Reasons for forming the clarification

There may be many reasons for a company to create an updated document. For example:

- The company's accountant discovered discrepancies in the report, which had already been submitted to the Pension Fund of the Russian Federation.

- In the quarter, which has not yet ended, it turned out that it would be necessary to recalculate insurance premiums for previous reporting periods. For example, an employee went on vacation, which he has not yet earned (in advance), and now he is resigning, so part of the paid vacation must be returned, which is done by the accountant.

The correctness of filling out the updated document depends on the mistake made. For example, the RSV-1 adjustment for the 1st quarter of 2016 will be submitted in the next period. If the error was discovered later, you will also need to fill out a corrective report, indicating the type in section 6.

The adjustment document must be filled out according to certain rules.

Procedure for submitting the RSV form

Calculation of insurance premiums is provided by payers to the tax office at their location quarterly no later than the 30th day of the month following the reporting month. The report is completed throughout the year on a cumulative basis. The reporting periods are:

- first quarter;

- first half of the year;

- 9 months;

- year.

If the last day for submitting the report falls on a weekend, the deadline is postponed to the first working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

Calculation of insurance premiums must be provided electronically if the number of employees exceeds 25 people. If not, then the report can be submitted to the Federal Tax Service on paper.

If you are a payer, but did not pay wages to employees during the reporting period, this does not exempt you from filing a report. In this case, the calculation is submitted with zero indicators.

When to make corrections and how to do it

Since the procedure for paying insurance premiums from 2021 is regulated by the Tax Code in Chapter 34, the procedure for making corrections complies with the rules of tax legislation.

Thus, Article 81 of the Tax Code of the Russian Federation provides for the mandatory submission of a corrective report in the event of an error being discovered that led to an underestimation of the tax amount. If the error did not lead to non-payment of tax, then the payer has the right not to submit an adjustment, but to make corrections in the current period.

The procedure for making corrections to the DAM is prescribed in clause 1.2 of Appendix 2 to Order MMV-7-11 / [email protected] The updated calculation is drawn up in the same form in which the primary one was provided. The serial number of the correction must be indicated on the title page.

The correct data from the primary one is transferred to the updated DAM and corrections are made to the incorrect ones.

A special procedure has been established for filling out section 3, intended to reflect information about accruals in relation to each individual employee. It is filled out only for those employees for whom changes are made. For other employees, Section 3 does not need to be filled out in the adjusting report.

To avoid a fine for incomplete payment of social contributions (Article 122 of the Tax Code of the Russian Federation), it is necessary to pay the arrears and late fees to the budget before submitting the updated DAM. Penalties must be calculated in accordance with Article 75 of the Tax Code of the Russian Federation.

Filling out the updated calculation

The general principle for filling out the updated RSV-1 calculation is as follows: it must include not only the corrected data, but also all other indicators of the form, including those that were initially correct. Next, we will consider some of the features of filling out the updated calculation, compiled according to the form that has been in effect since August 7, 2015.

Title page

In the “Adjustment number” field, you must indicate which account updated estimate is being submitted. If the primary calculation is corrected for the first time, then the clarification number will be 001, the second time - 002, etc.

In the “Reason for clarification” field, one of the following codes is entered (clause 5.1 of the Procedure for filling out the RSV-1): “1” - indicators relating to the payment of pension contributions (including additional tariffs) are specified; “2” - the amounts of accrued pension contributions are changed (including at additional tariffs); “3” - clarifications relate to medical premiums or other indicators that do not affect individual accounting information for insured persons.

Please note: if accrued and paid pension contributions are simultaneously updated, it is also necessary to adjust individual information for insured persons. In this case, the code “2” should be entered in the “Reason for clarification” field. By indicating this code, the policyholder notifies the Pension Fund of the Russian Federation that the updated calculation includes adjusted individual information for employees.

Sections 1 and 2

These sections in the updated calculation are filled out according to the same rules as in the initial calculation (except for subsection 2.5.). Sections 1 and 2 of the updated calculation must be compiled again, indicating the correct (corrected) data. There is no need to explain the differences compared to the original calculation.

Regarding subsection 2.5. “Information on packs of documents containing the calculation of the amounts of accrued insurance premiums in relation to insured persons”, it is filled out by policyholders who have entered personalized information in sections 6 of the calculation. Let us remind you that sections 6 of the calculation are formed into packs. The list of packages containing personalized information is reflected in subsection 2.5. Therefore, if, as part of the clarification, the number of sections 6 of the calculation changes, then the content of subsection 2.5 will also need to be changed. (see below for more on this).

Section 3

This section of the calculation is filled out by policyholders who have the right to apply reduced insurance premium rates in accordance with Article 58 of Law No. 212-FZ. For example, subsection 3.2. Section 3 is intended for organizations and entrepreneurs on the simplified tax system who are engaged in “preferential” types of activities, and, accordingly, can pay contributions at a reduced rate (clause 8, part 1, article 58 of Law No. 212-FZ). If when filling out subsection 3.2. If the accountant made a mistake in the initial calculation, then in the updated calculation you need to fill out this subsection again, indicating the correct information.

Section 4

Section 4 of the calculation reflects the amounts of recalculation of insurance premiums from the beginning of the billing period. We are talking about the amounts that the policyholder must pay extra based on the decision of the Pension Fund of the Russian Federation, or in the event of an independent discovery of an error that led to an underestimation of the amount of contributions. In addition, this section is filled out if the policyholder himself has identified that it is necessary to adjust the base for insurance premiums, but has not made any errors in calculating contributions (clause 24 of the Filling Out Procedure).

However, when filling out the updated calculation, no new information needs to be entered into section 4. This section can be included in the adjusted calculation only if this section was filled out in the primary calculation for the adjusted reporting period. In such a situation, the data from section 4 of the primary calculation is simply transferred to the same section of the updated calculation.

Section 5

This section is filled out by organizations that pay remuneration to students for activities carried out in the student team under employment or civil contracts. If it is necessary to correct the content of section 5, then in the updated calculation this section must be filled out again, reflecting the correct indicators.

Section 6

Starting from reporting for the first quarter of 2014, individual accounting information for insured persons is presented as part of the DAM-1 calculation. For this purpose, the calculation form contains Section 6 “Information on the amount of payments and other remunerations and the insurance period of the insured person.” The procedure for clarifying this section raises a large number of questions. Therefore, let us dwell on the features of clarifying individual (personalized) accounting information in more detail.

Who submits the DAM for the 1st quarter of 2021

Calculation of insurance premiums has been introduced since 2021. It replaced several forms that were canceled after the transfer of insurance premiums to the tax authorities: RSV-1, RSV-2, RSV-3 and partially 4-FSS.

Employers making payments must submit the DAM for the 1st quarter of 2021:

- employees working under employment contracts (regardless of its validity period);

- persons with whom GPC agreements have been concluded;

- authors of works under copyright contracts;

- “physicists” under agreements on the alienation of the exclusive right to certain results of intellectual activity, publishing license agreements, license agreements on granting the right to use the results of intellectual activity.

The following employers submit RSV:

- organizations;

- separate sections of Russian organizations that independently pay income to their employees and pay contributions to the budget from it;

- separate units of foreign organizations operating in Russia;

- IP;

- heads of peasant farms;

- an individual without individual entrepreneur status.

Zero RSV is given by:

- the only founders who also serve as CEOs;

- organizations or individual entrepreneurs if they had no activities and no payments to employees during the reporting period;

- heads of peasant farms in the absence of employees and activities.

Individual entrepreneurs, lawyers, private notaries who do not have employees do not submit insurance premium calculations.

On paper or electronically?

There are several ways to submit the DAM for the 1st quarter of 2021:

- On paper - if the number of employees is no more than 10 people.

If during the reporting period you paid income to a maximum of 10 employees, the calculation can be submitted both on paper and electronically.

- In electronic form - if the number of employees is 11 people. and more.

If in the 1st quarter of 2021 income was paid to more than 10 employees, the DAM is submitted exclusively in the form of an electronic document signed with an electronic signature. It is sent to the Federal Tax Service via telecommunication channels (TCC) through electronic document management operators.

Let us remind you that in 2021, the calculation was submitted electronically if the average number of employees who received income for the previous period exceeded 25 people.

Updated calculation of insurance premiums in 2021: example of filling out

Companies are required to submit an updated calculation of insurance premiums in 2021 if, due to an error in the original report, premiums were underpaid. In this article we will tell you in detail when and how to submit an updated calculation of insurance premiums in 2021. An example of filling will help to prevent annoying mistakes.

If additional contributions have not been paid due to an error in the calculation, the tax inspectorate will be fined 20% of the underpaid amount (Article 122 of the Tax Code of the Russian Federation). Sanctions for other tax violations are in the table. However, the policyholder is exempt from the fine if he submitted an updated ERSV before the inspectors discovered the error (clause 1 of Art.

81 of the Tax Code of the Russian Federation).

So, an updated calculation of insurance premiums must be filled out and submitted if you made a mistake in the primary reporting and it led to an underpayment of premiums.

If, due to an error, you overpaid your fees, you do not need to submit an update. However, without an updated calculation, you will not be able to return or offset overpaid contributions.

If an error in reporting did not affect the payment of contributions, in this case you have the right to decide for yourself whether to make an adjustment to the calculation or not.

In the next section, read our recommendations on how to correctly submit an updated calculation of insurance premiums for 2021 in 2019.

Experts from the Glavbukh magazine report

Tax officials promised not to impose fines for non-payment of contributions if the company underestimated the base and the contributions themselves in the quarterly ERSV. The error can be corrected in the annual calculation.

From the material “Tax officers will be less likely to fine for contributions”

How to fill out an updated calculation if there is an error in the employee’s personal data

Let's say you made a mistake in section 3 in subsection 3.1 in your full name. The question arises: is it necessary to submit an update in this case? You are required to submit an updated calculation, since due to an error, incorrect information will end up in the employee’s personal account with the Pension Fund.

Let us dwell on how to submit an updated calculation of insurance premiums if there is a mistake in the last name. The procedure for filling out is as follows.

View 17 examples of filling in for calculating contributions using real numbers

On the title page of the calculation you indicate the serial number of the adjustment – “1–”, “2–”, etc. Next, fill out section 1 and all applications that were in the original calculation without changes. Fill out Section 3 only for those employees in whose information you made an error. The Federal Tax Service explained the detailed procedure for filling out Section 3 in a letter dated June 28, 2017 No. BS-4-11/ [email protected]

In the clarification, fill out two sections at once for the employee 3. In the first, enter erroneous information from the original calculation. Indicate them in subsection 3.1. In subsection 3.2, enter zeros in all lines. In the second subsection 3.1, write down the correct last name of the employee and other data. In subsection 3.2, indicate payments and accrued pension contributions.

A similar procedure must be followed if you indicated an incorrect SNILS or passport data in a single calculation of insurance premiums. Details are in the article “How to replace the employee’s tax identification number and passport when calculating contributions.”

Lyubov Kotova answers,

Head of the Department of Legal Regulation of Insurance Premiums of the Department of Tax and Customs Policy of the Ministry of Finance of Russia

“When calculating contributions, indicate personal data that is relevant on the day when you submit the ERSV to the inspectorate. Please indicate your personal details using your passport or other identification document. After submitting the ERSV, a person’s first or last name may change, in which case do not submit the updated calculation.”

From the recommendation How to clarify the calculation of insurance premiums (ERSV)

How to fill out an updated calculation if you made a mistake in the amount in section 3

Let's look at another situation. You provided correct personal information in section 3, but made a mistake in payments or contributions. You need to decide how to correctly fill out the updated calculation of insurance premiums. In section 3, you again fill out information only for those employees for whom you made mistakes.

On the title page of the updated calculation you put the adjustment number. Next, transfer all the data from the original calculation, but taking into account corrections in payments, contributions, etc. You do not fill out subsections 3.1 and 3.2 for all employees, but only for those whose information you made a mistake.

For these employees, fill out one subsection 3.1 and 3.2. Please provide all correct information in these sections.

Example. How to fill out the specified subsection 3.2 in the calculation of contributions

The organization paid contributions at regular rates in 2021. The accountant submitted the annual calculation of contributions for 2021 in January 2019. However, the accountant later discovered that he had not included in the calculation the employee’s bonus for December 2021 and the contributions accrued from it. Prize amount – 20,000 rubles. We'll show you how an accountant will fill out an updated calculation for 2021.

On the title page he will indicate the correction number “1–”. In section 1, the accountant will show the corrected amounts of contributions payable, taking into account the accrued premium. In subsections 1.1, 1.2 and Appendix 2, the accountant will show payments taking into account the forgotten premium, as well as additional accrued insurance premiums.

In section 3, the accountant will fill out information for the employee. In subsection 3.1 it will show the employee's personal data. Subsection 3.2 contains all accrued payments for October - December 2021, as well as pension contributions. In December, the accountant will show a bonus of 20,000 rubles, as well as additional accrued pension contributions of 4,400 rubles. (RUB 20,000 x 22%). See the sample for completed subsection 3.2.

An example of filling out an updated calculation of insurance premiums in 2019 for 2021

How to fill out an updated calculation of contributions if you did not make mistakes in section 3

Let's look at the last situation. You filled out Section 3 correctly in the original contribution calculation, but made an error in other information. For example, they indicated the incorrect amount of compensation received from the Social Insurance Fund.

How to respond to the request of the Federal Tax Service regarding discrepancies in the ERSV

Source: https://www.glavbukh.ru/art/97150-utochnennyy-rsv-2019-primer

If the RSV-1 adjustment is submitted after the end of the next quarter

For example, you discovered errors in the Calculation for 2015 already at the end of May 2021. Corrections are made in this order (clause 27 of the Procedure, approved by Resolution of the Board of the Pension Fund of January 16, 2014 No. 2p). The first thing you need to do is fill out the correct section 6 of the RSV-1 form that was used in the period for which you are filling it out. For this:

- in subsection 6.3, in the “Reporting period (code)” and “Calendar year” fields, enter the code of the period and the year in which you are making corrections;

- In the “corrective” field of subsection 6.3, put an “X” if you are changing any information. This will mean that the type of adjustment in RSV-1 is corrective. Fill in the remaining lines of subsections 6.1-6.5 in the usual manner with correct information;

- complete subsection 6.6.

When submitting the current RSV-1, include the adjustment to section 6 as part of it. In our example, adjusting section 6 for 2015 must be included in the DAM-1 Calculation for the first half of 2021.

In subsection 2.5.2 of the reporting for the current period, fill in information about the corrections. Reflect the amounts of recalculation of insurance premiums for the previous period on line 120 of section 1 and in section 4 of the RSV-1 for the current period.

How can I clarify the data in the adjustment report?

How to clarify the DAM for the 1st quarter of 2021 if errors were identified by the Federal Tax Service at the stage of incoming control?

The inspectorate must notify the reporting submitter of the discovery of shortcomings (and the resulting non-acceptance of the DAM) by sending him a notification no later than:

- the first working day following the day the report was received in electronic form;

- 10 working days, also counted from the date of receipt, but for a report submitted on paper.

In order for the updated version of the reporting to be accepted by the date of submission of the first (unaccepted) version, it must be submitted to the Federal Tax Service no later than:

- 5 working days from the date of notification made according to electronically submitted reports;

- 10 working days from the date of sending the notification for a paper version of the report.

If the report passes control at the Federal Tax Service upon acceptance, but the submitter of the report, after submitting it, independently identifies errors that require clarification (for example, the calculation does not take into account income subject to contribution at all, or the income is mistakenly classified as non-taxable), then submitting an adjustment DAM for 1 quarter of 2020 will be carried out using the rules contained in Art. 81 Tax Code of the Russian Federation.

When filling out the updated version of the RSV, two things will distinguish it from the original one:

- in the field specially designed for this on the title page, you must indicate the correction number;

- the same correction number is indicated in the corrected information in section 3; in this case, the updated report will only include changed personal information, and those that were initially correct do not need to be resubmitted.

The data in Section 1 should be filled out in the usual manner, but with numbers corresponding to the corrections made.

Correct filling of the adjustment RSV 1

The accountant identified an error in the report, which was submitted, for example, in the 2nd quarter of the reporting period. Now you will need to generate a document with the already corrected data. If the RSV-1 adjustment for the 2nd quarter of 2021 is submitted before the end of the next reporting quarter, then you will need to make the following entries in section 6:

- In field 6.3 “Original” we put X.

- We indicate the number of the clarifying document - “001”.

Next, all fields are filled in as usual with correct data. Then the document is submitted to the Pension Fund.

If the error was discovered when the next quarter was already completed, then the document is filled out in the following order (PFR PP clause 27):

- “6.3”—indicate the period and year of the reporting period in which corrections need to be made. For example, 1 sq. is corrected. 2016, and reporting is submitted in the 3rd quarter, then in the corrective document you need to enter 1st quarter. 2021

- An X is placed in the field for corrective data, which means that the document is already a correction of the previous submitted report.

- The following lines are filled in according to the usual rules with the correct data.

Section 6 contains three types of document forms:

- Initial - if the document is submitted initially.

- Corrective - if errors need to be corrected in the document.

- Undoing - to cancel previous data in the document.

Based on which document needs to be corrected, canceled or the original created, the type of document is selected and marked in the appropriate field. If the reason for the clarification in RSV-1 and its decoding is not entirely clear, let’s see what codes there are for the reason for the clarification and what they correspond to.

| Updated document code | In what case should you use |

| 1 | Changes in information about contributions that have been paid. |

| 2 | Changing the details of contributions that have been accrued. |

| 3 | To clarify information on contributions that were paid to the medical service. fear. |

How to submit an adjustment document

When the reason for the clarification has been identified in the RSV-1 and all necessary corrections have been made, the document must be submitted to the regulatory authority.

The Pension Fund of Russia does not give any special instructions on the deadlines for submitting documents with corrections. Therefore, it can be submitted during the reporting period when the error was discovered (FZ-27).

It can be provided as a separate document or together with the reporting document for the quarter.

If the organization has 24 employees, a document is provided on paper, carefully filled out. If there are more than 25 people on staff, it must be submitted electronically, otherwise it will not be accepted and a fine will be imposed on the organization. The fine will be 200 rubles if reports are submitted in the wrong format. If you submit with errors, the fine will be greater.

This report is submitted quarterly.

It is advisable to avoid filling out clarifying documents, as fines may also be imposed for errors, except in cases where the accountant independently identified discrepancies.

Nuances of submitting a corrective report on the DAM

The DAM corrective report for the 1st quarter of 2021 must be submitted if errors and inaccuracies are identified. Let's consider when filing an adjustment report is required:

Among the most common situations that require clarification, experts name the following:

More complete information on the topic can be found in ConsultantPlus. Full and free access to the system for 2 days.

- Errors were found in the data of insured persons: TIN, SNILS were incorrectly indicated or missing, the address does not correspond to the address classifier (KLADR), etc.

- Differences in the 6-personal income tax and RSV indicators were established. In some cases this is the norm, for example when transferring dividends, but more often these are still calculation errors. If discrepancies are justified, it is recommended to attach an explanation to the calculation.

Note! If errors in the DAM did not lead to an understatement of the tax base for contributions and do not relate to the personal data of employees, an update on the DAM for the 1st quarter of 2021 does not need to be submitted.

When is it necessary to submit an updated calculation?

There are two ways to correct errors and inaccuracies made when preparing the RSV-1 calculation. The policyholder can submit an updated calculation for the period in which errors were made, or take them into account when preparing the calculation for the current reporting period. Which method should be used in this or that situation?

If the policyholder himself reveals the error

Law No. 212-FZ provides for the only case when the policyholder is required to submit an updated calculation. This must be done if the accountant independently discovered errors or distortions in the initial calculation that led to an underestimation of the amount of contributions payable. If the error resulted in an overpayment of premiums or did not in any way affect the amount of premiums payable, then the policyholder has the right, but not the obligation, to submit an updated calculation (Part 1 and Part 2 of Article 17 of Law No. 212-FZ).

At the same time, according to the current Procedure for filling out the RSV-1, the policyholder may not submit an “update” for previous periods, but recalculate contributions in the current reporting period. Moreover, even if the errors he identified led to an underestimation of the amount of contributions. To do this, you need to reflect the additional accrued amount of contributions for previous periods in line 120 of section 1 and in section 4 of the DAM-1 calculation for the current period (clause 3, 7.3, 24 of the Procedure for filling out the DAM-1). You will also have to clarify individual information for employees (submit sections 6 of the calculation with the adjustment type “corrective” or forms SZV-6, if periods before 2014 are being specified). Unfortunately, the Procedure for filling out RSV-1 does not clearly state in what situations it is necessary to recalculate contributions in the current reporting period.

Expert of the “Kontur.Otchet PF” service Elena Kulakova (on the “Accounting Online” forum she writes under the nickname KEGa) believes that this option is more suitable for adjusting data for previous years. But it is better not to use it to correct errors in accrued contributions for previous reporting periods of the current year. After all, if the policyholder in such a situation reflects the additional accrued amount of contributions for previous periods in line 120 of section 1 and in section 4 of the calculation for the current period, then the data in column 3 of subsection 2.1. “Total since the beginning of the billing period” will differ from the organization’s accounting data. Therefore, to correct errors for previous reporting periods of the current year, it is preferable to submit an updated calculation.

If you need to adjust the database, but there was no error

If the policyholder himself has determined that it is necessary to adjust the base for insurance premiums, but he has not made any errors in calculating premiums, then there is no need to submit an updated calculation. In such a situation, according to the current Procedure for filling out the RSV-1, the necessary changes must be made to the calculation for the current reporting period. Section 4 of the calculation is intended for this (for an example of filling out this section, see the article “New form RSV-1: features of filling out and submitting the calculation for the first half of 2015”).

If the error is detected by the inspectors

If, during the check of the RSV-1 calculation, inspectors from the Pension Fund of Russia unit identified an error that resulted in underpayment of contributions, they do not have the right to require the policyholder to submit an updated calculation. Additional insurance premiums accrued based on the results of the audit must be reflected on line 120 of section 1 and in section 4 of the RSV-1 form for the next reporting period. In addition, for employees for whose benefits the inspectors have accrued additional contributions, it is necessary to provide corrective personal accounting information as part of the DAM-1 for the period in which the decision was made based on the results of the inspection.

Five cases when information in the Pension Fund needs to be corrected

If errors are found in the personalized accounting information, the company must correct them within two weeks (clause 34 of the Instructions on the procedure for maintaining individual (personalized) accounting of information about insured persons, approved by order of the Ministry of Health and Social Development of Russia dated December 14, 2009 No. 987n). 1C:Enterprise 8 users can create corrective or cancel information themselves. They are automatically converted into electronic format for transmission as part of a single package.

The greatest difficulty in creating adjustments is not the process of creating them, but the answer to the question: in what case and in what composition should they be submitted? For example, if errors are found in the calculation or payment of contributions, then there is no need to adjust previous periods. It is necessary to make transfers and additional accruals in the current reporting period and reflect them in the ISHD form of the current period. In other situations, adjustments are required. Let's consider these situations in detail.

Information about experience was submitted with an error

An error in information about experience is the simplest case that requires correction. The most common reason for such errors is that documents confirming an employee’s illness or vacation were received by the accountant late, after the personalized information had been transmitted. That is, wages and insurance premiums were calculated on the basis of available information; accordingly, in the outgoing information, the period of vacation or illness was not highlighted in the total length of service. Or even worse - days of vacation or sickness are generally “no longer counted” if absence from work at the time of reporting was registered as “absence for an unknown reason.”

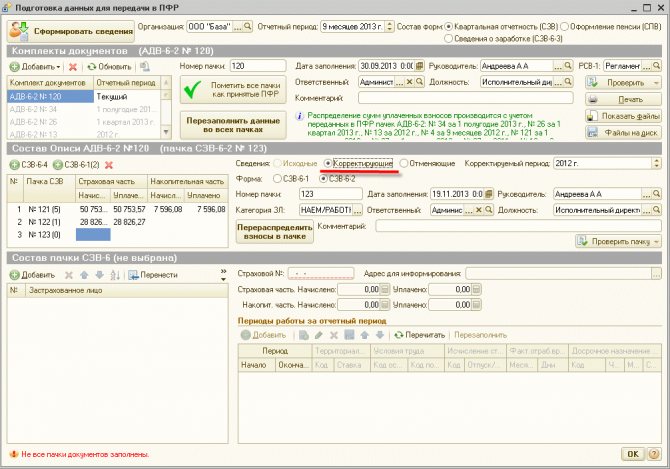

If such an error is detected, you need to create a pack of SZV-6 KORR; to do this, add a new corrective pack at the bottom of the screen in the Contents of the ADV-6-2 inventory (see Fig. 1). Then add the employee whose information is being adjusted to the SZV-6 pack composition and enter the correct record of experience. The amounts of accrued and paid insurance and savings contributions to the Pension Fund do not need to be changed; they must be indicated as they were before. The CORR form is submitted indicating the current period and the period for which the adjustment is being made. The clarifying form RSV-1 for the previous period is not needed.

Rice. 1. Preparation of data for transfer to the Pension Fund

Employee information was not transmitted at all

The situation is much more complicated when information about the employee, his length of service and contributions was not transmitted at all, while the paid contributions were distributed among other employees, that is, they were indicated correctly for the enterprise as a whole. In this case, you first need to create and separately submit to the Pension Fund an ISHD form for the previous period with data on the length of service of the missed employee and with zero amounts of calculated and paid contributions. You need to agree with the Pension Fund of Russia branch on one of the options for correcting the error: adjust the amounts of paid contributions for all employees for the previous period or reflect the payment of contributions of the missed employee in the current period. Depending on the chosen method, a CORR form is generated in the current period indicating the calculated contributions of one employee, or an additional CORR form is generated for all employees indicating the redistributed amounts for the previous period.

As for the accrued insurance premiums, they were probably calculated incorrectly or were not accrued at all, which was the reason for the error. Additional insurance premiums must be paid in the current period. Since the total amount of contributions paid in the previous period does not change, there is no need to generate an updated DAM-1. But if the missed employee’s contributions were nevertheless calculated, but were not included in the outgoing information, then you will have to prepare a clarifying RSV-1. It is also necessary to generate a clarifying RSV-1 in the case where, due to the absence of an employee, the amount of contributions paid was also distorted.

There was a mistake in the employee's insurance number

When submitting information, we made a mistake in the employee's insurance number. In this situation, essentially two mistakes occurred: they did not submit information for one employee and at the same time transferred information to someone else whose number coincided with the erroneous one. Therefore, in the set of information for the current period, you need to include a canceling form for the previous period, containing the amounts previously indicated in the ISHD form, but with a minus sign. In order to be able to include a CORR form with the correct amounts in the same package of documents, you need to separately submit to the Pension Fund the ISHD form with the correct records of experience and zero amounts for the employee, indicating the correct insurance number. The clarifying form RSV-1 for the previous period is not needed.

Error in the category of the insured person

The category code of the insured person in the CORR form must correspond to that specified in the initial information. If the information was calculated at the correct rate, but the wrong category of the insured person was indicated, then the situation is similar to the previous one. The only difference is that you need a clarifying RSV-1 for the previous period.

Sources

- https://saldovka.com/nalogi-yur-lits/vznosyi-v-pfr-i-fss/utochnennyiy-rsv-1-prichinyi.html

- https://ppt.ru/art/buh-uchet/rsv-korrektirovka

- https://www.klerk.ru/buh/articles/497020/

- https://macros-ht.ru/spravochnik/rsv-prichiny-utochneniya/

- https://nalog-nalog.ru/strahovye_vznosy/edinyj_raschet_po_strahovym_vznosam/korrektirovka_rsv_za_1_kvartal/

- https://nsovetnik.ru/strahovye-vznosy/kak-sdat-korrektirovku-rsv-za-1-kvartal/

- https://buh.ru/articles/documents/33784/

How to submit an adjustment under the RSV: hot questions and examples of filling out

The corrective form is submitted only if the original one is accepted. If the original report received a refusal to accept it, you need to correct the shortcomings and resend the original one.

The corrective form always includes Section 1 with appendices 1 and 2 (or Section 2 in the case of peasant farms). The presentation of other sections and applications depends on the situation. Let's look at the most common scenarios.

If employee data does not need to be adjusted

In this case, the report includes only data on the organization with the adjustment number on the title page. There is no need to include employee data in the report. To remove employees from the report, uncheck them in Section 3.

If Section 1 is in automatic calculation mode, be sure to update the list of employees. For example, Kontur.Extern calculates amounts for all employees in the list, regardless of whether they are selected or unchecked. Check the box only for those employees who should be included in the adjustment report.

Also, in some systems, for example in Externa, amounts for employees and for the organization are reconciled only in the original report. To check the adjustment, use the following algorithm.

Algorithm for checking a corrective report

- Remove the correction number from the title page, if it is there.

- Update the list of employees in Section 3.

- Set the fields in Section 1 applications to automatic mode.

- Check the relevance of the data in previous periods.

- If the data is not up to date, download reports in pre-import mode into the service.

- Run the scan. Correct errors if any.

- Put the correction number on the title page.

- Generate and send a report.

If you report through Kontur.Extern, the task is simpler. The system will warn you if you try to send a report with the details of a previously sent report.

Here are some tips:

- If the Federal Tax Service has accepted the initial report and you want to send an adjustment, the system will tell you which number you need to indicate.

- If the initial report has not yet been accepted, Extern will inform you that it is too early to send the adjustment and will advise you to wait for a response from the Federal Tax Service.

- If the primary report is rejected, Extern will warn you that before sending the adjustment you must submit the primary report with number = 0.

Reporting through another system? Connect to Extern with a 50% discount (not valid in all regions).

Catch a discount

If you need to adjust data on employees in Section 3 (except for full name and SNILS)

On the title page, indicate the correction number (for example, “1–,” “2–,” and so on). According to the filling procedure, include in the form only those employees for whom you need to correct the data.

For each employee, indicate the adjustment number, keeping the serial numbers. Unused numbers can be added to new employees.

Please note: checks in the service work for all employees only if the title has an adjustment number = 0. To check the report, use the above algorithm.

Please indicate the correction number on the title page. For example, “1–”, “2–”, etc. Then create two employee cards and send them in one calculation:

- With incorrect SNILS, zero (deleted) Subsection 3.2 and adjustment number “1”. In lines 160-180, indicate the sign “no”.

- With the correct SNILS, correct amounts in Subsections 3.2.1 and 3.2.2, adjustment number “0” and a new serial number of the employee (not previously used).

If the error in the full name and SNILS was formatted and last quarter it was possible to send a report with it, but now it is not (for example, numbers and dashes in the full name, spaces at the end of the full name, incorrect SNILS), check with the inspector what to do.

Example 1: SNILS is not the same, but real

In the original report, instead of Ivanov Ivan Ivanovich working in the organization with SNILS 001-001-002 13, Ivanov Ivan Ivanovich with SNILS 001-001-001 12 was indicated. Both SNILS numbers exist and can be loaded into the Federal Tax Service database.

To prepare the adjustment, we create two employee cards. The first is with an error that needs to be corrected, the second is with data that should be in the report.

On the first card in Section 3, tick Ivanov Ivan Ivanovich with SNILS number 001-001-001 12. In his card:

- Specify a non-zero adjustment number;

- In lines 160-180, mark “No”;

- Remove section 3.2.

In the second card in Section 3, tick Ivan Ivanovich Ivanov with SNILS number 001-001-002 13. In his card:

- specify the correction number = 0;

- Fill in the correct information for the remaining positions.

Example 2: non-existent SNILS

In the original report, instead of Ivanov Ivan Ivanovich working in the organization with SNILS 001-001-001 12, Ivanov Ivan Ivanovich @ was indicated! with SNILS 001-001- 002 18.

Such SNILS should not pass the check for the control ratio, and the full name should not be checked according to the scheme. The Federal Tax Service should not have accepted such a report. If this happens, contact the inspector for clarification.

If you forgot to include an employee in the original report

Include the forgotten employee in the adjustment form with the adjustment number in the employee card = 0. The amounts in Section 1 and Appendices 1 and 2 to Section 1 change taking into account this employee and are indicated as they should be throughout the organization).

Please note that each time you send a new correction, you must put a new number on the title page.

Report for employees through Kontur.Extern. Loading data into RSV from SZV-M. Importing data from 2-NDFL 5.06. Zero RSV in no time. Free for 3 months.

Register

If an employee was included in the original report by mistake

Submit the adjustment to this employee by deleting Subsection 3.2 from his card. In lines 160-180, indicate the sign “no” and reduce the number of insured persons in lines 010 of Appendices 1 and 2. The amounts in Section 1 and Appendices 1 and 2 to Section 1 change taking into account this employee, that is, they are reduced.

This way you will reset the data on it in the Federal Tax Service database. We advise you to coordinate further actions with the inspection.

If you included one employee instead of another

Both employees must be included in the corrective report:

- Unnecessary - with zero (removed) Subsection 3.2 and adjustment number “1”. In lines 160-180, indicate the sign “no”.

- Required - with correct data, correct amounts in Subsections 3.2.1 and 3.2.2 and adjustment number “0”.

Section 1 with Subsections 1 and 2 needs to be adjusted: subtract the amounts of the erroneously added employee from the total amounts of the organization and add the amounts for the employee who was forgotten to be included.

If the right to apply a reduced tariff has been acquired/lost (recalculation of contributions from the beginning of the year)

In the clarifying calculations for previous reporting periods in Appendix 1, indicate the new tariff code (08/02). Change the contribution amounts in Section 1 and Appendices 1 and 2 to Section 1 to take into account the new tariff.

All employees must be included in the corrective report. In each employee’s card, indicate an adjustment number other than 0, maintaining the serial numbers of the employees. In Subsection 3.2.1 you need to indicate two categories of the insured person (NR and PNED):

- the old category with zero amounts.

- a new category with the correct amounts.

Source: https://kontur.ru/articles/5615