Accounting principles

Accounting involves collecting and structuring information about the economic activities of an organization. All transactions should be confirmed by primary documents and recorded in registers using special entries. Since all amounts are in monetary terms, they are positive. But sometimes an accountant has to use entries with a negative value. This is reversal, or red reversal. Let's understand what a reversal is in accounting in simple words - correcting an error (inaccuracy), adjusting previously recorded values. It is used in accounting and tax accounting, especially in demand in budgetary organizations. Regulated by the accounting regulations “Correcting errors in accounting and reporting” (PBU 22/2010, approved by order of the Ministry of Finance of Russia dated June 28, 2010 No. 63n).

What is a reversal?

It is prohibited to delete entries in accounting documents. You also cannot cross out incorrect information. Reversal is used to correct errors. This is wiring with a minus sign. It allows you to correct incorrect data. As a result, two mutually exclusive entries appear in accounting, one of which has a minus. The wiring duplicates each other. Let's look at the main features of reversal:

- the entry is made for the period in which the error was made;

- the main sign of a reversal is the presence of a minus;

- without such a record, the final reporting will be incorrect;

- The adjusting entry is made for the amount for which the difference was established.

IMPORTANT! Reversal rules are extremely important. If they are ignored, turnover is likely to be overestimated, which is unprofitable for the enterprise.

The use of red storno has been limited

In December 2021, several orders of the Russian Ministry of Finance came into force:

- order No. 246n dated October 28, 2020 (registered with the Ministry of Justice of Russia on December 9, 2020);

- order No. 253n dated October 30, 2020 (registered with the Russian Ministry of Justice on December 11, 2020);

- Order No. 256n dated October 30, 2020 (registered with the Ministry of Justice of Russia on December 11, 2020).

They updated the editions of accounting instructions No. 162n, No. 174n, No. 183n. One of the main amendments is the maximum reduction in the grounds for using the red reversal method in accounting. As of December 11, 2020, accountants have only 5 reasons left for this method of correcting erroneous entries:

- When correcting errors of the current year and previous years in accordance with the requirements of the standard “Accounting Policies, Estimates and Errors” and clause 18 of Instruction No. 157n.

- Adjustment of indicators on authorization accounts downward.

- When the indicators of estimated assignments for income (receipts) decrease.

- When reflecting the excess of the planned cost of finished products over the actual one, when attributing to the financial result the amounts of trade margins on goods sold, written off due to natural loss, defects, spoilage, shortages, natural disasters, etc.

- When reflecting the employee’s debt for the return of overpaid wages, vacation pay, and other payments arising during recalculation.

Instead of the red reversal method, reverse posting is used for operations on:

- adjusting the calculations of the founders and subordinate budgetary and autonomous institutions for assigned property;

- changes in the value of land plots due to a decrease in their cadastral value;

- clarification of the valuation of the formed reserves for future expenses in the direction of reduction;

- early termination or termination of a lease agreement, gratuitous use.

For uniform reflection in accounting, it is necessary to amend the accounting policies.

What is red storno

In the latest issue of accounting educational program, Alexey Ivanov talks about an unusual type of posting, which was invented by our compatriot A.A. back in 1889. Beretti. He himself called such postings the “color wire method,” but in modern accounting they are called red reversals.

Hi all! Alexey Ivanov is with you, the knowledge director of the online accounting “My Business” and the author of the telegram channel “Accounting Translator”. Every Friday on our blog at The Clerk I talk about accounting. I started with the basics, then I will move on to more complex matters. For those who are just preparing to become an accountant, this will help them get to know the profession better. Seasoned chief accountants should look at familiar categories from a different angle.

Today I’ll tell you about a specific type of accounting entries - reversals. The word “storno” - storno, like many other accounting terms, comes from the Italian language. Literally it means “account transfer”. But a more accurate understanding of the mechanics of work is given by the verb stornare - to turn back. This is exactly what reversal posting allows you to do. Reversal is the entry of a negative number into the account turnover. Unlike regular entries, which are written in black or blue, reversal entries are written in red. Therefore, this technique is often called the red storno method.

In accounting, reversal is used to correct erroneous entries. The second direction of using reversals is to reflect positive deviations of the actual value of assets from their accounting value (savings). During the month, all write-offs are made at a predetermined cost, and at the end of the month, the actual cost of materials or products is determined. If you wrote off more than necessary, reversal comes to the rescue. That is, in essence, this is also a correction of an error, but an error planned in advance - for the convenience of work.

If it is not technically possible to highlight it in color, the reversal transaction is outlined in a frame.

Example.

The accountant of Horns and Hooves LLC wrote off 20,000 rubles for the production of hooves. At the end of the month, he began to check with the storekeeper. According to the accountant, at the beginning of the month there were 20,000 rubles worth of hooves in the warehouse, and all of them went into production. According to the storekeeper, at the beginning of the month there were 20,000 rubles worth of hooves, but only 2,000 rubles were spent in production, and the remaining hooves cost 18,000 rubles. are in storage. It turned out that the accountant once again pressed the zero when submitting the invoice request, but only 2,000 rubles had to be written off.

Incorrect posting: Dt 20 Kt 10 20,000 rub. If it is not clear how the wiring is compiled, then here I described the methodology in detail and conducted a master class on drawing it up.

Corrective entry: [Dt 20 Kt 10 18,000 rub.] - unfortunately, the Clerk does not have text highlighted in color, I use a frame.

The figure above the post shows the structure of account 10 “Materials” after making corrections.

Despite the Italian name, reversal entries are a Russian contribution to accounting theory. Domestic accountant Alexander Aleksandrovich Beretti suggested correcting errors by recording negative values. In issue 11 of the magazine Accounting for 1889, his article “The Method of Colored Wire” was published, in which Beretti criticized the approach adopted at that time - the method of reverse wire. The essence of this approach was to make a reverse entry to correct the incorrect posting.

In our example, this would be posting Dt 10 Kt 20 for 18,000 rubles. But, as Beretti rightly noted, this approach makes one mistake into two: the turnover on accounts is overstated, and this can lead to an incorrect interpretation of the turnover. If you don’t delve into the depth of the operation, it follows from the wiring that materials were manufactured in production and transferred to the warehouse. Beretti called for an end to this vicious practice and the use of a colored wire method, which would later be called reversal.

Attention: correction

Let's figure out what it means in accounting to reverse, and what legal acts and instructions govern such operations. At its core, a reversal entry is an adjustment to a positive entry that has already been made. Such an entry always has a minus sign and is therefore highlighted in red. The minus sign itself is not placed - its combination with money contradicts the laws of mathematics and logic. To make it clear that this amount is not added, but subtracted, the color red is used. All regular entries are made either black or blue, and the reversal is always carried out:

- in red pen on paper registers;

- in red font when using computer equipment and special programs.

This happens both on debit and credit and always means that the amount allocated in this way should be subtracted when summing up the results. In principle, accountants replace such adjustments with regular entries, so-called reverse entries, thereby increasing account turnover. As a result, the excess amounts will still have to be deducted, but after summing up the results, which is quite inconvenient, this increases the risk of getting an unreliable balance.

Why can't you do regular “black” wiring instead of “red”?

Sometimes, by mistake in accounting, instead of posting a reversal, the accountant makes a reverse entry. For example, you need to reverse an erroneous posting:

Debit 26 Credit 60 in the amount of 150,000 rubles. due to an error by the accounting service - in fact there should not be a write-off.

The specialist does not make the correction by writing:

Dt 26 Kt 60 – 150,000 REVERSE, and by recording Dt 60 Kt 26,150,000

The final account balances will be identical for both accounting entry options, but with reverse entries, the accountant artificially increases the turnover of debit and credit accounts, which distorts the data and requires additional analytics during analysis.

What are reversal entries used for?

Any red reversal in accounting implies an action related to:

- with the correction of an error made in the previous posting;

- write-off of realized trade margins;

- bringing the accounting (planned) cost of material assets into line with the actual price, if the latter turned out to be lower;

- a decrease in the value of valuation reserves and the need to make adjustments to accounting data.

IMPORTANT!

In 2021, reverse postings are used when reversing, red reversal is used taking into account the restrictions introduced.

All cases of using the red reversal method are directly indicated in the manuals and PBUs. For example, paragraph 25 of PBU 5/01 provides for such an adjustment to the reserve for doubtful debts. But still, this method must be fixed in the accounting policy of the organization.

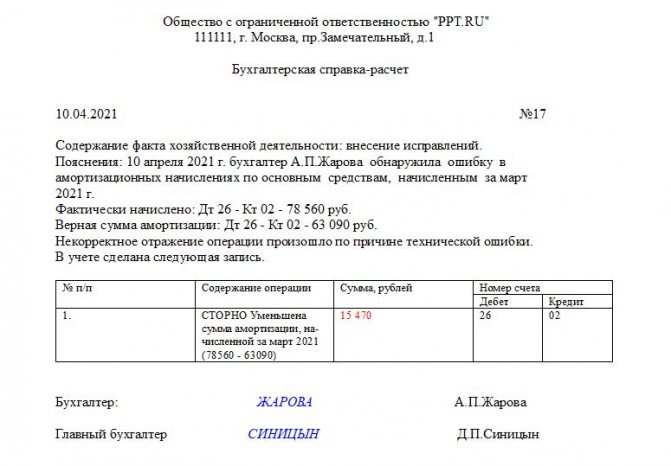

Documenting

An accountant, even if the accounting policy allows him to do so, who has made an error in the amount or made an entry to the wrong account, does not have the right to make entries in the red reversal in accounting; they must be justified. Such an operation must be documented with an accounting certificate indicating the reason for which the reversal was made and the amount of the correction. Without such a certificate, the operation during the inspection is considered unfounded - its reasons are not obvious to the inspectors without additional explanation. This is what a sample of a prepared accounting statement with postings looks like:

Corrections by reversal are allowed to be made both in accounting and tax accounting. The main condition for correcting accounting errors in this way is that the reporting has not yet been approved. If the reporting is approved, it is necessary to change the data in it, and this is much more difficult. Any reversal entry is not a panacea; it is used only in those situations where it is justified.

Method of additional recording (posting)

If the cost indicators of a transaction need to be increased due to an identified distortion, and the amount of the initial entry is erroneously indicated, and not the accounting entry itself, the method of additional entries is used.

The correction is made by making an additional entry with the same account correspondence for the amount of the difference between the correct transaction amount and the amount reflected in the previous entry.

In other words, to correct the error, the same posting is made, but only for the missing amount.

Example

The organization discovered that the cost of services for routine car repairs is reflected in the accounting records in the amount of 5,000 rubles. instead of 6000 rub. (excluding VAT).

That is, the amount of the business transaction was erroneously underestimated by 1000 rubles.

To correct an error in accounting, the following entry was made:

Debit account 26 “General business expenses” Credit account 60 “Settlements with suppliers and contractors” - 1000 rubles. — the cost of services for routine car repairs, which was erroneously not taken into account earlier, was taken into account as part of general business expenses.

Example

From the cash desk of the enterprise, wages were paid to employees in the amount of 20,000 rubles. The accounting entry erroneously indicated the amount of 2,000 rubles, i.e. entry made:

Debit of account 70 “Settlements with personnel for wages”, Credit of account 50 “Cash” - 2000 rubles.

To correct the error, an additional entry is made for the amount of the difference between the correct and incorrect entries - 18,000 rubles. (20,000 - 2000):

Debit of account 70 “Settlements with personnel for wages”, Credit of account 50 “Cash” - 18,000 rubles.