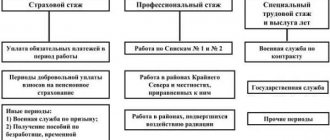

Does part-time work count towards length of service?

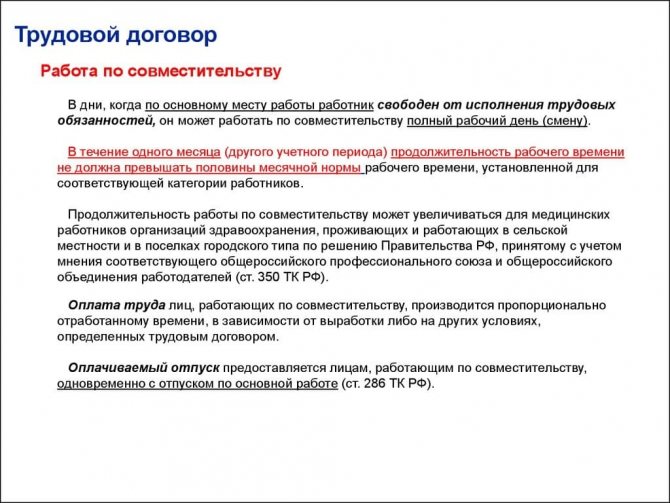

As stated in Part 1 of Art. 11 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, the insurance period (before the pension reform of 2002 it was called labor) includes all periods of work performed in the territory of the Russian Federation, during which insurance contributions were paid to the Pension Fund. At the same time, employees working part-time, in accordance with Art. 287 of the Labor Code of Russia have equal rights with those who work in their only (or main) place of work. Also, part-time workers can count on all labor guarantees and compensation in full.

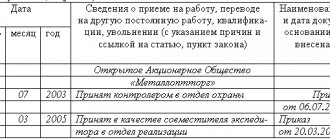

Important: an employee can confirm the fact of working as a part-time worker when applying for a pension, including by submitting an employment contract drawn up in accordance with Art. 60.1 TK.

The employer has a relationship with the employee’s social insurance, according to subclause. 1 clause 1 art. 9 of the Law “On the Fundamentals of Compulsory Social Insurance” dated July 16, 1999 No. 165-FZ, arise from the moment the employment contract is concluded. Consequently, the obligation to pay insurance premiums for an employee arises immediately after the conclusion of the employment contract. Thus, we can make an unambiguous conclusion that for a part-time employee who has entered into an employment contract, the time spent performing his work activity will be fully included in the insurance period.

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

Features of provision

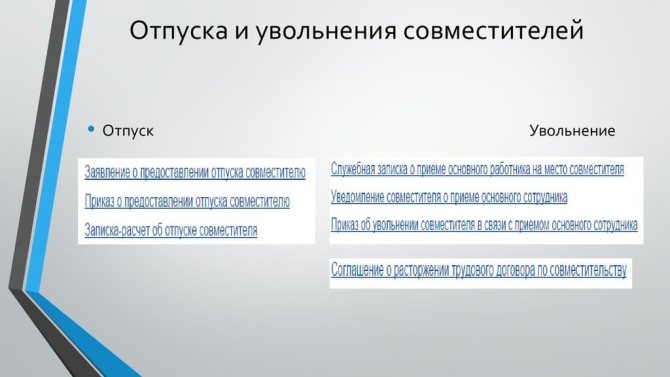

Maternity leave for women working part-time is calculated on a general basis, and she has the right to receive maternity payments from each employer. Since the workload of additional work may be insignificant, women often take maternity leave at their main place of work, while continuing to work part-time.

We recommend that you read how maternity payments are calculated in this material.

Additional work that is not formalized by an employment contract does not give the right to receive any payments.

What is included in the length of service when working part-time during maternity leave?

According to clause 3, part 1, art. 12 of Law No. 400-FZ, the period when an employee is on maternity leave at his main place of work is counted towards his insurance period. Moreover, in Part 5 of Art. 256 of the Labor Code states that this period is counted towards the total continuous labor and professional experience.

While on maternity leave at their main place of work, maternity workers can take part-time jobs under conditions that do not contradict Art. 282 TK. As mentioned above, during the period of part-time work, the length of service continues to be calculated, but it is not summed up with the same calendar periods of being on maternity leave (i.e., the length of service is simply counted for the general period). In addition, working part-time while on maternity leave does not provide the employee with any privileges for early retirement.

As for the insurance period, in this case the subsequent calculation of the pension and determination of the amount of sick leave is influenced by the fact that insurance premiums for the part-time employee continue to be paid by the employer from the additional place of work.

***

Thus, although labor legislation does not directly determine whether part-time work is included in the total length of service, an analysis of the Labor Code norms regulating the working conditions of part-time workers and the guarantees provided to them, as well as the norms of Law No. 400-FZ, allows us to conclude that this The period of work is included in the length of service.

Ticketing

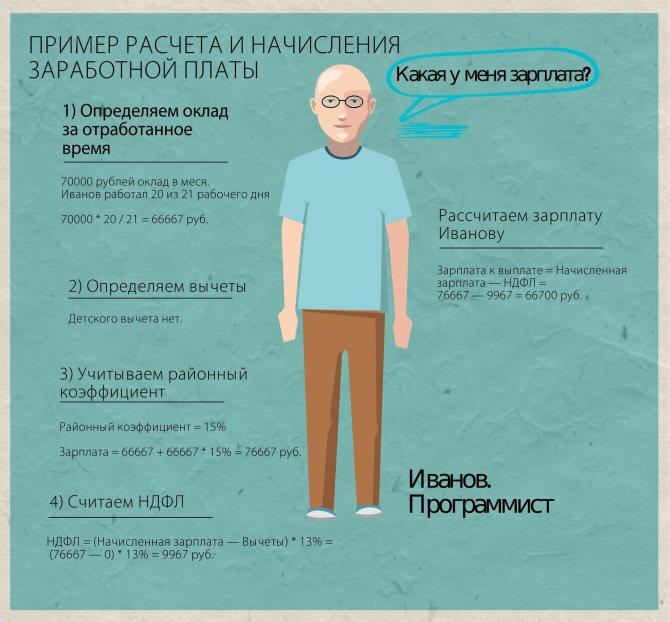

In order to receive all the required payments, the part-time worker must be officially employed under an employment contract. The accrual of funds to internal and external part-time workers has a number of significant differences.

External

The procedure for paying financial resources to an external part-time worker is determined by work activity over several years. Usually the last two years are used for calculation. The following situations may occur:

- part-time worker worked in the same organizations as currently;

- part-time worker worked at other enterprises;

- the work was performed both at the last place of work and in other organizations.

If a part-time worker has worked for more than two years, then he provides as many sick leaves as he has jobs. In this case, monetary compensation is paid by all employers. This provision is regulated by the second part of Article 13 of Law No. 255-FZ.

If the insured person performed his professional duties in several organizations, and during the two years preceding the insured event, worked for other policyholders, then any types of payments are made at one place of work. It is chosen by the employee himself based on financial benefits. This applies not only to payments for sick leave, but also to payments for maternity leave and the period of child care.

In this situation, only one sick leave is issued, but in addition to it, the following documents are submitted:

- certificates of all income from each place of work;

- a document confirming that no payments were made by other employers.

In the absence of these documents, cash payments may be denied. If there are several sick leaves, payments are made for each of them.

Internal

When calculating monetary compensation to an internal part-time worker, the calculation is made based on the average daily earnings.

It is calculated on the basis of all employee income received within two calendar years. Income also includes payment for part-time work. In this case, only one sick leave is issued. The insurance period for a part-time worker is calculated in accordance with Article 16 of Law No. 255-FZ. Calculation is carried out on a calendar basis. If several periods coincide in time, then only one of such periods is counted towards the length of service. Work experience affects the amount of payments, which are made as follows:

- less than 5 years of experience – 60% payment;

- experience from 5 to 8 years – payment of 80%;

- worked for more than 8 years - 100% payment.

The rules for calculating and confirming insurance experience can be found here.

The main document to confirm work experience is the work book. It must be located at the main place of work, and its certified copy is used for all calculations.

What the law says

Unfortunately, the very concept of external combined experience is simply absent. Remembering the pension reform, it should be taken into account that at the current moment the main role is played by length of service, namely the job at which insurance contributions were made.

The length of service includes the time when a citizen received material funding for completing an author’s order. The main thing is that annual contributions do not fall below the established threshold. Otherwise, the number of months will be taken into account in proportion to the amounts contributed.

Does part-time work count towards your pension? Answer in video:

For better understanding, let's give an example. If, with this type of activity (combined), only 50 percent of the minimum insurance premium is paid to the Pension Fund, then only six months of work will be taken into account. In this case, the additional work may indeed be taken into account.

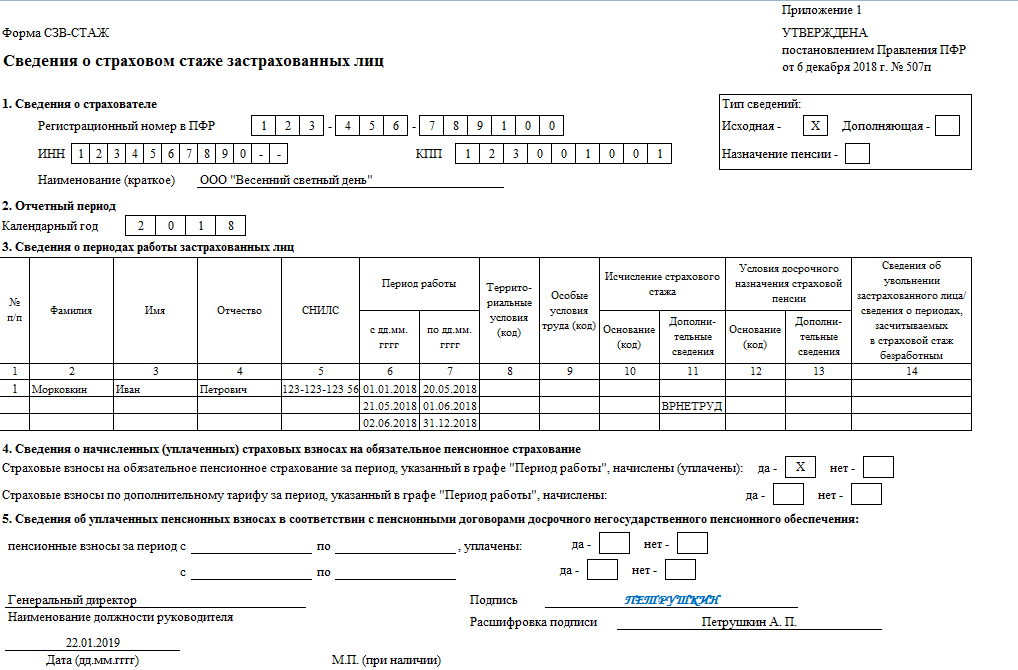

SZV-experience report

Part-time work, like regular work activities, must be displayed in a mandatory form in the SZV-experience certificate.

What exactly is written:

- Activities carried out under an employment contract;

- Services provided under the author's agreement;

- Registration under a civil agreement.

What salary will be paid for caring for pensioners? Read more at.

The last mentioned work is usually carried out on an irregular or reduced schedule. In this case, it is worth thinking that the actual time worked is taken into account in the Pension Fund.

If we consider the recommendations for filling out the certificate, then it should contain information about the time actually worked and the interest rate. Sometimes the problem arises because the legislation does not provide clear language on this issue.

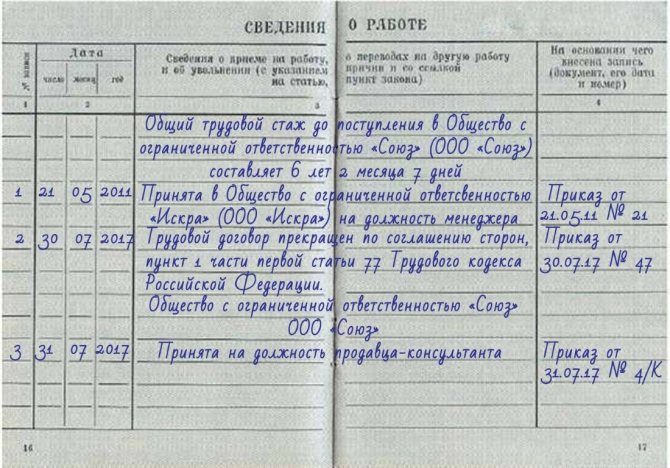

Record of work experience. Photo 26-2.ru

Although most personnel workers still include information about part-time work in the SZV-experience statement.

Legislation

Part-time work is a rather complex area of industrial relations, regulated by the Labor Code of the Russian Federation in its latest edition, adopted on July 19, 2021. Thus, Article No. 282 of the Labor Code of the Russian Federation explains the general provisions of part-time work. Article No. 44 talks about the rules for concluding employment agreements. Article No. 60, in several paragraphs, describes the principles of part-time work in more detail. Article No. 276 regulates the part-time work of executives, and Article No. 348 describes the principles of part-time work for coaches and athletes.

Calculation of part-time experience

When considering this type of work as under an author's contract, we have already touched upon this point. In this case, everything is quite clear. But how to count if part-time employment occurs simultaneously with the main activity.

In the calendar plan, work overlaps one another. In fact, it is necessary to take into account insurance premiums for both working periods. This is what is of decisive importance when calculating pension payments. In this case, the logic of the Pension Fund is quite simple and clear.

The amount of the insurance premium paid will ultimately be counted. If we talk about the number of days (months, years) worked, then this only matters if a person is going to retire before the deadline. Such a measure will be extremely beneficial for a number of professions, for example teachers.

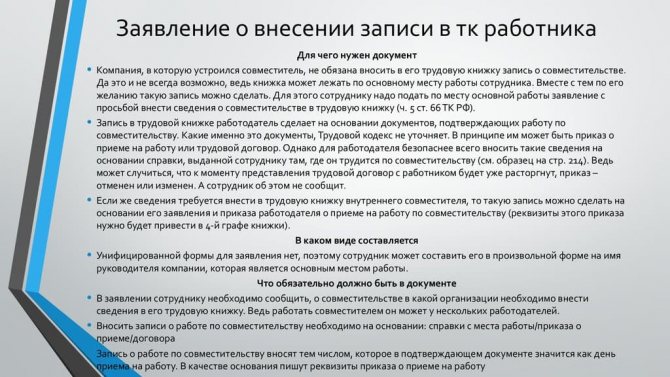

Is an entry required in the work book?

It should be understood that part-time work is usually not included in the work book. However, citizens are faced with the fact that the Pension Fund categorically does not want to include in the calculation periods that were not indicated in the specified document. What to do in such a case?

Calculation of experience. Photo novostipmr.com

In fact, such statements are not true. The fact is that when calculating, they pay attention not to what is written in the document, but to the information that is indicated in a specialized accounting database. Accordingly, if information about insurance deductions is available in the database, then the citizen has nothing to worry about.

Working nuances

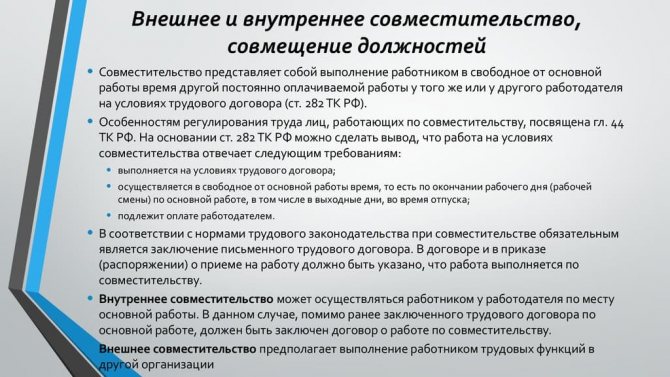

Part-time work can be internal and external. With internal part-time work, an employee performing certain duties can do additional work for his employer. In this case, an additional employment agreement will be required.

It is not allowed to force an employee to perform part-time work without his consent.

It is allowed for an employee to hold multiple jobs in the same position. Thus, a teacher at an educational institution can teach one subject and, as a part-time student, give lectures on another subject. Internal part-time work is not a system for receiving one-time tasks, but is associated with the regular performance of professional duties. When registering an internal part-time job, HR employees make an appropriate entry in the work book. In case of external part-time work, the employee himself decides on the need for such an entry.

External part-time work involves performing professional duties for another employer in your free time from your main job.

The number of organizations for external part-time work is not limited.

Part-time work contains the following positive factors for an employee:

- receiving additional funds;

- increase in pension provision;

- the opportunity to learn a new profession.

As a result of improving their qualifications or mastering a related profession, an employee can increase their professional status and count on a more prestigious position. An employee working part-time has the right to all social guarantees that are associated with vacation, sick leave and accounting for length of service. In addition, part-time workers are subject to the following nuances related to the performance of professional duties and internal regulations:

- disciplinary violations;

- failure to perform one's duties in good faith;

- achievements in work.

Warnings for violations of discipline, as a rule, are not entered in the work book, with the exception of the dismissal of an employee under a negative article of the Labor Code. Incentives and gratitude, on the contrary, are always recorded in the employment document.

Despite the fact that the relationship between employer and employee is clearly regulated by articles of the Labor Code and other legislative acts, violations in this area are very common. Therefore, it is very important that such relationships are documented.

Combination during maternity leave

Another important point is when a person, while on maternity leave, finds a part-time job. Will this time count? As in previous cases, labor activity goes into the general “piggy bank” if the employer has made the appropriate contributions.

However, with regard to calendar time, since there is no overlap with the main activity, combining it during maternity leave cannot in any way affect early retirement.

Who can retire early? Watch the video:

The same applies to sick leave for temporary disability. If during a given period a citizen was engaged in a combination of jobs and made deductions, this is also taken into account in the calculation.

What penalties does the bank impose on a loan? Read more.

What conclusions can be drawn from all of the above? First of all, the legislation does not provide clear language on this issue. However, both the employer and personnel officers often act in the interests of employed citizens.

What should they consider themselves? In order for the combination to have a positive effect when calculating a pension, it is necessary to make insurance contributions for the entire period of work.

Many citizens quite naturally have a question: is study included in the length of service? It is relevant both for students who are currently studying and for those who are soon to retire. Let's look at this in more detail.

What is total work experience?

Current legislation does not define the concept of length of service. However, based on the provisions of Article 20 of the Federal Law “On State Pension Security,” we can conclude that it is the time during which the citizen carried out labor and other socially useful activities.

It should be noted that the concept of “work experience” is gradually becoming a thing of the past and is a kind of atavism in Russian legislation. After the pension reform, a different type of experience began to play a leading role in calculating pensions - insurance, which is understood as the periods during which the employer transferred legally established insurance contributions to the Pension Fund of the Russian Federation, and, more recently, to the Federal Tax Service. Labor without it actually does not play a role in assigning payments and determining their size, since only those periods that are also periods of insurance coverage are counted in it. The exception is cases of preferential retirement provided for in Article 27 of the Federal Law “On Labor Pensions” - in some situations provided for by this rule of law, the insurance period does not matter.

Is training included in the experience?

Before the 2002 reform, studying at a higher educational institution or technical school was included in the work experience. After the reform, it was not taken into account, with certain exceptions (for example, such an exception was training in some higher educational institutions).

After the adoption of the Federal Law “On Insurance Pensions” in 2013, exceptions allowing the inclusion of study time in the total duration of working activity became even fewer (for example, periods of study in higher educational institutions were not taken into account at all). This is primarily due to the fact that currently only those periods of work during which the insurance period is valid are considered to be work experience. And while a person is studying, his insurance experience is not counted, since at this time no one is paying insurance premiums for him, from which the citizen’s pension will subsequently be formed.

Despite this, for those who studied before the reform, the years of study are included in the total length of service and are taken into account when assigning payments and calculating the total duration of a citizen’s working life.

Let's look in more detail at whether work experience is included when studying in:

- school;

- technical school;

- vocational school;

- college;

- higher education institution;

- military and departmental educational institutions.

At school

Years of study in college are not counted towards work experience. However, in this case there are exceptions. Thus, persons studying in medical schools can count on including their studies in the preferential length of service for the appointment of an early pension for a medical worker. However, this exception applies only under one condition: before entering study, the citizen must already be working in a medical institution. If he enters a medical school immediately after school, the time spent studying there will not be counted towards his length of service. In addition, while studying there is no insurance period, which ultimately will also affect the doctor’s final pension.

At the technical school

As a general rule, studying at a technical school is not included in the periods of a citizen’s working life.

In vocational school

The time during which a citizen studies at a vocational technical school, or vocational school, is also not included in the length of service.

In college

Studying in college is not considered a period of a citizen’s working life, and therefore is not taken into account when assigning pension payments to him.

At a university (institute, university, graduate school)

Higher education institutions include:

- institutions;

- universities;

- academy.

Training in them is also not taken into account when determining the total length of work experience. This rule also applies to postgraduate training (for example, postgraduate studies).

For medical workers studying at the relevant universities, the same rule applies as for students of medical schools: the period of receiving education is included in the preferential medical period, but only on the condition that before admission the citizen had already worked in a medical institution.

True, in all of the above cases, inclusion in the length of study in various educational organizations occurs if the student, while undergoing training:

- officially works under an employment contract in his free time from studies;

- serves in state civil service or municipal service;

- is an individual entrepreneur and pays insurance premiums for himself;

- is self-employed and also pays insurance premiums for himself.

In the Ministry of Internal Affairs

When studying at various departmental educational institutions (universities of the Ministry of Defense, Ministry of Internal Affairs, Federal Penitentiary Service), cadets have the right to include the training period in their total service time. True, such inclusion occurs on the basis of one year of study for six months of full-time service. Include no more than five years of study. That is, if a cadet decides to continue his postgraduate studies with the aim of obtaining an academic degree, this time will not be counted towards his length of service.

Another benefit is provided for law enforcement officers and military personnel. If they graduated from a civilian university, and not a departmental one, and after that entered the service, the period of study at this university will also be included in their length of service (remember that for all other citizens it is not included in the total length of service). Time spent studying at a civilian university is added to length of service on the same basis as studying at a departmental educational institution - at the rate of one year of study for six months of service. At the same time, it is not at all necessary that the university where the citizen studied has a military department.

You can learn about what is included in the length of service for granting a pension and in what cases studies are included in it from this video:

Thus, as of 2021, periods of study are not included in the length of service and are not taken into account when determining a pension. The exception is departmental and military universities - for their cadets, the period of training in these educational organizations is added to their length of service. Also, some relaxations apply to medical workers. However, those who studied before the 2002 pension reform have the right to count on the inclusion of periods of study in the total time of working activity.

Dear readers! If you need specialist advice on pensions and state benefits, we recommend that you immediately contact qualified practicing lawyers on social issues:

Moscow and region

St. Petersburg and region

You can also tell the online consultant:

Dear readers! If you need specialist advice on pensions and state benefits, we recommend that you immediately contact qualified practicing lawyers on social issues:

Moscow and region

St. Petersburg and region

Is full-time study at a technical school in Soviet times included in the length of service for a pension?

Hello Svetlana! The question can be considered from two sides:

1) Article 13 of Federal Law-400:

8. When calculating the length of service in order to determine the right to an insurance pension, periods of work and (or) other activities that took place before the entry into force of this Federal Law and were counted towards the length of service when assigning a pension in accordance with the legislation in force during the period of implementation work (activity) may be included in the specified length of service using the rules for calculating the relevant length of service provided for by the specified legislation (including taking into account the preferential procedure for calculating length of service), at the choice of the insured person.

The previous law determined - Federal Law-173, paragraph 4, article 30:

For the purpose of determining the estimated size of the labor pension of insured persons in accordance with this paragraph, the total length of service is understood as the total duration of labor and other socially useful activities until January 1, 2002, which includes:

periods of preparation for professional activity - training in colleges, schools and courses for personnel training, advanced training and retraining, in educational institutions of secondary vocational and higher vocational education (in secondary specialized and higher educational institutions), stay in graduate school, doctoral studies, clinical residency;

And Law 340-1:

Article 91. Study included in the total work experience Preparation for professional activity - training in colleges, schools and courses for personnel training, advanced training and retraining, in secondary specialized and higher educational institutions, stay in graduate school, doctoral studies, clinical residency is included in the total length of service on a par with the work listed in Article 89 of the Law. Then the study will only be included in the calculation of pension capital as of 01/01/2002, but not in the insurance period.

2) Either this leads to the second conclusion - since earlier, according to Law 340-1, studies were counted against length of service, then now they must be counted not only for calculating pension capital, but also in the insurance period for determining the right to a pension.

But the first option will work.

Is part-time work included in the length of service?

Work experience when working part-time is actually the amount of contributions made by the employer to the Pension Fund. Let's find out how it affects the calculation of pensions. ConsultantPlus TRY FREE Get access

The number of years worked affects the amount of your future pension. But there are different forms of employment. Some people combine two jobs, others simply work part-time or a week. But is part-time work included in the length of service and will such earnings count towards retirement?

Cases provided for by law

The legislation spells out all the provisions relating to payments to a person working part-time. This is very important because it is directly related to the insurance period. When working part-time, the corresponding amounts are deducted from the employee in the Social Insurance Fund, therefore, when applying for sick leave, certain requirements must be met. They are spelled out in Chapter 1 of Law No. 255 FZ.

When applying for a certificate of incapacity for work, the patient of the medical institution must inform the doctor about all places of work, if there are several of them. In this case, several forms are filled out and provided to the personnel department of each organization. In this case, a sick leave certificate is issued at the main place of work, and for places of work where the patient works part-time, documents with the appropriate marking are presented.

The legislative framework

Let us turn to Federal Law No. 400-FZ of December 28, 2013. In Article 3 there is no such concept as the length of service of an external part-time worker. She recommends taking into account the total duration of periods of work. The text does not specify the form of employment. Article 11 states that the main thing is the calculation and payment of insurance premiums for the period of employment.

In accordance with Article 13, this condition applies even to citizens who received remuneration under copyright contracts. If the total amount of deductions for the year is not lower than the minimum established, the author is credited for the full year worked.

If less, then the number of months is determined in proportion to the amounts paid. For example, if you paid 50% of the minimum amount to the Pension Fund, you received six months of external part-time work experience. Thus, there is no reason to doubt: it turns out that part-time work is included in the length of service.

How to calculate the length of work experience for part-time workers

Speaking about how part-time work experience is considered, we note that, in accordance with Article 11 of Federal Law No. 400-FZ, periods of working activity are included in insurance experience. There is no differentiation between main work and additional work.

The main feature of the period that is counted in the insurance biography is that during it insurance premiums were paid for the worker. Part-time work experience is included in the length of service, because additional work presupposes official employment and the conclusion of an employment contract and entails the employer’s obligation to pay contributions.

Thus, part-time work is included in the length of service and is important when assessing pension rights. In addition to deciding whether part-time work is included in the length of service, it is important to remember the insurance premiums paid for the part-time worker. Payment of insurance premiums affects how part-time work experience is taken into account: if a payment is received from the employer, the current month is counted in the citizen’s work history. If you didn’t enter, they didn’t count. The total amount of contributions paid is important for calculating the individual pension coefficient. This is the value that is necessary to determine a citizen’s right to an old-age insurance pension and calculate the amount of his monthly pension.

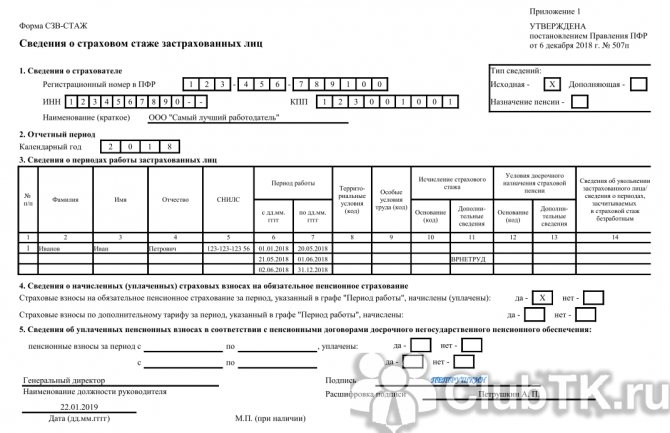

Report on the SZV-STAZH form for external part-time workers

Appendix 5 to Resolution of the Board of the Pension Fund No. 507p dated December 6, 2018 explains how to fill out this form. It specifically mentions:

- working under an employment contract;

- workers under a copyright contract;

- executed under a civil law contract.

The last two categories of employees often work less than five days a week and eight hours a day. And this suggests that the time worked part-time is taken into account by the Pension Fund.

From the recommendation on filling out section 3 “Information about the period of work”, we learn that we need to reflect the actual time worked or the share of the rate. From this we can also conclude that the experience of a part-time worker in the self-employed worker is included.

However, there is no clear wording in the legislation. Therefore, personnel officers, when deciding whether to include external part-time workers in SZV-STAZH, usually proceed from the principle “what is not excluded” is included. The main thing is that the relationship with the employee is formalized, and contributions are deducted stably.

Sample form filling

Is it necessary to display part-time workers in reports?

Every year, all employers, including legal entities, individual entrepreneurs, lawyers, notaries, must submit reports for the past year to the regional division of the Pension Fund by March 1 of the current year. The document contains data on all persons for whom the employer pays insurance premiums, including workers:

- under an employment contract;

- civil contract;

- author's order agreement.

The procedure for filling out this form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p. The procedure does not explain whether part-time workers are included in SZV-STAZH, but given that such employment is formalized by an employment contract, it is obvious that employers are required to submit information about them. SZV-STAZH part-time contains the same information as for employees working at their main location:

- FULL NAME. employee;

- his SNILS:

- work period;

- special working conditions;

- availability of grounds for early assignment of pension.

SZV-STAGE for external part-time workers is filled out in the usual manner, as for main employees. It is not necessary to indicate separately that the employee is an external part-time worker; the answer to the question of whether to include external part-time workers in SZV-STAZH is clear - yes, otherwise the employer who concealed information about the insured person will face a fine.

The EXPERIENCE report to the Pension Fund of the Russian Federation for an internal part-time worker has its own peculiarities: it assumes that the person works in two positions for the same employer. If none of these positions gives the citizen the right to early retirement, information about him is indicated in one line. If one of the positions gives such a right, work experience in it should be indicated on a separate line. Thus, two report lines are dedicated to the same employee.

How is part-time experience considered?

Speaking about the authors, we have already partially answered this question. Let's consider the situation as a whole, regardless of the type of contract.

Part-time work experience is included in the length of service. And if such work occurs simultaneously with activities at the main place, in the calendar calculation they overlap each other. In value terms, insurance premiums from both workplaces are taken into account.

It is the latter that is of fundamental importance for the assignment of an old-age pension. If deductions are received for a month, it is included in the work history.

The calendar duration of up to an hour needs to be clarified only for early retirement. For example, for part-time teaching staff, data on the volume of teaching load is entered into SZV-STAZH.

Accounting for IPC during part-time work for the insurance period

As already noted, the insurance period for part-time work is not cumulative with the length of service at the main place of work. But the amount of the accumulated IPC increases, since upon official employment, contributions to the Pension Fund are transferred from an additional place of work .

Emelyanenko Natalya Leonidovna

Worked as a legal assistant in a law firm for 6 years

Ask a Question

Additional official earnings, increasing the IPC, will allow you to receive larger monthly pension payments in the future.

For example, Petrov’s part-time job in 2021 at an additional place of work will have a salary of 15,000 rubles before personal income tax. We will calculate the additional IPC that Petrov will receive for 2020.

His annual income will be

[15,000 12] = 180,000 rubles

The employer contributes 16% of Petrov’s salary to the Pension Fund. At the same time, there are standard insurance premiums (NSVyd), which are determined by the state. It is impossible to pay more than these standard contributions to the Pension Fund. In 2021, NSVyears are calculated from a maximum base of 1,292,000 rubles (Government Decree No. 1407 of November 6, 2019) Then

NSVyear = [1,292,000 rubles · (16% / 100) ] = 206,720 rubles

Contributions to the Pension Fund that the employer will make for Petrov will be

CVyear = [180,000 rubles · (16% / 100)] = 28,800 rubles

The total amount of points is determined by the formula (clause 18 of Article 15 of Law No. 400-FZ of December 28, 2013)

IPCyear = (SVyear / NSyear) · 10 = (28,800 / 206,720) = 1.39

Thus, Petrov will receive plus 1.39 points in addition to the IPC from his main place of work.

To summarize, we can say the following: official part-time work will not lead to an increase in length of service and to retirement before the established age. However, part-time work will increase pension coefficients, which will lead to an increase in future pensions.

Is part-time work included in the length of service?

Part-time work represents an additional form of employment for a person who has a primary job and is also willing to work in a second one. As a general rule, part-time work is not included in the length of service, since it is already taken into account at the main place, and multiplying factors do not apply in this case.

If an employee has lost his main job, but remains a part-time worker, then such activity is already counted, since in this situation this particular type of employment becomes the only one.

Part-time work is an option for additional employment. This form assumes that the employee has a main job, and along with it he also has another one.

At the same time, this person needs to work at the second workplace on a regular basis. Part-time work at another enterprise does not constitute a part-time job; the employee must be employed in a second position; there is a requirement to draw up an employment contract in this case. Of course, this work must also be paid. It is also stipulated that a part-time person must perform labor functions at a second workplace during a period of time free from employment at the main one.

There are two types of part-time work: external and internal.

External assumes that this person, in addition to his main job at one enterprise, also has an additional one in another organization. In this case, activities in the same specialty or profession, as well as in different areas, are allowed.

Internal assumes that an employee combines positions in the same company, that is, works in different professions or in different positions.

By law, a person can only have one main job. At the same time, the number of places he occupies part-time is formally not limited in any way. It has been established that it is required to obtain consent from the main employer, at the same time, the company in which this person works as a part-time worker does not have the authority to agree or not to accept a second similar position.

If an employee worked in two places for a certain period, then the length of service only applies to one. No doubling occurs. If during the year he maintained both the main and the additional, then in the end he will have a year of experience. This period is not only not doubled for him (to get two years), but also not recalculated with a coefficient (to get an indicator between a year and two). The result in any case is a year.

At the same time, a special situation arises if a person has lost his main job, but he still has an additional one. Since it is assumed that part-time work is possible only in a situation where the employee also has a main job, there is no certainty on how to interpret this provision. This situation is not regulated by law.

However, in any case, if such a place of work exists, the employee’s length of service continues. According to the law, part-time workers have equal rights with employees who have the main form of employment. Therefore, the part-time worker is entitled to all standard guarantees, and the situation is not affected by the fact that he does not have a main place. In this special case, part-time work counts.

It has been established that the main source of information regarding the time periods during which an employee worked at a particular enterprise is the work record book. At the same time, entering information about part-time work is a matter left to the discretion of the employer at the main place. The work record book is kept there. The responsible person within the company has the right to enter such data at the request of the employee.

In the absence of relevant information in the work book, other documents may be considered as confirmation of the fact that the employee worked as a part-time employee. In particular, such a fact can be certified by an agreement concluded between the company and the employee. It is necessary that this document be drawn up in accordance with the Labor Code of the Russian Federation, which was in force on the date of its signing.

In addition, this fact can be additionally confirmed by a number of other papers. In particular, it can be proven by providing extracts from orders for the enterprise. Also, by law, an enterprise is required to provide information regarding the earnings of a part-time worker in the relevant salary sheet. It is also possible to refer to the information contained in such a document.

What is part-time work

To begin with, let us recall that part-time work can be internal and external. In simple terms, internal part-time work is working in two different positions in one organization (with one employer). For example, you can work in your main position as a full-time automated process control engineer, and at the same time be a part-time worker in the position of occupational safety and health specialist for 0.5 times the salary.

External part-time work involves working for different employers. In this case, one place will be the main one, and the other will be additional. Part-time work is performed in free time from the main one.

To perform part-time work, an employment contract is concluded, and taxes are withheld from the accrued salary and contributions are transferred to the pension fund and social insurance fund. Also, part-time workers are subject to all provisions of labor legislation (including various guarantees and compensations) applied to main employees (Article 287 of the Labor Code of the Russian Federation).

Impact on retirement

Additional work affects the amount of pension a person receives. However, its significance does not lie in the fact that it adds length of service, but in the fact that the employee has the opportunity to pay pension contributions in two or more places. Thus, he makes larger contributions to the state than at one main place.

Working part-time also does not affect length of service.

Calculation example

Engineer Ivanov has been working at the company since 2007. For 2015 and 2016, his earnings amounted to 490 and 520 thousand rubles. In addition, he worked part-time for 4 years in another company, where during the specified period he earned 195 and 190 thousand rubles. In July 2017, Ivanov went on sick leave, where he stayed from 10 to 15.

Since Ivanov has not changed jobs either this year or the previous two, he draws up two sick leave certificates, which he submits to the financial service at each place of work. Monetary compensation will be received from each organization.

Compensation at the main place of work.

Earnings for two years are summed up, divided by the taxable base and multiplied by a percentage depending on the length of service. The result is multiplied by the number of days spent on sick leave. (490,000 + 520,000) / 730 * 100% = 1,383.56. 1,383.56 X 6 = 8,391.36 rubles.

The same operation is performed with funds received part-time (195,000 + 190,000) / 730 * 100% = 527.39 X 6 = 3,164.34 rubles. The entire amount of monetary compensation received during the illness will be 11,555.7 rubles.