For each month worked, the employee is accrued 2.33 days of paid leave. If he did not have time to use them before his death, this compensation will be added to his salary. A total of 28 vacation days accrue over 12 months.

First of all, it is necessary to calculate how many vacation days the employee has accumulated:

Unused vacation = Number of years worked x 28 + 28 / 12 x Number of months worked in total - The total number of vacation days that the employee spent during the entire period of work.

If an employee has worked for more than half a month, it is counted as a whole period and is included in the accounting. The resulting number is also rounded to the nearest whole in favor of the employee, regardless of the arithmetic rules.

If the employee has worked for less than 1 year, the following formula is used:

28 / 12 x Number of months worked – Number of vacation days used.

The amount of compensation is calculated taking into account the established days:

Compensation = Unused vacation days x Average daily salary.

In turn, the average daily earnings are calculated:

ZPsr. = Salary amount for 12 months / 12 / 29.3.

Let's look at the calculation of the full payment using an example.

Berezkina I.M. submitted an application to the organization where her husband worked until his death for payment of his wages and funeral benefits, attaching all the necessary documents to the application.

Berezkin K.N. did not go to work on the day of his death, April 28, 2019. His salary was 34,561 rubles per month, the average daily salary was 1,179 rubles 55 kopecks. He has accumulated 28 days of vacation (since the last time he took a vacation was in April 2021).

The application was submitted in May 2021. At that time, the funeral benefit was 5,701 rubles 31 kopecks. In addition, the organization’s collective agreement established financial assistance to the families of deceased employees in the amount of 4,000 rubles.

Thus, Berezkina’s widow will receive:

- salary balance – 34,561 x 28/30 = 32,265 rubles 93 kopecks;

- compensation for unused vacation – 28 x 1,179.55 = 33,027 rubles 40 kopecks;

- funeral allowance – 5,701 rubles 31 kopecks;

- financial assistance from the organization - 4,000 rubles.

A total of 74,994 rubles and 64 kopecks will be transferred to her.

Taxation and insurance premiums

Neither personal income tax nor insurance premiums are deducted from payments received in connection with the death of an employee , which is justified in the following regulations:

- pp. 3 p. 3 art. 44 of the Tax Code of the Russian Federation states that obligations to pay taxes and insurance premiums terminate in connection with the death of the taxpayer;

- pp. 8 clause 1 art. 217 of the Tax Code of the Russian Federation prohibits levying tax on funeral benefits, and clause 8 of the same article - on financial assistance paid by the employer of the deceased to his family;

- clause 18 art. 217 of the Tax Code of the Russian Federation - amounts received by inheritance are not subject to taxation (if wages and other payments passed into the inheritance estate and were received by relatives through a notary);

- pp. 1 clause 1 art. 422 of the Tax Code of the Russian Federation - a ban on collecting tax contributions from funeral benefits.

Payment terms

Important

The issuance of wages, compensation for unused vacation and other mandatory accruals must be made within a week from the transfer to the enterprise of documents confirming that the employee has died.

To receive this money, you must contact your employer before 4 months have passed since the death.

The funeral benefit provided for by Law No. 8-FZ is paid on the day all necessary documents are provided. To receive money, a citizen must contact his former employer no later than 6 months from the burial or death of the employee.