Is study included in the total length of service? According to current legislation, no. If the training took place before 2002, yes, because this was established by the law in force before 2002.

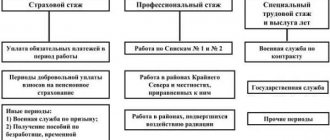

The insurance period (production) is the time when pension contributions were made for a citizen. Its main significance is that it influences the formation of pension contributions (currently the minimum for assigning a pension is 15 years).

Pension legislation is constantly changing, but a new law cannot worsen a citizen’s situation. According to the previous law, the time of study was taken into account when assigning pension benefits, but according to the current law, it is not. Therefore, whether studying at an institute is included in the length of service depends on the period during which it occurred.

Is study included in the total work experience?

Until 1992, pensions were assigned on the basis of Resolution of the Council of Ministers of the USSR No. 590 of 08/03/1972, from 1992 to 2002 - according to the law on pensions No. 340-I of November 20, 1990. In accordance with these legislative acts, years of study are included in the total work experience if a citizen received education in higher and secondary specialized educational institutions.

Since 2002, Federal Law No. 173 of December 17, 2001 on pensions has been enacted in Russia. In accordance with Art. 10-11 of this law, the period of study is not taken into account when assigning a pension. The very concept of “work experience” has been replaced by “insurance”.

In 2015, the legislation changed again. Federal Law No. 400 came into force, adopted on December 28, 2013 and still in force to this day. He increased the number of periods counted in labor output, but the period of education was not included in it.

In accordance with Art. 11 of the new 400-FZ, insurance coverage includes the following periods:

- military service;

- receiving unemployment or disability benefits;

- caring for a young child under one and a half years old;

- caring for a disabled person, an elderly citizen over 80 years old, a disabled child;

- unjustified detention;

- living together with a military spouse (or military spouse) in an area where there was no opportunity to carry out work activities;

- living with a spouse abroad.

According to the law, it turns out, and this is indicated in paragraph 8 of Art. 13 400-FZ, that study is included in the length of service for a pension if it was carried out before 2002. This term refers to the acquisition of knowledge in secondary and higher educational institutions.

General provisions

The periods of time during work and other activities that are included in the insurance period are determined in accordance with Law No. 173-FZ, and from 2021 have the number 400. According to this law, this includes the time of work or performing any other activity on the territory Russia, provided that appropriate insurance contributions were made during this period of time.

Thus, according to this law, the time spent studying at a university, during which insurance premiums are not paid, is not taken into account when calculating the insurance period and, accordingly, will not be calculated in the process of determining the amount of the pension.

It is worth noting that the previously existing legislation, which was adopted back in the days of the USSR, provided for the inclusion in the work experience of the time of study in higher, secondary or special institutions, and therefore, if this period of time fell on you in 1956-1986 years, this time will be taken into account.

The answer to the question whether military service is included in the insurance period or not is very important when determining the length of service that affects the calculation of a pension.

Where and in what order you can order and receive a certificate of insurance experience, find out here.

When will training time be counted?

University, technical school, and graduate school are taken into account when assigning a pension; college is included in the length of service for a pension, but not school years; studying at a comprehensive school has never been included in the calculation. And they count only when completing training before 2002.

The exception is cases when the student carried out labor activities in his free time from classes.

According to Soviet legislation, vocational education was equal to these types of education, so the answer to the question of whether courses are included in the pension experience is positive if they were completed before 2002 and related to vocational training (advanced training, etc.).

Is studying at a vocational school included in the insurance period?

In accordance with previously existing legislation, preparation for professional activity, which, in particular, includes training in schools and specialized educational institutions, was necessarily taken into account in the process of calculating total work experience along with working hours.

However, at the moment, the periods that are included in the insurance period are established by completely different legislation, and the inclusion of time spent studying in various vocational schools cannot be included in the insurance period.

The training took place at a departmental university

In accordance with Law No. 4468-1 of February 12, 1993 and Government Decree No. 941 of September 22, 1993, training is included in the length of service for receiving a pension in the internal affairs bodies within 5 years. This rule applies to employees who entered the service before 01/01/2012, subject to graduation from an educational institution (Part 2, Article 17, Article 22 of the Federal Law of November 30, 2011 No. 342-FZ “On service in the internal affairs bodies of the Russian Federation and making amendments to certain legislative acts of the Russian Federation", clause 2 of article 35 of the Federal Law of March 28, 1998 No. 53-FZ "On military duty and military service", order of the Minister of Defense of the Russian Federation of April 7, 2015 No. 185).

Based on 342-FZ dated November 30. 2011, 53-FZ dated 03/28/1998, order of the Ministry of Defense of the Russian Federation No. 185 dated 04/07/2015, enrollment in universities of the Ministry of Internal Affairs or the Ministry of Defense is actually entry into service with the signing of contracts.

Reference to the law

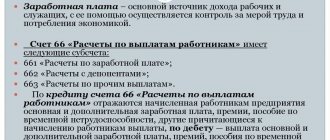

Part 1 of Article 16 of Law No. 255-FZ provides for the inclusion of the following periods of time in the length of service:

- work in accordance with an employment contract;

- performing duties in a municipal or civil institution;

- other activities that required mandatory payment of contributions to the Social Insurance Fund.

Pupils and students are not among the citizens who require compulsory social insurance, and therefore the time of study is not included in the insurance period. It is worth noting that from January 1, 2007, the insurance period completely replaced the work experience that was used earlier, and if on that date it turned out that the work experience before January 1, 2007 was greater than the insurance period, it replaced it. But it is worth noting that to determine benefits, length of service was used exclusively in situations where its value exceeded the insurance value.

The duration of continuous experience is determined in accordance with the relevant rules, which were approved by the Council of Ministers of the USSR back in 1973, and according to these rules, the time of study in higher and secondary institutions was not taken into account when calculating the experience, but it included time of study in various vocational and technical institutions schools and colleges

How to process pension accrual taking into account the time spent studying at a technical school

The time spent studying in educational institutions is not mentioned in Federal Law No. 400 “On Labor Pensions” as counted towards the insurance period. The possibility of including it in such a period is established depending on the contributions to extra-budgetary funds. If such payments were not made, then the periods of study do not give the right to early retirement.

Studying at a technical school

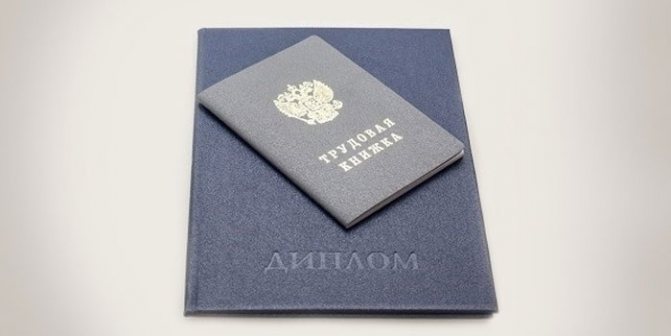

The same rules apply to studying at technical schools and vocational schools. The period is included in the work experience if it was carried out before the introduction of changes in 2002 and is included in the work book, and education is confirmed by a diploma.

If the acquisition of knowledge was carried out after 2002, then confirmation is required:

- entry in the work book;

- payments to the Pension Fund of insurance contributions;

- undergoing professional practical training if there were deductions to extra-budgetary funds;

- registration as an individual entrepreneur, subject to the deduction of funds to finance the insurance part.

If the work book does not contain information about periods of work or it is lost or damaged, proof of activity from the employer is required. In case of work carried out after 2002, the data is recorded according to individual (personalized) accounting.

The time spent receiving education at a school or college is counted if contributions were made to the Russian Pension Fund on the basis of an employment contract.

Whether the period is included in the length of service is determined at the time of registration of the pension on the basis of the legislation in force at the time of completion of studies.

Example of a diploma issued before 2002

With regard to education received before 2002, the period is included in the length of service; after this period - only when making contributions to the insurance portion of the Pension Fund of the Russian Federation.

Postgraduate education in postgraduate internship and other forms

If the student receiving an education already had a work record, the period of work before completing the training will also be summed up with subsequent years of work. However, the period during which the person studied will be excluded from this amount.

However, it is possible to take into account certain time during the period spent receiving education. Basically, this time refers to production practice. This period can be taken into account and attributed to seniority. It is mandatory to sum up this time if the student was officially employed, received a salary, and all necessary deductions were made from it.

Students can also work part-time during their studies. For example:

- get officially employed during the holidays;

- remote work, but it is mandatory that the employer makes all necessary contributions to the Pension Fund.

What does length of service include?

Those citizens who managed to cover this period have the right to recalculate the final amount of their pension. However, for this it will be necessary to resort to a special formula that will determine the size of the pension. A citizen who is already receiving a pension can use this opportunity if he believes that modern methods are less effective and beneficial for him.

Thus, a citizen can receive time spent studying at a technical school as credit for his insurance experience in several cases:

- if the pensioner decided that the method of calculating a pension taking into account the time of study would be more correct for him;

- During his student years, the pensioner underwent practical training, for which he received a salary, and also contributed personal income tax amounts to the Pension Fund.

In any case, the pensioner will need official registration.

What is not included in work experience

According to Federal Law No. 125 on higher education, postgraduate study refers to a type of form of education. Postgraduate students can be admitted both full-time and part-time. According to pension legislation, such periods are not included in either the length of service or the insurance period, since they are not taken into account when determining the right to a pension.

Based on Order of the Ministry of Health No. 23 of February 17, 1993, the same rules are established for clinical residency when undergoing off-the-job training.

The internship lasts 1 year after graduation. A referral for appointment to a position is issued by the chief physician on the basis of an order from a healthcare institution.

While receiving additional education, the employee is assigned a salary, from which contributions to the Pension Fund are made.

The employee’s duties are carried out on the basis of the labor regulations with the right to benefits also entitled to other medical personnel. Thus, the period of internship training is counted towards the length of service and is taken into account when calculating the pension.