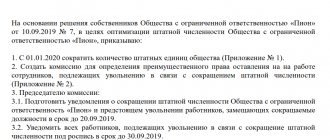

Organizations and individual entrepreneurs must submit information to the tax office about such an indicator as the average number of their employees.

Here is a sample certificate of the average number of employees. Download the official form of information on the average number of employees. All fields of the certificate on the average number of employees are filled in by the taxpayer. WATCH THE VIDEO ON THE TOPIC: Filling out the Certificate of Earnings and Excluded Periods

Who submits data on the average number of employees?

All entrepreneurs are required to submit information on the average number of employees to the tax office (at the place of registration of the enterprise or organization). It doesn’t matter whether we are talking about an individual entrepreneur or an LLC, another form of organizing production activities.

This requirement is stated in paragraph 7 of Article 5 of Law No. 268 of December 30, 2006. Starting from 2007, even entrepreneurs who do not have employees were required to submit such data. It’s just that in this case, when preparing the appropriate reporting, they entered the number “zero” in the required column. Since 2014, for individual entrepreneurs without employees, the report on the average headcount has been canceled

How is the number calculated?

Rules for counting list data:

- All persons registered under employment contracts are included.

- Owners are hired and paid for their labor.

- Both present and absent persons are taken into account.

- The data must match the data in the timesheets.

Average Average number is used in calculating various activity coefficients: labor productivity, average pay level.

The average number also includes:

- Persons entered into under civil contracts. They are considered as ordinary employees hired into the organization for full time. The exception is entrepreneurs.

- External part-time workers. They are considered as part-time employees.

Contents of the document

The form requires the following information:

- Taxpayer Identification Number (TIN) and checkpoint (only for companies).

- Code and name of the tax office where the certificate is provided.

- Full name of the company or full name of a private businessman.

- The value of the staffing indicator. If the calculation results in an incomplete number, it must be rounded in accordance with mathematical rules.

- The date on which the indicator was calculated and is current. For long-established companies, this is the first of January of the current year, and for newly registered companies, this is the first day of the month following the month of registration.

- Full name of the head of the company, as well as his personal signature and company stamp, or the full name of a private businessman and his personal signature. In both cases, the date of formation and signing of the document is indicated.

- If a representative is filling out the certificate, information about him must be indicated. Also, the number and name of the document confirming his rights is indicated, and a photocopy of it is attached.

The taxpayer must fill out all fields of the certificate himself. The only exception is the lower right section. It will be filled out by a tax specialist. A sample certificate of staffing levels is given below.

Sample certificate of human resources

| No. | Last name, first name, patronymic of the specialist | Education (which educational institution you graduated from, year of graduation, specialty obtained) | Job title | Work experience in this or similar position, years |

| Management level (manager and his deputies, chief accountant, chief economist, chief lawyer) | ||||

| 1 | ||||

| 2 | ||||

| . | ||||

| Specialists (including product specialists, purchasing managers, sales managers, warranty service managers) | ||||

| 1 | ||||

| 2 | ||||

| . | ||||

| Other personnel (including forwarders, drivers, loaders, security guards, etc.) | ||||

| 1 | ||||

| 2 | ||||

| . |

A table with other personnel is also possible. This includes employees working in the organization, but not directly related to the implementation of the contract for this competition. The table looks similar.

What should a human resources certificate contain?

As a rule, this is a table on the official letterhead of the enterprise, which consists of the following columns:

- Serial number

- Full name of the employee

- Education

- Job title

- Work experience

Vote:

You can view a sample resume for a manager and what his responsibilities include here.

- Information on the average number of individual entrepreneurs is submitted at the place of registration of the individual entrepreneur.

- Enterprises submit a report at the place of registration of their legal address.

A certificate of the number of employees, the form of which is presented on our portal, is not submitted for separately located divisions of the organization. Information on the average headcount does not apply to declarations, therefore failure to submit may result in fines for the organization and its management:

- in the amount of 300 - 500 rubles - per official.

- in the amount of 200 rubles – for a legal entity or entrepreneur;

In addition, certificates of headcount in any form may be needed by banks, credit institutions, company owners and other users.

Why report headcount?

Tax officials are interested in information about the number of personnel working in a company or private businessman. The number of employees employed affects the collection of certain types of fees. Also, this indicator is important when choosing a tax system. With a patent, the average number cannot exceed fifteen people, and with simplification - one hundred people.

Also, a certificate of the number of employees is required by tax authorities in order to know which companies are required to submit various reports only in electronic format, and which have the right to report in paper form.

In some cases, information about the number may be required by the Pension Fund or a credit institution.

Does a resigned employee have the right to request a certificate?

According to the law, an employee who quit can also demand the certificate he needs from his former employer.

True, only one type of such document is legally established, the issuance of which is prohibited from being refused: this is a salary certificate (for example, for receiving subsidies, pensions, benefits and other social benefits). Information for such documents is stored in the archives of the enterprise.

Instructions on how to calculate the average number of employees

In order to obtain this denominator, it is necessary to follow a similar formula.

After summing up the results for each month, the resulting amount must be divided by the number of months in the year (12). Even if the company took breaks in the work process and did not function for several months, the formula does not change and the number of months in the year should appear in the divisor. You can view a sample resume for a manager and what his responsibilities include here.

How to draw up a certificate of the number of employees of an organization

If the number of workers does not exceed one hundred people, then reports can be submitted in paper form; if more, the reception is carried out in electronic format.

By law, since 2008, all employers have an obligation to submit reports for the previous working year on the personnel composition of their organization.

Documents listing the composition are submitted when opening or closing, as well as when reorganizing the work of an enterprise.

This calculation does not take into account the owners of the company, who will not receive compensation. These include students, lawyers, military personnel, employees under civil contracts, persons located abroad, working at other enterprises and therefore not receiving a salary, collaborating with authorities and external part-time workers.

Who issues the certificate

Typically, the certificate is issued by the head of the department whose jurisdiction includes the requested information.

If an employee needs a certificate about his profession or position, then he must contact the personnel department, if about wages - accordingly, to the accounting department, etc.

But if the head of a structural unit can directly prepare the certificate, then it must be certified by the director of the company or a person authorized to sign such documents.

Sample certificate of number of employees to the tax office

In the case when the form is submitted by a representative, the form is signed by an authorized person of such a representative, and the document justifying the authority is provided separately.

Also at the end of the form is the date the certificate was issued.

How to determine the average number of employees? In order for the certificate of staffing, sample below, to be drawn up correctly, it is necessary to correctly calculate the company's average number indicator. From 2020

Letter on the number of employees sample

/ / 04/16/2020 164 Views You can add a topic to your favorites list and subscribe to email notifications.

Are young ladies on maternity leave considered full-time employees or do they need to be registered separately?

and external part-time workers? I want to draw the moderator’s attention to this message because: A notification is being sent... Veta [email hidden] Russian Federation, St. Petersburg #2[255078] September 9, 2020, 10:34 And if one of the employees is 0.5 rates, so write - full-time employees - 17.5?

I want to draw the moderator’s attention to this message because: A notification is being sent... Attention Submission authorities The average headcount in the form of a certificate is submitted by all taxpayers, regardless of the registration form: To the Federal Tax Service authorities before January 20 for the previous year.

Letter on staffing levels for a bank

After summing up the results for each month, the resulting amount must be divided by the number of months in the year (12). Even if the company took breaks in the work process and did not function for several months, the formula does not change and the number of months in the year should appear in the divisor. You can view a sample resume for a manager and what his responsibilities include here.

The same as we were taught at school: we need to find the sum of values for all 12 months (from January to December inclusive) and divide the found figure by 12. So, the principle is simple: when the number after the decimal point is 4 or a smaller value, we simply remove decimal places. Let's say, 2.3 is rounded to 2. If the decimal point is followed by the number 5 or a greater value, we add one to the whole number.

A letter that will exclude the bank’s claims against the company

- persons located abroad;

- employees sent to other enterprises and not receiving payment for their work;

- employees who submitted a letter of resignation and stopped working earlier than the appointed date or without warning the administration;

- employees working under contracts with state-owned enterprises;

- external part-time workers.

A certificate of the average number of employees looks like this: Sample certificate of the average number of employees Included in the payroll:

- regular employees;

- seconded employees while maintaining wages, including employees sent abroad for a short period of time;

- sick employees;

- employees with government powers;

- truants;

- employees registered for part-time or part-time work. The operating time is taken proportionally.

An example of a certificate on the number of employees at the enterprise

However, these reporting forms are list-based, i.e.

contain information about all employees.

This means transferring a copy of such a report to one employee means disclosing the personal data of other employees. NCT USSR 04/30/1930 No. 169). but sometimes these 11 months are not so spent.> Attention to the Head of the State Unitary Enterprise of the city.

We invite you to familiarize yourself with Installing Glonass on a car

Help example:

Company letterhead of LLC “OUR COMPANY”

Certificate of availability of service personnel

Source: https://sobercar.ru/spravka-o-nalichii-sotrudnikov-v-shtate-obrazets/

Deadlines for submission and responsibility for non-submission

Long-established private businessmen must submit a certificate before the twentieth of January of the year following the reporting year. Newly registered companies and entrepreneurs are required to submit a certificate by the twentieth day of the month following the month of registration.

Responsibility for failure to provide a certificate of the number of employees is a fine of 200 rubles. Also, persons responsible for the generation and submission of this report may receive a fine. The fine for them will be from 300 to 500 rubles.

Video on the topic:

Documentation confirming the number of personnel

- At the top of the form, the taxpayer fills out the TIN and KPP fields, guided by the Tax Registration Certificate.

- Further, after the words “Submitted to,” the full name of the tax accounting authority where the information must be submitted is indicated, and its code is indicated in the cells of the corresponding field.

- The next line contains the name of the person conducting business activities, or the full name of the organization submitting the information, in accordance with the constituent documentation.

- In the field below, the reporting date for submitting information is indicated - January 1 of this year in the order “day-month-year”.

The TIN and KPP at the location of the branch (branch, representative office) of a foreign organization operating on the territory of the Russian Federation are indicated on the basis of a Certificate of registration with the tax authority in Form N 2401 IMD and (or) an information letter on registration with the tax authority of the branch foreign organization in form N 2201I, approved by Order of the Ministry of Taxes of Russia dated 04/07/2000 N AP-3-06/124 “On approval of the regulations on the peculiarities of accounting by tax authorities of foreign organizations” (registered with the Ministry of Justice of Russia on June 2, 2000, registration number 2258 ; “Bulletin of normative acts of federal executive bodies”, June 19, 2000, No. 25).

Blanker.ru

- The next field contains the average number of employees.

- The lower left section confirms the accuracy of filling out the form. An individual entrepreneur puts his signature and the day the document was drawn up. If the taxpayer is an organization, its head enters his personal information, the day the form was drawn up, and the signature and seal of the organization in the appropriate field.

- If the certificate is certified by a legal representative who is an individual, he signs the form, indicating his name and the day the form is filled out.

- If the organization is also represented by an organization, its head confirms the completed form with his signature, indicating the full name of the organization, the day of compilation and affixing the organization’s seal.

- The name of the document giving the representative the corresponding authority is indicated below.