Inventory structure

In order to guarantee the uninterrupted production process and satisfy managerial needs, companies form certain reserves, to control which the position outlined in today’s topic is used.

The latter refers to assets used as raw materials or materials during the production of goods for sale, as well as to meet the management needs of enterprises.

As for the tasks pursued from the point of view of inventory accounting, the following should be highlighted:

- control over the safety of inventory items in warehouses, as well as during their processing;

- ensuring the adequacy and timeliness of document flow for the movement of inventory items, determining and indicating the costs associated with their production, assessing the actual cost of used inventory items and their balances in warehouses, as well as on balance sheet items;

- constant monitoring of compliance with established inventory standards, as well as detection of surplus and unused inventory and their sale;

- ensuring the timeliness and completeness of settlements with contractors for supplied materials, as well as control over inventory items in transit.

Taking into account the role performed by certain PMZ in the production cycle, they should be divided into groups such as:

- base and raw materials;

- auxiliary raw materials;

- purchased semi-finished products;

- generated waste and fuel materials;

- components, containers and materials for its manufacture;

- household supplies and equipment.

As for the applied unit of measurement of PMZ, here, in addition to the nomenclature number, a batch, a homogeneous composition, etc. can be accepted.

Composition of the MPZ

Absolutely every business entity periodically needs materials that can take part in the main production and be used to solve auxiliary tasks, including the management process.

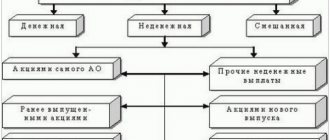

Based on the chart of accounts and the economic activities of the enterprise, the following elements appear within the composition of the inventories:

- raw materials and basic materials;

- auxiliary materials;

- purchased semi-finished products;

- waste elements;

- fuel resources;

- container;

- spare parts;

- inventory;

- other supplies for business activities.

A significant part of these elements is used as labor tools. They are completely consumable and transfer their value to the price of the products that are produced.

Receipt of materials can be achieved through different methods, among the main routes are:

- the result of one’s own production labor;

- purchase from a supplier for a fee;

- free receipt of resources for use;

- receiving as a contribution;

- other variations.

It is permissible to take measures to account for materials received by the organization at the actual cost or at the accounting value. In the process of determining the actual price, purchase costs are taken into account. If an organization begins to use accounting prices, the use of subsidiary accounts is relevant.

Features of inventory accounting

As practice shows, a company’s inventory can arrive at its warehouse as a result of their purchase, gratuitous receipt, or as a contribution to its authorized capital. Account 10 is used to keep records of this category of goods.

Thus, the cost of inventory items at the time of their delivery to the warehouse can be taken into account using the following methods:

- at the cost of goods and materials prevailing at the time of delivery. In the circumstances, position 10 applies;

- at the discount price, when the 15th position is additionally used to form the cost of these inventories.

It is recommended that the most preferred method of accounting for minimum wages be reflected in the organization’s accounting policies.

Account 15 in accounting

The main aspect of using account 15 is that this account summarizes information on the procurement and acquisition of inventories, which relate to funds in circulation:

The difference between the actual cost and the accounting price is called a deviation. To reflect deviations in accounting, account 16 “Deviation in the cost of material assets” is used.

Typical transactions for account 15 are presented in the table below:

| Dt | CT | Contents of operation |

| 60 | 51 (50) | The paid cost of the supplier's inventory is taken into account |

| 15 | 60 | The cost (excluding VAT) of inventories according to the supplier’s accompanying documents is taken into account |

| 19 | 60 | VAT paid included |

| 10 | 15 | The purchased goods and materials were credited to the warehouse at the discount price |

| 15 | 16 | The excess of the book price over the actual cost is written off |

| 16 | 15 | The excess of the actual price over the accounting cost is written off |

Application of 15 accounts in transactions

When using item 15 to record transactions, its debit part reflects the purchase price of the company's inventory according to the settlement documents received from the supplier.

Taking into account the source of origin of goods and materials and the nature of the costs of their production and delivery, account 15 is debited in correspondence with 60, 76, 71, 20, 23 and other accounts.

At the time of actual receipt and capitalization of inventories, they are written off as credit 15 of the balance sheet position and debit of 10 or 41 accounts.

In a situation where the book price of inventory exceeds its actual cost, the difference in the indicated entry must be reversed. In this case, the entry will look like this:

Dt 16

Kt 15 reversible.

The debit balance of account 15 at the end of the reporting period indicates the existence of PMZ in transit. As for Form No. 1 of financial statements, the balance of account 15 at the end of the reporting period is transferred to line 1210. If we are talking about the purchase of equipment for installation, which is subsequently reflected in account 07, then the balance of item 15 should be reflected in line 1190 balance sheet.

What is the difference between FC and CA?

FC is the purchase price plus all additional costs associated with the purchase (delivery, consulting, intermediary commission, insurance, customs duties, etc.).

CA is a planned cost determined by the financial services of an enterprise for a certain period of time. The basis is usually taken as current contract prices, prices of previous periods, estimated prices, average prices for a group of similar goods.

When establishing a CA, as a rule, they use the method that allows them to get as close as possible to the FC. In addition, the accounting department should periodically review the CA. If it turns out that the planned price deviates from the actual price by more than 10%, it must be revised.

The existence of two options for calculating cost is due to the fact that when forming the FC, time gaps arise between the accounting of the actual reserves and the accounting of transportation and procurement costs related to these reserves. If such time intervals are insignificant, or the amounts of procurement costs are insignificant, the FC is used when calculating the cost, otherwise the UC is used.

Attention! Debit balance by account 15 at the beginning of the period indicates the presence in the accounting of goods in transit (inventory, the ownership of which has transferred to the buyer on the basis of shipping documents, but they have not yet arrived at the warehouse).

The methods and procedure for calculating costs are prescribed in the accounting policy.

Practical examples and postings

Let's imagine a situation where a certain company purchased PMZ in the amount of 2,700 pieces for a total amount of 478,000 rubles, including VAT in the amount of 86,040 rubles. The receipt of materials was carried out at the book value of the inventory in the amount of 190 rubles. for 1 unit. To support the production process, the company wrote off 600 units of inventory.

In this situation, the accounting entries for account 15 should look like this:

- Dt 60 - Kt 51 - 478,000 rubles, settlements with the supplier for PMZ;

- Dt 15 - Kt 60 - 391,960 rubles, the actual cost of purchased inventories;

- Dt 19 - Kt 60 - 86,040 rubles, accounting for value added tax;

- Dt 10 - Kt 15 - 513,000 rubles, registration at the warehouse at book value;

- Dt 15 - Kt 16 - 35,000 rubles, write-off of the difference between the accounting and actual price;

- Dt 20 - Kt 10 - 114,000 rubles, write-off of inventory items into production;

- Dt 20 - Kt 16 - 7,777.78 rubles, write-off of the amount at the end of the reporting period.

Accounting procedure

For the purpose of rational planning of accounting work, the following accounting accounts are used:

- 10 – these are materials (with corresponding subaccounts);

- 11 – this account characterizes animals that are being raised and fattened;

- 15 – reflects the procurement and purchase of special material assets;

- 16 – we are talking about a probable deviation in the cost indicator of the MC;

- 41 – commodity items;

- 43 – manufactured products, ready for consumption.

As for the areas that are on the balance sheet, it is most often advisable to use the following accounts:

- 002 - goods and materials that are accepted for responsible storage;

- 003 – materials that were accepted by the enterprise for the purpose of subsequent processing;

- 004 – positions that were accepted for commission;

- invoice for special equipment transferred for use.

The accounting activities for this account are quite simple and understandable; several standard entries will be discussed below.

Material reserves: concept and classification

When defining the concept of inventory, accountants are guided by PBU 5/01 - a document that defines the rules for their accounting.

The following assets are recognized as material reserves:

- used as raw materials for the production of products that will subsequently be sold;

- which themselves can be realized;

- which are used for management purposes.

How to create a commission for writing off inventory ?

Inventory, therefore, can be represented by finished products, goods, and actual materials and raw materials. The nature of inventories can be different, and for effective accounting and subsequent internal and external audits, it is necessary to correctly classify them, first of all, by their role in the production process. Usually distinguished:

- raw materials and materials;

- spare parts;

- fuel;

- semi-finished products purchased externally (purchased);

- auxiliary materials, etc.

This classification underlies analytical accounting data. The classification takes into account the specifics of production and types of activities. For example, if an organization is conducting its own construction, the category “building materials” is distinguished, and if we are talking about agricultural production, the category “seeds”, “feed” is distinguished.

Auxiliary materials include materials that improve the production process and make it easier: cleaning rags, paints and varnishes and others like them.

Analytical data can take into account the order of use of the MPZ:

- in production (raw materials, supplies);

- for sale (products, goods);

- as means of labor (equipment, household supplies).

If a company has inventories that do not belong to it, for example, those given to it for storage under an agreement, they are separated into a separate category in accounting, while others are classified as the property of this legal entity. Here there is a classification according to the nature of ownership.

Classification of MPZ

A significant part of the inventories is used as objects of labor and is directly involved in the production process. Such materials are fully used in production and their cost is fully included in the final cost of the finished product.

Inventory and equipment are classified depending on the role they play in the production process of the enterprise. The following groups of MPZ are distinguished:

- Raw materials and basic materials;

- Supporting materials;

- Purchased materials (semi-finished products);

- Waste and fuel;

- Containers and packaging materials, spare parts;

- Inventory and household supplies.

Analytical accounting of inventories is carried out in analytical registers

To obtain more detailed information about inventories, the organization uses analytical accounting. It is advisable to conduct it not only in monetary terms, but also in physical terms. Analytical accounting is created for a specific synthetic account. Therefore, the amount of the balance in monetary terms on analytical accounts is equal to the balance of the corresponding synthetic account, and the amount of turnover on analytical accounts will be equal to the amount of turnover on the synthetic account.

According to account 10 “Materials”, it is recommended to maintain analytical accounting:

- in count;

- by variety;

- for financially responsible persons;

- by storage locations;

- etc.

For example, for quantitative accounting of material, cards or inventory books are created. The responsible person, as primary documents are received, enters data on the movement of material value into a card or book.

If the list of material assets used is small, it is recommended to use a material report. This is convenient when carrying out construction work for each financially responsible person, since construction material is usually delivered to the work site, and not to the warehouse. Analytical accounting data is relevant when conducting inventories of inventories and when compiling cost calculations for the products of a manufacturing enterprise.

For example, for animals being raised and fattened, analytics is carried out:

- by number of goals,

- in terms of productivity and quality,

- by live weight gain,

- etc.

As a general rule, we do not include the amount of “input” VAT in the cost of the material, but take it into account separately on account 19 “VAT”.

How is analytical accounting of inventories carried out?

The main task of analytical accounting of inventories is to enter detailed information on various nomenclature units of values. Such accounting should be carried out both in monetary and physical terms.

Since analytical accounting is carried out according to a specific synthetic account, the balance in value terms for all analytical accounts must be equal to the balance for the corresponding synthetic account. The size of turnover on analytical accounts should be equal to the size of turnover on synthetic accounts.

Companies have every right to independently choose the level of specificity of information. Basically, they make choices depending on the characteristics of their activities.

For example, counting 10 can be done by:

- Quantity;

- Storage places;

- Sizes;

- Blossom;

- Other things.

To record the number of inventories, it is necessary to create a warehouse accounting book or special accounting cards for each object. As primary documentation is received, the authorized employee must enter information about the movement of goods and materials there.

If there are few material assets, it is worth using material reporting. Basically, such reporting is used during construction work, because building materials are delivered not to a warehouse, but directly to the construction site.

Analytical accounting information is important when carrying out inventories, as well as when calculating the cost of goods.

Methods for analytical accounting of material inventories

In order to maintain operational inventory records of material inventories, there are two ways:

- Quantitative-sum;

- Baldovy.

With the quantitative-cumulative method, analytical accounting cards are created based on the characteristic features of the inventory nomenclature. The movement of materials in the warehouse is reflected on the basis of primary documents.

The end of the reporting period, usually a month, the turnover is summed up in these cards and the balance on the last day of the month is calculated. Then, the totals of receipts, expenses and balances of inventories are posted to the balance sheet.

It should be taken into account that all summary information reflected in the accounting sheet must be verified with the turnover of the 10th account. The balance of this account and its turnover must be the same.

The balance method of analytical accounting of material inventories is based on calculating only their cost. However, the use of this method is possible only in those organizations where there is a fairly extensive inventory list. Also, an important point when implementing this method is the presence of a well-functioning mechanism that allows you to maintain continuous records of materials and reflect all operations on their movement directly at the moment of their completion.

However, there are times when the presence of a continuous inventory accounting system brings difficulties to the work of the organization's employees. This is due to the fact that very often the places where materials are stored and retail outlets are located at some geographical distance. Therefore, in these cases it is not advisable to establish a continuous accounting regime. It would be better to establish a periodic method for tracking material inventory levels. Depending on the number of material items, a reporting period is established for reconciliation. As a rule, inventory can be carried out based on the total turnover for the month, or at the end of each week.

Movement of inventories

The procedure for accounting for inventories is determined at the legislative level. More specifically, this procedure is described in some detail in PBU 5/01 “Accounting for inventories.” This document includes raw materials, materials, and semi-finished products (purchased of our own production) as inventory items. These inventory assets must necessarily participate in the production process of the enterprise's products.

In addition, the enterprise must also keep records of inventory, production and household tools and accessories, which are also directly involved in the production process. As a rule, the useful life of these materials is less than 1 year, and they are written off at one time.

Note 2

The main task of accounting for an enterprise's inventory is to summarize all data on the movement of these inventories. The movement of inventory assets means their receipt, movement and write-off for certain purposes.

Receipt of inventories under sales contracts is carried out on the basis of an invoice from the supplier (TORG-12), a waybill and other accompanying documents. All incoming inventories are transferred to the organization's warehouse in accordance with primary documents, which are verified with actual availability.

The movement of inventories is carried out on the basis of the requirements of the invoice form 11-. This document is drawn up in two copies, one for the party receiving the materials, the other for the person who delivers the materials to the warehouse. Another form for moving materials is the TORG-13 form. This form is an invoice that reflects the movement of goods to a particular department or warehouse. These documents are intended for internal use. They play a very important role because they allow us to identify and return excess unused materials back to the warehouse, return unused materials to accountable persons, and track defective semi-finished products and raw materials.

Write-off of materials on the basis of sales contracts is carried out on the basis of an invoice for the release of inventory items (TORG-12), transport documentation, namely TTN and form 1-t, an invoice and a power of attorney certified by the signatures and seals of the recipient organization.

The write-off of inventories based on the results of the inventory is carried out on the basis of the inventory list of inventory items IVN-3 and the write-off act. This procedure is carried out based on the results of the inventory. The reasons for write-off can be: theft, natural disasters, physical and moral unfitness.

Receipt of inventory items from other activities is carried out on the basis of the act of recording inventory items as a result of dismantling buildings in the M-35 form. This procedure is carried out in the case of dismantling real estate objects, and the resulting material assets are placed in a warehouse.

Examples of accounting entries

Due to the extreme diversity of types of inventories, accounting policy options for them, and specific accounting situations, accounting schemes can also be different. Here are the most common options.

Admission:

- D10 K60;

- D19 K60;

- D68 K19 – materials were purchased from the supplier, VAT was allocated and submitted for deduction.

Postings for goods are made in the same way; instead of account 10, account 41 is used. For trading organizations, the markup is taken into account by posting D41 K42. Finished products account for D43 K20, 23, 29, etc. - by type of production.

This actual cost method is used most often. If a decision is made to use additional accounts for materials and finished products, the accounting price (cost) method is used; for materials, the receipt will be reflected as follows:

- D15 K60 – purchase price of goods and materials – excluding VAT;

- D10 K15 – cost of receipt;

- D15(16) K16(15) deviations of fact and accounting value;

- D20, 23, etc. K 16 (or reversal if deviations are minus).

A similar scheme will take place for finished products:

- D43 K40 – accounting value of GP;

- D40 K20, etc. – actual cost;

- D90/2 K40 - discrepancies between the fact and the accounting cost (or reversal, see balance on account 40).

Retirement:

- D20, 23, 29, 25, 26 K10 – materials for production, for experimental work, industrial maintenance, for the production of containers;

- D90 K41, 43 – shipment of goods and products to buyers.

- D94 K10,41,43 – shortages, damage to goods and materials.

The reflection of accounting data in the accounts could be, for example, like this. Let's assume that 1 thousand items of goods and materials have been purchased. in the amount of 120,000 rubles, incl. VAT 20%:

- D60 K51 120,000 rub. payment to the supplier for materials;

- D10 K60 100,000 rub. capitalization of inventory items;

- D19 K60 20,000 rub. VAT reflected;

- D19 K19 20,000 rub. to deduct VAT.

Inventory of inventories

In accordance with the requirements of regulatory acts in the field of accounting, at least once a year, an organization must conduct an inventory of its property (assets).

During the inventory, the actual presence of the corresponding property objects (assets) is revealed, which is compared with the data of the accounting registers.

The procedure for conducting an inventory (the number of inventories in the reporting year, the dates of their conduct, the list of property checked during each of them, etc.) is determined by the head of the organization, except for cases when an inventory is required.

Documents that accompany the accounting of receipt of inventories

Inventory accounting is associated with the preparation of documents, which can be divided into two groups: external and internal.

External documents are those issued by suppliers of goods and materials: waybill and invoice, waybill. Internal documents document material assets moved within the organization.

The receipt of material assets at the warehouse is accompanied by a receipt order in form No. M-4, an act of acceptance of materials in form No. M-7 (for uninvoiced deliveries). The release of materials into production and for other needs is accompanied by the issuance of a limit and intake card in form No. M-8.

The transfer of materials between structural units of the enterprise or responsible persons may be accompanied by a requirement-invoice for the release of materials in form No. M-11. This form is also used to return unused material to the warehouse.

If the structural units of the enterprise are located remotely from each other, an invoice in form No. M-15 is used to transfer materials between them. It is also used to transfer material assets to third-party companies, for example, when transferring raw materials.

Since January 2013, the organization has the right to use its own forms of primary documents (Law “On Accounting” dated December 6, 2011 No. 402-FZ), securing them in its accounting policies.

Objectives of accounting for inventories

Property accounting is carried out to achieve the following tasks:

- supervision over the safety of materials and equipment at all stages of their transformation and in all storage areas;

- competent documentation of activities related to the movement of consignments;

- monitoring compliance with standards for individual elements of inventories, identifying (in order to eliminate) excess supply of valuables and timely sale of surplus;

- ensuring timely settlements with sellers of such assets, supervision of valuables in the process of movement.

Regulatory acts regulating the issue of organizing warehouse accounting of the movement of raw materials and materials

The list of important laws regulating the accounting of inventories is as follows:

- – here information is disclosed on the classification of property, its valuation at the time of receipt and release, and the provision of information on these activities in the necessary forms;

- – here the details of accounting for materials, containers, finished products and goods are described in more detail, and the aspects of warehouse accounting are also revealed.

- – concerns the topic regarding the disclosure of information on primary documents documenting all operations on the movement of assets.