The tax period code in the declaration is a two-digit code entered in a specific field of the declaration or payment slip. This code is required for tax authorities who, when processing the information provided by machine, determine what period of time is the basis for calculating tax. In addition, in certain situations, this code may contain other information. For example, using the code you can find out that the company files a declaration upon liquidation for the last tax period.

Taxable period

A tax period is understood as a certain time interval for which the tax base is determined. Moreover, for each type of tax, the legislation establishes its own time period, for example, a month, a quarter or a year. In addition, for certain taxes, tax periods are also divided into reporting periods, for each of which advance payments are calculated and paid. The reporting period for each tax is determined by the Tax Code of the Russian Federation and they are presented: quarter, half year and 9 months.

Important! In certain cases, a monthly form may also be used, for example, if a company is required to pay income tax on actual profits, then advances are calculated for a reporting period equal to a month.

What is the difference between the reporting period and the tax period?

In paragraph 1 of Art.

55 of the Tax Code of the Russian Federation states that a tax period is a period of time, the duration of which is determined by legislation on specific taxes. At the end of this period, the taxpayer needs to determine the tax base for a certain tax and calculate the amount from it to pay to the budget. A tax period may include one or more reporting periods. Tax periods for various taxes can be a calendar year, quarter or month (clauses 2, 3, Article 55 of the Tax Code of the Russian Federation).

The definition of the reporting period is given in the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Reporting period is a time interval during which certain documented facts of the company's economic activities occur. Organizations and individual entrepreneurs reflect these facts in accounting. At the end of the reporting period, financial statements are generated in accounting (Article 15 of Law No. 402-FZ).

The main reporting period is a year; there are also intermediate reporting periods - a quarter and/or a month (clause 5 of Article 13 of the Law “On Accounting”).

As for VAT, for both taxpayers and tax agents the tax and reporting periods are identical - this is a quarter (Article 163 of the Tax Code of the Russian Federation).

Sometimes the countdown of the period does not begin on January 1 (registration of organizations and individual entrepreneurs occurs throughout the entire calendar year). In this case, the tax period specifically for VAT is the period of time from the date of registration to the end of the current quarter.

Tax period code in the organization’s property tax return

When calculating property tax, the previous year is taken into account for the tax period (379 Tax Code of the Russian Federation). Reporting periods may not be established, in which case the calculation and payment of advance payments will not be required. However, this type of tax has some nuances. Companies that have branches, divisions or real estate in other regions are required to submit their own declaration for each facility.

The property tax of companies is regional, which means that payments go to the budget of the region in which the payment is made, and not to the state budget. Separate divisions of the company must pay this tax independently. Situations are also possible in which the parent company does not pay advance payments, and its divisions or branches located in other regions are required to pay advance payments 2-4 times a year.

Important! If a company has real estate in another region that does not belong to a separate division, then the parent company must draw up a separate declaration for it and send it to the tax region at the location of the property.

The tax period codes included in the declaration will be identical to the income tax declaration codes. For example, when submitting an annual declaration, code “34” is entered. Submission of reports for each month for this type of tax is not provided (

VAT reporting period

The VAT reporting period coincides with the tax period and is a quarter. This means that VAT reporting is prepared quarterly (that is, data is entered into the form not on an accrual basis, but separately for each quarter). In other words, the VAT return is submitted to the Federal Tax Service at the end of each quarter of the year and contains only data related to that specific quarter.

The deadline for filing VAT reports in 2020-2021 is no later than the 25th day of the month following the tax period (Clause 5, Article 174 of the Tax Code of the Russian Federation). This provision applies to both VAT taxpayers and tax agents for this tax.

The declaration must be submitted electronically.

Important! ConsultantPlus warns: An exception to this rule are some tax agents, as well as foreign organizations that pay the “Google tax.” If you are a tax agent, you can submit a VAT return on paper only if the following conditions are simultaneously met... Read the explanations of K+ experts by receiving trial demo access to the system. It's free.

If the declaration is submitted on paper, it is considered unsubmitted. In this case, a fine will be charged for failure to submit a declaration (Article 119 of the Tax Code of the Russian Federation), and the account may also be blocked (clause 3 of Article 76 of the Tax Code of the Russian Federation).

Recommendations from ConsultantPlus experts will help you unblock your account. A free trial of full access to the legal system is available.

In addition to taxpayers, VAT returns are submitted (clause 5 of Article 174 of the Tax Code of the Russian Federation):

- tax agents who are not VAT payers or are exempt from performing duties related to the calculation and payment of VAT;

- enterprises that are not VAT payers, but have issued an invoice with the allocated VAT amount.

When liquidating or reorganizing an enterprise, it is better to coordinate the time for submitting VAT reports with the local tax authorities (clause 5 of Article 55 of the Tax Code of the Russian Federation). If there is no such agreement with the inspectors, then the declaration should be submitted within the prescribed period. But this must be done before the date of liquidation/reorganization, since after making an entry about this in the Unified State Register of Legal Entities, the enterprise no longer exists and there is no one to submit reports to.

Since the 4th quarter of 2021, the VAT declaration form and the procedure for filling it out have been in effect, which were approved by order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3 / [email protected] as amended. Order of the Federal Tax Service dated August 19, 2020 No. ED-7-3/ [email protected]

Starting with reporting for the 3rd quarter of 2021, the VAT return form will change (Federal Tax Service order No. ED-7-3 dated March 26, 2021/ [email protected] ). See here for details.

Read more about the rules for filling out the declaration:

- “What is the procedure for filling out a VAT return (example, instructions, rules)”;

- “Procedure for filling out the VAT return for the 2nd quarter of 2021.”

and in other articles in the section devoted to the VAT return.

Tax period code in the declaration according to the simplified tax system

Important! Under the simplified taxation system (simplified taxation system), the tax period is understood as a calendar year, and the reporting period is understood as a quarter, half a year and 9 months. Unlike income tax, calculations for advance payments are not submitted to the tax office.

As with the taxes discussed above, standard codes are used for the simplified tax system, that is, code “34” is entered in the declaration for the simplified tax system for the year. In addition, some special tax period codes are also used:

| Special tax period code | What does it mean |

| 50 | Indicated upon liquidation or reorganization of a company |

| 95 | Last tax period under the old tax system |

| 96 | Applicable in the last period of work of an individual entrepreneur using the simplified tax system |

If a taxpayer loses the right to work under the simplified tax system during the year, then the tax period will be the period of time while the right to the simplified tax system was still available. For example, the company lost the right to use the simplified tax system in October, so it will have to file a declaration after the expiration of this right, and indicate 9 months as the reporting period (code “33”).

Tax period for VAT

The tax period for VAT is quarterly (Article 163 of the Tax Code of the Russian Federation). If the enterprise was registered after January 1, then the beginning of its VAT tax period will be considered the day of its registration (Clause 2 of Article 55 of the Tax Code of the Russian Federation). If the company was liquidated or reorganized, then the last tax period will be considered the day of its liquidation (reorganization), i.e., the day when the procedure was formalized by the corresponding entry in the Unified State Register of Legal Entities (clause 3 of Article 55 of the Tax Code of the Russian Federation).

See also: “How long is the tax period in the VAT return?”

Tax period code in the UTII declaration

When applying UTII (single tax on imputed income), the tax period is one quarter. In addition, in this case it will also be the reporting period. The deadline for submitting the UTII declaration to the tax office is until the 20th of the month following the reporting quarter, and payment is due until the 25th. The tax period codes in the UTII declaration are indicated as follows:

| Taxable period | Tax period code |

| 1st quarter | 21 |

| 2nd quarter | 22 |

| 3rd quarter | 23 |

| 4th quarter | 24 |

In addition, there are also special codes when filing a declaration in the event of liquidation or reorganization of a company: codes from 51 to 56 - for the first, second, third and fourth quarters, respectively. The number “5” in the code, which is in first place, indicates that this period is the last for the company’s activities. After this, the company is liquidated or reorganized into another company, which may apply a different taxation system.

When and how to submit a VAT report for the 3rd quarter of 2021

The deadline for submitting the VAT return for the 3rd quarter of 2021 is determined in paragraph 5 of Art. 174 of the Tax Code of the Russian Federation and requires submitting a report to the Federal Tax Service no later than the 25th day of the month following the expired tax period.

In October 2021, there will be the usual “movement” due to the last day of the deadline falling on a weekend (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). The VAT return for the 3rd quarter of 2021 can be submitted without penalty until the end of October 26, 2021 (Sunday, October 25 is postponed to the 26th).

The VAT return can only be submitted electronically via TCS channels. Let us recall that according to the norms of paragraph 5 of Art. 174 of the Tax Code of the Russian Federation, a paper declaration will be considered not submitted by any method of delivery to the tax office.

The electronic filing rule also applies to “zero”. The only option to report on the absence of VAT-taxable transactions on paper is to submit a EUND, if possible.

The deadline for submitting the EUND differs from the deadline for submitting the declarations it replaces. According to Art. 80 of the Tax Code of the Russian Federation must be submitted no later than the 20th day of the month following the reporting period. That is, if instead of the VAT return for the 3rd quarter of 2021 you decided to submit the Unified Tax Code, you must do this before October 20, 2021. According to the calendar, this is Tuesday, so there are no postponements.

Quarterly codes

For certain types of tax, reporting periods are coded quarterly. It allows you to facilitate the automatic processing of information provided in declarations. The following codes are distinguished:

- Standard quarterly codes for income tax.

- Quarterly codes for income tax for consolidated groups of taxpayers (CGT).

- Quarterly company property tax codes.

- Quarterly UTII codes.

When paying property tax, the following coding is used:

- 1st quarter – 21;

- 2nd quarter – 17;

- 3rd quarter – 18.

In case of reorganization or liquidation:

- 1st quarter – 51;

- 2nd quarter – 47;

- 3rd quarter – 48.

Tax return submission method code

Companies, in addition to the tax period code, also need to enter the code of the method and place of submission in the declaration. Based on the presentation methods, the following encodings are distinguished:

| Code | What does it mean |

| 01 | By registered mail |

| 02 | Personally to the tax office, on paper |

| 03 | On paper with a duplicate on electronic media |

| 04 | Via the Internet, certified by an electronic signature |

| 05 | Another method of submission |

| 08 | By mail with an electronic copy attached |

| 09 | In person on paper with a barcode |

| 10 | By mail on paper with a barcode |

Tax return submission place code

Some codes have also been approved at the place of submission of the income tax return, simplified tax system, UTII and property:

| Code | What does it mean |

| 120 | At the place of residence of the individual entrepreneur |

| 210 | By legal address of the organization |

| 215 | At the legal address of the successor company, which is not a major taxpayer. |

For the UTII declaration at the place of submission, the following codes are established:

- 214 – when submitting a declaration at the location of the Russian company (if the organization is not a major taxpayer);

- 245 – at the place of activity of a foreign company, which is carried out with the help of a representative office of the Russian Federation;

- 310/320 – at the place of business of the company/individual entrepreneur;

Rules for calculating and paying VAT

The rules by which value added tax is calculated and paid are prescribed in Chapter 21 of the Tax Code of the Russian Federation. Taxpayers are organizations and individual entrepreneurs. The objects of taxation are:

- sale of goods, works, services on the territory of the Russian Federation;

- construction and installation works and transfer of goods and services for own needs;

- import of goods into the customs territory of the Russian Federation.

The tax base is determined as the cost of goods, works, and services.

Article 164 of the Tax Code of the Russian Federation establishes three tax rates: 18%, 10% and 0%. From January 1, 2019, the basic rate of 18% was increased to 20% (303-FZ dated August 3, 2018). The remaining two rates will continue to operate without changes.

Organizations and individual entrepreneurs that apply special tax regimes (USN, UTII, PSN) are exempt from the obligation to pay VAT. Also, organizations and individual entrepreneurs whose income for the previous two months did not exceed two million rubles can receive an exemption by application.

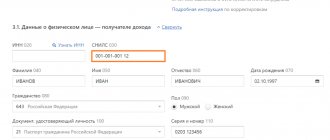

Tax period code when filling out a declaration

Each person receiving income in accordance with the legislation of the Russian Federation must be taxed and submit financial statements on a timely basis.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

What types are there?

For a number of fees, the tax period of 1 calendar year is relevant.

The rules define several options:

- provided that the organization is registered from January 1 to November 30, the period for it lasts from the moment of opening until December 31;

- if the company was registered from December 1 to December 31, then for it it lasts until December 31 of the next calendar year from the date of making an entry with the registration authority;

- if the structure has undergone a reorganization or liquidation procedure, then for it the period from January 1 of the year when it actually ceased its activities until the moment when the clarifying entry was made in the register is considered;

- provided that the company was registered and was liquidated within 1 calendar year, the tax period for it is considered to be the period from the moment of inclusion in the state register and until the recording of liquidation is made by the registering authority.

The following type is considered to be a quarter:

- if the registration of a person was carried out at least 10 days before its end, then for it there will be a period from the date of inclusion in the register until the end of the quarter in which it was carried out;

- if the enterprise was entered into the register less than 10 days before the end of the quarter, then the period from the moment of registration until the end of the next trimester is recognized.

In some cases, a tax period can be recognized as a time period of 1 month, 9 and the first half of the year.

Code in the declaration

When a taxpayer prepares reporting documents, he needs to indicate the tax period code. It is a combination of 2 numbers that is entered when filling out the title page. If there are doubts regarding the correctness of the entered codes, they can always be clarified in the orders of the FSIN.

According to VAT

The Tax Code of the Russian Federation establishes that in this case 1 quarter should be used. Accordingly, the period for which it is necessary to report will be the same.

The codes in the declaration will be the following digital values:

| I quart. | 21 |

| II | 22 |

| III | 23 |

| IV | 24 |

According to the simplified tax system

If an organization provides a report using a simplified system, then it must be submitted once a year. The calendar year is divided into reporting periods in the same way as when calculating income tax. In this case, there is no need to submit reports to the Federal Tax Service. The return must indicate standard code 34 for the tax period per year.

When closing an individual entrepreneur, 50 is used on the simplified tax system. It is also used during reorganization and liquidation.

Structures that work on imputation submit reports every quarter. In this case, use the following codes:

| For the first quarter | 21 |

| II | 22 |

| III | 23 |

| IV | 24 |

3-NDFL

When filling out the declaration, the following codes are used:

| When preparing a report for 1 calendar year | 34 |

| For 1, 2, 3, etc. months | 35, 36, etc. accordingly, up to 45 |

| Due to the liquidation of the organization | 50 |

For income tax

When filling out the declaration, you should use the following codes:

- for a voluntary association of legal entities when creating reports for the first quarter, half a year, 9 months and a year, 13, 14, 15, 16 are used, respectively;

- quarterly reporting periods - 21, 31, 33, 34 for the 1st, 2nd, 3rd and 4th quarters, respectively;

- when providing monthly reports - 35, 36, 37, etc. up to 45;

- when liquidating or reorganizing an enterprise, code 50 should be indicated;

- if taxpayers pay monthly advances based on actual profits, then the designations will be 57, 58, 59, etc. up to 68.

For property

Drawing up a declaration involves entering the following codes:

| When submitting reports for the 1st and 2nd half of the year | 17 and 18 respectively |

| When reorganizing the structure for half a year and 9 months | 47 and 48 |

| When preparing an advance report for the 1st quarter | 21 |

| If the company has undergone reorganization | 51 |

Examples of filling in the period code

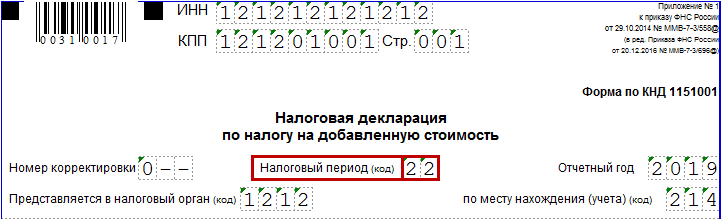

Period codes in tax reporting usually consist of two digits, the first of which serves as an indicator of belonging to a certain type of report - VAT returns, income taxes, property taxes, etc.

The first digit of the tax period code of the VAT return is 2 (or 5 for the VAT report if the applicant organization is reorganized/liquidated).

The second digit of the period code depends on the quarter number: 1 means the first quarter, 2 means the second quarter, 3 means the third quarter, 4 means the fourth quarter.

That is, period code 21 in the VAT return means that this is a report for the first quarter:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

And period code 22 in the VAT return is the report indicator for the second quarter:

The third quarter code is 23, the fourth quarter code is 24.

When filling out the VAT return for the first quarter, the reorganized/liquidated organization will enter the code 51, and for the second quarter - code 52, the third quarter - 53, and the fourth quarter - 54.

If an organization has to submit an updated declaration, the codes in the update are filled in according to the same rules.

What happens if you enter an incorrect period code on the title page - numbers that do not correspond to Appendix No. 3 to the Procedure for filling out a VAT report? How can I fix the detected error?

Providing a declaration

The document must indicate the amount of income received for a certain period of time.

Filing deadlines may vary and depend primarily on the type of declaration itself.

In addition to their income, persons must enter a number of values into this document:

- all resources that, according to Russian legislation, are subject to taxation;

- the size of the tax base;

- a list of benefits provided by the state when paying fees;

- sources of profit.

Reporting period

It is considered the time period during which the business operations of a structural unit are carried out, reflected in accounting and reporting.

The following types exist:

| Quarterly | in this case, a report is provided for every 3 months |

| Annual | compiled once a calendar year |

The first reporting year for a company is the time period from the moment it was entered into the state register until December 31 (if the registration period fell on the day after September 30). Or from the moment of registration until December 31 of the following year (if it was added to the register after September 30).

When filing your tax returns, you need to keep an eye on changes in your financial statements. Codes are subject to change. Therefore, before submitting reports, you should clarify them with the Federal Tax Service.

Video on the topic:

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

List of VAT codes

According to Order of the Ministry of Finance No. 104 of 2009, not only quarters, but also months are encrypted with the tax period code in the VAT return. January – 01, … December – 12.

When liquidating an enterprise, the quarters are indicated as follows:

- I – 51.

- II – 54.

- III – 55.

- IV – 56.

Codes by month during liquidation:

- First quarter: 71, 72 and 73 respectively.

- Second: April - 74, May - 75, June - 76.

- Third: 77, 78 and 79.

- Latest: 80, 81, 82 for October, November and December.

Art. 55 clause 1 of the Tax Code of the Russian Federation implies several reporting periods in one tax segment. Regarding VAT, these indicators are the same - each reporting period is equal to one taxable period. The declaration is not filled out on an incremental basis - it reflects information only for a specific period of time.

Who must submit a VAT return?

Anyone who has had at least one transaction requiring the calculation and payment of tax during the tax period (in our case, the third quarter of 2021) must report VAT. It could be:

- operation or operations “standardly” taxed with VAT (named in paragraph 5 of Article 174 of the Tax Code of the Russian Federation);

- a payment made in favor of another person, by which the payer becomes a tax agent for VAT, i.e. is obliged to withhold tax at the source and transfer it to the budget of the Russian Federation (such cases are listed in paragraphs 2–5 of Article 161 of the Tax Code of the Russian Federation);

- issuing a VAT invoice to the buyer in cases where the seller:

- is not initially a VAT payer, for example, is in a special regime or enjoys an exemption under Art. 145 Tax Code of the Russian Federation;

- conducts activities that are exempt from VAT according to the norms of the Tax Code of the Russian Federation.

If an organization (or individual entrepreneur) is a VAT payer (for example, it is located on OSNO or moves goods across the customs border of the EAEU), but there were no transactions with VAT in the reporting period, it still needs to be declared by submitting a zero declaration.

Also, if during the reporting period there was a suspension of activity - there were not only no transactions with the object of taxation, but also no movement of funds through accounts and in the cash register, it is allowed to submit a single simplified tax return (USTD) instead of a VAT return.

Application of codes in practice

VAT reports are submitted to the tax office on forms approved by the Ministry of Finance. The importance of correct completion is due to the fact that errors lead to resubmission of the report. Their untimely identification is fraught with the risk of violation of the Tax Code and corresponding administrative measures.

To fill out the declaration, information is taken from the following databases:

- List of invoices from counterparties;

- Database for control of invoice forms;

- Book of sales and purchases;

- Information from tax and accounting reports.

The form consists of 12 pages, including the front page. It contains the following information:

- TIN/KPP;

- Document version. If it is submitted for the first time during the reporting period, then 0 is entered; if this is a clarification, then 1, 2 or another corresponding figure;

- Tax period code according to the above rules;

- Information about the company.

Section 1 contains the following points:

- OKTMO/KBK codes;

- The final tax amount is reflected in clauses 030, 040 and 050;

If in the current reporting period there were transactions for which VAT must be charged, then you should fill out paragraph 3. The following should be indicated here:

- The amount of tax according to the established rates;

- Amount of restored VAT;

- Deductions.

The value of the 1st point is formed as the sum of lines 200 and 210.

Sections 8 and 9 are filled out in accordance with data from the book of sales, purchases and other accounting documents.

Sections 4 and 6 are intended for companies engaged in exporting. All documents confirming the right to export and types of exported goods are taken into account here.

The finished report is submitted in electronic format. The title page and the first section must be completed. The remaining blocks are filled in depending on the type of transactions performed in the reporting period.

If an error is found in a document, a correction on the same form is unacceptable. To correctly display the information, a new report is drawn up - a corrective declaration.

VAT return form for the 3rd quarter of 2020

The VAT return for the 3rd quarter of 2021 should be drawn up in the form approved by Order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/558 as amended on November 20, 2019. When preparing the declaration, fill out those sections for which the taxpayer has data.

A commercial company or individual entrepreneur on OSNO who simply sells and buys something (not a VAT tax agent, not an exporter or an intermediary) must enter data in:

- title page;

- section 1, which shows the amount of VAT payable (reimbursable from the budget);

- section 3, which provides the calculation of the tax amount;

- sections 8 and 9, which duplicate information from the purchase book and sales book, respectively.

You may also need to fill out section 7. It reflects VAT-free transactions.

The remaining sections of the declaration have individual purposes. They are included in the report if there were corresponding transactions. For example, VAT tax agents fill out section 2.

For those taking the “zero” level, only the title page and section 1 will be completed (from which it will follow that neither tax payable nor tax refundable occurred in the tax period).

Due to the fact that the declaration is in any case prepared electronically, using software, we will not, as usual, provide in the article an example of filling out a paper declaration. Let's just touch on some changes in the filling process in 2021.