Who can receive the payment

Bonuses for length of service vary in size, it all depends on factors, both external and internal:

- The size of the salary and the dynamics of its increase. The salary increases - the additional payment increases. This is explained by the fact that it is calculated as a percentage of the salary. A year is not counted as two, like in the military.

- Region. For example, in the North, regional coefficients are increased. They increase the premium as they are included in the formation of the monetary allowance.

- Kind of activity.

Longevity bonuses for different categories of employees (by duration):

| % premium | Ministry of Internal Affairs, firefighters, Ministry of Emergency Situations | Budget positions | Teachers, doctors, scientists |

| 10% | 2-5 | 2-5 | 1-3 |

| 15% | 5-7 | 5-7 | — |

| 20% | 10-15 | 10-15 | 3-5 |

| 25% | 15-20 | — | — |

| 30% | 20-25 | more than 15 | more than 5 |

| 40% | more than 25 | — | — |

REFERENCE: the premium is set not only as a percentage, but also as a fixed amount.

How to get a bonus for experience

Additional payment for length of service in 2021 is calculated on the basis of the citizen’s work book, which is stored in the personnel department. In addition, the presence of orders regarding the employee that explain his length of service is taken into account. The availability of the right to additional payment is determined by the personnel department of the enterprise where the person works. Employees are required to issue an order to accrue an increase to the official salary to a specific person.

Additional payments for teacher-librarian

From January 1, 2005, employees of state and municipal libraries, in accordance with Article 30 of the Law of Law “On Libraries and Librarianship” dated January 27, 1995, were introduced an additional payment for length of service. 3 years – 10% of official salary; 10 - 20%; 20 - 30%. Such additional payments are not made to part-time workers. Additional pay for length of service is calculated from the official salary without taking into account additional payments and allowances.

According to the section “Qualification characteristics of positions of educational workers” of the Unified Qualification Directory of Positions of Managers, Specialists and Employees[3], the positions of pedagogical workers include: teacher, instructor (except for teachers classified as faculty members of universities), teacher-organizer, social educator, teacher-defectologist, teacher-speech therapist (speech therapist), educational psychologist, teacher (including senior), tutor (with the exception of tutors engaged in the field of higher and additional vocational education), teacher-librarian (the title of the position is used in educational institutions implementing educational programs of primary general, basic general, secondary (complete) general education), senior counselor, additional education teacher (including senior), music director, accompanist, head of physical education, physical education instructor, methodologist (including senior), instructor-methodologist ( including the senior), labor instructor, teacher-organizer of the basics of life safety, trainer-teacher (including the senior), master of industrial training. The Government of the Russian Federation has approved a different list of positions, work in which is counted towards length of service, giving the right to early assignment of an old-age pension to persons engaged in teaching activities.

We recommend reading: If a Child is Registered in an Apartment, Is It Possible to Sell an Apartment in

Rules for calculating the allowance

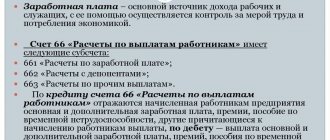

Having received an order for a percentage increase for length of service, the accounting department of the enterprise must be based on the calculation rules:

- When calculating the additional payment, the length of service obtained only at the main place of work is taken into account. Part-time work does not count.

- Other provisions for calculating the duration of their service apply to certain categories of persons undergoing military service. For example, a month of sunshine can be calculated in one and a half, two months.

- The work experience includes not only the time when a person worked on site, but also time intervals:

- maternity leave;

- the citizen actually did not work while maintaining his job.

- For social workers: the time spent working in government organizations is taken into account, regardless of who the enterprise was subordinate to. Earnings are calculated according to the wage regulations for the category of employees.

IMPORTANT: the employee should not wait long for the bonus for length of service to be calculated. Additional payment is made starting from the next month after the relevant order is issued. Accordingly, the right to it was obtained.

Example:

The personnel service is considering the possibility of awarding a bonus for the length of service to Maria Igorevna Brusnichkina. She works as a teacher. She began her career after college, in 2014, or more precisely on September 16. In three years, in 2021, her experience will be 3 years. She is entitled to 10% of her salary, but only from October.

REFERENCE: the presence of a bonus for length of service does not terminate the rights of citizens working at enterprises to other payments. If a person is entitled to several additional payments, they are added together.

To receive payments, the interested person must provide documents to the personnel service. Their list depends on the category of service. For example:

- for persons passing the Armed Forces - a military ID;

- work book (for employees of government organizations);

- documents (from the archive);

- orders (in case the citizen does not have a work book).

IMPORTANT: the employer cannot refuse to pay bonuses if they are established by law. If their appointment is the initiative of the head of the company, he can cancel the financial incentive.

Preferential pension for teachers based on length of service - will there be changes in 2021?

- The teaching experience includes the entire period of work of a teacher until September 1, 2000, regardless of the fulfillment of working time standards (training or teaching load) at that time. From September 1, 2000, work time will be taken into account in the length of service only when fulfilling the teaching or training load established for the salary rate. Regardless of the volume of teaching load, the work experience for teachers is counted:

- primary classes of general education institutions;

- comprehensive schools in rural areas (except for evening and open shift schools).

- Time spent working as a teacher, teacher-educator or nursery nurse is taken into account in the preferential length of service only until 01/01/1992.

- The term of work as a director (manager or supervisor) before 09/01/2000 is taken into account in full, and after this date - only when conducting teaching activities in the prescribed scope:

- in institutions for children - at least 6 hours per week (240 hours per year);

- in secondary professional institutions education - at least 360 hours per year.

- For employees of institutions of additional education for children, the period of work before 01/01/2001 is counted in full, and after this date it is taken into account only if the following conditions are met:

- as of January 1, 2001, there is at least 16 years and 8 months of work experience in these institutions;

- there is a fact of working in these institutions in the positions provided for in the List in the period from 01.11.1999 to 31.12.2000.

You may like => Can bailiffs describe the property in an apartment if the owner of the property is another person

How to calculate teaching experience for retirement based on length of service?

Teachers, educators and other citizens engaged in teaching activities will be able to apply for an early pension, regardless of their age, after working for 25 years in their profession. As noted earlier, the new pension reform for teachers will not affect the length of service required to receive a preferential pension - it will still be 25 years.

The main nuance is that after the introduction of the pension reform, the retirement date for teachers will also be postponed by 5 years (after the end of the transition period). At the moment, the transition is still ongoing. In 2021 and 2020, the period for taking a cold holiday was increased by only 1.5 years . For 2021, the period will increase by 3 years .

Amount of additional payments

How to calculate the premium? There is no single size of payments, since this indicator is set as a percentage of the salary. Let's look at the example of employees of the Ministry of Internal Affairs:

It is necessary to calculate the salary for an employee of the Ministry of Internal Affairs: salary - 13,000, according to rank - 11,000, length of service - 20 years 1 m. Service life - from 20 to 25 years, he is entitled to a 30% bonus. This is seniority. Let's consider it as a simple example: (13000+11000)*30% = 8600 rubles. Allowance amount: 8600+13000+11000. Total 32600.

The legislator introduced bonuses for employees of the budgetary and military spheres. Commercial organizations, that is, private ownership, are not required to establish additional payments based on length of service. Their presence is the right of the employer and his attitude towards employees. No one can guarantee a citizen additional payments for length of service for working in such an organization.

In order to understand what you should expect, you need to familiarize yourself with the labor and collective agreement, bonus provisions, and other local acts of the company regulating the issue of remuneration.

If additional payments are established at the enterprise, they are determined as a percentage of the salary amount. If an employee was sick or was on a business trip, then usually the bonus is not counted. It is usually set by the employer. The minimum rate is 5%, the maximum is 30%.

If a private company has provided for the payment of a bonus for its staff, then it is obliged to familiarize the employee, upon signature, with the local act where the payment is prescribed. In particular, when clarifying the issue of the allowance, the act reflects the following information:

- size;

- calculation algorithm;

- accrual procedure.

The signature of the employees, indicating that they have read the act, is recorded in a journal or familiarization sheet (Article 68 of the Labor Code of the Russian Federation).

Teacher's salary in 2021: what to expect

- salary. It depends on the number of teaching hours that the teacher worked in one week. Throughout the Russian Federation today, the base rate for a subject is at least 18 hours. If this rate is lower, then the teacher must “reach” the rate through additional classes, including with children who need special learning conditions, for example, home schooling;

- bonus for experience and length of service;

- bonus for methodological work in an educational institution;

- additional payments for conducting extracurricular educational systems (clubs, extracurricular activities);

- regional allowances (for example, northern ones or for special working conditions - in the northern and equivalent regions).

You may like => Who has the right to Chernobyl status

How and what does a teacher's salary consist of?

If changes are made to labor legislation, the level of a teacher’s salary will have to become significantly higher than the minimum wage, at which he is currently in more than 80% of the regions - according to the All-Russian Trade Union of Education Workers.

List of positions of educational support staff: secretary of the educational unit, senior duty officer, duty officer, dispatcher of an educational institution, laboratory assistant, counselor, junior teacher, assistant teacher.

The basis for determining salary is the minimum wage, which cannot be less than the subsistence level. Thus, it is assumed that the new system of calculating salaries for public sector employees will help equalize salaries, but will not reduce them , since both the regional minimum wage and other nuances will be taken into account depending on the specific subject of the Russian Federation.

New payroll system

Since 2021, a new system for calculating salaries for public sector employees has been launched in Russia. It includes a base rate and a tariff scale of 18 categories. Regardless of the region of the country, employees will receive the same salary, since the requirements for wage systems in certain industries are now set not by regional authorities, but by the Cabinet of Ministers.

Today, the number of changes in the amount of wages that will definitely be available to teachers includes the September Order of the Government of the Russian Federation on increasing teachers’ wages by 3% . The Order came into effect on October 1, 2021, which means that its impact on teachers’ salaries will be felt at the beginning of 2021.

Supplement to pension for length of service

According to the explanation of the Pension Fund, citizens receiving pensions cannot count on an additional percentage of the total service life. The fund's specialists had to explain this to the general public due to increasing rumors that pensioners with a long period of service may apply for a recalculation of the benefits they receive. The duration of labor activity is determined when assigning state support.

REFERENCE: In some regions, incentive payments for seniority have been established for pensioners. It is necessary to find out the nuances from the social protection authorities. For example, in the Altai Republic an increase is provided for pensioners for length of service.

Preferential pension for teachers based on length of service: how to retire early under the new law in 2021?

- Every year this standard will increase by 1 year until the final value is fixed in 2023 ( 5 years ).

- In 2021 and 2021, preferential conditions for retirement will apply - payments will be processed six months earlier than planned. This means that for those who have completed their service in 2021, the receipt of their pension will be delayed only for one and a half years instead of two.

Due to pension reform, the date of assignment of pension is postponed:

Employees of the pedagogical sphere carry out their activities in special working conditions. Therefore, a number of state privileges are provided for them. The state guarantees teachers the opportunity to retire earlier than the majority of working citizens. Read the latest news about the conditions and rules for early retirement according to the length of service for teachers in 2021, who has the right to early retirement according to the new law, and how to retire early according to the new law.

It turns out that teachers who, by law, will acquire their right to a preferential pension in 2026, will only be able to receive it in 2034, that is, after 8 years. It turns out that the retirement age of teachers will increase, despite the remaining working experience of 25 years.

What does the salary of Russian teachers consist of? How is the salary increase for teachers planned from September 1, 2021 and how much will it actually be increased? Increase teachers’ salaries by 200%. It is precisely this coefficient, according to Decree of the President of the Russian Federation No. 599 of 2021 (“”), that was included in the dynamics of a systematic increase in wages for workers in the field of education and science.

Increase in long service bonus in 2019

If there are special conditions, a certain category of citizens can count on an increase in the premium:

- Obtaining the status of “Veteran of Labor”.

- Women with 30 years of experience – additional accrual of one pension point.

- Men - with more than 35 years of experience - similar enrollment.

- Men with a duration of 35+5 years – a conversion of 5 coefficient units occurs.

In addition, citizens who have worked in the field of agriculture with more than 30 years of experience are entitled to apply for the bonus.

The premium is fixed at 25%. Order a free legal consultation

Length of service for employees of the Ministry of Internal Affairs and military personnel

After working for two years, employees are entitled to an additional payment to their monetary remuneration.

Its size cannot exceed 40%. Such monetary incentives are possible if the labor activity in the Ministry of Internal Affairs lasts more than 25 years. In other cases, it is graduated, starting from 10% (2-5 years), adding 5% every 5 years. Exception: 25 years of experience: increase – 10%. Read about the long service bonus for military personnel.

In the video, the length of service of employees of the Ministry of Internal Affairs: